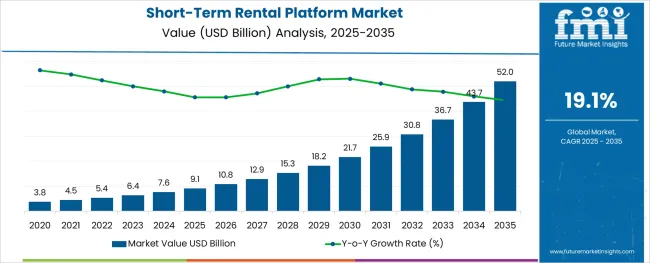

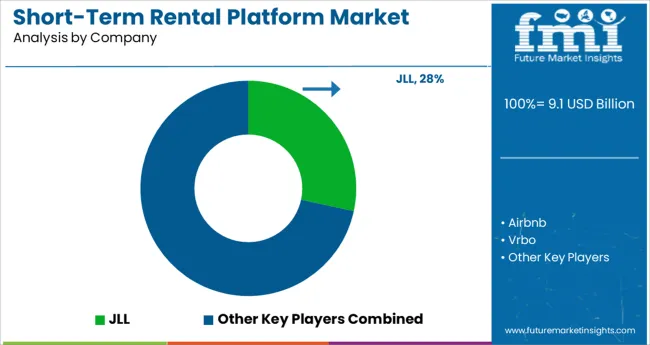

The Short-Term Rental Platform Market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 52.0 billion by 2035, registering a compound annual growth rate (CAGR) of 19.1% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Deployment, Accommodation, and End User and region. By Deployment, the market is divided into On-Premise Short-Term Rentals, Cloud-Based Short-Term Rentals, and Web-Based Short-Term Rentals. In terms of Accommodation, the market is classified into House/Apartment, Hotel/Hostel, and Others. Based on End User, the market is segmented into Individuals, Businesses, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Deployment, Accommodation, and End User and region. By Deployment, the market is divided into On-Premise Short-Term Rentals, Cloud-Based Short-Term Rentals, and Web-Based Short-Term Rentals. In terms of Accommodation, the market is classified into House/Apartment, Hotel/Hostel, and Others. Based on End User, the market is segmented into Individuals, Businesses, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

The influence of the internet and social media platforms is increasing consumer awareness of services and offerings. Key businesses are offering a variety of services, exotic destinations, and amenities, as well as services tailored specifically for female visitors, in order to gain market share. Short-term rental is becoming increasingly popular among the general public due to their low cost as well as a large amount of space and comfort they provide. The government's large investments in the development of connectivity and infrastructure, particularly in developing countries, are boosting the market growth in the short-term rental platform market.

The growing tourism industry and the increasing popularity of short-term rental properties are two key factors driving the global short-term rental platform market growth. The global increase in tourist numbers creates a high demand for vacation rental properties. Baby boomers have made significant contributions to the growth of the travel and tourism industry. The demand for short-term vacation rental properties is especially high. When properly marketed, these properties generate higher returns than long-term rental properties. Furthermore, the increased comfort and affordability offered by short-term rental properties will attract consumers to such spaces, which is expected to support market growth in the coming years.

Another important trend driving the growth of the global short-term rental platform market is the ability of online vacation rental sites and other channels to facilitate real-time bookings. This added value will make booking vacation rentals more convenient, resulting in higher customer satisfaction. The availability of instant booking options in the global vacation rental market has increased the degree of product or service differentiation.

Many current market vendors have invested in autoresponder technology to save time and money. This technology enables automated responses to inquiry emails and repetitive inquiries, resulting in a unique user experience that is expected to positively impact market growth during the forecast period.

With the advancement of technology, many rental providers have adopted an online mode of communication to reach out to customers. Furthermore, modern tech-savvy travelers can easily navigate through websites on online portals, compare prices and reviews, obtain information about vacation rentals, and choose vacation rental stay with additional offers.

According to the analysis, the hotel/hostel accommodation type accounts for more than 65.7% of the vacation rental market and is expected to remain high for the forecast tenure.

Travelers prefer home and hostel accommodations because they are more comfortable, private, convenient, and safe. Hotels are spacious and well-equipped, and they are available at reasonable prices in rural and remote areas. As a result, such features entice travelers to use vacation rentals in the tourism industry.

The number of individual visitors is expected to increase because the above traveler segment is mostly engaged in leisure, work, and study-related activities.

Middle and young-age travelers are enthusiastic travelers who travel frequently to explore and discover new places, both for leisure and for work. In addition, with rising tourism trends and an increase in resorts and amusement parks, there is an increase in participation from solo travelers. As a result, individual travelers will boost vacation rental market sales.

During the forecast period, North America is likely to hold a 24.6% share of the market. The USA is the leading country in rental services, and it is significantly contributing to the growth of North America's short-term rental platform share.

The short-term rental platform market in the USA has evolved through various stages and is now one of the leading markets in the hospitality industry. Aside from that, the USA is a developed market for resorts and condominiums. The rapid development of resorts and condominiums, such as spas, boats, private beaches, and yoga centers, and the inclusion of luxurious amenities, is enticing travelers to choose the short-term rental platform market.

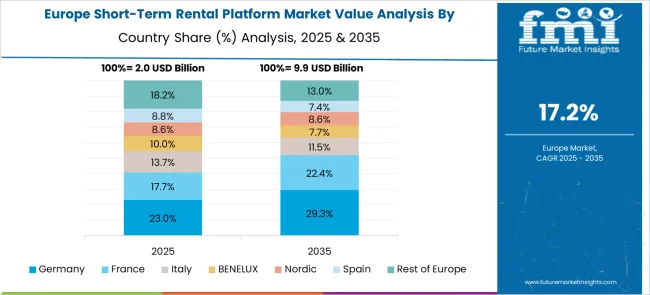

Europe is distinguished by the presence of prominent tourism operators. Furthermore, growing tourism activities in Europe have significantly contributed to market expansion due to the high attractiveness of tourist destinations and the presence of sophisticated infrastructure. Germany, the United Kingdom, and Spain are expected to have significant market shares in Europe.

During the forecast period, Asia Pacific is expected to be a promising market. Asia Pacific is one of the world's most popular tourist destinations. The growing reliance of many economies on tourism, as well as rising government spending on sophisticated infrastructure to attract tourists, is a major driver of the market. Furthermore, governments in countries such as India, Indonesia, China, Vietnam, Australia, and Thailand are focusing on growing the tourist industry to generate revenue, create jobs, and promote the region's overall development. Furthermore, demand is expected to rise as travelers become more aware of the availability of vacation rentals. As a result, Asia Pacific is expected to be the region with the fastest growth.

Lodgify, a travel tech start-up, has just raised €30 million for its vacation rental software as the sector expands. The Barcelona-based team is now planning to expand globally, providing hosts with enhanced tools to help them grow their vacation rental business.

The travel industry has had a year of impressive and sustained growth, demonstrating how resilient travel tech innovators and start-ups have been in recent years. The market is currently undergoing an exciting period of growth and innovation, catering to a renewed appetite for travel, adventure, and exploration.

One of the most important trends in this space has been the rise in popularity of short-term rentals, which allow travelers to book local stays for their vacation, workcation, or even digital nomad life. It means that those who offer vacation rentals will have more customers to cater to, as well as more competition in the market.

The market is distinguished by the presence of a few established players as well as new entrants. Many major players are increasing their focus on the growing vacation rental trend. Market participants are diversifying their service offerings in order to maintain market share.

Latest Developments in the Short-Term Rental Platform Market

Meredith Lodging planned to expand into the Mount Hood region in June 2025 by acquiring Mt Hood Vacation Rentals.

Hotels in Latin America will band together in June 2025 to launch their own online booking platform and tools.

Booking Holdings Inc. purchased Getaroom from Court Square Capital Partners for USD 7.6 billion in December 2024. The brand hopes to increase the value of its pipeline through this acquisition.

Tripadvisor will launch two new hotel technology solutions, Spotlight and Reputation Pro, in October 2024. Both want to improve their hospitality businesses by increasing traveler trust, attracting new customers, and making data-driven decisions to increase profitability.

Adaptation is the key to success and thriving in the rental platform industry

The changes brought about by the sharing economy, like those brought about by globalization, are novel, complex, and frequently unpredictable. There will be winners and losers, and there will be a great deal of adjusting to do. Some of the transitions will be difficult. However, the changes we've seen in travel patterns, other aspects of real estate, and how space defines our lives are very real.

According to the World Travel & Tourism Council, the travel and tourism industries account for approximately 10% of global GDP and jobs, with the short-term accommodations segment representing a rapidly growing share of this market. These are vast economic domains undergoing significant transformations.

Individuals, businesses, and governments that adapt to them will reap significant benefits, improving economies and lives.

There is no denying that technology has made many aspects of our lives better. In fact, without the Internet, you would never be able to rent out short-term rental properties to strangers from all over the world.

As many as 94% of rental property owners admit they could do more to promote their vacation rental properties. While vacation rental platforms continue to be extremely effective, it is critical to go beyond these platforms in order to generate even more interest in your property listings.

Not only is the short-term rental market becoming saturated. In all business sectors, competition is heating up! Smaller e-commerce websites, for example, are closing. They simply cannot compete with Amazon, which accounts for nearly 40% of all US e-commerce sales.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 19.1% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Deployment, By Accommodation, By End User, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | 9flats.com Pte Ltd.; Airbnb Inc.; Booking Holdings Inc.; Expedia Group Inc.; Hotelplan Holding AG; MakeMyTrip Pvt. Ltd.; NOVASOL AS; Oravel Stays Pvt. Ltd.; TripAdvisor Inc.; Wyndham Destinations Inc. |

| Customization & Pricing | Available upon Request |

The global short-term rental platform market is estimated to be valued at USD 9.1 billion in 2025.

It is projected to reach USD 52.0 billion by 2035.

The market is expected to grow at a 19.1% CAGR between 2025 and 2035.

The key product types are on-premise short-term rentals, cloud-based short-term rentals and web-based short-term rentals.

house/apartment segment is expected to dominate with a 55.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Short-Term Vacation Rental Market Trends – Growth & Forecast 2025 to 2035

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Parental Control Software Market Report - Demand & Outlook 2025 to 2035

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

P2P Rental Apps Market Size and Share Forecast Outlook 2025 to 2035

Breakdown for IBC Rental Business Market: Trends, Players, and Innovations

Car Rental Service Market Trends - Growth & Forecast 2024 to 2034

Boat Rental Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Yacht Rental Market Size and Share Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Vacation Rental Website Market Size and Share Forecast Outlook 2025 to 2035

Vacation Rentals Industry Analysis By Platform, By Service Type, By End User, By Region – Forecast for 2025 to 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Compressor Rental Market Size, Share, and Forecast 2025 to 2035

Two Wheeler Rental Market Size and Share Forecast Outlook 2025 to 2035

Online Home Rental Market Analysis – Trends, Growth & Forecast 2025 to 2035

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Wooden Pallet Rental Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA