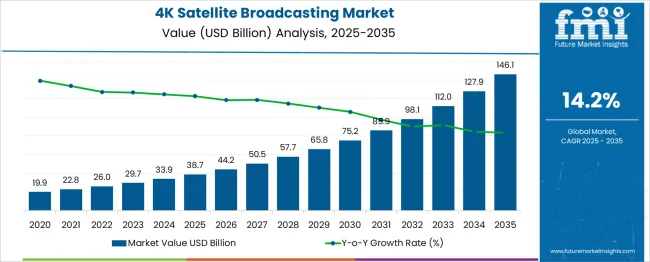

The 4K Satellite Broadcasting Market is estimated to be valued at USD 38.7 billion in 2025 and is projected to reach USD 146.1 billion by 2035, registering a compound annual growth rate (CAGR) of 14.2% over the forecast period.

| Metric | Value |

|---|---|

| 4K Satellite Broadcasting Market Estimated Value in (2025 E) | USD 38.7 billion |

| 4K Satellite Broadcasting Market Forecast Value in (2035 F) | USD 146.1 billion |

| Forecast CAGR (2025 to 2035) | 14.2% |

The 4K satellite broadcasting market is advancing steadily as the demand for ultra-high-definition content rises globally. Increasing consumer expectations for superior visual quality, driven by advancements in display technologies and the widespread adoption of 4K TVs, have prompted broadcasters to enhance transmission standards.

Satellite broadcasting remains pivotal in delivering uninterrupted, high-resolution content across vast geographic areas, especially where cable or fiber infrastructure is limited. Continuous investment by satellite operators in compression technologies, bandwidth optimization, and hybrid broadcast-broadband models is supporting the seamless delivery of 4K content.

The appeal of immersive viewing experiences, particularly in live events, and the growth of pay-TV and subscription-based platforms are fostering sustained market interest. The outlook remains positive as broadcasters, content providers, and satellite companies align to meet rising consumer expectations, creating long-term value in both developed and emerging markets.

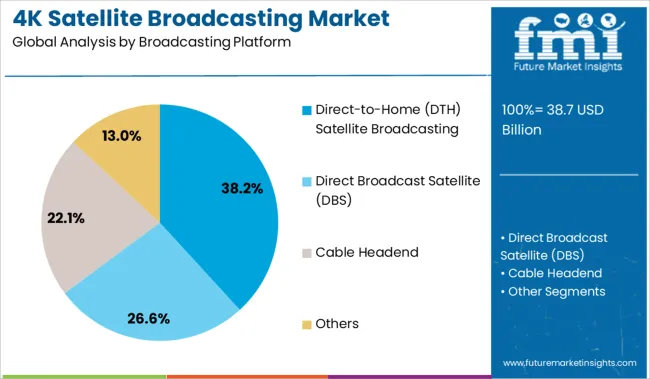

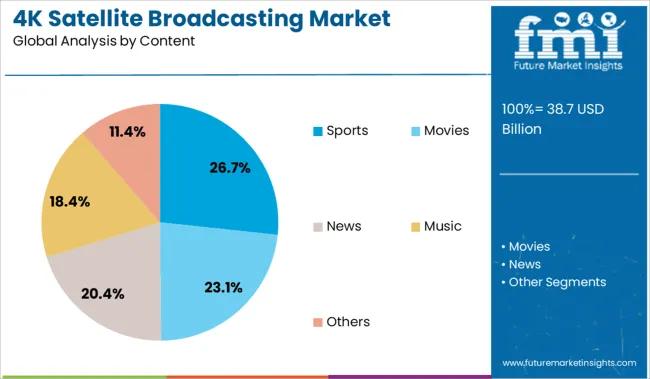

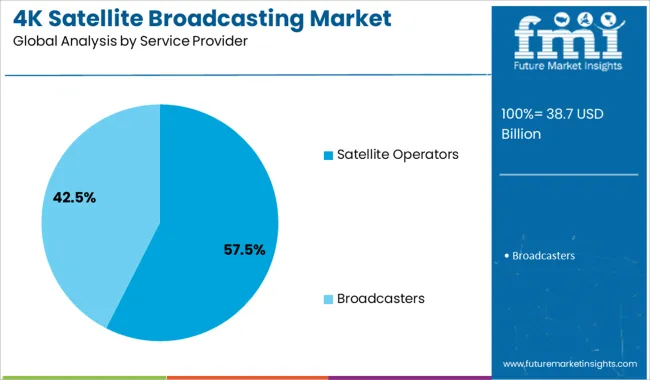

The 4k satellite broadcasting market is segmented by broadcasting platform, content, service provider, and end use and geographic regions. The 4 K satellite broadcasting market is divided into Direct-to-Home (DTH) Satellite Broadcasting, Direct Broadcast Satellite (DBS), Cable Headend, and Others. The 4k satellite broadcasting market is classified into Sports, Movies, News, Music, and Others. The 4 K satellite broadcasting market is segmented into Satellite Operators and Broadcasters. The end use of the 4k satellite broadcasting market is segmented into Residential and Commercial. Regionally, the 4k satellite broadcasting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Direct-to-Home (DTH) satellite broadcasting segment leads the broadcasting platform category with a 38.2% market share, driven by its widespread coverage, scalability, and direct connectivity to end users without dependency on ground infrastructure. DTH platforms are favored for their ability to deliver uninterrupted 4K content, especially in rural and remote regions where fiber or cable access is limited or cost-prohibitive.

This segment has benefited from technological upgrades in signal compression and modulation techniques, enabling efficient transmission of high-bandwidth 4K streams. The competitive pricing of DTH packages and bundled service offerings has further strengthened consumer uptake.

As broadcasters expand their 4K channel offerings and integrate value-added features like multi-language support and interactive content, DTH is expected to retain its leading role due to its robust reach and ability to support high-definition viewing experiences at scale.

The sports content segment accounts for 26.7% of the market, reflecting the strong viewer demand for high-resolution and immersive live sports experiences. Broadcasters and content producers have prioritized 4K coverage of major sporting events, leveraging the format’s clarity and detail to capture fast-paced action and vibrant stadium environments.

This segment has experienced significant traction due to the global popularity of live sports and the willingness of viewers to pay premiums for superior broadcast quality. Investments in mobile production units and satellite uplink technologies capable of 4K resolution have enabled real-time delivery of sports events across multiple regions.

As rights holders and streaming platforms focus on enhancing audience engagement, the demand for 4K sports broadcasting is expected to rise further. Continued innovation in camera technologies and live broadcast infrastructure will support the segment's future expansion.

The satellite operators segment leads the service provider category with a 57.5% market share, highlighting their crucial role in enabling 4K content delivery across vast and diverse geographies. These operators provide the core infrastructure for content transmission, offering reliable bandwidth, global reach, and redundancy essential for consistent 4K signal quality.

The segment has seen continued growth as operators invest in high-throughput satellites, advanced transponders, and flexible payload configurations to accommodate increasing data loads associated with ultra-HD broadcasting. Strategic partnerships between satellite companies and broadcasters have further accelerated the rollout of 4K services, especially in markets with limited terrestrial network infrastructure.

As competition intensifies and content expectations rise, satellite operators are positioned to remain key enablers of 4K broadcasting through scalable, efficient, and high-capacity transmission capabilities.

4K satellite broadcasting continues to expand as content providers and viewers demand ultra-high definition delivery over wide areas. In 2024, nearly 28% of new satellite TV launches offered native 4K channels. Markets in North America, Europe and the Middle East see strong uptake. Broadcasters adopt satellite multicast plus over-the-top fallback to deliver UHD in underserved regions.

Satellite operators have introduced bandwidth-efficient codecs such as HEVC to deliver 4K channels within existing transponder capacity. In Europe, encoding upgrades reduced per-channel bandwidth use by approximately 22 %. Providers bundling 4K content with HD fallback and OTT options reduced subscriber churn by 9 % in North American pay‑TV markets. Middle East broadcasters expanded regional sports and premium series in 4K, growing ARPU by 17 %. Operators now implement multicast with multicast retransmission to rural zones, cutting uplink redundancy and improving video latency by close to 18 %. These methods support scalable delivery while maximising audience reach and retaining legacy user segments.

Broadcast infrastructure upgrades required for 4K satellite services incur significant capital costs, especially for uplink earth station and compression systems installations. HEVC encoders and modulator upgrades cost 14–18% more than prior-generation devices. Spectrum licence approval timelines add 6–8 weeks in regulated regions such as North America and parts of Asia. Satellite capacity shortages in premium Ka-band zones have pushed uplink booking windows out by up to 12 days. Operators in emerging regions face limited MODCOD configuration support from local teleport providers, which slows the rollout of local 4K channels. Equipment vendors supplying turnkey playout to DVB‑S2X standards report demand surges, but a lack of local certification services delays adoption in East African and Central Asian markets.

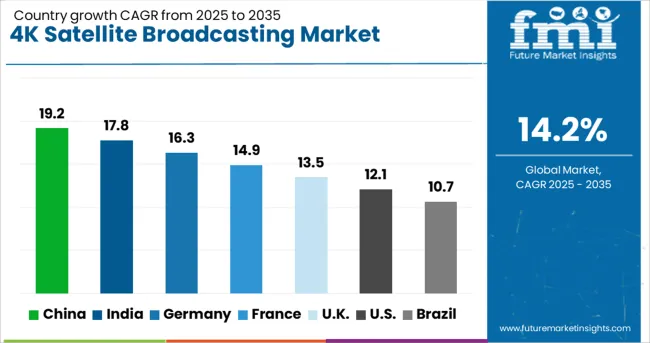

| Country | CAGR |

|---|---|

| China | 19.2% |

| India | 17.8% |

| Germany | 16.3% |

| France | 14.9% |

| UK | 13.5% |

| USA | 12.1% |

| Brazil | 10.7% |

The 4K satellite broadcasting market is projected to grow at a 14.2% CAGR globally from 2025 to 2035. China leads with a 19.2% CAGR, marking a +35% premium over the global average, backed by increased government-led HD broadcasting upgrades and private satellite investments. India records 17.8%, or +25%, fueled by growing consumer demand for high-resolution entertainment. Germany posts 16.3%, or +15%, with expansion driven by satellite content syndication across Europe. The UK, at 13.5%, aligns closely with the global pace, while the USA, at 12.1%, is -15% below the global rate, due to slower transition from cable to satellite among existing subscribers. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The 4K satellite broadcasting market in China is advancing at a CAGR of 19.2%. State-backed infrastructure initiatives are driving transponder upgrades and increasing satellite payloads with 4K compatibility. CCTV’s expansion of ultra-high-definition channels is being matched by provincial broadcasters adopting HEVC compression standards. ChinaSat-26 and similar satellites are deploying frequency reuse techniques to increase channel count. Domestic electronics brands are aligning production with DVB-S2X transmission requirements to meet household demand for 4K satellite-compatible receivers.

Demand for 4K satellite broadcasting in India is expanding at a CAGR of 17.8%. DTH operators such as Tata Play and Airtel Digital TV are integrating 4K set-top boxes with multi-language channel support. ISRO-backed GSAT satellites are enabling expanded bandwidth for ultra-HD transmission. Uptake is strongest in tier-1 and tier-2 cities where broadband reliability remains limited. TV manufacturers are promoting bundled offers combining 4K sets with DTH subscriptions to accelerate market penetration in high-density regions.

The 4K satellite broadcasting market in Germany is growing at a CAGR of 16.3%. Public broadcasters such as ARD and ZDF are expanding live sports and cultural programming in 4K resolution. SES Astra is optimizing orbital capacity with hybrid satellite-terrestrial models to deliver uncompressed content. Demand is supported by strong 4K TV penetration and low-latency viewing expectations. Satellite distributors are investing in scalable modulation technologies to manage increased signal traffic efficiently across urban and rural regions.

Demand for 4K satellite broadcasting in the United Kingdom is advancing at a CAGR of 13.5%. Sky is expanding UHD offerings with on-demand and sports broadcasting services, enabled through multi-feed satellites. Freesat is piloting support for 4K via DVB-S2X and next-gen compression formats. Penetration is highest among households in England and Scotland with 55-inch+ screens. Viewer engagement has increased for 4K live concerts, documentaries, and multi-angle sporting broadcasts, driving further investment in uplink and playout infrastructure.

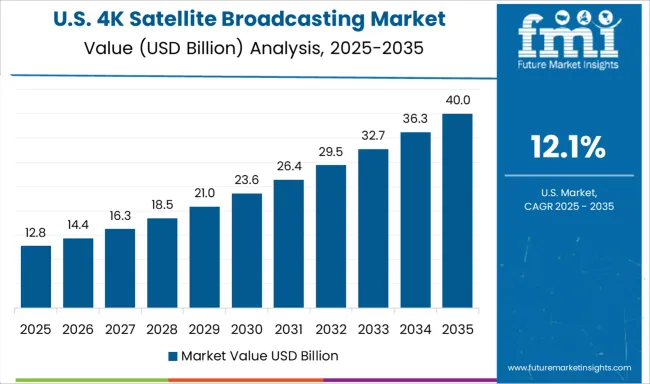

The USA 4K satellite broadcasting market is growing at a CAGR of 12.1%. Providers such as DISH and DirecTV are focused on premium sports, nature, and entertainment channels delivered via hybrid satellite-streaming systems. Consumer uptake of 4K televisions is high, but network redundancy and compression technology remain key areas of upgrade. Satellite operators are transitioning to Ka-band and implementing AI-enhanced signal correction to reduce jitter in ultra-high-definition transmissions over long ranges.

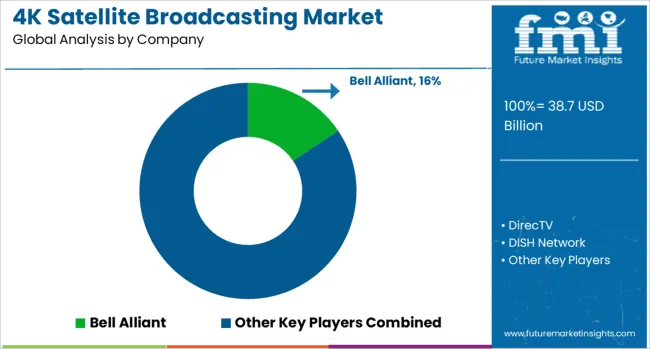

The 4K satellite broadcasting market is led by Bell Aliant, competing with DirecTV and DISH Network in North America, while Sky dominates European UHD offerings. Satellite capacity providers SES and Eutelsat have dedicated transponders for 4K content, supported by Harmonic's compression technologies that reduce bandwidth requirements by 50% compared to early implementations. The sector maintains relevance for live events coverage, with 78% of major sports leagues now producing in 4K for satellite distribution. Emerging markets show particular growth potential, where Hispasat and Intelsat enable 4K adoption despite limited terrestrial infrastructure. Challenges include rising production costs and competition from OTT platforms, though satellite's guaranteed quality of service remains crucial for broadcasters.

Recent innovations include hybrid satellite/5G distribution models and AI-powered upscaling solutions for legacy content conversion.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.7 Billion |

| Broadcasting Platform | Direct-to-Home (DTH) Satellite Broadcasting, Direct Broadcast Satellite (DBS), Cable Headend, and Others |

| Content | Sports, Movies, News, Music, and Others |

| Service Provider | Satellite Operators and Broadcasters |

| End Use | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bell Alliant, DirecTV, DISH Network, Eutelsat, Harmonic, Hispasat, Intelsat, SES, and Sky |

| Additional Attributes | Dollar sales by service type (direct-to-home, contribution feeds, cable relay) and application (sports, entertainment, education), demand dynamics across UHD content licensing, satellite fleet upgrades, and consumer set-top box adoption, regional trends led by Asia‑Pacific with North America increasing 4K content throughput, innovation in HEVC compression, spot beam optimization, and low-latency uplink systems, and operational impact of bandwidth efficiency, signal quality consistency, and device compatibility constraints. |

The global 4k satellite broadcasting market is estimated to be valued at USD 38.7 billion in 2025.

The market size for the 4k satellite broadcasting market is projected to reach USD 146.1 billion by 2035.

The 4k satellite broadcasting market is expected to grow at a 14.2% CAGR between 2025 and 2035.

The key product types in 4k satellite broadcasting market are direct-to-home (dth) satellite broadcasting, direct broadcast satellite (dbs), cable headend and others.

In terms of content, sports segment to command 26.7% share in the 4k satellite broadcasting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

4K Drawing Tablet with Screen Market Size and Share Forecast Outlook 2025 to 2035

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

Ultra-High Definition (UHD) Panel (4K) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle Market Forecast Outlook 2025 to 2035

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA