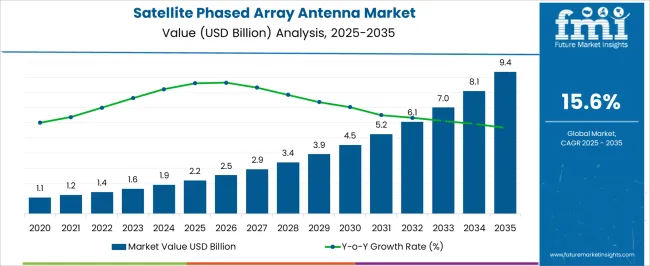

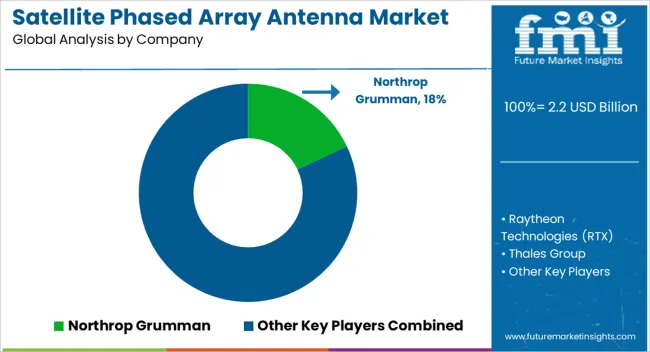

The satellite phased array antenna market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 9.4 billion by 2035, registering a compound annual growth rate (CAGR) of 15.6% over the forecast period.

From 2020 to 2025, the market doubled from USD 1.1 billion to USD 2.2 billion, fueled by rising demand for high-throughput satellite connectivity, low Earth orbit (LEO) constellation rollouts, and early integration of electronically steered antennas in defense and mobility platforms. This first 5-year block marked the transition from prototype demonstrations to commercial deployments, with adoption in aviation and maritime sectors beginning to scale. Between 2026 and 2030, growth accelerates from USD 2.5 billion to USD 4.5 billion, capturing nearly 37% of the decade’s absolute opportunity. This stage is characterized by broader adoption of electronically steered phased arrays across broadband internet providers, in-flight connectivity systems, and defense communications.

Increasing affordability through advances in semiconductor manufacturing and antenna miniaturization allows deeper penetration into commercial aviation and terrestrial mobility markets. The final block, spanning 2031 to 2035, records the strongest expansion, from USD 5.2 billion to USD 9.4 billion, contributing almost half of the total growth. By this phase, mass-market adoption in consumer satellite broadband, integration with 5G backhaul, and high-reliability defense applications position phased array antennas as a mainstream standard. Strategic consolidation among antenna manufacturers and satellite operators further accelerates deployment at scale. Overall, the market’s three-phase journey underscores a shift from niche defense applications to global commercial adoption, transforming phased array antennas into a critical enabler of next-generation connectivity.

| Metric | Value |

|---|---|

| Satellite Phased Array Antenna Market Estimated Value in (2025 E) | USD 2.2 billion |

| Satellite Phased Array Antenna Market Forecast Value in (2035 F) | USD 9.4 billion |

| Forecast CAGR (2025 to 2035) | 15.6% |

The satellite phased array antenna market holds a significant role within the global satellite communication ecosystem, representing nearly 28–30% share of the broader satellite ground equipment domain due to its capability to deliver high-speed, low-latency connectivity for both defense and commercial networks. Within the aerospace and defense communication infrastructure, the share stands close to 22–24%, driven by its adoption in military satellites, naval vessels, and airborne platforms where advanced beamforming ensures uninterrupted connectivity across multiple theaters. In the commercial satellite broadband segment, satellite phased array antennas capture nearly 18–20%, supported by the rapid rollout of low Earth orbit constellations and growing consumer demand for broadband-on-the-move services in aviation and maritime industries.

Within the satellite IoT and machine-to-machine connectivity ecosystem, the share is about 12–14%, reflecting increased reliance on compact, electronically steered antennas for real-time monitoring across logistics, agriculture, and energy sectors. Growth momentum is being propelled by rising investments from both private operators and government-backed agencies in North America, Europe, and Asia, with phased arrays seen as critical to enabling high-throughput satellite services. Despite challenges in cost optimization and thermal management, adoption continues to expand as no alternative solution provides comparable scalability, adaptability, and multi-beam performance. The long-term outlook positions phased array antennas as a cornerstone technology within next-generation satellite communication, where global coverage, mobility, and interoperability are key.

The market is experiencing significant expansion, supported by increasing demand for high-speed, reliable satellite communication across commercial, defense, and space exploration applications. The adoption of phased array technology is being driven by its ability to enable electronic beam steering without mechanical movement, improving performance and reducing maintenance requirements. Growth is further accelerated by advancements in materials, miniaturization of components, and integration of AI-based control systems that enhance adaptability in dynamic environments.

Investments in low Earth orbit satellite constellations and next-generation broadband services are also fueling market penetration. Additionally, the shift toward software-defined architectures is enabling real-time reconfiguration and multi-beam capabilities, broadening the scope of applications.

As global data transmission requirements intensify and satellite networks become more critical for connectivity, phased array antennas are positioned to play a central role in ensuring high-capacity, low-latency communication Continuous innovation and supportive government initiatives are expected to sustain the market’s upward trajectory.

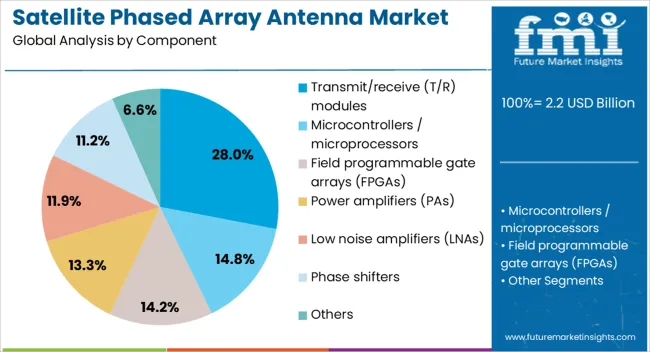

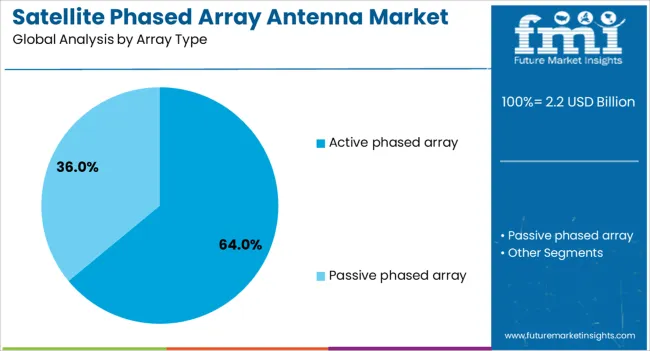

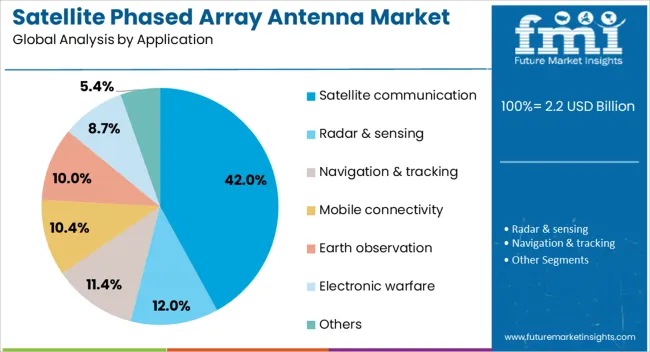

The satellite phased array antenna market is segmented by component, array type, application, end use, and geographic regions. By component, satellite phased array antenna market is divided into transmit/receive (T/R) modules, microcontrollers / microprocessors, field programmable gate arrays (FPGAs), power amplifiers (PAs), low noise amplifiers (LNAs), phase shifters, and others. In terms of array type, satellite phased array antenna market is classified into active phased array and passive phased array. Based on application, satellite phased array antenna market is segmented into satellite communication, radar & sensing, navigation & tracking, mobile connectivity, Earth observation, electronic warfare, and others. By end use, satellite phased array antenna market is segmented into defense & security, commercial, and research & academic institutions. Regionally, the satellite phased array antenna industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transmit/receive (T/R) modules component segment is expected to account for 28% of the satellite phased array antenna market revenue share in 2025, making it a leading component category. Growth in this segment has been driven by the critical role these modules play in signal transmission and reception, enabling precise electronic beam steering and high-frequency performance. The increasing adoption of high-throughput satellites and multi-beam configurations has elevated demand for efficient T/R modules that can operate across wide frequency ranges. Enhanced by advances in semiconductor technologies, these modules now deliver higher power efficiency, reduced size, and improved thermal management. Their modular design allows integration into both large and compact antenna arrays, making them versatile for multiple satellite platforms The rising need for scalable solutions in both commercial and defense sectors has reinforced the importance of T/R modules as a foundational element in phased array antenna systems, supporting their continued leadership in the market.

The active phased array segment is projected to hold 64% of the market revenue share in 2025, establishing itself as the dominant array type. This leadership is supported by the inherent advantages of active architectures, where each radiating element has its own power amplifier and phase shifter, enabling independent control and greater signal accuracy. Active phased arrays provide enhanced beam agility, improved reliability through redundancy, and better adaptability to changing mission requirements. Their capability to support multi-beam operations and high data rate communications has made them a preferred choice in both geostationary and non-geostationary satellite systems. The segment’s growth is further supported by defense modernization programs and commercial satellite broadband initiatives that demand high-performance antennas. Continuous technological advancements are improving efficiency and lowering costs, enabling broader adoption across industries This combination of performance, scalability, and mission flexibility underpins the segment’s strong position in the global market.

The satellite communication application segment is forecasted to command 42% of the market revenue share in 2025, making it the largest application area. This segment’s dominance is attributed to the rising need for high-capacity communication links in both civilian and military domains. Expanding demand for broadband internet in remote regions, maritime connectivity, and airborne communication systems has accelerated adoption. Phased array antennas used in satellite communication offer the advantage of electronically steerable beams, enabling uninterrupted connectivity even with moving platforms. The growth of low Earth orbit satellite constellations is further amplifying the need for advanced antennas that can rapidly track multiple satellites. Governments and private operators are investing heavily in satellite infrastructure to meet the surging global data consumption As these trends continue, satellite communication is expected to remain the primary driver for phased array antenna deployments, reinforcing its leadership position in the overall market.

The satellite phased array antenna market is being shaped by rising adoption, material improvements, dual-sector expansion, and efficiency challenges. Growth continues as phased arrays emerge as indispensable in global satellite communication.

The satellite phased array antenna industry is witnessing greater adoption as demand for high-capacity satellite communication expands. Defense agencies, commercial operators, and government programs are increasingly procuring electronically steered antennas to support reliable and flexible connectivity. Low Earth orbit satellite constellations have amplified requirements for multi-beam and adaptive antenna systems, ensuring continuous coverage for mobile users. Commercial aviation and maritime sectors have become vital users, relying on phased arrays for broadband-on-the-move services. The capability to manage multiple connections simultaneously without mechanical steering has been viewed as a significant upgrade over traditional systems. This adoption pattern underlines phased arrays as an essential enabler for global satellite communication infrastructures.

The integration of advanced materials in phased array antenna manufacturing has elevated performance across bandwidth, signal quality, and thermal stability. High-frequency operations demand antennas that minimize losses while ensuring compact and lightweight structures, making material science a decisive factor. The industry is exploring dielectric substrates, lightweight composites, and novel conductive materials to achieve higher efficiency levels. Thermal dissipation has also been enhanced, addressing operational challenges in space and terrestrial platforms. This material-driven transformation has created opportunities for antenna manufacturers to develop solutions that deliver better performance at reduced size and weight. Such advancements continue to strengthen the role of phased arrays in next-generation satellite communication programs.

Satellite phased array antennas have extended their reach across both defense and commercial domains. Defense applications benefit from secure, jam-resistant connectivity for surveillance, navigation, and mission-critical communication, while commercial adoption focuses on broadband services in aviation, maritime, and remote locations. Telecom operators are increasingly investing in these antennas to integrate satellite backhaul with terrestrial networks, supporting 5G expansion in underserved regions. The ability to seamlessly switch between satellites, combined with electronic beam steering, has improved operational efficiency across applications. This dual adoption has broadened the market base, ensuring phased arrays maintain relevance across strategic defense projects and consumer-driven communication industries.

The satellite phased array antenna market faces cost and power efficiency challenges. High production expenses arise from complex semiconductor integration, testing requirements, and design optimization for different frequencies. Power consumption remains a critical issue, especially in mobile and airborne applications where energy efficiency is prioritized. Manufacturers are under pressure to reduce costs while maintaining performance, pushing them to explore scalable production techniques and advanced chip integration. These constraints create barriers for widespread adoption in cost-sensitive regions, though ongoing research and collaborations are expected to gradually reduce pricing pressures. Cost and efficiency remain central themes shaping procurement decisions globally.

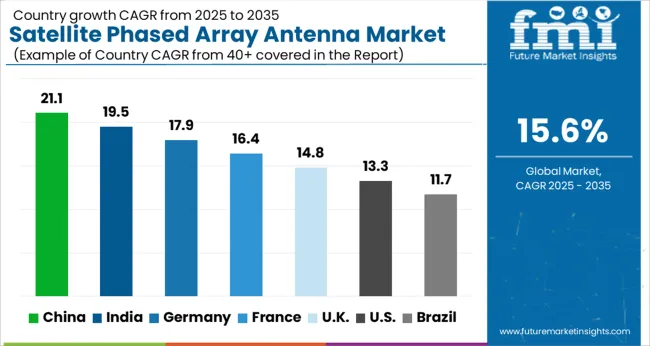

| Country | CAGR |

|---|---|

| China | 21.1% |

| India | 19.5% |

| Germany | 17.9% |

| France | 16.4% |

| UK | 14.8% |

| USA | 13.3% |

| Brazil | 11.7% |

The satellite phased array antenna market is projected to expand globally at a CAGR of 15.6% from 2025 to 2035, fueled by the growing need for high-throughput satellite communication, mobility solutions, and integration with next-generation constellations. China leads with a CAGR of 21.1%, supported by aggressive deployment of low Earth orbit satellites, domestic manufacturing expansion, and strong investment in military-grade phased arrays. India follows at 19.5%, benefiting from government-backed satellite programs, broadband penetration initiatives, and wider adoption in defense and maritime sectors. France posts 16.4%, shaped by European space agency programs and rising adoption in aviation and maritime broadband. The United Kingdom achieves 14.8%, with growth stemming from telecom integration and phased array adoption for global connectivity solutions. The United States records 13.3%, reflecting steady replacement demand, strong aerospace contracts, and phased array integration in defense but restrained by a mature infrastructure base. These country-level trajectories illustrate how Asia-Pacific is driving rapid expansion, Europe maintains balanced growth through aerospace investments, and North America sustains a mature but consistent position, making phased arrays a central component of satellite communication progress.

China’s CAGR for the satellite phased array antenna market stood at 18.6% during 2020–2024 and improved further to 21.1% across 2025–2035, highlighting accelerated expansion. Early performance was influenced by investments in indigenous satellite programs and steady adoption in military-grade applications. The stronger phase reflects massive deployment of low Earth orbit constellations, integration of phased arrays into broadband services, and government-backed space infrastructure investments. Domestic manufacturers have scaled up production capacities, targeting aviation, maritime, and defense sectors simultaneously. By 2035, China is expected to maintain its position as the leading global market, with expansion sustained by state-led initiatives and export opportunities across Asia and Africa.

India’s CAGR for the satellite phased array antenna market was 17.2% between 2020–2024 and rose to 19.5% for 2025–2035, marking accelerated adoption. The earlier period was shaped by initial deployment of phased arrays in defense communication and pilot programs under ISRO satellite launches. Stronger progress in the later phase is attributed to broadband expansion initiatives, defense modernization, and maritime adoption, which collectively pushed demand. Indigenous manufacturers have benefitted from favorable policy frameworks, while private players entered partnerships to integrate phased arrays in telecom backhaul solutions. India’s growing demand for space-based communication makes it one of the fastest-expanding regions.

France’s CAGR for the satellite phased array antenna market stood at 14.9% during 2020–2024 and moved upward to 16.4% between 2025–2035, showing steady progression. The earlier period reflected gradual integration of phased arrays in defense communication programs and aerospace projects. Growth gained more strength later with European Space Agency-backed initiatives, aviation broadband expansion, and deployment in maritime connectivity solutions. French manufacturers have invested in phased array compatibility with commercial and defense-grade satellites, which strengthened market penetration. NATO obligations and EU defense programs have also provided additional growth stimuli, ensuring France remains a vital hub for European satellite communication infrastructure.

The United Kingdom’s CAGR for the satellite phased array antenna market recorded 13.2% in 2020–2024 and increased to 14.8% during 2025–2035, highlighting a stronger trajectory. The earlier phase reflected steady procurement linked to telecom trials and defense testing programs. The rise in the following years is explained by higher investment in satellite broadband expansion, integration of phased arrays into 5G networks, and NATO-driven military modernization initiatives. Aerospace applications and aviation broadband adoption further supported the increase, while private telecom companies also accelerated trials. The UK’s improved growth outlook reflects its strategic position as a European technology hub.

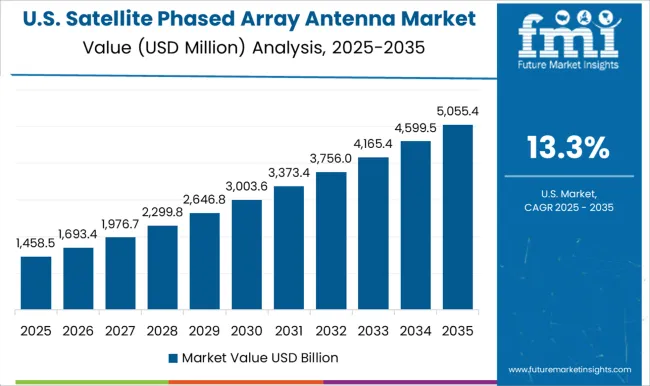

The United States posted a CAGR of 12.1% during 2020–2024 and rose moderately to 13.3% for 2025–2035, reflecting a mature but stable market. Early years were defined by replacement-driven procurement cycles and gradual adoption in commercial aviation and defense programs. The increase in the following period is linked to integration of phased arrays in high-throughput satellites, greater demand for in-flight broadband, and phased array upgrades in defense projects such as secure battlefield networks. While expansion remains slower than Asia, the USA continues to command influence due to established aerospace infrastructure and steady adoption of phased arrays across multiple domains.

The satellite phased array antenna market is defined by participation from leading defense contractors, aerospace firms, and antenna technology specialists working to deliver high-performance, electronically steered solutions for military and commercial applications. Northrop Grumman plays a pivotal role with its phased array radar expertise, advancing defense and space communication platforms. Raytheon Technologies (RTX) focuses on multi-mission antenna systems, offering integration of secure communication and electronic defense capabilities across satellite programs. Thales Group has strengthened its position in Europe through phased array adoption in defense satellites, secure broadband communication, and aerospace networks. Lockheed Martin contributes by embedding phased array systems in military satellite constellations, enhancing secure data links and resilient communication frameworks. Kymeta has emerged as a disruptive player in electronically steered flat-panel antennas, targeting commercial broadband, connected vehicles, and maritime communication solutions.

Honeywell delivers phased array antennas integrated with aviation broadband and satellite communication platforms, supporting both defense and commercial aviation markets. These companies differentiate through expertise in defense-driven satellite programs, material innovation, and integration of phased arrays into evolving satellite constellations. Strategic advantages are being pursued through international defense contracts, commercial broadband partnerships, and technology collaborations, positioning them as central players in the long-term growth of phased array antenna deployment.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 billion |

| Component | Transmit/receive (T/R) modules, Microcontrollers / microprocessors, Field programmable gate arrays (FPGAs), Power amplifiers (PAs), Low noise amplifiers (LNAs), Phase shifters, and Others |

| Array Type | Active phased array and Passive phased array |

| Application | Satellite communication, Radar & sensing, Navigation & tracking, Mobile connectivity, Earth observation, Electronic warfare, and Others |

| End Use | Defense & security, Commercial, and Research & academic institutions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Northrop Grumman, Raytheon Technologies (RTX), Thales Group, Lockheed Martin, Kymeta, and Honeywell |

| Additional Attributes | Dollar sales, share, competitive landscape, regional adoption, defense contracts, commercial broadband growth, material innovations, and technology integration trends shaping long-term demand. |

The global satellite phased array antenna market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the satellite phased array antenna market is projected to reach USD 9.4 billion by 2035.

The satellite phased array antenna market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in satellite phased array antenna market are transmit/receive (t/r) modules, microcontrollers / microprocessors, field programmable gate arrays (fpgas), power amplifiers (pas), low noise amplifiers (lnas), phase shifters and others.

In terms of array type, active phased array segment to command 64.0% share in the satellite phased array antenna market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Satellite Ground Station Market Trends – Growth & Forecast 2024-2034

Satellite Launch Vehicle Market Trends – Growth & Forecast 2024-2034

Satellite Antenna Market

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

LEO Satellite Market Size and Share Forecast Outlook 2025 to 2035

UAV Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA