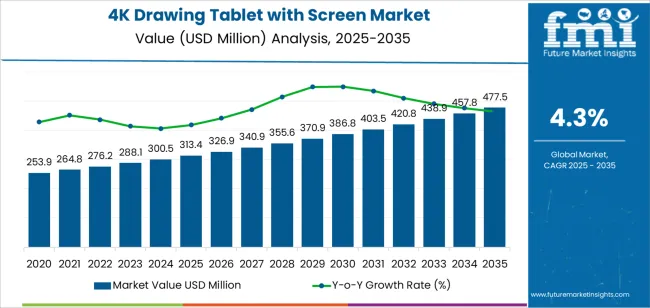

The global 4K drawing tablet with screen market is projected to reach USD 477.5 million by 2035, recording an absolute increase of USD 164.1 million over the forecast period. The market is valued at USD 313.4 million in 2025 and is set to rise at a CAGR of 4.3% during the assessment period. The overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for digital content creation tools worldwide, driving demand for efficient professional illustration and design solutions and increasing investments in creative industry infrastructure and remote work technology adoption projects globally. However, high product costs and competition from tablet computers with stylus support may pose challenges to market expansion.

The market expansion reflects fundamental shifts in creative professional workflows, where 4K drawing tablets with screens enable artists and designers to achieve superior precision and natural drawing experiences while maintaining seamless integration with professional software applications. Content creators across animation studios, graphic design agencies, and independent freelance operations face mounting pressure to improve productivity and output quality, with 4K screen drawing tablets typically providing 40-60% improvement in workflow efficiency over conventional non-display tablets, making these technologies essential for modern digital art production. The transition toward high-resolution content creation and increasing client expectations for detailed visual work creates demand for professional-grade input devices that can deliver pressure sensitivity levels exceeding 8,192 levels and color accuracy supporting wide gamut standards.

Technological advancements in display technology, pen sensor systems, and ergonomic design are reshaping the 4K drawing tablet with screen landscape. Modern systems incorporate laminated displays that eliminate parallax between pen tip and screen cursor, enabling precise artwork creation. Integration with leading creative software including Adobe Creative Suite, Clip Studio Paint, and Corel Painter allows seamless workflow compatibility across professional applications. Advanced pressure sensitivity and tilt recognition technologies enable natural brush behavior and shading techniques that replicate traditional media experiences, supporting artistic expression that meets professional illustration and concept art requirements within digital production environments.

Government creative industry development initiatives and digital skills training programs accelerate market growth. Educational institutions worldwide invest in digital art infrastructure to prepare students for careers in animation, game development, and graphic design industries. Corporate training programs for design teams and marketing departments drive demand for professional drawing tablets that enable in-house content creation capabilities. Industry adoption of remote work models creates sustained investment in home studio equipment that enables creative professionals to maintain productivity outside traditional office environments, driving purchases of high-performance drawing tablets with 4K displays that deliver studio-quality results in distributed work arrangements supporting global creative project collaboration.

Between 2025 and 2030, the 4K drawing tablet with screen market is projected to expand from USD 313.4 million to USD 386.8 million, resulting in a value increase of USD 73.4 million, which represents 44.7% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for professional digital art creation tools and remote creative work solutions, product innovation in pen technology and display quality optimization, as well as expanding integration with cloud-based creative platforms and workflow automation systems. Companies are establishing competitive positions through investment in advanced pressure sensitivity technologies, color calibration capabilities, and strategic market expansion across residential creative professionals, commercial design studios, and educational institution applications.

From 2030 to 2035, the market is forecast to grow from USD 386.8 million to USD 477.5 million, adding another USD 90.7 million, which constitutes 55.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized display tablets, including ultra-wide color gamut models and integrated ergonomic workstation configurations tailored for specific creative disciplines, strategic collaborations between hardware manufacturers and software developers, and an enhanced focus on sustainable manufacturing practices and product longevity. The growing emphasis on content creator economy growth and professional skill development will drive demand for advanced, high-performance 4K drawing tablets with screens across diverse digital art and design applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 313.4 million |

| Market Forecast Value (2035) | USD 477.5 million |

| Forecast CAGR (2025-2035) | 4.3% |

The 4K drawing tablet with screen market grows by enabling creative professionals to achieve superior artistic precision and workflow efficiency while maintaining natural drawing experiences that replicate traditional media techniques. Digital artists and designers face mounting pressure to produce high-quality content within compressed timelines, with 4K drawing tablets typically providing 30-50% improvement in creative productivity over standard resolution alternatives, making these technologies essential for professional illustration, concept art, and graphic design operations. The creator economy expansion creates demand for professional-grade tools that can deliver broadcast-quality artwork for animation production, game asset creation, and commercial illustration projects requiring color accuracy and detail resolution.

Government initiatives promoting creative industries and digital skills development drive adoption in art education programs, design studios, and freelance creative businesses, where professional drawing tools have a direct impact on output quality and competitive positioning. The global shift toward remote work arrangements and distributed creative teams accelerates 4K drawing tablet demand as professionals seek equipment that enables studio-quality work from home office environments. However, premium pricing ranging from USD 1,000 to USD 3,500 per device and learning curve requirements for transitioning from traditional media may limit adoption rates among amateur artists and budget-constrained educational institutions.

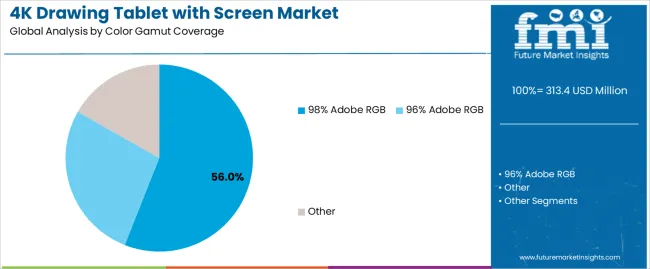

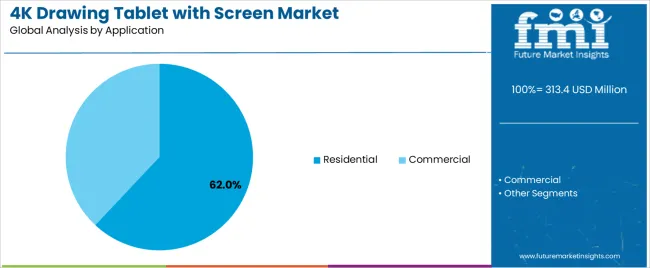

The market is segmented by color gamut coverage, application, and region. By color gamut coverage, the market is divided into 98% Adobe RGB, 96% Adobe RGB, and other. Based on application, the market is categorized into residential and commercial. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The 98% Adobe RGB segment represents the dominant force in the 4K drawing tablet with screen market, capturing approximately 56.0% of total market share in 2025. This advanced category encompasses premium display panels with wide color gamut coverage, professional-grade color calibration capabilities, factory color accuracy certification, and support for multiple color space standards, delivering comprehensive color reproduction performance for demanding professional applications. The 98% Adobe RGB segment's market leadership stems from its essential role in professional creative workflows requiring accurate color representation for print production, client presentation, and cross-media content development where color consistency determines project success.

The 96% Adobe RGB segment maintains a substantial 35.0% market share, serving creative professionals and advanced enthusiasts requiring high color accuracy through quality display technology, reliable color reproduction, and professional workflow compatibility at more accessible price points. The other segment accounts for 9.0% market share, featuring standard color gamut displays, entry-level professional models, and specialized configurations for specific applications.

Key advantages driving the 98% Adobe RGB segment include:

Residential applications dominate the 4K drawing tablet with screen market with approximately 62.0% market share in 2025, reflecting the growing creator economy and increasing numbers of freelance artists, independent illustrators, and content creators working from home studios and personal workspaces. The residential segment's market leadership is reinforced by widespread adoption among freelance designers, digital art enthusiasts, online content creators, and remote creative professionals who require professional-grade tools for client work, personal projects, and skill development activities conducted outside traditional studio environments.

The commercial segment represents 38.0% market share through specialized deployments including animation studios, graphic design agencies, architectural visualization firms, game development studios, and advertising agencies that equip creative teams with standardized professional drawing tablet configurations supporting collaborative workflows and consistent output quality across multiple artists.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to creative industry evolution and workflow transformation. First, content creation industry growth creates increasing requirements for professional drawing tools, with global animation, gaming, and digital media sectors expanding by 8-12% annually, requiring proven technologies that support production pipeline efficiency in concept art, character design, and visual development applications. Second, remote work adoption drives professionals toward home studio equipment investments, with 40-60% of creative professionals now operating flexible work arrangements that necessitate personal ownership of professional-grade drawing tablets replacing shared studio equipment. Third, social media and online platform monetization enables independent artists to generate sustainable income streams, with creator economy participants investing USD 2,000-5,000 in professional equipment to improve content quality and competitive positioning in crowded digital marketplaces.

Market restraints include premium device pricing creating adoption barriers, as professional 4K drawing tablets with screens represent significant capital investments that require careful budget consideration compared to consumer tablets with stylus support priced at one-third to one-fifth the cost of professional alternatives. Technical complexity and learning curve requirements pose challenges for artists transitioning from traditional media, as digital workflow mastery requires 100-300 hours of practice to achieve proficiency levels comparable to traditional drawing skills developed over years. Software compatibility and driver stability issues create frustration points, as users must maintain updated drivers and troubleshoot occasional compatibility problems with creative software updates that can disrupt workflow productivity during critical project deadlines.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where government programs supporting digital skills development and creative industry expansion provide training subsidies and equipment grants that incentivize professional tool adoption. Technology advancement trends toward battery-free pen technology with enhanced pressure sensitivity, laminated displays eliminating parallax gaps, and integrated adjustable stands optimizing ergonomic positioning are driving next-generation product development. However, the market thesis could face disruption if tablet computers with advanced stylus support achieve professional-grade pressure sensitivity and color accuracy specifications that match dedicated drawing tablets while offering additional computing functionality at comparable price points.

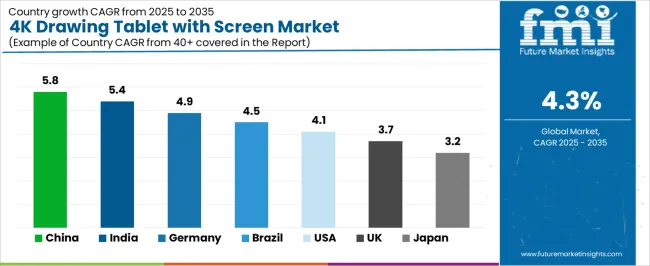

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| USA | 4.1% |

| UK | 3.7% |

| Japan | 3.2% |

The 4K drawing tablet with screen market is gaining momentum worldwide, with China taking the lead thanks to aggressive digital content creation industry expansion and animation sector development programs. Close behind, India benefits from IT sector diversification into creative services and government digital skills initiatives, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where design industry excellence and professional creative education programs strengthen its role in European digital art tool adoption.

Brazil demonstrates robust growth through expanding creative economy and increasing freelance digital artist population, signaling continued investment in professional creative tools. Meanwhile, the USA stands out for its mature animation and gaming industries with established professional tool adoption, while the UK and Japan continue to record consistent progress driven by design agency presence and manga/anime industry digital transformation. Together, China and India anchor the global expansion story, while established markets build stability and premium segment development into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

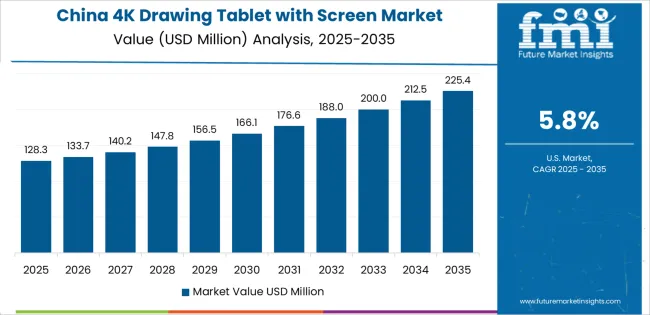

China demonstrates the strongest growth potential in the 4K Drawing Tablet with Screen Market with a CAGR of 5.8% through 2035. The country's leadership position stems from comprehensive animation industry development initiatives, massive gaming sector expansion representing over 30% of global gaming revenue, and government cultural industry promotion policies driving adoption of professional digital art tools. Growth is concentrated in major creative industry clusters, including Beijing, Shanghai, Shenzhen, and Hangzhou regions, where animation studios, game development companies, and design agencies are equipping creative teams with 4K drawing tablets for character design, concept art, and visual development workflows.

Distribution channels through e-commerce platforms, specialty electronics retailers, and direct manufacturer sales expand deployment across professional studios, independent artists, and art education institutions. The country's Made in China 2025 strategy provides policy support for cultural and creative industry development, including subsidies for digital skills training and creative enterprise equipment purchases.

Key market factors:

In metropolitan technology centers, creative industry clusters, and educational institutions, the adoption of 4K drawing tablets with screens is accelerating across animation outsourcing studios, game art development teams, and independent digital artist communities, driven by Digital India initiatives and National Skill Development Corporation creative skills programs. The market demonstrates strong growth momentum with a CAGR of 5.4% through 2035, linked to comprehensive IT sector diversification into creative services and increasing focus on digital content creation capability development.

Indian creative professionals are implementing professional drawing tablet workflows and digital art production systems to serve international client markets while meeting quality standards required by global entertainment industry outsourcing projects. The country's Animation, Visual Effects, Gaming and Comics sector development programs create sustained demand for professional creative tools, while increasing emphasis on independent content creation drives adoption of equipment enabling high-quality output for domestic and export markets.

Germany's advanced design industry demonstrates sophisticated implementation of 4K drawing tablet technology, with documented case studies showing 40-60% workflow efficiency improvement through digital tool adoption across automotive design studios, industrial design consultancies, and architectural visualization firms. The country's creative industry infrastructure in major design centers, including Berlin, Munich, Hamburg, and Frankfurt regions, showcases integration of professional drawing tablets with existing creative workflows, leveraging expertise in precision engineering and design excellence traditions.

German creative professionals emphasize tool quality and long-term reliability, creating demand for premium drawing tablets that support professional commitments and meet rigorous durability standards for intensive daily usage patterns. The market maintains strong growth through focus on professional market segments and premium product categories, with a CAGR of 4.9% through 2035.

Key development areas:

The Brazilian market leads Latin American adoption based on integration with expanding animation industry and growing independent digital artist community supporting domestic content creation and international outsourcing services. The country shows solid potential with a CAGR of 4.5% through 2035, driven by creative economy growth and increasing digital content demand across São Paulo, Rio de Janeiro, Brasília, and Porto Alegre metropolitan areas. Brazilian creative professionals are adopting 4K drawing tablets for professional illustration work, particularly in comic book production, digital painting, and concept art applications serving domestic entertainment industry and international client markets. Technology deployment channels through specialty electronics retailers, online marketplaces, and direct importation expand coverage across diverse creative professional segments and skill levels.

Leading market segments:

The USA 4K drawing tablet with screen market demonstrates mature implementation focused on established entertainment industry studios and independent creative professional adoption, with documented integration across major animation studios including Disney, Pixar, DreamWorks, and game development companies operating throughout California, Washington, Texas, and New York creative industry clusters.

The country maintains steady growth momentum with a CAGR of 4.1% through 2035, driven by continued entertainment industry production volume and mature freelance creative economy supporting 3-5 million active digital artists and designers. Major creative software companies including Adobe maintain headquarters and development operations in the USA, creating strong ecosystem integration between software platforms and hardware manufacturers optimizing compatibility and workflow efficiency.

Key market characteristics:

In London, Manchester, Bristol, and Edinburgh creative industry clusters, design agencies, animation studios, and independent creative professionals are implementing 4K drawing tablet workflows to address client project requirements in advertising, editorial illustration, and digital content production, with documented case studies showing workflow efficiency improvements enabling 20-30% increased project capacity without additional staffing.

The market shows solid growth potential with a CAGR of 3.7% through 2035, linked to UK creative industries economic contribution and increasing emphasis on digital skills development supporting post-industrial economy transition. British creative professionals are adopting professional drawing tablets and digital illustration techniques to maintain competitive positioning in European and global creative services markets while serving domestic client demands for high-quality visual content.

Market development factors:

Japan's 4K drawing tablet with screen market demonstrates sophisticated implementation focused on manga, anime, and illustration industries, with documented integration of professional drawing tablets achieving industry-leading artwork quality and production efficiency across digital manga creation, anime pre-production, and commercial illustration workflows.

The country maintains steady growth through emphasis on artistic quality and technical precision, with a CAGR of 3.2% through 2035, driven by established manga industry digital transformation and continued anime production volume supporting 300+ animation studios and thousands of independent manga artists across Tokyo, Osaka, Kyoto, and other metropolitan centers. Japanese creative professionals prioritize pen feel and pressure curve responsiveness when evaluating drawing tablet quality, creating demand for refined input characteristics matching traditional pen and brush experiences.

Key market characteristics:

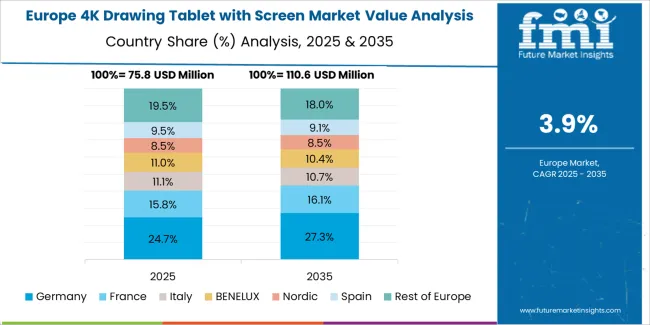

The 4K drawing tablet with screen market in Europe is projected to grow from USD 78.4 million in 2025 to USD 115.3 million by 2035, registering a CAGR of 3.9% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced design industry infrastructure and major creative centers including Berlin, Munich, and Hamburg design clusters.

France follows with a 22.3% share in 2025, projected to reach 22.6% by 2035, driven by animation industry presence and graphic design sector strength in Paris and Lyon regions. The United Kingdom holds a 19.5% share in 2025, expected to reach 19.8% by 2035 through creative services industry growth. Italy commands a 13.2% share in both 2025 and 2035, backed by fashion design and architectural visualization sectors. Spain accounts for 9.5% in 2025, rising to 9.7% by 2035 on creative education expansion. The Netherlands maintains 6.8% market share throughout the forecast period. The Rest of Europe region is anticipated to hold 7.0% in 2025, expanding to 7.2% by 2035, attributed to increasing 4K drawing tablet adoption in Nordic countries and emerging Central & Eastern European creative industry development programs.

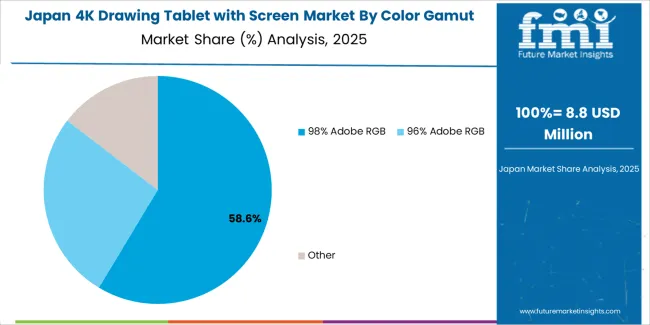

The Japanese 4K drawing tablet with screen market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of 98% Adobe RGB displays and advanced pen technology with existing digital art production workflows across manga studios, anime production facilities, and independent professional illustrators. Japan's emphasis on artistic precision and color reproduction fidelity drives demand for premium drawing tablets that support professional quality standards and meet rigorous performance expectations in commercial illustration environments.

The market benefits from strong partnerships between domestic market leader Wacom and Japanese creative software ecosystem, creating comprehensive workflow integration that prioritizes natural drawing experience and reliable performance. Creative professionals in Tokyo, Osaka, and other metropolitan centers showcase advanced drawing tablet implementations where systems deliver pressure sensitivity and color accuracy meeting manga industry professional standards and anime pre-production quality requirements.

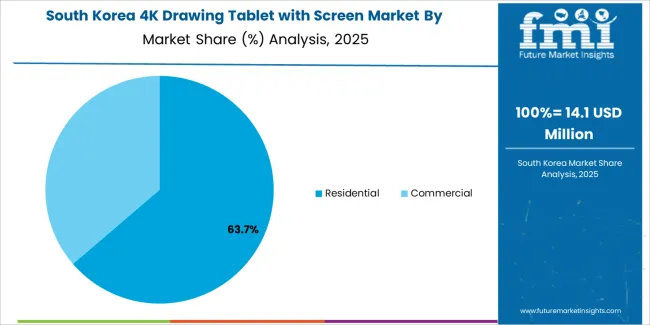

The South Korean 4K drawing tablet with screen market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive product support and technical services capabilities for webtoon creation and game concept art applications. The market demonstrates increasing emphasis on digital content creation and professional illustration tools, as Korean webtoon artists and game development studios increasingly demand drawing tablets that integrate with domestic creative platforms and sophisticated digital publishing systems deployed across Naver Webtoon, KakaoPage, and major game development companies.

Regional electronics retailers are gaining market share through strategic partnerships with international manufacturers including Wacom and Chinese suppliers, offering specialized services including Korean language support and customized warranty programs for creative professionals. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean creative industry associations, creating hybrid distribution models that combine international product quality with local market understanding and content creator community engagement.

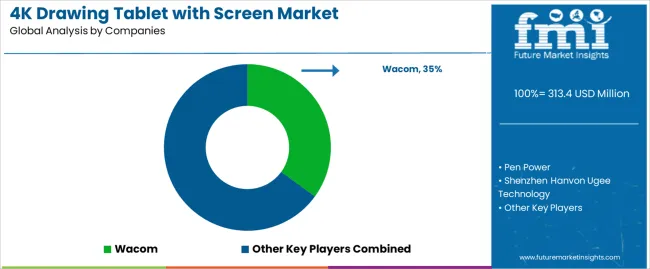

The 4K drawing tablet with screen market features approximately 12-15 meaningful players with moderate concentration, where the top three companies control roughly 55-60% of global market share through established brand recognition and comprehensive product portfolios. Competition centers on pen technology performance, display quality, and professional workflow integration rather than price competition alone. Wacom leads with approximately 35.0% market share through its comprehensive professional product line and decades-long industry leadership position.

Market leaders include Wacom, Shenzhen Huion, and Shenzhen Hanvon Ugee Technology, which maintain competitive advantages through extensive patent portfolios in pen digitizer technology, established professional artist communities providing product feedback and endorsements, and proven reliability track records supporting mission-critical creative workflows across entertainment industry studios. These companies leverage research and development investments in pressure sensitivity algorithms, display lamination technologies, and ergonomic design optimization to defend market positions while expanding into emerging creative professional segments and educational institution markets.

Challengers encompass Pen Power and Guangzhou Gaomon, which compete through value-oriented product positioning and strong regional presence in Asia-Pacific markets offering professional-grade performance at competitive price points. Product specialists focus on specific market segments or price categories, offering differentiated capabilities in compact portable models, large-format professional displays, and entry-level professional configurations serving different creative discipline requirements and budget constraints.

Emerging manufacturers from China create competitive pressure through aggressive pricing strategies and rapid product development cycles, particularly in markets including India, Southeast Asia, and Latin America where price sensitivity among independent artists and small studios provides opportunities for cost-effective alternatives to premium Japanese brands. Market dynamics favor companies that combine proven pen technology performance with comprehensive driver software support and active professional community engagement that addresses the complete creative workflow from initial device setup through advanced technique mastery and long-term product reliability.

| Item | Value |

|---|---|

| Quantitative Units | USD 313.4 million |

| Color Gamut Coverage | 98% Adobe RGB, 96% Adobe RGB, Other |

| Application | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Wacom, Pen Power, Shenzhen Hanvon Ugee Technology, Shenzhen Huion, Guangzhou Gaomon |

| Additional Attributes | Dollar sales by color gamut coverage and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with professional drawing tablet manufacturers and distribution networks, technical specifications and performance requirements, integration with professional creative software applications and digital art workflows, innovations in pen technology and display quality, and development of specialized drawing tablet configurations with enhanced ergonomics and color accuracy capabilities. |

The global 4k drawing tablet with screen market is estimated to be valued at USD 313.4 million in 2025.

The market size for the 4k drawing tablet with screen market is projected to reach USD 477.5 million by 2035.

The 4k drawing tablet with screen market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in 4k drawing tablet with screen market are 98% adobe rgb, 96% adobe rgb and other.

In terms of application, residential segment to command 62.0% share in the 4k drawing tablet with screen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

Ultra-High Definition (UHD) Panel (4K) Market Size and Share Forecast Outlook 2025 to 2035

Fiber Drawing Machine Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Screen Printing Mesh Market Size and Share Forecast Outlook 2025 to 2035

Screen Cleaner Market Analysis by Type, Application and Region from 2025 to 2035

Screenless Display Market

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Rainscreen Cladding Market Growth - Trends & Forecast 2025 to 2035

Lab Screening Test Kit Market

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Sand Screens Market Analysis - Size, Growth, and Forecast 2025 to 2035

Touchscreen Controller Market Growth - Trends & Outlook 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Touchscreen Gloves Market

Oral Screening Systems Market

Multi-Screen Super Glass Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA