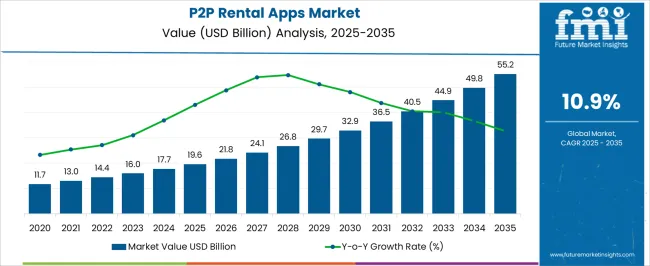

The P2P Rental Apps Market is estimated to be valued at USD 19.6 billion in 2025 and is projected to reach USD 55.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.9% over the forecast period. Between 2025 and 2030, the market climbs steadily to USD 32.9 billion, driven by expanding consumer interest in access-over-ownership models. Demand is particularly strong in sectors like transportation, vacation rentals, and equipment sharing, where flexibility and cost efficiency are highly valued. Increasing smartphone penetration and improved internet infrastructure support higher adoption rates, while secure digital payment options and transparent user reviews build trust among users. Rental apps benefit from shifting consumer preferences toward more sustainable consumption patterns, where sharing assets reduces waste and upfront costs.

Service providers are innovating to offer specialized platforms that cater to niche rental needs, contributing to market segmentation and growth. The rise of remote work and changing lifestyles also encourages short-term rentals for both personal and professional purposes. By 2030, the P2P rental apps market will establish a firm foundation for long-term expansion, with growing acceptance across diverse demographics worldwide.

| Metric | Value |

|---|---|

| P2P Rental Apps Market Estimated Value in (2025 E) | USD 19.6 billion |

| P2P Rental Apps Market Forecast Value in (2035 F) | USD 55.2 billion |

| Forecast CAGR (2025 to 2035) | 10.9% |

The emergence of trust-building technologies like real-time ID verification, user ratings, and in-app dispute resolution has enhanced user confidence, driving widespread adoption. Economic factors such as inflation and rising ownership costs have reinforced the appeal of shared access to goods, spaces, and services. App developers are focusing on user-friendly interfaces, hyperlocal listings, and scalable backend infrastructure to serve a growing base of renters and providers.

The integration of AI-driven personalization, push-based recommendations, and usage analytics is further refining user engagement and retention. Continued growth is expected to be supported by increased investment in proptech and mobile-first ecosystems, along with the expansion of vertical-specific rental segments tailored to urban and Gen Z consumers.

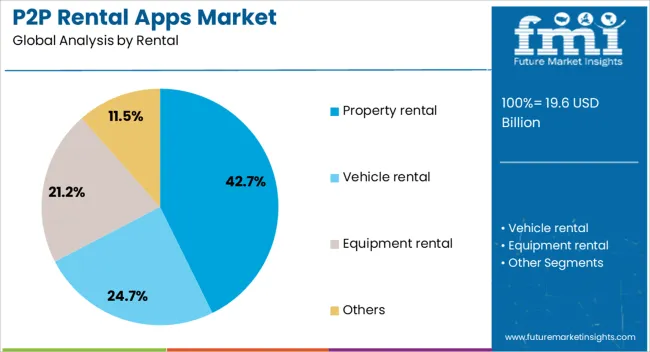

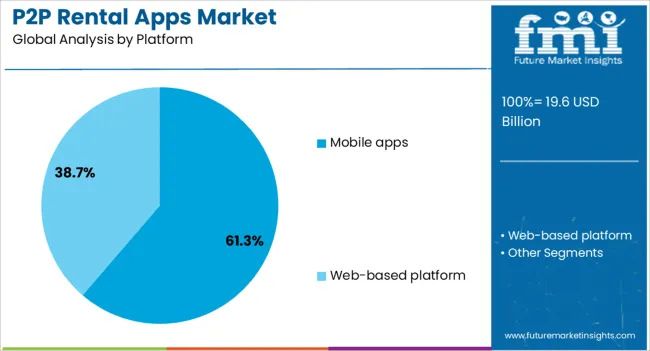

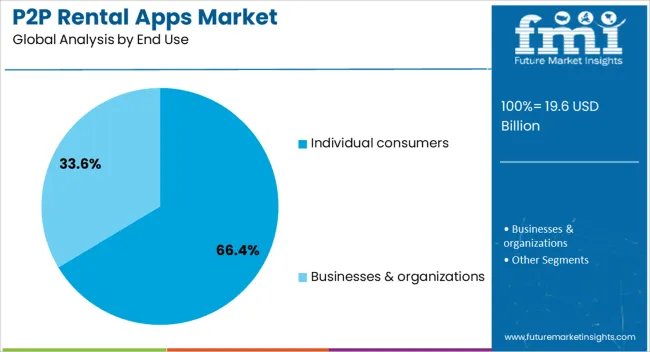

The market is segmented by rental, platform, end use, and geographic regions. The P2P rental apps market is divided into Property rental, Vehicle rental, Equipment rental, and Others. In terms of the platform, the p2p rental apps market is classified into Mobile apps and Web-based platforms. Based on end use, the p2p rental apps market is segmented into Individual consumers and Businesses & organizations. Regionally, the p2p rental apps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Property rental is expected to contribute 42.7% of the total market revenue in 2025, making it the leading rental category within the P2P rental apps market. This dominance is being supported by rising demand for short-term and flexible accommodation solutions across urban and semi-urban regions.

Shifts in work patterns, such as remote or hybrid models, have led to increased mobility, prompting users to opt for temporary property rentals. Additionally, regulatory shifts supporting short-stay accommodations and the rise of digital nomadism have contributed to consistent demand growth.

Property owners are also leveraging P2P platforms to maximize asset utilization and earn passive income, while platforms continue to add value through dynamic pricing algorithms, verified listings, and integrated check-in services.

Mobile apps are projected to account for 61.3% of the total revenue in the P2P rental apps market by 2025, positioning them as the leading platform type. This leadership stems from the ubiquity of smartphones and increasing consumer preference for on-the-go access to services.

Mobile-native applications offer intuitive design, faster search capabilities, push notifications, and seamless integration with GPS, messaging, and payment systems making them more engaging than web platforms. Real-time inventory updates, biometric login options, and app-exclusive promotions further drive usage frequency and loyalty.

The app environment also supports continuous data collection and personalization, enabling P2P rental platforms to optimize user experiences and enhance monetization strategies.

Individual consumers are expected to represent 66.4% of the total user base and revenue share in 2025, establishing them as the primary end users of P2P rental apps. This dominance is being driven by shifting attitudes toward ownership, especially among younger and urban populations who prioritize access, flexibility, and cost efficiency.

Individuals are increasingly using these platforms to rent homes, vehicles, tools, and electronics on a need-only basis. The availability of peer reviews, simplified booking workflows, and peer-to-peer trust frameworks has reduced friction in user acquisition and retention.

Platforms are optimizing their interfaces to cater to first-time users while introducing loyalty programs, referral bonuses, and micro-insurance options to retain engagement and build trust within the individual consumer segment.

The P2P rental apps market is expanding rapidly as consumers prefer access over ownership, fueled by growing smartphone adoption and digital payment systems. These apps connect individual asset owners with renters seeking flexible, affordable solutions for cars, tools, equipment, and more. Rising awareness of the sharing economy concept supports market penetration across urban and suburban regions. Challenges include ensuring trust, security, and navigating complex local regulations. Innovation focuses on improved verification systems, insurance integration, and seamless user experience to build consumer confidence and drive further adoption.

Trust remains the cornerstone of P2P rental app success. Platforms invest heavily in identity verification, background checks, and secure payment gateways to minimize fraud and disputes. User review systems and transparent ratings encourage responsible behavior and help users make informed choices. Many apps offer insurance coverage or guarantees that protect both owners and renters from damage or liability claims. These measures reduce barriers caused by apprehension over safety and reliability. Ongoing improvements in customer support and dispute resolution processes also play a critical role in sustaining user confidence, particularly as higher-value or specialized assets enter the rental ecosystem.

As competition intensifies, platforms differentiate by targeting specific rental categories or geographic regions. Some focus on vehicle sharing, others on construction tools, luxury goods, or outdoor equipment. Customizing app interfaces and booking flows to match user expectations enhances engagement and retention. Features such as instant booking, flexible rental periods, in-app messaging, and smart pricing algorithms improve convenience. Integration with digital wallets and contactless access solutions further streamline the rental process. Partnerships with local service providers and community organizations help build credibility and expand the user base. This niche focus, combined with a seamless user experience, is crucial for platforms to gain loyal customers in crowded markets.

P2P rental apps face a complex regulatory environment that varies across cities and countries. Issues around taxation, liability, consumer protection, and data privacy require constant attention. Some jurisdictions impose licensing or insurance requirements that can limit app operations or increase costs. Platforms must work closely with policymakers to clarify rules and ensure compliance, often tailoring features to meet local legal demands. Proactive engagement helps avoid fines or shutdowns and fosters a collaborative environment for sharing economy growth. Transparency about terms of service, privacy policies, and data handling also reassures users and regulators, supporting long-term market stability.

The market continues to diversify as P2P rental apps expand beyond traditional goods like cars and tools into categories such as electronics, event equipment, recreational vehicles, and even fashion. This broadening of offerings attracts new customer segments and boosts average transaction values. Emerging economies with rising smartphone penetration and urbanization present fertile ground for market expansion. Localized marketing and culturally adapted app experiences help capture these opportunities. Moreover, integrating sustainable consumption messaging resonates with environmentally conscious consumers, aligning with global trends. Continued innovation in technology and business models will unlock further growth and position P2P rental apps as key players in the evolving sharing economy landscape.

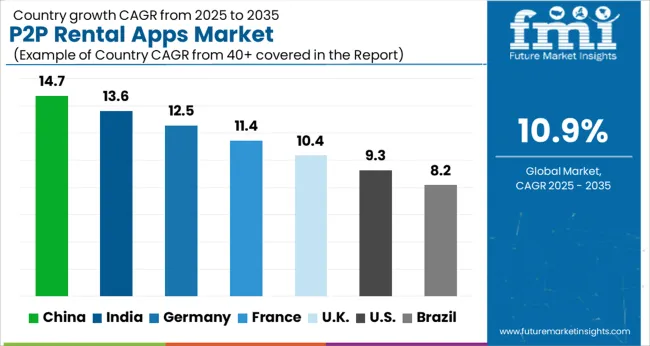

The global P2P rental apps market is expanding rapidly at a 10.9% CAGR, driven by growing digital adoption and sharing economy trends. China leads with 14.7% growth, supported by widespread smartphone penetration and innovative platform development. India follows closely at 13.6%, fueled by increasing internet access and urbanization. Germany records 12.5% growth, reflecting strong regulatory frameworks and tech innovation. The United Kingdom grows at 10.4%, driven by consumer demand for convenient rental services. The United States, a mature market, shows 9.3% growth, shaped by established platforms and evolving user preferences. These countries collectively influence market trends through technological advancements, regulatory oversight, and consumer engagement strategies. This report includes insights on 40+ countries; the top countries are shown here for reference.

China P2P rental apps market is expanding rapidly at a 14.7% CAGR, fueled by widespread smartphone adoption and growing sharing economy awareness. Urban millennials and Gen Z actively use these platforms for renting everything from electronics to vehicles, driven by convenience and cost savings. Strong government support for digital infrastructure and fintech innovations enhances platform scalability. Compared to Western markets, China leads with highly integrated payment and social features, making rental experiences seamless and trustworthy. Rising demand in tier-2 and tier-3 cities broadens market reach.

India P2P rental apps market grows at 13.6% CAGR, driven by increasing internet access and growing trust in digital transactions. Urban professionals and small business owners leverage rental platforms to access goods without high upfront investments. Compared to China, India faces challenges like digital literacy and payment infrastructure but is catching up fast with localized app designs and vernacular language support. Government initiatives promoting digital payments and startup ecosystems boost platform innovation. Rural penetration remains limited but shows potential for future growth.

Germany P2P rental apps market grows at 12.5% CAGR, supported by strong environmental awareness and a mature digital economy. Consumers prefer renting to reduce waste and maximize resource use, especially in categories like tools, electronics, and vehicles. Compared to Asian markets, Germany has stricter data privacy laws influencing platform design and user trust. Rental platforms collaborate with local municipalities and sustainability initiatives to boost adoption. Emphasis is placed on secure transactions and transparent review systems.

United Kingdom market grows at a 10.4% CAGR, with consumers embracing sharing economy platforms for cost-effective access to goods. Rental apps in the UK focus on user experience and reliability to compete in a crowded market. Compared to Germany, the UK benefits from a diverse population and widespread urbanization, fostering varied rental categories. Integration with local services like delivery and insurance enhances convenience. Increasing environmental concerns support demand for reuse and sharing platforms.

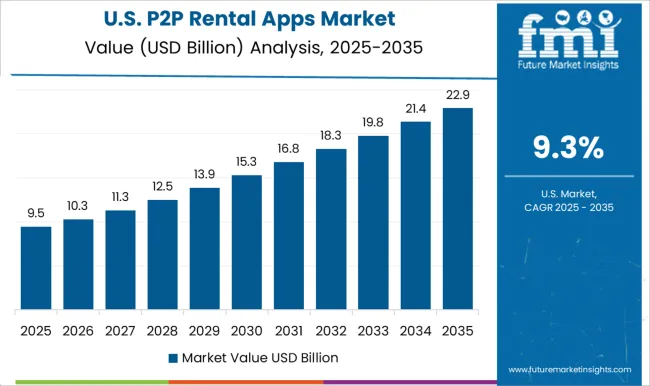

United States P2P rental apps market grows at 9.3% CAGR, driven by a strong culture of sharing and entrepreneurial innovation. Platforms offer broad categories, including property, vehicles, and tools, catering to urban and suburban users alike. Compared to European and Asian markets, the USA market emphasizes scalability and integration with gig economy services. Investments in AI and blockchain enhance trust and efficiency. Regulatory scrutiny varies by state, influencing operational strategies. COVID-19 pandemic accelerated adoption by promoting contactless transactions.

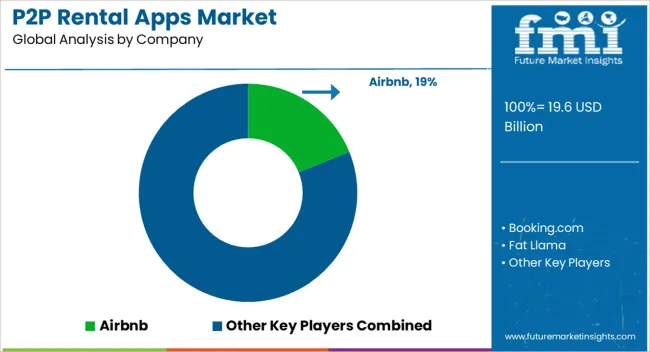

The peer-to-peer (P2P) rental apps market is highly competitive, featuring a blend of well-established platforms and innovative niche players. Airbnb and Booking.com dominate as global leaders, offering extensive listings across accommodation types, from private homes to unique experiences. Their massive user bases, seamless booking processes, and robust customer support set high standards for the industry, appealing broadly to travelers seeking convenience and variety. In contrast, niche platforms like Fat Llama, Getaround, Outdoorsy, RVshare, ShareGrid, and Turo focus on specific rental categories such as equipment, vehicles, recreational vehicles, and camera gear.

These apps carve out specialized markets by targeting users with particular needs, such as renting cameras for photography, cars for short-term use, or RVs for travel adventures. Their competitive advantage lies in tailored experiences, community trust-building, and addressing gaps left by generalist platforms. Zillow Rentals offers a slightly different angle, concentrating on residential rentals and connecting landlords with prospective tenants in a more traditional rental context. This contrasts with the short-term and sharing economy focus of most P2P apps. The market is therefore shaped by a dynamic balance between broad-reaching giants and focused niche players, with competition driven by user experience, variety, trust, and convenience. This diversity fosters innovation and constant evolution in how people share and rent assets peer-to-peer.

P2P rental platforms are investing in more user-friendly interfaces, offering instant bookings, contactless transactions, and streamlined payment systems. This trend is driven by the growing demand for quick access to rentals, especially for short-term use cases. For example, Turo has continued to lead the P2P car rental market, focusing on expanding its global footprint and adding new features like insurance coverage and car delivery services. The company is also capitalizing on the growing demand for electric vehicle rentals.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.6 Billion |

| Rental | Property rental, Vehicle rental, Equipment rental, and Others |

| Platform | Mobile apps and Web-based platform |

| End Use | Individual consumers and Businesses & organizations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbnb, Booking.com, Fat Llama, Getaround, Outdoorsy, RVshare, ShareGrid, Turo, Vrbo, and Zillow Rentals |

| Additional Attributes | Dollar sales vary by platform type, including mobile apps and web-based platforms; by rental category, such as property, fashion, electronics, and tools; by user base, spanning individuals, small businesses, and enterprises; and by region, led by North America, Europe, and Asia-Pacific. Growth is driven by the sharing economy, sustainability trends, and mobile accessibility. |

The global p2p rental apps market is estimated to be valued at USD 19.6 billion in 2025.

The market size for the p2p rental apps market is projected to reach USD 55.2 billion by 2035.

The p2p rental apps market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in p2p rental apps market are property rental, _residential, _vacation rentals, _shared spaces, vehicle rental, _cars, _motorcycle & scooter, _recreational vehicle, equipment rental, _tools & machinery, _sports & fitness equipment, _photography equipment and others.

In terms of platform, mobile apps segment to command 61.3% share in the p2p rental apps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Parental Control Software Market Report - Demand & Outlook 2025 to 2035

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

Breakdown for IBC Rental Business Market: Trends, Players, and Innovations

Car Rental Service Market Trends - Growth & Forecast 2024 to 2034

NFT Dapps Market Size and Share Forecast Outlook 2025 to 2035

Boat Rental Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Super Apps Market Size and Share Forecast Outlook 2025 to 2035

Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Yacht Rental Market Size and Share Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Event Apps Market Analysis – Size, Trends & Forecast 2025 to 2035

Fitness Apps Market Report - Trends & Forecast 2025 to 2035

Vacation Rental Website Market Size and Share Forecast Outlook 2025 to 2035

Vacation Rentals Industry Analysis By Platform, By Service Type, By End User, By Region – Forecast for 2025 to 2035

The Furniture Rental Services Market is segmented by material, application and region from 2025 to 2035.

Furniture Rental Market by Product, Material, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

Serverless Apps Market Size and Share Forecast Outlook 2025 to 2035

Short-Term Rental Platform Market Size and Share Forecast Outlook 2025 to 2035

In Vehicle Apps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA