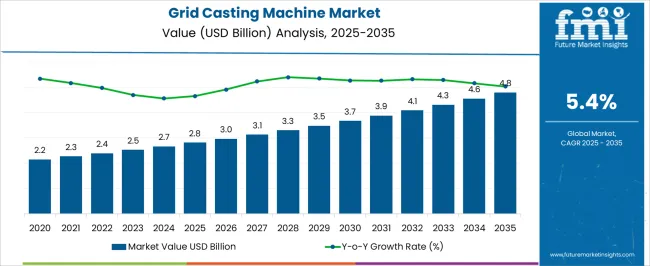

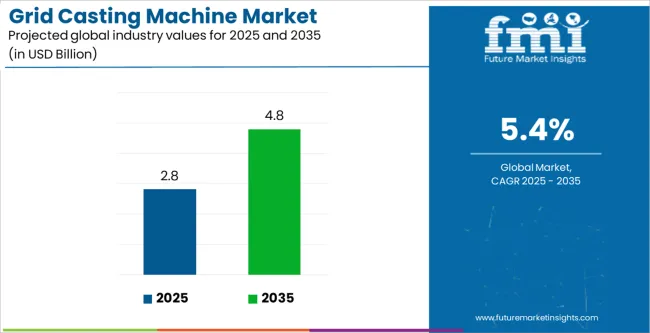

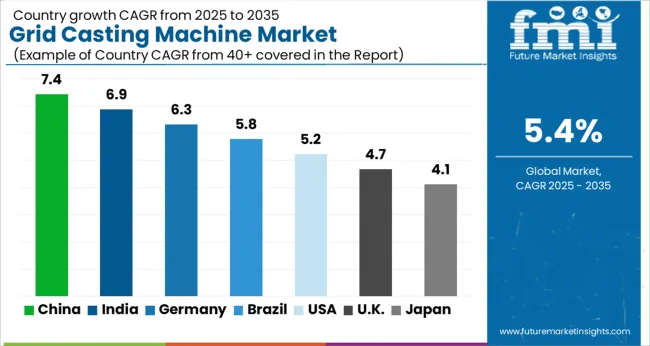

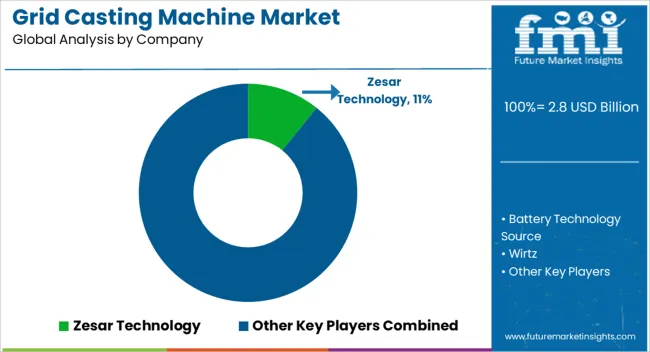

The Grid Casting Machine Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Grid Casting Machine Market Estimated Value in (2025 E) | USD 2.8 billion |

| Grid Casting Machine Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The grid casting machine market is expanding steadily, supported by increasing demand for lead-acid batteries across automotive, industrial, and backup power applications. Industry publications and manufacturing reports have emphasized that improvements in casting technologies are enhancing battery performance, efficiency, and consistency, thereby driving wider adoption of advanced grid casting machinery.

Growth in the automotive industry, particularly the rising need for batteries in conventional and hybrid vehicles, has been a key driver of demand. Furthermore, the ongoing electrification of transport and expansion of renewable energy storage systems have increased production volumes of lead-acid batteries, encouraging battery manufacturers to invest in modern casting equipment.

Continuous innovation in machine automation, energy efficiency, and precision control systems has reduced operational costs and improved output quality, making advanced machines an attractive investment. Future growth is expected to be underpinned by heightened industrialization, infrastructure development in emerging economies, and replacement demand for grid casting machines as manufacturers upgrade to automated and environmentally compliant systems.

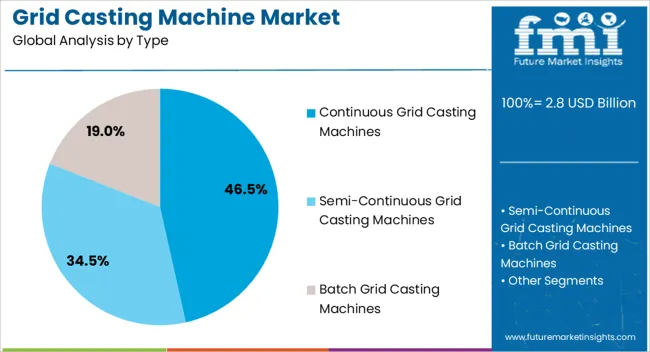

The Continuous Grid Casting Machines segment is projected to account for 46.5% of the grid casting machine market revenue in 2025, securing its place as the leading type segment. This dominance has been driven by the efficiency and consistency offered by continuous processes compared to traditional batch systems.

Manufacturers have increasingly adopted continuous machines to achieve higher throughput, uniform grid quality, and reduced material wastage. Industry sources have highlighted that continuous casting ensures better metallurgical properties, resulting in enhanced durability and conductivity of battery grids.

Additionally, these machines integrate advanced automation and control systems, which improve precision and minimize production errors. Their scalability has also supported large-volume battery production in automotive and industrial applications. With the demand for cost-effective and high-performance lead-acid batteries continuing to rise, the Continuous Grid Casting Machines segment is expected to maintain its growth momentum, reinforced by ongoing technological advancements and the shift toward automated manufacturing lines.

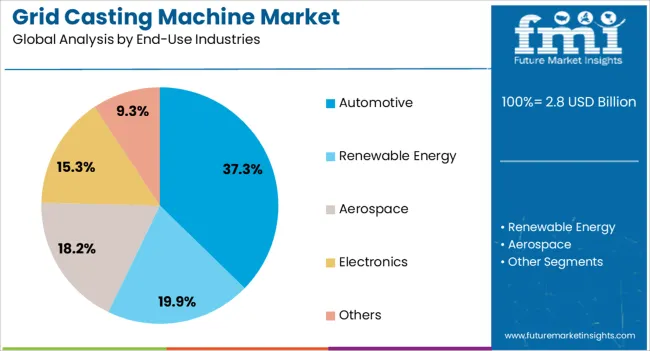

The Automotive segment is projected to hold 37.3% of the grid casting machine market revenue in 2025, establishing itself as the dominant end-use industry. Growth of this segment has been influenced by the high consumption of lead-acid batteries in vehicles for starting, lighting, and ignition functions.

The automotive industry has relied heavily on grid casting machines to ensure consistent quality and performance of battery grids, which are critical for reliable vehicle operation. Rising vehicle production, coupled with increasing adoption of hybrid and electric vehicles that still utilize lead-acid batteries for auxiliary power, has fueled demand for advanced grid casting solutions.

Press releases and investor updates from battery manufacturers have underscored significant capacity expansions to meet automotive sector requirements, further boosting machine adoption. Additionally, regulatory standards emphasizing battery performance, durability, and recycling have reinforced the need for precision grid casting technologies. As global automotive production scales further, particularly in emerging economies, the Automotive segment is expected to remain the key driver of demand in the grid casting machine market.

Electrification of Vehicles and EV Demand Boosts Industry Growth

As more vehicles get electrified, the machines used to make the lead grids for batteries are also in demand. Although electric vehicles mostly use lithium-ion batteries, traditional lead-acid batteries are still needed for some, like hybrids. These lead grids are made using grid casting equipment.

As more cars go electric to reduce pollution, the demand for these lead grids and the machines that make them keeps growing. This shows how the move to electric vehicles impacts the demand for these machines. As more electric vehicles are, sold the industry benefits. Grid casting equipment manufacturers can prosper with this shift.

More Countries Investing in Renewable Energy Fosters Industry Growth

As more countries turn to solar and wind power to fight climate change, they need better ways to store this energy. Lead-acid batteries, made using grid casting equipment, are essential for storing this power. So, as more energy from renewable sources is produced, the demand for these machines grows too. This shows how the move to renewable energy is boosting the industry.

A greater emphasis on a future without fossil fuels is expected. As the focus on renewable energy projects rises, manufacturers can benefit.

| Segment | Continuous Grid Casting Machines (Type) |

|---|---|

| Value Share (2025) | 46.50% |

Continuous grid casting machines are expected to lead in 2025. These machines are considered better than batch ones because they produce faster and without stopping. They ensure that the lead grids made for batteries are of the same quality every time.

These machines can also change how they work easily to make different kinds of grids. They use advanced technology to work automatically and can fit in with other machines easily.

Even though they cost more at first, they end up being cheaper in the long run because they can make more grids without any problems. And if a company wants to make more grids, they can just add on to these machines without much trouble. These traits boost their demand in the industry.

| Segment | Automotive (End-use Industries) |

|---|---|

| Value Share (2025) | 37.30% |

The automotive industry segment is expected to lead in the end-use indsutry category in 2025. More cars are becoming electric, but regular cars with gas engines are still popular. These regular cars use lead-acid batteries. Hybrid vehicles that use both gas and electricity also use these batteries.

Even when vehicles get old and need new batteries, people often choose lead-acid batteries because they're cheaper and work with many different vehicles. Trucks, buses, and heavy machines also use these batteries. All of this means that machines used to make these batteries are in high demand in the automotive industry.

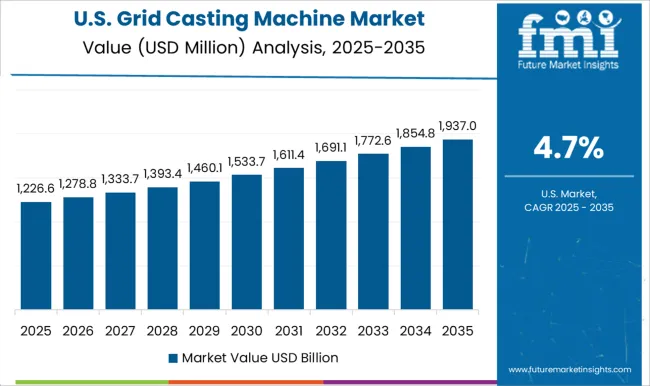

The demand for grid casting machines in the United States is anticipated to amplify at 4.80% CAGR until 2035. Making sure the country has enough energy and is safe from threats is given importance. Batteries made using special machines play a big part in this by providing backup power and helping keep the electricity stable.

The government encourages using cleaner energy with incentives like tax breaks, which boosts the demand for these batteries. Also, as extreme weather becomes more common, there's a need for stronger electricity systems.

This means more batteries are needed, creating opportunities for companies that make these special machines. So, by focusing on clean energy and helping make the electricity system stronger, businesses can do well in the United States industry.

Wirtz Manufacturing Company specializes in battery manufacturing equipment and is located in the United States. The brand focuses on research and development to introduce new technology and strengthen its networks.

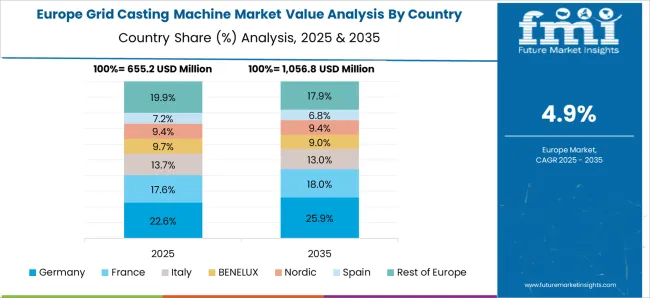

The sales of grid casting machine in Germany is in line to amplify at 5.20% CAGR till 2035. German consumers want more electric cars and cleaner industries, so they need machines that make batteries for these cars and factories. These machines make batteries that help electric cars work better and also support industries by providing backup power.

As more electric cars are used and industries become cleaner, the need for these machines grows. So, German companies that make these machines have a chance to sell more because they can help meet the country's goals for cleaner transportation and industries.

The growth of the grid casting machine market in China is estimated at 4.70% CAGR until 2035. Chinese manufacturers sell a significant number of electric cars, so they need a greater number of machines to make batteries for these cars. These machines are also used to make batteries for other vehicles.

As China's cities get bigger and they need more electricity, there's a bigger demand for batteries and the machines that make them. Chinese companies are working on making these machines better and smarter to keep up with the demand.

Zhongshan Kaixiang Electric Technology Co., Ltd. engages in battery equipment production and is popular in China. The company focuses on product innovation and customization. It invests in talent development and technological advancements for unparalleled growth.

Market trends and drivers for the grid casting machine industry hint expansion at 6.30% CAGR in India till 2035. The government helps companies that make these machines, and India is also starting to use more electric vehicles. This means more demand for batteries and the machines that make them. Overall, it's a good time for companies in India that make grid casting equipment.

Gravita India Limited is a pioneer in lead products and equipment for the battery industry. The company focuses on diversification into new product categories. It focuses on sustainable practices to comply with regulations and consumer preferences.

Grid casting machine market analysis in Australia indicates expansion at 5.80% CAGR until 2035. Like other countries, Australia is using more renewable energy like solar and wind power. This means there's a bigger need for batteries to store this energy. Also, in remote areas and islands of the country, they use batteries for power, and these machines help make them too.

In Australia's mining industry, big machines need batteries to work, and these machines help make these batteries strong. When there are big storms or disasters, Australia needs batteries to keep things running. So, there's notable demand for grid casting equipment in Australia to make batteries for different uses.

The grid casting machine industry is highly competitive, with prominent companies vying for global supremacy. Established businesses such as WIRTZ Manufacturing Company and SoVema Group dominate the industry due to their significant experience and technological knowledge.

To preserve their competitive advantage, they spend on research and development, strategic alliances, and acquisitions. However, smaller specialized firms flourish by providing bespoke solutions at competitive prices. Technological improvements and industry trends fuel competitiveness, whilst regulatory concerns and industry dynamics influence strategic decisions.

Recent Development

The global grid casting machine market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the grid casting machine market is projected to reach USD 4.8 billion by 2035.

The grid casting machine market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in grid casting machine market are continuous grid casting machines, semi-continuous grid casting machines and batch grid casting machines.

In terms of end-use industries, automotive segment to command 37.3% share in the grid casting machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Grid Packings Market Size and Share Forecast Outlook 2025 to 2035

Grid Scale Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Griddles Market

On Grid Residential Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid Solar PV Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

AC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Mini Grid Market Size and Share Forecast Outlook 2025 to 2035

Microgrid Market Size and Share Forecast Outlook 2025 to 2035

BGA Packaging Market Insights – Size, Demand & Growth through 2034

Smart Grid Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Analytics Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Home Area Network (HAN) Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Technology Market Analysis - Growth, Demand & Forecast 2025 to 2035

Power Grid Market Size, Share, Trends & Forecast 2024-2034

Smart Grid Sensors Market

Ground Grid Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA