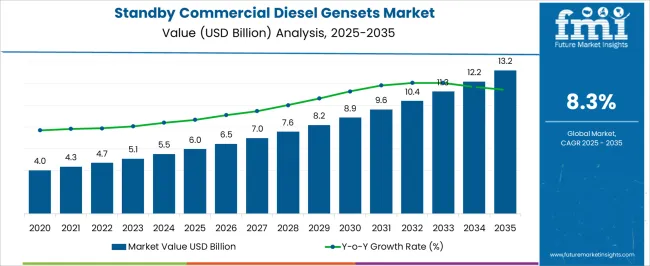

The standby commercial diesel gensets market is forecasted to expand from USD 6.0 billion in 2025 to USD 13.2 billion by 2035, registering a CAGR of 8.3%. This growth creates an absolute dollar opportunity of USD 7.2 billion across the forecast period. Early years reflect solid gains, with values climbing from USD 6.5 billion in 2026 to USD 8.2 billion in 2029, highlighting steady adoption.

By mid-decade, the market is projected to reach USD 9.6 billion in 2031, demonstrating continued growth momentum. This predictable expansion provides companies opportunities to align investments, improve distribution channels, and optimize offerings for sustained market capture. Later years deliver the most significant incremental gains, with the market moving from USD 10.4 billion in 2032 to USD 13.2 billion in 2035. This final stage contributes nearly USD 2.8 billion to the overall opportunity, underscoring the importance of scaling production and enhancing efficiency.

Intermediate years such as 2033 (USD 11.3 billion) and 2034 (USD 12.2 billion) illustrate how growth accelerates toward the end of the forecast. In total, the USD 7.2 billion absolute dollar opportunity provides a clear path for stakeholders to capture long-term revenue, expand portfolios, and strengthen their position in standby commercial diesel gensets.

| Metric | Value |

|---|---|

| Standby Commercial Diesel Gensets Market Estimated Value in (2025 E) | USD 6.0 billion |

| Standby Commercial Diesel Gensets Market Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

In the standby commercial diesel gensets market, the first breakpoint occurs between 2025 and 2027, when the market rises from USD 6.0 billion to USD 6.5 billion. This early phase reflects steady demand growth and moderate annual increments of around USD 0.2–0.3 billion. The next significant breakpoint is around 2029–2031, as the market expands from USD 8.2 billion to USD 9.6 billion, signaling a stronger growth phase with higher absolute dollar gains. These stages are critical for manufacturers and distributors to optimize production, secure supply chains, and capture revenue during periods of increasing market adoption.

The final major breakpoint is observed between 2033 and 2035, when the market climbs from USD 11.3 billion to USD 13.2 billion, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2032 (USD 10.4 billion) and 2034 (USD 12.2 billion), act as bridging periods that sustain momentum and prepare the market for peak expansion.

The market is experiencing robust growth due to the increasing demand for reliable backup power solutions across various commercial sectors. The growing dependency on continuous power supply, driven by the expansion of data centers, telecom infrastructure, and critical facilities, is shaping the current market landscape.

The market outlook remains positive as urbanization accelerates and the need for uninterrupted operations becomes more critical in emerging and developed economies alike. Investments in infrastructure upgrades and heightened focus on energy security are further fueling demand.

Additionally, technological advancements that improve fuel efficiency and reduce emissions are enhancing the appeal of diesel gensets for standby applications. As businesses and institutions prioritize resilience against power outages, the market is poised to grow steadily, with significant opportunities for genset manufacturers and service providers.

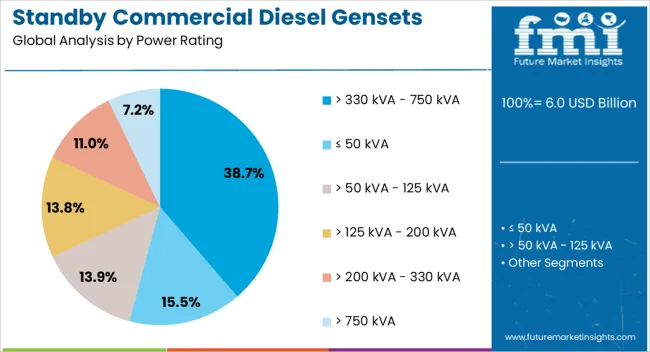

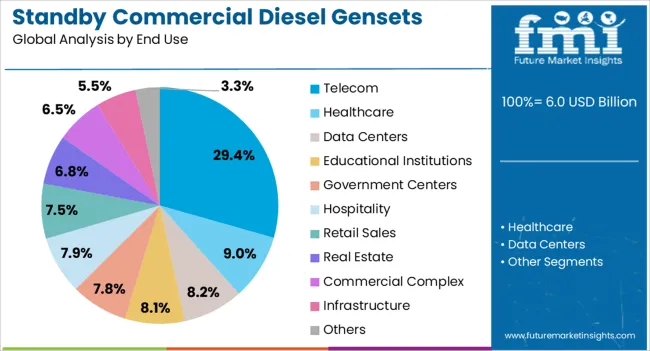

The standby commercial diesel gensets market is segmented by power rating, end use, and geographic regions. By power rating, standby commercial diesel gensets market is divided into > 330 kVA - 750 kVA, ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, and > 750 kVA. In terms of end use, standby commercial diesel gensets market is classified into Telecom, Healthcare, Data Centers, Educational Institutions, Government Centers, Hospitality, Retail Sales, Real Estate, Commercial Complex, Infrastructure, and Others. Regionally, the standby commercial diesel gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power rating segment of greater than 330 kVA up to 750 kVA is projected to hold 38.7% of the Standby Commercial Diesel Gensets market revenue in 2025, making it the leading power rating category. This dominance can be attributed to its suitability for mid-sized commercial applications that require substantial backup power without the complexity and costs associated with larger systems.

The segment’s growth has been supported by demand from facilities such as hospitals, medium-sized manufacturing units, and commercial complexes that balance power needs with operational efficiency. The gensets in this range offer an optimal combination of capacity and flexibility, allowing businesses to ensure power continuity during outages.

Furthermore, advancements in engine technology within this range have improved fuel consumption rates and reduced maintenance requirements, making these gensets a preferred choice for many commercial end users.

The telecom end use segment is anticipated to account for 29.4% of the market revenue in 2025, establishing it as a key driver within the Standby Commercial Diesel Gensets market. This prominence arises from the critical need for an uninterrupted power supply to telecom towers and data transmission hubs, which operate round the clock.

The expansion of mobile networks, particularly in remote and underserved areas, has necessitated reliable backup power solutions to maintain service quality and network uptime. Diesel gensets provide a dependable source of power in locations where grid reliability is inconsistent or unavailable.

Additionally, the growth of 5G infrastructure has further intensified demand in this segment due to higher energy requirements and stringent uptime expectations. The telecom sector’s investment in resilient energy solutions is expected to sustain and increase the share of standby diesel gensets deployed in this market.

The standby commercial diesel gensets market is growing due to increasing demand for uninterrupted power in commercial buildings, hospitals, data centers, and critical facilities. North America and Europe lead with advanced emission-compliant gensets integrating fuel efficiency, automation, and remote monitoring for high-reliability applications. Asia-Pacific is expanding rapidly due to grid instability, industrial growth, and urbanization. Manufacturers differentiate through power ratings, noise control, emissions compliance, and after-sales support. Regional variations in energy infrastructure, regulatory frameworks, and cost sensitivity influence adoption, procurement decisions, and competitive positioning globally.

Standby commercial diesel gensets are adopted based on their rated power capacity and load-handling capabilities. In North America and Europe, high-capacity units are preferred for commercial complexes, hospitals, and data centers, ensuring uninterrupted operation during grid failures. These regions demand gensets that can handle peak loads, maintain stability, and support critical operations without performance degradation. In Asia-Pacific, mid-range gensets dominate markets for offices, retail, and small industrial units, where affordability and functional reliability are key priorities. Differences in power rating and load management affect procurement budgets, installation planning, and operational efficiency. Leading suppliers target high-performance segments with advanced load optimization, while regional players focus on robust, cost-effective units. These contrasts shape adoption patterns, system design, and competitiveness across global commercial sectors.

Regulatory compliance for emissions significantly influences genset design and adoption. Europe and North America enforce strict emission standards, including EPA and EU Stage regulations, prompting manufacturers to provide low-emission, fuel-efficient gensets equipped with advanced after-treatment systems such as SCR and DPF. These standards increase capital expenditure but ensure compliance, reduce environmental impact, and enhance brand credibility. In the Asia-Pacific region, adoption is mixed; high-budget commercial and industrial facilities follow similar regulations, while cost-sensitive regions continue to use conventional units due to regulatory leniency and price considerations. Differences in emission compliance affect product engineering, certification processes, and market entry strategies. Suppliers investing in advanced emission technologies gain advantages in premium markets, while regional players maintain affordability and accessibility. Regulatory contrasts directly influence competitiveness, market penetration, and adoption timelines globally.

Automation features, remote monitoring, and fuel efficiency are key differentiators in standby commercial diesel gensets. In North America and Europe, facilities demand gensets integrated with automatic transfer switches, real-time monitoring, fault diagnostics, and fuel optimization to minimize downtime and operational costs. These features improve reliability, reduce manual intervention, and ensure continuous power supply. In the Asia-Pacific region, users often prioritize cost-effectiveness and essential functionality over advanced automation, focusing on practical monitoring and operation. Differences in automation and energy efficiency impact the total cost of ownership, operational reliability, and adoption decisions. Premium manufacturers offering fully automated, fuel-optimized gensets gain higher-value contracts, while regional suppliers capture demand for functional, reliable, and affordable solutions. Feature contrasts strongly shape adoption, customer satisfaction, and long-term deployment in critical commercial applications.

Distribution channels and service support play a crucial role in standby genset adoption. North America and Europe rely on professional dealer networks, OEM contracts, and long-term maintenance programs that include installation, commissioning, and periodic servicing to ensure reliable operation. These markets value prompt technical support and structured service agreements that minimize downtime and operational risk. Asia-Pacific often depends on local distributors, regional service providers, and online procurement platforms to reach small and medium commercial customers, with after-sales support varying in quality and response time. Differences in distribution and service networks affect installation efficiency, user confidence, and repeat business. Leading suppliers leverage multi-channel distribution with integrated service solutions, while regional players focus on accessible and cost-effective delivery models.

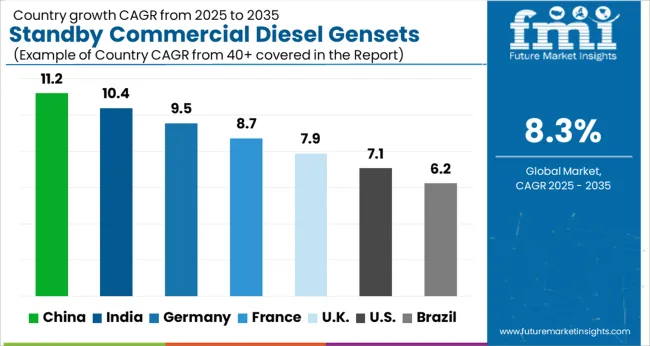

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

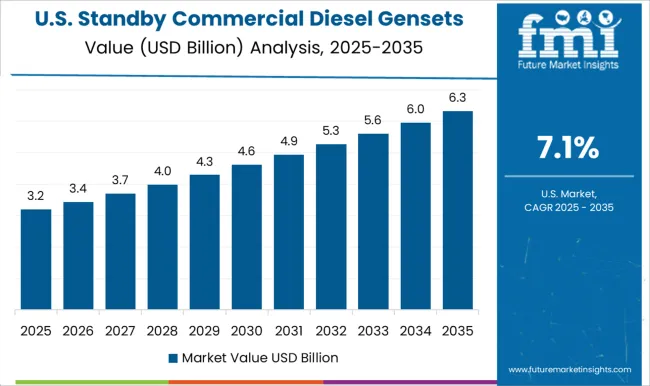

| USA | 7.1% |

| Brazil | 6.2% |

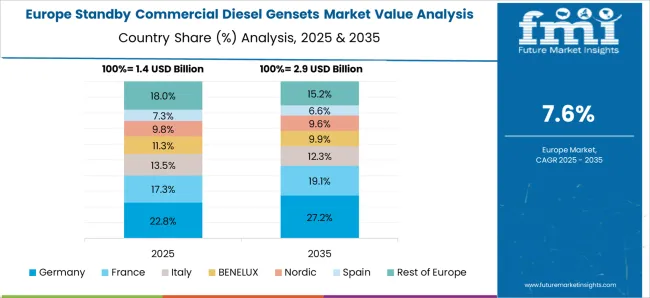

The global standby commercial diesel gensets market was projected to grow at an 8.3% CAGR through 2035, driven by demand in commercial buildings, industrial facilities, and backup power applications. Among BRICS nations, China recorded 11.2% growth as large-scale production and assembly facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 10.4% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 9.5% maintained substantial output under strict industrial and operational regulations, while the United Kingdom at 7.9% relied on moderate-scale operations for commercial backup power solutions. The USA, expanding at 7.1%, remained a mature market with steady demand across commercial and industrial segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top markets are analyzed bellow for reference.

The standby commercial diesel gensets market in China is growing at a CAGR of 11.2% driven by rising demand from commercial buildings, hospitals, industrial facilities, and data centers requiring reliable backup power. Organizations adopt diesel gensets to ensure continuous operations during grid failures, power outages, and emergency situations. Growth is supported by urban infrastructure expansion, increasing commercial construction, and the need for high capacity and efficient backup systems. Suppliers provide a range of diesel gensets with advanced control systems, high fuel efficiency, and low maintenance requirements suitable for commercial and industrial applications. Distribution through equipment dealers, industrial suppliers, and direct sales channels ensures wide accessibility. Adoption is further driven by rising power reliability concerns and demand for uninterrupted operations. China remains a leading market due to its large commercial infrastructure, industrial base, and growing demand for high performance backup power systems.

India is witnessing growth at a CAGR of 10.4% in the standby commercial diesel gensets market due to rising demand from hospitals, commercial buildings, industrial facilities, and critical infrastructure. Diesel gensets are widely adopted to provide uninterrupted power during grid failures, outages, and emergency situations. Growth is supported by expanding urban development, commercial construction projects, and increasing power demand in industrial zones. Suppliers provide gensets with high fuel efficiency, robust performance, and advanced monitoring systems suitable for commercial and industrial applications. Distribution through industrial equipment dealers, service providers, and online channels ensures market accessibility across urban and semi-urban regions. Adoption is further boosted by growing awareness of reliable backup power solutions and operational continuity requirements. India continues to see strong market growth due to increasing commercial infrastructure and industrial energy needs.

Germany is growing at a CAGR of 9.5% in the standby commercial diesel gensets market, supported by demand from commercial buildings, data centers, industrial facilities, and hospitals. Diesel gensets are widely used to ensure continuous operations, prevent downtime, and maintain operational reliability. Growth is supported by industrial modernization, data center expansion, and strict energy continuity requirements. Suppliers provide gensets with advanced control systems, high fuel efficiency, low emissions, and robust performance suitable for critical backup applications. Distribution channels include equipment dealers, industrial suppliers, and service providers, ensuring widespread accessibility. Adoption is further driven by regulatory compliance, reliability standards, and increasing focus on uninterrupted operations in commercial and industrial sectors. Germany remains a key European market due to its advanced industrial base and emphasis on high quality backup power solutions.

The United Kingdom market is expanding at a CAGR of 7.9% due to increasing adoption in commercial buildings, hospitals, industrial facilities, and critical infrastructure. Organizations implement diesel gensets to provide backup power, ensure operational continuity, and maintain productivity during outages. Growth is supported by urban development, rising commercial construction, and increasing reliance on reliable energy solutions. Suppliers provide high performance gensets with fuel efficiency, robust operation, and advanced control systems suitable for commercial applications. Distribution through industrial equipment dealers, service providers, and online channels ensures accessibility across regions. Adoption is further driven by the need for dependable backup power, business continuity, and risk management strategies. The United Kingdom continues to see steady market growth due to increasing demand for high reliability and efficient diesel gensets in commercial and industrial sectors.

The United States market is growing at a CAGR of 7.1% supported by rising demand from commercial buildings, data centers, hospitals, and industrial operations. Diesel gensets are widely used to ensure operational continuity, maintain productivity, and provide reliable backup power during outages and emergencies. Growth is supported by urban development, industrial expansion, and the need for high reliability energy solutions. Suppliers offer gensets with advanced control features, high fuel efficiency, low maintenance requirements, and robust performance for commercial and industrial applications. Distribution channels include industrial equipment dealers, service providers, and online platforms, ensuring wide market accessibility. Adoption is further driven by demand for uninterrupted operations, energy reliability, and critical infrastructure support. The United States remains a key market due to large commercial infrastructure, industrial energy needs, and increasing focus on backup power reliability.

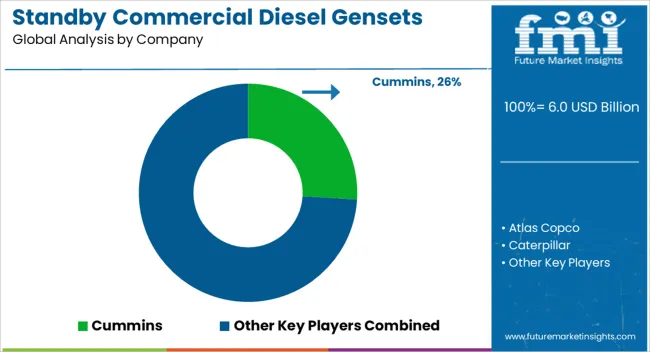

The standby commercial diesel gensets market is dominated by established suppliers such as Cummins, Atlas Copco, Caterpillar, Doosan Portable Power, Generac Power Systems, HIMOINSA, Hipower, JCB, Kirloskar, Mahindra Powerol, Mitsubishi Heavy Industries, Pinnacle Generators, Perkins Engines, Powerica, Pramac, Rhelko, Sudhir Power, and Yanmar Holdings. These companies provide reliable diesel gensets primarily for commercial buildings, industrial facilities, hospitals, and data centers, where a continuous power supply is critical. Their products emphasize high efficiency, durability, and the ability to operate under demanding load conditions. Leading players differentiate through engine performance, fuel efficiency, low noise output, and compliance with regional emission standards. Cummins, Caterpillar, and Mitsubishi Heavy Industries focus on large-scale industrial solutions, offering high-capacity gensets capable of handling peak loads. Atlas Copco, Doosan, and Generac Power Systems target mid-range commercial applications with versatile, easy-to-install models, while Kirloskar, Mahindra Powerol, HIMOINSA, and Yanmar strengthen regional distribution networks in emerging markets.

Companies like Perkins Engines and Hipower provide specialized engines with robust maintenance support for long-term operational reliability. The market is witnessing a growing emphasis on digital monitoring, remote diagnostics, and automated load management systems, enabling users to track performance and reduce downtime. Rising demand for backup solutions in areas with unstable grid power, along with regulatory pressure to adopt low-emission engines, is driving product upgrades. Additionally, suppliers are expanding service infrastructure and financing options to cater to both large-scale enterprises and small-to-medium commercial establishments, making standby diesel gensets increasingly accessible and efficient for diverse applications worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 Billion |

| Power Rating | > 330 kVA - 750 kVA, ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, and > 750 kVA |

| End Use | Telecom, Healthcare, Data Centers, Educational Institutions, Government Centers, Hospitality, Retail Sales, Real Estate, Commercial Complex, Infrastructure, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins, Atlas Copco, Caterpillar, Doosan Portable Power, Generac Power Systems, HIMOINSA, Hipower, JCB, Kirloskar, Mahindra Powerol, Mitsubishi Heavy Industries, Pinnacle Generators, Perkins Engines, Powerica, Pramac, Rhelko, Sudhir Power, and Yanmar Holdings |

| Additional Attributes | Dollar sales vary by power rating, including below 100 kVA, 100–500 kVA, and above 500 kVA; by application, such as commercial buildings, data centers, healthcare facilities, and retail outlets; by end-use, spanning hospitality, education, and BFSI sectors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for reliable backup power, infrastructure expansion, and business continuity needs. |

The global standby commercial diesel gensets market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the standby commercial diesel gensets market is projected to reach USD 13.2 billion by 2035.

The standby commercial diesel gensets market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in standby commercial diesel gensets market are > 330 kva - 750 kva, ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 330 kva and > 750 kva.

In terms of end use, telecom segment to command 29.4% share in the standby commercial diesel gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Crew boats (Standby Crew Vessels) Market

Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA