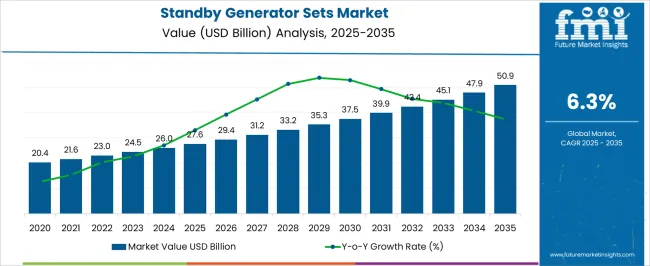

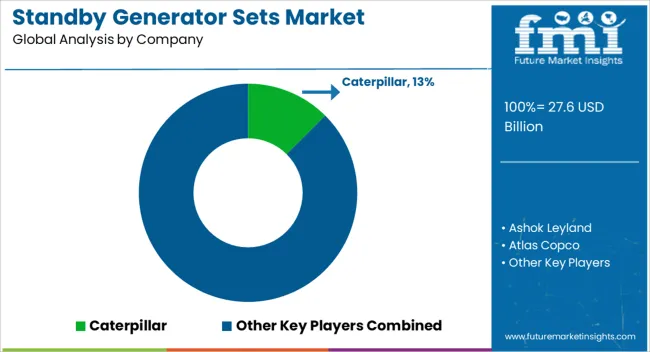

The standby generator sets market, valued at USD 27.6 billion in 2025 and projected to reach USD 50.9 billion by 2035 at a CAGR of 6.3%, presents a trajectory consistent with a market in the growth to early maturity stage of its lifecycle. The adoption curve indicates steady and incremental demand as industries, commercial facilities, and residential sectors increasingly prioritize backup power solutions in response to reliability concerns and grid instability.

The market’s year-on-year expansion reflects a balanced growth path rather than aggressive acceleration, suggesting adoption is widening but not in an exponential phase. In the early years of the forecast, adoption is driven by industries and healthcare facilities requiring uninterrupted operations. By the mid-phase of the cycle, adoption broadens as commercial spaces and residential customers integrate generator sets for resilience during outages. The latter half of the timeline shows a gradual transition toward maturity, with replacement demand and efficiency upgrades becoming prominent drivers.

While technological advances in fuel efficiency and hybrid systems extend growth, the pace suggests a stabilizing trajectory by 2035. The adoption lifecycle demonstrates that the market is advancing through the growth stage, with steady uptake leading to early maturity by the end of the forecast period, characterized by sustained but moderated expansion.

| Metric | Value |

|---|---|

| Standby Generator Sets Market Estimated Value in (2025 E) | USD 27.6 billion |

| Standby Generator Sets Market Forecast Value in (2035 F) | USD 50.9 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The standby generator sets market represents a key segment within the global power generation and backup energy industry, emphasizing reliability, resilience, and uninterrupted power supply. Within the broader distributed energy generation sector, it accounts for about 5.6%, driven by adoption across residential, commercial, and industrial applications. In the emergency and backup power systems market, it holds nearly 6.1%, reflecting widespread use in healthcare, data centers, and critical infrastructure. Across the electrical distribution and energy management equipment category, the share is 4.5%, supporting integration with switchgear, transfer switches, and control systems.

Within the industrial and construction equipment sector, it represents 3.9%, highlighting demand for site operations and continuous productivity. In the renewable hybrid and microgrid integration space, it secures 3.3%, emphasizing combined use with solar, wind, and storage solutions for enhanced energy reliability. Recent developments in this market have centered on fuel diversification, digital monitoring, and hybridization. Advancements include natural gas-powered and bi-fuel standby gensets, reducing dependence on diesel while improving operational efficiency. Key players are investing in IoT-enabled monitoring, predictive maintenance systems, and cloud-based dashboards for real-time performance tracking. Hybrid generator sets integrated with battery storage are gaining traction to lower fuel consumption and emissions.

Compact and modular designs are being deployed for easy installation in urban and remote settings. Strategic collaborations between generator manufacturers, energy management companies, and renewable solution providers are shaping product innovation.

The Standby Generator Sets market is witnessing robust growth driven by the increasing demand for reliable power backup solutions across various industries. The current market scenario is shaped by expanding industrialization, frequent power outages in developing regions, and growing investments in infrastructure development.

The market outlook remains positive due to the rising need for uninterrupted power supply in critical sectors such as manufacturing, healthcare, and commercial enterprises. Technological advancements improving fuel efficiency and emission control are further accelerating adoption.

Additionally, growing environmental regulations and the push for cleaner energy sources are influencing product innovations. As businesses focus on operational continuity and energy security, the demand for standby generator sets is expected to sustain strong growth, supported by emerging economies and the modernization of existing power infrastructure.

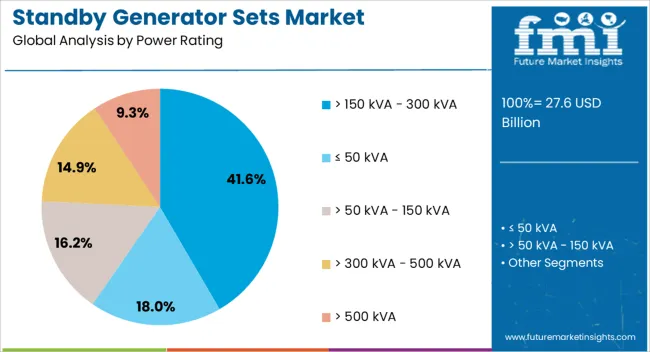

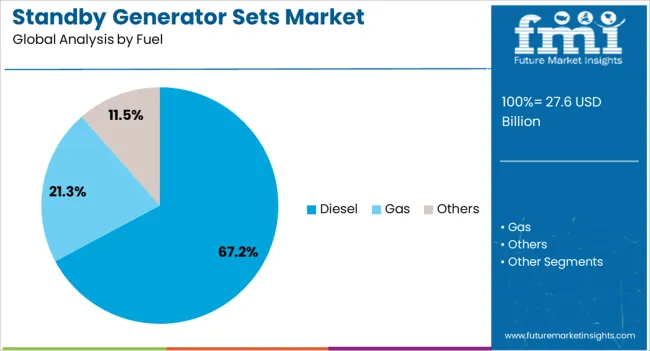

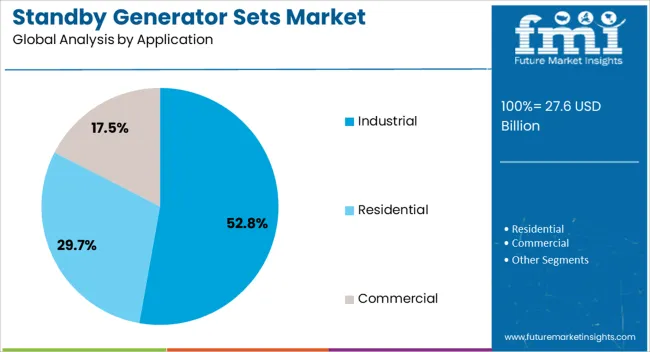

The standby generator sets market is segmented by power rating, fuel, application, and geographic regions. By power rating, standby generator sets market is divided into > 150 kVA - 300 kVA, ≤ 50 kVA, > 50 kVA - 150 kVA, > 300 kVA - 500 kVA, and > 500 kVA. In terms of fuel, standby generator sets market is classified into Diesel, Gas, and Others. Based on application, standby generator sets market is segmented into Industrial, Residential, and Commercial.

Regionally, the standby generator sets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Power Rating segment of more than 150 kVA to 300 kVA is projected to hold 41.6% of the market revenue share in 2025, making it the leading category. This dominance is attributed to its suitability for medium to large-scale industrial and commercial applications where a balance between power output and operational efficiency is essential.

The segment’s growth is driven by the increasing requirement for backup power that can support critical loads without oversizing, thus optimizing capital and operational expenditures. Moreover, these generator sets provide scalability and flexibility for diverse power needs, which has encouraged their widespread adoption.

The ability to integrate with advanced monitoring and control systems also enhances their appeal in modern power management scenarios.

The Diesel fuel segment is expected to account for 67.2% of the Standby Generator Sets market revenue share in 2025, establishing it as the dominant fuel type. This leadership is largely due to diesel’s high energy density, availability, and cost-effectiveness compared to alternative fuels.

Diesel-powered generators offer robust performance, durability, and ease of maintenance, making them highly preferred for continuous and emergency power backup. Additionally, diesel technology has benefited from long-term industrial use and well-established supply chains, which support reliability and quick refueling. Despite the rise of cleaner energy alternatives, diesel remains the preferred choice in regions where fuel infrastructure is well-developed and stringent power continuity requirements exist.

The Industrial application segment is anticipated to hold 52.8% of the market revenue share in 2025, leading all application categories. The critical need for continuous power supply in industries such as manufacturing, oil and gas, chemical processing, and heavy machinery operations is driving this leadership.

Industrial facilities require reliable and high-capacity backup power solutions to prevent costly downtime and ensure safety and operational compliance. The growth in this segment is supported by expanding industrial activity globally and increasing regulatory emphasis on power resilience.

Furthermore, the integration of automated control systems and predictive maintenance features in standby generators has enhanced their reliability and efficiency, making them indispensable in industrial environments.

The market has evolved as a vital segment supporting continuous power supply across residential, commercial, and industrial applications. These systems provide automatic backup electricity during outages, ensuring uninterrupted operations for critical infrastructure such as healthcare facilities, data centers, and manufacturing plants. Growing dependence on reliable power, combined with an increase in weather-related disruptions, has fueled adoption.

Diesel and natural gas generator sets dominate the segment, with hybrid and cleaner alternatives emerging as sustainable options. Advancements in automation, remote monitoring, and load management technologies have further strengthened the integration of standby generator sets across global power systems.

Increasing frequency of grid failures and natural disasters has heightened reliance on standby generator sets. Healthcare, communication, and financial services have emphasized continuous operations, leading to robust investments in backup solutions. Residential adoption has also accelerated, particularly in regions prone to storms and prolonged outages. Industrial facilities have incorporated large capacity generator sets to safeguard productivity and prevent costly downtime. Rising demand for uninterrupted power supply has created consistent opportunities for manufacturers, distributors, and service providers. The market’s expansion continues to be supported by the growing gap between power demand and stable electricity supply in emerging economies.

Rapid advancements in generator technologies have improved efficiency, performance, and safety features. Remote monitoring systems now allow operators to track fuel consumption, load conditions, and maintenance schedules in real time. Integration of digital controllers has optimized power management, making systems more reliable and user friendly. Hybrid configurations combining diesel, natural gas, and renewable energy sources are increasingly being deployed to reduce fuel dependency and emissions. Noise reduction mechanisms and compact designs have further enhanced usability in residential and commercial spaces. These innovations have not only increased operational efficiency but have also expanded the scope of standby generator sets across diverse sectors.

The rising penetration of standby generator sets across commercial and industrial environments has been a key driver for market growth. Data centers, manufacturing facilities, and logistics hubs require uninterrupted electricity to ensure continuous operations. Compliance with safety regulations and operational standards has also compelled businesses to invest in reliable backup systems. The expanding use of digital infrastructure, including cloud services and automated production, has further intensified demand. Meanwhile, small and medium sized enterprises are increasingly investing in cost effective standby units to safeguard against operational disruptions. This broadening commercial and industrial adoption continues to accelerate the long term growth of the market.

The market faces challenges linked to environmental concerns, stringent emissions standards, and rising fuel costs. Diesel generator sets, while dominant, are under scrutiny for their carbon emissions and noise levels.

Regulatory authorities in many regions have introduced strict limits on permissible emissions, compelling manufacturers to adopt cleaner technologies and advanced filtration systems. Fuel price volatility has further affected operating costs for end users, creating pressure on affordability. The competition from alternative energy storage solutions such as batteries has introduced new challenges.

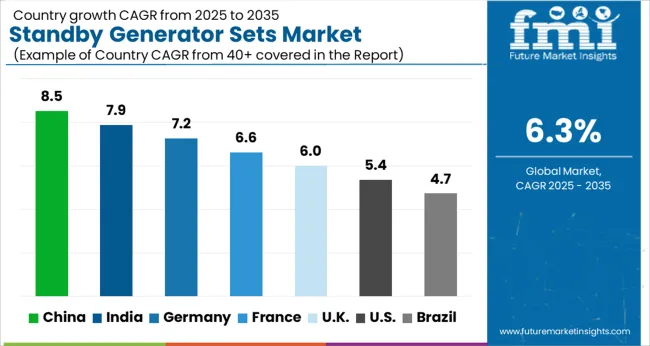

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The market is projected to expand at a forecast CAGR of 6.3% between 2025 and 2035, with notable advancements across key economies. India at 7.9% and Germany at 7.2% are strengthening their presence through steady infrastructure activity and reliable backup power integration. China remains the largest growth contributor at 8.5, supported by strong industrial and commercial reliance. The UK at 6.0% and the USA at 5.4% are maintaining consistent demand, driven by requirements for power continuity across critical sectors. This scenario highlights the role of diversified applications and evolving energy needs in shaping market progression globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to achieve a CAGR of 8.5%, influenced by rapid industrialization, infrastructure projects, and demand for uninterrupted power supply in commercial establishments. Adoption has been encouraged by manufacturing hubs and urban clusters requiring reliable backup power during grid instability. Domestic manufacturers such as Weichai and Yuchai focus on large capacity diesel and gas generator sets, while international suppliers maintain partnerships with local distributors. Government investment in healthcare, transportation, and digital infrastructure continues to create demand for efficient backup systems. The market outlook remains strong, supported by consistent power reliability needs across industrial and residential segments in China.

India is estimated to grow at a CAGR of 7.9%, supported by demand from data centers, commercial complexes, and manufacturing sectors. Frequent grid interruptions and seasonal outages have encouraged adoption of high capacity standby systems across urban and semi urban regions. Domestic manufacturers such as Kirloskar and Mahindra Powerol continue to lead with diesel generator sets tailored for both small and large enterprises. Increasing construction of hospitals, IT hubs, and logistics facilities further boosts market demand. The outlook indicates sustained growth, driven by energy security requirements and the expansion of mission critical industries in India.

The German market is expected to expand at a CAGR of 7.2%, driven by the emphasis on reliable power supply in healthcare, logistics, and industrial facilities. Adoption has been strengthened by stricter regulations for emergency power systems in critical infrastructure. Manufacturers such as MTU Onsite Energy and Caterpillar Germany focus on high performance systems integrating digital monitoring and efficient fuel management. Germany’s increasing data center investments have further accelerated demand. The market remains promising as businesses prioritize operational continuity and compliance with energy reliability standards.

The market in the United Kingdom is forecast to grow at a CAGR of 6.0%, influenced by rising investments in healthcare, telecom, and industrial projects. Demand has been reinforced by the need for uninterrupted power in critical applications and frequent integration with renewable energy systems. Domestic distributors import significant volumes from European and U S manufacturers to cater to commercial and residential users. Hybrid and natural gas powered standby systems are gaining traction due to regulatory emphasis on reduced emissions. Market prospects remain steady as reliability of power supply becomes a major consideration across industries in the U K.

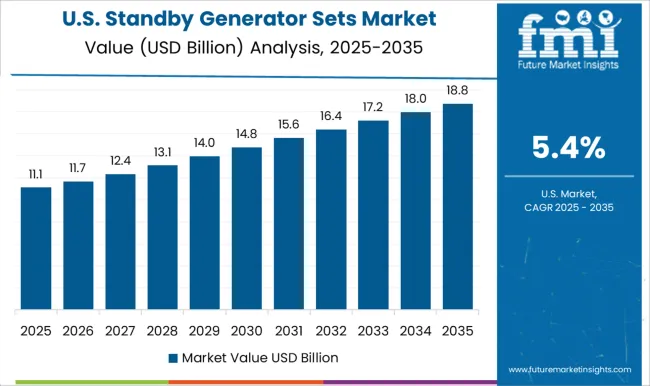

The market in the United States is expected to advance at a CAGR of 5.4%, driven by demand from residential users, data centers, and commercial facilities. Increasing weather related outages and grid reliability concerns have stimulated adoption of medium and large capacity systems. Manufacturers such as Generac, Cummins, and Kohler dominate the market with extensive product lines catering to diverse applications. Rising penetration of smart monitoring systems and integration with renewable energy have further enhanced market growth. The outlook is stable as both households and industries continue to prioritize power reliability solutions in the U S.

The market is defined by a mix of multinational corporations and regional leaders, each offering varied power solutions to industrial, commercial, and residential users. Caterpillar, Cummins, and Rolls-Royce are positioned as global heavyweights, delivering high-capacity standby systems favored in data centers, manufacturing hubs, and large infrastructure projects. Generac Power Systems and Briggs and Stratton strengthen their hold in the residential and small business segments with compact and reliable units that balance performance with affordability. European and Asian players such as Atlas Copco, Wartsila, and JCB contribute advanced engineering capabilities, integrating fuel efficiency and emission compliance technologies into their offerings.

Indian manufacturers like Kirloskar, Ashok Leyland, Mahindra Powerol, and Powerica dominate regional markets by focusing on cost-competitive solutions with robust after-sales support, catering to power reliability challenges in emerging economies. Himoinsa and Hipower leverage their expertise in tailored configurations, offering flexible standby systems adaptable for diverse applications. Competitive strategies are shaped by innovation in hybrid power systems, remote monitoring, fuel versatility, and compliance with stricter emission norms. Increasing demand from healthcare, IT infrastructure, and residential housing continues to intensify competition, driving firms toward strategic partnerships, localized manufacturing, and sustainable product portfolios.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.6 Billion |

| Power Rating | > 150 kVA - 300 kVA, ≤ 50 kVA, > 50 kVA - 150 kVA, > 300 kVA - 500 kVA, and > 500 kVA |

| Fuel | Diesel, Gas, and Others |

| Application | Industrial, Residential, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Ashok Leyland, Atlas Copco, Briggs and Stratton, Cummins, Eaton, Generac Power Systems, Gillette, Himoinsa, Hipower, JCB, Kirloskar, Rhelko, MAHINDRA POWEROL, Powerica, Rolls-Royce, Wartsila, and Yamaha Motor |

| Additional Attributes | Dollar sales by generator type and capacity, demand dynamics across residential, commercial, and industrial sectors, regional trends in backup power adoption, innovation in fuel efficiency, noise reduction, and remote monitoring, environmental impact of emissions and fuel consumption, and emerging use cases in data centers, healthcare facilities, and critical infrastructure support. |

The global standby generator sets market is estimated to be valued at USD 27.6 billion in 2025.

The market size for the standby generator sets market is projected to reach USD 50.9 billion by 2035.

The standby generator sets market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in standby generator sets market are > 150 kva - 300 kva, ≤ 50 kva, > 50 kva - 150 kva, > 300 kva - 500 kva and > 500 kva.

In terms of fuel, diesel segment to command 67.2% share in the standby generator sets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Standby Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Crew boats (Standby Crew Vessels) Market

Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Gas Generator Sets Market Growth - Trends & Forecast 2025 to 2035

Hydrogenerators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA