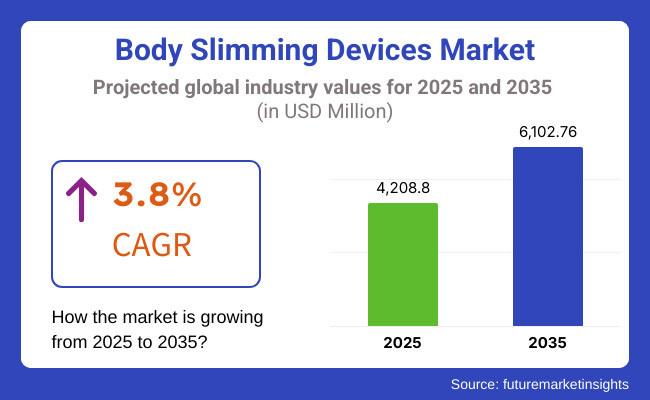

The body slimming devices industry is projected to experience substantial growth during the forecast period 2025 to 2035. The sector’s growth is driven by increasing demand for non-surgical weight loss treatments, an increase in aesthetics technology, and the increasing rate of obesity. Its growth is expected to be approximately USD 4,208.8 million in 2025 and reach approximately USD 6,102.76 million by 2035 at a compound annual growth rate (CAGR) of 3.8% over the forecast period.

Some of the major key drivers in this sector include the increasing need for non-invasive body contouring procedures, increasing disposable incomes, and the influence of social media on beauty ideals. Technological advancements in radiofrequency (RF), cryolipolysis, high-intensity focused ultrasound (HIFU), and laser lipolysis are also driving the body slimming device industry.

High costs of devices, regulatory problems, and variability in treatment effectiveness could challenge adoption. Medical spa growth, home-use slimming devices, and tailored body sculpting treatments are the main opportunities for industry players.

North America has been leading the body slimming device industry, driven by high-end user spending on aesthetics procedures, advanced healthcare facilities, and demand for less invasive body contouring procedures. The United States is the largest country having cryolipolysis and radiofrequency-based fat loss devices. The sector’s growth is also driven by the growth of med spas, influencer marketing, and social media campaigns.

The issues dominating the industry are the potential regulatory oversight by the FDA, the high costs of treatments, and the long-term effectiveness. Implementing AI-based personalized treatment plans and increasing demand for home-use devices for slimming and reinstating are anticipated to facilitate consumer engagement. Further, the increasing adoption of body contouring among men and awareness of body positivity is augmenting the demand for customized solutions among diverse consumer segments.

Europe tends to be a robust body slimming device industry, with a growing focus on wellness, fitness and body aesthetics. Countries including, Germany, the UK, and France are those with a high demand for non-invasive fat reduction technologies, making them leaders in terms of adoption.

Other trends shaping the European economy in aesthetic device manufacturing include a growing emphasis on sustainability and a growing number of combination treatments that bring together several slimming technologies. Furthermore, the collaboration between aesthetic clinics and fitness centres is forming a new distribution channel for offering body contouring solutions.

Similar trends can be observed across Europe as consumers become wiser about personalization and seek body sculpting solutions aimed at developing the right treatment plans, giving rise to a growing demand boost for AI-powered analysis tools to assess body composition and offer customized treatment plans.

Asia-Pacific region is projected to experience significant growth in the body slimming device industry from 2025 to 2035. The country's growth is primarily driven by the increase in disposable income, the growing number of beauty-conscious consumers, and rising rates of obesity. Countries including China, Japan, and South Korea are among the countries with the highest level of innovation and demand for fat reduction by technology.

However, widespread adoption is challenged by inequalities in developing economies, regulatory inconsistencies, and counterfeit products. Rising medical tourism in countries such as Thailand, South Korea, and India for aesthetic treatment is driving the industry’s growth. The growing acceptance rate of non-invasive body composition techniques (aesthetic body treatments) for men and younger consumers is expected to influence industrial trends for the entire region.

Challenges

There are several challenges prevailing in the global body slimming device industry, including high treatment costs, scepticism on treatment efficacy, and regulatory hurdles in various regions. The challenge with non-invasive fat reduction has been consumer scepticism over the long-term efficacy of the procedure, resulting in slower industrial adoption.

Moreover, consumer confidence is also impacted due to concerns regarding side effects such as skin burns, uneven fat removal and temporary numbness. This is further compounded by unregulated online platforms that are flooded with counterfeit or low-quality slimming devices affecting brand reputation and trust.

Moreover, thanks to a growing competitive landscape with newcomers providing cheaper alternatives, traditional players are under increasing pressure to innovate and stand out from the competition. However, the requirement of skilled professionals to use advanced slimming devices can slow down the growth of the industry in a few regions, acting as a barrier for smaller clinics and wellness centres to adopt the devices in developed countries.

Opportunities

Body slimming devices are witnessing innovative technologies like integration with AI and machine learning to offer personalized treatments for fat reduction. Consumers are looking for more tailored solutions based on body composition analysis and metabolic rate instead of a one-size-fits-all approach, driving demand for smart devices for slimming.

The rise of direct-to-consumer models in tandem with subscription-based weight-reducing services is bringing the market reach to new horizons. Also, synergetic outcomes from the growing adoption of combination therapies (pairing body slimming treatments with an accompanying skin tightening and muscle toning solution) are augmenting any clinic treatment outcome.

Due to the increasing demand for convenient aesthetic therapies, the development of non-invasive, pain-free, and portable body slimming devices for home usage is contributing to the growth of the industry. In addition, innovation in energy-based body contouring technologies is enhancing safety, comfort, and efficacy, increasing patient confidence in non-invasive fat reduction procedures.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Emphasis on safety and efficacy of non-invasive body slimming devices, with regulatory bodies facilitating approvals for innovative treatments. | Implementation of comprehensive guidelines ensuring standardized protocols for advanced technologies, including AI-assisted and combination therapy devices. |

| Adoption of cryolipolysis, radiofrequency, and laser-based devices offering non-invasive fat reduction and skin tightening solutions. | Integration of artificial intelligence and machine learning to personalize treatment plans, enhance device precision, and improve patient outcomes. |

| Increased awareness leading to higher demand for minimally invasive procedures with minimal downtime and effective results. | Growing preference for personalized and holistic body contouring solutions that align with individual health and aesthetic goals, supported by digital health platforms. |

| Rising obesity rates, sedentary lifestyles, and cultural emphasis on physical appearance driving demand for body slimming devices. | Expansion of the wellness and aesthetics industry, technological innovations offering enhanced treatment experiences, and increasing disposable incomes facilitating access to advanced body contouring procedures. |

| Initial efforts towards eco-friendly manufacturing processes and reducing the environmental impact of disposable components in devices. | Comprehensive adoption of sustainable practices, including the use of recyclable materials, energy-efficient manufacturing, and initiatives aimed at reducing electronic waste associated with medical devices. |

| Reliance on established distribution networks with a focus on ensuring the availability of devices in clinics and wellness centers. | Optimization of supply chains through digital technologies, enhancing transparency and efficiency, and ensuring timely delivery of devices to diverse settings, including home-use products for personalized care. |

The body slimming device industry in the United States is experiencing steady growth, driven by increasing health consciousness and demand for non-invasive fat reduction solutions. In 2025, the industry is expected to be valued at approximately USD 4.17 billion and is projected to reach USD 5.76 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.8%.

The body slimming devices industry consists of sales of body slimming devices and related services. The obesity rates are increasing which means there is a great demand for effective weight management solutions! New devices are more sophisticated and safer for use, with technical improvements in non-invasive treatment of the skin such as cryolipolysis and radiofrequency.

Furthermore, many individuals seek body sculpting options since such procedures entail little downtime and lowered associated risks. Social media platforms, Instagram and TikTok, are also contributing factor of demand of aesthetic treatment, which is leading people to appearance enhancement. The industry is also being fueled by the increasing availability of user-friendly-at-home slimming machines that can widen the reach of these solutions.

| Year | Industry Size (USD Billion) |

|---|---|

| 2025 | 4.17 |

| 2035 | 5.76 |

China's body slimming device market is poised for significant growth, fueled by urbanization and increasing disposable incomes. In 2025, the market was valued at approximately USD 70.9 million. It is projected to reach USD 163.3 million by 2035, with a

CAGR of 9.5%.

The emergence of several key drivers is boosting the body-slimming device market in China. The changing lifestyle is a significant by-product of rapid urbanization and rising demand for health monitoring and slimming solutions. Growth of Technological Adoption Consumer Smart and Connected Devices for Total Health Tracking.

The market growth is also driven by government health initiatives that promote public health awareness. Their increased availability, due to the growth of e-commerce, also improves their distribution. Furthermore, the increased fitness trend and the upsurge in interest in wellness activities are also contributing to the demand for body slimming devices, as individuals look for an effective and non-invasive solution.

| Year | Industry Size (USD Million) |

|---|---|

| 2025 | 70.9 |

| 2035 | 163.3 |

India's body slimming device industry is experiencing robust growth, attributed to increasing health consciousness and a rising middle-class population. In 2025, the industry will be valued at approximately USD 54.6 million, holding about 7.3% of the global market share. It is projected to reach USD 139.5 million by 2035, reflecting a CAGR of 11.2%.

Innovative technological advancements in body slimming departments primarily fuel the growth of India's body slimming device market. Growing health consciousness is driving consumers to focus on wellness, thus driving the adoption of health monitoring solutions. Economic growth and increasing disposable incomes enable investment ability towards these devices.

Greater internet access has catalysed the digitalization of the healthcare industry, which, in turn, enables the adoption of smart health devices. Proactive health management is also bolstered by government initiatives and public health campaigns. Also, the expanding fitness and wellness sector and the growth of gyms and wellness centres are contributing to the demand for body slimming devices as many people are looking for effective ways to achieve their fitness goals.

| Year | Industry Size (USD Million) |

|---|---|

| 2025 | 54.6 |

| 2035 | 139.5 |

Germany's body slimming device industry is set for steady growth, supported by a strong healthcare infrastructure and high health awareness. In 2025, the market is expected to be valued at approximately USD 42.0 million. It is projected to reach USD 63.6 million by 2034, with a CAGR of 4.7%.

Germany's body slimming device market is poised for steady growth due to several factors. The country's advanced healthcare system supports the widespread adoption of health monitoring devices, while the ageing population increases the need for regular health assessments. Technological innovation continuously enhances the accuracy and functionality of devices, attracting more consumers.

A cultural focus on preventive health care further bolsters the demand for slimming solutions. Additionally, Germany’s strong fitness culture fosters an environment where people actively seek effective and precise body-slimming devices to complement their wellness goals, driving continued growth in the market.

| Year | Industry Size (USD Million) |

|---|---|

| 2025 | 42.0 |

| 2035 | 63.6 |

The United Kingdom's body slimming device industry is poised for growth, driven by increasing health awareness and technological adoption. In 2025, the industry will be valued at approximately USD 39.0 million. It is projected to reach USD 63.7 million by 2035, reflecting a CAGR of 5.8%.

The United Kingdom’s body slimming device sector is growing at a rapid pace, with several key factors contributing to its development. The rise in popularity of non-invasive aesthetic treatments, such as body contouring, over surgical procedures is similar to the trend among consumers toward non-invasive body augmentation. As a slim-down tech, from cryolipolysis to radiofrequency and ultrasound fat reduction comes to the fore.

The growing demand for devices is driven by the expanding wellness & fitness sector which includes increasing gym membership. Slimming devices are easily available on e-commerce platforms, allowing consumers to buy from the comfort of their homes. Moreover, growing consumer inclination toward non-invasive body contouring is supplemented by celebrity endorsements and social media influencer marketing campaigns, which also propel the sector’s expansion.

| Year | Industry Size (USD Million) |

|---|---|

| 2025 | 39.0 |

| 2035 | 63.7 |

Cryolipolysis or fat freezing is a popular non-surgical fat reduction technique for areas like the abdomen and thighs. It works by freezing fat cells that are naturally disposed of by the body. It is anticipated that fat reduction with minimal downtime will gain electrifying momentum.

It is popular in countries including North America and Europe, growing at a rapid rate in Asia-Pacific with the rise of medical spas. HIFU (High-Intensity Focused Ultrasound) is another comparable criterion where ultrasound waves are focused to reduce fat and wrinkle the skin. In countries like South Korea and Japan, it's getting popular, and the future trends are like AI-powered devices combined with treatment adapted to get even better results.

The body slimming devices are used primarily at plastic surgery and cosmetic clinics for procedures like cryolipolysis, HIFU and diode laser. These serve clients looking for non-invasive body contouring and fat reduction. drivers include the rising demand for non-surgical procedures, higher disposable income, and the trend for combination treatments.

The industry is dominated by North America and Europe, while the Asia-Pacific region is driving growth owing to increasing engagement in medical tourism and cosmetic dermatology. Ambulatory surgical centers (ASCs) are also becoming very popular as they provide an economically feasible, outpatient treatment option associated with less downtime. However, there are trends where AI can provide all help your pre-treatment, treatment and post-treatment.

The body slimming device industry is highly competitive, driven by increasing consumer demand for non-invasive fat reduction treatments, technological advancements, and the growing aesthetic and wellness industry.

Companies are investing in laser-based, radiofrequency, ultrasound, and cryolipolysis technologies to maintain a competitive edge. The industry is shaped by well-established medical device manufacturers, beauty tech firms, and emerging aesthetic solution providers, each contributing to the evolving landscape of body contouring treatments.

Top Companies and Estimated Market Share

Allergan (AbbVie)

Key Product: CoolSculpting (cryolipolysis)

Market Share: ~20-25%

Dominates the non-invasive fat reduction segment due to FDA approvals and strong clinical validation.

Solta Medical (Bausch Health Companies)

Key Product: Thermage (radiofrequency skin tightening)

Market Share: ~10-15%

A leader in radiofrequency-based body contouring.

Cynosure (Hologic)

Key Products: SculpSure (laser lipolysis), MonaLisa Touch

Market Share: ~15-20%

Strong in laser-based technologies and expanding into emerging markets.

Syneron Candela

Key Products: UltraShape, CoolGlide

Market Share: ~10-12%

Focuses on combination technologies (ultrasound + radiofrequency).

Alma Lasers

Key Products: Accent, Soprano

Market Share: ~8-10%

Known for diversified devices for fat reduction and skin tightening.

Lumenis

Key Product: Legend Pro

Market Share: ~5-8%

Strong in multifunctional platforms for aesthetics.

Cutera

Key Product: truSculpt

Market Share: ~5-7%

Specializes in radiofrequency and laser devices.

Zeltiq (Acquired by Allergan)

Integrated into Allergan’s portfolio, contributing to its dominance.

Home-Use Device Brands (e.g., Ziip Beauty, NuFACE, Silk’n)

Collective Market Share: ~10-15%

Rapid growth in consumer-grade devices for at-home use.

North America: Allergan, Cynosure, and Solta Medical lead.

Europe: Syneron Candela and Alma Lasers have strong footholds.

Asia-Pacific: Local players (e.g., WONTECH, Lutronic) compete with global brands due to cost advantages.

Technology: Companies investing in AI, hybrid devices (e.g., RF + ultrasound), and pain-free treatments gain traction.

Medical vs. Consumer Channels: Allergan and Cynosure lead in clinical settings, while brands like NuFACE target direct-to-consumer markets.

Mergers/Acquisitions: Consolidation (e.g., Hologic acquiring Cynosure) reshapes competitive landscapes.

A sector focused on non-invasive technologies (e.g., RF, cryolipolysis) for fat reduction and body contouring, driven by rising demand for aesthetic treatments.

Allergan (CoolSculpting), Cynosure (SculpSure), and Solta Medical (Thermage) dominate with ~50% combined market share.

North America leads (40% share), but Asia-Pacific grows fastest due to rising disposable incomes and beauty standards.

Table 01: Global Market Value (US$ million) Analysis and Forecast 2024 to 2034, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2024 to 2034, by Product

Table 03: Global Market Value (US$ million) Analysis and Forecast 2024 to 2034, by End-user

Table 04: Global Market Value (US$ million) Analysis and Forecast 2024 to 2034, by End-user

Table 05: North America Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 06: North America Market Value (US$ million) Analysis and Forecast 2024 to 2034, by Product

Table 07: North America Market Volume (Units) Analysis and Forecast 2024 to 2034, by Product

Table 08: North America Market Value (US$ million) Analysis and Forecast 2024 to 2034, by End-user

Table 09: Latin America Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 10: Latin America Market Value (US$ million) Analysis and Forecast 2024 to 2034, by Product

Table 11: Latin America Market Volume (Units) Analysis and Forecast 2024 to 2034, by Product

Table 12: Latin America Market Value (US$ million) Analysis and Forecast 2024 to 2034, by End-user

Table 13: Europe Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 14: Europe Market Value (US$ million) Analysis and Forecast 2024 to 2034, by Product

Table 15: Europe Market Volume (Units) Analysis and Forecast 2024 to 2034, by Product

Table 16: Europe Market Value (US$ million) Analysis and Forecast 2024 to 2034, by End-user

Table 17: South Asia Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 18: South Asia Market Value (US$ million) Analysis and Forecast 2024 to 2034, by Product

Table 19: South Asia Market Volume (Units) Analysis and Forecast 2024 to 2034, by Product

Table 20: South Asia Market Value (US$ million) Analysis and Forecast 2024 to 2034, by End-user

Table 21: East Asia Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 22: East Asia Market Value (US$ million) Analysis and Forecast 2024 to 2034, by Product

Table 23: East Asia Market Volume (Units) Analysis and Forecast 2024 to 2034, by Product

Table 24: East Asia Market Value (US$ million) Analysis and Forecast 2024 to 2034, by End-user

Table 25: Oceania Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 26: Oceania Market Value (US$ million) Analysis and Forecast 2024 to 2034, by Product

Table 27: Oceania Market Volume (Units) Analysis and Forecast 2024 to 2034, by Product

Table 28: Oceania Market Value (US$ million) Analysis and Forecast 2024 to 2034, by End-user

Table 29: Middle East and Africa Market Value (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 30: Middle East and Africa Market Value (US$ million) Analysis and Forecast 2024 to 2034, by Product

Table 31: Middle East and Africa Market Volume (Units) Analysis and Forecast 2024 to 2034, by Product

Table 32: Middle East and Africa Market Value (US$ million) Analysis and Forecast 2024 to 2034, by End-user

Figure 01: Global Market Volume (Units), 2019 to 2023

Figure 02: Global Market Volume (Units) and Y-o-Y Growth (%) Analysis, 2024 to 2034

Figure 03: Body Slimming Devices, Pricing Analysis per unit (US$), in 2023

Figure 04: Body Slimming Devices, Pricing Forecast per unit (US$), in 2034

Figure 05: Global Market Value (US$ million) Analysis, 2019 to 2023

Figure 06: Global Market Forecast and Y-o-Y Growth, 2024 to 2034

Figure 07: Global Market Absolute $ Opportunity (US$ million) Analysis, 2024 to 2034

Figure 08: Global Market Value Share (%) Analysis 2023 and 2034, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Product

Figure 10: Global Market Attractiveness Analysis 2024 to 2034, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2034, by End-user

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by End-user

Figure 13: Global Market Attractiveness Analysis 2024 to 2034, by End-user

Figure 14: Global Market Value Share (%) Analysis 2023 and 2034, by Region

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Region

Figure 16: Global Market Attractiveness Analysis 2024 to 2034, by Region

Figure 17: North America Market Value (US$ million) Analysis, 2019 to 2023

Figure 18: North America Market Value (US$ million) Forecast, 2024 to 2034

Figure 19: North America Market Value Share, by Product (2023 E)

Figure 20: North America Market Value Share, by End-user (2023 E)

Figure 21: North America Market Value Share, by Country (2023 E)

Figure 22: North America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 23: North America Market Attractiveness Analysis by End-user, 2024 to 2034

Figure 24: North America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 25: United States Market Value Proportion Analysis, 2023

Figure 26: Global Vs. United States Growth Comparison

Figure 27: United States Market Share Analysis (%) by Product, 2023 to 2034

Figure 28: United States Market Share Analysis (%) by End-user, 2023 to 2034

Figure 29: Canada Market Value Proportion Analysis, 2023

Figure 30: Global Vs. Canada. Growth Comparison

Figure 31: Canada Market Share Analysis (%) by Product, 2024 to 2034

Figure 32: Canada Market Share Analysis (%) by End-user, 2024 to 2034

Figure 33: Latin America Market Value (US$ million) Analysis, 2019 to 2023

Figure 34: Latin America Market Value (US$ million) Forecast, 2024 to 2034

Figure 35: Latin America Market Value Share, by Product (2023 E)

Figure 36: Latin America Market Value Share, by End-user (2023 E)

Figure 37: Latin America Market Value Share, by Country (2023 E)

Figure 38: Latin America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 39: Latin America Market Attractiveness Analysis by End-user, 2024 to 2034

Figure 40: Latin America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 41: Mexico Market Value Proportion Analysis, 2023

Figure 42: Global Vs Mexico Growth Comparison

Figure 43: Mexico Market Share Analysis (%) by Product, 2024 to 2034

Figure 44: Mexico Market Share Analysis (%) by End-user, 2024 to 2034

Figure 45: Brazil Market Value Proportion Analysis, 2023

Figure 46: Global Vs. Brazil. Growth Comparison

Figure 47: Brazil Market Share Analysis (%) by Product, 2024 to 2034

Figure 48: Brazil Market Share Analysis (%) by End-user, 2024 to 2034

Figure 49: Argentina Market Value Proportion Analysis, 2023

Figure 50: Global Vs Argentina Growth Comparison

Figure 51: Argentina Market Share Analysis (%) by Product, 2024 to 2034

Figure 52: Argentina Market Share Analysis (%) by End-user, 2024 to 2034

Figure 53: Europe Market Value (US$ million) Analysis, 2019 to 2023

Figure 54: Europe Market Value (US$ million) Forecast, 2024 to 2034

Figure 55: Europe Market Value Share, by Product (2023 E)

Figure 56: Europe Market Value Share, by End-user (2023 E)

Figure 57: Europe Market Value Share, by Country (2023 E)

Figure 58: Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 59: Europe Market Attractiveness Analysis by End-user, 2024 to 2034

Figure 60: Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 61: United Kingdom Market Value Proportion Analysis, 2023

Figure 62: Global Vs. United Kingdom Growth Comparison

Figure 63: United Kingdom Market Share Analysis (%) by Product, 2024 to 2034

Figure 64: United Kingdom Market Share Analysis (%) by End-user, 2024 to 2034

Figure 65: Germany Market Value Proportion Analysis, 2023

Figure 66: Global Vs. Germany Growth Comparison

Figure 67: Germany Market Share Analysis (%) by Product, 2024 to 2034

Figure 68: Germany Market Share Analysis (%) by End-user, 2024 to 2034

Figure 69: Italy Market Value Proportion Analysis, 2023

Figure 70: Global Vs. Italy Growth Comparison

Figure 71: Italy Market Share Analysis (%) by Product, 2024 to 2034

Figure 72: Italy Market Share Analysis (%) by End-user, 2024 to 2034

Figure 73: France Market Value Proportion Analysis, 2023

Figure 74: Global Vs France Growth Comparison

Figure 75: France Market Share Analysis (%) by Product, 2024 to 2034

Figure 76: France Market Share Analysis (%) by End-user, 2024 to 2034

Figure 77: Spain Market Value Proportion Analysis, 2023

Figure 78: Global Vs Spain Growth Comparison

Figure 79: Spain Market Share Analysis (%) by Product, 2024 to 2034

Figure 80: Spain Market Share Analysis (%) by End-user, 2024 to 2034

Figure 81: Russia Market Value Proportion Analysis, 2023

Figure 82: Global Vs Russia Growth Comparison

Figure 83: Russia Market Share Analysis (%) by Product, 2024 to 2034

Figure 84: Russia Market Share Analysis (%) by End-user, 2024 to 2034

Figure 85: BENELUX Market Value Proportion Analysis, 2023

Figure 86: Global Vs BENELUX Growth Comparison

Figure 87: BENELUX Market Share Analysis (%) by Product, 2024 to 2034

Figure 88: BENELUX Market Share Analysis (%) by End-user, 2024 to 2034

Figure 89: East Asia Market Value (US$ million) Analysis, 2019 to 2023

Figure 90: East Asia Market Value (US$ million) Forecast, 2024 to 2034

Figure 91: East Asia Market Value Share, by Product (2023 E)

Figure 92: East Asia Market Value Share, by End-user (2023 E)

Figure 93: East Asia Market Value Share, by Country (2023 E)

Figure 94: East Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 95: East Asia Market Attractiveness Analysis by End-user, 2024 to 2034

Figure 96: East Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 97: China Market Value Proportion Analysis, 2023

Figure 98: Global Vs. China Growth Comparison

Figure 99: China Market Share Analysis (%) by Product, 2024 to 2034

Figure 100: China Market Share Analysis (%) by End-user, 2024 to 2034

Figure 101: Japan Market Value Proportion Analysis, 2023

Figure 102: Global Vs. Japan Growth Comparison

Figure 103: Japan Market Share Analysis (%) by Product, 2024 to 2034

Figure 104: Japan Market Share Analysis (%) by End-user, 2024 to 2034

Figure 105: South Korea Market Value Proportion Analysis, 2023

Figure 106: Global Vs South Korea Growth Comparison

Figure 107: South Korea Market Share Analysis (%) by Product, 2024 to 2034

Figure 108: South Korea Market Share Analysis (%) by End-user, 2024 to 2034

Figure 109: South Asia Market Value (US$ million) Analysis, 2019 to 2023

Figure 110: South Asia Market Value (US$ million) Forecast, 2024 to 2034

Figure 111: South Asia Market Value Share, by Product (2023 E)

Figure 112: South Asia Market Value Share, by End-user (2023 E)

Figure 113: South Asia Market Value Share, by Country (2023 E)

Figure 114: South Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 115: South Asia Market Attractiveness Analysis by End-user, 2024 to 2034

Figure 116: South Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 117: India Market Value Proportion Analysis, 2023

Figure 118: Global Vs. India Growth Comparison

Figure 119: India Market Share Analysis (%) by Product, 2024 to 2034

Figure 120: India Market Share Analysis (%) by End-user, 2024 to 2034

Figure 121: Indonesia Market Value Proportion Analysis, 2023

Figure 122: Global Vs. Indonesia Growth Comparison

Figure 123: Indonesia Market Share Analysis (%) by Product, 2024 to 2034

Figure 124: Indonesia Market Share Analysis (%) by End-user, 2024 to 2034

Figure 125: Malaysia Market Value Proportion Analysis, 2023

Figure 126: Global Vs. Malaysia Growth Comparison

Figure 127: Malaysia Market Share Analysis (%) by Product, 2024 to 2034

Figure 128: Malaysia Market Share Analysis (%) by End-user, 2024 to 2034

Figure 129: Thailand Market Value Proportion Analysis, 2023

Figure 130: Global Vs. Thailand Growth Comparison

Figure 131: Thailand Market Share Analysis (%) by Product, 2024 to 2034

Figure 132: Thailand Market Share Analysis (%) by End-user, 2024 to 2034

Figure 133: Oceania Market Value (US$ million) Analysis, 2019 to 2023

Figure 134: Oceania Market Value (US$ million) Forecast, 2024 to 2034

Figure 135: Oceania Market Value Share, by Product (2023 E)

Figure 136: Oceania Market Value Share, by End-user (2023 E)

Figure 137: Oceania Market Value Share, by Country (2023 E)

Figure 138: Oceania Market Attractiveness Analysis by Product, 2024 to 2034

Figure 139: Oceania Market Attractiveness Analysis by End-user, 2024 to 2034

Figure 140: Oceania Market Attractiveness Analysis by Country, 2024 to 2034

Figure 141: Australia Market Value Proportion Analysis, 2023

Figure 142: Global Vs. Australia Growth Comparison

Figure 143: Australia Market Share Analysis (%) by Product, 2024 to 2034

Figure 144: Australia Market Share Analysis (%) by End-user, 2024 to 2034

Figure 145: New Zealand Market Value Proportion Analysis, 2023

Figure 146: Global Vs New Zealand Growth Comparison

Figure 147: New Zealand Market Share Analysis (%) by Product, 2024 to 2034

Figure 148: New Zealand Market Share Analysis (%) by End-user, 2024 to 2034

Figure 149: Middle East and Africa Market Value (US$ million) Analysis, 2019 to 2023

Figure 150: Middle East and Africa Market Value (US$ million) Forecast, 2024 to 2034

Figure 151: Middle East and Africa Market Value Share, by Product (2023 E)

Figure 152: Middle East and Africa Market Value Share, by End-user (2023 E)

Figure 153: Middle East and Africa Market Value Share, by Country (2023 E)

Figure 154: Middle East and Africa Market Attractiveness Analysis by Product, 2024 to 2034

Figure 155: Middle East and Africa Market Attractiveness Analysis by End-user, 2024 to 2034

Figure 156: Middle East and Africa Market Attractiveness Analysis by Country, 2024 to 2034

Figure 157: GCC Countries Market Value Proportion Analysis, 2023

Figure 158: Global Vs GCC Countries Growth Comparison

Figure 159: GCC Countries Market Share Analysis (%) by Product, 2024 to 2034

Figure 160: GCC Countries Market Share Analysis (%) by End-user, 2024 to 2034

Figure 161: Türkiye Market Value Proportion Analysis, 2023

Figure 162: Global Vs. Türkiye Growth Comparison

Figure 163: Türkiye Market Share Analysis (%) by Product, 2024 to 2034

Figure 164: Türkiye Market Share Analysis (%) by End-user, 2024 to 2034

Figure 165: South Africa Market Value Proportion Analysis, 2023

Figure 166: Global Vs. South Africa Growth Comparison

Figure 167: South Africa Market Share Analysis (%) by Product, 2024 to 2034

Figure 168: South Africa Market Share Analysis (%) by End-user, 2024 to 2034

Figure 169: North Africa Market Value Proportion Analysis, 2023

Figure 170: Global Vs North Africa Growth Comparison

Figure 171: North Africa Market Share Analysis (%) by Product, 2024 to 2034

Figure 172: North Africa Market Share Analysis (%) by End-user, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Body Armor Plates Market Size and Share Forecast Outlook 2025 to 2035

Body Composition Monitor and Scale Market Size and Share Forecast Outlook 2025 to 2035

Body Tape Market Size and Share Forecast Outlook 2025 to 2035

Body Blurring Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Body Contouring Market Size and Share Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Body Armor Market Analysis - Size, Share & Forecast 2025 to 2035

Body-Worn Temperature Sensors Market Analysis by Type, Application, and Region through 2025 to 2035

Body Fat Measurement Market Analysis - Trends, Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Body Augmentation Fillers

Body Firming Creams Market Growth & Forecast 2025-2035

Body Luminizer Market Trends & Forecast 2025 to 2035

Body Scrub Market Growth & Forecast 2025 to 2035

Body Dryer Market

Body In White Market

Antibody Market Size and Share Forecast Outlook 2025 to 2035

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Antibody Therapy Market Insights - Growth, Demand & Forecast 2025 to 2035

Antibody Profiling Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Antibody Purification Service Market - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA