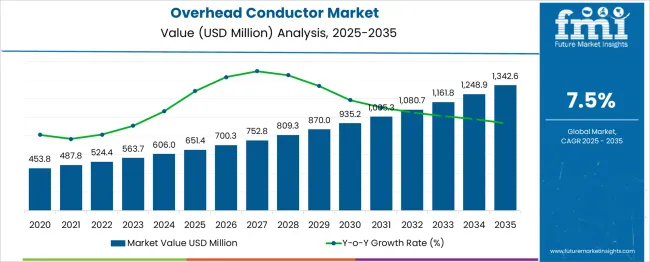

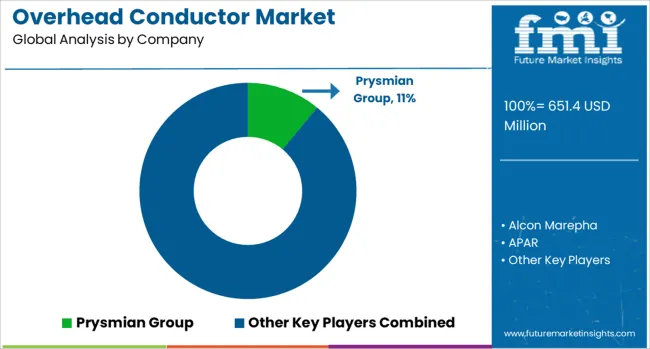

The Overhead Conductor Market is estimated to be valued at USD 651.4 million in 2025 and is projected to reach USD 1342.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

Analyzing peak-to-trough fluctuations across the 2025–2035 forecast reveals consistent year-on-year growth, with no discernible dips, but variation in acceleration intensity. Between 2025 and 2029, the market grows from USD 651.4 million to USD 809.3 million, reflecting an average annual growth of approximately 5.6%, marking a moderate incline driven by baseline infrastructure upgrades and regional utility investments. The growth peaks during the 2030–2033 window, as the market jumps from USD 870.0 million to USD 1,080.7 million, achieving an average annual increase of over 7.5%. This acceleration aligns with increased electrification projects, long-distance transmission expansions, and rising demand in emerging economies. From 2033 to 2035, the pace slightly tapers, though still strong, growing from USD 1,080.7 million to USD 1,342.6 million, averaging nearly 11.6% annual growth, indicating a final surge before market stabilization. Despite fluctuations in growth speed, no trough or negative trend emerges across the forecast horizon, underscoring a resilient and high-demand trajectory for overhead conductors in the global power transmission landscape.

| Metric | Value |

|---|---|

| Overhead Conductor Market Estimated Value in (2025 E) | USD 651.4 million |

| Overhead Conductor Market Forecast Value in (2035 F) | USD 1342.6 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The Overhead Conductor Market forms a crucial subset of the broader Power Transmission and Distribution (T&D) Infrastructure Market, which is experiencing steady expansion due to increasing electricity demand, grid modernization efforts, and cross-border transmission projects. Overhead conductors, accounting for an estimated 18–22% share of total T&D hardware expenditure globally, serve as the primary medium for bulk power movement over long distances. As emerging economies scale up renewable energy integration and grid interconnectivity, demand for high-capacity and low-loss conductors such as ACCC and HTLS types has been rising significantly. Within the parent market, overhead conductors are closely tied to the growth of high-voltage transmission projects and government-backed rural electrification drives.

The shift toward smart grids and the electrification of transport systems also elevate the importance of efficient transmission, bolstering the market’s relevance. In regions like Asia-Pacific and Africa, where power deficits remain a constraint, overhead conductors remain the most viable and cost-effective solution compared to underground cables, securing their dominance in infrastructure investments. By 2035, the global T&D market is expected to cross USD 400 billion, with overhead conductors maintaining a healthy double-digit contribution. Their share is projected to rise marginally due to increasing adoption of advanced conductor technologies designed for energy efficiency and environmental resilience.

The overhead conductor market is gaining traction due to expanding transmission infrastructure, the integration of renewable energy sources, and the replacement of aging grid assets across developed and emerging economies. Increasing investments in ultra-high voltage (UHV) and extra-high voltage (EHV) networks are compelling utilities to deploy advanced conductors with higher thermal and mechanical performance.

Environmental regulations, focus on grid resilience, and the need to minimize transmission losses have created a fertile environment for technologically upgraded conductor types.

As utilities prioritize efficiency, low sag, and increased current-carrying capacity, market participants are innovating in composite and hybrid conductor materials to meet long-distance and high-load requirements.

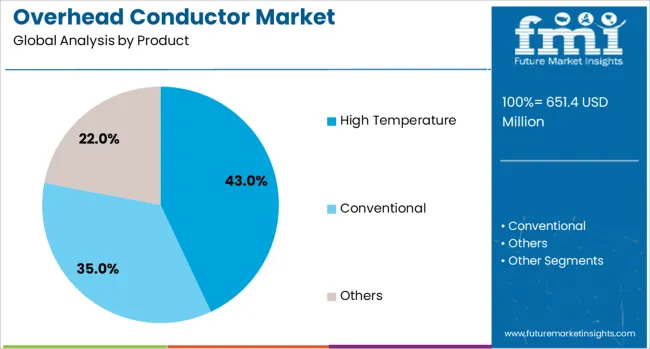

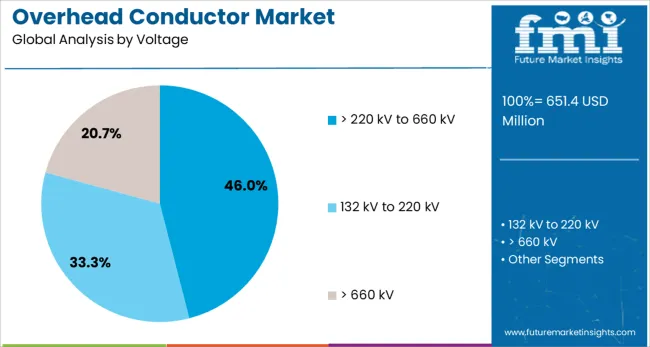

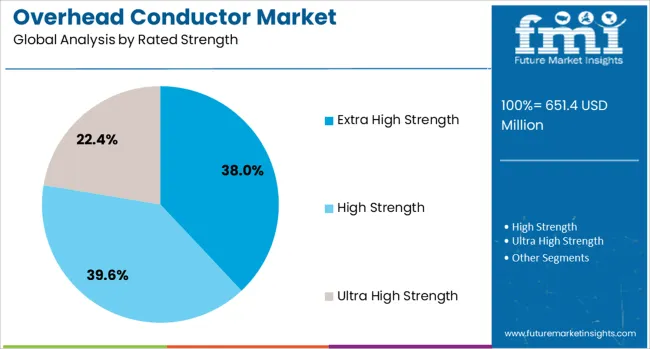

The overhead conductor market is segmented by product, voltage, rated strength, current, application, and geographic regions. By product of the overhead conductor market is divided into High Temperature, Conventional, and Others. In terms of voltage, the overhead conductor market is classified into > 220 kV to 660 kV, 132 kV to 220 kV, and > 660 kV. Based on the rated strength of the overhead conductor, the market is segmented into Extra High Strength, High Strength, and Ultra High Strength. The current overhead conductor market is segmented into HVAC and HVDC. By application, the overhead conductor market is segmented into High Tension, Extra High Tension, and Ultra High Tension. Regionally, the overhead conductor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

High temperature conductors are expected to account for 43.0% of the overhead conductor market by 2025, making it the dominant product category. These conductors are gaining popularity due to their ability to operate under elevated temperatures without significant loss in tensile strength or conductivity.

As energy grids carry higher loads due to electrification and urbanization, high temperature variants offer a cost-effective upgrade option over reconductoring or new tower installations.

Their deployment also supports efficient right-of-way utilization and reduces thermal sag, particularly across long transmission spans in regions with fluctuating climates.

The >220 kV to 660 kV voltage class is projected to lead with 46.0% market share in 2025. This segment’s dominance reflects ongoing global expansion in high-capacity transmission corridors linking remote renewable energy projects to load centers.

These voltages are optimal for bulk power transfer with minimal line losses, making them central to inter-regional transmission projects.

Upgrades and expansion initiatives, especially in Asia, the Middle East, and parts of Africa, are boosting demand for robust conductors capable of withstanding high voltage stress over long distances.

Extra high strength rated conductors are anticipated to contribute 38.0% of the market share by 2025. Their superior tensile strength makes them essential for applications in rugged terrains, long-span installations, and areas with adverse weather conditions.

These conductors reduce the need for additional towers, offer better sag performance, and provide long-term structural reliability.

As utilities modernize their infrastructure to withstand increasing environmental pressures, the demand for conductors with enhanced mechanical endurance is set to rise.

The overhead conductor market is witnessing steady growth driven by rising investments in electricity transmission and aging grid infrastructure replacement. These conductors are essential for long-distance, high-voltage transmission and are being increasingly adopted across utility-scale and regional power distribution projects. Demand is growing due to the expansion of electricity access and the integration of high-capacity lines. Market participants are focusing on materials offering better strength-to-weight ratios and thermal performance. Regional grid upgrades and interconnectivity goals also reinforce the demand for advanced conductor systems.

The growing need for reliable electricity delivery across urban and rural regions is encouraging significant investment in grid modernization and high-capacity transmission lines. Overhead conductors play a key role in power transfer over long distances and are a critical component of infrastructure expansion. Utility companies are focusing on reinforcing existing lines and building new corridors to meet evolving power demand. Overhead conductor systems support both alternating and direct current transmission, making them versatile for varied geographic and capacity requirements. As more regions aim to connect isolated generation sources with consumption centers, long-distance transmission becomes vital. Advanced conductors with low sag and improved thermal limits are favored in these upgrades. Industry stakeholders are working closely with regional transmission operators to deliver customized solutions for different load profiles and terrain. This broad spectrum of applications across grid extension and reinforcement projects contributes significantly to the increasing demand for overhead conductors worldwide.

Although overhead conductors serve critical functions, they face challenges related to material constraints and installation. Conductors must perform reliably under diverse weather and load conditions while maintaining low resistance and mechanical stability. Traditional materials like aluminum and steel core combinations have limited tensile strength and may not handle high-temperature loads effectively. Advanced materials offer improvements but often come with higher costs or require specialized handling. Installation in remote or uneven terrain adds further complexity, requiring specialized equipment and trained crews. In some regions, right-of-way access and clearance regulations can delay deployment or increase costs. Compatibility with existing towers or infrastructure may also be limited, requiring retrofitting or reinforcement. Additionally, securing regulatory approvals and performing environmental assessments can lengthen project timelines. These issues contribute to longer project lead times and higher implementation risks. Until new materials and easier deployment methods are more widely accessible, technical and logistical barriers will continue to challenge market participants.

The demand for regional power interconnection and cross-border transmission lines offers significant growth opportunities for overhead conductor suppliers. Many countries are working toward enhancing regional energy trade, balancing peak loads, and increasing transmission reliability. Overhead conductors are integral to building the infrastructure required for these long-range, high-capacity interconnections. Utilities and governments are investing in corridor development plans to connect different grid zones across countries and regions. These projects often involve building high-voltage lines over large and sometimes challenging geographic areas, increasing the demand for conductors with high strength and efficient current-carrying capacity. Vendors that offer tailored solutions, including heat-resistant and low-loss conductors, are well positioned to capture such large-scale contracts. Additionally, multi-country initiatives to stabilize energy supplies and improve regional access to electricity reinforce this trend. As cross-border connectivity becomes a focus for economic and infrastructure development, the need for advanced conductor systems in international projects continues to grow

The development of overhead conductor systems is frequently slowed by regulatory and environmental considerations. Approvals for new transmission lines require compliance with complex permitting processes and land acquisition regulations. Environmental impact assessments must often be completed before projects can begin, especially in forested, agricultural, or protected areas. Concerns about visual intrusion, electromagnetic exposure, and ecosystem disruption can trigger opposition from communities and stakeholders. In densely populated or ecologically sensitive areas, overhead lines may be restricted or subject to route changes, increasing costs and planning complexity. These constraints often lead to lengthy project delays or even cancellations. Additionally, international projects may face inconsistent regulatory requirements, making cross-border coordination difficult. Variations in technical standards, legal frameworks, and grid integration policies across regions further complicate deployments. Until more unified planning policies or streamlined permitting pathways are adopted, regulatory and environmental factors will remain key restraints affecting the timely execution of overhead conductor projects.

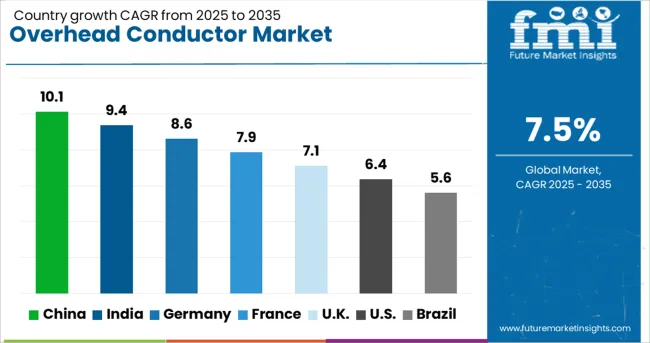

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The global overhead conductor market is projected to grow at a CAGR of 7.5% through 2035, driven by grid modernization, renewable energy integration, and transmission capacity expansion. Among BRICS nations, China leads with 10.1% growth, supported by massive grid development projects, high-voltage transmission lines, and strong domestic manufacturing. India follows at 9.4%, driven by rural electrification, smart grid deployment, and infrastructure investments under government-led initiatives. Within the OECD region, Germany reports 8.6% growth, reflecting focus on energy transition, high-efficiency conductors, and cross-border transmission networks. The United Kingdom shows steady growth at 7.1%, backed by offshore wind connectivity and aging grid upgrades. The United States, a mature market growing at 6.4%, emphasizes reliability standards, infrastructure renewal, and integration of distributed energy resources. These countries are shaping the future of power transmission through policy, innovation, and large-scale deployment. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China leads the overhead conductor market with a CAGR of 10.1%, powered by rapid electrification, grid modernization, and rural power distribution upgrades. Expanding renewable energy infrastructure, particularly in wind and solar, demands long-distance, high-efficiency transmission lines supported by advanced conductors. Ultra-high-voltage (UHV) projects across provinces such as Sichuan, Inner Mongolia, and Yunnan have been major drivers. The government’s continued focus on green energy integration and reduction of transmission losses has encouraged widespread deployment of composite core and heat-resistant conductors. Local manufacturers are developing high-capacity aluminum alloy variants to meet both domestic needs and export demand. China’s Belt and Road Initiative is also enabling cross-border electricity trade, pushing demand for reliable overhead systems. Strategic investment in smart grid technologies and electrification of remote areas is further solidifying the role of overhead conductors in national energy policy.

Overhead conductor market in India is growing at a CAGR of 9.4%, supported by rural electrification, smart grid rollout, and industrial power demand. With increasing energy access targets under government schemes like Saubhagya and Deen Dayal Upadhyaya Gram Jyoti Yojana, overhead conductors are crucial for last-mile connectivity. Renewable energy growth, especially in solar parks across Rajasthan, Gujarat, and Madhya Pradesh, has created a demand for high-efficiency conductors capable of handling fluctuating loads. Distribution companies are investing in low-sag, high-temperature conductors to address losses and network overload. Indian manufacturers are innovating with cost-effective, corrosion-resistant materials suitable for diverse geographic zones. Urban power upgrades, industrial corridor development, and ongoing transmission infrastructure projects continue to push the adoption of advanced overhead conductor systems. India’s unique blend of legacy grid modernization and frontier electrification presents a dynamic market outlook.

Germany’s overhead conductor market, growing at a CAGR of 8.6%, is shaped by the country’s clean energy transition, known as the "Energiewende." The phase-out of nuclear power and coal has heightened the need for efficient electricity transmission from renewable generation hubs in the north to consumption centers in the south. This has resulted in high-voltage overhead conductor installations across several federal states. German utilities are adopting low-resistance, high-durability conductors to minimize losses and comply with EU energy directives. Upgrades to existing grid infrastructure, combined with the integration of offshore wind and photovoltaic farms, are expanding the demand for advanced conductor solutions. Environmental and aesthetic considerations have also led to innovations in compact conductor designs for urban settings. With a high focus on grid reliability and environmental protection, Germany remains a technology-forward market in the European power transmission space.

The United Kingdom is experiencing a CAGR of 7.1% in the overhead conductor market, driven by its decarbonization strategy, offshore wind integration, and network renewal projects. With aging transmission infrastructure needing upgrades, utilities are replacing legacy conductors with high-capacity, low-sag alternatives. The National Grid’s investment in interconnectors and new substations is increasing demand for specialized conductors capable of supporting higher voltages. Expansion of offshore wind farms in the North Sea also necessitates robust transmission links to inland grids. UK-based firms are working closely with European suppliers to adopt environmentally compliant conductor systems. There’s also a focus on minimizing visual impact, leading to the adoption of slim-profile conductors and hybrid pylon structures. Government energy transition goals and the need to meet net-zero targets are creating strong tailwinds for market growth across distribution and transmission segments.

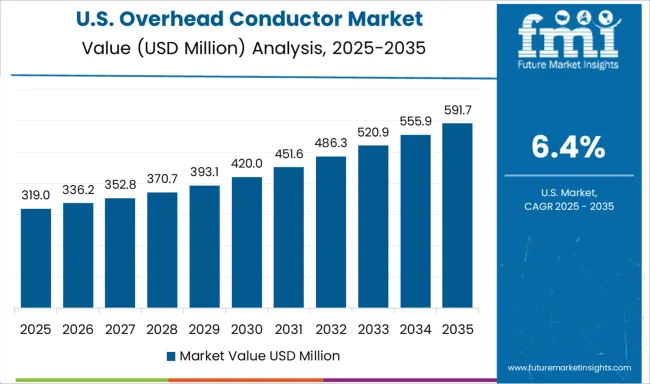

The United States overhead conductor market is expanding at a CAGR of 6.4%, fueled by grid reliability concerns, renewable energy integration, and aging infrastructure replacement. Transmission projects across regions like the Midwest, Texas, and the Pacific Northwest are adopting high-temperature, low-sag (HTLS) conductors to improve performance. With rising solar and wind penetration, utilities are upgrading transmission corridors to accommodate variable loads. The Bipartisan Infrastructure Law and federal incentives for grid modernization have created momentum for high-efficiency conductor deployment. USA manufacturers are investing in lightweight composite-core conductors and corrosion-resistant alloys for coastal and high-temperature applications. Wildfire mitigation in California and the West has also led to conductor replacements focused on safety and durability. As distributed energy systems expand, reliable overhead transmission remains a backbone of national power strategy.

The 5-Isopropyl-m-xylene market is a niche segment within the broader aromatic hydrocarbons and specialty intermediates industry, serving applications in organic synthesis, material science, and pharmaceutical R&D. This compound, valued for its unique substituted xylene structure, is primarily used in research environments and as a chemical intermediate in fine chemical development. The global overhead conductor market features a mix of multinational cable manufacturers, regional specialists, and vertically integrated firms serving power utilities and infrastructure developers. Companies such as Prysmian Group, Nexans, and LS Cable and System Ltd are positioned at the top end, with vast international footprints and the ability to fulfill large-scale transmission and distribution contracts.

These firms benefit from long-standing relationships with grid operators and consistent investments in performance-driven materials. A diverse pool of regional players, including Gupta Power, Hindustan Urban Infrastructure, CABCON INDIA LIMITED, and Kelani Cables PLC, have built strong domestic networks by focusing on high-quality supply to state-run and private electricity boards. Their proximity to fast-growing power sectors in Asia and the Middle East allows them to address demand spikes and local project requirements more effectively. Firms such as Elsewedy Electric and Riyadh Cable Group Company play a similar role in MENA markets, anchoring infrastructure development in their regions. Meanwhile, manufacturers like CTC Global Corporation, Lamifil, and Midal Cable are carving out positions with specialized conductor types that emphasize current carrying capacity and thermal resistance.

With increasing pressure on aging transmission lines and growing electrification in emerging economies, competition is becoming less about scale and more about delivery timelines, supply assurance, and grid reliability. Companies that can consistently align with utility priorities and adapt to regional project cycles are gaining an edge in both tenders and long-term contracts.

As reported by Cable World News, during November–December 2023, Terna Rete Italia upgraded a 380 kV line between Rondissone and Turbigo using Tratos’s carbon-core HTLS conductors, doubling ampacity while maintaining existing pylons. The composite conductor reduced sag and enabled efficient grid capacity expansion.

As disclosed by ProjectX India on January 15, 2025, Advait Energy Transitions secured a contract to reconductor two transmission lines in Gujarat 64 km with HTLS DOG-equivalent conductors boosting capacity while keeping the same weight. This conversion reflects India's rapid grid modernization.

| Item | Value |

|---|---|

| Quantitative Units | USD 651.4 Million |

| Product | High Temperature, Conventional, and Others |

| Voltage | > 220 kV to 660 kV, 132 kV to 220 kV, and > 660 kV |

| Rated Strength | Extra High Strength, High Strength, and Ultra High Strength |

| Current | HVAC and HVDC |

| Application | High Tension, Extra High Tension, and Ultra High Tension |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, Alcon Marepha, APAR, Bekaert, CABCON INDIA LIMITED, CMI Limited, CTC Global Corporation, Eland Cables, Elsewedy Electric, Gulf Cable & Electrical Industries Co, Gupta Power, Hindustan Urban Infrastructure Limited, KEI Industries Limited, Kelani Cables PLC, Lamifil, LS Cable and System Ltd, LUMPI-BERNDORF Draht- und Seilwerk GmbH, Midal Cable, Neccon, Nexans, and Riyadh Cable Group Company |

| Additional Attributes | Dollar sales vary by conductor type and voltage class, with conventional conductors dominating and high-temperature UHV (>800 kV) conductors growing fastest. Asia‑Pacific leads volume, while Europe and North America deliver higher value. Pricing fluctuates with aluminum alloy and material costs. Growth accelerates via grid modernization, smart grid integration, and renewable-energy transmission expansion under regulatory mandates |

The global overhead conductor market is estimated to be valued at USD 651.4 million in 2025.

The market size for the overhead conductor market is projected to reach USD 1,342.6 million by 2035.

The overhead conductor market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in overhead conductor market are high temperature, _tal, _ztal, _others, conventional, _acsr, _aaac, _acar, _aacsr, _aac, others, _acfr, _accr, _accc, _crac, _gap conductors and _others.

In terms of voltage, > 220 kv to 660 kv segment to command 46.0% share in the overhead conductor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conventional Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

Overhead Crane Market Size and Share Forecast Outlook 2025 to 2035

Overhead Cables Market Size, Growth, and Forecast 2025 to 2035

Semiconductor Laser Diode Driver Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Vacuum Feedthroughs Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Assembly and Testing Service Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Lift-off Resists Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Grade Carbon Fiber Rigid Felts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Semiconductor Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Grade Carbon Fiber Soft Felts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Semiconductor Fingerprint Collector Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Semiconductor Metrology and Inspection Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Defect Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Bonding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Rectifiers Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Bonding Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Memory Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor & IC Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA