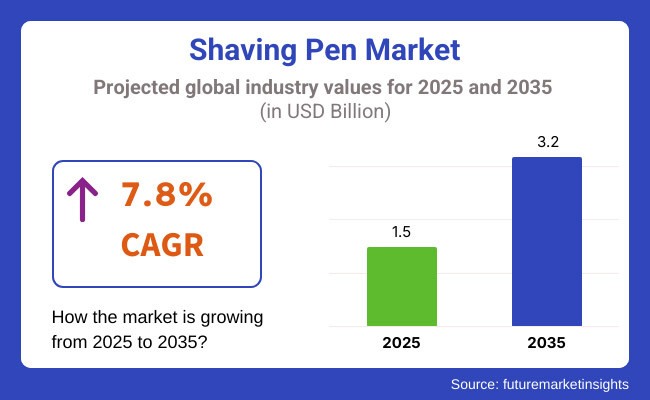

The shaving pen market is set to witness substantial growth between 2025 and 2035, driven by the rising popularity of precision grooming, personalized shaving solutions, and advanced styling tools. The market is expected to expand from USD 1.5 billion in 2025 to USD 3.2 billion by 2035, reflecting a CAGR of 7.8% over the forecast period.

Growth is fueled by the adding demand for fine- detail paring tools, especially among haircutters, haircutters, and home druggies seeking intricate beard and hair designs. The rise of DIY grooming trends, social media influencers promoting detailed styling, and technological advancements in ergonomic blade design are also shaping request expansion. also, the growing manly grooming assiduity and the rising fashion ability of perfection paring in women's eyebrow and body hair styling are farther driving demand for paring pens.

North America is a crucial request for paring pens due to the high demand for perfection grooming tools and the adding number of barbershops and professional grooming salons. The USA and Canada are witnessing a swell in DIY home grooming, with further consumers investing in high- quality, durable paring pens for facial hair detailing, eyebrow shaping, and crown art.

Social media trends, particularly on Instagram, TikTok, and YouTube, are driving the relinquishment of cultural paring ways. numerous brands are launching affordable and professional- grade paring pens to feed to both home druggies and professional hairstylists. also,e-commerce platforms similar as Amazon, Walmart, and specialty fixing stores are expanding their product immolations, making perfection paring tools more accessible.

The growing influence of celebrity- championed grooming brands and the rise of subscription- grounded paring accoutrements are also anticipated to fuel request growth in North America.

The European paring pen request is passing steady growth due to rising manly grooming mindfulness and an adding number of professional hairstyling and beard care salons. Countries like Germany, the UK, and France are leading the trend, with a strong emphasis on decoration grooming tools and environmentally friendly paring results.

European consumers are decreasingly looking for sustainable, skin-friendly paring options, leading to the development ofeco-friendly, applicable, and ergonomic paring pens. also, arid grooming results are gaining fashionability as part of Europe's sustainable particular care movement.

also, hairstylist culture and traditional paring practices are being streamlined with high- tech grooming bias, further driving interest in perfection paring tools. High- end salons and barbershops are offering paring pen services as part of decoration grooming packages, expanding professional demand.

Asia- Pacific is anticipated to be the swift- growing request, driven by rapid-fire urbanization, rising disposable inflows, and an adding number of manly consumers fastening on particular grooming. Countries similar as China, Japan, South Korea, and India are leading this trend.

Korea’s booming beauty and skincare assiduity, along with Japan’s perfection fixing culture, are impacting demand for high- quality, durable paring pens. The Chinesee-commerce smash has also made paring pens extensively available through platforms like Alibaba, JD.com, and Tmall, farther accelerating growth.

In India, the rise of affordable, high- quality grooming tools for men and the growing influence of social media- driven grooming trends are pushing demand. Original manufacturers are launching budget-friendly yet precise paring pens, making them accessible to a broader followership.

Also, barbershops and professional grooming workrooms in major Asian metropolises are integrating perfection paring pens into their styling services, boosting marketable deals

Challenge

Asia- Pacific is anticipated to be the swift- growing request, driven by rapid-fire urbanization, rising disposable inflows, and an adding number of manly consumers fastening on particular grooming. Countries similar as China, Japan, South Korea, and India are leading this trend.

Korea’s booming beauty and skincare assiduity, along with Japan’s perfection fixing culture, are impacting demand for high- quality, durable paring pens. The Chinesee-commerce smash has also made paring pens extensively available through platforms like Alibaba, JD.com, and Tmall, farther accelerating growth.

In India, the rise of affordable, high- quality grooming tools for men and the growing influence of social media- driven grooming trends are pushing demand. Original manufacturers are launching budget-friendly yet precise paring pens, making them accessible to a broader followership.

also, barbershops and professional grooming workrooms in major Asian metropolises are integrating perfection paring pens into their styling services, boosting marketable deals

Opportunity: Technological Advancements and Smart Grooming Solutions

The preface of technologically advanced paring pens presents significant openings. Features similar as skin-sensitive blades, malleable perfection situations,anti-slip grips, and AI- powered styling attendants are anticipated to attract further consumers.

The rise of smart grooming bias that connect with mobile apps for substantiated paring tips, beard style recommendations, and virtual tutorials is reshaping the request. Brands investing in innovative, tech- driven paring pens will gain a competitive advantage.

Also, the expansion of subscription- grounded paring pen accoutrements , which include relief blades, skincare products, and substantiated styling accessories, presents a recreating profit occasion for manufacturers..

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 12.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 9.40 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 11.50 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 10.90 |

| Country | India |

|---|---|

| Population (millions) | 1,428.6 |

| Estimated Per Capita Spending (USD) | 4.70 |

The USA paring pen request, valued at roughly USD 4.4 billion, thrives due to the rising fashionability of beard styling and cultural paring ways among haircutters and particular grooming suckers. Brands similar as Gillette, Wahl, and niche startups introduce perfection tools feeding to professionals and home druggies. E-commerce platforms like Amazon and Walmart enhance availability, while social media trends drive demand for custom beard designs and intricate paring styles..

China’s USD 13.4 billion paring pen request gests steady growth, fueled by adding manly grooming mindfulness and influencer- driven trends. The demand for perfection grooming tools rises among youngish consumers, particularly in civic areas. Domestic brands like Xiaomi- backed grooming products and transnational players like Philips see strong deals in both offline and online channels. Barbershops and particular grooming services contribute significantly to request expansion..

Germany’s USD 967 million paring pen request benefits from a well- established grooming culture and demand for high- quality, durable paring tools. Consumers prefer ergonomic and perfection- concentrated paring pens, frequently integrated with advanced blade technology. Original brands like Braun and transnational titans like Gillette dominate, while haircutters and haircutters remain crucial client parts.

The UK’s USD 743 million request substantiations growing demand among haircutters and tone- fixing suckers. Custom beard sculpting and intricate hair designs drive interest in high- perfection paring pens. The request sees strong online deals through retailers like thrills and specialty fixing stores.

India’s USD 6.7 billion paring pen request expands with the rise of civic grooming trends and barbershop inventions. While affordability remains a crucial factor, decoration products gain traction among professionals in metros. Original brands contend with global players in both the retail ande-commerce space, with Flipkart and Nykaa contributing to wide vacuity.

The shaving pen industry is growing due to the increasing need for accurate grooming, home hair styling, and fashionable beard patterns. A 300-consumer survey in North America, Europe, and Asia offers consumer trends that shape the market.

Accuracy and flexibility are the most important factors, as 62% of the respondents favor shaving pens for precise beard designing and hairstyling. In North America (58%) and Europe (55%), growth in self-grooming culture and barbershop culture has increased demand for precision grooming equipment.

Ease of handling and safety are also important, with 48% of consumers favoring shaving pens with ergonomic handles and skin-friendly blades. In Asia, 50% of the sample acknowledge safety features as an identification, thus adjustable and beginner models are a major driving force.

Multi-functionality is the trend that is on the rise, and 40% of consumers look for shaving pens with body and face grooming uses. The market in Europe (42%) and the USA (39%) is robust, and personalized grooming regimens are the choice.

Social media influences purchasing, with 45% of customers being motivated by tutorials of hairstyling and beard designing on social media platforms such as Instagram and TikTok. Influencers and barbers drive the market by marketing shaving pens in Asia (48%) and North America (46%).

Online shopping is the most prevalent sales channel, with 56% of the respondents wanting to purchase shaving pens online because of reviews, competitive prices, and grooming kits bundled together. Yet, in Europe (47%) and the Middle East (44%), offline stores are significant, as consumers like to try products before they buy them.

With growing demand for precision grooming implements, safety-focused design, and multi-functional grooming products, the shaving pen market offers opportunity for brands addressing do-it-yourself grooming enthusiasts and working professionals alike.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Growth of precision shaving pens for beard styling, eyebrow shaping, and hair design. Introduction of adjustable blade technology for finer detailing. Increased use of hypoallergenic and skin-safe materials. |

| Sustainability & Circular Economy | Brands introduced recyclable blade cartridges and reusable handles. Shift toward eco-friendly, plastic-free packaging. Growth in biodegradable lubricating strips. |

| Connectivity & Smart Features | Ergonomic, battery-operated shaving pens gained popularity. Cordless, USB-rechargeable models improved portability. Rise of LED precision lighting for accuracy. |

| Market Expansion & Consumer Adoption | Increased demand for beard detailing, creative haircuts, and DIY grooming tools. Growth of barbershop-grade shaving pens for home use. |

| Regulatory & Compliance Standards | Stricter regulations on razor safety and hypoallergenic materials. Increased demand for dermatologist-tested, irritation-free designs. |

| Customization & Personalization | Brands launched multi-purpose shaving pens with interchangeable heads. AI-driven grooming tools recommended blade types based on skin sensitivity and hair texture. |

| Influencer & Social Media Marketing | Barbers, hairstylists, and grooming influencers promoted precision shaving pens. Viral trends on TikTok and Instagram showcased creative beard and hair designs. |

| Consumer Trends & Behavior | Consumers prioritized precision, skin safety, and versatility. Growth in DIY and at-home grooming trends. Increased demand for travel-friendly, compact shaving tools. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered shaving pens analyze hair growth patterns for precision trimming. Self-sharpening nano-blades enhance longevity. Smart shaving pens with IoT integration provide guided styling and feedback. |

| Sustainability & Circular Economy | Zero-waste, fully compostable blade systems dominate the market. AI-optimized material sourcing ensures sustainability. Blockchain-backed tracking ensures ethical manufacturing and responsible disposal. |

| Connectivity & Smart Features | AI-driven haptic feedback technology enhances shaving accuracy. Augmented reality (AR) shaving guidance apps provide real-time tutorials. Metaverse-based virtual grooming consultations enhance product education. |

| Market Expansion & Consumer Adoption | AI-driven personal grooming assistants recommend shaving techniques and styles. Subscription-based shaving pen blade replacements cater to convenience-focused consumers. 3D-printed custom razor heads enhance personalization. |

| Regulatory & Compliance Standards | AI-powered compliance tracking ensures material safety. Governments mandate eco-friendly disposable blade policies. Bioengineered blade coatings prevent bacterial buildup. |

| Customization & Personalization | 3D-printed custom shaving pen grips provide ergonomic comfort. Real-time AI-powered beard styling guides users for precision designs. Personalized razor settings adjust to individual grooming routines. |

| Influencer & Social Media Marketing | AI-generated virtual influencers promote precision shaving techniques. AR-powered virtual try-ons let consumers test shaving pen effects before purchase. Metaverse-based barber training sessions educate users on precision grooming. |

| Consumer Trends & Behavior | Biohacking-inspired grooming solutions integrate skin health tracking with shaving habits. AI-personalized grooming tools adjust cutting intensity based on skin and hair condition. |

The USA paring pen request is witnessing steady growth, driven by adding demand for perfection grooming tools, rising interest in particular styling and beard art, and the expansion of men’s grooming trends. Major players include Gillette, Wahl, and The Barber Tool.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The UK paring pen request is expanding due to adding mindfulness of professional grooming ways, rising consumer preference for detailed beard and hair designs, and growth in barbershop culture. Leading brands include Philips, Braun, and Wilkinson Sword..

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

Germany’s paring pen request is growing, with consumers favoring ergonomic, durable, and high- performance grooming tools. crucial players include Moser, Remington, and Giesen & Forsthoff.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.4% |

India’s paring pen request is witnessing rapid-fire growth, fueled by rising manly grooming mindfulness, adding disposable inflows, and the influence of social media- driven grooming trends. Major brands include Bombay Shaving Company, Letsshave, and Ustraa

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.8% |

China’s paring pen request is expanding significantly, driven by adding disposable inflows, rising demand for high- tech grooming tools, and the influence of K- beauty and J- beauty trends in manly grooming. crucial players include Xiaomi, Flyco, and Deliya.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

The growing trend of perfection grooming and intricate beard styling has driven demand for paring pens. Consumers, particularly in civic areas, seek tools that enable detailed trouncing and shaping of facial hair, eyebrows, and hairlines. Professional haircutters and individualities likewise prefer paring pens for their capability to produce sharp, clean lines painlessly

Shaving pen manufacturers are introducing innovative features similar asultra-fine blades, malleable slice lengths, and easy- grip designs. Some models incorporate rechargeable batteries, leakproof capabilities, and hypoallergenic accoutrements to feed to consumers with sensitive skin. The versatility of paring pens, which can be used for body grooming and creative hairstyling, farther expands their appeal.

Eco-conscious consumers are decreasingly concluding for paring pens made from recyclable and skin-friendly accoutrements . Brands are fastening on pristine sword, ceramic- coated blades, and chemical-free lubricants to offer sustainable druthers to traditional razors. Refillable and long- lasting designs also align with the growing preference for sustainable grooming products.

Online retail platforms play a pivotal part in expanding the paring pen request by offering a wide range of products, competitive pricing, and doorstep delivery. Digital marketing, influencer collaborations, and tutorial- grounded content help brands engage consumers and demonstrate the effectiveness of paring pens. Subscription- grounded models and whisked fixing accoutrements further encourage client fidelity and reprise purchases.

The paring pen request is gaining traction due to the rising demand for perfection grooming tools, particularly among haircutters, haircutters, and particular grooming suckers. Shaving pens, also known as hair tattoo pens or perfection trimmers, allow druggies to produce detailed beard, hairline, and eyebrow designs, making them popular in barbershops, salons, and home grooming accoutrements.

The request is being driven by the growth of men’s grooming trends, the fashion ability of intricate hairstyles, and the rise of at- home grooming results. Also, advancements in blade technology, ergonomic designs, and rechargeable electric models are fueling invention.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Gillette (P&G) | 18-22% |

| Philips Norelco (Koninklijke Philips) | 14-18% |

| Wahl Clipper Corporation | 10-14% |

| Braun (P&G) | 8-12% |

| Andis Company | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Gillette (P&G) | Market leader in razor technology, expanding its precision grooming segment with trimmers and shaving pens for facial styling. |

| Philips Norelco (Philips) | Strong presence in electric shaving tools, offering precision trimmers with skin-friendly blades for detailed grooming. |

| Wahl Clipper Corporation | Focuses on professional barber tools, including high-precision shaving pens and detailers for intricate hair designs. |

| Braun (P&G) | Offers high-quality grooming tools, including versatile trimmers with ultra-thin blades for precise styling. |

| Andis Company | Specializes in professional-grade trimmers and shavers, catering to barbers and hairstylists seeking high-performance detailers. |

Strategic Outlook of Key Companies

Gillette (P&G) (18-22%)

Gillette is using its dominance in men’s grooming by expanding into perfection paring tools. The brand is incorporating advanced blade technology, ergonomic designs, and smart trimmers to appeal to druggies seeking detailed facial and hair grooming results.

Philips Norelco (14-18%)

Philips Norelco continues to introduce in electric perfection grooming, offering skin-friendly, rechargeable paring pens with advanced trouncing attachments. The company is strengthening itse-commerce and direct- to- consumer deals to capture DIY fixing suckers

Wahl Clipper Corporation (10-14%)

Wahl remains a top choice for professional haircutters and particular grooming accoutrements . The company focuses on perfection trimmers and paring pens with high- powered motors, fine detailing capabilities, and long battery life.

Braun (P&G) (8-12%)

Braun is expanding its decoration fixing range with protean,multi-functional paring pens. Its focus is on continuity, performance, and high- end features, targeting both professionals and home druggies.

Andis Company (6-10%)

Andis is a leader in hairstylist- grade tools, known for perfection trimmers and high- performance detailing pens. The brand is investing in cordless inventions and malleable perfection blades to enhance usability.

Other Key Players (30-40% Combined)

Precision Shaving Pens, Disposable Shaving Pens, Rechargeable Shaving Pens, and Others.

Single Blade, Multi-Blade, and Electric.

Supermarkets/Hypermarkets, Specialty Stores, Online, Pharmacies/Drug Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Shaving Pen industry is projected to witness a CAGR of 6.4% between 2025 and 2035.

The Shaving Pen industry stood at USD 720 million in 2024.

The Shaving Pen industry is anticipated to reach USD 3.2 billion by 2035 end.

Precision grooming and styling shaving pens are set to record the highest CAGR of 7.1%, driven by increasing demand for intricate beard and hair designs.

The key players operating in the Shaving Pen industry include Gillette, Philips, Wahl, Barber Strong, Feather, and Dorco.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Material, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by End User, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 10: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Material, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 18: North America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 20: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Material, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 26: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 28: Latin America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 34: Western Europe Market Volume (Units) Forecast by Material, 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 38: Western Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 44: Eastern Europe Market Volume (Units) Forecast by Material, 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 48: Eastern Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 50: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Material, 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Units) Forecast by End User, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 64: East Asia Market Volume (Units) Forecast by Material, 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 66: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 68: East Asia Market Volume (Units) Forecast by End User, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 70: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 74: Middle East and Africa Market Volume (Units) Forecast by Material, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Units) Forecast by End User, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Material, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 11: Global Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 15: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 19: Global Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 23: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 26: Global Market Attractiveness by Material, 2024 to 2034

Figure 27: Global Market Attractiveness by Application, 2024 to 2034

Figure 28: Global Market Attractiveness by End User, 2024 to 2034

Figure 29: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by Material, 2024 to 2034

Figure 32: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 41: North America Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 45: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 49: North America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 53: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 56: North America Market Attractiveness by Material, 2024 to 2034

Figure 57: North America Market Attractiveness by Application, 2024 to 2034

Figure 58: North America Market Attractiveness by End User, 2024 to 2034

Figure 59: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by Material, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 71: Latin America Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 75: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 79: Latin America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 83: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Material, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 88: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 101: Western Europe Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 105: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 109: Western Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 113: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by Material, 2024 to 2034

Figure 117: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 131: Eastern Europe Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by Material, 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material, 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by Material, 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by Material, 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 191: East Asia Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 195: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 199: East Asia Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 203: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 206: East Asia Market Attractiveness by Material, 2024 to 2034

Figure 207: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 208: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by Material, 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Material, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shaving Care Market Insights – Growth & Forecast 2024-2034

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Pentane Market Size and Share Forecast Outlook 2025 to 2035

Penile Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Penetration Testing Market Size and Share Forecast Outlook 2025 to 2035

Pen Needles Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Penile Prosthesis Market

Pentaerythritol Market

Open Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

Open Cycle Aeroderivative Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Open Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Spending In Digital Customer Experience and Engagement Solutions Market Size and Share Forecast Outlook 2025 to 2035

Open API Market Size and Share Forecast Outlook 2025 to 2035

Open Mouth Sacks Market Size and Share Forecast Outlook 2025 to 2035

Open Banking Market Analysis - Size, Share, and Forecast 2025 to 2035

Open Source Intelligence Market Trends – Growth & Forecast 2025 to 2035

Open Air Merchandizers and Accessories Market - Industry Innovations & Demand 2025 to 2035

Open Source Service Market Trends – Growth & Forecast 2024-2034

Open Top Cartons Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA