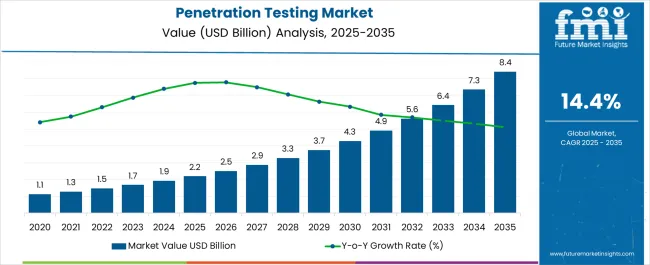

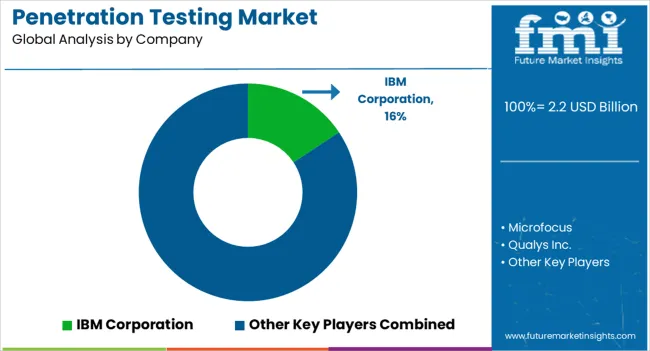

The Penetration Testing Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 14.4% over the forecast period.

| Metric | Value |

|---|---|

| Penetration Testing Market Estimated Value in (2025 E) | USD 2.2 billion |

| Penetration Testing Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 14.4% |

The penetration testing market is expanding steadily. Increasing frequency of cyberattacks, stringent compliance requirements, and the rising need for proactive vulnerability assessment are driving adoption across industries. Current market dynamics are characterized by higher awareness among enterprises, strong regulatory oversight, and growing integration of penetration testing into broader cybersecurity frameworks.

Market participants are focusing on developing scalable service models, integrating automation, and leveraging artificial intelligence to enhance testing accuracy and speed. The future outlook is shaped by the increasing digitalization of enterprises, growing attack surface across cloud and IoT environments, and the shift toward continuous security validation. Demand growth is further supported by rising investment in managed security services and the need to maintain resilience against sophisticated threat actors.

The growth rationale lies in the ability of penetration testing solutions to identify risks before exploitation, provide compliance assurance, and strengthen overall security posture These factors are expected to sustain robust market expansion over the forecast period.

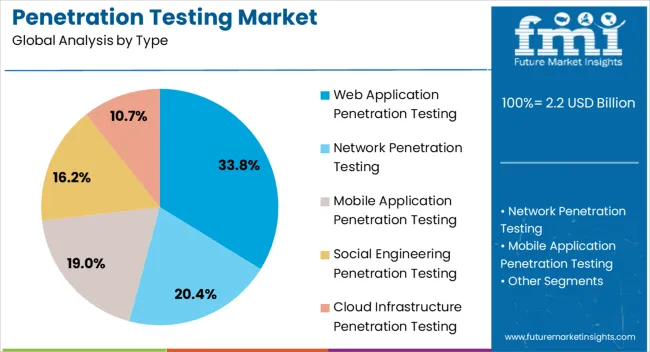

The web application penetration testing segment, representing 33.80% of the type category, is leading the market due to the critical role of web applications in digital operations. Rising instances of application-layer attacks, such as cross-site scripting and SQL injection, have reinforced the demand for targeted testing.

The segment benefits from increasing enterprise focus on securing customer-facing platforms and transactional portals. Its market strength is supported by technological enhancements that improve test coverage, reduce false positives, and align results with compliance requirements.

Adoption has also been driven by the integration of penetration testing with DevSecOps practices, ensuring security is embedded early in the development lifecycle As digital transformation accelerates, web application testing is expected to remain the most prominent type, maintaining strong adoption across industries.

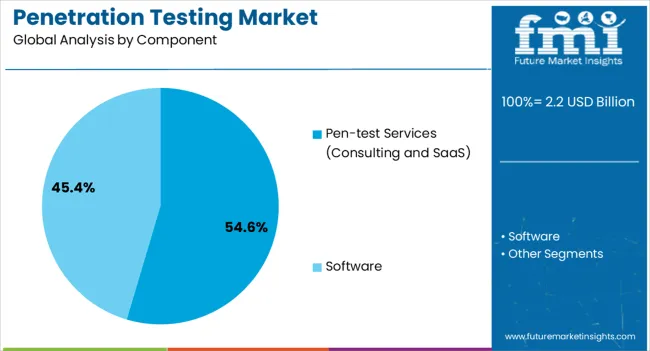

Pen-test services, including consulting and SaaS models, hold 54.60% of the component category and dominate the market due to their scalability and flexibility. Enterprises have been increasingly relying on specialized service providers to perform advanced testing, leveraging their expertise and industry certifications.

SaaS-based penetration testing platforms have gained traction as they offer continuous monitoring, real-time updates, and cost efficiency. Consulting services continue to play a vital role in tailoring assessments to organizational needs and ensuring compliance with regional and international standards.

Growing demand for outsourced expertise, combined with the inability of many enterprises to maintain in-house testing capabilities, has reinforced the leading position of pen-test services This dominance is expected to persist as cybersecurity threats evolve and enterprises seek reliable, expert-driven solutions.

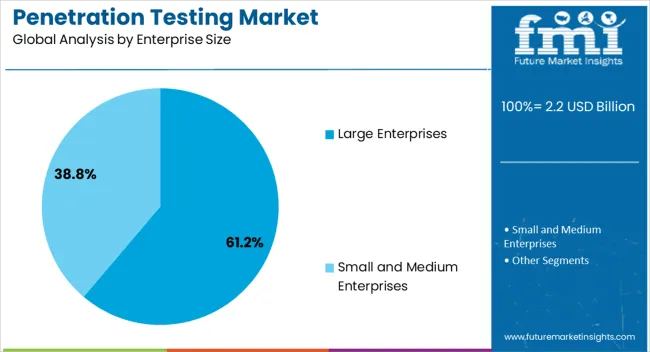

The large enterprises segment, accounting for 61.20% of the enterprise size category, has emerged as the primary contributor due to the scale and complexity of their digital infrastructure. These organizations face higher regulatory scrutiny, greater financial exposure, and increased reputational risk from cyber incidents.

Large enterprises allocate significant budgets to cybersecurity, which has enabled the integration of advanced penetration testing into their overall defense strategy. Adoption has been further supported by global operations that require compliance with diverse regulatory frameworks, driving the need for comprehensive and recurring assessments.

Investments in automation and AI-driven testing have also been concentrated in this segment, enabling continuous validation of security measures The segment is expected to retain its dominance as large enterprises continue to prioritize robust and proactive cybersecurity strategies.

The scope for global penetration testing market insights rose at a 13.3% CAGR between 2020 and 2025. The penetration testing market is anticipated to develop at a moderate CAGR of 14.4% over the forecast period from 2025 to 2035.

| Attributes | Details |

|---|---|

| Market Value in 2020 | USD 1,018.1 million |

| Market Value in 2025 | USD 1,676.6 million |

| CAGR from 2020 to 2025 | 13.3% |

Between 2020 and 2025, the global penetration testing market experienced significant growth, with a Compound Annual Growth Rate (CAGR) of 13.3%. During this period, the market value increased from USD 1,018.1 million in 2020 to USD 1,676.6 million in 2025. The robust growth was driven by a heightened awareness of cybersecurity threats and the importance of identifying and addressing vulnerabilities proactively.

Looking ahead to the forecast period from 2025 to 2035, the penetration testing market is expected to expand at a moderate CAGR of 14.4%. The projection underscores the ongoing significance of cybersecurity and the sustained demand for penetration testing services. Companies are increasingly recognizing the need to safeguard their digital assets and protect sensitive data, contributing to the steady growth of this market.

The below table showcases CAGRs in terms of the five countries spearheaded by the United States, China, the United Kingdom, Germany, and Japan.

| The United States | 6.5% |

|---|---|

| The United Kingdom | 4.5% |

| Germany | 4.7% |

| Japan | 14.3% |

| China | 18.7% |

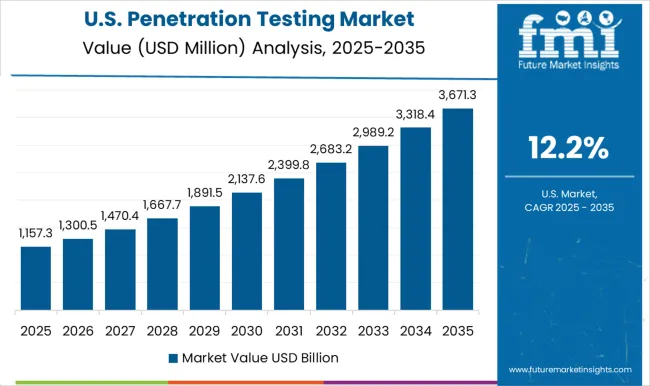

The United States expanded at a CAGR of 6.5% by 2035 in the penetration testing market. The country robust cybersecurity industry, a multitude of businesses that prioritize data protection, and stringent compliance requirements contributed to its market leadership.

As cyber threats evolved, American companies invested significantly in penetration testing to proactively identify vulnerabilities. The trend is expected to persist, with the United States playing a pivotal role in shaping the global penetration testing landscape.

China exhibited significant growth and registered a CAGR of 18.7% by 2035, making it a major player in the global penetration testing market. The country rapid digital transformation and the proliferation of online activities increased the demand for cybersecurity services, including penetration testing.

China organizations recognized the importance of safeguarding their digital assets and sensitive data, resulting in substantial market growth. As China continues to expand its digital footprint, its share of the penetration testing market is anticipated to remain substantial, reflecting the country evolving cybersecurity landscape.

The United Kingdom accounted for a CAGR of 4.5% by 2035, underscoring its commitment to cybersecurity and data protection. British businesses and government agencies prioritized penetration testing as a proactive measure to secure their digital environments.

With increasing cyber threats and compliance regulations, the demand for penetration testing services in the United Kingdom is expected to grow. This indicates the country dedication to maintaining a strong security posture and adapting to emerging cybersecurity challenges.

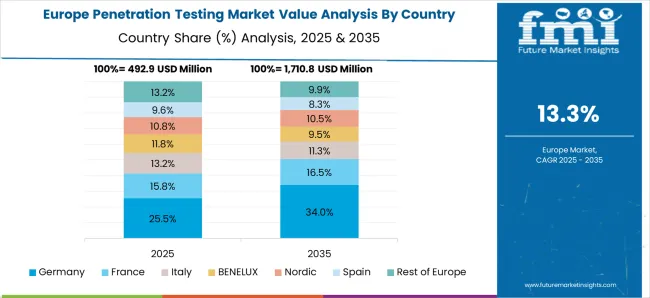

Germany expanded at a CAGR of 4.7% by 2035, reflecting the country focus on cybersecurity and data privacy. German organizations, known for their robust industrial sector, recognized the significance of identifying and mitigating vulnerabilities.

Regulatory requirements and a proactive approach to cybersecurity drove the adoption of penetration testing. As Germany cybersecurity landscape evolves, the market share for penetration testing is expected to remain substantial, reflecting the country commitment to data protection.

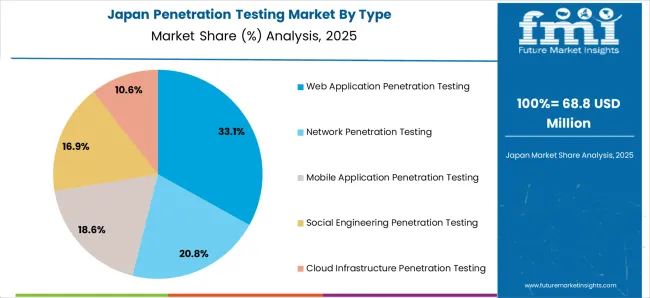

The country advanced technological landscape and extensive digitization initiatives contributed to the strong demand for penetration testing services with a CAGR of 14.3% by 2035. Japan organizations emphasized security measures to protect sensitive information and critical infrastructure.

Given Japan ongoing technological advancements and the evolving threat landscape, the penetration testing market is expected to maintain a significant presence in the country, solidifying its role as a cybersecurity leader.

The table below highlights how network penetration testing is projected to lead the type market, expanding at a market share of 34.3% in 2025. The table further details how software is anticipated to witness a market share of 65.1% in 2025.

| Category | Market Share in 2025 |

|---|---|

| Network Penetration Testing | 34.3% |

| Software | 65.1% |

In the realm of penetration testing, network penetration testing is set to take the lead by capturing a significant market share of 34.3% in 2025. The category focuses on evaluating the security of network infrastructure, identifying vulnerabilities, and assessing the resilience of an organization network against potential cyber threats.

As networks continue to be the lifeblood of digital operations, ensuring their security remains paramount. The growing complexity of network environments, coupled with the ever-evolving cyber threat landscape, drives the demand for network penetration testing services. The market dominance underscores the critical role network security plays in safeguarding digital assets and data.

The software category is poised to grow substantially, commanding a significant market share of 65.1% in 2025. The market underscores the increasing emphasis on securing software applications and systems in an era of digital transformation. As software plays a central role in virtually every aspect of modern business operations, vulnerabilities within software can be a gateway for cyberattacks.

Penetration testing within the software domain is instrumental in identifying and addressing these vulnerabilities, ensuring that applications and systems are resilient to cyber threats. The surge in software-based solutions, including mobile apps and web platforms, intensifies the demand for software penetration testing to maintain data integrity and protect digital assets.

Many key penetration testing manufacturers are inclined to invest significantly in innovation, research, and development practices to uncover increased penetration testing applications. With technology, players also focus on ensuring safety, quality, and customer satisfaction to captivate an increased customer base. Some of the latest developments include

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1,913.6 million |

| Projected Market Valuation in 2035 | USD 7,363.3 million |

| CAGR Share from 2025 to 2035 | 14.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Type, Component, Enterprise Size, Vertical, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | IBM Corporation; Microfocus; Qualys Inc.; Synopsys Inc.; Core Security SDI Corporation; Whitehat Security; Trustwave Holdings Inc.; Checkmarx.com LTD; VERACODE Inc.; Secure Works Inc.; Acunetix |

The global penetration testing market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the penetration testing market is projected to reach USD 8.4 billion by 2035.

The penetration testing market is expected to grow at a 14.4% CAGR between 2025 and 2035.

The key product types in penetration testing market are web application penetration testing, network penetration testing, mobile application penetration testing, social engineering penetration testing and cloud infrastructure penetration testing.

In terms of component, pen-test services (consulting and saas) segment to command 54.6% share in the penetration testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Penetration Tester Market

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA