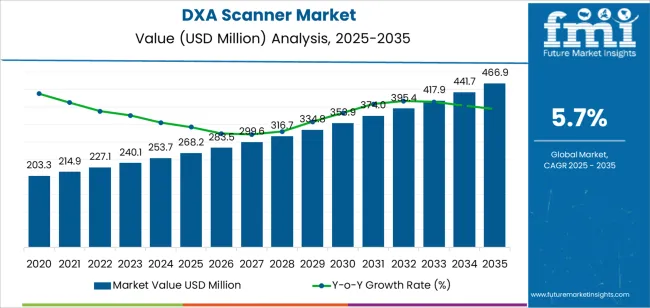

The global DXA scanner market is forecasted to reach USD 466.9 million by 2035, recording an absolute increase of USD 198.7 million over the forecast period. The market is valued at USD 268.2 million in 2025 and is set to rise at a CAGR of 5.7% during the assessment period. The market size is expected to grow by nearly 1.7 times during the same period, supported by increasing prevalence of osteoporosis and bone-related disorders in aging populations, growing awareness about early diagnosis of bone health conditions, and expanding healthcare infrastructure in developing economies driving adoption of advanced diagnostic imaging systems. The market expansion reflects growing requirements for accurate bone density measurement capabilities in clinical applications, where DXA scanners deliver superior diagnostic precision and reproducibility compared to conventional radiographic assessment methods.

The market demonstrates strong momentum across developed and emerging healthcare economies, where medical imaging industries are transitioning from conventional diagnostic methods to advanced imaging systems that offer superior diagnostic accuracy and patient throughput capabilities. DXA scanner technology addresses critical healthcare challenges including early detection of osteoporotic conditions, accurate fracture risk assessment in elderly populations, and longitudinal monitoring of bone health status across extended treatment periods. The healthcare sector's shift toward preventive medicine and personalized treatment approaches creates steady demand for diagnostic imaging solutions capable of providing quantitative bone density measurements, body composition analysis, and fracture risk evaluation with minimal radiation exposure and consistent measurement reliability. Orthopedic specialists and endocrinologists are adopting DXA scanners for patient assessment where diagnostic accuracy directly impacts treatment selection and therapeutic intervention timing.

Healthcare providers and diagnostic imaging centers are investing in DXA scanner systems to enhance diagnostic capabilities through improved measurement precision and expanded clinical application options. The integration of advanced detector technologies and optimized scanning protocols enables these systems to achieve examination times 25-40% shorter than earlier generation platforms while maintaining diagnostic image quality standards. The initial capital investment requirements for medical imaging equipment and technical expertise barriers for optimal system operation may pose challenges to market expansion in resource-limited healthcare settings and regions with limited access to specialized radiologic training programs.

Between 2025 and 2030, the market is projected to expand from USD 268.2 million to USD 334.8 million, resulting in a value increase of USD 66.6 million, which represents 33.5% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for accurate bone density assessment in geriatric populations, product innovation in detector technology and scanning software platforms, as well as expanding integration with electronic health record systems and picture archiving communication networks. Companies are establishing competitive positions through investment in advanced detector designs, automated analysis algorithms, and strategic market expansion across hospital radiology departments, outpatient diagnostic centers, and specialized bone health assessment facilities.

From 2030 to 2035, the market is forecast to grow from USD 334.8 million to USD 466.9 million, adding another USD 132.1 million, which constitutes 66.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized scanning systems, including portable DXA configurations and multi-purpose scanning platforms tailored for specific anatomical sites and patient populations, strategic collaborations between medical device manufacturers and healthcare information technology providers, and an enhanced focus on radiation dose optimization and examination workflow efficiency. The growing focus on preventive healthcare and early disease detection will drive demand for advanced, high-performance DXA scanner solutions across diverse clinical applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 268.2 million |

| Market Forecast Value (2035) | USD 466.9 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The DXA scanner market grows by enabling healthcare providers to achieve accurate bone mineral density measurements and comprehensive fracture risk assessment while reducing examination times in diagnostic imaging operations. Healthcare facilities face mounting pressure to improve diagnostic efficiency and patient care quality, with DXA scanning systems typically providing examination completion in 5-10 minutes compared to 15-20 minutes with older generation equipment, making these advanced imaging platforms essential for high-volume diagnostic operations. The orthopedic and endocrinology specialties' need for precise bone density quantification creates demand for advanced DXA solutions that can deliver reproducible measurements, accurate body composition analysis, and reliable longitudinal monitoring across diverse patient populations and treatment protocols.

Healthcare digitization initiatives promoting electronic health record integration and telemedicine capabilities drive adoption in hospital radiology departments, outpatient imaging centers, and specialized osteoporosis clinics, where diagnostic imaging efficiency has a direct impact on patient throughput capacity and clinical workflow productivity. The global shift toward value-based healthcare models and population health management accelerates DXA scanner demand as medical facilities seek diagnostic tools that enable early disease detection and minimize downstream healthcare costs through preventive intervention strategies. Limited reimbursement coverage in certain healthcare markets and higher equipment costs compared to basic radiographic systems may limit adoption rates among small-scale medical practices and regions with constrained healthcare budgets and limited diagnostic imaging infrastructure.

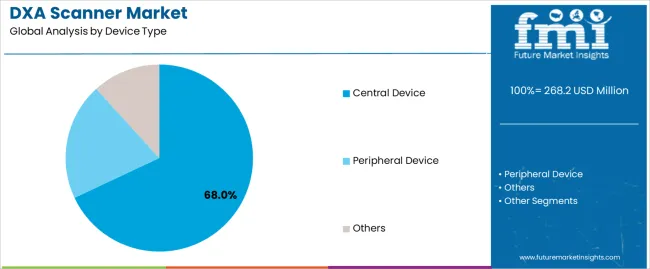

The market is segmented by device type, application, and region. By device type, the market is divided into central device, peripheral device, and others. Based on application, the market is categorized into clinical diagnosis and scientific research. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

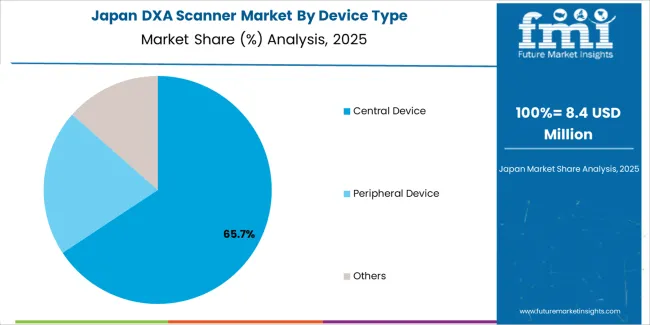

The central device segment represents the dominant force in the market, capturing approximately 68.0% of total market share in 2025. This advanced category encompasses standard dual-energy configurations, fan-beam scanning systems, and specialized platforms optimized for whole-body composition analysis, delivering comprehensive bone density assessment and superior measurement precision in clinical diagnostic operations. The central device segment's market leadership stems from its versatile scanning capabilities, established clinical validation across multiple diagnostic protocols, and compatibility with standard hospital radiology workflows across orthopedic practices, endocrinology departments, and specialized bone health assessment facilities.

The peripheral device segment maintains a substantial 24.0% market share, serving healthcare providers who require portable scanning solutions through compact forearm measurement systems, mobile screening platforms, and specialized point-of-care configurations that enable bone density assessment in community health settings. The others segment accounts for 8.0% market share, encompassing specialized veterinary applications and research-specific scanning configurations.

Key advantages driving the central device segment include:

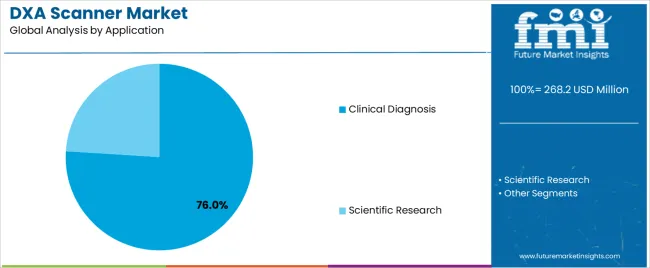

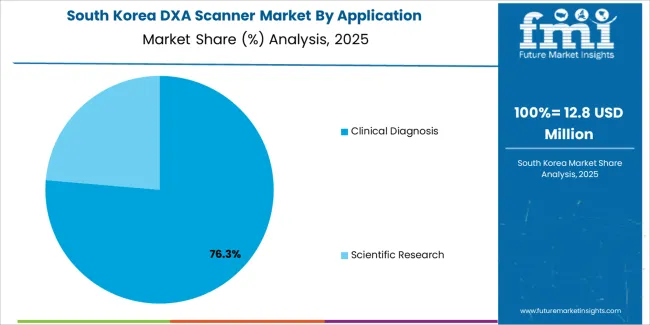

Clinical diagnosis applications dominate the market with approximately 76.0% market share in 2025, reflecting the extensive adoption of bone density measurement solutions across hospital radiology departments, outpatient diagnostic imaging centers, and specialized osteoporosis assessment clinics. The clinical diagnosis segment's market leadership is reinforced by widespread implementation in osteoporosis screening (32.0%), fracture risk assessment (28.0%), and treatment monitoring programs (16.0%), which provide essential diagnostic value and clinical decision support in preventive healthcare strategies.

The scientific research segment represents 24.0% market share through specialized applications including pharmaceutical clinical trials (10.0%), bone biology research studies (8.0%), and body composition investigation protocols (6.0%).

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to healthcare demographics and clinical practice patterns. First, global population aging creates increasing requirements for bone health assessment solutions, with the population aged 65 years and older exceeding 700 million individuals worldwide, requiring reliable DXA scanning systems for osteoporosis screening, fracture risk evaluation, and therapeutic monitoring in geriatric patient populations. Second, rising osteoporosis prevalence and fragility fracture incidence drive adoption of diagnostic imaging technology, with DXA scanners enabling early disease detection and treatment optimization in postmenopausal women and elderly male patients at elevated fracture risk. Third, healthcare quality initiatives and clinical guideline adoption accelerate deployment across medical facilities, with DXA scanners integrating into preventive medicine programs and chronic disease management protocols in primary care and specialty practice settings.

Market restraints include equipment cost barriers affecting small medical practices and resource-limited healthcare facilities, particularly where basic radiographic assessment remains adequate for initial bone health evaluation and where capital budgets constrain acquisition of specialized diagnostic imaging systems. Technical training requirements for proper scanning technique and image interpretation pose adoption challenges for facilities lacking experienced radiologic technologists, as DXA scanner performance depends on standardized patient positioning, proper anatomical landmark identification, and accurate region-of-interest placement that vary across scanning protocols and anatomical sites. Limited reimbursement coverage in certain healthcare markets creates additional barriers, as medical providers require eco-friendly payment models for routine bone density screening to justify equipment investment and operational expenses.

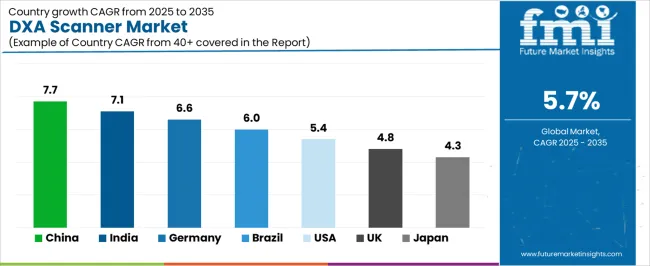

Key trends indicate accelerated adoption in Asian healthcare markets, particularly China and India, where aging population demographics and expanding health insurance coverage are driving preventive healthcare service utilization through government-sponsored screening programs and private sector medical facility expansion. Technology advancement trends toward lower radiation dose protocols, faster scanning capabilities, and artificial intelligence-assisted image analysis are driving next-generation product development. The market thesis could face disruption if alternative bone assessment technologies achieve breakthrough capabilities in providing equivalent diagnostic information through non-ionizing radiation modalities, potentially reducing demand for conventional DXA scanning in specific patient populations.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| Brazil | 6.0% |

| USA | 5.4% |

| UK | 4.8% |

| Japan | 4.3% |

The market is gaining momentum worldwide, with China taking the lead to aggressive healthcare infrastructure expansion and population aging initiatives. Close behind, India benefits from growing diagnostic imaging center development and government healthcare insurance programs, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding private healthcare networks and chronic disease prevention programs strengthen its role in South American medical device markets. The USA demonstrates robust growth through established osteoporosis screening guidelines and Medicare reimbursement policies, signaling continued adoption in preventive healthcare applications. Japan stands out for its advanced medical imaging infrastructure and comprehensive geriatric healthcare programs, while UK and Germany continue to record consistent progress driven by national health service protocols and specialized osteoporosis clinics. China and India anchor the global expansion story, while established markets build stability and technology leadership into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

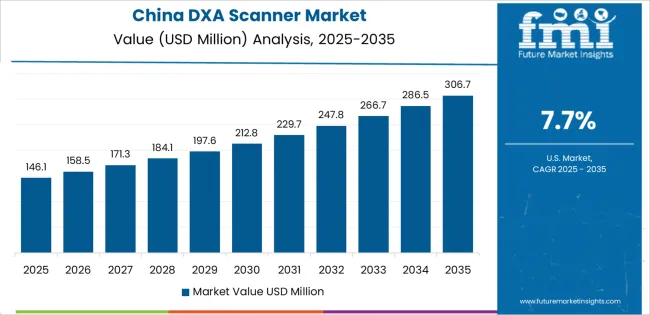

China demonstrates the strongest growth potential in the market with a CAGR of 7.7% through 2035. The country's leadership position stems from comprehensive healthcare system expansion, intensive population aging management programs, and aggressive medical imaging technology adoption targets driving deployment of advanced diagnostic equipment. Growth is concentrated in major urban healthcare regions, including Beijing, Shanghai, Guangdong, and Jiangsu, where tertiary hospitals, specialized diagnostic centers, and private medical facilities are implementing DXA scanning systems for osteoporosis screening and chronic disease management programs. Distribution channels through medical equipment distributors, hospital procurement departments, and direct manufacturer relationships expand deployment across public hospitals, private healthcare networks, and community health centers. The country's Healthy China 2030 initiative provides policy support for preventive healthcare technology adoption, including subsidies for diagnostic imaging equipment procurement and medical facility modernization programs.

Key market factors:

In the National Capital Region, Maharashtra, Tamil Nadu, and Karnataka healthcare zones, the adoption of DXA scanning systems is accelerating across tertiary care hospitals, specialized diagnostic imaging centers, and corporate healthcare networks, driven by Ayushman Bharat initiatives and increasing focus on non-communicable disease management. The market demonstrates strong growth momentum with a CAGR of 7.1% through 2035, linked to comprehensive healthcare infrastructure expansion and increasing investment in preventive medicine capabilities. Indian healthcare providers are implementing DXA scanner technology and digital health platforms to improve diagnostic accessibility while meeting clinical practice guidelines in orthopedic and endocrinology specialties serving urban and semi-urban patient populations. The country's National Health Policy creates steady demand for diagnostic imaging solutions, while increasing focus on health insurance coverage drives adoption of preventive screening services that enhance early disease detection capabilities.

Germany's advanced healthcare sector demonstrates sophisticated implementation of DXA scanning systems, with documented clinical studies showing comprehensive osteoporosis management programs achieving 35-45% fracture risk reduction in elderly populations through systematic screening protocols. The country's healthcare infrastructure in major metropolitan regions, including Bavaria, North Rhine-Westphalia, Baden-Württemberg, and Hesse, showcases integration of bone density assessment technologies with existing hospital information systems, leveraging expertise in orthopedic medicine and geriatric healthcare delivery. German healthcare providers emphasize evidence-based medicine and quality standards, creating demand for reliable DXA scanning solutions that support clinical guideline adherence and comprehensive patient care protocols. The market maintains strong growth through focus on preventive healthcare integration and medical technology excellence, with a CAGR of 6.6% through 2035.

Key development areas:

The Brazilian market leads in Latin American DXA scanner adoption based on expanding private healthcare networks and growing awareness of bone health management in aging populations across major urban centers. The country shows solid potential with a CAGR of 6.0% through 2035, driven by private health insurance expansion and increasing demand for preventive healthcare services across metropolitan areas and regional medical hubs. Brazilian healthcare providers are adopting DXA scanner technology for compliance with Brazilian Society of Endocrinology and Metabolism guidelines, particularly in postmenopausal osteoporosis screening requiring accurate bone density measurement and in geriatric medicine applications where fracture prevention impacts healthcare economics. Technology deployment channels through medical equipment importers, hospital procurement networks, and equipment leasing programs expand coverage across private hospital chains and independent diagnostic imaging centers.

Leading market segments:

The USA market leads in established DXA scanner utilization based on comprehensive Medicare reimbursement coverage and well-defined clinical practice guidelines for osteoporosis screening in postmenopausal women and elderly populations. The country shows solid potential with a CAGR of 5.4% through 2035, driven by established preventive healthcare protocols and increasing focus on fall prevention programs across healthcare delivery systems. American healthcare providers implement DXA scanning systems for guideline-concordant bone density assessment, particularly in primary care networks serving Medicare populations and in specialty endocrinology practices managing complex metabolic bone disorders. Technology deployment channels through group purchasing organizations, medical equipment dealers, and direct manufacturer relationships expand coverage across hospital radiology departments, outpatient imaging centers, and specialty physician offices.

Leading market segments:

The UK market demonstrates consistent implementation focused on National Health Service osteoporosis screening programs and specialized metabolic bone disease clinics, with documented integration of DXA scanning achieving 30-35% improvement in appropriate treatment initiation rates among high-risk elderly populations. The country maintains steady growth momentum with a CAGR of 4.8% through 2035, driven by National Osteoporosis Society guidelines and established fracture liaison service programs for secondary fracture prevention. Major healthcare regions, including Greater London, West Midlands, and North West England, showcase deployment of bone density assessment technologies that integrate with existing NHS digital infrastructure and support clinical decision pathways in primary and secondary care settings.

Key market characteristics:

Japan's market demonstrates sophisticated implementation focused on comprehensive geriatric healthcare programs and national osteoporosis screening initiatives, with documented integration of bone density assessment achieving 40-45% improvement in early osteoporosis detection rates among postmenopausal women. The country maintains steady growth momentum with a CAGR of 4.3% through 2035, driven by universal health insurance coverage and established clinical practice patterns emphasizing preventive medicine principles. Major healthcare regions, including Tokyo, Osaka, Aichi, and Kanagawa, showcase advanced deployment of diagnostic imaging technologies that integrate with comprehensive electronic medical record systems and national health database networks.

Key market characteristics:

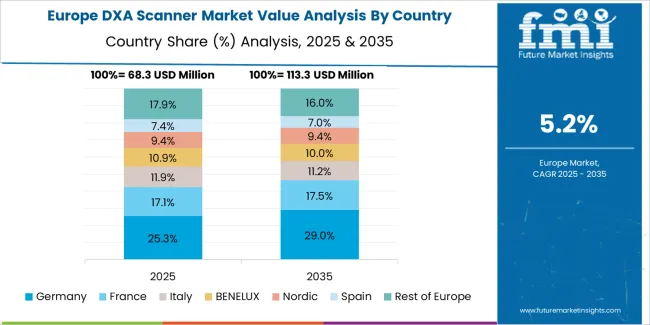

The DXA scanner market in Europe is projected to grow from USD 96.9 million in 2025 to USD 203.3 million by 2035, registering a CAGR of 7.7% over the forecast period. Germany is expected to maintain its leadership position with a 28.7% market share in 2025, declining slightly to 27.1% by 2035, supported by its comprehensive healthcare infrastructure and major medical centers, including university hospitals in Munich, Berlin, and Hamburg.

France follows with a 19.6% share in 2025, projected to reach 20.0% by 2035, driven by comprehensive national osteoporosis screening programs and specialized metabolic bone disease centers. The United Kingdom holds a 16.2% share in 2025, expected to reach 16.8% by 2035 through NHS fracture liaison services and specialized bone health clinics. Italy commands a 14.8% share in 2025, maintaining 14.9% by 2035, backed by national health service diagnostic imaging programs. Spain accounts for 11.4% in 2025, rising to 11.7% by 2035 on expanding private healthcare networks and geriatric medicine programs. The Rest of Europe region is anticipated to hold 9.3% in 2025, expanding to 9.5% by 2035, attributed to increasing DXA scanner adoption in Nordic countries and emerging Central & Eastern European healthcare modernization initiatives.

The Japanese market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of central device scanning systems with existing hospital information infrastructure across university medical centers, specialized orthopedic hospitals, and comprehensive geriatric care facilities. Japan's focus on preventive healthcare and systematic screening protocols drives demand for diagnostic imaging systems that support national health initiatives and clinical practice guidelines established by Japanese Society for Bone and Mineral Research. The market benefits from strong partnerships between international medical device manufacturers and domestic healthcare distributors including major trading companies, creating comprehensive service ecosystems that prioritize technical training and clinical application support programs. Healthcare centers in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced medical imaging implementations where DXA scanning systems achieve 96% protocol standardization compliance through comprehensive technologist certification programs and ongoing quality assurance initiatives.

The South Korean market is characterized by growing international medical device manufacturer presence, with companies maintaining significant positions through comprehensive technical support and clinical education capabilities for tertiary hospital radiology departments and specialized diagnostic imaging centers. The market demonstrates increasing focus on preventive healthcare services and health screening programs, as Korean healthcare providers increasingly demand advanced diagnostic imaging solutions that integrate with national health insurance systems and comprehensive electronic medical record platforms deployed across major medical centers. Regional medical equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including clinical training programs and application-specific consultation services for orthopedic specialty practices and internal medicine departments. The competitive landscape shows increasing collaboration between multinational medical device companies and Korean healthcare technology specialists, creating hybrid service models that combine international product development expertise with local clinical support capabilities and regulatory compliance knowledge.

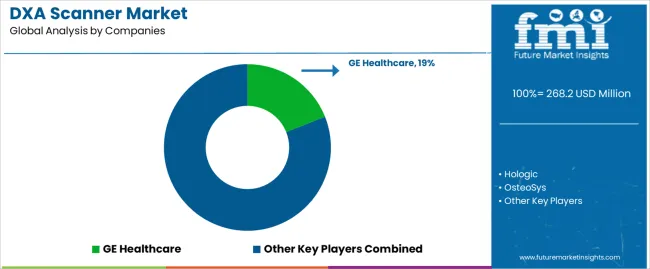

The DXA scanner market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 45-52% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on measurement accuracy, system reliability, and clinical workflow integration rather than price competition alone. GE Healthcare leads with approximately 19.0% market share through its comprehensive medical imaging solutions portfolio and global healthcare presence. Hologic maintains strong positioning with approximately 18.0% market share through specialized bone densitometry platforms and established clinical relationships in women's health applications.

Market leaders include GE Healthcare, Hologic, and OsteoSys, which maintain competitive advantages through global distribution infrastructure, advanced detector technology platforms, and deep expertise in clinical application support across orthopedic, endocrinology, and radiology specialties, creating trust and reliability advantages with hospital systems and outpatient diagnostic imaging centers. These companies leverage research and development capabilities in detector technology optimization and ongoing clinical education relationships to defend market positions while expanding into emerging healthcare markets and specialized application segments.

Challengers encompass Norland at Swissray and Fujifilm Healthcare, which compete through differentiated product offerings and strong regional presence in key healthcare markets. Product specialists, including Medilink, L' ACN, and Shenzhen XRAY, focus on specific device configurations or regional markets, offering differentiated capabilities in portable scanning solutions, cost-effective system options, and rapid service response capabilities.

Regional players and emerging medical device manufacturers create competitive pressure through localized manufacturing advantages and competitive pricing strategies, particularly in high-growth markets including China and India, where proximity to healthcare facilities provides advantages in technical support responsiveness and customer relationships. Market dynamics favor companies that combine proven measurement accuracy with comprehensive clinical training offerings that address the complete diagnostic workflow from patient scheduling through report generation and clinical interpretation support.

DXA scanners represent advanced diagnostic imaging solutions that enable healthcare providers to achieve accurate bone mineral density assessment and comprehensive fracture risk evaluation, delivering superior measurement precision and clinical workflow efficiency with minimal radiation exposure and reproducible longitudinal monitoring capabilities in preventive healthcare applications. With the market projected to grow from USD 268.2 million in 2025 to USD 466.9 million by 2035 at a 5.7% CAGR, these diagnostic imaging systems offer compelling advantages - accurate disease detection, efficient patient assessment, and evidence-based treatment guidance - making them essential for clinical diagnosis applications (76.0% market share), scientific research operations (24.0% share), and healthcare facilities seeking alternatives to conventional radiographic methods that compromise diagnostic accuracy through qualitative assessment limitations. Scaling market adoption and technology deployment requires coordinated action across healthcare policy, medical infrastructure development, medical device manufacturers, healthcare providers, and health insurance systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 268.2 million |

| Device Type | Central Device, Peripheral Device, Others |

| Application | Clinical Diagnosis, Scientific Research |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | GE Healthcare, Hologic, OsteoSys, Norland at Swissray, Fujifilm Healthcare, Medilink, L' ACN, Shenzhen XRAY, Kangda, Colorful, Xingaoyi, Pinyuan, Life Medical, Kanrota |

| Additional Attributes | Dollar sales by device type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with medical device manufacturers and distribution networks, healthcare facility requirements and specifications, integration with electronic health records and picture archiving systems, innovations in detector technology and scanning software platforms, and development of specialized diagnostic solutions with enhanced measurement precision and workflow efficiency capabilities. |

The global dxa scanner market is estimated to be valued at USD 268.2 million in 2025.

The market size for the dxa scanner market is projected to reach USD 466.9 million by 2035.

The dxa scanner market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in dxa scanner market are central device, peripheral device and others.

In terms of application, clinical diagnosis segment to command 76.0% share in the dxa scanner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Scanners Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Thermal Scanner Market Growth – Trends & Forecast 2020-2030

3D Laser Scanner Market Growth - Trends & Forecast 2025 to 2035

Micro-CT Scanners Market

Intraoral Scanner Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Narcotics Scanner Market Size and Share Forecast Outlook 2025 to 2035

Full Body Scanner Market Analysis - Size, Share & Forecast 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mobile LiDAR Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Global Intraoral IOL Scanner Market Analysis – Size, Share & Forecast 2024-2034

Polygon Mirror Scanner Motor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fixed Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Retinal Scanners Market

In-Counter Barcode Scanners Market Size and Share Forecast Outlook 2025 to 2035

Industrial Barcode Scanners Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA