The telescopic tool boxes market is projected to grow from USD 2.9 billion in 2025 to USD 6.2 billion by 2035, registering a CAGR of 7.8% during the forecast period. Sales in 2024 reached USD 2.6 billion, reflecting steady growth driven by increasing demand for portable and efficient tool storage solutions.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2.9 billion |

| Projected Market Size in 2035 | USD 6.2 billion |

| CAGR (2025 to 2035) | 7.8% |

This growth is attributed to the rising need for organized tool management in industries such as construction, automotive, and manufacturing, as well as the surge in DIY activities among consumers. The market's expansion is further supported by innovations in telescopic tool box designs and materials, enhancing their durability and appeal to various end-users.

Sustainability is a key driver in the telescopic tool boxes market, with manufacturers focusing on producing tool boxes made from recyclable and eco-friendly materials. Innovations include the development of lightweight yet durable materials, integration of smart features such as GPS tracking, and ergonomic designs for enhanced user comfort.

These advancements align with global sustainability goals and regulatory requirements, making telescopic tool boxes an attractive option for environmentally conscious consumers. Additionally, the development of modular and customizable storage solutions has enhanced efficiency and convenience for users, further driving market growth.

The telescopic tool boxes market is poised for significant growth, driven by increasing demand in construction, automotive, and manufacturing industries for portable and organized tool storage solutions. Companies investing in innovative, eco-friendly technologies are expected to gain a competitive edge.

The market's expansion is further supported by the growing DIY culture and the shift towards compact and efficient storage solutions. With continuous advancements in materials and manufacturing processes, the telescopic tool boxes market is set to offer lucrative opportunities for stakeholders over the forecast period.

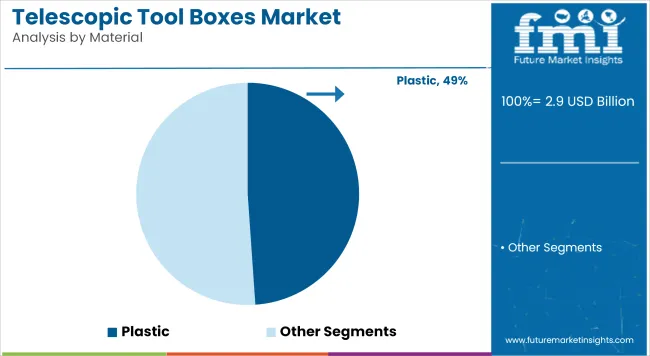

The market is segmented based on material, compartments, sales channel, end-use industry, and region. By material, the segmentation includes plastic (polypropylene, polycarbonate, ABS), aluminum, steel, and composite materials, with plastic emerging as the preferred choice due to its lightweight, corrosion resistance, and affordability for mass production.

By compartments, the classification includes single compartment, 2-3 compartments, 4-5 compartments, and 6 or more compartments, where 2-3 compartments dominate owing to optimal storage configuration for tools and accessories across professional applications.

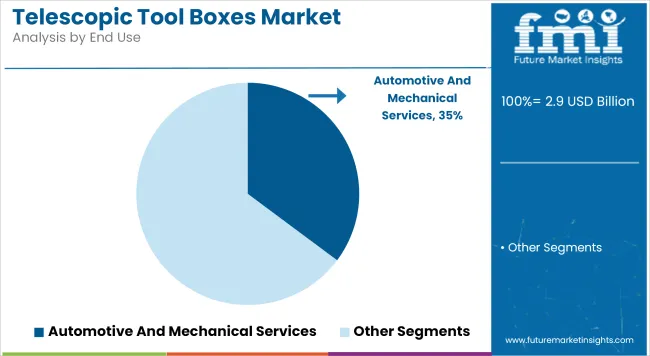

Sales channels are divided into online retail, offline retail (hardware stores, specialty stores), and direct sales (B2B), with offline retail leading due to direct product inspection and expert consultations influencing purchase behavior. End-use industries encompass automotive & mechanical services, construction, electrical & electronics maintenance, industrial manufacturing, and defense & aerospace maintenance. Regionally, the market spans North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Plastic tool boxes have been projected to account for 48.9% of the telescopic tool boxes market by 2025, driven by their lightweight nature, corrosion resistance, and cost-effective manufacturing. Variants made from polypropylene, polycarbonate, and ABS have been preferred for their impact strength, design flexibility, and chemical inertness across diverse operating environments.

Multi-compartment configurations and telescopic extensions have been engineered using high-precision injection molding processes, allowing for modularity and stack ability without structural compromise. Transparent lids, interlocking systems, and ergonomic handles have also been integrated to enhance portability and storage access.

Widespread adoption has been observed among DIY users, hobbyists, and small contractors seeking mobile tool storage at an accessible price point. Resistance to moisture, UV exposure, and common solvents has further made plastic tool boxes suitable for outdoor and vehicle-mounted applications.

Retail partnerships and online customization programs have been launched by leading manufacturers to address rising demand for consumer-personalized tool box layouts. Environmental compliance efforts have also resulted in the increased use of recycled plastics and REACH-certified compounds across production lines.

The automotive and mechanical services sector is estimated to hold a 35.2% share of the telescopic tool boxes market by 2025. The sector's reliance on a diverse range of tools necessitates efficient storage solutions. Telescopic tool boxes have provided mechanics and technicians with organized and easily accessible tool storage.

This organization has enhanced workflow efficiency and reduced downtime. The portability of telescopic tool boxes has been particularly advantageous in automotive repair settings. Technicians often need to move tools between different workstations or vehicles. The compact and extendable design of these tool boxes has facilitated this mobility. Additionally, their sturdy construction has ensured the safe transport of tools.

Incorporation of features such as lockable compartments and customizable layouts has further increased their utility in the sector. These features have allowed for secure storage of valuable tools and adaptation to specific workflow requirements. Moreover, the integration of smart technologies has begun to emerge, offering inventory tracking and tool management capabilities. Such advancements have aligned with the sector's move towards digitalization.

As the automotive and mechanical services sector continues to evolve, the demand for efficient and adaptable tool storage solutions is expected to grow. Telescopic tool boxes, with their combination of portability, durability, and customization, are well-positioned to meet these needs. Their contribution to improved operational efficiency underscores their value in the sector. Consequently, their market share is anticipated to remain significant in the foreseeable future.

High Manufacturing Costs

Production of telescopic tool boxes necessitates high-quality materials and precision engineering, which in turn leads to exorbitant manufacture costs. Besides pricing, the figure straightaway affects their market penetration, particularly in price-competitive regions.

Market Competition from Traditional Tool Storage

Many users still prefer conventional tool storage solutions like fixed toolboxes and tool chests. Resistance to the adoption of telescopic tool boxes comes from both customers 'familiarity with these traditional choices and their perceived costs.

Rising Demand for Portable and Modular Storage Solutions

Companies that make compact, portable and modular storage solutions are, however, being looked at for their telescopic tool boxes both by professionals-on-the-go as well as do-it-yourselves. By providing space efficiency and ease of transport, they can readily be sold.

Technological Advancements and Customization

Innovations in materials, such as lightweight yet durable composites, functions of products are increasing. Customization variables such as adjustable compartments and smart locks are offering opportunities for new markets.

With a rising demand for durable and mobile storage solutions, its market is surely growing. In addition, its application has gradually spread from automotive, construction other fields. New developments in material technology are also giving better product strength and durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

The United Kingdom's Telescopic Tool Boxes Market is burgeoning with a trend toward more compact and practical tool storage solutions. The increasing investment in infrastructure projects, rising incident rates of DIY work are only fueling this further. By this means the large scale loading and unloading equipment market growth is also proceeding quite steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.7% |

The European Union market for the telescopic tool box is thriving due to ergonomics design and continuous more sustainable material development. Germany and France are leaders in that respect, boy hood nations with strong industries construction sectors to drive demand - as well as being major contributors to such progress themselves. Moreover e-commerce promotion is also making products easier available.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.8% |

South Korea's Telescopic Tool Boxes Market is developing fast with increasing manufacturing and construction activities. Demand comes from the country's emphasis on innovative high-quality storage solutions. At the same time, growth in DIY culture and home improvement projects is playing a key role in market development overall.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.9% |

The telescopic tool boxes market is experiencing steady growth, driven by increasing demand for portable and space-efficient storage solutions across industries such as automotive, construction, and home improvement. Innovations in lightweight materials, modular designs, and smart organization features are enhancing product appeal. Key manufacturers are focusing on durability, ease of transport, and security features to gain a competitive edge in the market.

The overall market size for Telescopic Tool Boxes market was USD 2.9 billion in 2025.

The Telescopic Tool Boxes market is expected to reach USD 6.2 billion in 2035.

The demand for telescopic toolboxes will be driven by expanding construction, industrial automation, smart city projects, and increasing demand for durable, lightweight storage solutions across household, industrial, electrical, and automotive sectors.

The top 5 countries which drives the development of Telescopic Tool Boxes market are USA, European Union, Japan, South Korea and UK.

Metal Telescopic Tool Boxes demand supplier to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telescopic Masts Market Size and Share Forecast Outlook 2025 to 2035

Telescopic Inspection Mirror Market Size and Share Forecast Outlook 2025 to 2035

Telescopic Crane Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Telescopic Masts Companies

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Tool Tethering Market Size and Share Forecast Outlook 2025 to 2035

Tool Steel Market Size and Share Forecast Outlook 2025 to 2035

Tool Presetter Market Trend Analysis Based on Product, Category, End-Use, and Region 2025 to 2035

Understanding Market Share Trends in the Tool Box Industry

Tool Holder Collets Market

Tool Chest Market

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

CNC Tool Storage System Market

Brow Tools Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Key Players in the Hand Tools Market Share Analysis

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Smart Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA