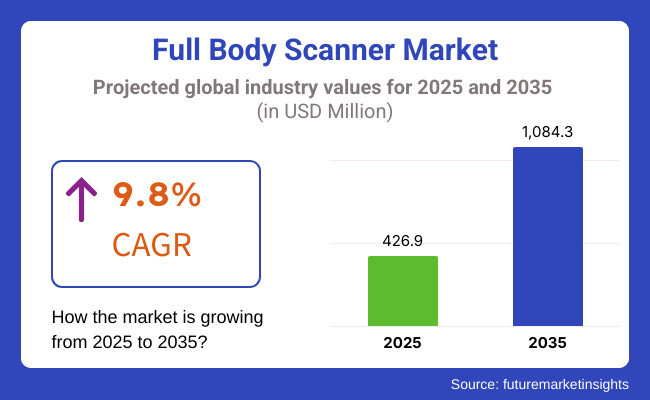

The global full body scanner market is poised for substantial growth over the next few years, with its market value expected to increase from USD 426.9 million in 2025 to USD 1,084.3 million by 2035. This significant expansion reflects a CAGR of 9.8% during the forecast period.

The surge in demand is largely attributable to escalating security concerns across the world, as governments and private organizations strive to enhance public safety and counter threats such as terrorism, smuggling, and other illegal activities. As security protocols become more stringent, the need for reliable, efficient, and non-intrusive screening solutions is more critical than ever.

Advancements in screening technologies have played a pivotal role in propelling market growth. Modern full body scanners employ cutting-edge millimeter-wave and X-ray-based imaging techniques, which offer real-time, high-resolution scans while maintaining minimal radiation exposure to individuals. These technologies have not only improved the accuracy of threat detection but have also enhanced user experience by reducing wait times and discomfort associated with manual pat-downs.

Integration of artificial intelligence (AI) and biometric systems into scanning devices has further augmented their capability to identify concealed threats, optimize security personnel deployment, and streamline passenger flow in high-traffic areas such as airports, transit hubs, and government buildings. These technological innovations are fueling investment and adoption globally, particularly in regions experiencing rapid urbanization and increasing air travel.

Another significant driver of market growth is the tightening of regulatory frameworks and security mandates worldwide. Governments and international agencies are imposing stricter security standards and compliance requirements, necessitating the deployment of advanced screening equipment in public spaces.

This regulatory pressure ensures continuous demand for full body scanners, especially in transportation sectors and high-security venues. The market is also supported by increasing awareness among organizations regarding the importance of safeguarding people and assets from potential threats. These factors are expected to sustain strong market momentum, making the full body scanner market a vital component of global security infrastructure through 2035.

The full body scanner market is segmented by application, including transport, airports, train stations, and infrastructure. From a technology perspective, the market is analyzed based on image processing and modelling as well as 3D body scanners. In terms of systems, the market is divided into millimeter wave systems and backscatter systems. Regionally, the market covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

The airport segment is projected to be the fastest-growing application within the full body scanner market, recording a CAGR of 10.6% between 2025 and 2035, driven by the sustained increase in global air passenger traffic, the modernization of airport infrastructure, and the ever-evolving nature of aviation security threats. In response to global terrorism risks and rising incidents of smuggling and contraband transport, civil aviation authorities and airport operators are continuously upgrading their screening technologies to meet stricter international security standards.

Full body scanners in airports are increasingly being integrated with AI-driven threat detection, biometric verification, and real-time imaging systems, significantly improving the speed and accuracy of passenger screening. Technologies like millimeter wave imaging have become standard in many international airports due to their ability to detect concealed objects without physical contact and with negligible radiation exposure.

Other key application segments, such as transport and train stations, are also witnessing steady growth, fueled by expanding urban mobility networks and the need to secure mass transit environments. Governments are increasingly investing in securing rail networks and public transportation systems, especially in densely populated cities across Asia and Europe. Infrastructure applications, including government buildings, correctional facilities, and high-security venues, continue to play an essential role in the market.

These facilities prioritize non-intrusive screening technologies to ensure safety without compromising operational efficiency. While not growing as rapidly as the airport segment, these areas remain vital contributors to overall market demand, supported by growing awareness and policy mandates for enhanced public safety.

| Application | CAGR (2025 to 2035) |

|---|---|

| Airports | 10.6% |

The 3D body scanners segment, projected to grow at a CAGR of 11.2% from 2025 to 2035, represents the fastest-growing technology in the full body scanner market. This growth is primarily driven by the increasing demand for more precise and comprehensive threat detection in high-security environments such as international airports, government installations, correctional facilities, and border control checkpoints.

Unlike traditional 2D scanning, 3D body scanners create detailed, three-dimensional representations of the human body, enabling more accurate detection of concealed items, including weapons, explosives, and contraband, regardless of their position or shape.

One of the main advantages of 3D scanners is their ability to capture volumetric data in real time. This allows for more effective differentiation between harmless personal items and potential threats, significantly reducing false alarms and improving screening throughput. In addition, the enhanced accuracy and depth perception offered by 3D imaging help security personnel make faster, more informed decisions, especially in high-pressure environments.

The image processing and modelling segment, while growing steadily, is experiencing relatively slower growth compared to 3D body scanners. This segment primarily supports the underlying software and analytical systems that power existing scanner hardware, enabling image interpretation, object recognition, and threat classification.

Although advancements in AI and machine learning are enhancing the capabilities of image processing platforms, their role is often complementary to the physical scanning hardware. These systems are crucial for improving the accuracy of existing millimeter wave and backscatter scanners by reducing false positives and enabling automated decision-making.

| Technology | CAGR (2025 to 2035) |

|---|---|

| 3D body scanners | 11.2% |

The millimeter wave system segment is experiencing rapid growth and is projected to maintain a 10.5% CAGR during the forecast period, making it the fastest-growing system technology in the full body scanner market. This technology has gained widespread adoption, particularly in airports and high-security venues, due to its ability to produce detailed, three-dimensional images that reveal concealed threats without physical contact or invasive procedures.

Millimeter wave scanners operate by emitting non-ionizing radio frequency waves that safely penetrate clothing but reflect off the skin and any hidden objects, allowing security personnel to identify weapons, explosives, and contraband efficiently.

One of the key advantages driving the popularity of millimeter wave systems is their enhanced safety profile. Unlike backscatter scanners that use low-dose X-rays, millimeter wave technology involves negligible radiation exposure, which has led to broader regulatory acceptance worldwide and increased passenger confidence. Additionally, millimeter wave scanners incorporate privacy-enhancing features, such as generating generic avatars instead of detailed body images, addressing privacy concerns, and improving user comfort during screening.

In contrast, the backscatter system segment, while still important, is growing at a slower pace. Backscatter scanners use low-dose X-rays to generate images, which are effective at detecting metallic and non-metallic objects hidden under clothing. However, concerns around radiation exposure, stricter regulatory scrutiny, and privacy issues have limited the expansion of backscatter technology in some regions. Additionally, advancements in millimeter wave systems have begun to overshadow backscatter systems due to their enhanced safety profile and faster screening capabilities.

| Systems | CAGR (2025 to 2035) |

|---|---|

| Millimeter Wave System | 10.5% |

Privacy Concerns and Regulatory Restrictions

One of the primary challenges in the full body scanner market is the public concern over privacy and personal data security. This type of scanner often employs either backscatter X-ray or millimetre-waveimaging systems, both of which sparked ethical discussions around human anatomy and the protection of data.

To focus on privacy concerns, regulatory agencies like the European Aviation Safety Agency (EASA) and USA Transportation Security Administration (TSA) have developed stringent guidelines for passenger screening, mandating that scanner manufacturers design devices with privacy-enabling technologieslike automatic threat detection and non-intrusive imaging capabilities. Resistanceto full-body scanning in some parts of the world over privacy concerns is still limiting adoption.

Manufacturers also face challengesdue to the increasing cost of compliance as security regulations evolve, with governments increasingly tightening X-ray exposure limits and data retention policies. Toovercome these regulatory challenges, organizations need to invest in privacy-compliant scanner designs and AI-based non-intrusive screening solutions.

High Initial Costs and Integration Challenges

Another key challenge is the high cost of full body scanners and the complexity of integrating them into existing security infrastructure. More significant AI-driven and automated scanning solutions require a substantial investment in hardware,software, and maintenance, which presents a challenge for smaller airports, transportation hubs, and private enterprises in adopting.

Furthermore, much of the old security system must be with considerable adjustments to support next-generation full body scannersin addition, raising installation and operational costs. This is due to the long return on investment (ROI) period and subsequent budget constraints in emergingeconomies. To overcome this challenge, manufacturers are developing cost effectivemodels of scanners, and also offering leasing options to increase the market accessibility.

AI-Powered and Contactless Screening Innovations

Artificial intelligence (AI) in full body scanning technologies is used interms of threat detection, decreased false alarms and quicker passenger screening. AI-based automatic scanning systems that can detect suspicious objects in real time, reduce operator errors,and increase detection accuracy, ensure that automatic detection is highly appealing to the airport sector and public safety automatons.

The use of terahertz imaging and passive screening technologies in the development of contactlessand radiation-free full body scanners is also opening up new market opportunities. These are increasingly being developed in airports,border control and high-security government sites where rapid, non-intrusive security screening needs to be done as security concerns.

Rising Adoption in Commercial and Public Infrastructure

Full body scanners are in demand not just in the airport but also in the shopping mall, the stadium, the hotel,and the corporate building; the more sophisticated the security, the more companies are willing to invest in it. Amidst escalating global security concerns, enterprises are investing in smart surveillance systems, biometric authentication and AI-enabled body scanners for better safetyin workplaces and public places.

The rising deployment of full body scanners in correctional facilities to prevent contraband smuggling worldwideto make way for new growth opportunities for manufacturers. AI-based and non-intrusive complete body scanners will soon turn into the standard.

The United States full body scanner market is experiencing strong growth, driven by increasing security concerns, rising investments in airport screening technology, and advancements in AI-integrated threat detection. The TSA has also continuously been working to upgrade the airportsecurity infrastructure so the demand for full body scanners based on millimeter wave technology full body scanners and backscatter X-ray technology full body scanners continues to witness significant growth.

Full body scanners are also being used increasingly in correctional facilities, border control, government buildings, and mass transit hubs to combat the smugglingof concealed weapons and contraband. The increasing integration of AI and automated threat detection software is further improving scanner accuracy, minimizing the duration of passenger screeningand decreasing false alarms. Additionally, with this effort, the trend toward non-ionizing and low-radiation imaging technologies is also propelling the evolution of privacy-centric, high-speed scanners that comply with USA health and data protectionstandards.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 10.3% |

The growth of the United Kingdom full body scanner market is moderate and is primarily driven by increasing security regulations at airport, risingconcern for terrorism and technological development in body scanner with AI support. AAP and air transport agencies such as the UK Border Force and Home Office are investing in progressive scanning solutions that may facilitate border security at ports and other placesconsidered high risk.

With London's Heathrow, Gatwick, andManchester airports investing in infrastructure upgrades to security, the demand for non-intrusive, high throughout, full body scanners are increasing. High-performance screening systems are being used at train stations, government buildings,and correctional institutions to avoid the entry of weapons and drug smuggling. Nowadays, with the introduction of AI-assisted full-body scanning devices featuring automated anomaly detection and integration with facial recognition systems, securityscreening is done promptly with guaranteed passenger anonymity.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 9.8% |

The European Union full body scanner market is expanding due to increased counter-terrorism efforts, airport security modernization, and rising investments in smart surveillance technologies. The leading nations Germany, France and the Netherlands are taking the lead by implementing AI-powered, automated full body scanners into the busiest terminalsof their airports and various border security checkpoints.

EUAviation Security Regulations require progressed security solutions, thus airports have started replacing existing systems with radiation-free, high-resolution body scanning systems. Governments are also ramping up security against mass-casualty threats, with full body scanners increasinglybeing rolled out in railway stations, stadiums and public event venues. AI-integrated screening technology and multi-spectral imaging solutions enhance the accuracy of security screening, while also reducingfalse positive finding and improving passenger throughput.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 10.1% |

The Japan full body scanner market is experiencing strong growth due to rising concerns over airport security, increasing deployment in high-speed rail networks, and advancements in non-invasive screening technologies. Airports in Japan including Tokyo Narita andOsaka Kansai are adopting state-of-the-art millimeter-wave scanners to enable faster and more efficient passenger screening.

With the 2025 Osaka Expo and various international sporting events on the horizon, security investments have surged. As a result, body scanners are increasingly being deployed in stadiums,concert halls and transit centers. Japan’s Robotics Revolution look set to accelerate the path to automated fullbody scanning systems bolstered by facial recognition and AI-driven threat detection. ANSR is also seeing a rise in adoption of low-radiation and high-precision scanners across publicbuildings and corporate security checkpoints that offers non-invasive yet sharper screening.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.7% |

South Korea full bodyscanner market is witnessing growth on the back of AI-based surveillance development, rise in investments at the airport, and growing field of full body scanning in defence and border security. Nextgeneration screen technologies: South Korea’s Incheon International Airport is at the forefront of this trend with its implementation of next-generation screening technologies, which allow passengers to have a seamless and faster security check.

Amid tensions in border security, theSouth Korean government is increasing installation of full body scanning infrastructure at customs checkpoints and military installations. Another key factor driving the demand for portable and AI-assisted full body scanners is theexpansion of urban security networks, subway safety measures, and stadium screening. Biometric verification and AI-assisted screening technologies are also evolving to create more intelligent and efficient security with high throughput andminimum contact during screening.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.0% |

The global full body scanner market is showing steady growth due to risingsecurity concerns, growing adoption of advanced screening technologies, and increasing investment in airport and border security infrastructure. Full body scanners are widely used in airports, government facilities, transportation hubs, and correctional institutions to detect danger material or concealed weapons, explosives, drugs, and other prohibited items without physical contact.

Driving factors include the development of millimeter-wave and X-ray scanning systems, the need to comply withregulations related to non-intrusive screening, and the increasing use of AI-based image analyzing systems. Eachof the leading manufacturers has put considerable focus on areas such as high-speed scanning, protective safety from radiation exposure and automated threat detection for security operations on a global scale.

Smiths Group plc

Smiths Group is a provider of full body scanners that include millimeter-wave screening for airport security solutions, government checkpoints, andcritical infrastructure protection. The firm’s EQO and B-SCAN series incorporatesautomated threat recognition, AI-powered anomaly detection and high-speed imaging for non-intrusive, efficient passenger screening. Smiths Group is investing in real-time data analytics and networked security system integration, expanding global viewcapabilities.

Rapiscan Systems (OSI Systems, Inc.)

Rapiscan Systems is a major supplier ofX-ray and millimeter-wave body scanners, focusing on high resolution threat detection technologies for the aviation and border industries. Its Rapiscan Secure 1000 and RTT series enable low-dose radiation scanning with automated detection algorithms, allowing for more accurate screenings and reducing the need for manualinspections. Rapiscan is expanding its AI-driven security analytics, enabling faster identification of concealed objects.

Leidos Holdings, Inc.

Leidos offers high-definition, non-intrusive full body imaging systemsfor the airport security environment. The company’s provision ATD series utilizes low-radiation, millimeter-wave imaging and automated software-based threatdetection. Leidos is reformatting its biometric integrated perspective to allow facialrecognition and AI-enabling scans to be used in tandem with body imaging to give connected multi-tiered security screening.

Nuctech Company Limited

Nuctech is China's largest manufacturer of full body scanners, providing high-speed, high-precision scanningsolutions for border checkpoints, prisons, and transportation hubs. It combines both millimeter-wave imaging and X-ray transmissiontechnologies to ensure improved detection of both metallic and non-metallic threats. Nuctech is growing into security screening allaround the world, targeting emerging markets with their more affordable and scalable, AI-based scanning systems.

Tek84 Inc.

Tek84 designs portable full body scanners for commercialuse, specifically for law enforcement and correctional facilities. Back to the Future When completed, the food-monitoring machine or nanobot would be similar in form to thecompany’s Intercept and Body Scan series, which utilize backscatter X-ray and millimeter-wave technology to allow real-time detection of contraband, weapons, and other hidden objects. Tek84 is focused on wireless security blurring, or the ability to easily access data remotely and network screening capabilitiesfor increased situational awareness.

Walk-through Scanners, Portal Scanners, Handheld Scanners

Millimetre Wave, X-ray

Airports & Transit Stations, Malls, Cineplex & Auditoriums, Prisons, Defense, Government Buildings, Offices & Embassies, Sports Arena & Events, Others

North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa

The global full body scanner market is projected to reach USD 426.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 9.8% over the forecast period.

By 2035, the full body scanner market is expected to reach USD 1,084.3 million.

The airports & transit stations segment is expected to dominate due to increasing global air travel, rising security threats, and regulatory mandates for enhanced passenger screening systems to detect concealed weapons and contraband.

Key players in the full body scanner market include Smiths Group plc, Leidos Holdings Inc., Rapiscan Systems, L3Harris Technologies, and Nuctech Company Limited.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Systems, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Systems, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Systems, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Systems, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Systems, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Systems, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Systems, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Systems, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Systems, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Systems, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Systems, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Systems, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Systems, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Systems, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Systems, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Systems, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Systems, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Systems, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Systems, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Systems, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Systems, 2023 to 2033

Figure 21: Global Market Attractiveness by Application, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by Systems, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Systems, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Systems, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Systems, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Systems, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Systems, 2023 to 2033

Figure 45: North America Market Attractiveness by Application, 2023 to 2033

Figure 46: North America Market Attractiveness by Technology, 2023 to 2033

Figure 47: North America Market Attractiveness by Systems, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Systems, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Systems, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Systems, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Systems, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Systems, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Systems, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Systems, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Systems, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Systems, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Systems, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Systems, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Systems, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Systems, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Systems, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Systems, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Systems, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Systems, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Systems, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Systems, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Systems, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Systems, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Systems, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Systems, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Systems, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Systems, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Systems, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Systems, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Systems, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Systems, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Systems, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Systems, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Systems, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Systems, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Systems, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Systems, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Systems, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fully Automatic Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Full-Bore F-Class Rifle Scope Market Size and Share Forecast Outlook 2025 to 2035

Fully Sealed Fully Insulated Inflatable Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Blood Gas Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Blood Cell Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Wet Chemical Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed Cartons Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Hydraulic Lifting Column Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic High Speed Nail Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Solid-Liquid Purge Trap Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed 3D Printing Smart Warehouse Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Liquid Metal Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Full-frame Oblique Cameras Market Size and Share Forecast Outlook 2025 to 2035

Body Armor Plates Market Size and Share Forecast Outlook 2025 to 2035

Body Composition Monitor and Scale Market Size and Share Forecast Outlook 2025 to 2035

Full-size Pickup Trucks Market Size and Share Forecast Outlook 2025 to 2035

Body Tape Market Size and Share Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Body Blurring Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA