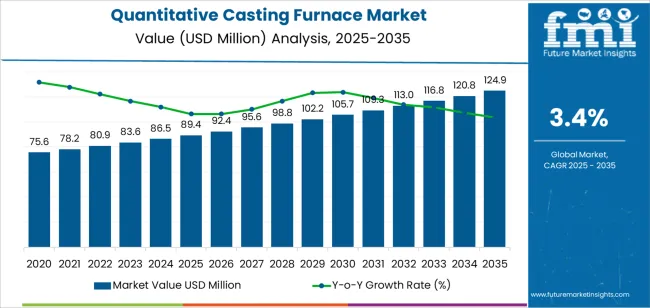

The quantitative casting furnace market is entering a sustained growth phase between 2025 and 2035, marked by a steady transition toward automation, precision dosing, and enhanced process control in metal casting operations. With its market value expected to grow from USD 89.4 million in 2025 to USD 124.9 million by 2035, the industry is set to expand by nearly 40% over the forecast period. This growth trajectory is supported by increased demand from automotive, aerospace, and heavy machinery manufacturing sectors, which are emphasizing precision in molten metal handling, reduced wastage, and consistent output quality.

Between 2025 and 2030, the quantitative casting furnace market is projected to reach USD 102.2 million, representing an addition of USD 12.8 million, or about 36% of the total growth anticipated through 2035. This phase is defined by the integration of automated dosing and temperature control systems that enable accurate molten metal delivery, minimize spillage, and ensure uniform casting. The growing emphasis on high-efficiency production in foundries is reshaping the competitive landscape, with automatic and semi-automatic casting furnace models replacing conventional systems. As foundry operators seek improved throughput and process repeatability, manufacturers are focusing on integrating programmable logic controllers (PLCs), digital flow sensors, and closed-loop control mechanisms within casting furnace designs.

The adoption of quantitative casting furnaces is becoming central to modern foundry practices, particularly where precision, consistency, and energy efficiency are critical. The first half of the decade will see the strongest uptake in advanced dosing furnaces designed for aluminum and magnesium alloys, metals that dominate in lightweight automotive and aerospace applications. These systems reduce operator dependency and support real-time control of melt flow, temperature, and pouring rate, which significantly improves casting integrity and reduces defects. The demand from automotive foundries is expected to remain a major driver, as manufacturers continue to invest in automated systems to achieve higher output accuracy in powertrain, wheel, and structural castings.

In addition to automotive, aerospace manufacturing is set to become an important end-user segment, particularly as the industry requires precision alloy components with stringent tolerance levels. Quantitative casting furnaces equipped with adaptive control algorithms and temperature uniformity optimization are being adopted to meet these needs. The machinery manufacturing sector is also contributing to growth through investments in continuous casting systems for heavy industrial parts.

Technological advancements in energy efficiency, melt recovery, and furnace insulation materials are further improving operational economics, making automated dosing furnaces increasingly cost-attractive despite higher initial capital costs. Manufacturers are focusing on product innovation, such as hybrid electric-induction systems that optimize energy use, and predictive maintenance features that extend equipment lifespan. The integration of smart monitoring solutions capable of tracking furnace performance, melt flow, and thermal dynamics in real time is redefining operational standards in foundries worldwide.

The latter half (2030-2035) will witness continued growth from USD 102.2 million to USD 124.9 million, representing an addition of USD 22.7 million or 64% of the decade's expansion. This period will be defined by mass market penetration of intelligent furnace technologies, integration with comprehensive foundry management platforms, and seamless compatibility with existing casting infrastructure. The quantitative casting furnace market trajectory signals fundamental shifts in how foundry operations approach metal dosing and quality management, with participants positioned to benefit from growing demand across multiple operation modes and application segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Equipment sales (automatic, manual systems) | 56% | Capex-led, foundry expansion-driven |

| Installation & commissioning services | 20% | System integration, calibration support | |

| Spare parts & consumables | 14% | Crucibles, heating elements, refractory | |

| Maintenance & technical support | 10% | Preventive maintenance, troubleshooting | |

| Future (3-5 yrs) | Intelligent furnace systems | 50-54% | IoT integration, automated dosing control |

| Digital monitoring & analytics | 16-20% | Real-time temperature tracking, process optimization | |

| Service-as-a-subscription | 12-16% | Performance guarantees, predictive maintenance | |

| Consumables & refractories | 10-14% | Advanced materials, extended lifespan components | |

| Consulting & optimization services | 8-12% | Process engineering, efficiency audits | |

| Data services (casting quality, energy metrics) | 4-7% | Benchmarking for foundry operators |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 89.4 million |

| Market Forecast (2035) | USD 124.9 million |

| Growth Rate | 3.4% CAGR |

| Leading Operation Mode | Automatic Casting Furnaces |

| Primary Application | Automobile Segment |

The quantitative casting furnace market demonstrates strong fundamentals with automatic casting furnaces capturing a dominant share through advanced dosing capabilities and foundry manufacturing optimization. Automobile applications drive primary demand, supported by increasing automotive production and precision casting requirements. Geographic expansion remains concentrated in developed markets with established foundry infrastructure, while emerging economies show accelerating adoption rates driven by local manufacturing initiatives and rising quality standards.

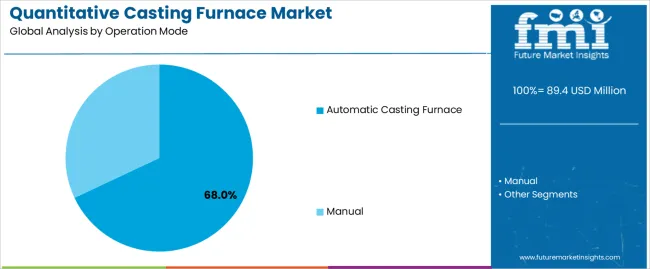

Primary Classification: The market segments by operation mode into manual and automatic casting furnaces, representing the evolution from basic melting equipment to sophisticated dosing systems for comprehensive foundry manufacturing optimization.

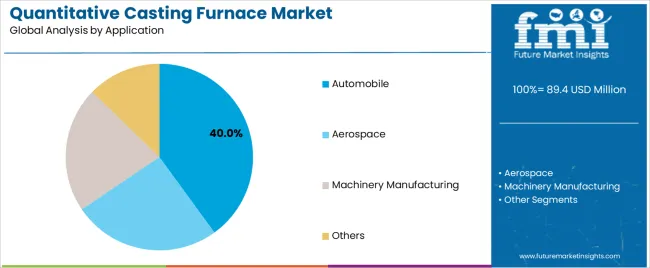

Secondary Classification: Application segmentation divides the quantitative casting furnace market into automobile, aerospace, machinery manufacturing, and other specialized sectors, reflecting distinct requirements for casting precision, production volume, and quality control standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by foundry expansion programs.

The segmentation structure reveals technology progression from standard melting equipment toward sophisticated dosing systems with enhanced automation and precision capabilities, while application diversity spans from automotive foundries to aerospace manufacturing operations requiring precise metal casting solutions.

Market Position: Automatic casting furnaces command the leading position in the quantitative casting furnace market with 68% market share through advanced control features, including superior dosing accuracy, operational consistency, and foundry manufacturing optimization that enable casting facilities to achieve optimal metal delivery across diverse automotive and aerospace environments.

Value Drivers: The segment benefits from foundry operator preference for reliable dosing systems that provide consistent casting performance, reduced labor requirements, and operational efficiency optimization without requiring significant process modifications. Advanced automation features enable precise temperature control, accurate metal dosing, and integration with existing foundry equipment, where dosing accuracy and operational reliability represent critical facility requirements.

Competitive Advantages: Automatic casting furnaces differentiate through proven operational reliability, consistent dosing characteristics, and compatibility with automated foundry systems that enhance facility effectiveness while maintaining optimal quality standards suitable for diverse automotive and aerospace applications.

Key market characteristics:

Manual casting furnaces maintain a 32% market position in the quantitative casting furnace market due to their cost advantages and operational simplicity. These systems appeal to facilities requiring moderate production capacity with lower capital investment for small-scale foundry applications. Market growth is driven by job shop expansion, emphasizing reliable melting solutions and operational flexibility through manual control systems.

Market Context: Automobile applications capture the largest share of the quantitative casting furnace market in 2025, with 40% market share. This is due to the widespread adoption of precision casting systems and increasing focus on automotive manufacturing optimization, component quality efficiency, and production volume applications that maximize output consistency while maintaining casting standards.

Appeal Factors: Automobile foundry operators prioritize dosing consistency, temperature control, and integration with existing production infrastructure that enables coordinated casting operations across multiple component lines. The segment benefits from substantial automotive investment and lightweighting programs that emphasize the acquisition of advanced furnace systems for quality optimization and manufacturing efficiency applications.

Growth Drivers: Automotive production programs incorporate quantitative furnaces as standard equipment for casting operations, while electric vehicle manufacturing increases demand for precision dosing capabilities that comply with quality standards and minimize material waste.

Market Challenges: Varying alloy compositions and complex casting geometries may limit system standardization across different component scenarios or production requirements.

Application dynamics include:

Aerospace applications capture 25% of the quantitative casting furnace market share in 2025 due to specialized casting requirements in aircraft components, engine parts, and structural elements. These operations demand high-precision furnace systems capable of operating with demanding alloy specifications while providing effective temperature control and dosing accuracy capabilities.

Machinery manufacturing applications account for 20% of the quantitative casting furnace market share in 2025, including industrial equipment, heavy machinery components, and specialized parts requiring reliable casting capabilities for operational optimization and production efficiency.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Automotive lightweighting & precision casting demand | ★★★★★ | Vehicle manufacturers require precise metal dosing with consistent quality and minimal waste across production volumes. |

| Driver | Foundry automation & Industry 4.0 adoption | ★★★★★ | Turns automatic furnaces from "optional" to "essential"; suppliers that provide intelligent systems and data integration gain competitive advantage. |

| Driver | Quality standards & traceability requirements | ★★★★☆ | Foundries need validated processes; demand for accurate dosing and digital documentation expanding addressable market. |

| Restraint | High capital investment & equipment costs | ★★★★☆ | Small foundries defer purchases; increases budget sensitivity and slows automatic equipment adoption in price-sensitive markets. |

| Restraint | Technical expertise & operator training requirements | ★★★☆☆ | Foundries face skill gaps and training challenges, limiting rapid adoption and increasing implementation complexity. |

| Trend | IoT integration & smart foundry systems | ★★★★★ | Real-time monitoring, predictive maintenance, and digital connectivity transform operations; intelligence becomes core value proposition. |

| Trend | Energy efficiency & sustainable casting | ★★★★☆ | Advanced insulation and heat recovery systems; environmental compliance and cost optimization drive competition toward efficiency solutions. |

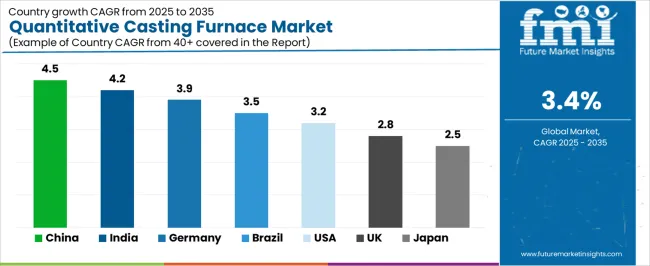

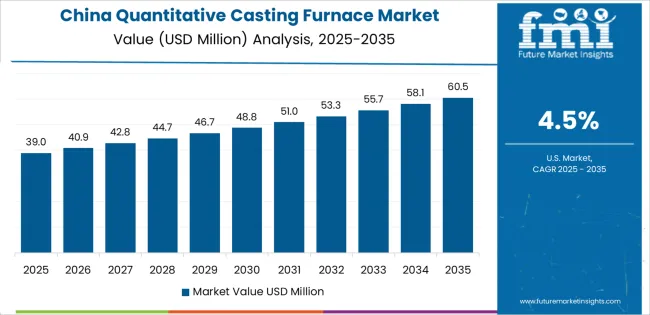

The quantitative casting furnace market demonstrates varied regional dynamics with Growth Leaders including China (4.5% growth rate) and India (4.2% growth rate) driving expansion through automotive manufacturing initiatives and foundry capacity development. Steady Performers encompass United States (3.2% growth rate), Germany (3.9% growth rate), and developed regions, benefiting from established foundry industries and manufacturing modernization adoption. Emerging Markets feature Brazil (3.5% growth rate) and developing regions, where automotive initiatives and manufacturing development support consistent growth patterns.

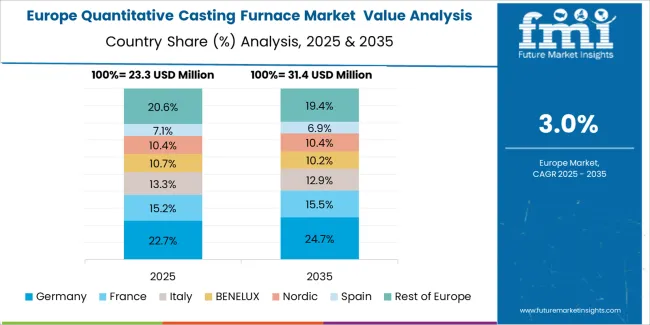

Regional synthesis reveals East Asian markets leading adoption through automotive expansion and foundry development, while North American countries maintain steady expansion supported by manufacturing technology advancement and quality standardization requirements. European markets show moderate growth driven by automotive applications and precision casting trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 4.5% | Lead with cost-effective automation | Localization requirements; domestic competition |

| India | 4.2% | Focus on automotive foundries | Budget constraints; infrastructure gaps |

| Germany | 3.9% | Offer premium precision systems | Over-engineering; conservative adoption |

| Brazil | 3.5% | Value-oriented solutions | Economic volatility; import barriers |

| USA | 3.2% | Provide process optimization | Market maturity; established suppliers |

| UK | 2.8% | Push digital integration | Manufacturing decline; Brexit impacts |

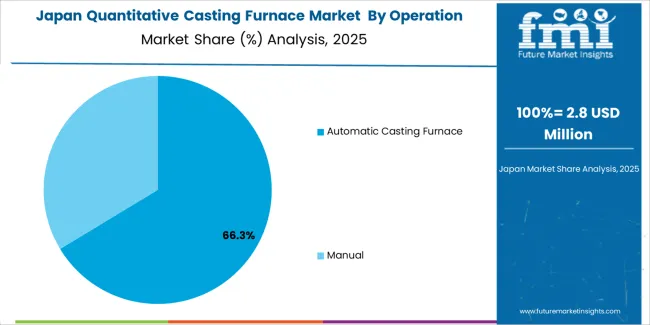

| Japan | 2.5% | Emphasize reliability features | Market maturity; replacement focus |

China establishes fastest market growth through aggressive automotive manufacturing programs and comprehensive foundry capacity development, integrating advanced quantitative casting furnaces as standard equipment in automotive component production and machinery manufacturing installations. The country's 4.5% growth rate reflects government initiatives promoting manufacturing quality and automotive industry development that mandate the use of precision dosing systems in foundry and casting facilities. Growth concentrates in major manufacturing regions, including Guangdong, Zhejiang, and Shandong, where foundry infrastructure showcases integrated furnace systems that appeal to casting operators seeking advanced dosing capabilities and quality control applications.

Chinese manufacturers are developing cost-effective casting furnace solutions that combine domestic production advantages with effective dosing features, including automated control systems and temperature management capabilities. Distribution channels through foundry equipment suppliers and automotive contractors expand market access, while government support for manufacturing quality supports adoption across diverse automotive and machinery segments.

Strategic Market Indicators:

In Gujarat, Maharashtra, and Tamil Nadu, automotive foundries and manufacturing facilities are implementing advanced quantitative casting furnaces as standard equipment for precision dosing optimization and quality control applications, driven by increasing automotive investment and manufacturing capability programs that emphasize the importance of casting accuracy. The quantitative casting furnace market holds a 4.2% growth rate, supported by government manufacturing initiatives and automotive development programs that promote furnace systems for foundry and manufacturing facilities. Indian operators are adopting casting systems that provide consistent dosing performance and quality features, particularly appealing in automotive regions where component quality and production efficiency represent critical operational requirements.

Market expansion benefits from growing automotive manufacturing capabilities and international technology partnerships that enable domestic deployment of casting furnace systems for automotive and machinery applications. Technology adoption follows patterns established in foundry equipment, where reliability and dosing accuracy drive procurement decisions and operational deployment.

Market Intelligence Brief:

United States establishes market leadership through comprehensive automotive programs and advanced foundry infrastructure development, integrating quantitative casting furnaces across automotive and aerospace applications. The country's 3.2% growth rate reflects established foundry industry relationships and mature casting technology adoption that supports widespread use of dosing systems in manufacturing and production facilities. Growth concentrates in major manufacturing centers, including Michigan, Ohio, and Indiana, where foundry technology showcases mature furnace deployment that appeals to operators seeking proven dosing capabilities and quality control applications.

American equipment providers leverage established distribution networks and comprehensive technical capabilities, including installation programs and process optimization support that create customer relationships and operational advantages. The quantitative casting furnace market benefits from mature quality standards and industry requirements that encourage furnace system use while supporting technology advancement and efficiency optimization.

Market Intelligence Brief:

Advanced foundry technology market in Germany demonstrates sophisticated quantitative casting furnace deployment with documented dosing effectiveness in automotive applications and manufacturing facilities through integration with existing quality systems and foundry infrastructure. The country leverages engineering expertise in casting technology and automation systems integration to maintain a 3.9% growth rate. Industrial centers, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, showcase premium installations where casting furnaces integrate with comprehensive foundry platforms and facility management systems to optimize metal dosing and casting effectiveness.

German manufacturers prioritize system precision and quality compliance in furnace equipment development, creating demand for premium systems with advanced features, including automated dosing and process monitoring integration. The quantitative casting furnace market benefits from established foundry technology infrastructure and a willingness to invest in advanced casting technologies that provide long-term operational benefits and compliance with international quality standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse automotive demand, including foundry modernization in São Paulo and Minas Gerais, manufacturing facility upgrades, and government automotive programs that increasingly incorporate casting furnace solutions for quality optimization applications. The country maintains a 3.5% growth rate, driven by rising automotive activity and increasing recognition of precision casting benefits, including waste reduction and quality enhancement.

Market dynamics focus on cost-effective furnace solutions that balance reliable dosing performance with affordability considerations important to Brazilian foundry operators. Growing automotive industrialization creates continued demand for modern casting systems in new facility infrastructure and foundry modernization projects.

Strategic Market Considerations:

United Kingdom's foundry sector shows measured quantitative casting furnace adoption with established automotive supply chains and manufacturing capabilities. The country maintains a 2.8% growth rate through foundry modernization initiatives and efficiency improvement programs. Manufacturing centers in Midlands, Northwest England, and Wales demonstrate furnace deployments that support automotive casting and industrial component requirements.

Market development focuses on efficiency optimization and quality enhancement that incorporate casting furnace technology for waste reduction and process improvement. British foundry operators prioritize operational reliability and technical support in equipment selection decisions.

Market Intelligence Brief:

Japan establishes mature market position through extensive foundry infrastructure and comprehensive automotive manufacturing capabilities, maintaining a 2.5% growth rate driven by equipment replacement cycles and precision optimization programs. The country's well-developed foundry sector supports widespread furnace deployment across automotive and machinery operations.

Market dynamics center on replacement demand and dosing precision optimization rather than capacity expansion, with foundry operators seeking accuracy improvements and efficiency enhancements through advanced casting furnace technology upgrades.

Strategic Market Considerations:

The quantitative casting furnace market in Europe is projected to grow from USD 32.0 million in 2025 to USD 42.6 million by 2035, registering a CAGR of 2.9% over the forecast period. Germany is expected to maintain its leadership position with a 38.4% market share in 2025, supported by its advanced automotive technology infrastructure and major foundry operations.

United Kingdom follows with a 22.6% share in 2025, driven by established automotive supply chains and foundry modernization initiatives. France holds a 16.8% share through specialized automotive applications and precision casting requirements. Italy commands a 12.2% share, while Spain accounts for 10.0% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.6% to 6.2% by 2035, attributed to increasing foundry modernization in Nordic countries and emerging manufacturing facilities implementing precision casting programs.

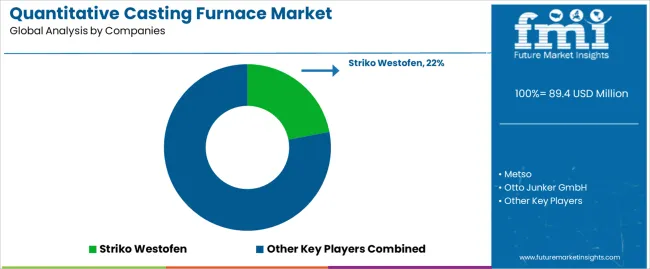

The quantitative casting furnace market exhibits a moderately consolidated structure with 10-14 credible players, where the top 3-5 manufacturers control approximately 58-64% of revenue. Market leadership is maintained through technical expertise, dosing accuracy capabilities, and comprehensive service networks in foundry equipment. Competition centers on temperature control precision, dosing consistency, and automation integration that ensures effective metal casting across diverse foundry applications.

Technology innovation focuses on intelligent temperature management, automated dosing systems, and predictive maintenance capabilities that provide operational reliability. Manufacturers with established automotive foundry relationships and comprehensive technical support create competitive advantages, while turnkey installation capabilities and process optimization services differentiate full-solution providers from equipment-only suppliers.

Commoditization affects standard manual furnaces and basic melting systems, while margin opportunities exist in automated intelligent platforms, process optimization services, and comprehensive maintenance programs. Market participants differentiate through engineering expertise, rapid commissioning capabilities, and proven track records with automotive casting operations.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Technology portfolios, foundry relationships, service networks | Proven reliability, multi-application support, comprehensive solutions | Innovation speed; regional customization |

| Technology innovators | Advanced automation; IoT integration; intelligent controls | Performance leadership; digital capabilities; predictive features | Service scale; global support infrastructure |

| Regional specialists | Local presence, application knowledge, installation teams | Proximity advantages; responsive service; market expertise | Technology breadth; international presence |

| Service-focused ecosystems | Installation services, process optimization, maintenance programs | Comprehensive support; operational expertise; customer relationships | Equipment diversity; technology development |

| Item | Value |

|---|---|

| Quantitative Units | USD 89.4 million |

| Operation Mode | Manual, Automatic |

| Application | Automobile, Aerospace, Machinery Manufacturing, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, and 16+ additional countries |

| Key Companies Profiled | Qinhuangdao Hongtong Machinery Co. Ltd., SINGAPORE TIHO EQUIPMENT PTE. LTD., Shanghai Weizhi Electromechanical Technology Co. Ltd., Striko Westofen, Metso, Otto Junker GmbH, Frech |

| Additional Attributes | Dollar sales by operation mode and application categories, regional adoption trends across East Asia, North America, and Western Europe, competitive landscape with foundry equipment manufacturers and casting technology suppliers, foundry operator preferences for dosing accuracy and temperature control, integration with foundry management platforms and quality monitoring systems, innovations in automation technology and precision enhancement, and development of intelligent furnace solutions with enhanced performance and foundry optimization capabilities. |

The global quantitative casting furnace market is estimated to be valued at USD 89.4 million in 2025.

The market size for the quantitative casting furnace market is projected to reach USD 124.9 million by 2035.

The quantitative casting furnace market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in quantitative casting furnace market are automatic casting furnace and manual.

In terms of application, automobile segment to command 40.0% share in the quantitative casting furnace market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Quantitative Pathology Imaging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

MRI-based Quantitative Biomarkers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Casting Mold Market Size and Share Forecast Outlook 2025 to 2035

Casting Multi-stage Centrifugal Blower Market Size and Share Forecast Outlook 2025 to 2035

Podcasting Market Size and Share Forecast Outlook 2025 to 2035

Die Casting Services Market Analysis - Growth & Forecast 2025 to 2035

Grid Casting Machine Market Size and Share Forecast Outlook 2025 to 2035

Metal Casting Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Investment Casting Market Size and Share Forecast Outlook 2025 to 2035

Automotive Casting Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Weather Forecasting Services Market - Growth & Forecast through 2034

AI Demand Forecasting Software Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Automotive Die-casting Lubricants Market – Size, Share, and Forecast 2025 to 2035

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

Television Broadcasting Services Market Insights – Growth & Forecast 2023-2033

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

North America Iron Casting Market - Growth & Demand 2025 to 2035

Differential Pressure Casting Machine Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA