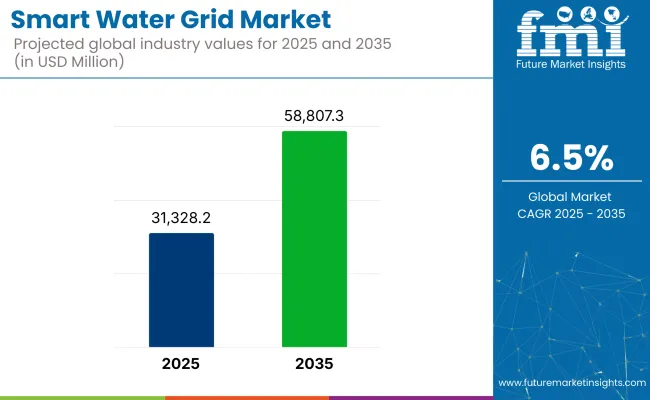

The Smart Water Grid Market is poised for significant growth over the forecast period, driven by increasing global demand for efficient water management, rapid urbanization, and advancements in digital water infrastructure. In 2025, the market is estimated to be valued at USD 31,328.2 million, with projections indicating it will reach USD 58,807.3 million by 2035, growing at a CAGR of 6.5%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 31,328.2 million |

| Industry Value (2035F) | USD 58,807.3 million |

| CAGR (2025 to 2035) | 6.5% |

The adoption of IoT-enabled smart meters, real-time water quality monitoring systems, and advanced leak detection solutions is revolutionizing water distribution networks, enhancing sustainability and reducing operational costs.

Intelligent water distribution solutions are the most demanded due to the water crisis and the need for water conservation. These systems include Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing technologies to optimize water distribution, minimize losses, and increase sustainability. They enable the governments and public utilities to be heavily invested in the digital transformation and proper resource management is performed by real-term monitoring, predictive analytics, and automated leak detection.

In addition, urbanization and climatic changes are the forces that resist to existing water facilities and they require intelligent networks. The smart meter, SCADA, and pressure management application that are newly used together are becoming operationally more efficient. The new directives concerning the sustainability of water use are making the smart water grid business prosper which, in turn, will be able to ensure the best resource use and will be resilient for the water scarcity that might come in the long term.

The smart water grid market is escalating due to the strong need to conserve water and replace the old facilities. In the international arena, governments and utilities are supporting the advancement of digitalization and automation processes, which will subsequently lead to a decrease in water losses and optimal resource allocation. The convergence of Artificial Intelligence (AI), Big Data, and Cloud technology is an extra add-on besides the already existing predictive maintenance and real-time decision-making that is permitting long term resilience.

Demonstrative rules which impose water savings and environmental regulations are the main reasons for the early embracing of the technology. And also, the rise in public-private cooperation, funding for smart city projects, and the like are providing the market entrances to be expanded.

The North American smart water grid market is being driven by the strict water conservation regulations and the significant investments in smart infrastructure. The United States and Canada are regarded as the foremost adopters of IoT-based smart meters, SCADA systems, and real-time leak detection technologies. The Federal initiatives like the Infrastructure Investment and Jobs Act (IIJA) in the USA are the major factors behind the modernity of various infrastructure facilities.

Besides, the rising issues regarding the draining infrastructure and non-revenue water losses are driving the utilities to opt for advanced analytics and AI-led water management solutions. Government and private partnerships and along with ongoing smart city initiatives, keep the progress of the market alive, thus making North America the leading area in the global adoption of the smart water grid.

The smart water grid market in Europe gets its dynamic growth from the strict environmental regulations and ambitious projects for sustainability. The Water Framework Directive of the European Union is pushing the use of smart water solutions, which is driving the investment in smart metering, pressure management, and AI-based predictive analytics. Top in the front for adoption are Germany, France, and the UK, which integrate smart water grids to make them part of the wider smart city initiatives.

Modern-day worries, droughts, and coupled with water scarcity, have made decision-makers accelerate the process of infrastructure modernization. The development of public-private partnerships and water management projects funding is projected to spur the growth of the regional market within a decade.

The Asia-Pacific region, including the smart water grid market, is gaining the fastest amount of expansion because of the modernization of cities, a growing population, and a greater amount of water scarcity. The states of China, India, and Japan are to pour in money for smart metering, AI and machine learning for the better utilization of the water resources.

The smart city projects of the region are being equipped with the most advanced water management systems to counteract with the limitation of resources. As a result of governmental programs such as China's Sponge City project, and India's AMRUT (Atal Mission for Rejuvenation and Urban Transformation), the overall adoption will reach a new level. Furthermore, the rise of industrial demand and the speeding up of the infrastructural changes are additional reasons for the expansion.

The rest of the world (RoW) market is experiencing the adoption of smart water grid solutions at a comparatively low speed, despite the recent urbanization and the rise of water resource management issues. In Latin America, countries such as Brazil and Mexico are putting money into smart metering and leak detection systems as a solution to tackle a high percentage of water losses.

The Middle East, which is in the process of looking for places with high population and low water availability, is taking advantages from the opportunities through AI and other technologies such. While, Africa will see the implementation of smart water grids via the humanitarian interventions and the sustainability projects that are led by governments, in turn, these actions will improve the water accessibility in the drought and infrastructure deficit areas.

Challenges

High Initial Investment Costs

The implementation of smart water grids requires substantial initial investments in IoT-enabled infrastructure, smart metering systems, data analytics platforms, and SCADA networks. Many municipal utilities, particularly in developing regions, face budget constraints that hinder large-scale adoption.

Additionally, upgrading legacy water distribution systems to integrate with modern digital solutions can be complex and costly. Although long-term cost savings from leak prevention, operational efficiency, and reduced non-revenue water losses are significant, the high upfront expenditure remains a major challenge. Governments and private stakeholders must collaborate to develop funding models and incentives to accelerate smart water grid adoption.

Cybersecurity Risks and Data Privacy Concerns

Smart water grids rely on IoT networks, cloud computing, and real-time data analytics, making them vulnerable to cybersecurity threats and data breaches. Unauthorized access or hacking of critical water infrastructure can lead to service disruptions, water contamination risks, and operational failures. Moreover, personal data collected from smart meters raises concerns over data privacy and regulatory compliance.

Many utilities lack the cybersecurity expertise and resources to effectively mitigate risks. Ensuring robust encryption, multi-layered security frameworks, and compliance with international cybersecurity standards is crucial to safeguarding smart water grid systems and maintaining public trust in digital water management solutions.

Opportunities

Advancements in AI and Predictive Analytics

The integration of Artificial Intelligence (AI) and predictive analytics is transforming smart water grids by enabling real-time monitoring, automated leak detection, and predictive maintenance. AI-powered algorithms can analyse vast amounts of data from IoT sensors, smart meters, and SCADA systems to optimize water distribution, detect anomalies, and reduce water losses.

Utilities can leverage machine learning models to forecast demand, prevent pipeline failures, and enhance operational efficiency. As AI technology continues to evolve, its role in automating decision-making and improving water conservation strategies presents a major growth opportunity for the smart water grid market over the next decade.

Expansion of Smart Cities and Government Initiatives

The rapid development of smart cities worldwide is fuelling the demand for intelligent water management solutions. Governments are prioritizing water conservation, sustainability, and digital transformation by integrating smart water grids into urban infrastructure projects.

Initiatives such as China’s Sponge City program, India’s AMRUT mission, and the EU’s Green Deal are driving large-scale adoption of IoT-enabled water monitoring systems. Additionally, financial incentives, public-private partnerships, and infrastructure modernization programs are creating new opportunities for market players. As cities grow and climate change intensifies water challenges, investments in smart water grid technology will continue to expand globally.

The Smart Water Grid sector has been on the path of serious transformation that lasted from the year two thousand twenty to the year two thousand twenty-four and was mainly the result of the problems arising from the ever more urgent need for water conservation and the environmental effect of the water crisis, as well as the necessity of the systems to be managed more efficiently.

Governments from different parts of the world have established interoperability frameworks for the improvement of water distribution and the sensors along with the process like of the data comprising digital twins have changed the industry. It is expected that the trading platforms from 2025 to 2035 will further engage with artificial intelligence, IoT and cloud technologies aside from smart water systems which will contribute to improved sustainability and the efficiency of the firms.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments imposed conservation measures on water resources and infrastructure repairs. |

| Technological Advancements | IoT-enabled water meters, AI-support leak detection, and cloud analytics for real-time monitoring. |

| Industry-Specific Demand | Utilities, municipalities, and industrial sectors had been putting resources in these solutions to lessen water loss. |

| Sustainability & Circular Economy | Candidate deployment of water reuse and recycling practices to maximize water resource management. |

| Production & Supply Chain | Reliance on conventional water designs with gradual smart improvements. |

| Market Growth Drivers | The main cause of this phenomenon was the growing feeling of a lack of water, but there were also government compensations and digital transitions in utilities. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter mandates on water usage efficiency, sustainability standards, and emission reductions. |

| Technological Advancements | AI-fostered predictive analytics, blockchain for water trading, and general implementation of decentralized water treatment solutions. |

| Industry-Specific Demand | Demand for smart city projects, agricultural sections, and private water companies seeking to increase efficiency were the main sectors responsible. |

| Sustainability & Circular Economy | High-tech wastewater treatment, AI-driven water-performance programs, and closed-loop water systems for industrial reuse. |

| Production & Supply Chain | Transition to entirely autonomous and AI-controlled water distribution systems leading to less waste. |

| Market Growth Drivers | Smart city projects' growth, AI, and block chain improvements, and the global focus on climate resilience are the key factors related to this. |

The USA market is predicted to have technical improvement owing to federal aid protocols like the Bipartisan Infrastructure Law, which dedicates a large amount of money for renewing the water utilities. The principal issues are the fear of old water infrastructure, and the answer arrival of IoT, AI, and real-time water quality monitoring systems are critical.

Utility firms have started utilizing the smart sensor and AMI metering schemes to conserve water and at the same time reduce the water loss. Utility penetration will be broadened through the urgent demand from both the municipal and industrial sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

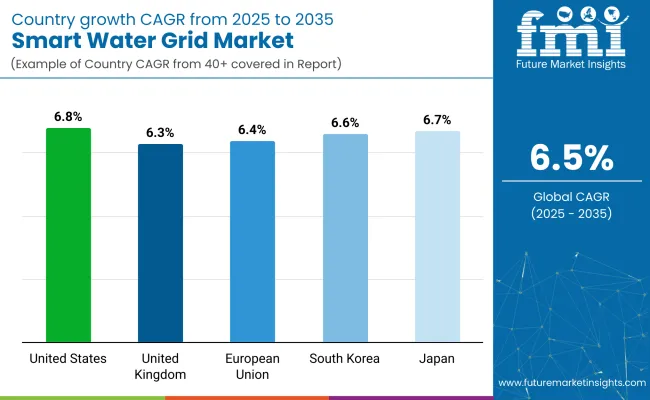

| United States | 6.8% |

The UK is advancing mainly by the voluntary Ofwat regulations, stimulating water firms to cut-down leakage and boost efficiency. The continuous technological invention of real-time monitoring solutions, smart meters, and digital twin technology is now covering a figurative distance.

Digital transformation for net-zero greenhouse gas emissions is an endeavor of the government of the UK, which is bringing along water grid digitalization to the advance. Besides, the UK is involved in the ventures in AI-driven maintenance tools and water management in the cloud.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

Market growth in the EU is largely owing to the implementation of strict regulations on water savings, including the EU Water Framework Directive. Countries like Germany, France, and Italy together with automated leak detection, real-time water quality monitoring and smart metering solutions are also pushing for new green water technologies.

The public-private partnerships (PPP) rise in the water infrastructure project sector is a major driving force. Innovations in the IoT-enables water distribution network and AI-based analytics are gaining traction in all sectors.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.4% |

Japan is tapping into state-of-the-art IoT and AI to modernize the smart water grid. The automation of the meter infrastructure (AMI) is also launched as a part of the government's plan to build a disaster-resilient water network amid earthquakes and typhoons. The leakage detection of the water utilities is based on machine learning and includes a water management system with the remote IQ measure. The 5G-based water monitoring networks integra are some of the initiatives that promote the Society 5.0 Concept.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.7% |

The country of South Korea sees the rise of the smart water industry with the use of the Korean New Deal which strongly emphasizes digital transformation of water management. Investing in the 5G-based smart water grids and AI-powered leak detection AI is one of the country’s aims.

The project along with many others is sponsored by the government, Smart water management (SWM) will also be part of the agenda. Furthermore, the resulting industrial growth of diagnostic and electronic parts within these sectors is the leading demand factor.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

Smart Infrastructure Leads the Market with Growing Adoption of IoT and Sensor Networks

Smart infrastructure, which is the logical connection of the water grid market, provides IoT devices, sensors, and the advanced metering infrastructure (AMI) to uplift the water distribution efficiency. The utilization of these devices by the authorities is constantly being on the rise due to their ability to monitor the water quality, detect leaks, and reduce non-revenue water (NRW) losses.

The government schemes for sustainable water management, specifically, in the urban tropics, are other stimulating factors for the promotion of such initiatives. North America and Europe take the top positions in the implementation of smart infrastructure anchored by water conservation necessities more rigorous. Emerging economies in Asia-Pacific are also the scene of rapid growth with more and more intelligent city projects that include water management solutions going digital.

Control & Automation Gains Traction with Rising Demand for Remote Monitoring

Control & automation technologies, especially SCADA, and automated valves, have huge potential for water grid optimization. These systems allow remote monitoring and decision-making in real-time, thus not only cutting expenses but also increasing efficiency. The rising shortage of water and the increasing demand for digital transformation are the two forces driving the deployment of these automated systems in utilities.

The Middle East and Africa have reported the highest growth due to the need for water conservation, whereas Europe and North America head the pack with AI-driven automation used to improve grid resilience and efficiency. According to the future predictions, the main focus will go to the power of AI through the predicted maintenance of the water networks.

Utility Sector Dominates Due to Increasing Focus on Smart Water Management

The utility sector takes the lead scenario in the smart water grids market, as globally water utilities resort to digital infusion to optimize their operations and cut losses. The implementation of advanced metering systems, data aggregation by means of artificial intelligence (AI) and the availability of dashboards with real-time information form the basis on which utilities model the future of water distribution and make it more sustainable.

Higher population density and water conservation policies are making regions like North America and Europe play a significant role in the market growth. Also, the developing countries in Asia-Pacific, one way or the other, are joining the movement by adopters of smart water grids that combat the challenge of old infrastructure through automatic leak detection and demand-responsive supply systems.

Commercial Segment Expands with Growing Demand for Efficient Water Usage

The commercial bulwark inclusive of industries, hotels, and office buildings is scrapbooking indisputable growth in cerebrating grid adoption. The companies give serious attention to investments in equipment including smart meters, automatic irrigation, and water recycling systems which consequently help them achieve adroit operational efficiency and fulfill the requirements of sustainability laws.

The manufacturing and hospitality industries are the ones at the forefront of this movement, using data as a driving factor to monitor water use and be more efficient. The demand from the Asia-Pacific and North America is fueled by corporates' sustainability drives and their commitment to corporate responsibility. The future is bright for the AI-based water analytics that will populate optimization of consumption patterns and recognize inefficiencies in commercial water networks due to its major rise.

The Smart Water Grid Market is at an incredible moment, the greatest part of which is the expansion that is taking place due to such factors as the increasing water shortage, living in urban areas, and the need for line-saving infrastructure. Smart water grids are built on the Internet of Things, artificial intelligence, and data analytics to enhance water distribution, minimize leaks, and realize environmental benefits.

The increasing utilization of smart meters, remotely operated overseers, and prediction analytics mainly the construction field where with the help of these machine tools the processes associated with constructions are more efficient and cheaper are reshaping the water field. Municipal, state, and federal governments as well as the legislative bodies around the world are carrying out policies strictly prohibiting water wastage which in turn leads to the increase in investments in smart infrastructure.

The diversification of the product portfolio is also highly influenced by the increased focus on sustainability, the issue with water and companies are stepping up their investments in energy-efficient and environmentally friendly water management innovations.

Moreover, the need for real-time monitoring and automatic control systems is pressing due to the rapid urbanization and the concomitant growth of industry, which spiral out further growth of the market. Global leaders and regional contributors emphasize technological development, lawfulness, and cost-effective production to consolidate their positions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Xylem Inc. | 12-16% |

| Itron Inc. | 10-14% |

| Siemens AG | 8-12% |

| Schneider Electric | 7-10% |

| Badger Meter Inc. | 5-8% |

| Other Companies | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Xylem Inc. | Offers AI-driven smart meters, leak detection, and real-time monitoring, enabling efficient water management and conservation while reducing non-revenue water losses through predictive analytics and automation. |

| Itron Inc. | Provides advanced metering infrastructure (AMI) with IoT-enabled water management, allowing utilities to track water usage, detect leaks, and optimize distribution networks for improved efficiency and sustainability. |

| Siemens AG | Develops SCADA systems, water quality monitoring tools, and smart network optimization solutions, ensuring data-driven decision-making and automation in municipal water supply and industrial water management. |

| Schneider Electric | Specializes in IoT-based water management, AI-driven predictive maintenance, and energy-efficient automation systems that enhance water utility operations, sustainability, and smart grid integration for optimized performance. |

| Badger Meter Inc. | Focuses on smart flow measurement, cloud-based analytics, and real-time monitoring solutions to help utilities manage water usage, reduce waste, and improve operational efficiency with precision metering technology. |

Key Company Insights

Xylem Inc.

Xylem Inc. is a smart water grid most notable producer; the firm is busy innovating with solutions for water disbursement. The product is a combination of AI-conducted analytics and via-Internet of Things prearranged surplus water estimation. Xylem’s smart meters and leak detection systems reduce non-revenue water losses and optimize utility operations.

The company has fortified its business across North America, Europe, and APAC through the strategies of purchasing and partnering. Xylem under really invests in sustainability by making sure its products are aligned with the global target of water conservation. The digital utility infrastructure improvements that it has made gives Xylem a very prominent role in the fast-growing sector of intelligent water technology.

Itron Inc.

Itron Inc. is a business well-known in the industry for metering infrastructure (AMI) alongside real-time water monitoring, and they provide IoT state-of-the-art technologies to water utilities. The services of Itron's smart water management systems allow sending consumption data, warning about leaks, and optimizing distribution efficiency. The company Itron holds a partnership with utility companies globally, thereby transforming water management into a digital environment.

The business is in the sustainability sector with the development of environmentally friendly solutions to deal with the issue of water scarcity. Investments that Itron poured into AI-fueled analytics and automation structure farther into the market its stronghold. The regional partnerships Itron has along with others makes it possible to reach even further and ameliorate the technological aspects of the water networks.

Siemens AG

Siemens AG has particular automation and SCADA solutions for municipal water systems and industrial water management. With the integration of these technologies, smart water network optimization, water quality monitoring, and data-driven decision-making are achieved. Aside from the strong global presence, the collaboration of the company who deals with the government and utility providers are on the smart city projects.

The firm is heavily vested in projects developing AI-based water quality monitoring and also machinery to find pipeline leaks. Along with the IoT automation, which is embedded inside the utility's processes, the company becomes a helping hand to the companies in terms of the situation where they may in the end save money and promote the health of the environment. In the way of digital transformation, and the promotion of infrastructure innovation, Siemens is ceaseless, fully embroiled in this process and as such assures to be a key player in the very changing smart water grid domain.

Schneider Electric

Schneider Electric has become a reference in energy-efficient automation and smart water management solutions. The company works on IoT-enabled water utility operations, AI-driven predictive maintenance, and cloud-based water monitoring platforms among others.

Schneider Electric ensures that the digital solutions they apply both enhance sustainability besides decreasing non-revenue water losses. The company is actively involved with the organization of municipal utilities in improving water distribution facilitating the process of smart grid operation. In addition to focusing on the restrictions and conserving the environment, Schneider Electric is expanding its digital watering solutions portfolio. The firm is a technological innovator.

Badger Meter Inc.

Badger Meter Inc. is famous for its precise flow measurement capabilities but it is also active in solving smart water problems. The company combines cloud-based analytics and proximity IoT sensing to achieve the best water usage efficiency. The fact that this solution gives utilities real-time data about the consumption, storage, and distribution trends facilitate utilities in finding devices which waste or are losing water to the environment and thus help them to be more efficient.

Badger Meter is significant in the municipal water sector, primarily by focusing on high-performance metering technology. The company's principles such as digital transformation and sustainability are the cornerstones of its smart water grid marketed presence. With the latest addition of IoT-based remote monitoring, the company Badger Meter always keeps up as a dependable provider of advanced water management solutions.

In terms of Technology, the industry is divided into Smart Infrastructure, Control & Automation, ICT & Analytical Software, Design & Engineering

In terms of Application, the industry is divided into Residential, Commercial, Utility

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Smart Water Grid market is projected to reach USD 31,328.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.5% over the forecast period.

By 2035, the Smart Water Grid market is expected to reach USD 58,807.3 million.

The Smart Infrastructure segment is expected to dominate the market, due to real-time monitoring, predictive maintenance, efficient leak detection, automated controls, data analytics, and integration with IoT, ensuring optimized water distribution and reduced operational costs.

Key players in the Smart Water Grid market include Xylem Inc., Itron Inc., Siemens AG, Schneider, Electric, Badger Meter Inc.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA