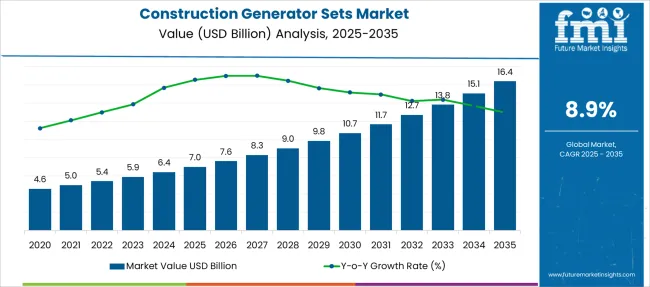

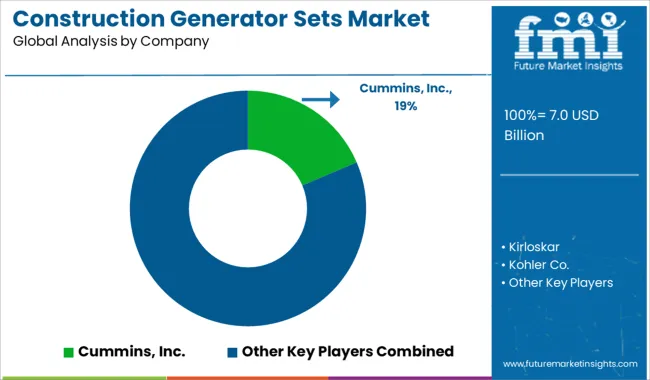

The Construction Generator Sets Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 16.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| Construction Generator Sets Market Estimated Value in (2025E) | USD 7.0 billion |

| Construction Generator Sets Market Forecast Value in (2035F) | USD 16.4 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The construction generator sets market is expanding steadily, driven by increased infrastructure development and the need for reliable power supply at construction sites. Growing investments in large-scale projects have created demand for robust power solutions capable of supporting heavy equipment and continuous operations.

The market benefits from improvements in generator technology, enhancing fuel efficiency and emission controls, which align with stricter environmental regulations. Construction firms are prioritizing uninterrupted power availability to minimize project delays and reduce operational costs.

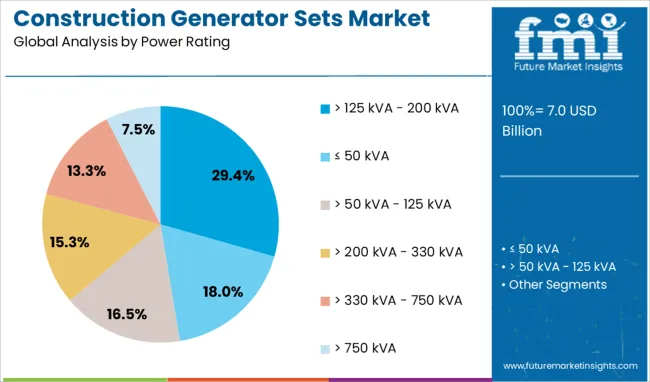

Emerging markets are witnessing rapid urbanization and industrialization, further fueling generator demand. The outlook remains positive as power reliability becomes critical for construction activities. Segment growth is expected to be led by generator sets with power ratings between >125 kVA and 200 kVA, diesel fuel-powered units, and prime/continuous power applications.

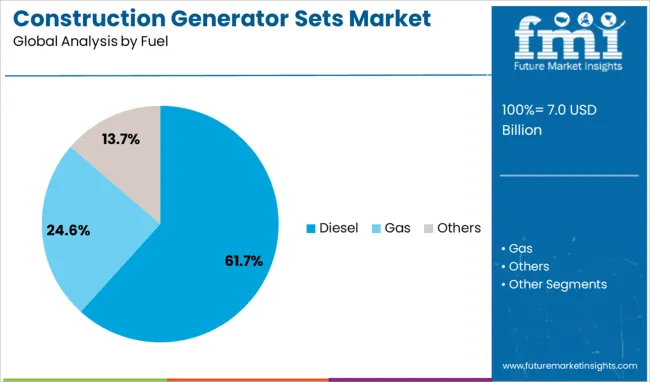

The construction generator sets market is segmented by power rating, fuel, application and geographic regions. The construction generator sets market is divided by power rating into > 125 kVA - 200 kVA, ≤ 50 kVA, > 50 kVA - 125 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA. In terms of fuel, the construction generator sets market is classified into Diesel, Gas, and Others.

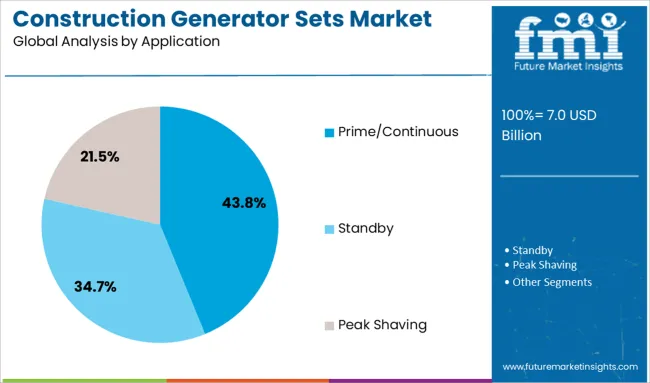

Based on the application of the construction generator sets, the market is segmented into Prime/Continuous, Standby, and Peak Shaving. Regionally, the construction generator sets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The >125 kVA - 200 kVA power rating segment is projected to hold 29.4% of the market revenue in 2025, maintaining its position as a leading category. This range provides a balanced solution for mid to large construction sites requiring substantial power output without excessive fuel consumption or size.

The segment’s popularity is due to its suitability for powering heavy machinery and multiple tools simultaneously. Contractors value these generators for their reliability and ease of transport.

The flexibility of this power rating to adapt to varying load requirements across projects supports consistent demand. As construction projects grow in scale and complexity, this power rating segment is expected to retain its dominance.

Diesel-powered generator sets are forecasted to account for 61.7% of the market revenue in 2025, remaining the preferred fuel type. Diesel engines are favored for their fuel efficiency, durability, and ability to handle heavy loads in demanding construction environments.

The wide availability of diesel fuel and established maintenance infrastructure contribute to the preference for diesel generators. These units are also recognized for their lower operational costs over time compared to alternatives.

Additionally, advancements in diesel engine technology have improved emissions performance, helping meet regulatory standards. Diesel fuel’s energy density and reliability make it the optimal choice for continuous and prime power supply in construction applications.

The Prime/Continuous application segment is projected to generate 43.8% of the market revenue in 2025, holding the largest share among application types. This segment’s growth is driven by the need for uninterrupted power to sustain ongoing construction activities and critical onsite operations.

Prime/continuous power generators are designed to run for extended periods under varying load conditions, making them essential for long-term projects. Their ability to provide stable power reduces downtime and improves equipment performance.

Construction companies increasingly rely on these generators to ensure operational efficiency and meet project deadlines. The segment is expected to continue leading as demand for reliable, long-duration power solutions grows in the construction sector.

The construction generator sets market is expanding due to increasing global infrastructure development and remote site electrification requirements. These gensets provide portable or standby power for construction tools, lighting, and temporary facilities in areas lacking reliable grid access. Diesel remains the dominant fuel type, though natural gas and hybrid systems are gaining traction.

Key applications include high-rise construction, tunneling, data center builds, and large‑scale projects. Demand growth is strongest in Asia‑Pacific, North America, and Europe, driven by construction activity and temporary power needs.

Manufacturers of generator sets for construction face mounting pressure from emission regulations in major markets. New standards targeting nitrogen oxide, particulate matter, and sound output require use of advanced aftertreatment systems or alternative fuels for compliance.

Diesel gensets must include components such as catalytic converters or particulate filters to meet allowable emission limits, increasing system complexity. Regulatory variation by region means that manufacturers must develop multiple versions of the same product, each tailored to local rules. This fragmentation raises engineering cost and extends product development timelines.

Regional testing and certification processes are required, adding administrative layers that delay market entry. Smaller manufacturers frequently struggle to support multiple compliant variants. These demands limit engineers to proven, emission‑certified designs, slowing adoption of new genset lines. Cost increases associated with compliance may also restrict competitiveness in price‑sensitive projects or emerging regions where regulations are less stringent.

Rapid growth in infrastructure projects worldwide offers significant opportunity for generator set suppliers. Construction of highways, bridges, metro systems, airports, high-rise buildings, and data centers often occurs in areas with insufficient grid capacity. Portable generator sets provide necessary electricity for equipment, temporary lighting, and jobsite needs.

As governments and private developers invest heavily in large-scale construction and smart infrastructure, the demand for high‑capacity and reliable power grows. Data‑center construction also requires backup systems during critical installation phases. Suppliers that provide robust, modular genset systems capable of enduring harsh outdoor conditions and prolonged runtime are favored.

Installation services and rental models further support deployment. Partnerships with construction contractors and rental fleets provide ongoing demand. As project timelines tighten and downtime becomes costly, reliable gensets become indispensable. This creates a long‑term growth pipeline for providers focused on construction sector requirements.

A notable trend in this market is rising adoption of generator sets powered by cleaner fuels such as natural gas or propane, as well as hybrid models combining gensets with solar or battery backup. These options allow operators to reduce fuel consumption, lower emissions, and comply with tightening regulations. Hybrid systems support quieter operation and better fuel efficiency, valued by urban construction sites.

Natural gas gensets are preferred in markets with available pipeline infrastructure. Manufacturers are introducing modular units that can switch between fuel types or engage battery support during low‑load periods. While diesel gensets remain powerful and reliable, hybrid configurations are increasingly preferred in environmentally sensitive or regulatory‑tight regions.

Supplier capabilities around multi‑fuel compatibility and integration of renewable energy components help win long‑term contracts. As construction firms emphasize cost optimization and environmental compliance simultaneously, hybrid and gas‑powered gensets gain market share relative to traditional diesel-only units.

Fluctuations in diesel, gas, or propane prices significantly affect the total operating cost of generator set fleets deployed at construction sites. Construction firms often operate on thin margins and cannot easily absorb sudden fuel cost increases, even when the power supply is critical.

Global crude dynamics, local tax structures, or changes in gas pricing policies drive price swings. This unpredictability complicates budgeting for long-term projects, especially those planned months in advance. Facilities relying on backup gensets may shift usage to reduce hours during peak fuel prices.

Suppliers who offer fuel-efficient models or advisory support for fuel procurement help alleviate this risk. Rental companies may face pressure to raise rental fees or offer fuel-inclusive packages to maintain profitability. In regions with limited fuel subsidy or unstable fuel markets, fuel cost volatility remains a key constraint affecting adoption decisions and pricing negotiations.

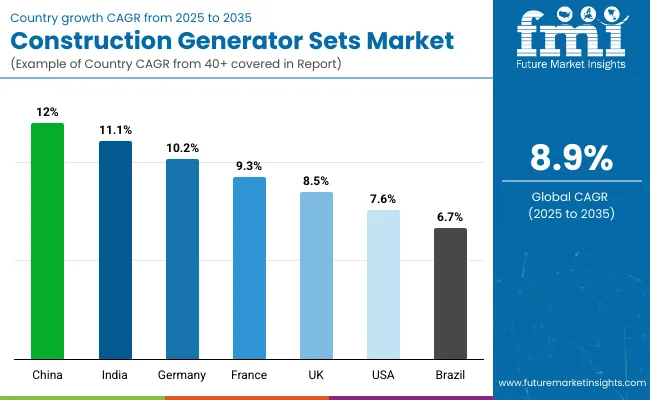

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The global construction generator sets market is projected to grow at a CAGR of 8.9% through 2035, supported by expanding infrastructure development and off-grid power requirements. Among BRICS nations, China leads with 12.0% growth, fueled by widespread construction activity and the deployment of standby power units on large-scale sites. India follows at 11.1%, where temporary power demand has been driven by urban expansion and industrial estate development. In the OECD region, Germany records 10.2% growth, supported by stringent reliability standards and consistent demand in commercial construction.

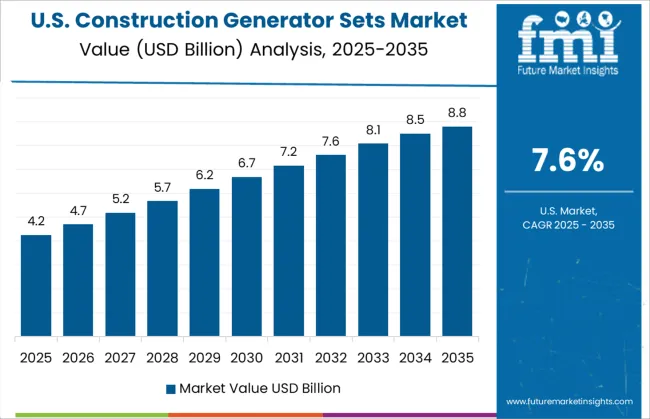

The United Kingdom, at 8.5%, continues to apply generator sets for infrastructure upgrades and remote site deployment. The United States, at 7.6%, remains a steady market with procurement driven by equipment reliability and emissions compliance. Market trends have been shaped by fuel efficiency mandates, operating hour limits, and procurement model requirements. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Growth of 12.0% CAGR has been registered in China, driven by widespread usage of generator sets at infrastructure and commercial construction sites. A noticeable rise in medium-capacity diesel and gas-powered units has been recorded across mixed-use developments and roadworks. Regulatory standards on emission limits have encouraged gradual integration of hybrid models in larger construction fleets.

High-altitude and remote zone operations have led to strong demand for heavy-duty sets with superior fuel efficiency. OEMs have expanded regional support networks to ensure on-site servicing and uptime assurance. Custom-built gensets with automatic load management systems have been adopted by tier-1 contractors.

In India, market has expanded at 11.1% CAGR, supported by increased deployment in road, rail, and industrial park development. A surge in mid-size genset demand has been observed in semi-urban and Tier-2 cities. Infrastructure contractors have opted for sound-attenuated and mobile models for ease of relocation. Hybrid generators combining solar support have been introduced in select construction zones where grid access remains limited. Local manufacturers have ramped up production of gensets compliant with CPCB norms. Equipment rental services have gained traction due to short project cycles and cost sensitivity.

Germany has reported a 10.2% CAGR in this segment, largely attributed to the role of gensets in temporary grid-independent construction activities. Units fitted with remote monitoring and real-time diagnostics have been increasingly preferred by civil contractors. Modular gensets for phased infrastructure rollouts have found usage in commercial and public building sites. Fuel-efficient models equipped with automated load balancing have gained prominence, especially for renovation and utility tunneling work. Construction equipment distributors have offered bundled genset packages with energy usage forecasts and preventive maintenance plans.

The United Kingdom has demonstrated an 8.5% CAGR, backed by steady usage of generator sets in residential, railway, and refurbishment projects. Construction contractors have preferred silent-operation models for inner-city applications. Compact gensets have been deployed for mobile site offices and temporary tool stations. Digital control panels enabling start-stop automation and fuel consumption reporting have supported wider adoption. Compliance with Stage V emissions legislation has led to upgrades in fleet specifications among equipment rental agencies. Select sites have trialed low-noise biofuel-powered sets for operations near schools and hospitals.

An 8.9% CAGR has been matched closely by the United States market, where demand has been shaped by backup needs at large commercial construction zones and highway expansion projects. Mobile gensets with trailer mounts have been deployed for asphalt and concrete batching applications. Equipment integrators have supported builders with telematics-enabled power solutions. Cost-efficient generators with multi-voltage output have seen usage in regional projects with fluctuating load demands. Infrastructure upgrades in hurricane-prone zones have pushed up requirements for weather-resistant sets with extended fuel autonomy.

The construction generator sets market is dominated by a mix of globally established manufacturers and regional players offering diesel and gas-powered solutions for consistent energy supply across remote and urban project sites. Cummins, Inc. leads with a broad range of heavy-duty gensets that are deployed on large-scale construction sites requiring high reliability and fuel efficiency. Caterpillar remains a dominant force due to its robust lineup of industrial-grade gensets designed to withstand harsh operational conditions while offering scalable power output.

Generac Power Systems, Inc. and Kohler Co. are recognized for their portable and standby generator systems, particularly suited for mid-sized construction firms requiring flexible deployment. Kirloskar and Mahindra POWEROL are leading Indian suppliers, offering cost-effective generator solutions with strong regional support, especially in infrastructure and real estate development. Atlas Copco AB and HIMOINSA provide integrated power modules featuring sound-attenuated enclosures and modular deployment options, ideal for urban construction environments with noise restrictions.

Yamaha Motor Co., Ltd. and Honda India Power Products Ltd. serve the portable genset segment with compact, reliable units favored for light-duty and temporary construction applications. Emerging players like Powerica Limited and Rapid Power Generation Ltd. are gaining market share by offering custom-built gensets aligned with project-specific requirements. Companies like Aggreko focus on rental power, catering to short-term construction needs. Others, including J C Bamford Excavators Ltd., Ashok Leyland, and Greaves Cotton Limited, offer vertically integrated power solutions that complement their construction equipment lines, enhancing operational continuity on-site.

According to Kirloskar Oil Engines Ltd, the company introduced Dual Fuel Kits on December 11, 2023, enabling diesel generators to operate using a combination of diesel and natural gas. These kits facilitate seamless fuel switching through an electronic controller, enhancing operational efficiency and helping to reduce emissions.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Power Rating | > 125 kVA - 200 kVA, ≤ 50 kVA, > 50 kVA - 125 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA |

| Fuel | Diesel, Gas, and Others |

| Application | Prime/Continuous, Standby, and Peak Shaving |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins, Inc., Kirloskar, Kohler Co., Generac Power Systems, Inc., Yamaha Motor Co., Ltd., Powerica Limited, Sterling and Wilson Pvt. Ltd., HIMOINSA, Caterpillar, Atlas Copco AB, J C Bamford Excavators Ltd., Mahindra POWEROL, Deere & Company, Ashok Leyland, Greaves Cotton Limited, Mitsubishi Heavy Industries, Ltd., Wartsila, Rapid Power Generation Ltd., Honda India Power Products Ltd., FG Wilson, Aggreko, and Champion Power Equipment |

| Additional Attributes | Dollar sales by construction generator set type including diesel, gas, and hybrid models, by power rating such as below 75 kVA, 75–375 kVA, and above 375 kVA, by application in residential, commercial, and industrial construction, and by region including North America, Europe, and Asia-Pacific; demand driven by infrastructure growth, power reliability needs, and remote project deployment; innovation in fuel efficiency, low-emission engines, and telematics integration; costs influenced by engine technology, emission compliance, and raw material prices. |

The global construction generator sets market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the construction generator sets market is projected to reach USD 16.4 billion by 2035.

The construction generator sets market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in construction generator sets market are > 125 kva - 200 kva, ≤ 50 kva, > 50 kva - 125 kva, > 200 kva - 330 kva, > 330 kva - 750 kva and > 750 kva.

In terms of fuel, diesel segment to command 61.7% share in the construction generator sets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA