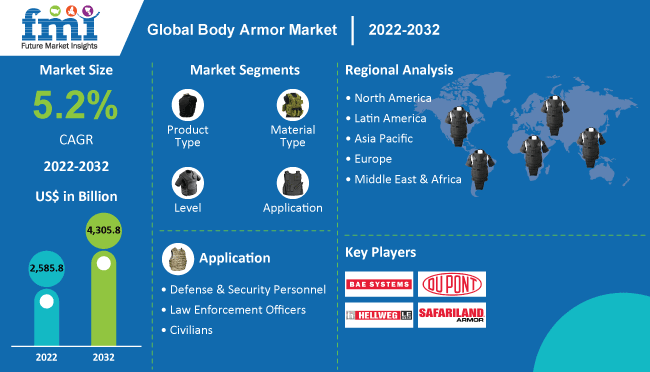

The global body armor market is expected to experience substantial growth over the next decade, with its value projected to reach USD 2.8 billion by 2025 and USD 5 billion by 2035. This expansion reflects a CAGR of 6.2% during the forecast period.

The market’s growth trajectory is shaped by increasing demand from both military and civilian sectors, driven by concerns over personal safety, rising geopolitical tensions, and rapid advancements in protective gear technology. As governments and security forces worldwide invest heavily in upgrading their defense capabilities, the adoption of modern, lightweight, and efficient body armor systems is becoming more prevalent.

One of the key driving factors of this market is the growing emphasis on modernization programs for defense and law enforcement. Governments across regions, including the Asia Pacific, the Middle East, and North America, are investing in next-generation body armor to better protect soldiers and law enforcement personnel in high-risk operations.

These modernization initiatives often involve replacing outdated protective gear with advanced materials that provide superior protection without compromising mobility or comfort. Additionally, the global rise in urban warfare, terrorism threats, and border conflicts has made it imperative for security agencies to equip their personnel with state-of-the-art protective equipment. This trend is also being mirrored in the civilian domain, where rising crime rates and mass shooting incidents are encouraging private security personnel and even civilians to seek personal body armor solutions.

Moreover, the market is benefiting significantly from continuous innovation in materials and design. Leading companies such as Armor Express, Safariland, DuPont de Nemours, Inc., and BAE Systems are focusing on the development of modular, lightweight body armor systems that offer enhanced protection with greater wearability.

Breakthroughs in advanced materials, such as aramid fibers and ultra-high-molecular-weight polyethylene (UHMWPE), are contributing to enhanced ballistic resistance and improved comfort. These innovations not only enhance performance but also drive down the weight of body armor systems, making them more practical for a wider range of users. As a result, the market is poised for strong and sustained growth through 2035, driven by security needs, technological advancements, and the increasing prioritization of personnel safety across both public and private sectors.

The body armor market is segmented by product type, application, and region. By product type, the market is categorized into soft armor, hard armor, and accessories. Based on application, the market is segmented into defense & security personnel, law enforcement officers, and civilians. Regionally, the market analysis encompasses North America, Latin America, Europe, South Asia, East Asia, Oceania, the Middle East, and Africa.

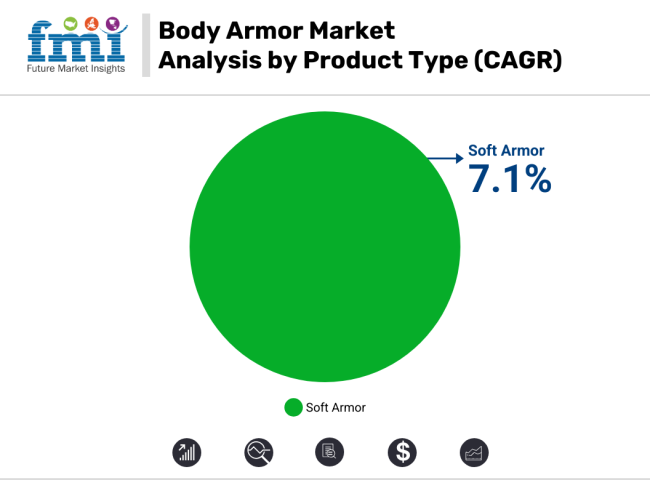

Soft armor is expected to dominate in terms of both growth rate and overall market share throughout the forecast period. With a projected CAGR of 7.1% from 2025 to 2035, the segment is primarily driven by the increasing demand from law enforcement agencies and the private security sector, which prioritize lightweight, concealable, and highly wearable protective gear.

Technological advancements play a crucial role in driving the growth of this segment. Innovations in materials, such as aramid fibers and ultra-high-molecular-weight polyethylene (UHMWPE), have significantly enhanced the performance of soft armor by providing better ballistic protection while maintaining comfort and flexibility.

These improvements have made soft armor an ideal choice for personnel operating in urban or non-combat environments where mobility and discretion are essential. Moreover, the rising global awareness of personal safety and the increase in active shooter incidents have fueled the adoption of soft armor among civilians and non-military professionals.

On the other hand, hard armor remains crucial for military and tactical units, particularly in combat scenarios where high-velocity ammunition and explosive devices are common threats. Though its growth rate is comparatively lower, its importance in defense procurement remains vital. Meanwhile, the accessories segment, comprising trauma pads, plate carriers, and tactical pouches, is witnessing steady growth due to rising interest in customizable and modular armor systems, which allow users to adapt to various mission requirements.

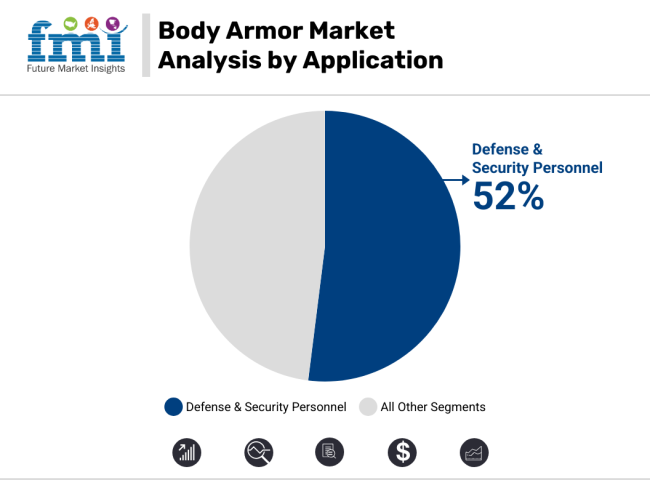

The defense & security personnel segment dominates the market, accounting for approximately 52% of the global market share in 2025. This dominance is driven by substantial investments in military modernization programs, increasing defense budgets, and the persistent need for advanced personal protection in active combat and high-risk operations. Defense agencies across North America, Europe, Asia Pacific, and the Middle East are actively procuring state-of-the-art body armor systems designed to withstand high-caliber ballistic threats and explosive fragments.

These systems are being upgraded to feature ceramic-composite plates, titanium reinforcements, and modular configurations that enhance protection without sacrificing maneuverability. As geopolitical tensions and unconventional warfare threats continue to rise globally, national defense forces are prioritizing the large-scale deployment of these protective solutions to safeguard personnel in both battlefield and peacekeeping scenarios.

Although the law enforcement officer and civilian segments are growing, driven by urban crime, terrorism concerns, and rising public demand for personal safety, their market share remains lower compared to the defense sector. The defense & security personnel segment underlines its pivotal role in shaping the body armor industry, backed by government-funded procurement and long-term defense strategies.

The USA body armor market is likely to grow at a CAGR of 6.8%. Several structural drivers sustain this growth. Firstly, the USA Department of Defense continues to expand investments in lightweight, high-performance soldier protection gear under programs like the Next Generation Personal Protection Equipment (NGPPE) initiative. Secondly, local law enforcement agencies benefit from federal funding under the Ballistic Vest Partnership Program, fueling routine replacement and upgrades of tactical gear.

Moreover, rising civilian uptake of body armor, primarily driven by school shootings, civil unrest, and preparedness culture, has expanded the market scope. Civilians are increasingly purchasing NIJ-certified soft armor vests and bulletproof backpacks via online channels.

USA manufacturers, such as Safariland, Point Blank Enterprises, and Armor Express, dominate the domestic supply chain, supported by NIJ testing standards and in-country ballistic testing laboratories. Challenges persist around balancing comfort, mobility, and multi-threat protection, alongside managing the impact of material cost fluctuations. Regulatory clarity and consistent federal funding position the USA as the cornerstone of body armor innovation globally.

Canada’s body armor market is likely to grow at a CAGR of 6.3%. The Canadian Armed Forces and Royal Canadian Mounted Police (RCMP) continue to drive structured demand, focusing on modernization, lightweight protection, and multi-threat resistance. Federal procurement is often consolidated under the Public Services and Procurement Canada (PSPC), which ensures NIJ and NATO-standard compliance in tactical and ballistic armor acquisitions. Recent commitments under the Strong, Secure, Engaged (SSE) defense policy have further accelerated replacement cycles for frontline gear and armor systems.

In the civilian segment, rising personal safety concerns, particularly in urban centers, have led to an uptick in discreet body armor purchases. Legal access to soft body armor remains permitted in most provinces, fueling demand among private security contractors and risk-averse professionals such as journalists and wilderness guides.

E-commerce has become a growing channel, offering easy access to compliant armor products with transparent ratings and testing data. Domestic innovation is modest but growing, with local firms like Pacific Safety Products and PRE Labs gaining traction. The Canadian market also faces supply chain sensitivity to USA export controls, making local production increasingly strategic.

Brazil’s body armor market is likely to grow at a CAGR of 6.7%. High crime rates in urban areas, persistent gang violence, and regular deployments of military police units drive consistent demand for body armor across law enforcement agencies. The country’s PolíciaMilitar and Polícia Civil are among the largest institutional buyers of soft armor, tactical vests, and ballistic helmets. Local manufacturing has been prioritized under national procurement guidelines, with domestic producers like Glágio do Brasil and CBC Defense Technologies fulfilling a significant share of state contracts.

Civilian demand is also on the rise in Brazil, particularly among security professionals, personnel operating armored vehicles, and residents in high-risk areas. The regulatory framework allows possession of body armor with authorization, contributing to a burgeoning consumer market for stab-resistant and Level IIIA-rated vests. In parallel, public-private collaboration initiatives for officer safety and municipal policing reforms are expanding the market’s reach.

However, budget constraints and procurement delays at the state level occasionally hamper modernization programs. Brazil’s domestic supply chain, although established, faces challenges related to certification consistency and raw material imports, which can limit scalability and product innovation cycles.

Mexico’s armor market is set to expand at a CAGR of 6.8%. The nation’s ongoing struggle with organized crime and cartel-related violence makes ballistic protection essential for both federal and state-level law enforcement. Entities such as the Guardia Nacional and Policía Federal are key institutional buyers, regularly updating their armor inventories to match evolving threat environments. Additionally, Mexico’s Secretariat of National Defense (SEDENA) invests significantly in armor for military patrols deployed in high-risk zones across border regions and urban centers.

Civilian demand for body armor in Mexico is comparatively high among private security operators, armored transport professionals, and high-profile individuals in law, politics, and business. Legal frameworks allow limited civilian ownership under special permits, which has given rise to a niche market for concealable and lightweight armor solutions. Domestic production is led by firms like MARS Armor and Grupo Atenea, although a sizable share of advanced composites and ceramic inserts is still imported.

The government’s public security modernization plan aims to increase local sourcing while improving transparency in procurement. Despite this, concerns around product standardization and corruption in defense supply contracts remain operational challenges.

Germany’s body armor market is expected to grow at a CAGR of 6.4%. The German Bundeswehr continues to update its personal protection systems under the "Infanterist der Zukunft" (Future Soldier) program, which incorporates lightweight ballistic vests, modular carriers, and trauma-reducing inserts. The Bundespolizei (Federal Police) and state-level law enforcement agencies have also accelerated the procurement of advanced body armor, particularly in response to terrorism threats and evolving civil security challenges in urban areas.

Germany enforces strict product certification through the VPAM and STANAG standards, ensuring a high-quality benchmark for protective gear across both military and law enforcement applications. The domestic market is served by leading players such as MehlerVario System and BSST GmbH, who supply integrated solutions including ballistic shields, helmets, and tactical vests. Civilian usage remains limited and tightly regulated, primarily restricted to licensed security personnel.

However, Germany is also emerging as a key R&D and export hub for next-gen armor systems across Europe, benefiting from a mature defense industrial base and strong EU alignment on security technologies. Public trust in institutional policing further reinforces stable demand for protective solutions.

The United Kingdom’s body armor market is likely to grow at a CAGR of 6.2%. The Ministry of Defence (MoD) remains the principal driver of demand, procuring advanced body armour under initiatives such as the Personal Clothing System and the Virtus Soldier System.

These programs prioritize modular and ergonomic protection, featuring scalable armor plates and quick-release mechanisms for improved mobility. In tandem, local police forces, particularly the Metropolitan Police and regional tactical units, have increased adoption of lightweight ballistic vests and covert stab-resistant body armor in response to knife crime and terrorism threats.

British manufacturers such as BAE Systems, Cooneen Defence, and NP Aerospace supply a wide range of armor solutions, from soft armor to composite plates and bomb suits. Rigorous compliance with HOSDB (Home Office Scientific Development Branch) and CAST standards ensures consistency and quality across applications.

While civilian use of body armor is not prohibited in the UK, it is regulated by the usage context and is often limited to licensed professionals, such as security contractors, doormen, and journalists. The UK market also faces budgetary scrutiny post-Brexit, but sustained investments in force protection and counterterrorism continue to uphold demand.

India’s body armor market is expected to grow at a CAGR of 7.0%. The market is heavily driven by the needs of the Indian Armed Forces, Central Armed Police Forces (CAPFs), and state police units that operate in conflict-prone zones such as Jammu & Kashmir and Naxalite-affected regions. The Ministry of Defence has prioritized the indigenization of soldier protection systems under the "Make in India" and "Atmanirbhar Bharat" initiatives, significantly boosting domestic production of ballistic vests and helmets.

Leading Indian defense manufacturers, such as MKU Limited and Tata Advanced Systems, are increasingly focusing on lightweight, NIJ and BIS-compliant armor solutions for military and law enforcement use. Procurement policies now favor local firms, with recent contracts aimed at replacing outdated body armor stockpiles across battalions.

On the civilian front, demand is rising modestly among security personnel and high-net-worth individuals in metropolitan cities, although access remains tightly regulated under Indian arms and security laws. A key challenge in India remains the timely execution of procurement and maintaining standardization across a vast and decentralized public security apparatus. However, innovation in nanomaterials and aramid fiber processing is gaining momentum in R&D hubs.

China’s body armor market is set to grow at a CAGR of 6.8%. As part of its military modernization strategy, the People’s Liberation Army (PLA) is undergoing large-scale upgrades in personal protective equipment, particularly for frontline infantry units. The government’s “Made in China 2025” initiative actively promotes domestic development of advanced defense technologies, including ballistic-resistant composites and modular armor systems. Key defense contractors such as China South Industries Group and Xinxing Cathay are primary suppliers of armor for the PLA and paramilitary police forces.

In addition to military demand, China’s internal security forces, including the People’s Armed Police and municipal SWAT units, routinely procure body armor for riot control, anti-terrorism drills, and border patrol operations. While civilian usage is restricted by stringent regulations, certified body armor is increasingly deployed by security personnel in banking, logistics, and VIP protection.

China’s R&D ecosystem, supported by academic-military collaboration, is rapidly innovating in ultra-light ceramic plate technology and nanofiber-based soft armor. However, concerns remain around product transparency and the consistency of testing standards, particularly for export markets. State-backed procurement pipelines and controlled pricing enable China to be a major volume player globally.

Japan’s body armor market is likely to grow at a CAGR of 6.5%. Demand is primarily driven by the Japan Self-Defense Forces (JSDF) and the National Police Agency (NPA), both of which have prioritized modern, lightweight protective equipment in response to evolving threat scenarios, including regional tensions and domestic terrorism preparedness. Japan maintains strict procurement standards and relies heavily on advanced materials, such as aramid fibers and ceramic composites, to strike a balance between protection and comfort.

Domestic manufacturers like Toyobo and Komatsu are key suppliers of ballistic materials and modular armor components for use in tactical vests, helmets, and ballistic plates. Japan’s emphasis on quality control and rigorous ballistic testing ensures high reliability across both military and law enforcement deployments.

Civilian access to body armor is highly restricted, limited only to authorized professionals in high-risk occupations. However, technological innovation remains a national strength. Japan is investing in next-generation armor systems that incorporate pressure-sensitive fabrics and wearable electronics for real-time monitoring. Although the market is smaller than that of other regional players, Japan’s high defense spending per capita and technological leadership sustain consistent growth.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.8 billion |

| Projected Market Size (2035) | USD 5 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion |

| By Product Type | Soft Armor, Hard Armor, Accessories |

| By Application | Defence & Security Personnel, Law Enforcement Officers, Civilians |

| By Material Type | Aramid, Ultra-High-Molecular-Weight Polyethylene (UHMWPE), Steel, Ceramic, Composite, Others |

| By Sales Channel | Institutional Procurement, Direct-to-Consumer (DTC), Tactical Retailers |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, China, India, Japan, Brazil, Mexico, Australia |

| Key Players | Armor Express, Safariland, Point Blank Enterprises, LUPU, Heckler & Koch Defense, BAE Systems, Ceradyne, DuPont de Nemours, Inc., Honeywell International Inc., USA Armor Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by company, region-wise and country-wise performance metrics |

In terms of product type, the industry is divided into soft, hard, and accessories.

The industry is further divided by applications that are defence & security personnel, law enforcement officers, and civilians.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The body armor industry is expected to reach USD 2.8 billion in 2025.

The industry is anticipated to grow to USD 5 billion by 2035.

The industry is projected to grow at a CAGR of 6.2% from 2025 to 2035.

Primary users include defence and security personnel, law enforcement officers, and select civilian groups such as private security professionals.

Leading companies include Armor Express, Safariland, Point Blank Enterprises, LUPU, Heckler & Koch Defense, BAE Systems, Ceradyne, DuPont de Nemours, Inc., Honeywell International Inc., and USA Armor Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Level, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Level, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Level, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Level, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Level, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Level, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Level, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Level, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Level, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Level, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Level, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Level, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Level, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Level, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Level, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Level, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Level, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Level, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Level, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Level, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Level, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Level, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Level, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Level, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Level, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Level, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Level, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Level, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Level, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Level, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Level, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Level, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Level, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Level, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Level, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Level, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Level, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Level, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Level, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Level, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Level, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Level, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Level, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Level, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Level, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Level, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Level, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Level, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Level, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Level, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Level, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Level, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Level, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Level, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Level, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Level, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Level, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Level, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Level, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Level, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Level, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Level, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Level, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Level, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Body Armor Plates Market Size and Share Forecast Outlook 2025 to 2035

Body Composition Monitor and Scale Market Size and Share Forecast Outlook 2025 to 2035

Body Tape Market Size and Share Forecast Outlook 2025 to 2035

Body Blurring Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Body Contouring Market Size and Share Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Body-Worn Temperature Sensors Market Analysis by Type, Application, and Region through 2025 to 2035

Body Fat Measurement Market Analysis - Trends, Growth & Forecast 2025 to 2035

Body Slimming Devices Market Analysis by Product, End-User and Region through 2035

Leading Providers & Market Share in Body Augmentation Fillers

Body Firming Creams Market Growth & Forecast 2025-2035

Body Scrub Market Growth & Forecast 2025 to 2035

Body Luminizer Market Trends & Forecast 2025 to 2035

Body Dryer Market

Body In White Market

Antibody Market Size and Share Forecast Outlook 2025 to 2035

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Antibody Therapy Market Insights - Growth, Demand & Forecast 2025 to 2035

Antibody Profiling Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Antibody-mediated Rejection Prevention Market Overview - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA