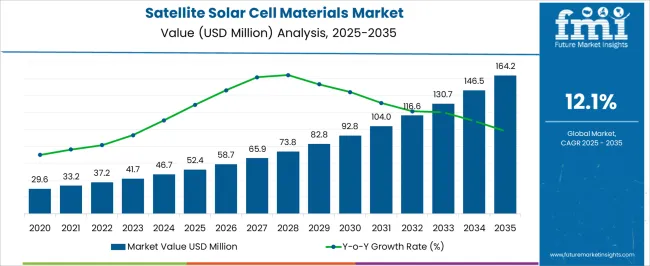

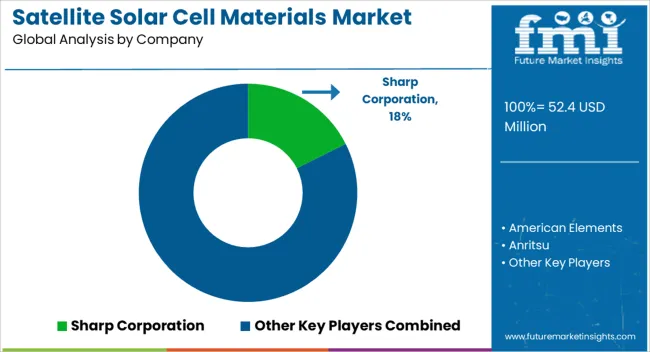

The satellite solar cell materials market is estimated to be valued at USD 52.4 million in 2025 and is projected to reach USD 164.2 million by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period.

The year-on-year rise from USD 52.4 million in 2025 to USD 82.8 million in 2029 demonstrates steady acceleration. Growth during this stage is shaped by rising demand for high-efficiency solar cells in satellite manufacturing, where durability, lightweight properties, and energy conversion efficiency are critical. With commercial satellite launches increasing and defense applications expanding, the need for advanced solar cell materials is reinforcing this consistent upward curve. Between 2025 and 2030, the growth pattern highlights the role of innovation and rising satellite deployments in driving material demand. As satellite operators seek longer mission life and improved power generation in orbit, the choice of solar cell materials becomes increasingly decisive.

This steady progression underscores how manufacturers are responding with materials engineered for high radiation resistance and superior thermal stability. The transition from USD 65.9 million in 2027 to USD 92.8 million in 2030 illustrates a strong adoption curve, with opportunities spreading across commercial communication, earth observation, and scientific missions. The trajectory signals a clear pathway of expansion, with stakeholders positioned to benefit from growing satellite activity and the pressing need for more efficient power generation in space systems.

| Metric | Value |

|---|---|

| Satellite Solar Cell Materials Market Estimated Value in (2025 E) | USD 52.4 million |

| Satellite Solar Cell Materials Market Forecast Value in (2035 F) | USD 164.2 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

The satellite solar cell materials market occupies a focused yet strategically important share across multiple broader industries, with its relevance concentrated in high-performance applications. Within the space-based solar power market, satellite solar cell materials contribute nearly 20%, reflecting their indispensable role in harnessing solar energy for orbital platforms. In the satellite components and subsystems market, their share is about 12%, as solar cells serve as the primary energy source for communication, navigation, and Earth observation satellites. Within the aerospace materials market, satellite solar cell materials account for approximately 6%, representing a specialized but vital segment where lightweight, radiation-resistant, and high-efficiency materials are prioritized. In the photovoltaic materials market, their share is more limited at close to 4%, as terrestrial applications dominate, yet satellite-grade solar cells remain a distinct premium niche.

Finally, in the defense and space technology market, satellite solar cell materials hold around 8%, underlining their importance in powering military satellites, reconnaissance systems, and space defense infrastructure. Collectively, these percentages highlight that while satellite solar cell materials form a relatively small slice of large industries such as aerospace and photovoltaics, their critical role in space-based energy generation secures higher shares in satellite-specific and defense-driven segments. This positioning underscores their value as a specialized material class, essential for the reliability, performance, and longevity of orbital assets.

The satellite solar cell materials market is expanding rapidly, driven by increased satellite deployment for communications, defense, weather monitoring, and earth observation. Rising investments in space programs from both government and private sectors have accelerated demand for lightweight, durable, and high-efficiency solar materials.

These materials are crucial for optimizing satellite energy output and reducing launch costs. Innovations in thin-film technology, radiation resistance, and thermal stability have made premium solar materials more viable for long-duration missions.

Additionally, as satellite constellations grow in number and complexity, material efficiency and lifecycle performance are becoming critical differentiators in the supply chain. Favorable aerospace policies and a robust pipeline of satellite launches are expected to support sustained growth in this sector.

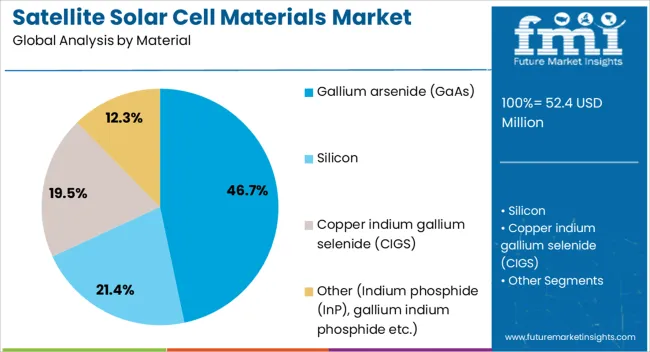

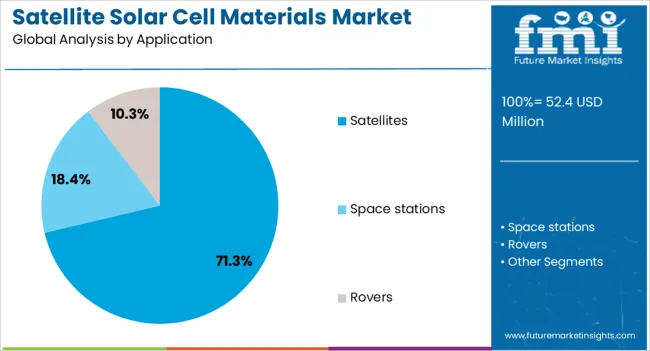

The satellite solar cell materials market is segmented by material, application, and geographic regions. By material, satellite solar cell materials market is divided into gallium arsenide (GaAs), silicon, copper indium gallium selenide (CIGS), and other (Indium phosphide (InP), gallium indium phosphide etc.). In terms of application, satellite solar cell materials market is classified into satellites, space stations, and rovers. Regionally, the satellite solar cell materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Gallium arsenide (GaAs) is projected to dominate the materials segment with a 46.70% share in 2025. Its high efficiency, superior radiation resistance, and performance under high-temperature conditions make it ideal for satellite applications. Unlike silicon, GaAs cells retain power output more effectively in space environments with extreme conditions. The ability to support multi-junction architectures enhances its relevance in missions demanding high energy density within compact areas. With the proliferation of high-throughput satellites and interplanetary missions, demand for GaAs continues to outpace that for conventional alternatives. Technological improvements in deposition processes and cost-reduction strategies have further reinforced its position as the go-to material for premium satellite applications.

The satellites segment is expected to lead the application category with a 71.30% market share in 2025. This dominance stems from the steady increase in satellite launches for navigation, surveillance, climate observation, and telecommunications. Solar cells are integral to powering satellite systems in orbit where maintenance is impossible, demanding extremely reliable materials. Satellite operators prioritize energy solutions that offer long-term efficiency, minimal degradation, and reduced mass, requirements well met by the latest material innovations. With countries scaling up their low-earth orbit (LEO) constellations and exploratory missions, the demand for advanced solar cell materials in this segment is set to remain exceptionally strong.

The satellite solar cell materials market is expanding as reliance on satellites for communications, navigation, and defense grows globally. Opportunities are increasing with large commercial constellations and deep-space missions, while trends emphasize multi-junction efficiency, lightweight composites, and radiation-resistant designs. Challenges remain in cost barriers, material sourcing, and supply chain resilience. In my opinion, long-term competitiveness will favor manufacturers that combine innovation with cost-effective production, positioning them to meet rising demand from both government and commercial satellite operators worldwide.

Demand for satellite solar cell materials has been reinforced by the growing reliance on satellites for communication, navigation, earth observation, and defense operations. High-efficiency materials such as gallium arsenide and multi-junction solar cells are preferred for their superior energy conversion and durability in harsh orbital environments. With satellite constellations expanding rapidly, the need for reliable and lightweight solar cell materials is intensifying. In my opinion, demand will continue to grow as global space programs and commercial satellite operators prioritize long-lasting, high-output energy solutions.

Opportunities are increasing in commercial satellite constellations for broadband internet, earth monitoring, and defense applications. Companies deploying large fleets of low-earth orbit (LEO) satellites are creating high-volume requirements for solar cell materials. Space agencies are also funding exploratory missions that demand advanced solar technologies capable of powering deep-space probes. I believe suppliers that provide cost-efficient, high-performance solar cell materials with consistent reliability will capture substantial opportunities, particularly as the commercial satellite sector grows beyond traditional government-driven missions and creates scalable procurement needs.

Trends in this market highlight adoption of multi-junction solar cells and lightweight composites that maximize efficiency while minimizing payload mass. Thin-film technologies are also gaining traction due to their flexibility and adaptability for compact satellite designs. Research collaborations are focusing on improving radiation resistance and operational lifespans of solar materials. In my opinion, these trends illustrate a decisive industry movement toward performance optimization, where innovation in efficiency and weight reduction will define competitive advantages for satellite solar cell material manufacturers worldwide.

Challenges include the high costs associated with manufacturing advanced solar cell materials, particularly gallium arsenide and multi-junction types. Supply chain constraints for rare materials, along with quality consistency requirements, further complicate production. Smaller satellite operators often struggle with affordability, limiting adoption outside of large-scale programs. In my assessment, only suppliers with strong upstream integration, reliable sourcing, and scalable production capacity will overcome these hurdles, while others may face difficulty competing in a market where performance and cost efficiency are equally critical.

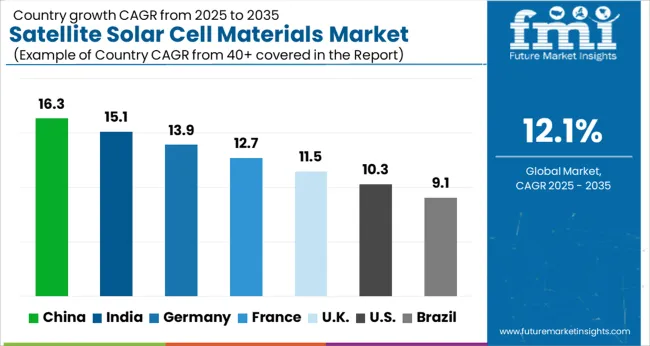

| Country | CAGR |

|---|---|

| China | 16.3% |

| India | 15.1% |

| Germany | 13.9% |

| France | 12.7% |

| UK | 11.5% |

| USA | 10.3% |

| Brazil | 9.1% |

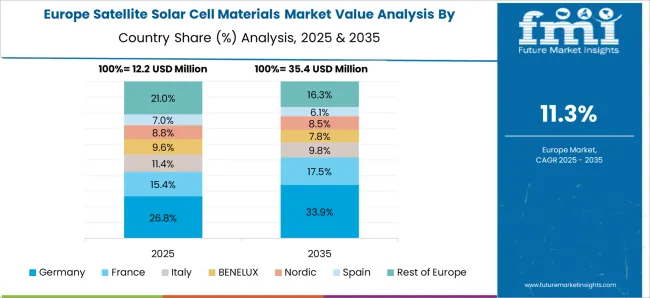

The global satellite solar cell materials market is projected to grow at a CAGR of 12.1% from 2025 to 2035. China leads with a growth rate of 16.3%, followed by India at 15.1%, and France at 12.7%. The United Kingdom records a growth rate of 11.5%, while the United States shows the slowest growth at 10.3%. Expansion is driven by the surge in satellite launches for communication, navigation, and Earth observation, alongside increasing investments in space exploration and defense applications. Emerging markets such as China and India are accelerating through government-backed programs and growing private space ecosystems, while developed economies like the USA, UK, and France emphasize high-efficiency solar materials, durability under radiation, and long-term performance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The satellite solar cell materials market in China is projected to grow at a CAGR of 16.3%. The rapid increase in satellite launches, both for defense and commercial purposes, is fueling adoption of high-performance solar materials. Chinese manufacturers are focusing on gallium arsenide (GaAs) and multi-junction solar cells to improve efficiency and resilience in space environments. The government’s significant investments in satellite constellations and lunar exploration programs are supporting strong growth. Collaborations between state-owned enterprises and private companies are further enhancing innovation and scaling up production.

The satellite solar cell materials market in India is expected to grow at a CAGR of 15.1%. The Indian Space Research Organisation (ISRO) is a primary driver of demand, supported by frequent satellite launches for communication, navigation, and Earth observation. The country’s focus on cost-effective satellite development has boosted interest in reliable and efficient solar materials. Domestic manufacturing capacity is expanding, with collaborations between public research institutions and private players. India’s increasing participation in global space missions and international satellite launch services is further enhancing demand for high-quality solar cell materials.

The satellite solar cell materials market in France is projected to grow at a CAGR of 12.7%. France’s strong aerospace sector, driven by CNES and collaborations with the European Space Agency (ESA), underpins growth. The country is investing in advanced solar materials such as triple-junction cells to support long-duration space missions. Demand is also supported by growing commercial satellite operations and defense-related space applications. France’s focus on research, combined with established aerospace companies, ensures innovation in durability, efficiency, and integration of solar cell materials into satellite systems.

The satellite solar cell materials market in the UK is projected to grow at a CAGR of 11.5%. Growth is driven by the expansion of commercial satellite services and the country’s investments in space technology. The UK is focusing on partnerships with international space agencies and private companies to strengthen its position in the space supply chain. Demand for lightweight, radiation-resistant solar materials is rising as more satellites are designed for communication, defense, and scientific missions. The development of small-satellite programs and nanosatellites is also fueling adoption of innovative solar materials.

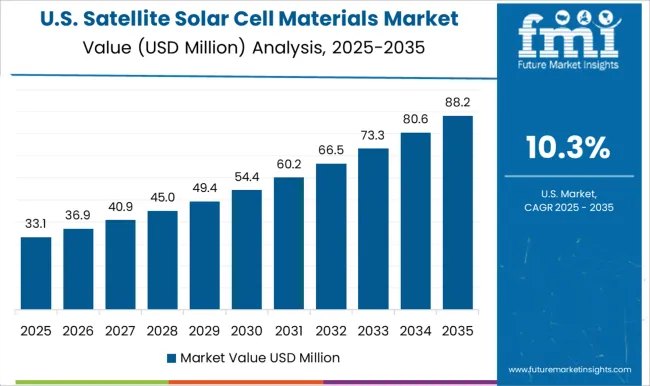

The satellite solar cell materials market in the USA is projected to grow at a CAGR of 10.3%. Although slower than emerging economies, the USA remains a global leader in advanced space technologies. NASA, SpaceX, and other aerospace companies are heavily investing in next-generation solar materials to improve efficiency and withstand harsh radiation environments. Defense applications and satellite constellations for communication and Earth monitoring further sustain demand. With strong R&D capabilities and private sector innovation, the USA market continues to focus on multi-junction solar cells, lightweight composites, and high-reliability designs for long-duration missions.

Competition in satellite solar cell materials is anchored in semiconductor purity, efficiency optimization, and aerospace-grade reliability. Sharp Corporation and CESI lead with high-efficiency multi-junction solar cells widely adopted in commercial and defense satellites. Sumitomo Electric and Freiberger Compound Materials supply gallium arsenide and germanium substrates, ensuring the performance foundation for advanced photovoltaic assemblies. Stanford Advanced Materials and Wafer World specialize in wafers and precision cuts, providing critical input for cell fabrication. American Elements and Western Minmetals supply rare earths, indium, and specialty alloys that strengthen the upstream supply chain. Logitech supports manufacturing with precision polishing and wafer preparation systems, adding value to material consistency. This mix highlights a chain of integrated manufacturers and niche suppliers, each competing to deliver reliability under the extreme conditions of orbit.

Strategies emphasize performance margins and compliance with space-grade requirements. Sharp and CESI promote their cells’ conversion efficiency and flight heritage, appealing to mission planners prioritizing durability and energy density. Substrate producers like Freiberger and Sumitomo Electric compete on wafer quality, doping precision, and defect control, often highlighted in datasheets and brochures. Specialty providers such as American Elements and Western Minmetals focus on secure sourcing of high-purity elements, critical for aerospace programs seeking material resilience. Marketing collateral frequently stresses radiation hardness, thermal stability, and compatibility with satellite integration systems. Visuals present cross-sections of multi-junction structures, efficiency graphs, and qualification test results under simulated orbital conditions. By combining technical rigor with proof of in-orbit performance, brochures position these materials as indispensable components that safeguard mission reliability while extending the operational lifespan of satellites across commercial, defense, and scientific deployments.

| Item | Value |

|---|---|

| Quantitative Units | USD 52.4 million |

| Material | Gallium arsenide (GaAs), Silicon, Copper indium gallium selenide (CIGS), and Other (Indium phosphide (InP), gallium indium phosphide etc.) |

| Application | Satellites, Space stations, and Rovers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sharp Corporation, American Elements, CESI, Freiberger Compound Materials GmbH, Logitech, Stanford Advanced Materials, Sumitomo Electric, Wafer World, Western Minmetals (SC) Corporation, American Elements, and Sumitomo Electric |

| Additional Attributes | Dollar sales by material type (monocrystalline silicon, polycrystalline silicon, multi-junction cells), Dollar sales by application (LEO satellites, MEO satellites, GEO satellites), Trends in lightweight and high-efficiency solar technology, Use in power generation for communication and defense satellites, Growth in commercial satellite launches, Regional manufacturing clusters in North America, Europe, and Asia-Pacific. |

The global satellite solar cell materials market is estimated to be valued at USD 52.4 million in 2025.

The market size for the satellite solar cell materials market is projected to reach USD 164.2 million by 2035.

The satellite solar cell materials market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in satellite solar cell materials market are gallium arsenide (gaas), silicon, copper indium gallium selenide (cigs) and other (indium phosphide (inp), gallium indium phosphide etc.).

In terms of application, satellites segment to command 71.3% share in the satellite solar cell materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Satellite Ground Station Market Trends – Growth & Forecast 2024-2034

Satellite Launch Vehicle Market Trends – Growth & Forecast 2024-2034

Satellite Antenna Market

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

LEO Satellite Market Size and Share Forecast Outlook 2025 to 2035

UAV Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA