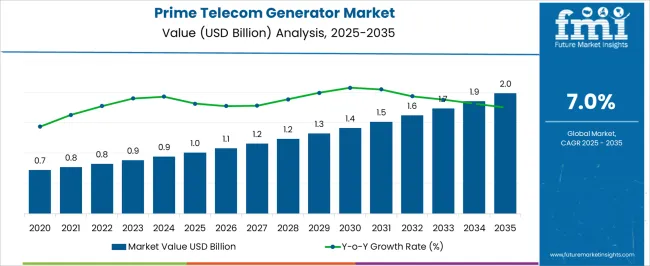

The Prime Telecom Generator Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. This represents a cumulative incremental growth of USD 0.4 billion over the five-year span. Growth is paced at small but consistent annual increments, with contributions of USD 0.1 billion each year except 2027–2028, which remains flat.

This reflects a period of stability, possibly influenced by demand fluctuations or procurement cycles, before resuming expansion toward the medium-term horizon of telecom infrastructure investments. Incremental growth analysis highlights the importance of gradual infrastructure upgrades and the increasing requirement for reliable backup energy systems in telecom operations.

The CAGR of 7 percent underlines steady momentum, with long-term gains concentrated beyond 2030. By 2035, the sector doubles its 2025 size, achieving USD 2.0 billion, but early growth is modest. These insights suggest that the 2025–2030 phase serves as a preparatory foundation for accelerated adoption in later years, positioning telecom generators as a critical enabler of network reliability across expanding mobile and broadband ecosystems.

| Metric | Value |

|---|---|

| Prime Telecom Generator Market Estimated Value in (2025 E) | USD 1.0 billion |

| Prime Telecom Generator Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The prime telecom generator market is expanding as telecom operators and infrastructure providers seek reliable power solutions to support growing data traffic and network coverage. The rising demand for uninterrupted communication services in both urban and remote areas has increased the need for dependable backup power systems.

Technological progress in generator design has improved fuel efficiency and reduced emissions, making modern generators more attractive to network operators focused on sustainability. Additionally, expanding telecom infrastructure, including 5G rollout and rural network expansion, has driven the adoption of prime generators with varying power capacities.

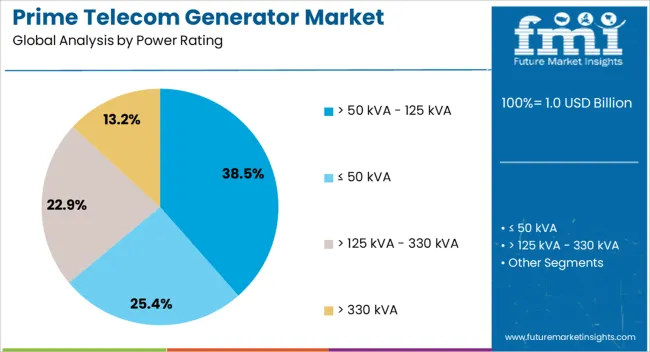

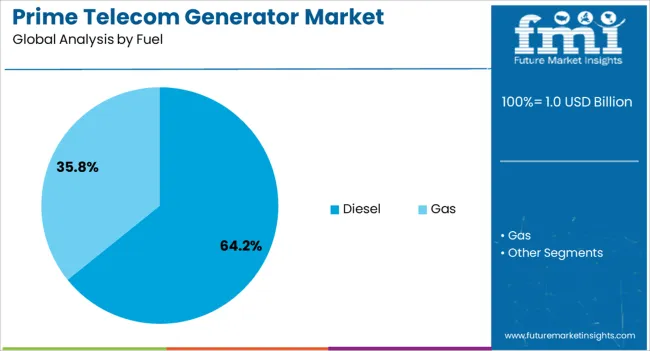

Regulations aimed at minimizing environmental impact and operational costs have also influenced product development and selection. Market growth is expected to continue as telecom networks increase capacity and reliability requirements. Segmental growth is anticipated to be led by generators in the > 50 kVA to 125 kVA power rating range and diesel-fueled models due to their balance of power output, reliability, and fuel availability.

The prime telecom generator market is segmented by power rating, fuel, and geographic regions. By power rating, the prime telecom generator market is divided into > 50 kVA - 125 kVA, ≤ 50 kVA, > 125 kVA - 330 kVA, and > 330 kVA. In terms of fuel, the prime telecom generator market is classified into Diesel and Gas. Regionally, the prime telecom generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 50 kVA to 125 kVA power rating segment is projected to account for 38.5% of the prime telecom generator market revenue in 2025, holding the largest share among power categories. This segment’s popularity is attributed to its suitability for medium-scale telecom sites requiring a consistent and scalable power supply.

Network providers have preferred generators in this range as they offer enough capacity to handle peak loads without unnecessary oversizing, improving fuel efficiency and cost-effectiveness. The balance between power output and size allows for easier installation and maintenance in telecom base stations and data centers.

Growing urbanization and expanding mobile network infrastructure have increased demand for generators in this power bracket, especially in areas with unreliable grid power. As telecom operators seek to optimize energy use while maintaining uptime, the > 50 kVA to 125 kVA segment is expected to retain its market dominance.

The Diesel segment is projected to hold 64.2% of the prime telecom generator market revenue in 2025, maintaining its leading position among fuel types. Diesel generators have been widely adopted due to their reliability, availability, and established infrastructure for fuel supply.

Their ability to operate continuously under demanding conditions makes them ideal for telecom applications where power interruptions can cause significant service disruptions. Additionally, diesel engines have benefited from advancements that have improved fuel efficiency and reduced emissions, aligning with stricter environmental regulations.

Telecom operators have also valued diesel generators for their lower operating costs compared to alternative fuel sources in many regions. The segment’s resilience and performance in diverse climatic and operational settings contribute to its sustained preference. With ongoing improvements in diesel engine technology and fuel quality, diesel-fueled prime telecom generators are expected to remain the backbone of backup power solutions in the telecom sector.

The prime telecom generator market is driven by rising demand for reliable power supply in expanding telecom networks, especially with the rollout of 5G. Opportunities are growing in supporting infrastructure projects, while emerging trends in hybrid and energy-efficient solutions are reshaping the market. However, high initial investment and maintenance costs remain significant barriers. By 2025, overcoming these challenges through cost-effective solutions and improved service models will be crucial for continued market growth.

The prime telecom generator market is growing due to the rising demand for reliable and uninterrupted power supply in the telecom industry. As telecom networks expand, especially in remote or off-grid locations, the need for continuous, stable power solutions becomes critical. Telecom generators provide backup power to ensure smooth operations during power outages. By 2025, the increasing reliance on telecommunications for both personal and business needs will continue to drive demand for dependable power generation solutions.

Opportunities in the prime telecom generator market are expanding with the growth of telecom networks and the rollout of 5G infrastructure. The demand for continuous, high-quality power supply to support these advanced networks is increasing, especially as telecom companies work to build and upgrade their 5G networks. By 2025, the deployment of 5G will require more robust and efficient power generation solutions, creating significant opportunities for prime telecom generator manufacturers.

Emerging trends in the telecom generator market highlight the increasing shift toward hybrid and energy-efficient power solutions. Hybrid generators, combining traditional fuel sources with renewable energy, are gaining popularity for their ability to reduce fuel consumption and operating costs. These generators provide sustainable power generation while offering reliability. By 2025, energy-efficient telecom generators will become more common as the industry focuses on reducing environmental impact and increasing operational efficiency.

Despite growth, challenges such as high initial investment and maintenance costs persist in the prime telecom generator market. The cost of high-quality, reliable telecom generators can be prohibitive for some telecom operators, particularly in developing regions. Additionally, these generators often require ongoing maintenance and specialized servicing, adding to the total cost of ownership. By 2025, addressing these barriers through cost-effective solutions and improved maintenance programs will be essential for wider adoption.

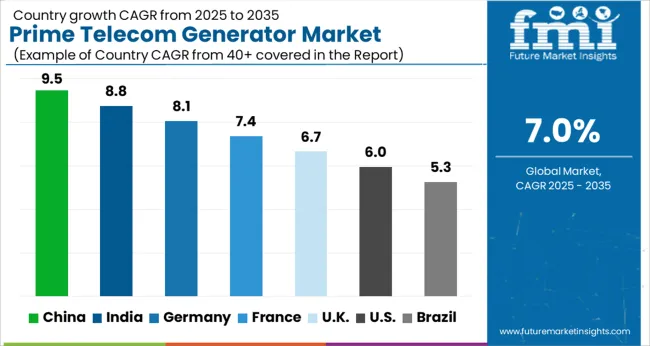

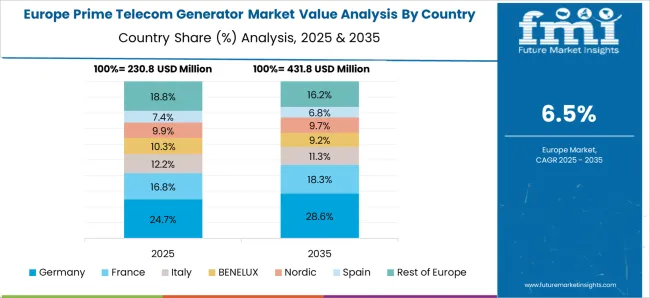

The global prime telecom generator market is projected to grow at a 7% CAGR from 2025 to 2035. China leads with a growth rate of 9.5%, followed by India at 8.8%, and France at 7.4%. The United Kingdom records a growth rate of 6.7%, while the United States shows the slowest growth at 6.0%. These varying growth rates are driven by factors such as the increasing demand for reliable power solutions in telecom infrastructure, rising investments in 5G network expansion, and the need for uninterrupted power supply in remote areas. Emerging markets like China and India are witnessing higher growth due to rapid industrialization, telecom network expansion, and growing energy needs, while more mature markets like the USA and the UK experience steady growth driven by the ongoing upgrades and expansion of telecom infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The prime telecom generator market in China is growing at a strong pace, with a projected CAGR of 9.5%. China’s massive telecom infrastructure expansion, driven by the rollout of 5G networks and the increasing demand for uninterrupted power supply, is driving the market for telecom generators. The country’s need for reliable power sources in remote regions, coupled with the growing number of telecom towers and base stations, continues to support demand for prime telecom generators. Additionally, China’s focus on ensuring stable telecom network operations, particularly in rural and underserved areas, further accelerates market growth.

The prime telecom generator market in India is projected to grow at a CAGR of 8.8%. India’s rapidly expanding telecom sector, particularly in rural and underserved regions, is driving the demand for reliable and continuous power supply solutions. The need for power backup systems in telecom towers and base stations, particularly in areas with unstable electricity grids, is contributing to the market’s growth. Additionally, India’s ongoing 4G and upcoming 5G network rollouts, along with the government’s push for digital infrastructure, are increasing the need for telecom generators to ensure uninterrupted service and power stability.

The prime telecom generator market in France is projected to grow at a CAGR of 7.4%. France’s established telecom infrastructure, along with increasing investments in 5G and fiber optic networks, is driving demand for prime telecom generators. The country’s focus on ensuring a reliable and sustainable energy supply for telecom towers, particularly in remote and rural areas, is contributing to the market growth. Additionally, the growing emphasis on energy-efficient and low-emission power generation solutions in telecom infrastructure is driving the adoption of advanced telecom generators in the French market.

The prime telecom generator market in the United Kingdom is projected to grow at a CAGR of 6.7%. The UK ’s ongoing investments in 5G infrastructure and the need for reliable backup power solutions in telecom networks are driving steady demand for prime telecom generators. The increasing demand for continuous, high-quality power for telecom base stations and towers, particularly in areas with poor grid reliability, is contributing to the market’s expansion. Additionally, the country’s regulatory focus on reducing carbon emissions and promoting energy-efficient technologies is fueling the adoption of eco-friendly telecom generators.

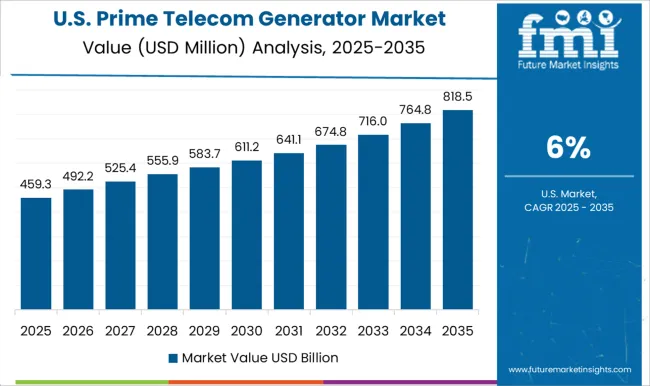

The prime telecom generator market in the United States is expected to grow at a CAGR of 6.0%. The USA market remains steady, driven by the need for backup power solutions in telecom towers, particularly for 4G and upcoming 5G networks. With the USA continuing to expand and upgrade its telecom infrastructure, the demand for reliable power sources for uninterrupted service is increasing. Additionally, the USA focus on renewable energy integration and energy-efficient technologies is encouraging the adoption of cleaner, more sustainable telecom generators.

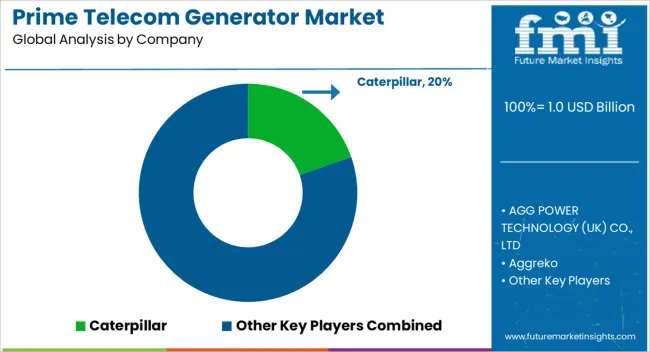

The prime telecom generator market is dominated by Caterpillar, which leads with its reliable, high-performance generators designed for the telecommunications sector, ensuring uninterrupted power supply to telecom networks and data centers. Caterpillar’s dominance is supported by its strong brand recognition, innovative technology, and global service network, providing scalable and efficient solutions for both large telecom operators and small network providers. Key players such as Aggreko, Cummins, Inc., and FG Wilson maintain significant market shares by offering energy-efficient, durable prime power generators that are ideal for telecom applications in remote or off-grid locations. These companies focus on providing high uptime, fuel-efficient solutions that meet the growing demand for reliable telecom infrastructure. Emerging players like AGG Power Technology (UK) Co., Ltd., Kohler Co., and Mahindra Powerol are expanding their market presence by offering cost-effective, compact generators designed for niche telecom applications, such as small-scale telecom networks or backup systems. Their strategies include enhancing fuel efficiency, reducing emissions, and providing tailored solutions for renewable energy integration. Market growth is driven by the increasing demand for uninterrupted telecom services, the rise in mobile network infrastructure, and the need for efficient power generation in remote areas. Innovations in hybrid power systems, energy storage integration, and low-emission technologies are expected to shape competitive dynamics and fuel continued growth in the global prime telecom generator market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Power Rating | > 50 kVA - 125 kVA, ≤ 50 kVA, > 125 kVA - 330 kVA, and > 330 kVA |

| Fuel | Diesel and Gas |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, AGG POWER TECHNOLOGY (UK) CO., LTD, Aggreko, Atlas Copco AB, Cummins, Inc., FG Wilson, Generac Power Systems, Inc., GREEN POWER SYSTEMS s.r.l., Kohler Co., MAHINDRA POWEROL, Mitsubishi Heavy Industries, Ltd., Starkgen, SWT, The Pai Kane Group, and YANMAR HOLDINGS CO., LTD. |

| Additional Attributes | Dollar sales by generator type and application, demand dynamics across telecommunications, data centers, and emergency backup sectors, regional trends in prime telecom generator adoption, innovation in fuel-efficient and hybrid power solutions, impact of regulatory standards on emissions and energy efficiency, and emerging use cases in 5G infrastructure and remote connectivity. |

The global prime telecom generator market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the prime telecom generator market is projected to reach USD 2.0 billion by 2035.

The prime telecom generator market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in prime telecom generator market are > 50 kva - 125 kva, ≤ 50 kva, > 125 kva - 330 kva and > 330 kva.

In terms of fuel, diesel segment to command 64.2% share in the prime telecom generator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Standby Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Diesel Fired Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Telecom Site Management Software Market Size and Share Forecast Outlook 2025 to 2035

Generator Bushing Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Telecom Mounting Hardware Market Size and Share Forecast Outlook 2025 to 2035

Telecom Billing And Revenue Management Market Size and Share Forecast Outlook 2025 to 2035

Telecom Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Telecom Analytics Market Size and Share Forecast Outlook 2025 to 2035

Telecom Internet Of Things (IoT) Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Prime Power Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Telecom Network Infrastructure Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA