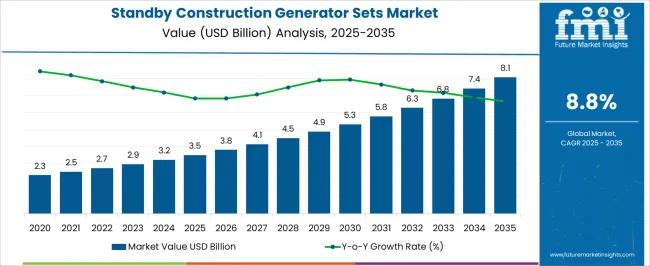

The Standby Construction Generator Sets Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period. The gradual growth from USD 3.5 billion to USD 8.1 billion highlights steady investment in production efficiency, component sourcing, and distribution networks.

Major cost components in the value chain include raw materials such as high-grade steel, copper for windings, and engine components, collectively representing a substantial portion of manufacturing expenditures. The assembly phase involves precision engineering of engines, alternators, and control units, where labor, quality assurance, and testing costs contribute significantly to the overall cost structure. Additional operational expenditures arise from compliance with environmental and safety regulations, including emissions standards and noise control measures, which influence both capital and operational costs. Logistics and distribution channels further impact cost allocation, with transportation of bulky generator sets to construction sites and storage facilities forming a notable share. Value addition is driven by technological enhancements, including automated control systems, remote monitoring, and fuel efficiency improvements, which allow manufacturers to command premium pricing while reducing operational costs for end-users.

The progressive increase from USD 3.5 billion to USD 8.1 billion demonstrates that cost optimization across raw material procurement, manufacturing efficiency, and distribution strategies is a key factor in sustaining market growth and competitive advantage over the forecast period.

| Metric | Value |

|---|---|

| Standby Construction Generator Sets Market Estimated Value in (2025 E) | USD 3.5 billion |

| Standby Construction Generator Sets Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The standby construction generator sets market is gaining momentum as construction activity expands across emerging and developed economies, driven by infrastructure development and urbanization initiatives. Increasing frequency of grid instability and the need for uninterrupted power at construction sites have reinforced the importance of backup power systems.

Contractors are prioritizing reliable generator sets to maintain project timelines and minimize operational disruptions. Technological enhancements in generator efficiency, noise reduction, and emission control are also supporting broader adoption.

Government regulations around onsite energy reliability, especially in critical infrastructure projects, are further boosting demand. As construction projects become more time sensitive and power dependent, the need for standby generator sets is expected to remain strong, particularly in remote and off grid areas where utility connections are limited or unreliable.

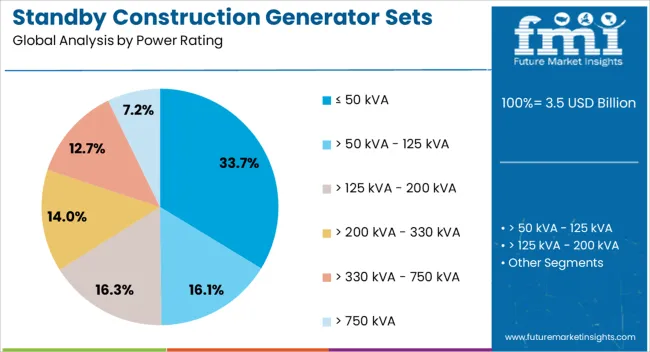

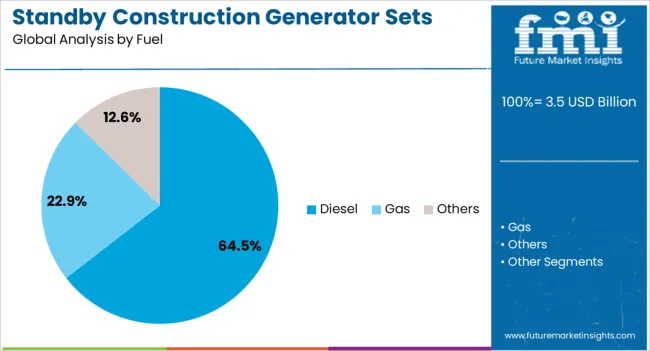

The standby construction generator sets market is segmented by power rating, fuel type, and geographic region. By power rating, the standby construction generator sets market is divided into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA. In terms of fuel, the standby construction generator sets market is classified into Diesel, Gas, and Others. Regionally, the standby construction generator sets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 50 kVA segment is anticipated to account for 33.70% of the total market share by 2025 within the power rating category, positioning it as a key segment. This is due to its suitability for small to mid-scale construction projects where mobility, ease of installation, and cost efficiency are critical.

These units are preferred in residential, commercial renovation, and small infrastructure projects where lower power capacity meets operational needs effectively. Additionally, their compact size, fuel efficiency, and reduced noise levels make them ideal for urban and confined job sites.

As developers seek dependable yet affordable power solutions for decentralized projects, the ≤ 50 kVA segment continues to experience strong demand across multiple geographies.

The diesel fuel segment is expected to represent 64.50% of the total market share by 2025 within the fuel category, making it the dominant source for standby construction generator sets. Diesel generators are renowned for their durability, fuel reliability, and ability to deliver consistent power in demanding environments.

Their efficiency under heavy load conditions and lower maintenance needs contribute to their widespread usage on construction sites. Furthermore, advancements in diesel engine technology have enabled compliance with emission norms while maintaining performance.

Despite the global transition toward cleaner energy, the cost-effectiveness and proven reliability of diesel-powered units continue to secure their leadership in this market segment.

The market has been expanding due to the increasing need for reliable power backup at construction sites, mining operations, and remote infrastructure projects. These generator sets have been valued for their high output, durability, and rapid deployment capabilities. Market growth has been reinforced by technological advancements in diesel and gas-powered units, hybrid systems, and digital monitoring solutions. Rising construction activities, urban development, and industrial expansion have further strengthened demand. Standby generator sets have become essential for ensuring uninterrupted operations and compliance with safety and operational regulations globally.

The market has been primarily driven by the growing scale of construction activities and infrastructure development projects. Continuous power supply has been essential to maintain equipment operation, lighting, and on-site safety systems. Diesel-powered generator sets have been preferred due to high fuel efficiency, load capacity, and operational reliability in remote or off-grid areas. Hybrid systems incorporating battery storage and gas alternatives have reduced fuel dependency and environmental impact. Contractors and project managers have increasingly relied on modular generator units for flexibility, rapid installation, and load adaptability. Government-funded infrastructure initiatives, large-scale commercial projects, and industrial expansion in emerging economies have reinforced demand, positioning standby construction generator sets as critical assets for uninterrupted power and operational efficiency.

Technological advancements have significantly influenced the market by enhancing performance, efficiency, and monitoring capabilities. Modern generator sets have been equipped with digital control panels, remote monitoring systems, and predictive maintenance features to ensure operational continuity. Noise reduction, emission control, and fuel optimization technologies have addressed environmental regulations and workplace safety requirements. The integration of hybrid power solutions, which combine diesel, gas, and battery storage, has improved energy efficiency and reduced operational costs. Automated start/stop systems and load management controls have enhanced reliability during peak load demands. These innovations have allowed generator sets to operate efficiently under harsh construction conditions, increasing adoption in remote sites, emergency backup scenarios, and large-scale infrastructure projects globally.

The market has been reinforced by increasing deployment in remote construction sites, mining operations, and disaster recovery scenarios. Generator sets have ensured uninterrupted power supply for heavy machinery, temporary lighting, communication systems, and safety equipment in areas lacking grid connectivity. Portable and modular units have facilitated rapid relocation and deployment according to site requirements. Emergency preparedness, extreme weather conditions, and unexpected power outages have further increased reliance on standby generators. Construction companies, industrial operators, and municipal agencies have prioritized these solutions to maintain productivity, operational safety, and project timelines. Rising awareness of operational risks, coupled with the availability of fuel-efficient and environmentally compliant units, has strengthened market adoption globally.

Despite growth, the market has faced challenges associated with high capital expenditure, fuel costs, and operational maintenance. Diesel-powered units require regular servicing, fuel management, and adherence to emission standards, increasing operational complexity. Harsh environmental conditions at construction sites, including dust, heat, and moisture, have influenced equipment longevity and reliability. Noise pollution regulations and environmental restrictions in urban areas have affected deployment flexibility. Manufacturers have responded by providing hybrid solutions, remote monitoring, preventive maintenance programs, and modular designs for ease of transport and operation. Continuous innovation in fuel efficiency, emissions reduction, and digital control systems has helped overcome challenges, ensuring a reliable power supply across construction projects and remote industrial applications worldwide.

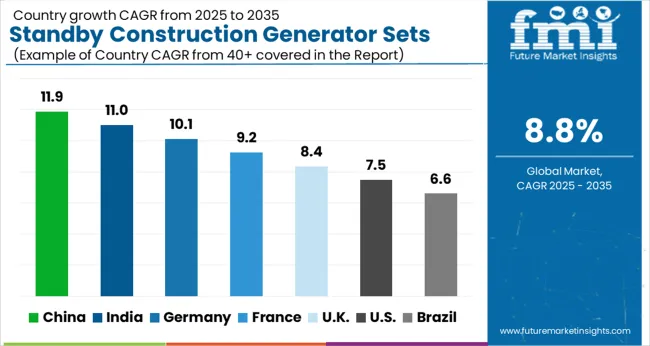

| Countries | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

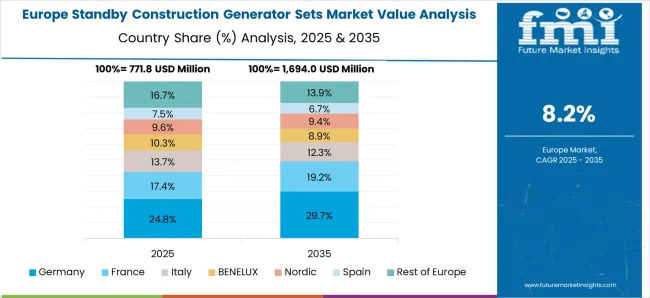

The market is expected to grow at a CAGR of 8.8% between 2025 and 2035, driven by rising construction activities, demand for reliable power supply, and adoption of advanced generator technologies. China leads with an 11.9% CAGR, propelled by large-scale infrastructure projects and increasing industrial power requirements. India follows at 11.0%, supported by expanding urban construction and mining sectors. Germany, at 10.1%, benefits from technological advancements and strict power reliability standards. The UK, growing at 8.4%, focuses on commercial and infrastructure power solutions, while the USA, at 7.5%, sees steady demand from industrial and construction applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 11.9%, fueled by rising infrastructure projects, urban development, and construction activities. Increasing demand for reliable power backup solutions at construction sites is driving market growth. Manufacturers are focusing on integrating fuel-efficient engines, low-emission technology, and advanced monitoring systems to improve operational efficiency. Government-led industrial expansion and construction programs further enhance adoption.

India is forecasted to grow at a CAGR of 11.0%, driven by ongoing urbanization, industrialization, and government infrastructure initiatives. The adoption of durable, high-capacity, and energy-efficient construction generator sets supports market expansion. Integration of hybrid and IoT-enabled monitoring systems enhances performance, reduces downtime, and improves maintenance efficiency.

Germany is anticipated to grow at a CAGR of 10.1% due to increasing demand for reliable power solutions in industrial and construction sectors. Focus on emission reduction, fuel efficiency, and regulatory compliance accelerates market adoption. Advanced diesel-electric hybrid systems and automated monitoring enhance operational efficiency while meeting stringent environmental standards.

The United Kingdom is projected to grow at a CAGR of 8.4%, supported by demand from construction, industrial, and emergency sectors. Adoption of portable and efficient generator sets for temporary construction sites is rising. Integration of smart control systems, low-emission engines, and hybrid solutions improves energy efficiency and operational reliability. Government investment in infrastructure modernization further strengthens market potential.

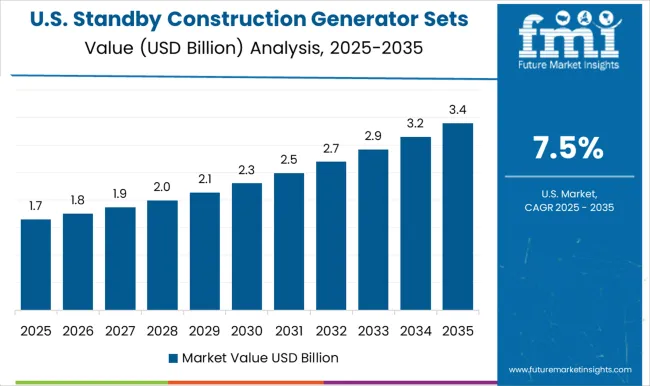

The United States is forecasted to grow at a CAGR of 7.5%, driven by increasing construction, mining, and industrial activities. Portable, durable, and fuel-efficient generator sets are in high demand to ensure uninterrupted power supply. Manufacturers are adopting hybrid solutions and IoT-based monitoring systems to enhance performance, reduce operational costs, and improve reliability.

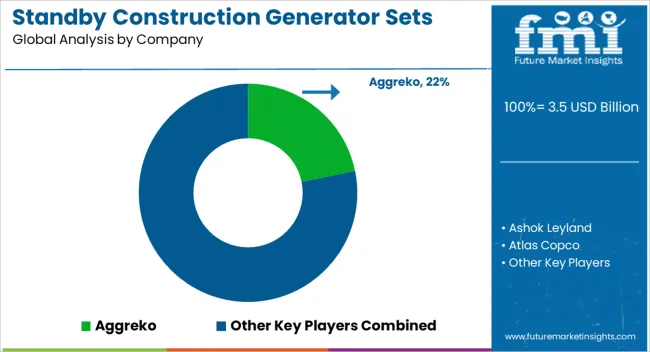

The market is experiencing steady growth driven by increasing construction activities, infrastructure development, and the demand for reliable power backup solutions at sites with intermittent electricity supply. Leading players in this sector include Aggreko, Ashok Leyland, and Atlas Copco, which provide high-performance generator sets tailored for construction environments. These companies focus on delivering systems that combine durability, fuel efficiency, and ease of mobility, ensuring uninterrupted power supply for machinery and on-site operations.

Caterpillar, Cummins, and Deere & Company are recognized for their robust and technologically advanced generators, offering solutions with features such as automatic load management, remote monitoring, and low-emission engines. Generac Power Systems, Greaves Cotton, and HIMOINSA further enhance market competitiveness with compact, portable, and energy-efficient generator sets suitable for diverse construction requirements.

Additionally, companies like Kirloskar, Mahindra Powerol, Mitsubishi Heavy Industries, and Wärtsilä focus on integrating innovative control systems and emission-compliant engines, catering to regulatory standards and sustainability objectives. Market expansion is supported by growing urbanization, infrastructure projects, and increased demand for reliable on-site power in emerging economies.

Investments in research and development, along with customized power solutions for construction applications, strengthen the positioning of these providers. Collectively, they are advancing the market by offering dependable, high-capacity standby generator sets that meet the dynamic needs of the construction industry worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Power Rating | ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA |

| Fuel | Diesel, Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aggreko, Ashok Leyland, Atlas Copco, Caterpillar, Cummins, Deere & Company, Generac Power Systems, Greaves Cotton, HIMOINSA, J C Bamford Excavators, Kirloskar, Mahindra Powerol, Mitsubishi Heavy Industries, Powerica, Rehlko, Sterling and Wilson, Wärtsilä, and Yamaha Motor |

| Additional Attributes | Dollar sales by generator type and power rating, demand dynamics across construction, commercial, and industrial sectors, regional trends in backup power adoption, innovation in fuel efficiency and noise reduction, environmental impact of emissions and fuel usage, and emerging use cases in remote construction sites and emergency power solutions. |

The global standby construction generator sets market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the standby construction generator sets market is projected to reach USD 8.1 billion by 2035.

The standby construction generator sets market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in standby construction generator sets market are ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 330 kva, > 330 kva - 750 kva and > 750 kva.

In terms of fuel, diesel segment to command 64.5% share in the standby construction generator sets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standby Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Commercial Diesel Gensets Market Size and Share Forecast Outlook 2025 to 2035

Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Standby Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Crew boats (Standby Crew Vessels) Market

Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA