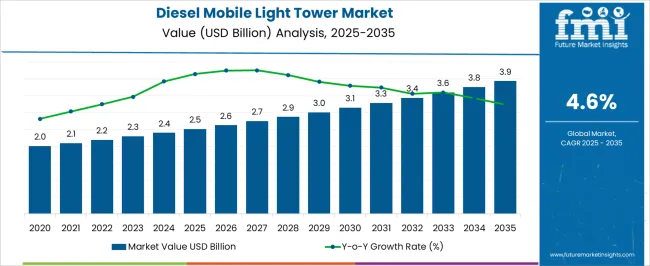

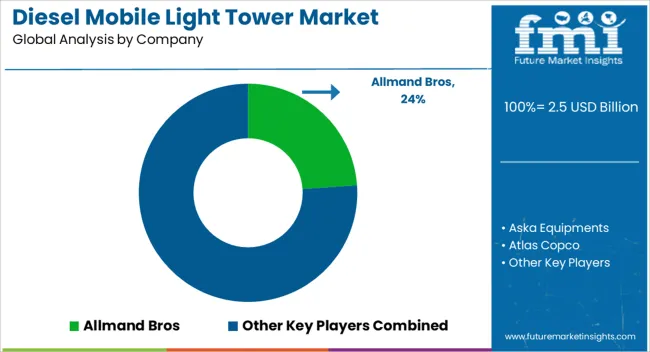

The diesel mobile light tower market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

Initial market penetration from 2025 to 2027 shows a slow increase from USD 2.5 billion to USD 2.7 billion, reflecting early adoption primarily in segments requiring temporary lighting solutions for construction sites, outdoor events, and emergency operations. During this early phase, customers demonstrate cautious investment, influenced by operational costs, diesel fuel considerations, and awareness of alternative lighting technologies. Between 2028 and 2032, the market enters a broader adoption stage, growing from USD 2.9 billion to USD 3.4 billion, indicating early majority engagement as cost-efficient models and standardized designs increase appeal. The adoption lifecycle during this phase is driven by enhancements in fuel efficiency, portability, and compliance with environmental regulations, which facilitate integration into both public and private projects.

From 2033 onward, the market approaches full maturity, achieving USD 3.9 billion by 2035. Growth is increasingly supported by replacement demand, fleet expansions, and retrofitting projects in regions with established construction and infrastructure sectors. The trajectory reflects a gradual, steady adoption pattern, with technological stability and operational reliability positioning Diesel Mobile Light Towers as a mature, mainstream solution for temporary and mobile lighting requirements across diverse industrial applications.

| Metric | Value |

|---|---|

| Diesel Mobile Light Tower Market Estimated Value in (2025 E) | USD 2.5 billion |

| Diesel Mobile Light Tower Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The diesel mobile light tower market represents a specialized segment within the global construction and industrial lighting industry, emphasizing portable illumination, energy efficiency, and rugged performance. Within the broader industrial equipment and lighting solutions sector, it accounts for about 5.5%, driven by demand from construction sites, mining operations, and outdoor events. In the mobile lighting and temporary illumination segment, it secures 6.0%, reflecting reliance on diesel-powered towers for remote or off-grid applications. Across the construction equipment and site support market, the share is 4.2%, supporting operations requiring flexible and rapid deployment.

Within the emergency response and disaster management category, it represents 3.8%, highlighting applications in power outages, rescue operations, and public safety. In the industrial maintenance and infrastructure development sector, it contributes about 3.4%, emphasizing portable illumination for inspection, repair, and operational continuity. Recent developments in this market have focused on hybridization, fuel efficiency, and digital control integration. Innovations include diesel-electric hybrid towers, LED lamp retrofits for lower energy consumption, and remote monitoring systems for operational tracking. Key players are collaborating with construction firms, rental companies, and event management providers to enhance portability, runtime, and durability.

Adoption of modular and telescopic tower designs is gaining traction to facilitate transportation and deployment in confined or uneven sites. The integration with solar-assist systems and IoT-enabled maintenance alerts is being deployed to reduce fuel usage and downtime. These trends demonstrate how technological integration, operational efficiency, and environmental considerations are shaping the diesel mobile light tower market.

The diesel mobile light tower market is experiencing consistent growth driven by the rising need for reliable, portable lighting solutions in remote and temporary worksites. Increasing infrastructure development projects, large-scale construction activities, and outdoor event setups are creating strong demand for these towers. The diesel-powered units offer extended operational runtime and flexibility in locations where grid connectivity is limited or unavailable.

Technological advancements in fuel efficiency, noise reduction, and durability have enhanced their adoption across diverse environments. Furthermore, the integration of advanced control systems for optimized fuel consumption and lighting performance is improving operational efficiency.

Stringent safety regulations and the growing emphasis on worker productivity during night-time operations are also contributing to the expansion of the market. The future outlook remains positive as industries continue to prioritize dependable and adaptable lighting solutions for both planned and emergency applications.

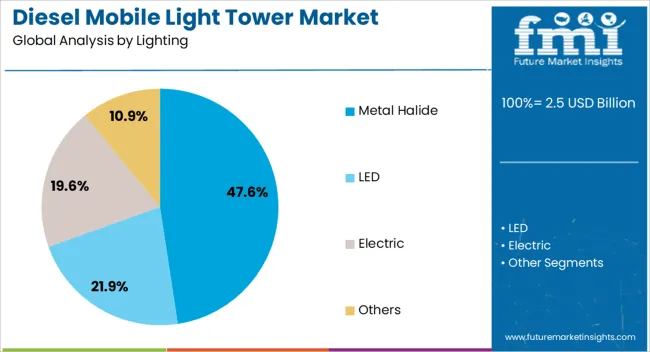

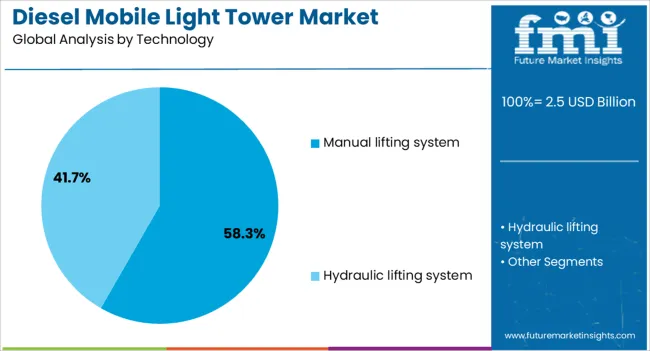

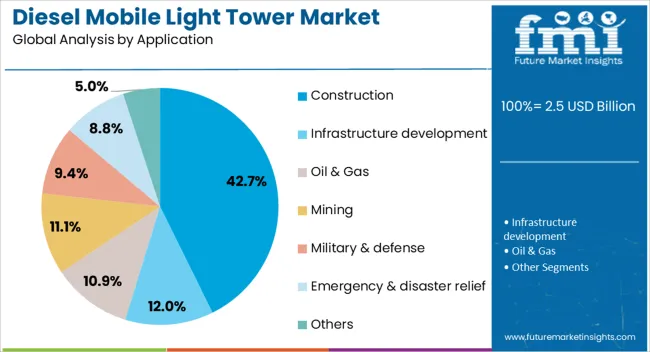

The diesel mobile light tower market is segmented by lighting, technology, application, and geographic regions. By lighting, diesel mobile light tower market is divided into metal halide, LED, electric, and others. In terms of technology, diesel mobile light tower market is classified into manual lifting system and hydraulic lifting system. Based on application, diesel mobile light tower market is segmented into construction, infrastructure development, oil & gas, mining, military & defense, emergency & disaster relief, and others. Regionally, the diesel mobile light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metal halide lighting segment is anticipated to hold 47.60% of total revenue by 2025 within the lighting category, making it the leading segment. This dominance is attributed to its high-intensity illumination, broad coverage capability, and suitability for large outdoor areas.

Metal halide technology is valued for delivering bright, white light that improves visibility and safety in night-time operations. Its durability and proven track record in challenging work environments have reinforced its demand in industries requiring continuous and effective lighting.

As construction, mining, and event operations continue to expand globally, the preference for metal halide solutions remains strong, sustaining its leadership position.

The manual lifting system segment is projected to account for 58.30% of total revenue by 2025 within the technology category, securing its place as the most preferred option. This is due to its cost-effectiveness, ease of use, and low maintenance requirements.

Manual systems are particularly favored in environments where simplicity, quick setup, and reliability are crucial. Their operational flexibility in both small and large-scale projects, combined with minimal training requirements, makes them attractive for a wide range of applications.

The robustness of manual lifting systems in harsh conditions further strengthens their market share.

The construction application segment is expected to represent 42.70% of total market revenue by 2025, making it the dominant application. This growth is driven by the high demand for extended working hours, safety compliance, and efficient illumination in infrastructure and building projects.

Diesel mobile light towers are essential in enabling continuous work during night shifts and in low-light conditions, thereby increasing project productivity. Their mobility, rugged build, and ability to operate independently of power grids make them highly suitable for construction sites in remote or developing areas.

As global construction activity continues to rise, the reliance on these towers is expected to remain significant, ensuring the segment's leading position.

The market has experienced substantial growth due to increasing demand for portable and reliable lighting solutions across construction, mining, events, emergency services, and outdoor operations. Diesel-powered light towers offer high luminosity, fuel efficiency, and extended operational life, making them suitable for temporary or remote applications where grid access is limited. Rising infrastructure projects, urban development, and large-scale outdoor events have boosted market adoption. Technological innovations, including LED integration, hybrid systems, and smart controls, have improved energy efficiency and operational flexibility

Diesel mobile light towers are extensively deployed at construction sites and mining operations to ensure safe and continuous operations during night shifts or low-light conditions. These towers provide high-intensity lighting to support excavation, material handling, and assembly activities while maintaining energy efficiency and durability under harsh environmental conditions. Portable deployment allows rapid relocation across sites, which enhances productivity and reduces downtime. Construction and mining contractors increasingly prefer diesel-powered towers due to their reliability, robust engine performance, and low maintenance requirements. Growth in global infrastructure development, industrial expansion, and demand for efficient project execution continues to propel the adoption of diesel mobile light towers in these sectors.

Technological advancements have transformed diesel mobile light towers through LED lighting integration, intelligent control systems, and hybrid fuel options. LED fixtures reduce energy consumption and improve lumen output while extending lamp lifespan. Smart controllers allow remote monitoring, automated dimming, and operational diagnostics, improving efficiency and reducing maintenance efforts. Hybrid systems combining diesel with solar or battery backup enhance sustainability and reduce fuel consumption and emissions. Innovations in engine technology, corrosion-resistant materials, and modular tower designs further improve operational performance in diverse environments. These technological enhancements allow users to achieve cost savings, reduce environmental impact, and maintain consistent lighting performance across temporary or mobile applications.

Beyond industrial applications, diesel mobile light towers are widely used in public events, emergency response, disaster relief, and outdoor recreational activities. Event organizers deploy light towers for concerts, festivals, and sports events to ensure proper visibility and safety. Emergency and disaster relief operations rely on mobile lighting solutions for search, rescue, and recovery in remote or power-deficient locations. Outdoor operations such as road construction, maintenance, and security patrols also benefit from portable lighting solutions. Rising investments in public safety, infrastructure maintenance, and recreational projects are expanding the adoption of diesel mobile light towers beyond traditional industrial settings, diversifying market opportunities.

The market faces challenges due to stringent emission regulations, fuel standards, and noise control requirements in several regions. Manufacturers must invest in engines that comply with environmental and safety standards while maintaining performance and reliability. Operational challenges, such as fuel logistics, maintenance of diesel engines, and wear under harsh conditions, can impact efficiency and operating costs. The fluctuating diesel prices and supply chain constraints may affect adoption in cost-sensitive applications. Market participants are increasingly focusing on hybrid and cleaner engine technologies, remote monitoring systems, and durable designs to address regulatory pressures and operational limitations while maintaining user convenience and performance.

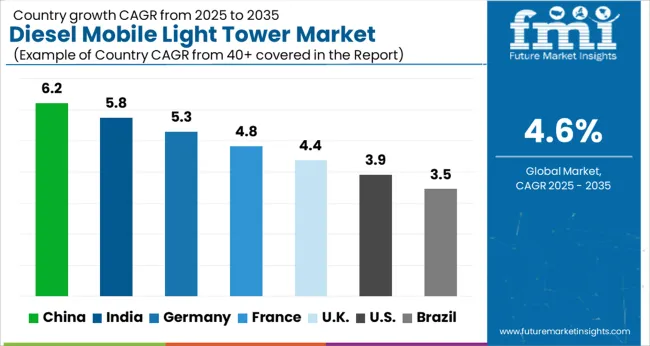

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

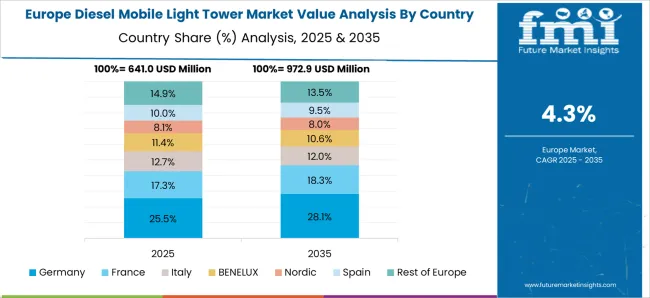

The market is expected to grow at a CAGR of 4.6% from 2025 to 2035, driven by increasing construction and outdoor event activities. Germany achieved 5.3%, supported by modernization of construction equipment and infrastructure projects. India recorded 5.8%, reflecting rising demand in industrial and temporary lighting solutions. China led with 6.2%, fueled by large-scale construction operations and rapid urban development initiatives. The United Kingdom registered 4.4%, backed by infrastructure upgrades and event management applications. The United States accounted for 3.9%, where steady demand is driven by maintenance projects and outdoor industrial sites. These regions collectively represent key markets advancing production, deployment, and technological innovation in diesel mobile light towers globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 6.2%, fueled by rising infrastructure projects, rapid urban and industrial development, and a growing focus on temporary lighting solutions in construction and mining sectors. Adoption has been reinforced by manufacturers producing modular, fuel efficient, and durable diesel light towers suitable for harsh environments. Increasing deployment in large scale road construction, railway projects, and emergency operations enhances market growth. Technological advancements such as remote monitoring, automated lighting adjustment, and IoT integration are being incorporated to improve efficiency and reduce operational costs.

India is expected to grow at a CAGR of 5.8%, supported by growth in road, railway, and industrial construction, alongside increasing adoption in mining operations. Adoption is reinforced by rising demand for portable, high intensity, and low maintenance lighting towers. Domestic manufacturers collaborate with contractors, rental providers, and government infrastructure programs to meet temporary and long term lighting needs. Deployment in disaster response, outdoor events, and night time construction enhances market traction. Continuous technological upgrades for energy efficiency and durability further boost demand.

Germany is projected to grow at a CAGR of 5.3%, driven by adoption in industrial, energy, and civil engineering sectors. Adoption is reinforced by demand for high quality, low emission, and modular mobile light towers compliant with EU standards. Domestic manufacturers focus on durability, portability, and environmentally friendly solutions. Temporary lighting for construction sites, maintenance projects, and industrial operations provides steady market demand. Technological innovations, such as remote control and energy efficient lighting, are increasingly integrated.

The United Kingdom is expected to grow at a CAGR of 4.4%, supported by demand in construction, infrastructure, and temporary industrial projects. Imports dominate premium equipment, while domestic manufacturers provide cost efficient solutions. Adoption is reinforced by increasing night time construction, industrial maintenance, and outdoor event lighting. Emphasis on energy efficiency, durability, and compliance with UK safety standards supports growth. Rental services for short term projects contribute significantly to market expansion.

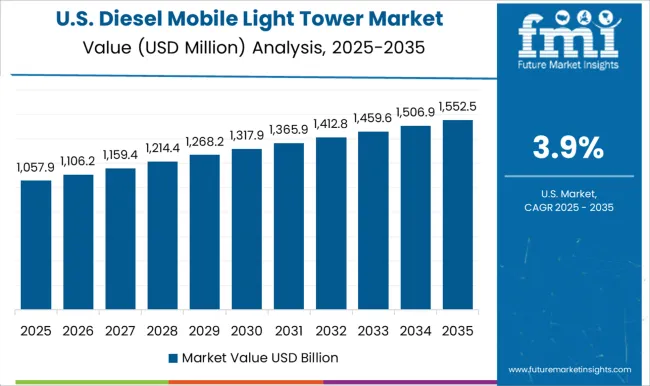

The United States is projected to grow at a CAGR of 3.9%, driven by adoption in commercial construction, mining, energy projects, and emergency operations. Domestic manufacturers focus on robust, portable, and fuel efficient diesel light towers with long operational life. Rising demand in remote construction sites, outdoor events, and disaster response supports market growth. Technological integration such as automated lighting, remote monitoring, and IoT enabled control enhances operational efficiency and reduces maintenance requirements.

The market is dominated by companies specializing in portable lighting solutions for construction sites, outdoor events, mining operations, and emergency response applications. Key players such as Caterpillar, Atlas Copco, and Generac Power Systems focus on providing durable, high-performance light towers with robust diesel engines, extended runtime, and energy-efficient lamp technologies. Allmand Bros and Doosan Portable Power emphasize modular designs and mobility, enabling rapid deployment and operational flexibility in remote and challenging environments. J C Bamford Excavators and Wacker Neuson integrate advanced control systems and ergonomic features to enhance usability, reliability, and maintenance efficiency.

Companies like Chicago Pneumatic, Inmesol Gensets, and Multiquip provide compact and cost-effective solutions suitable for small- to medium-scale projects, offering ease of transport and assembly. United Rentals and Colorado Standby operate primarily as rental and distribution channels, expanding market reach and enabling temporary deployment solutions for seasonal or short-term requirements. Competitive differentiation in this market is driven by product durability, fuel efficiency, ease of transport, lighting intensity, and compliance with environmental emission standards. Continuous innovation in LED technology, noise reduction, and hybrid integration is shaping market growth, as demand rises from construction, mining, and industrial sectors worldwide. Companies are investing in after-sales service, digital monitoring solutions, and global distribution networks to maintain a strong market presence.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 billion |

| Lighting | Metal Halide, LED, Electric, and Others |

| Technology | Manual lifting system and Hydraulic lifting system |

| Application | Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allmand Bros, Aska Equipments, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, Doosan Portable Power, Generac Power Systems, Inmesol Gensets, J C Bamford Excavators, Larson Electronics, Multiquip, Trime, United Rentals, and Wacker Neuson |

| Additional Attributes | Dollar sales by tower type and application, demand dynamics across construction, mining, and event management sectors, regional trends in mobile lighting adoption, innovation in fuel efficiency, LED integration, and portability, environmental impact of diesel emissions and fuel consumption, and emerging use cases in emergency response, temporary work sites, and large-scale outdoor events. |

The global diesel mobile light tower market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the diesel mobile light tower market is projected to reach USD 3.9 billion by 2035.

The diesel mobile light tower market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in diesel mobile light tower market are metal halide, led, electric and others.

In terms of technology, manual lifting system segment to command 58.3% share in the diesel mobile light tower market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Power Engine Market Size and Share Forecast Outlook 2025 to 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Diesel Engine Management System Market

Diesel Common Rail Injection Systems Market

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

E-Diesel Market Size and Share Forecast Outlook 2025 to 2035

No.2 Diesel Fuel Market

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Marine Diesel Engine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Diesel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA