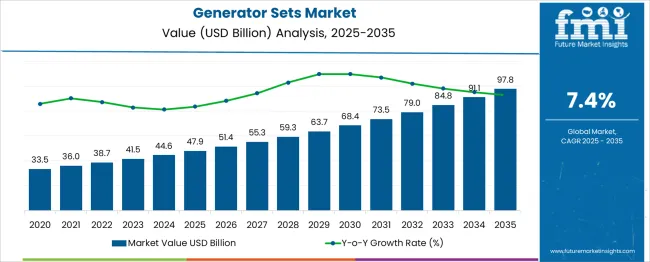

The Generator Sets Market is estimated to be valued at USD 47.9 billion in 2025 and is projected to reach USD 97.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. The growth curve from the given dataset displays a smooth, consistent, and slightly steepening pattern, characteristic of sustained compound expansion. From 2025 to 2028, annual increments range between USD 3.5 and USD 4.0 billion, reflecting steady adoption across industrial, commercial, and residential segments. Post-2029, the curve shows a mild acceleration, with yearly gains surpassing USD 5.0 billion by 2034. This gradual steepening suggests that market momentum will strengthen in the latter part of the forecast period, likely driven by infrastructure investments, grid reliability challenges, and demand for backup power in data centers and healthcare facilities.

The shape of the growth curve is linear-compound rather than exponential, indicating that while adoption is steady, it is not characterized by sudden spikes or volatility. The trajectory suggests predictable and sustained market expansion without signs of early saturation. The gradual but consistent incline ensures stable opportunities for manufacturers and service providers, making the Generator Sets Market a prime example of balanced long-term growth with a well-defined and stable curve progression.

| Metric | Value |

|---|---|

| Generator Sets Market Estimated Value in (2025 E) | USD 47.9 billion |

| Generator Sets Market Forecast Value in (2035 F) | USD 97.8 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The generator sets market is undergoing dynamic evolution driven by power reliability concerns, rising infrastructure development, and increased demand for backup power across developing economies. Grid instability, particularly in rural and semi-urban regions, is influencing the demand for decentralized power generation solutions.

Government investments in telecom towers, healthcare infrastructure, and data centers are expanding the operational landscape for gensets, particularly in low- and mid-capacity segments. Environmental compliance and fuel-efficiency regulations are pushing manufacturers toward hybrid and cleaner-burning fuel technologies.

Additionally, fleet electrification and growing off-grid construction activity are contributing to consistent demand across commercial and residential applications. The market is likely to witness continued innovation in noise reduction, remote monitoring, and emission control technologies to align with evolving sustainability targets and urban regulatory mandates.

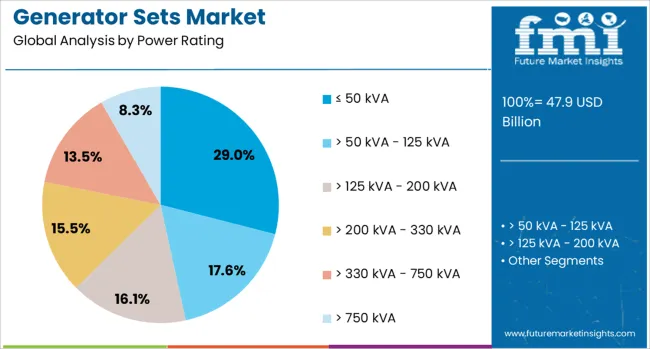

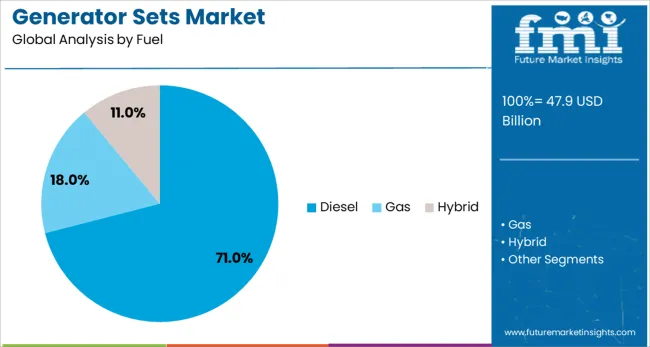

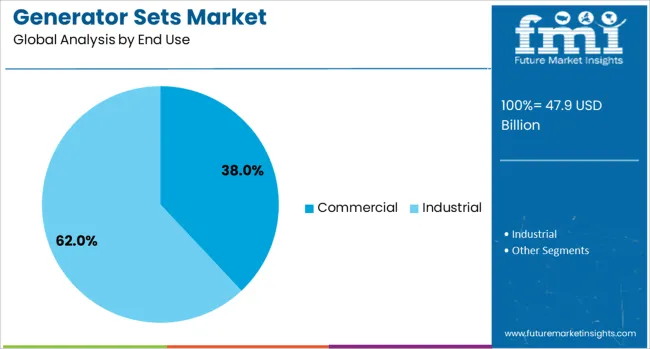

The generator sets market is segmented by power rating, fuel, end use, application, sales channel, and geographic regions. By power rating of the generator sets market is divided into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA> 750 kVA. In terms of fuel, the generator sets market is classified into Diesel, Gas, and Hybrid. Based on end use, the generator sets market is segmented into Commercial, Industrial, and Residential. By application, the generator sets market is segmented into Standby, Peak shaving, and Prime/continuous. The sales channel of the generator sets market is segmented into Dealer and Online Retail. Regionally, the generator sets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 50 kVA segment is expected to contribute 29.00% of the total market share in 2025, positioning it as a key driver of growth in decentralized power demand. This dominance is being shaped by the segment’s suitability for small-scale applications, including rural households, telecom base stations, and small commercial establishments where grid power is unreliable.

Compact size, portability, and lower capital investment make this range an ideal choice for temporary installations and standby power needs. Rapid urbanization in tier-2 and tier-3 cities, coupled with rising deployment of mobile tower infrastructure, continues to favor low-capacity gensets.

Additionally, simplified compliance requirements for this category and easy serviceability in remote regions further reinforce its widespread adoption.

Diesel generator sets are projected to lead the market with a 71.00% share in 2025, reflecting their dominance in high-load and long-duration backup applications. The reliability, high thermal efficiency, and operational longevity of diesel gensets have maintained their strong preference across commercial, construction, and industrial sectors.

Despite emerging fuel alternatives, diesel remains cost-effective in regions with limited access to natural gas pipelines or grid-based energy sources. Continuous advancements in emission control technologies, including Tier 4 compliance and particulate filtration systems, are enabling diesel gensets to remain viable in emissions-sensitive markets.

Their compatibility with load fluctuations and ease of refueling in remote and off-grid zones continue to secure their market leadership.

The commercial sector is projected to account for 38.00% of the generator sets market revenue in 2025, establishing it as the leading end-use segment. Increased demand from healthcare centers, data hubs, retail chains, and office complexes is driving the need for an uninterrupted power supply, particularly in regions with erratic grid performance.

The proliferation of SMEs and service-oriented businesses is expanding genset deployment across urban and semi-urban areas. Commercial buildings often require compact, silent-running, and remotely monitored genset systems, leading to higher adoption of smart, diesel-powered, or hybrid solutions.

Business continuity planning, regulatory mandates for emergency power backup, and growth in e-commerce warehousing are also reinforcing the segment’s dominant position.

Generator sets have been positioned as a core component of global energy infrastructure, serving as both primary and standby power solutions across multiple sectors. Their deployment has extended from large-scale industrial operations and infrastructure projects to commercial facilities, healthcare institutions, data centers, and residential buildings. The versatility of generator sets, available in diesel, gas, and hybrid variants, has enabled them to address a wide range of operational requirements. They have been critical in ensuring uninterrupted electricity supply in regions with unstable grids, remote areas, and mission-critical applications.

The global surge in infrastructure development, combined with rapid industrial expansion, has significantly contributed to generator set demand. Major projects such as airports, metro systems, mining operations, oil and gas facilities, and manufacturing plants have relied on generator sets for both temporary and continuous power needs. In regions with incomplete or unreliable grid connectivity, high-capacity units have been used to operate heavy machinery, lighting systems, and essential site equipment without disruption. Industrial operations have adopted scalable generator solutions that allow capacity adjustments based on seasonal or project-based energy demands. Remote extraction industries such as mining and oil exploration have required rugged, fuel-efficient models capable of withstanding harsh environments. The construction sector has increasingly preferred portable and containerized generator configurations for site mobility, while permanent installations have been favored in high-production facilities where downtime results in substantial financial losses.

The importance of generator sets in mission-critical and high-traffic environments has continued to rise as operational risks from power interruptions have increased. Hospitals and emergency response centers have depended on rapid-start generator systems to ensure uninterrupted operation of life-support devices and critical infrastructure. Data centers, which process vast amounts of information in real time, have relied on redundant generator arrays paired with UPS systems to safeguard against outages that could cause service failures or data loss. Telecommunications infrastructure, including cellular base stations and satellite ground stations, has required dependable backup power to maintain connectivity during grid instability. In the commercial sector, shopping centers, hotels, and office towers have used mid-sized generator units to keep essential systems such as elevators, air conditioning, and lighting operational during blackouts. These sectors have favored fuel-efficient, low-noise designs that balance reliability with environmental and operational considerations.

Continuous innovation in generator technology has expanded their operational capabilities, reduced lifecycle costs, and improved environmental performance. Integration of microprocessor-based control units has allowed precise load management, automated switching between grid and generator power, and advanced diagnostics. Hybrid configurations that combine generator sets with renewable sources such as solar or wind have been increasingly deployed to reduce fuel consumption and extend operational runtime in off-grid applications. Real-time remote monitoring through IoT-enabled platforms has provided fleet operators with predictive maintenance alerts, performance analytics, and fuel optimization insights. Noise and vibration control technologies, such as advanced acoustic enclosures and isolation mounts, have enhanced usability in urban and sensitive environments. Development of low-emission engines and compatibility with cleaner fuels, including natural gas and biodiesel, has positioned generator sets as a transitional technology bridging conventional energy and sustainable solutions.

While generator sets remain indispensable in many sectors, the market has been challenged by tightening emission regulations, fluctuating fuel costs, and the rise of competitive energy technologies. Governments in multiple regions have introduced stricter standards for nitrogen oxide, carbon dioxide, and particulate matter emissions, prompting manufacturers to invest in advanced after-treatment systems and alternative-fuel capabilities. Diesel generator users have been particularly affected by fuel price volatility, which has influenced long-term operational budgeting. Renewable energy systems with energy storage capabilities have emerged as potential substitutes in select applications, offering reduced operating costs and lower emissions. However, their ability to provide instant, high-load power remains limited compared to generator sets. Maintaining competitiveness will require manufacturers and operators to focus on cleaner technologies, diversified fuel use, and integrated energy solutions that combine conventional reliability with modern sustainability demands.

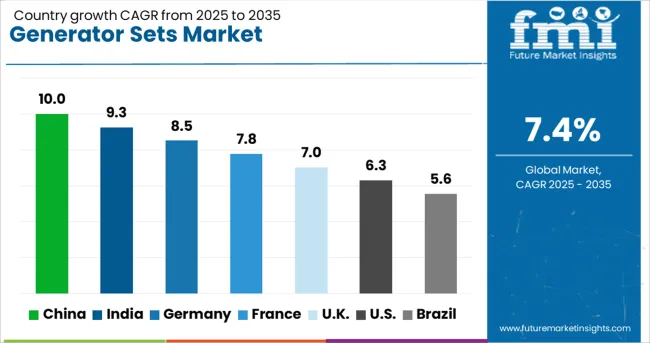

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

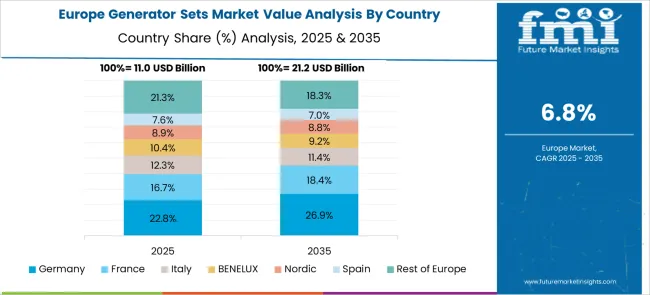

The generator sets market is projected to grow at a CAGR of 7.4% from 2025 to 2035, supported by rising backup power needs, infrastructure expansion, and technological improvements in fuel efficiency. China is expected to lead with a 10.0% CAGR, driven by large-scale industrial projects and grid reliability challenges. India, with a 9.3% growth rate, benefits from rapid construction activities and rural electrification programs. Germany, growing at 8.5%, focuses on integrating advanced emission control technologies and hybrid power solutions. The U.K., with a 7.0% CAGR, is influenced by infrastructure modernization and commercial sector demand. The U.S., expanding at 6.3%, sees growth from data center expansion and emergency preparedness investments. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to register a CAGR of 10.0% between 2025 and 2035 in the generator sets market, supported by extensive infrastructure development, industrial capacity expansion, and backup power demand from data centers. Large-scale manufacturing facilities are increasingly integrating high-capacity diesel and gas generator sets to ensure uninterrupted operations during grid fluctuations. Domestic manufacturers are enhancing product portfolios with low-emission engines and hybrid power systems to align with national energy efficiency targets. Growth in remote construction projects and renewable energy integration is also prompting the deployment of dual-fuel models. Government-backed investments in energy security are strengthening the adoption of advanced generator technologies in both commercial and public sector projects.

India is expected to achieve a CAGR of 9.3% in the generator sets market, driven by rapid commercial real estate growth, manufacturing sector investments, and persistent grid reliability challenges. Urban commercial hubs are deploying medium- and high-capacity generator sets to ensure uninterrupted operations, particularly in IT parks, hospitals, and retail complexes. The shift toward natural gas and hybrid generators is gaining momentum due to lower operational costs and reduced emissions. Local manufacturers are expanding their dealer networks in rural and semi-urban regions to cater to agricultural processing units and small-scale industries, where dependable power remains a critical requirement.

Germany is projected to grow at a CAGR of 8.5% in the generator sets market, with growth supported by stringent energy efficiency regulations and adoption of low-noise, low-emission designs. Demand is particularly strong from manufacturing plants, healthcare facilities, and large-scale event infrastructure. The integration of smart monitoring systems and remote diagnostics is increasing operational efficiency and reducing maintenance downtime. German engineering expertise is enabling the development of high-performance, fuel-flexible generator models suited for both domestic and export markets. Hybrid generator systems paired with battery storage solutions are gaining popularity among environmentally conscious buyers.

The United Kingdom is expected to record a CAGR of 7.0% in the generator sets market, supported by heightened emphasis on power resilience in commercial, healthcare, and transport sectors. Outdoor event organizers and temporary construction sites remain consistent buyers of portable generator units, while data centers are increasingly investing in large-scale diesel and gas systems. The market is also witnessing demand for ultra-low emission models in line with evolving environmental compliance requirements. Rental services are playing a significant role, allowing businesses to access high-capacity units without long-term capital expenditure.

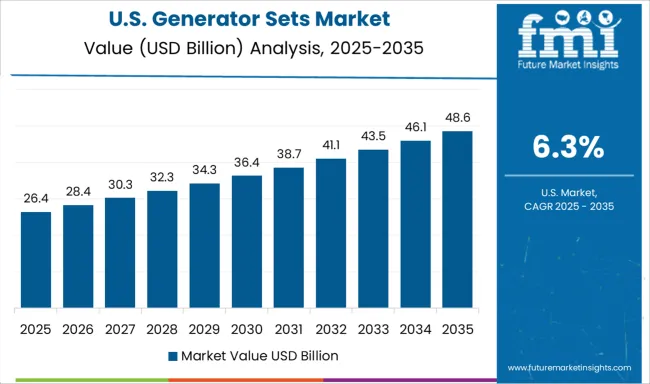

The United States is projected to post a CAGR of 6.3% in the generator sets market, supported by increasing reliance on backup power in residential, commercial, and industrial applications. The growing frequency of extreme weather events and grid disruptions is driving strong uptake in standby and portable generator systems. Data center operators, manufacturing facilities, and large retail chains are adopting high-capacity units with advanced load management capabilities. Renewable energy hybrid generators are also gaining traction, particularly in off-grid and remote area applications. The rental generator segment is experiencing growth due to rising demand from construction and entertainment sectors.

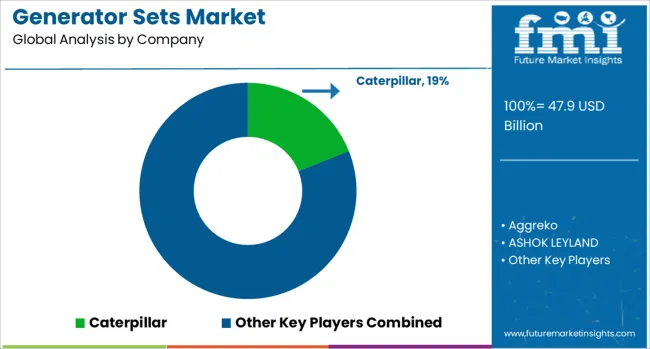

The market is driven by requirements for reliable backup and prime power solutions across industrial, commercial, and residential applications. Market growth is influenced by rising infrastructure development, increasing energy demand in remote areas, and the necessity for uninterrupted power supply in critical operations. Manufacturers compete on fuel efficiency, emission compliance, load management technology, and adaptability to diverse operating conditions. Caterpillar, Cummins, and Generac Power Systems hold strong global positions with extensive product portfolios covering diesel, gas, and hybrid generator sets. Aggreko is recognized for its large-scale rental solutions supporting events, emergency response, and temporary power needs. Atlas Copco and FG Wilson deliver high-performance units for demanding industrial environments, integrating advanced control systems for operational efficiency.

Honda Motor and Briggs & Stratton dominate the portable and small-capacity segment for residential and light commercial use, while Deere & Company extends its agricultural machinery expertise to power generation. Kirloskar, Greaves Cotton, and MAHINDRA POWEROL maintain strong regional networks in Asia, focusing on cost-effective, rugged solutions for emerging markets. ASHOK LEYLAND and HIMOINSA serve both domestic and export markets with tailored products for variable climatic conditions. Future growth is expected to be shaped by stricter environmental regulations, increasing adoption of natural gas-powered units, and integration of digital monitoring systems for predictive maintenance and remote operation.

| Item | Value |

|---|---|

| Quantitative Units | USD 47.9 Billion |

| Power Rating | ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA |

| Fuel | Diesel, Gas, and Hybrid |

| End Use | Commercial, Industrial, and Residential |

| Application | Standby, Peak shaving, and Prime/continuous |

| Sales Channel | Dealer, Online, and Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Aggreko, ASHOK LEYLAND, Atlas Copco, Briggs & Stratton, Cummins, Deere & Company, FG Wilson, Generac Power Systems, Greaves Cotton, HIMOINSA, Honda Motor, Huu Toan, J C Bamford Excavators, Kirloskar, and MAHINDRA POWEROL |

| Additional Attributes | Dollar sales by generator type and power rating, demand dynamics across industrial, commercial, and residential applications, regional trends in deployment across Asia-Pacific, North America, and Europe, innovation in hybrid fuel systems, remote monitoring technologies, and low-emission engine designs, environmental impact of fuel consumption, noise pollution, and exhaust emissions, and emerging use cases in renewable energy backup systems, mobile disaster relief units, and off-grid power solutions for remote operations. |

The global generator sets market is estimated to be valued at USD 47.9 billion in 2025.

The market size for the generator sets market is projected to reach USD 97.8 billion by 2035.

The generator sets market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in generator sets market are ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 330 kva, > 330 kva - 750 kva and > 750 kva.

In terms of fuel, diesel segment to command 71.0% share in the generator sets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Generator Sets Market Growth - Trends & Forecast 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Generator Bushing Market Size and Share Forecast Outlook 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Hydrogenerators Market

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Motor Generator Set Market Size, Growth, and Forecast 2025 to 2035

Pulse Generator Market

Ozone Generators Market

VR Headsets Market Size and Share Forecast Outlook 2025 to 2035

Signal Generator Market Analysis by Product, Technology, Application, End-use, and Region through 2035

Silent Generator Market Analysis by Sound Level, Type, Phase, Power Rating, Fuel, Application, End User, and Region through 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA