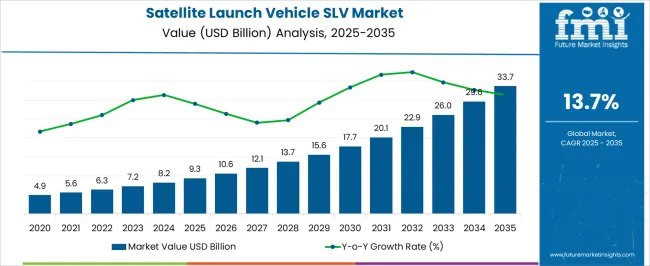

The Satellite Launch Vehicle (SLV) Market is estimated to be valued at USD 9.3 billion in 2025 and is projected to reach USD 33.7 billion by 2035, registering a compound annual growth rate (CAGR) of 13.7% over the forecast period. A Saturation Point Analysis highlights key phases of acceleration and market maturity. Between 2025 and 2030, the market grows from USD 9.3 billion to USD 15.6 billion, contributing USD 6.3 billion in growth, with a CAGR of 11.5%. This period reflects a phase of strong growth, driven by increasing demand for satellite launches, especially for communication, defense, and Earth observation purposes.

The market benefits from technological advancements, reduced launch costs, and increased accessibility to space. From 2030 to 2035, the market continues its growth trajectory, moving from USD 15.6 billion to USD 33.7 billion, contributing USD 18.1 billion in growth, with a CAGR of 17.3%. This sharp increase indicates a phase of acceleration, supported by the development of reusable launch technologies, greater participation from private companies, and expanding demand for satellite-based services globally. The higher growth rate in the second half of the period shows the market moving closer to its saturation point, where competition and innovation drive expansion. While the growth rate starts to slow down as the market matures, demand for satellite launches remains strong, leading to continued growth through 2035.

| Metric | Value |

|---|---|

| Satellite Launch Vehicle (SLV) Market Estimated Value in (2025 E) | USD 9.3 billion |

| Satellite Launch Vehicle (SLV) Market Forecast Value in (2035 F) | USD 33.7 billion |

| Forecast CAGR (2025 to 2035) | 13.7% |

SpaceX, Arianespace, Blue Origin, Boeing Defense, Space & Security, Firefly Aerospace, ISRO (Indian Space Research Organisation), Lockheed Martin Corporation, Mitsubishi Heavy Industries, Ltd., Northrop Grumman Corporation, Relativity Space, Rocket Factory Augsburg (RFA), Rocket Lab USA, Inc., United Launch Alliance (ULA), Vast Space (acquired Virgin Orbit assets)The satellite launch vehicle market is undergoing transformative growth, driven by expanding global demand for satellite-based connectivity, earth observation, and defense applications. Increased deployment of satellite constellations by commercial players, alongside rising investments in space exploration by national space agencies, is reshaping launch dynamics.

The market is benefiting from the shift toward reusable launch systems, fuel-efficient propulsion technologies, and private-sector innovation in modular vehicle design. Strategic collaborations between governments and private aerospace firms have accelerated technology validation and launch frequency.

Moreover, regulatory reforms enabling commercial launch operations and streamlined licensing are encouraging new entrants, particularly in low-cost access-to-space segments. The emergence of launch-on-demand services and miniaturized payload ecosystems is expected to drive sustained demand for launch vehicles across varied weight classes and orbital missions.

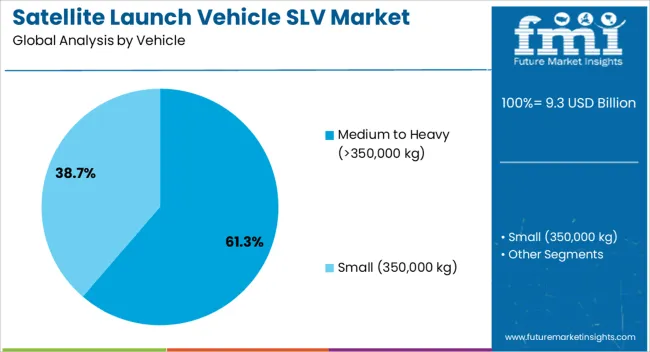

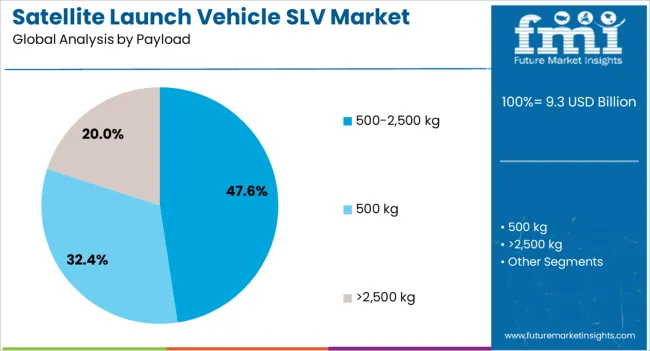

The satellite launch vehicle (SLV) market is segmented by vehicle, payload, object, launch, stagesubsystem, and geographic regions. The satellite launch vehicle (SLV) market is divided into Medium to Heavy (>350,000 kg) and Small (350,000 kg). In terms of payload, the satellite launch vehicle (SLV) market is classified into 500-2,500 kg, 500 kg, and >2,500 kg.

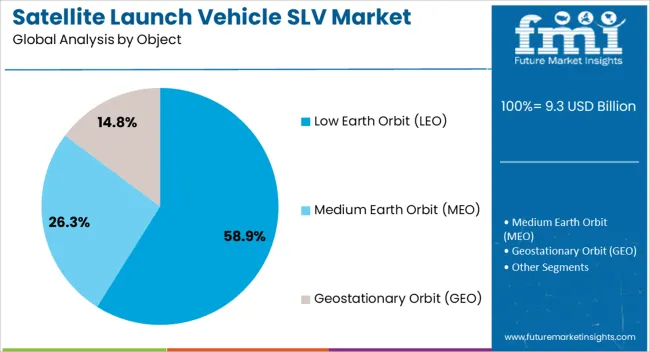

Based on the object, the satellite launch vehicle (SLV) market is segmented into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO). By launch, the satellite launch vehicle (SLV) market is segmented into Single-Use Expendable and Reusable. By stage, the satellite launch vehicle (SLV) market is segmented into two-stage, single-stage, and three-stage.

By subsystem, the satellite launch vehicle (SLV) market is segmented into Propulsion Systems, Structure, Guidance, Navigation & Control Systems, Telemetry, Tracking & Command Systems, Electrical Power Systems, and Separation Systems. Regionally, the satellite launch vehicle (SLV) industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The medium to heavy vehicle category is projected to account for 61.30% of the satellite launch vehicle market revenue in 2025, establishing it as the dominant vehicle segment. This leadership is being reinforced by its capability to deliver multiple or large payloads across diverse orbits in a single mission.

These vehicles offer improved cost-per-kilogram economics and have been preferred for deploying large satellite constellations and complex government payloads. Enhanced thrust capacity, modular integration features, and compatibility with both expendable and partially reusable designs have strengthened adoption.

As commercial satellite projects scale up in quantity and weight, medium to heavy SLVs are being prioritized for their mission versatility, reliability, and global launch readiness.

Payloads in the 500–2,500 kg range are expected to hold 47.60% of the SLV market revenue share in 2025, making it the leading payload class. Growth in this segment is being propelled by rising deployment of medium-sized communication satellites, navigation payloads, and high-resolution imaging systems.

This weight category supports optimal launch economics and is well-suited for both commercial and defense missions, particularly those requiring higher performance without the bulk of heavier geosynchronous payloads. The ability to accommodate varied satellite form factors and maintain compatibility with multiple launch platforms has boosted adoption.

Ongoing developments in satellite miniaturization, combined with mission-specific configurations, are further expanding launch frequency in this payload bracket.

Low Earth Orbit (LEO) is anticipated to lead the SLV market with a 58.90% revenue share in 2025. This segment’s strength is attributed to LEO’s strategic advantages such as lower latency, shorter orbital periods, and lower launch costs compared to higher altitude orbits.

It has become the preferred orbit for broadband constellations, earth observation missions, and experimental payload testing. The rapid proliferation of LEO-focused satellite programs by both startups and established aerospace companies has increased launch cadence, thereby favoring SLVs optimized for LEO missions.

Advances in propulsion control, mission agility, and rapid deployment capabilities are further reinforcing demand for LEO-targeted launch solutions.

The satellite launch vehicle (SLV) market is experiencing growth driven by increasing demand for satellite launches in sectors such as communications, earth observation, and navigation. SLVs are crucial for carrying payloads into space, with advancements in vehicle design, propulsion technology, and cost-effective solutions driving the sector. The growing commercial space industry and space exploration initiatives, along with rising government and private investments in satellite technology, are further accelerating market expansion. Despite challenges like high launch costs and regulatory hurdles, there are significant opportunities in miniaturized satellite payloads and emerging markets.

The increasing demand for satellite launches in commercial, governmental, and scientific sectors is a significant driver for the growth of the satellite launch vehicle market. Satellites play a vital role in modern communication, earth observation, and navigation systems. With the growing need for enhanced communication networks, climate monitoring, and global positioning, the demand for satellite launches is expected to rise.The expansion of space exploration missions by both government space agencies and private entities is driving the need for reliable and cost-efficient launch vehicles. The increasing miniaturization of satellites, particularly small satellite constellations, is contributing to the demand for launch vehicles capable of delivering these payloads into space, further boosting market growth.

One of the key challenges in the satellite launch vehicle market is the high cost associated with launching satellites into space. Developing and manufacturing SLVs involves significant investment in research, development, and infrastructure, which translates into high launch costs. These costs can be a barrier for smaller companies or emerging space agencies with limited budgets.

Regulatory hurdles such as licensing requirements, safety regulations, and coordination with space agencies and international bodies complicate the process of launching vehicles. The complexity of ensuring compliance with safety and environmental regulations, along with the need for space traffic management, adds to the challenges. Overcoming these financial and regulatory constraints is critical to the long-term growth and scalability of the SLV market.

The satellite launch vehicle market presents significant opportunities with the rise of small satellite constellations and the growing commercialization of space. The demand for small and medium-sized satellites, used for communication, Earth observation, and internet services, is rapidly increasing. These smaller payloads require more affordable and frequent launch options, which creates a market for dedicated small satellite launch vehicles. Additionally, the growing involvement of private companies in the space industry, such as SpaceX and Blue Origin, is driving competition and innovation in the SLV sector. The development of reusable launch vehicles and cost-effective solutions offers further growth opportunities. As more private companies and government entities expand their space programs, the market for satellite launch vehicles continues to expand, offering new avenues for investment and technological development.

A key trend in the satellite launch vehicle market is the increasing development of reusable launch vehicles. Companies like SpaceX and Rocket Lab are pioneering the use of reusable boosters, which reduce the cost of launching satellites by allowing vehicles to be refurbished and reused for multiple missions. This technology is significantly reducing the cost per launch, making space access more affordable for a broader range of customers. Furthermore, advancements in propulsion technologies, such as the development of electric propulsion systems and hybrid engines, are improving the efficiency and performance of SLVs. These innovations are making it possible to carry heavier payloads, increase launch frequencies, and enhance the overall reliability of launch vehicles, driving further adoption in both commercial and governmental sectors.

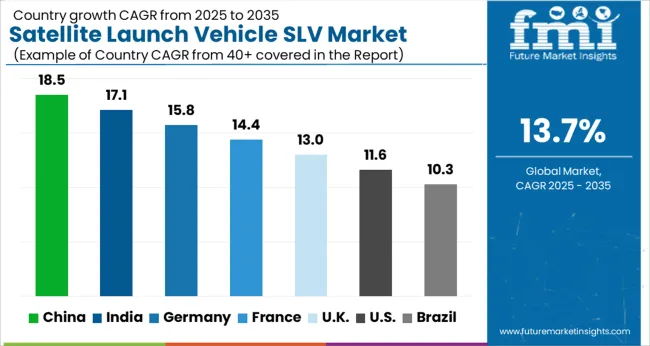

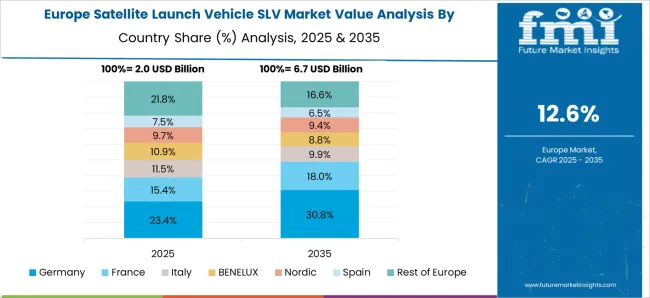

The satellite launch vehicle (SLV) market is projected to grow at a global CAGR of 13.7% from 2025 to 2035. China leads with a CAGR of 18.5%, followed by India at 17.1%, and Germany at 15.8%. The United Kingdom records 13.0%, while the United States stands at 11.6%. The increasing demand for satellite communication, Earth observation, and space exploration is propelling growth in these markets. China and India lead the growth in BRICS nations, supported by their growing space exploration programs and government-backed space initiatives. In contrast, OECD countries such as Germany, the UK, and the USA show steady growth, driven by the demand for advanced satellite deployment solutions and space missions. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 18.5% through 2035, supported by the country's ambitious space exploration goals and significant government investments in space infrastructure. China’s space program, led by the China National Space Administration (CNSA), has made major strides in satellite development and launch capabilities. The country’s growing need for satellite-based applications, including communication, Earth observation, and weather forecasting, is driving the demand for advanced satellite launch vehicles. As China intensifies its efforts in space missions, including manned missions and interplanetary exploration, the demand for SLVs is expected to rise significantly.

India is projected to grow at a CAGR of 17.1% through 2035, with a robust demand for satellite launch vehicles driven by the country’s expanding space program. The Indian Space Research Organisation (ISRO) plays a significant role in developing and launching satellites, with a growing number of commercial and scientific satellite missions. India’s focus on enhancing space exploration capabilities, including the launch of satellites for telecommunications, remote sensing, and navigation, is fueling the market for SLVs. Additionally, the increasing participation of private players in India’s space industry and advancements in satellite technology are expected to further accelerate market growth.

Germany is projected to grow at a CAGR of 15.8% through 2035, supported by the country’s expanding space exploration initiatives. As Europe’s space hub, Germany plays a pivotal role in satellite development and deployment, with its space agency, the German Aerospace Center (DLR), supporting the growth of the space industry. The increasing demand for satellites in telecommunications, defense, and Earth observation, along with the country’s focus on building robust space infrastructure, drives the market for satellite launch vehicles. Furthermore, Germany’s strategic partnerships within the European Space Agency (ESA) enhance its capabilities in space missions.

The United Kingdom is projected to grow at a CAGR of 13.0% through 2035, with demand for satellite launch vehicles driven by the UK’s growing space industry. The country’s emphasis on space technology innovation, particularly in commercial satellite launches and small satellite applications, accelerates market growth. The UK government’s push to support space exploration programs and private sector participation contributes to increased demand for satellite launch vehicles. Moreover, the UK’s strategic partnerships with global space agencies and its burgeoning spaceports infrastructure further boost the country’s position in the satellite launch vehicle market.

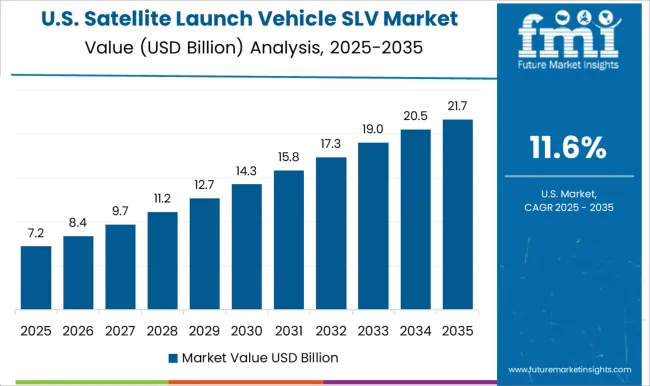

The United States is projected to grow at a CAGR of 11.6% through 2035, with increasing demand for satellite launch vehicles driven by the nation’s robust space industry. The USA has a well-established space exploration program, with the National Aeronautics and Space Administration (NASA) and private companies like SpaceX playing crucial roles in advancing satellite launch technologies. The growing need for satellite communications, defense applications, and space exploration missions is expected to drive SLV demand. Additionally, advancements in reusable rocket technology and increased commercial satellite launches further contribute to the market’s growth in the USA

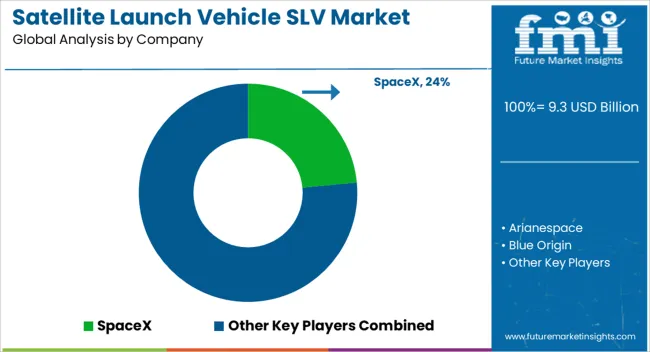

The satellite launch vehicle (SLV) market is led by prominent players specializing in space exploration and satellite launch services. SpaceX is the clear market leader, revolutionizing the space industry with its Falcon and Starship rockets, which emphasize reusability, cost-efficiency, and frequent launches. SpaceX’s advanced technology and low-cost solutions have made it a preferred choice for both commercial and government satellite launches.

Arianespace, a European leader, offers Ariane, Vega, and Soyuz rockets, providing highly reliable satellite launch services for international clients. The company is recognized for its proven track record in launching heavy payloads into orbit. Blue Origin focuses on reusable rocket technology, with its New Shepard and New Glenn rockets designed for orbital satellite deployment and space tourism. Boeing Defense, Space & Security and Lockheed Martin Corporation are key players with their Atlas V and Delta IV launch vehicles, which cater to both military and commercial satellite missions. These companies emphasize high reliability and performance, particularly for defense and government customers. ISRO provides affordable and reliable satellite launch services with its PSLV and GSLV vehicles, especially for emerging space markets. Mitsubishi Heavy Industries, Ltd. and Northrop Grumman Corporation offer dependable and innovative satellite launch solutions, focusing on governmental and international clients. Emerging companies such as Relativity Space, Firefly Aerospace, Rocket Lab USA, and Virgin Orbit are targeting the growing small satellite market, offering cost-effective, rapid, and flexible solutions for smaller payloads.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 Billion |

| Vehicle | Medium to Heavy (>350,000 kg) and Small (350,000 kg) |

| Payload | 500-2,500 kg, 500 kg, and >2,500 kg |

| Object | Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO) |

| Launch | Single-Use Expendable and Reusable |

| Stage | Two Stage, Single Stage, and Three Stage |

| Subsystem | Propulsion Systems, Structure, Guidance, Navigation & Control Systems, Telemetry, Tracking & Command Systems, Electrical Power Systems, and Separation Systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SpaceX, Arianespace, Blue Origin, Boeing Defense, Space & Security, Firefly Aerospace, ISRO (Indian Space Research Organisation), Lockheed Martin Corporation, Mitsubishi Heavy Industries, Ltd., Northrop Grumman Corporation, Relativity Space, Rocket Factory Augsburg (RFA), Rocket Lab USA, Inc., United Launch Alliance (ULA), and Virgin Orbit |

| Additional Attributes | Dollar sales by vehicle type (reusable, expendable) and end-use segments (commercial, government, military, small satellite). Demand dynamics are driven by the increasing need for satellite communications, space exploration missions, and the growing small satellite market. Regional trends show strong growth in North America and Europe, with increasing satellite launch activity in Asia-Pacific, driven by the growth of private space companies and space programs. |

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Satellite Ground Station Market Trends – Growth & Forecast 2024-2034

Satellite Antenna Market

Satellite Launch Vehicle Market Trends – Growth & Forecast 2024-2034

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

LEO Satellite Market Size and Share Forecast Outlook 2025 to 2035

UAV Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA