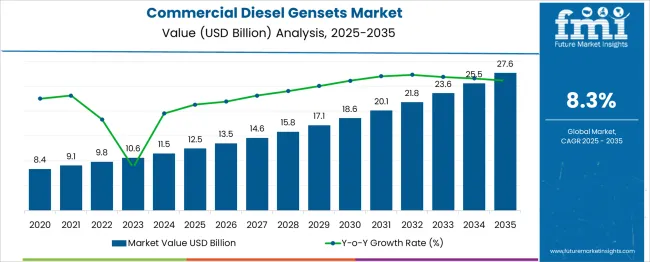

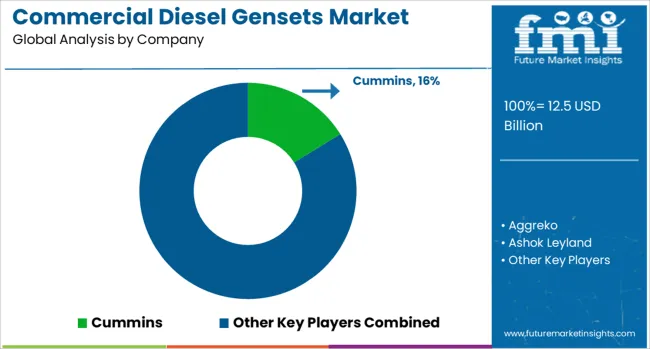

The Commercial Diesel Gensets Market is estimated to be valued at USD 12.5 billion in 2025 and is projected to reach USD 27.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Diesel Gensets Market Estimated Value in (2025 E) | USD 12.5 billion |

| Commercial Diesel Gensets Market Forecast Value in (2035 F) | USD 27.6 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The commercial diesel gensets market is witnessing steady growth as businesses seek reliable and efficient backup power solutions to mitigate the impact of power outages. Increasing dependence on uninterrupted power supply, especially in critical sectors like data centers, has driven demand for high-performance diesel generators. The rise in digital infrastructure and cloud computing facilities has intensified the need for gensets with optimal power ratings that balance capacity and fuel efficiency.

Moreover, growing infrastructure development and urbanization have contributed to increased deployment of diesel gensets across commercial and industrial sectors. Regulatory focus on emissions and advancements in engine technology are encouraging manufacturers to develop cleaner and more fuel-efficient gensets.

Going forward, the market is expected to grow due to increased investments in power backup systems and rising awareness about energy security. Segmental growth is projected to be led by gensets with power ratings above 125 kVA up to 200 kVA, the data center end-use segment, and standby power applications.

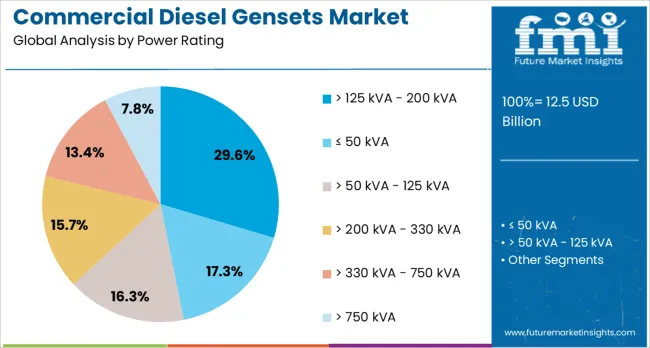

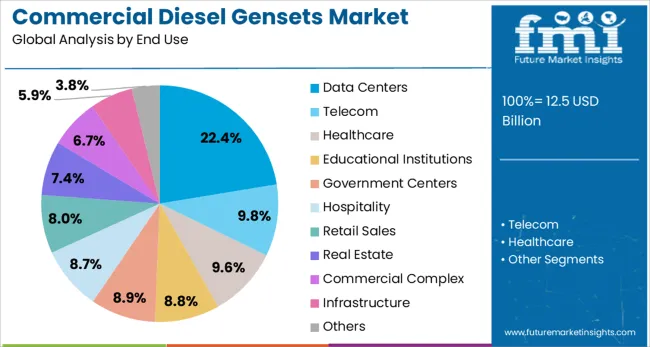

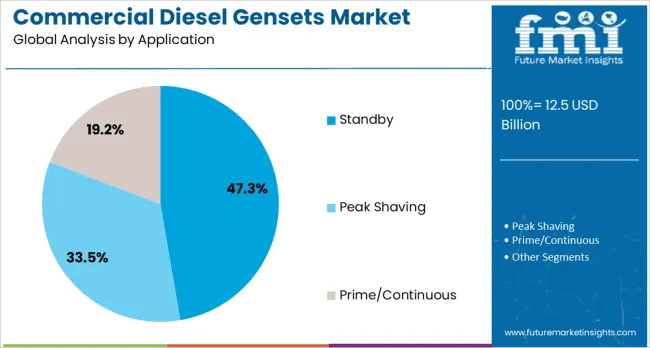

The commercial diesel gensets market is segmented by power rating, end use, and application and geographic regions. By power rating of the commercial diesel gensets market is divided into > 125 kVA - 200 kVA, ≤ 50 kVA, > 50 kVA - 125 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA. In terms of end use of the commercial diesel gensets market is classified into Data Centers, Telecom, Healthcare, Educational Institutions, Government Centers, Hospitality, Retail Sales, Real Estate, Commercial Complex, Infrastructure, and Others. Based on application of the commercial diesel gensets market is segmented into Standby, Peak Shaving, and Prime/Continuous. Regionally, the commercial diesel gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The segment with power ratings above 125 kVA up to 200 kVA is expected to contribute 29.6% of the commercial diesel gensets market revenue in 2025, maintaining its position as the leading power rating category. This segment has gained prominence due to its suitability for mid-sized commercial facilities requiring reliable power backup without excessive capacity. The balance of power output and fuel efficiency makes these gensets ideal for facilities with variable load demands.

Their relatively compact size and ease of installation have further driven adoption in urban and suburban commercial setups. The segment benefits from demand in applications where continuous power availability is critical but space and budget constraints exist.

With growing reliance on stable power supply, the >125 kVA - 200 kVA gensets are expected to sustain market leadership.

The data centers segment is projected to hold 22.4% of the commercial diesel gensets market revenue in 2025, remaining the dominant end-use sector. Data centers require uninterrupted power to prevent operational disruptions and data loss, which has positioned diesel gensets as a preferred backup solution. The expansion of cloud services, digital transformation, and increasing data generation have intensified the need for robust power infrastructure.

Diesel gensets provide the reliability and quick startup times necessary to support critical data center operations during power failures. Enhanced monitoring systems and integration with facility management tools have improved genset performance in this segment.

As data centers continue to expand globally, their demand for dependable backup power will reinforce the segment’s leading role.

The standby application segment is anticipated to account for 47.3% of the commercial diesel gensets market revenue in 2025, securing its position as the primary application. Standby gensets are essential for providing emergency power during outages and are widely used across commercial facilities, healthcare, and critical infrastructure. The segment’s growth has been driven by increased awareness of power reliability and disaster preparedness.

Facilities prefer standby generators that can seamlessly take over during grid failures to maintain operations without interruption. This demand is particularly high in regions with unstable power supply or frequent outages.

As businesses emphasize operational continuity and resilience, the standby application segment is expected to maintain its market dominance.

Demand for Commercial Diesel Gensets is increasing as businesses prioritize reliable backup power and off-grid flexibility. Sales of modular and fuel-optimized gensets are rising across data centers, hospitals, logistics parks, and construction sites. The strongest growth is recorded in regions with grid instability and elevated uptime expectations.

Demand for Commercial Diesel Gensets jumped 29% in 2025, propelled by stringent uptime mandates across healthcare, IT, and retail infrastructure. Facilities using gensets with smart load-sharing and auto-start controls reported 18% fewer outages caused by grid disruptions. OEMs offering Tier 4-compliant engines improved fuel economy by 22% during backup operations. Strong adoption is observed in Southeast Asia and Sub-Saharan Africa due to persistent grid volatility. Data centers and multisite retailers are driving investment in high-efficiency gensets with remote monitoring capabilities, especially in metro and semi-urban locations.

Sales of modular and containerized genset systems rose 32% year-over-year in 2025, supported by demand for flexible deployment in phased projects. Plug-and-play gensets accelerated deployment timelines while reducing installation risks. Installation time was reduced by nearly 28% using preconfigured modular units, and over 40% of commercial projects now include automated transfer switches and telemetry-enabled panels. Providers offering predictive diagnostics and long-term service subscriptions experienced a 25% surge in repeat orders, particularly from commercial facilities undergoing low-disruption genset upgrades or replacing legacy infrastructure.

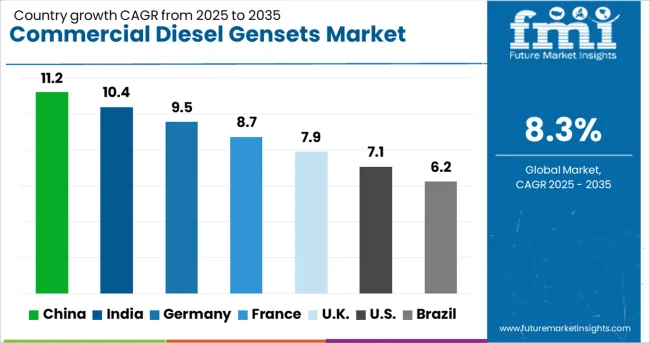

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

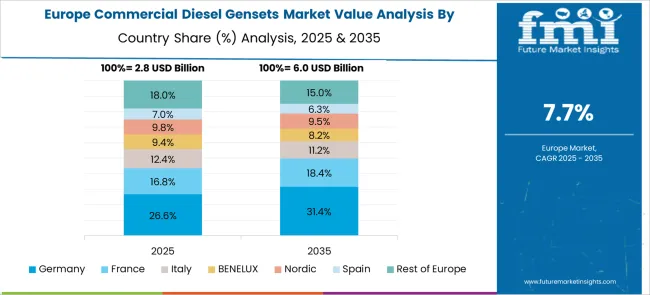

The global market is anticipated to register a CAGR of 8.3% from 2025 to 2035. China leads with a strong 11.2% CAGR, underpinned by robust industrial infrastructure expansion, frequent power outages in tier-2 cities, and rising demand for standby power in telecom and healthcare sectors. India follows at 10.4%, driven by rural electrification programs, data center growth, and construction sector resilience.

Germany, growing at 9.5%, is experiencing a surge in backup power investments due to energy transition policies and grid instability concerns. The UK (7.9%) sees consistent demand from logistics, commercial real estate, and healthcare facilities. The USA market, expanding at 7.1%, reflects upgrades in emergency response systems and high adoption in storm-prone regions. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at 11.2% CAGR, driven by industrial development and the need for consistent power supply in manufacturing clusters. Frequent power fluctuations and rising connectivity requirements in telecom and healthcare sectors enhance the demand for backup systems.

Large-scale commercial complexes and transportation hubs are incorporating genset-based emergency solutions. Domestic manufacturers are expanding production and introducing fuel-efficient models to address operating cost concerns. Partnerships with construction firms and infrastructure developers are improving product penetration in high-demand zones.

India is forecast to grow at 10.4% CAGR, supported by government programs for electricity access and strong growth in commercial real estate and industrial facilities. Increasing investment in data centers and healthcare infrastructure is creating a need for uninterrupted power systems.

Manufacturers are offering compact, low-noise gensets suitable for urban environments. Service-based models, including rental and maintenance contracts, are gaining popularity among businesses seeking cost optimization. Regional manufacturing hubs are also accelerating genset adoption for critical production processes.

Germany is expected to grow at 9.5% CAGR, driven by backup power requirements in commercial sectors affected by energy transition challenges. Businesses in logistics, financial services, and retail are prioritizing diesel gensets for reliable performance during grid instability. Increasing adoption of hybrid systems combining diesel with battery storage solutions offers flexibility in operations. Domestic manufacturers are enhancing genset efficiency with advanced electronic control systems and digital monitoring. Public procurement in critical sectors such as healthcare and emergency response is further stimulating demand.

The United Kingdom is anticipated to grow at 7.9% CAGR, led by consistent demand from logistics centers, commercial offices, and healthcare institutions. Backup systems are being installed to manage power continuity for essential services and business-critical operations.

Vendors are focusing on noise-reduction technologies to meet stringent building codes. Compact genset models designed for quick deployment in urban projects are gaining traction. Growing use of rental solutions for construction projects and short-term applications is supporting market expansion.

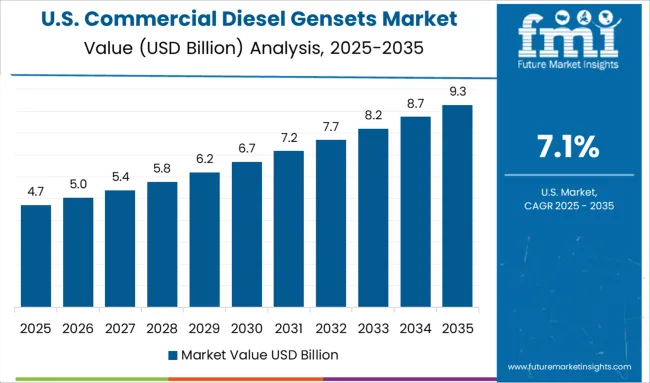

The United States is forecast to grow at 7.1% CAGR, driven by increased deployment in storm-prone regions and upgrades in emergency preparedness systems. Commercial facilities, data centers, and healthcare networks are adopting high-capacity gensets for power resilience.

Manufacturers are investing in automated monitoring solutions for predictive maintenance and enhanced performance tracking. Genset providers are partnering with facility management companies to deliver turnkey installation and servicing packages. Growing demand for backup systems in telecom and transportation hubs adds further momentum to the market.

Cummins holds a leading position in the commercial diesel gensets market, driven by its extensive engine portfolio and strong after-sales network. Caterpillar, Generac Power Systems, and Kirloskar Oil Engines are strengthening their market presence with advancements in fuel efficiency and adherence to stringent emissions standards.

Aggreko, Mitsubishi Heavy Industries, and Rolls-Royce focus on expanding deployments in healthcare facilities, data centers, and other mission-critical operations. Competition is centered on reliability, modularity for scalable power solutions, and comprehensive service coverage.

Manufacturers introducing hybrid configurations and integrating remote monitoring and predictive maintenance solutions are witnessing higher adoption, particularly in grid-constrained and power-deficit regions. Strategic emphasis on technology-driven customization and operational resilience further defines competitive strategies across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.5 Billion |

| Power Rating | > 125 kVA - 200 kVA, ≤ 50 kVA, > 50 kVA - 125 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA |

| End Use | Data Centers, Telecom, Healthcare, Educational Institutions, Government Centers, Hospitality, Retail Sales, Real Estate, Commercial Complex, Infrastructure, and Others |

| Application | Standby, Peak Shaving, and Prime/Continuous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins, Aggreko, Ashok Leyland, Atlas Copco, Caterpillar, Deere & Company, FG Wilson, Generac Power Systems, HIMOINSA, Huu Toan, J C Bamford Excavators, Kirloskar Oil Engines, Kohler Co., Mahindra Powerol, Mitsubishi Heavy Industries, Powerica, Rolls-Royce, SUDHIR POWER, SUPERNOVA GENSET, and Wartsila |

| Additional Attributes | Dollar sales by genset capacity segment (≤ 50 kVA, 50-125 kVA, >750 kVA) and application model (standby, peak-shaving, prime), demand dynamics across commercial, telecom, healthcare and data-center sectors, regional dominance in Asia‑Pacific with North America leadership, innovation in low‑emission hybrid systems and IoT monitoring, and environmental impact via emissions compliance and fuel efficiency. |

The global commercial diesel gensets market is estimated to be valued at USD 12.5 billion in 2025.

The market size for the commercial diesel gensets market is projected to reach USD 27.6 billion by 2035.

The commercial diesel gensets market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in commercial diesel gensets market are > 125 kva - 200 kva, ≤ 50 kva, > 50 kva - 125 kva, > 200 kva - 330 kva, > 330 kva - 750 kva and > 750 kva.

In terms of end use, data centers segment to command 22.4% share in the commercial diesel gensets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standby Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA