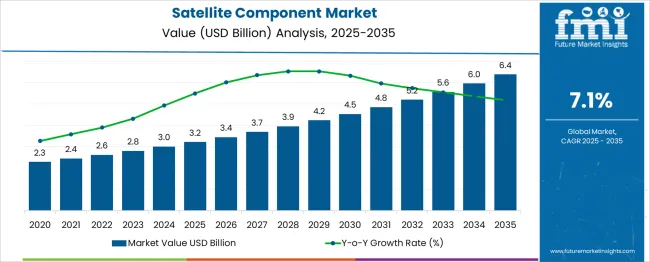

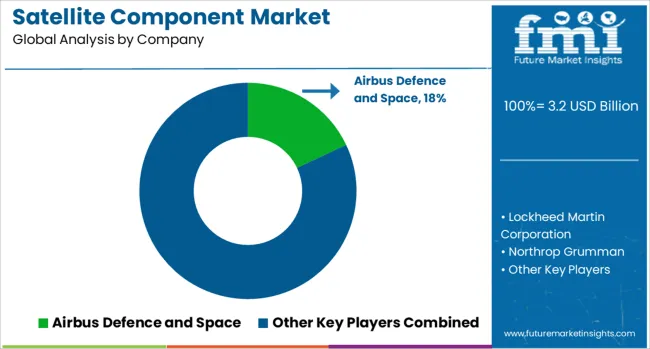

The satellite component market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. Across the entire forecast period, the data shows a steady upward trajectory with no observable dips or reversals. Annual increments rise gradually, starting with USD 0.2 billion between 2025 and 2026 and reaching USD 0.4 billion between 2034 and 2035. The absence of negative growth or flat periods indicates a market with no identifiable troughs and, therefore, no cyclical compression.

A typical peak-to-trough pattern involves a downturn following a high point, often triggered by policy shifts, funding limitations, or external shocks. In this case, each successive year shows a clear gain in absolute value, with no contraction in revenue. Increasing satellite launches, miniaturization of payloads, and rising demand from navigation, Earth observation, and broadband constellations consistently support growth. Both commercial and defense-driven applications contribute to sustained procurement across multiple regions. The absence of troughs confirms the market’s structural momentum, which is reinforced by long-cycle investment in space infrastructure and satellite manufacturing. From 2025 through 2035, the satellite component market displays uninterrupted growth, with no peak-driven reversals or contraction intervals.

| Metric | Value |

|---|---|

| Satellite Component Market Estimated Value in (2025 E) | USD 3.2 billion |

| Satellite Component Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The satellite component market grows from USD 3.2 billion in 2025 to USD 6.4 billion in 2035, with a CAGR of 7.1%. Across the entire forecast period, the data shows a steady upward trajectory with no observable dips or reversals. Annual increments rise gradually, starting with USD 0.2 billion between 2025 and 2026 and reaching USD 0.4 billion between 2034 and 2035. The absence of negative growth or flat periods indicates a market with no identifiable troughs, and therefore, no cyclical compression. A typical peak-to-trough pattern involves a downturn following a high point, often triggered by policy shifts, funding limitations, or external shocks. In this case, each successive year shows a clear gain in absolute value, with no contraction in revenue.

Growth is consistently supported by increasing satellite launches, miniaturization of payloads, and rising demand from navigation, Earth observation, and broadband constellations. Both commercial and defense-driven applications contribute to sustained procurement across multiple regions. The absence of troughs confirms the market’s structural momentum, which is reinforced by long-cycle investment in space infrastructure and satellite manufacturing. From 2025 through 2035, the satellite component market displays uninterrupted growth, with no peak-driven reversals or contraction intervals.

Positive momentum has been noted across the Satellite Component Market as constellations for broadband connectivity, Earth observation, and secure defense communications expand globally. Industry revenue has been supported by rising launch frequency, miniaturization of payloads, and sustained investment from both public agencies and private equity. Software-defined architectures and modular hardware have been preferred because rapid payload reconfiguration has been required once spacecraft reach orbit.

Supply chains have been reinforced through strategic partnerships that ensure component reliability and radiation tolerance, while additive manufacturing and advanced materials have reduced production lead times and mass. Future growth is expected as low-latency services are demanded by autonomous transport, climate monitoring, and disaster response networks.

Regulatory encouragement for universal digital inclusion and the emergence of sovereign space programs in emerging economies are further strengthening demand. Overall, a resilient outlook has been established in which sustained technological progress and ongoing capital inflows are anticipated to maintain a favorable trajectory for manufacturers and integrators..

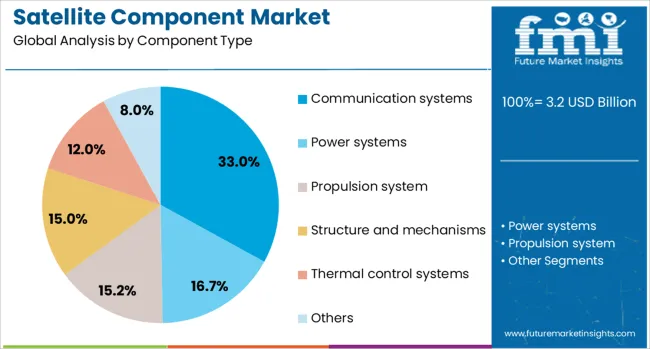

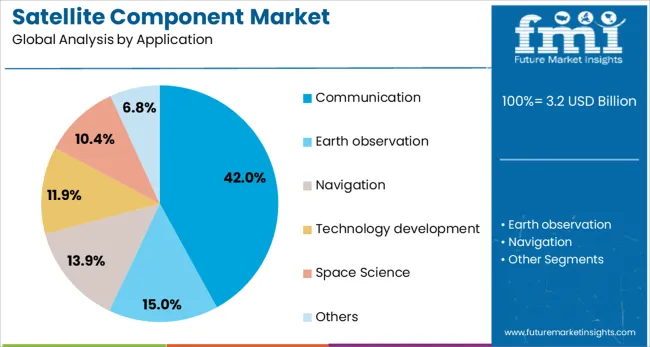

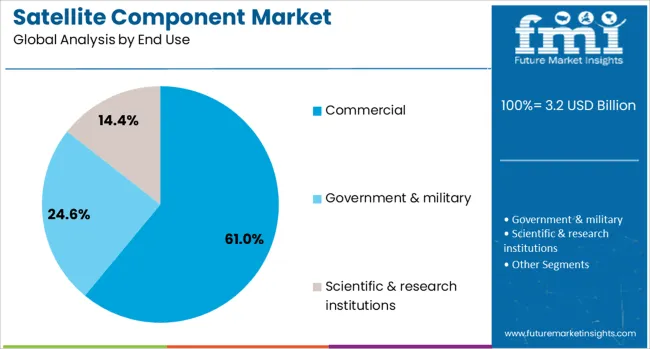

The satellite component market is segmented by component type, application, and end use and geographic regions. The satellite component market is divided into Communication systems, Power systems, Propulsion systems, Structure and mechanisms, Thermal control systems, and Others. In terms of application, the satellite component market is classified into Communication, Earth observation, Navigation, Technology development, Space Science, and Others. The end use of the satellite component market is segmented into Commercial, Government & military, and Scientific & research institutions. Regionally, the satellite component industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

A revenue share of 33 % has been attributed to the Communication systems Component Type Segment in 2025, and dominance has been maintained through the essential role these subsystems play in linking satellites with ground infrastructure and inter satellite networks. High bandwidth transponders, flexible beam forming antennas, and advanced frequency converters have been installed to meet escalating throughput targets and spectrum efficiency requirements.

Growth has been assisted by rising demand for broadband connectivity in remote areas and by cloud service backhaul that relies on resilient space links. Investment in digital signal processors has been prioritized because on board reconfigurability allows service providers to adapt to shifting traffic patterns without physical intervention.

Reliability metrics and long operational life have been ensured through radiation hardened designs and rigorous qualification testing. As orbit congestion intensifies, dynamic channel allocation enabled by software controlled communication payloads has been valued, thereby reinforcing the segment’s leadership within the component landscape..

The Communication Application Segment is projected to account for 42 % of market revenue in 2025, and leadership has been underpinned by unwavering demand for continuous data exchange across maritime, aviation, and terrestrial sectors. Expanding direct to device services and the proliferation of Internet of Things terminals have required ubiquitous coverage, encouraging operators to deploy multilayer networks that combine geostationary, medium, and low Earth orbits.

Growth has been accelerated by governmental objectives to bridge the digital divide, prompting subsidized capacity procurement for rural broadband initiatives. Enhanced spectral reuse and spot beam technology have been adopted to maximize capacity while controlling capital expenditure.

Energy efficient amplifiers and adaptive coding techniques have improved link performance, supporting higher data rates without proportional increases in power consumption. The ability of satellite communication platforms to provide resilient connectivity during terrestrial network failures has been recognized as a strategic advantage, thereby sustaining robust investment and cementing the segment’s leading position..

A commanding 61 % of market revenue has been associated with the Commercial End Use Segment in 2025, and expansion has been propelled by vigorous activity among private constellation operators, satellite internet providers, and downstream service enterprises. Capital availability through venture funding and public market listings has enabled rapid fleet deployment, while declining launch costs have lowered entry barriers. Commercial operators have emphasized agile manufacturing processes that shorten design cycles and allow iterative improvement, thereby enhancing competitiveness.

Demand for high resolution imagery, real time vessel tracking, and low latency broadband has been served through diversified payload portfolios, supporting recurring revenue models based on data subscriptions rather than one time hardware sales. Strategic partnerships with telecom carriers and cloud hyperscalers have been formed to integrate satellite capacity into terrestrial networks, resulting in seamless global coverage. Regulatory reforms that facilitate licensing and spectrum allocation for private entities have reduced administrative hurdles, encouraging further participation.

Trustworthiness has been reinforced through adherence to debris mitigation guidelines and responsible orbital stewardship, which is increasingly valued by investors and customers. As commercial missions continue to demonstrate operational reliability and profitable service delivery, sustained growth within this segment is anticipated over the forecast period..

Demand for satellite components has increased due to rapid deployment of low-earth orbit constellations and government-backed space telecommunications projects. High-frequency RF transceivers and solar array modules accounted for over 41 % of component shipments in 2024. Manufacturing of precise antenna subassemblies and onboard avionics represented approximately 29 % of new module volumes. Growth was noted in nanosat and miniature satellite systems, which captured nearly 35 % of launch manifest allocations.

Satellite component demand has been driven by SWaP-efficient designs that support high-bandwidth operations in small satellite platforms. CubeSats and microsatellite bus systems accounted for nearly 38 % of payload design specifications in recent launch cycles. High-speed S- and X-band RF amplifiers and signal processing units were featured in 45 % of module configurations targeting broadband, Earth observation, or IoT connectivity payloads. Lightweight composite frame materials, deployable solar panels, and precision microthrusters improved performance in 28 % of mission-critical nodes. High-throughput communication demand and multi-transponder configurations have expanded component adoption across new commercial and academic satellite deployments.

Development of radiation-hardened electronic components and precision optics remains cost-intensive, with certification and testing extending development cycles by up to 22 %. Complex supply chains for specialized microelectronics have introduced lead-time delays in nearly 18 % of procurement orders. Industry-standard compliance for space-grade assemblies increased BOM cost by 19 %, especially for components such as multi-layer ceramic capacitors and GaN-based amplifiers. Thermal management and vibration isolation modules added to the platform's weight and complexity. Replacement and repair capability is limited in orbit, so reliability standards are high; roughly 7 % of modules are rejected during pre-launch thermal-vacuum qualification testing.

Growth is emerging in satellite servicing, where components such as robotic grappling mechanisms and smart docking adapters have been adopted in 24 % of new servicing mission designs. In-orbit manufacturing of high-performance antenna reflectors using deployable membrane structures has captured 21 % of new payload architecture proposals. Reconfigurable payload buses with modular plug-in component slots support mission adaptability across 30 % of medium-sized satellite platforms. Satellite mesh networking and inter-satellite laser links have opened demand for precision beam-steering units in 26 % of next-gen constellations. Onboard reconfiguration capability for frequency band switching has been specified in 28 % of LEO broadband models.

Edge-processing modules enabling onboard AI analytics and data compression were integrated in 32 % of satellite platforms to reduce downlink transmission load. Reconfigurable software-defined radios (SDR) featured in 29 % of communication payloads, supporting dynamic frequency allocation. Recyclable composite materials such as bio-polymers and regolith-derived metals were introduced in 18 % of structural enclosures to minimize launch mass. Remote firmware patch capability and telemetry monitoring enabled predictive fault detection in 27 % of commissioned units. Standardized modular connectors and plug-and-play interfaces were adopted in 24 % of component suites to support rapid assembly and future upgrade paths.

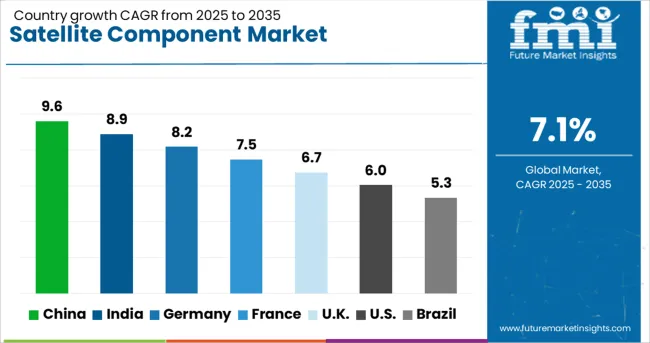

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

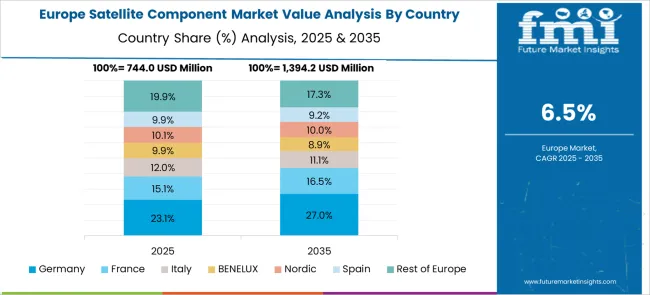

The global satellite component market is expected to grow at a CAGR of 7.1% from 2025 to 2035. China is growing at 9.6%, which is approximately 35% higher than the global rate, supported by strong investments in LEO satellite constellations and state-backed aerospace programs. India is expanding at 8.9%, or 25% faster than average, driven by a rising number of private satellite launches under ISRO’s evolving regulatory framework. Germany is also above average at 8.2%, reflecting its precision manufacturing base and ESA participation. The UK, at 6.7%, and the US, at 6.0%, grow more slowly, trailing the global rate by 6% and 15% respectively. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China secured a 9.6% share in 2025 due to concentrated investment in low-Earth orbit satellite constellations and military-grade components. Chinese suppliers, particularly in Sichuan and Inner Mongolia, prioritized advanced onboard computers, reaction wheels, and high-frequency transmitters tailored for strategic payload delivery. Collaborations between CASC, CETC, and private ventures like GalaxySpace contributed to production scalability. Ground control infrastructure also supported long-term component validation cycles, improving component lifespan assurance. Localized rare earth sourcing enhanced availability of high-tolerance magnetic and thermal shielding materials for orbital assemblies.

India held an 8.9% share in 2025, driven by the Make in India initiative and ISRO’s strategic vendor onboarding programs. Component suppliers in Bengaluru, Hyderabad, and Pune specialized in solar arrays, attitude control modules, and radiation-hardened PCBs for national and private launches. An increasing number of nanosatellite programs by startups such as Pixxel and Dhruva Space boosted domestic sourcing of miniaturized hardware. Material substitution with space-grade composites reduced weight margins and launch costs. Quality compliance under IN-SPACe guidelines improved flight-readiness testing for indigenous components.

Germany posted an 8.2% share in 2025, supported by robust aerospace engineering clusters in Bavaria and Baden-Württemberg. High-reliability components such as telemetry antennas, signal modulators, and star trackers were developed for both GEO and interplanetary missions. Fraunhofer institutes and DLR-backed programs facilitated radiation testing and real-time software-hardware integration. Manufacturing workflows emphasized modular designs for multi-mission reuse, especially within ESA projects. German producers remained key suppliers for satellite buses used by global primes, with advanced manufacturing centers supporting rigorous quality inspection.

The United Kingdom maintained a 6.7% share in 2025, with satellite component growth focused on Cubesat and telecom payload segments. Innovation hubs in Glasgow and Oxford facilitated production of compact structure panels, propulsion systems, and S-band communication modules. Funding from the UK Space Agency supported low-volume pilot runs for space electronics. Industry players such as SSTL and AAC Clyde Space enhanced domestic integration of flight-ready systems. Radiation shielding and thermal management innovations were a priority for LEO operational environments.

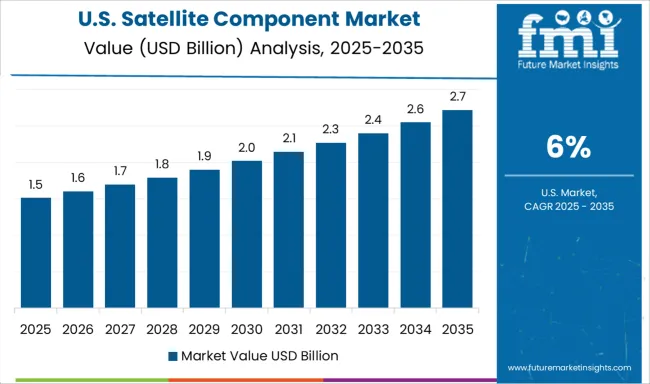

The USA reported a 6.0% share in 2025, driven by expanding private sector launches and NASA-DoD joint missions. Suppliers in California, Colorado, and Virginia manufactured high-capacity power management systems, star sensors, and deployable solar structures. Firms like Northrop Grumman and Ball Aerospace advanced integration of AI-enabled on-orbit diagnostic subsystems. Component supply chains prioritized ITAR compliance and material traceability across long-duration missions. Emphasis was placed on in-space servicing compatibility, enabling replacement-ready architecture in modular formats.

The market includes companies involved in manufacturing subsystems for communications, navigation, Earth observation, and scientific payloads. Airbus Defence and Space supplies structural panels, onboard computers, and electric propulsion modules for commercial and government satellites. Lockheed Martin Corporation integrates advanced payload support systems, sun sensors, and space-grade batteries in its satellite platforms, with components designed to meet extreme orbital temperature and radiation demands. Northrop Grumman develops key components such as deployable antennas, avionics, and guidance systems for geostationary and low Earth orbit (LEO) missions. Thales Alenia Space provides integrated components like thermal control units, reaction wheels, and modular satellite buses to support scalable configurations for civilian and defense applications. OHB SE, based in Germany, contributes mechanical assemblies, propulsion modules, and power systems tailored for scientific and commercial satellite constellations. L3Harris Technologies focuses on satellite communication payloads, precision pointing assemblies, and signal processing electronics used in surveillance, meteorology, and secure data relays. Key performance criteria across the market include mass-to-power ratios, radiation-hardened materials, in-orbit lifespan, modularity, and compatibility with launch vehicle constraints.

Airbus, Thales, and Leonardo entered early-stage merger discussions to unify satellite divisions across Europe. Mercury Systems strengthened its satellite communication portfolio by acquiring PCTEL’s RF filter business. Filtronic transitioned into space hardware by supplying RF modules and amplifiers to Starlink and ESA. Gilat Satellite Networks acquired DataPath and launched SkyEdge IV for broadband satellite terminals. Voyager Technologies consolidated avionics and satellite subsystem companies under a unified platform. Compact RF systems, high-throughput transceivers, and vertically integrated supply chains are reshaping the competitive dynamics of the global satellite component market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Component Type | Communication systems, Power systems, Propulsion system, Structure and mechanisms, Thermal control systems, and Others |

| Application | Communication, Earth observation, Navigation, Technology development, Space Science, and Others |

| End Use | Commercial, Government & military, and Scientific & research institutions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus Defence and Space, Lockheed Martin Corporation, Northrop Grumman, Thales Alenia Space, OHB SE, and L3Harris Technologies |

| Additional Attributes | Dollar sales by component type (power systems, antennas, processors) and application (telecom, earth observation, navigation), demand across satellite operators, constellation deployment and defense systems, led by Asia‑Pacific with North America catching up, innovation in miniaturized high-performance payloads and radiation-hardened smart modules. |

The global satellite component market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the satellite component market is projected to reach USD 6.4 billion by 2035.

The satellite component market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in satellite component market are communication systems, _transponders, _antennas, _receivers/transmitters, power systems, propulsion system, structure and mechanisms, thermal control systems and others.

In terms of application, communication segment to command 42.0% share in the satellite component market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle Market Forecast Outlook 2025 to 2035

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Laser Communication Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Satellite Ground Station Market Trends – Growth & Forecast 2024-2034

Satellite Antenna Market

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

LEO Satellite Market Size and Share Forecast Outlook 2025 to 2035

UAV Satellite Communication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA