The satellite launch vehicle market is expanding steadily as global demand for satellite-based communication, navigation, and Earth observation systems continues to rise. Market momentum is being driven by increasing government investments in space exploration, growing participation of private aerospace firms, and technological advancements that enhance payload capacity and launch efficiency. Current developments reflect a strategic shift toward cost-effective, reusable launch systems that optimize mission frequency and reduce turnaround times.

The integration of digital monitoring and advanced propulsion technologies is improving performance reliability and operational safety. Future growth is expected to be supported by rapid satellite constellation deployments, expanding defense applications, and increasing commercial interest in broadband and imaging satellites.

The overall market outlook remains positive as infrastructure modernization, cross-border partnerships, and evolving mission requirements continue to reinforce the need for diverse launch capabilities Sustained innovation, combined with favorable regulatory frameworks and growing private capital inflow, is anticipated to position the industry for long-term scalability and competitiveness.

| Metric | Value |

|---|---|

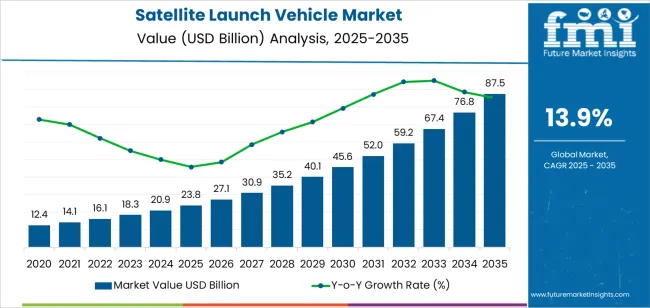

| Satellite Launch Vehicle Market Estimated Value in (2025 E) | USD 23.8 billion |

| Satellite Launch Vehicle Market Forecast Value in (2035 F) | USD 87.5 billion |

| Forecast CAGR (2025 to 2035) | 13.9% |

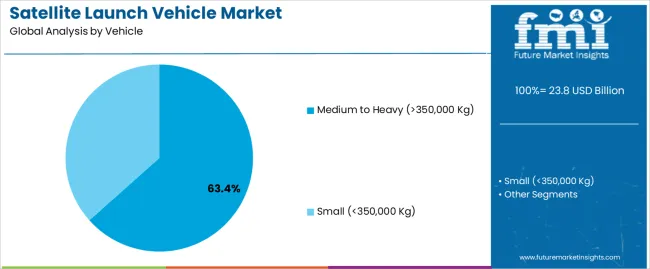

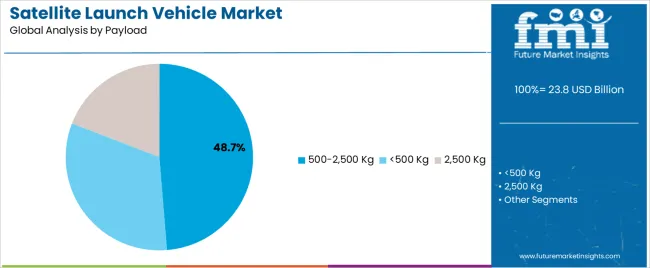

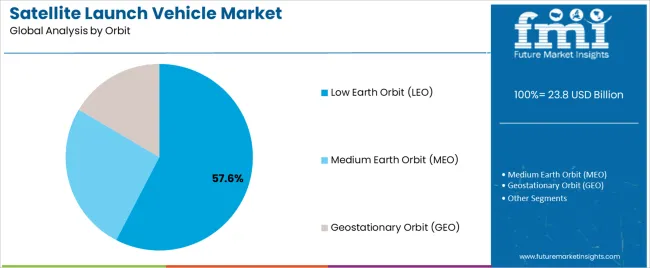

The market is segmented by Vehicle, Payload, Orbit, Launch, Stage, and SubSystem and region. By Vehicle, the market is divided into Medium to Heavy (>350,000 Kg) and Small (<350,000 Kg). In terms of Payload, the market is classified into 500-2,500 Kg, <500 Kg, and 2,500 Kg. Based on Orbit, the market is segmented into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO). By Launch, the market is divided into Reusable and Single-Use/Expendable. By Stage, the market is segmented into Two Stage, Single Stage, and Three Stage. By SubSystem, the market is segmented into Propulsion System, Structure, Guidance, Navigation & Control System, Telemetry, Tracking & Command System, Electrical Power System, and Separation System. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

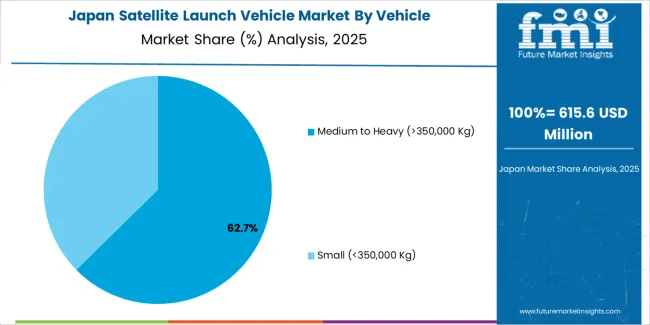

The medium to heavy vehicle segment, representing 63.40% of the vehicle category, has emerged as the dominant class due to its ability to carry higher payload capacities exceeding 350,000 kg. Its market leadership is being reinforced by consistent demand from national space agencies and large commercial satellite operators.

High mission reliability, scalability, and suitability for multiple satellite deployments have strengthened the preference for these vehicles. Continuous advancements in propulsion systems and material engineering have improved fuel efficiency and structural resilience.

The growing use of modular configurations and partially reusable designs has further enhanced cost optimization and mission flexibility As satellite networks expand and mission complexity increases, medium to heavy launch vehicles are expected to retain their strong market position, driven by sustained investment in heavy-lift infrastructure and international collaboration in space logistics.

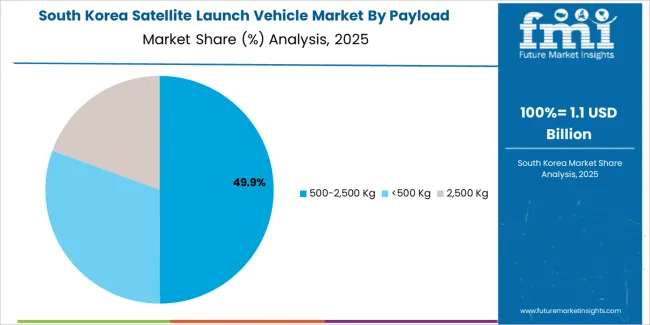

The 500–2,500 kg payload segment, accounting for 48.70% of the payload category, has maintained a leading position due to its alignment with the rising trend of small and medium satellite constellations. This payload range offers an optimal balance between cost-efficiency and mission versatility.

Market growth has been supported by increasing commercial satellite launches for Earth observation, data communication, and scientific research. Manufacturers are focusing on enhancing adaptability through multi-satellite deployment systems and improved integration interfaces.

Demand is further strengthened by the growing presence of private space startups seeking affordable and flexible launch solutions Continuous miniaturization of satellite components and advancements in payload integration technologies are expected to sustain segment dominance and accelerate deployment cycles across both government and commercial missions.

The low Earth orbit (LEO) segment, holding 57.60% of the orbit category, has remained the preferred choice for most satellite launches due to its proximity, lower fuel requirements, and faster deployment capabilities. LEO enables high-resolution imaging, low-latency communication, and rapid data transmission, making it ideal for a wide range of applications including broadband internet, surveillance, and scientific exploration.

Increasing focus on mega-constellations and Earth observation missions has significantly boosted LEO deployment frequency. Cost efficiencies achieved through shorter mission durations and reusable launch systems have reinforced its market leadership.

Technological improvements in trajectory design, orbital insertion precision, and satellite clustering are further enhancing mission productivity As global demand for connectivity and real-time data continues to grow, LEO is expected to sustain its leading share and remain the focal point of satellite launch vehicle innovation and investment.

| Attributes | Details |

|---|---|

| Top Vehicle Type | Small (<350,000 kg) |

| CAGR from 2025 to 2035 | 13.7% |

| Attributes | Details |

|---|---|

| Top Payload | <500 kg |

| CAGR from 2025 to 2035 | 13.5% |

| Countries | CAGR through 2035 |

|---|---|

| United States | 14.2% |

| United Kingdom | 15.0% |

| China | 14.7% |

| Japan | 15.6% |

| South Korea | 16.0% |

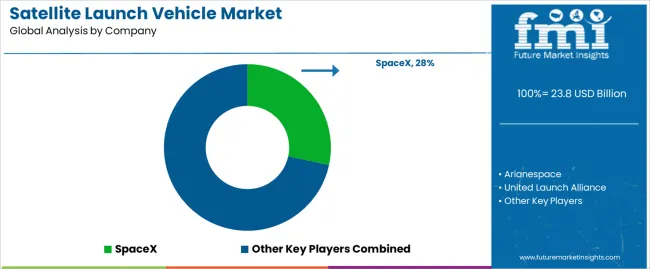

The market is highly competitive, with a diverse range of players from both the government and private sectors. The market is characterized by intense competition, technological advancements, and a focus on innovation.

A privately-owned segment of the market is characterized by a diverse range of players, including established aerospace companies, startups, and conglomerates from various industries.

These companies are involved in the development and launch of satellites for commercial and scientific applications, such as Earth observation, remote sensing, and communication. They also provide launch services to other companies and governments.

Recent Development in the Satellite Launch Vehicle Market

In 2025, Amazon recently announced that it has secured three launches with SpaceX, a private American aerospace manufacturer, to support the deployment of Project Kuiper. Project Kuiper is a plan to launch a constellation of low Earth orbit satellites that will provide high-speed, low-latency broadband internet to unserved and underserved communities around the world.

The global satellite launch vehicle market is estimated to be valued at USD 23.8 billion in 2025.

The market size for the satellite launch vehicle market is projected to reach USD 87.5 billion by 2035.

The satellite launch vehicle market is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in satellite launch vehicle market are medium to heavy (>350,000 kg) and small (<350,000 kg).

In terms of payload, 500-2,500 kg segment to command 48.7% share in the satellite launch vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Satellite Ground Station Market Trends – Growth & Forecast 2024-2034

Satellite Antenna Market

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

LEO Satellite Market Size and Share Forecast Outlook 2025 to 2035

UAV Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA