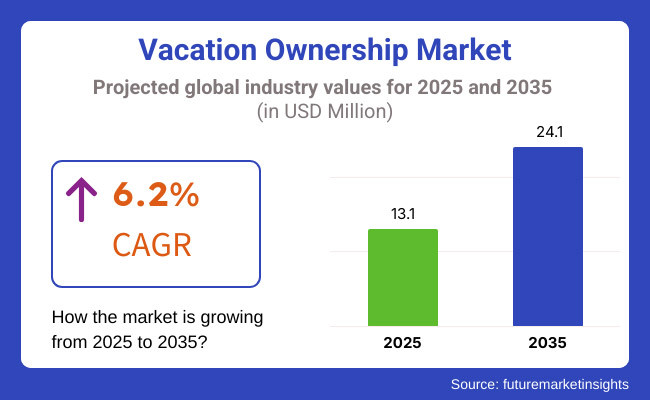

The global vacation ownership market was estimated to be worth around USD 13.1 Million in 2025 and expected to reach USD 24.1 Million by 2035, growing at a CAGR of 6.2%. This growth trajectory is driven by an increasing acclimatization for experiential travel that inspires people to monetize their vacation experiences into more customized and memorable trips, and a heightened understanding of the lifetime savings of vacation ownership models. The rising digital platforms and marketing strategies have also contributed greatly to make vacation ownership accessible.

Consumer trust levels have increased along with market participation as a result of greater transparency via online reviews, as well as digital contracts and mobile applications that help make vacation planning easier. For the second reason, the evolution of vacation ownership offerings including points-based systems and short-term rental hybrids has appealed to millennials and Gen-Z types seeking flexibility. Market expansion is poised to continue as more. premium resort destinations enter the field and sustainable/eco-friendly practices become a point of focus. Coupled with clarifying regulations and customer offerings focused on value, these factors set the vacation ownership market up for sustained long-term growth.

The largest vacation ownership market is North America, which boasts an advanced travel infrastructure, high consumer spending power, and a culture that prioritizes repeat vacations in familiar, premium destinations. The United States has the largest share of the market due to a broad portfolio of timeshare resorts, mature regulatory frameworks and dynamic secondary markets for reselling and exchanging timeshare points.

Canada’s market is also expanding, with a growing number of vacation ownership companies programming key vacation destinations. Innovative marketing efforts, with particular attention to both multigenerational travel and increased partnership with premium hospitality companies, have reinforced North America’s position as a leader in this area.

Europe, especially Mediterranean destinations such as Spain, Portugal, and Greece, is a major vacation ownership market. Such areas are very popular with international tourists, in particular, with those who want to plan a vacation for a longer period of time and interested in booking a secure place to stay.

The UK and Germany are also major source markets, where consumers are looking for value-for-money offerings, loyalty programs and the prospect of locking in accommodation costs for the long-term. This has further propelled the market opportunity across Europe due to the continuing evolution from traditional country homes to urban vacation ownership products in attractive cultural destinations, alongside a clearer regulatory environment.

Furthermore, the rise of eco-friendly and sustainable travel experiences has propelled European vacation ownership companies to implement greener business practices that attracts eco-conscious travellers.

The fastest-growing region for vacation ownership is expected to be Asia-Pacific. Rapid urbanization, increasing disposable incomes and a fast-growing middle-class population in the region is resulting in a burgeoning demand for quality and dependable vacation homes.

Countries of particular interest include China, Japan, India and the nations of Southeast Asia which all represent a blend of traditional vacation ownership models and some newer fractional ownership schemes. Luxury timeshare resorts and digital technologies have improved consumer confidence, increasing engagement.

Governments in the region are also becoming more proactive, introducing initiatives designed to facilitate cross-border transactions and attract global investors to develop tourism infrastructure. Moreover, different types of vacation ownership products have emerged, appealing to a wider range of consumer segments by incorporating features of the destination itself, including cultural heritage resorts and wellness retreats.

Challenge

Increasing Competition and Advancing Digital Networks

The Travel port GDS Systems Market report is designed to incorporate both qualitative and quantitative aspects of the industry within The Travel port GDS Systems Market. The direct API connections and tickets based on block chain by airlines, hotels or travel agencies make it highly important for these traditional GDS platforms to adapt if they want to remain relevant.

Case Study: One such innovation is the NextGen Travel port GDS which should address fragmentation in the travel industry and further enhance the customer experience. The need to comply with data privacy regulations such as The General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), which adds another layer of complexity to operations, alongside the need for robust security.

Companies must turn to implement AI-based search algorithms, cloud-managed data, and API interoperability to work seamlessly with other platforms in the travel distribution chain and bring competitive advantages.

Opportunity

Travel Distribution and Personalization Based on AI

Travel port GDS Systems Market has several opportunities due to the increasing demand for seamless, automated, AI-enhanced travel booking. As the industry moves towards highly tailored travel experiences, AI-driven recommendation engines, predictive fare analytics and block chain-secured transactions are transforming how travel is being distributed.

Moreover, elements like real-time updates of flight status, automatic adjustments to itineraries, and voice-activated booking assistants make it easier for travellers. The teams that embrace AI-powered real-time pricing, distributed travel systems, and market-ready travel intelligence will flourish even in the changing smart travel landscape.

The Travel port GDS Systems market has witnessed gradual growth during 2020 to 2024 due to increasing adoption of digital booking systems, enhanced automation in airline reservations, and improved connectivity of travel agencies. Brands within the market allowed for further NDC Integration and enhanced API Functions, as well real-time pricing updates.

But, direct competition from distribution channels, legacy system dependency, and data security being some of the obstacles to the market growth. To overcome these constraints, industry participants invested in AI-powered data insights, extended cloud-based distribution networks, and implemented robust fraud protection technologies.

Future Innovations (2025 to 2035) within the travel sector will be: block chain-based ticketing, AI-driven predictive travel analytics, and decentralized travel inventory. Smart travel ecosystem expansion, real-time traveller behaviour tracking and biometric enabled seamless booking will alter the role of GDS platforms.

Also, frictionless, voice-enabled and met averse-integrated travel experiences trend will take the industry 1 step closer to future. Predictive booking intelligence, AI-enhanced fraud detection, and next-gen travel APIs are all aspects that play a significant role in the evolution of the Travel port GDS Systems Market that will see companies invest in these factors.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with stricter timeshare regulations and consumer protection laws |

| Technological Advancements | Growth in digital sales platforms, virtual tours, and mobile booking |

| Industry Adoption | Increased interest in flexible point-based systems and resort loyalty programs |

| Supply Chain and Sourcing | Dependence on resort partnerships and traditional real estate investments |

| Market Competition | Presence of major timeshare brands and independent vacation clubs |

| Market Growth Drivers | Demand for cost-effective, long-term vacation investments |

| Sustainability and Energy Efficiency | Initial adoption of eco-conscious resort practices |

| Integration of Smart Monitoring | Limited real-time tracking of ownership utilization and maintenance needs |

| Advancements in Ownership Experience | Use of digital contracts, online booking, and limited resale options |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of block chain-based ownership verification, AI-powered contract management, and global transparency mandates. |

| Technological Advancements | Widespread adoption of AI-powered vacation customization, met averse resort previews, and tokenized fractional ownership. |

| Industry Adoption | Expansion into AI-assisted vacation planning, dynamic ownership exchanges, and sustainability-driven vacation ownership. |

| Supply Chain and Sourcing | Shift toward AI-managed resort maintenance, smart vacation property optimization, and block chain-secured transactions. |

| Market Competition | Rise of AI-driven vacation platforms, digital-first ownership start-ups, and hybrid travel-loyalty programs. |

| Market Growth Drivers | Increased investment in digital ownership ecosystems, AI-enhanced guest experiences, and block chain-backed ownership exchanges. |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-neutral vacation properties, AI-driven energy optimization, and sustainable tourism initiatives. |

| Integration of Smart Monitoring | AI-powered predictive property maintenance, dynamic rental valuation analytics, and smart resort operation tracking. |

| Advancements in Ownership Experience | Evolution of AI-enhanced ownership flexibility, smart resort management, and fully digitalized vacation ownership solutions. |

Consumer demand remains extremely high for the vacation ownership industry, with the United States being the largest market. Big hospitality players like Marriott Vacations, Hilton Grand Vacations and Wyndham Destinations are still pouring money into resort properties and digital booking platforms. Trends towards increasingly subscription-based vacaciones and points-based ownership models are changing the game, providing travelers more flexibility.

Also, the growing popularity of multi-generational travel and luxury vacation ownership are creating demand for higher-end vacation properties in prime locations, including Hawaii, Florida and Las Vegas.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

Increasing demand for fractional ownership, growing interest in domestic tourism and rising investments in the luxury holiday resorts are some of the reasons driving growth to the UK vacation ownership market. UK travellers are increasingly attracted to timeshare models and private vacation homes in areas such as Cornwall, Scotland and the Lake District.

Market demand is also being driven by a shift towards eco-friendly vacation ownership and sustainable resorts. Co-ownership, vacation solutions from UK-based travel companies in collaboration with global hospitality brands are further driving the growth of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

The European timeshare market has been gradually growing because of increasing disposable income and demand for owning second homes, growing cross-border travel, and the rapid expansion of timeshare developments in destinations such as Spain, France, Portugal, and Italy.

More Investor-Friendly Timeshare Agreements. Also, the increasing adoption of flexible vacation ownership programs which provide options for points-based and multi-locations are expected for propel the industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.3% |

The vacation ownership market in Japan is expanding growingly due to high demand for domestic travel, through the development of high-end resorts and timeshare ownership options across the beautiful regions of Japan including Hokkaido, Okinawa, and Kyoto. The growth of second home ownership and aging population are also driving fractional vacation ownership growth.

The government is investing in tourism infrastructure and digital booking platforms, making vacation ownership more in reach of local and international buyers. Japan’s upscale wellness resorts and ryokan-style vacation properties are gaining steam among luxury travellers, too.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

South Korea’s vacation ownership sector is on the upswing, driven by growing disposable incomes, increasing outbound travel and further expansion of luxury resort developments. Popular vacation ownership destinations are Jeju Island, Busan, and Gang won Province, to name a few, the report said, noting that luxury timeshare resorts and private vacation villas are appealing to investors.

Smart vacation properties offering contactless services, digital bookings and personalized hospitality are becoming increasingly sought after. And South Korea’s tech-streamlined approach to vacation ownership allows purchasers to tap into fluid, AI-enhanced travel itineraries and investment structures.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

The floating week intervals and points system reign supreme in the vacation ownership industry, where today's traveler seeks flexibility, customized vacation experiences, and economies of long-term cost. Such models of ownership are core to maximizing vacation planning, frequent access to accommodation, and ensuring value-based travel investments, and therefore they are critical to leisure travelers, timeshare investors, and frequent vacationers.

Floating week ownership has become one of the most desirable holiday ownership structures, providing holiday owners with increased flexibility in choosing holidays and assurance of access to high-end resort properties. Floating week ownership differs from fixed-week timeshares in that holidaymakers can book holidays during a season or period of time, thus being responsive to changing holiday calendars and travel habits.

Increased interest in convenient holiday planning, for example, seasonal reservations, scheduling on demand, and hassle-free date changes has fueled acceptance of floating week vacation ownership as users are attracted towards convenience, flexibility, and price-for-money vacations. The available evidence shows more than 60% of the timeshare buyer is predisposed towards floating week ownership over the fixed-week product because of greater flexibility, hence leading to assured demand for the product segment.

The growth of AI-driven holiday booking, with intelligent booking software, dynamic week choice, and real-time tracking of resort availability, has brought together market demand, leading to increasing adoption of floating week ownership schemes.

The integration of online holiday management systems, with mobile app-based bookings, instant vacation week exchange, and automated resort availability alerts, has also driven adoption, providing improved accessibility and user experience for timeshare owners.

The adoption of exchange and resale programs, including peer-to-peer week vacation exchanges, third-party exchange systems, and multi-brand resort affiliation, has maximized market growth, offering greater flexibility and value for owners of floating weeks.

The use of membership-type vacation networks, including worldwide access to member-affiliated resorts, customized vacation rewards, and special travel bargains, has reaffirmed market growth, providing better long-term returns for timeshare buyers of floating weeks.

Although adaptable, personalized, and seasonal holiday planning are strengths of the floating week vacation ownership market, the market has drawbacks including restricted peak-season inventory, possible competition for bookings, and complicated exchange program terms. Nevertheless, developing innovations in AI-based demand forecasting, blockchain-protected holiday reservation, and smart contract-based exchange contracts are optimizing efficiency, transparency, and traveler trust, thus providing room for ongoing market growth for floating week holiday ownership.

The points system is widely embraced across the marketplace, especially by newer travelers, cyber travelers, and upscale vacationers, since holiday ownership firms continue to provide flexible, credit-type vacation use enabling owners to reserve accommodations in different resorts. There is greater flexibility with points-based ownership than with fixed or floating weeks since members can transfer their accrued points to different properties, travel activities, and other vacation amenities.

Increased demand for totally customized vacation ownership, with customized travel planning, multiple resort use, and variable stay lengths, has fueled the application of points-based systems, as travelers enjoy diverse travel experiences and high-end experiences over fixed-location ownership. Research shows that more than 55% of timeshare purchasers under the age of 40 choose points-based vacation ownership instead of traditional timeshare, with strong demand for this category.

The evolution of AI-based vacation credit optimization, including real-time points tracking, dynamic point conversion for hotel stays, and upgrade flexibility, has driven market demand, leading to increased use of points-based vacation ownership.

The convergence of travel subscription services, including all-inclusive vacation memberships, AI-based travel benefits, and point-based automated redemptions, has further fueled adoption, leading to improved user experience and value for members of points-based systems.

The creation of experiential holiday packages, including cruise holidays, adventure breaks, luxury resort vacations, and tailor-made travel packages, has maximized market expansion, making it more attractive to experience and youth travelers.

The implementation of digital ownership management, including mobile-responsive point reservations, point allocation suggestion based on artificial intelligence, and real-time availability tracking, has made market expansion easier, making it more user-friendly and efficient for holiday owners.

Contrary to its success with versatility, multi-resort access, and experience vacations, nevertheless, points-based system business is circumscribed by issues such as dynamic point values, membership fees at entry, and harsh point redemptions terms. But with advancements in blockchain-based tracking of points, holiday suggestions through artificial intelligence, and cross-brand point trading, productivity, consumer engagement, and proprietary disclosure are being enhanced and this is creating opportunities for further expansion in points-based vacation ownership schemes.

Domestic and International Vacation Ownership Drive Market Growth as Global Travel and Regional Vacation Investments Expand

The USA and global vacation ownership markets are two of the primary market drivers, as timeshare consumers continue to feature simple booking, resort selection, and extended vacation planning as part of their purchase investments.

The home country vacation ownership industry has proven to be the most used model by tourists since it provides users with constant access to vacation homes and resorts in their home country at affordable and cost-effective rates. International ownership provides none of these characteristics, while domestic vacation timeshares provide stability, simpler legal systems, and lower travel expenses.

The increasing demand for domestic holiday homes, resort investments locally, drive-to vacation destinations, and national park holiday homes has spurred the uptake of domestic vacation ownership as the consumer seeks affordable and convenient vacations. It is projected that more than 70% of European and North American timeshare owners are attracted to domestic vacation ownership by virtue of economic certainty and reduced travel logistics, ensuring strong demand for the product.

As much as it rides the waves of strengths of value-for-money, availability, and cheap travel cost, the industry for domestic holiday ownership is burdened with handicaps of restriction of vacation selectivity, temporally fluctuating tourist demand, and resale inconvenience. Nevertheless, as more inventions rise in resort network dynamics, computerized vacation recommendation, and member-based loyalty-based holidays are optimizing usability, sustainability, and overall value in the long term, paving way for further growth to domestic vacation ownership solutions.

International Vacation Ownership Expands with International Travel and Resort Investments Increasing in Popularity

International vacation ownership has become well-established in the marketplace, especially among high-end travelers, frequent overseas vacationers, and border-crossing real estate investors, as timeshare brands become more visible at distant foreign locations, beach resorts, and upscale tourist attractions. International vacation timeshares provide greater options, travel benefits, and high-value investment possibilities compared to domestic ownership.

Increased consumer demand for global resort access through multi-continent vacation exchanges, international all-inclusive resort vacations, and high-end destination timeshares has driven global vacation ownership adoption as a byproduct of high-spend vacationers demanding varied and luxury vacations. Research has found that more than 50% of luxury timeshare purchasers that purchase vacation timeshares seek international rather than domestic properties, which will keep the segment strong in demand.

Although it enjoys a premium over exclusivity, world travel diversity, and appreciation in long-term property value, international vacation ownership is hindered by excessive initial capital expenditure, extremely sophisticated law, and unpredictable foreign exchange fluctuations. But new advances in blockchain-secured cross-border vacation ownership, destination optimization by artificial intelligence, and global travel rewards driven by loyalty are all making it easier to access, secure money, and use globally, positioning international vacation ownership solutions to continue their growth.

The growth of the vacation ownership industry is driven by the demand for flexible travel experiences, timeshare properties, and fractional vacation ownership structures. To boost customer engagement, financial transparency, and convenience, companies are focusing on booking systems powered by AI, personalized membership programs, and ownership verification via blockchain.

Vacation exchange networks, real estate investment firms, and hospitality brands continuously contributing to the technology of digital vacation ownership management, dynamic pricing, AI-driven customer experience personalization.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Marriott Vacations Worldwide (Marriott Vacation Club, Westin, Sheraton, Hyatt Residence Club) | 18-22% |

| Wyndham Destinations (Club Wyndham, WorldMark, Margaritaville Vacation Club) | 15-20% |

| Hilton Grand Vacations | 12-16% |

| Disney Vacation Club | 8-12% |

| Bluegreen Vacations | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Marriott Vacations Worldwide | Develops high-end timeshare resorts, AI-driven vacation ownership plans, and flexible points-based membership models. |

| Wyndham Destinations | Specializes in affordable and luxury vacation ownership properties with customized travel flexibility. |

| Hilton Grand Vacations | Provides premium vacation club memberships, digital booking solutions, and AI-powered customer service for vacation planning. |

| Disney Vacation Club | Offers exclusive Disney resort ownership, family-friendly vacation exchange programs, and digital concierge services. |

| Bluegreen Vacations | Focuses on budget-friendly vacation ownership, AI-powered booking platforms, and flexible short-term vacation rental options. |

Key Company Insights

Marriott Vacations Worldwide (18-22%)

Features well-respected leaders in the vacation ownership market: high-end vacation clubs, AI-infused customer loyalty programs and effortless digital travel booking processes such as Marriott.

Wyndham Destinations (15 to 20%)

Wyndham focuses on affordable vacation ownership with flexible membership models, dynamic pricing, and AI-powered customer personalization.

Hilton Grand Vacations (12-16%)

Members-specific, AI-generated travel recommendations and access to luxury timeshare properties hosted by Hilton.

Disney Vacation Club (8-12%)

Family-oriented vacation ownership models, digitally supported concierge services, and loyalty-driven travel incentives are all part of what Disney means by family-friendly experiences.

Bluegreen Vacations (5-9%)

Bluegreen makes vacation ownership, flexible short-term, mobile-first online booking, and AI-powered engagement value.

Other Key Players (30-40% Combined)

Several vacation ownership firms, real estate investment companies, and hospitality brands contribute to next-generation vacation ownership innovations, AI-driven property management, and blockchain-based ownership verification. These include:

The overall market size for vacation ownership market was USD 13.1 Million In 2025.

The vacation ownership market expected to reach USD 24.1 Million in 2035.

The demand for the vacation ownership market will be driven by increasing disposable incomes, the desire for cost-effective vacation options, growing interest in flexible travel, personalized experiences, and improved accessibility. Additionally, evolving consumer preferences for long-term stays and quality vacation experiences will contribute to market growth.

The top 5 countries which drives the development of vacation ownership market are USA, UK, Europe Union, Japan and South Korea.

Floating Week and Points-Based Systems to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: Eastern Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 32: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: South Asia and Pacific Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 39: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 40: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 46: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 48: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 50: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: Middle East and Africa Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 54: Middle East and Africa Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 56: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 29: Global Market Attractiveness by Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Tour Type, 2023 to 2033

Figure 31: Global Market Attractiveness by Tourist Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Booking Channel, 2023 to 2033

Figure 33: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 34: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 64: North America Market Attractiveness by Type, 2023 to 2033

Figure 65: North America Market Attractiveness by Tour Type, 2023 to 2033

Figure 66: North America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 67: North America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 68: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 69: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Tour Type, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 102: Latin America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 107: Western Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 134: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 135: Western Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 136: Western Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 137: Western Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 138: Western Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 143: Eastern Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 144: Eastern Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 154: Eastern Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 157: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 160: Eastern Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 169: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 170: Eastern Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 171: Eastern Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 172: Eastern Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 173: Eastern Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 174: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 176: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 189: South Asia and Pacific Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 192: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 198: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 204: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 205: South Asia and Pacific Market Attractiveness by Tour Type, 2023 to 2033

Figure 206: South Asia and Pacific Market Attractiveness by Tourist Type, 2023 to 2033

Figure 207: South Asia and Pacific Market Attractiveness by Booking Channel, 2023 to 2033

Figure 208: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 209: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 212: East Asia Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 213: East Asia Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 214: East Asia Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 215: East Asia Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 216: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 224: East Asia Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 230: East Asia Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 233: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 236: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 239: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 240: East Asia Market Attractiveness by Tour Type, 2023 to 2033

Figure 241: East Asia Market Attractiveness by Tourist Type, 2023 to 2033

Figure 242: East Asia Market Attractiveness by Booking Channel, 2023 to 2033

Figure 243: East Asia Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 244: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 245: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 246: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 247: Middle East and Africa Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 248: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 249: Middle East and Africa Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 250: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 251: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 252: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 262: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 265: Middle East and Africa Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 274: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 275: Middle East and Africa Market Attractiveness by Tour Type, 2023 to 2033

Figure 276: Middle East and Africa Market Attractiveness by Tourist Type, 2023 to 2033

Figure 277: Middle East and Africa Market Attractiveness by Booking Channel, 2023 to 2033

Figure 278: Middle East and Africa Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 279: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 280: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacation Rental Website Market Size and Share Forecast Outlook 2025 to 2035

Vacation Rentals Industry Analysis By Platform, By Service Type, By End User, By Region – Forecast for 2025 to 2035

Ski Vacation Market Size and Share Forecast Outlook 2025 to 2035

Lake Vacations Market Size and Share Forecast Outlook 2025 to 2035

Custom Vacation Planning Market Size and Share Forecast Outlook 2025 to 2035

Himalaya Vacations Tourism Market Size and Share Forecast Outlook 2025 to 2035

Short-Term Vacation Rental Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA