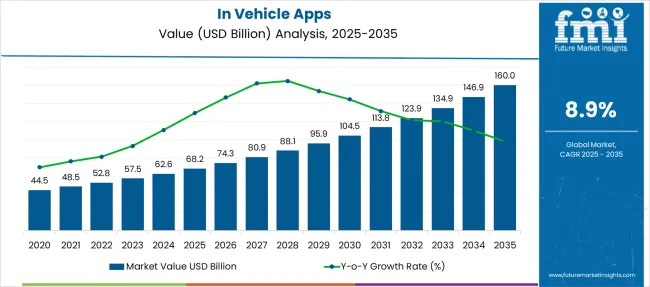

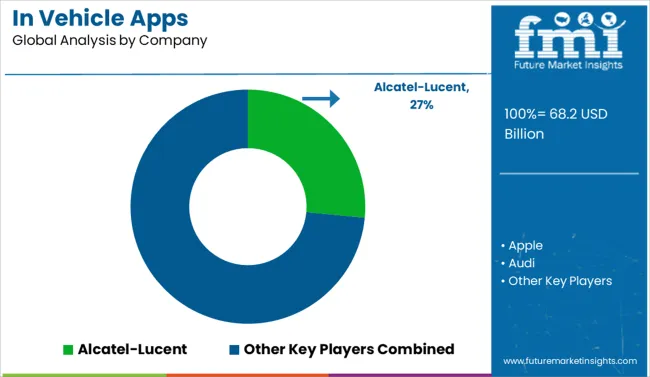

The In Vehicle Apps Market is estimated to be valued at USD 68.2 billion in 2025 and is projected to reach USD 160.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period. Based on our peak-to-trough analysis, volatility is evident. Growth accelerates sharply from USD 68.2 billion in 2025 to USD 104.5 billion by 2030, with annual increments exceeding USD 7 billion, attributed to AI-driven infotainment and connectivity mandates. A peak YoY rate of 10.5% occurs in 2029, signaling saturation risk for early adopters.

Post-2030, a trough effect emerges, moderating increments to USD 5–6 billion per annum as penetration reaches mature economies. Between 2032–2035, additions stabilize at USD 4 billion annually, suggesting the market’s marginal elasticity weakens under price normalization and higher competition from mobile integration. While CAGR over the decade remains robust, volatility analysis confirms that 2027–2030 is the prime investment window for monetizing emerging features such as AR dashboards and subscription-based app ecosystems.

The growth curve illustrates an accelerating upward trajectory, driven by the integration of advanced infotainment systems, connected car services, and AI-driven interfaces into modern vehicles. Adoption is being fueled by consumer demand for enhanced driving experiences and seamless connectivity.

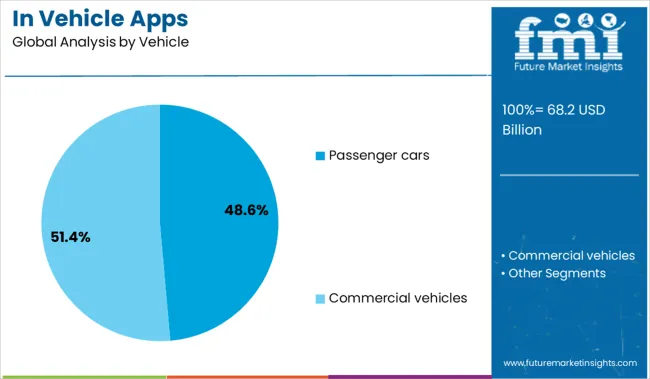

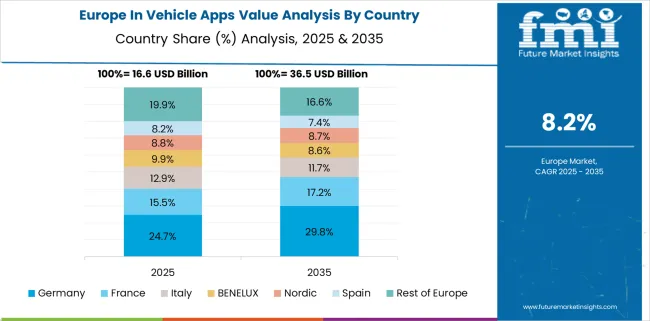

Passenger cars dominate the market with 48.6% share in 2025, supported by the surge in connected features like navigation, entertainment streaming, and real-time diagnostics. North America leads the market, driven by rapid adoption of automotive software ecosystems and partnerships between OEMs and tech companies. Asia-Pacific is the fastest-growing region, boosted by rising automotive production in China, Japan, and India, coupled with government-led smart mobility initiatives. Europe remains a key contributor through strong demand for premium vehicles and compliance with digital safety regulations.

| Metric | Value |

|---|---|

| In Vehicle Apps Market Estimated Value in (2025E) | USD 68.2 billion |

| In Vehicle Apps Market Forecast Value in (2035F) | USD 160.0 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The In Vehicle Apps Market market is expanding rapidly as consumer demand increases for connected mobility, personalized infotainment, and seamless smartphone integration within vehicles. Automakers are prioritizing app ecosystems that enhance driver experience, safety, and convenience through real time navigation, voice assistance, and smart diagnostics.

Advancements in 5G connectivity, vehicle-to-everything communication, and cloud-based telematics are enabling more dynamic and feature-rich applications across various vehicle segments. Original equipment manufacturers are partnering with technology providers to create proprietary platforms while also supporting popular operating systems for wider accessibility.

Regulatory developments supporting digital safety, remote software updates, and reduced driver distraction are further shaping the ecosystem. The market outlook remains optimistic as vehicles continue to evolve into connected digital hubs with increasing integration of entertainment, automation, and personalized driving interfaces.

The vehicle apps market is segmented by vehicle type, operating system, connectivity technology, app category, and region. By vehicle type, it includes passenger cars such as sedans, hatchbacks, and SUVs, as well as commercial vehicles categorized into light-duty, medium-duty, and heavy-duty classes. In terms of operating systems, the segmentation comprises iOS, Android, Windows, and others, addressing compatibility across platforms. Based on connectivity technology, it is divided into embedded, tethered, and integrated solutions for seamless in-vehicle connectivity.

By app category, the market encompasses infotainment apps, navigation apps, telematics apps, safety apps, communication apps, vehicle control apps, and others, supporting enhanced driving experience and vehicle performance. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The passenger cars segment is expected to account for 48.60 percent of total market revenue by 2025 within the vehicle category, making it the leading contributor. This leadership is driven by mass consumer adoption of smartphones and demand for real time in vehicle features such as streaming, navigation, and voice enabled controls.

Higher production volumes and rapid integration of infotainment systems in mid range and premium passenger vehicles have reinforced this dominance. Manufacturers have been focusing on software defined architectures, enabling app updates and feature enhancements through cloud connectivity.

The growing consumer preference for connected lifestyles and enhanced user experience has further strengthened the passenger cars segment's position as the primary platform for in vehicle app deployment.

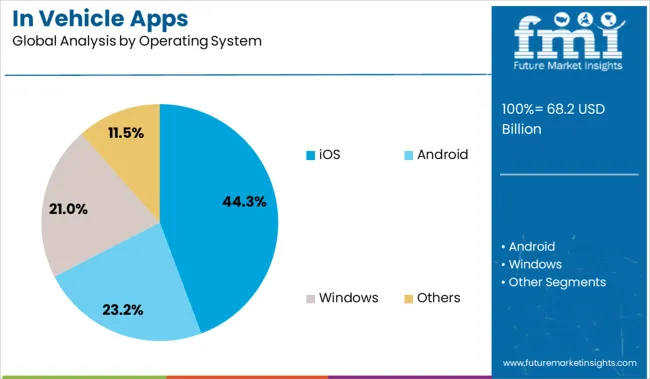

The iOS segment is projected to hold 44.30 percent of market revenue by 2025 under the operating system category, establishing it as the dominant platform. The seamless integration of iOS with Apple CarPlay, user interface consistency, and high brand loyalty among iPhone users have been central to its market leadership.

Automakers have widely adopted compatibility with iOS due to its stable ecosystem and strong consumer base in developed markets. The operating system supports features such as voice navigation, smart assistant access, and third party app usage in a vehicle safe format.

Additionally, regular system updates and a secure environment make iOS a preferred choice for both consumers and automotive developers, contributing to its substantial share in the In Vehicle Apps Market market.

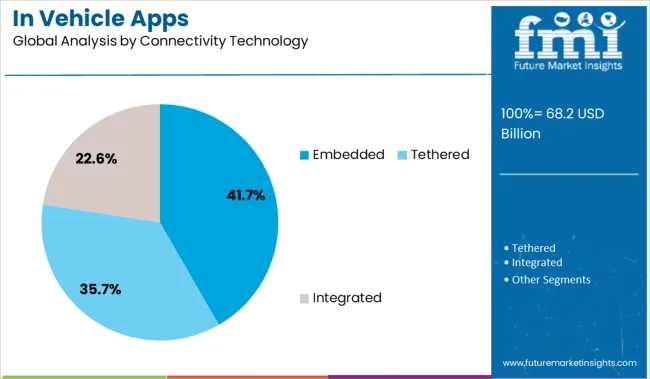

The embedded connectivity segment is expected to account for 41.70 percent of total revenue in 2025 under the connectivity technology category, positioning it as the leading segment. This growth is being driven by the increasing demand for always on connected services such as emergency response, vehicle tracking, and over the air updates.

Embedded systems offer superior integration, enhanced security, and reduced dependency on external devices compared to tethered or integrated smartphone solutions. Automakers are increasingly adopting embedded modules to comply with safety regulations and deliver a consistent connected experience regardless of device ownership.

As vehicles evolve into software defined platforms, embedded connectivity is becoming a core component of digital infrastructure, reinforcing its leading position in the market.

Passenger cars represented around 75 % of the installed base by 2023, while infotainment accounted for 40-45 % of total app usage. North America led with a 40 % revenue share, while Asia-Pacific posted the fastest growth. App categories span navigation, streaming, diagnostics, and vehicle management, with native and smartphone-integrated platforms both contributing to deployment across electric and connected vehicles.

Automakers continue embedding app ecosystems within onboard platforms to support real-time interaction and content access. In 2024 and 2025, over 85 % of new electric vehicle platforms included in-dash app stores or native frameworks. Android-based systems accounted for nearly 50 % of platform share, facilitating deployment of maps, voice assistants, and media services.

CarPlay and Android Auto remained active across 65-70% of mid-tier and compact segment vehicles. Automated software updates now trigger 20-25% of feature upgrades. OEMs are building usage-based revenue through premium app bundles, subscription tiers, and data-linked customization, particularly in ride-sharing and fleet telematics channels where adoption is tracking above 30%.

Data handling inconsistencies, cybersecurity gaps, and integration delays continue to limit uniform rollout. In 2024, more than 60% of Android Automotive systems lacked standard encryption protocols, raising exposure risk. Firmware mismatches delayed 18-24% of software rollouts across multi-brand fleets.

Fragmentation across infotainment units added 15% to total app development time. Privacy dashboards remain underused, while user opt-out rates for data collection climbed to 27% in pilot EV cohorts. Consent fatigue from repeated permissions and location prompts reduced engagement in over 30% of test groups. Monetization plans tied to ads, in-app purchases, or behavioral analytics now face pushback across core vehicle segments, leading to strategic halts in some OEM integrations.

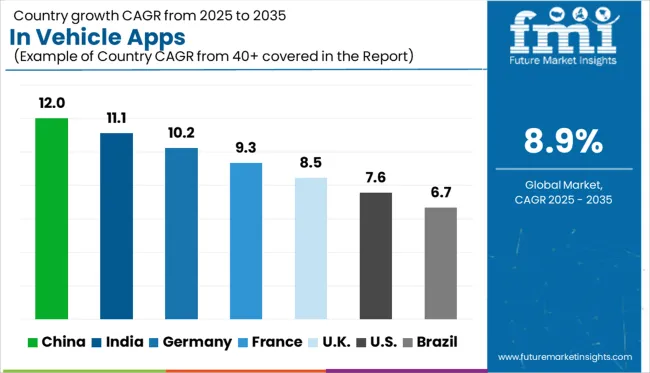

| Countries | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The global in-vehicle apps market is projected to grow at a CAGR of 8.9% between 2025 and 2035. China (BRICS) leads with a growth rate of 12.0%, outperforming the global average by 3.1 percentage points, supported by widespread connected car adoption and domestic innovation in infotainment and navigation systems.

India (BRICS) follows at 11.1% (+2.2 pp), driven by growing demand for digital driving assistance and in-car entertainment features. In the OECD region, Germany reports 10.2% (+1.3 pp), backed by strong automotive OEMs integrating proprietary and third-party app ecosystems. France posts 9.3% (+0.4 pp), maintaining a steady pace of growth aligned with EU digital mobility goals.

The UK records 8.5%, just 0.4 pp below the global average, suggesting a slightly slower adoption curve amid regulatory shifts and evolving data privacy frameworks. The report features insights from 40+ countries, with the top five shown below.

China shows a 12.0% growth rate in the in-vehicle apps market, ahead of the assumed global rate of 10.2%. App installations are being driven by domestic EV brands pushing infotainment bundles linked to ride navigation, payment systems, and passenger entertainment.

High-volume production of screen-integrated dashboards supports direct app embedding at the assembly line. Automakers are offering over-the-air update platforms for real-time app scaling, linked to vehicle location and performance data. Subscription-based apps for driver analytics are gaining traction in commercial fleets.

India posts an 11.1% growth rate in the in-vehicle apps sector, slightly above the global average of 10.2%. Usage expansion is centered around telematics integration in compact SUVs and mid-range sedans. App stores linked to navigation, audio control, and driver fatigue alerts are being deployed in vehicles under ₹15 lakhs. Vehicle tracking apps dominate in commercial vehicles used for logistics and school transport. Automakers are working with regional language developers to enable app compatibility for multilingual voice commands.

Germany registers a 10.2% growth rate in the in-vehicle apps market, matching the estimated global average. Luxury carmakers are leading adoption through in-house app ecosystems focused on navigation, service diagnostics, and EV route planning. App compatibility with third-party smart devices is now required by regulators to ensure digital continuity. Car-to-cloud syncing is supported by embedded 5G modems, which have become standard in most premium models. Software packages are tailored by trim level to maintain customer tiering.

France shows a 9.3% growth rate in the in-vehicle apps market, slightly below the global rate of 10.2%. Local automakers are developing proprietary app platforms that sync driving behavior to energy consumption, especially for hybrid vehicles. Compatibility with European Union digital infrastructure rules has delayed some cross-border app integration. Software modules for eco-driving scores and insurance-linked metrics are being rolled out in urban fleets. App permissions are subject to stringent consent protocols under GDPR compliance.

United Kingdom reports an 8.5% growth rate in the in-vehicle apps market, lower than the global average of 10.2%. App usage is clustered in navigation, EV charging station locators, and predictive maintenance schedules. Car buyers are opting for app suites that sync with public transport schedules to extend multimodal journey planning. Subscription fatigue is limiting app uptake in entry-level models, where only essential utilities are bundled. Electric vehicle drivers are engaging more with apps tied to charger availability and billing.

In-vehicle applications continue to transform the connected mobility landscape in 2025 as automakers and technology firms intensify competition to deliver immersive digital driving experiences. Alcatel-Lucent leads with a 26.5% market share, leveraging expertise in embedded software and robust data integration for next-generation infotainment ecosystems. Apple, Google, and Microsoft sustain dominance through CarPlay, Android Auto, and embedded service layers, particularly in electric and premium vehicle segments where seamless connectivity remains a key differentiator. Major OEMs, including Tesla, Toyota, Ford, Hyundai, and General Motors, are strengthening proprietary app ecosystems centered on predictive navigation, real-time diagnostics, and advanced voice control to boost driver engagement.

Tier-1 suppliers such as Harman International, Continental, and Robert Bosch are advancing integrated Human-Machine Interface (HMI) solutions and adaptive connectivity frameworks, reducing latency and enhancing personalization. Semiconductor leaders like Nvidia, NXP Semiconductors, and Renesas Electronics deliver high-performance chipsets enabling ultra-low latency, AI-driven graphics, and real-time sensor fusion for AR-based interfaces. The market trajectory is heavily influenced by evolving data privacy regulations, increasing demand for personalized UX design, and rising consumer expectations for OTA updates and ecosystem interoperability.

Key Developments in the In Vehicle Apps Market

| Item | Value |

|---|---|

| Quantitative Units | USD 68.2 Billion |

| Vehicle | Passenger cars, Sedans, Hatchbacks, SUV, Commercial vehicles, Light duty, Medium duty, and Heavy duty |

| Operating System | iOS, Android, Windows, and Others |

| Connectivity Technology | Embedded, Tethered, and Integrated |

| App | Infotainment apps, Navigation apps, Telematics apps, Safety apps, Communication apps, Vehicle control apps, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alcatel-Lucent, Apple, Audi, Continental, Elektrobit Automotive, Ford Motor Company, Garmin, General Motors, Google, Harman International Industries, Hyundai Motor Company, Microsoft, Nvidia, NXP Semiconductors, Renesas Electronics, Robert Bosch, Siemens, Tesla, TomTom, and Toyota Motor |

| Additional Attributes | Dollar sales by app category and vehicle connectivity level, growing integration in infotainment and navigation systems, stable usage across diagnostics and fleet management platforms, advancements in over-the-air updates and voice interfaces enhance user engagement and feature scalability |

The global in vehicle apps market is estimated to be valued at USD 68.2 billion in 2025.

The market size for the in vehicle apps market is projected to reach USD 160.0 billion by 2035.

The in vehicle apps market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in in vehicle apps market are passenger cars, sedans, hatchbacks, suv, commercial vehicles, light duty, medium duty and heavy duty.

In terms of operating system, ios segment to command 44.3% share in the in vehicle apps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Invar Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Road Test Instruments Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Driving Technology Solution Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

Infertility Treatment Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Interactive Whiteboard Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Instruments for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Injectable Osteoarthritis Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA