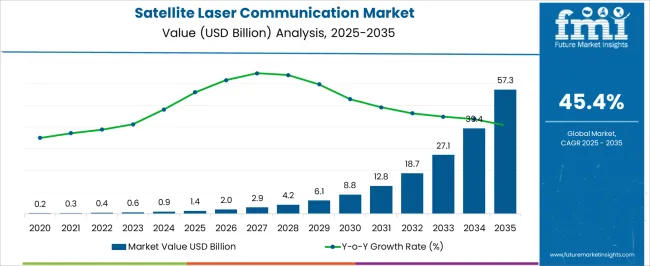

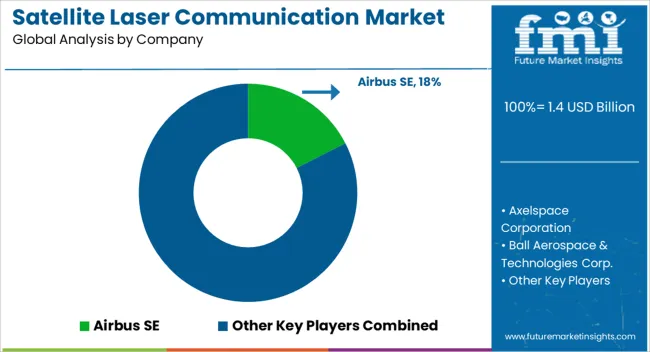

The satellite laser communication market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 57.3 billion by 2035, registering a compound annual growth rate (CAGR) of 45.4% over the forecast period. The satellite laser communication market is projected to undergo a striking expansion in the first five-year block from 2025 to 2030, with values rising from USD 1.4 billion to USD 8.8 billion. This growth trajectory highlights a remarkable surge, where the increasing need for global connectivity has reinforced demand for high-capacity, secure, and low-latency transmission solutions.

The trajectory indicates that satellite operators, defense agencies, and data-intensive sectors are shifting their focus to optical communication systems as the new industry standard. With the CAGR reflecting extraordinary expansion, it is fair to say that this segment is no longer experimental but rather indispensable to the broader satellite communication infrastructure. Between 2025 and 2030, with the market surpassing USD 8.8 billion, the five-year growth block presents a compelling case for stakeholders. The adoption of optical links for high-bandwidth satellite communication is being prioritized to manage surging data requirements from Earth observation, broadband connectivity, and cross-continental data transfer. The strong upward curve represents more than numerical progress, it reflects strategic restructuring across industries that depend heavily on secure space-based communication. Companies that develop scalable terminals and cost-effective ground station equipment are expected to dominate revenue capture.

| Metric | Value |

|---|---|

| Satellite Laser Communication Market Estimated Value in (2025 E) | USD 1.4 billion |

| Satellite Laser Communication Market Forecast Value in (2035 F) | USD 57.3 billion |

| Forecast CAGR (2025 to 2035) | 45.4% |

The satellite laser communication market holds a strategic but still developing share within its broader parent markets, reflecting its rapid adoption for high-capacity and low-latency connectivity. Within the satellite communication market, it contributes about 6-7% share, driven by increasing demand for broadband connectivity and the limitations of traditional radio-frequency systems. In the free-space optical communication market, satellite laser systems dominate with nearly 30-35% share, since they form the backbone for space-based laser links. Across the aerospace and defense communication systems market, its share is about 4-5%, supported by government investments in secure, high-speed communication for military satellites and defense networks.

In the space exploration and deep-space communication market, it holds around 10-12% share, as laser links are increasingly being tested for lunar, Martian, and interplanetary missions to transmit large volumes of scientific data. Wthin the ground station and satellite networking equipment market, it contributes about 3-4%, reflecting the ongoing development of compatible terminals and supporting infrastructure. Overall, the satellite laser communication market has become a pivotal enabler of next-generation connectivity, offering data rates magnitudes higher than conventional RF communication, reduced spectrum congestion, and increased security.

The satellite laser communication market is witnessing robust expansion, driven by the increasing demand for high-capacity, low-latency data transfer solutions for space-based applications. Growing deployment of advanced satellite constellations and the need for secure, interference-resistant communication links are supporting market growth. The technology’s ability to deliver high-speed data transmission with minimal signal loss over long distances is attracting adoption across defense, commercial, and scientific missions.

Rising investments in space infrastructure, coupled with strategic partnerships among space agencies and private aerospace firms, are strengthening innovation pipelines and accelerating commercialization. Market development is further supported by advancements in optical payload miniaturization, improved beam-tracking capabilities, and energy-efficient transmission systems.

Although regulatory approvals and high initial costs remain considerations, long-term adoption is expected to benefit from scalable deployment models and the gradual replacement of traditional RF-based systems Over the forecast horizon, expanding satellite networks and cross-sector applications are projected to drive sustained growth momentum and widen the technology’s global footprint.

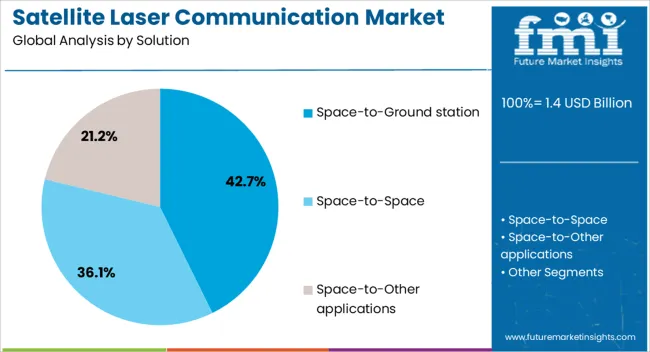

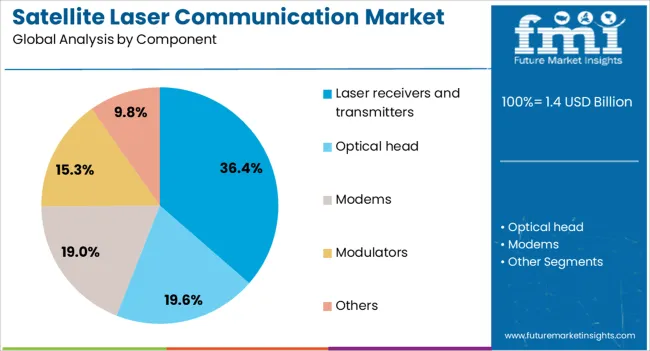

The satellite laser communication market is segmented by solution, component, range, end use, and geographic regions. By solution, satellite laser communication market is divided into Space-to-Ground station, Space-to-Space, and Space-to-Other applications. In terms of component, satellite laser communication market is classified into Laser receivers and transmitters, Optical head, Modems, Modulators, and Others.

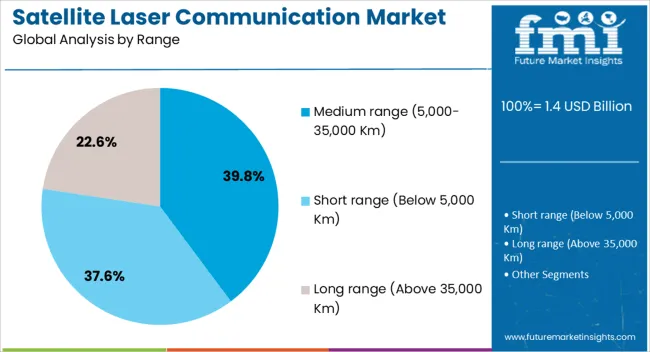

Based on range, satellite laser communication market is segmented into Medium range (5,000-35,000 Km), Short range (Below 5,000 Km), and Long range (Above 35,000 Km). By end use, satellite laser communication market is segmented into Commercial, Government, and Military. Regionally, the satellite laser communication industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The space-to-ground station segment, holding 42.7% of the solution category, has emerged as the leading configuration due to its critical role in enabling secure, high-speed communication between orbital platforms and terrestrial infrastructure. Its dominance has been supported by increasing demand from earth observation, scientific research, and broadband service providers seeking enhanced downlink capacity.

Integration with advanced ground station networks has enabled stable data reception under varying atmospheric conditions, improving operational reliability. Technological progress in adaptive optics and beam-pointing accuracy has further strengthened performance, reducing data loss and enhancing throughput.

Strategic investments by space agencies and commercial operators are fostering infrastructure expansion, while the rising number of LEO and GEO satellites is boosting connectivity requirements. The segment’s prominence is expected to persist as space missions prioritize robust space-to-ground communication links, with scalability and cross-compatibility serving as key enablers for sustained market share retention.

The laser receivers and transmitters segment, accounting for 36.4% of the component category, leads due to its indispensable function in enabling optical signal transmission and reception across varying distances. These systems are engineered for high precision, ensuring minimal signal distortion even under challenging operational environments.

Advancements in semiconductor laser diodes, photodetectors, and optical amplification technologies have driven improvements in power efficiency and bandwidth capabilities. The segment benefits from strong demand across defense intelligence, remote sensing, and high-data-rate communication applications, where secure, interference-free channels are essential.

Manufacturing scalability and modular designs are supporting integration into both small-scale CubeSats and large satellite platforms, widening the addressable market. Continued R&D investments focused on miniaturization, thermal management, and enhanced pointing stability are expected to reinforce the segment’s market leadership over the forecast period.

The medium range segment, representing 39.8% of the range category, dominates owing to its optimal balance between coverage capabilities and transmission efficiency, making it well-suited for LEO-to-ground and inter-satellite links within regional networks. This range enables high-bandwidth communication while maintaining lower power requirements compared to long-range systems, which supports cost-effective deployment.

Its relevance has been bolstered by the increasing number of mid-orbit satellites designed for broadband and Earth observation missions, where medium-range links deliver sufficient capacity without excessive latency. Technological innovations in precision beam control, atmospheric compensation, and signal modulation have improved reliability, even in variable weather conditions.

The segment’s adoption is being further encouraged by satellite constellation operators aiming to establish regional communication grids, where medium-range performance aligns with operational and economic objectives.

The satellite laser communication market is expanding as the need for high-speed and secure data transfer grows. Space exploration and LEO satellite constellations are creating promising opportunities, while inter-satellite optical links and quantum encryption are shaping key trends. However, atmospheric interference and high costs present challenges. Overall, the market is positioned for robust growth, with laser communication becoming central to future space connectivity.

The demand for satellite laser communication is rising due to the global need for high-speed, secure, and reliable data transfer. Conventional radio frequency (RF) systems face limitations in terms of bandwidth and spectrum congestion, making laser communication a more efficient alternative. Governments, defense organizations, and commercial satellite operators are driving adoption to support Earth observation, broadband connectivity, and space exploration. This growing reliance on uninterrupted data transmission ensures that demand for laser-based satellite links will remain strong across multiple application sectors.

The surge in space exploration activities, including lunar missions, Mars expeditions, and low Earth orbit (LEO) satellite constellations, has created vast opportunities for satellite laser communication systems. Laser links provide higher capacity and lower latency, enabling seamless communication between satellites and ground stations. Private space companies and government agencies are investing in optical inter-satellite links (OISL) to strengthen mission capabilities. These opportunities extend to interplanetary communication, where laser technology is positioned to become the backbone of long-distance data transfer in future missions.

A major trend in the market is the growing adoption of inter-satellite optical communication links, which form the backbone of advanced satellite constellations. Operators such as SpaceX, OneWeb, and others are increasingly using OISLs to improve connectivity, reduce reliance on ground stations, and provide low-latency global coverage. Another key trend is the integration of quantum encryption into laser communication systems for enhanced security. These developments indicate a shift toward fully interconnected satellite networks that provide faster, safer, and more scalable communication infrastructures.

Despite the benefits, the market faces challenges from atmospheric interference and high deployment costs. Weather conditions such as clouds, fog, and turbulence can disrupt laser beams, reducing reliability in ground-to-satellite communications. Additionally, the technology requires precise alignment between satellites, adding to technical complexities. The initial investment for developing and launching laser communication systems is also high, posing barriers for smaller operators. Overcoming these challenges requires adaptive optics, redundancy planning, and government-industry collaboration to make laser communication more commercially viable and resilient.

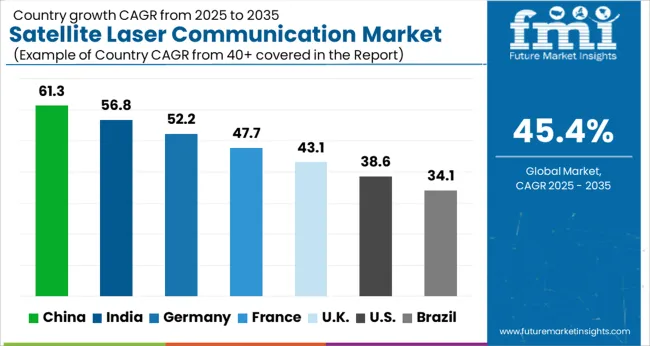

| Country | CAGR |

|---|---|

| China | 61.3% |

| India | 56.8% |

| Germany | 52.2% |

| France | 47.7% |

| UK | 43.1% |

| USA | 38.6% |

| Brazil | 34.1% |

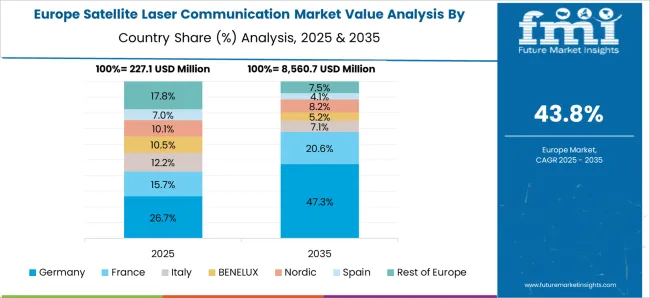

The global satellite laser communication market is forecast to record a CAGR of 45.4% from 2025 to 2035. China leads with a remarkable 61.3% growth rate, followed by India at 56.8% and Germany at 52.2%. The UK stands at 43.1%, while the USA records a comparatively modest 38.6%. Rising demand for secure, high-capacity, and low-latency data transmission is reshaping global satellite connectivity strategies. China and India dominate due to aggressive space programs and government-backed investments, while Germany and the UK are enhancing European collaboration in satellite networks. The USA continues to prioritize defense-driven and commercial space communication systems. The push for enhanced bandwidth, inter-satellite links, and secure data relay is expected to drive rapid global adoption of satellite laser communication. This report includes insights on 40+ countries; the top markets are shown here for reference.

The satellite laser communication market in China is expected to grow at a CAGR of 61.3%, making it the fastest-growing globally. China’s rapid expansion of its space program, supported by the China National Space Administration (CNSA), is fueling investments in satellite constellations equipped with laser-based inter-satellite links. This technology is being integrated into both defense and commercial applications, ensuring secure and high-capacity data transfer across space systems. China is also investing in ground-based infrastructure to enable seamless data relay for Earth observation and communication satellites. With its emphasis on reducing reliance on foreign technologies and establishing dominance in next-generation space communication, China continues to be the central hub for advancements in satellite laser communication systems.

The satellite laser communication market in India is projected to expand at 56.8% CAGR, driven by active initiatives under the Indian Space Research Organisation (ISRO). India is focusing on equipping its growing constellation of satellites with optical communication technologies to meet rising demand for secure and high-speed data transmission. The market is witnessing growth from collaborations between domestic technology firms and global players to integrate advanced systems into Indian satellite programs. Applications range from defense communications to disaster management and commercial satellite internet services. Government-backed investments, combined with private sector involvement, are pushing India toward self-reliance in space-based laser communication. With its competitive cost structures and ambitious space exploration roadmap, India is becoming a pivotal market for satellite laser communication adoption.

The satellite laser communication market in Germany is forecast to register a CAGR of 52.2%, supported by its leadership in European space collaboration. Germany is home to advanced aerospace research institutions and companies developing optical inter-satellite link technology. The market benefits from participation in European Space Agency (ESA) programs that prioritize secure, high-speed satellite communications across Europe. German firms are actively integrating laser systems into satellites used for Earth observation, defense, and broadband connectivity. The country’s focus on technology innovation and international partnerships ensures its strong position in the global market. Germany’s commitment to expanding its satellite infrastructure is expected to accelerate adoption of optical communication, making it a critical contributor to Europe’s space leadership.

The satellite laser communication market in the United Kingdom is projected to grow at 43.1% CAGR, driven by active participation in European and global satellite initiatives. UK-based companies are developing and deploying optical communication payloads for satellite constellations, targeting secure broadband and defense applications. Government-backed investments are supporting innovation in high-speed data transmission to strengthen the country’s digital infrastructure. Collaborations with ESA and private space firms are fueling demand for laser-equipped satellites in commercial and defense markets. With an increasing focus on building secure and resilient communication networks, the UK is positioning itself as a strong contender in the European satellite communication industry.

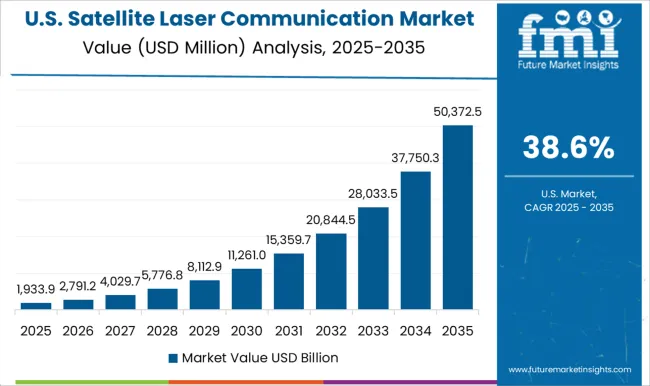

The satellite laser communication market in the United States is expected to expand at 38.6% CAGR, with demand coming from both defense and commercial segments. The USA Department of Defense and NASA are investing heavily in optical inter-satellite links to strengthen secure and low-latency data relay for space missions. Private space companies are also integrating laser communication into satellite constellations designed for global broadband coverage. Growing demand for enhanced bandwidth and secure transmission is driving adoption across military, aerospace, and commercial networks. The USA maintains leadership in innovation, yet its growth is relatively slower compared to Asian markets due to the maturity of existing satellite infrastructure. Nevertheless, defense and commercial investments ensure the USA remains a key global hub for satellite laser communication.

The satellite laser communication market is witnessing strong interest from aerospace and defense companies as the demand for high-speed, secure, and high-capacity data transmission continues to expand. Airbus SE has emerged as a prominent player by offering advanced optical communication terminals designed to support inter-satellite links and satellite-to-ground connectivity. Its solutions are aimed at enabling massive data transfers for applications such as Earth observation, broadband services, and military missions. Axelspace Corporation, based in Japan, is focusing on incorporating compact and efficient optical communication modules into its small satellite constellations.

The company is helping to enhance real-time Earth observation capabilities, creating a strong value proposition for industries that rely on constant monitoring and data-driven decision-making. Ball Aerospace & Technologies Corp. is contributing significantly to this market by delivering high-precision optical payloads tailored for both defense and commercial applications. Its expertise lies in developing systems that provide secure, low-latency, and high-bandwidth communication while reducing susceptibility to interference and jamming. These companies are shaping the industry by investing in miniaturization, scalability, and integration of laser communication technologies across diverse satellite platforms. Their strategies are focused on replacing traditional RF-based systems, which face limitations in bandwidth and security. With the rapid expansion of satellite constellations and growing data demand, satellite laser communication is being viewed as the next standard for global connectivity.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Solution | Space-to-Ground station, Space-to-Space, and Space-to-Other applications |

| Component | Laser receivers and transmitters, Optical head, Modems, Modulators, and Others |

| Range | Medium range (5,000-35,000 Km), Short range (Below 5,000 Km), and Long range (Above 35,000 Km) |

| End Use | Commercial, Government, and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus SE, Axelspace Corporation, and Ball Aerospace & Technologies Corp. |

| Additional Attributes | Dollar sales by communication type (inter-satellite, satellite-to-ground, satellite-to-aircraft) and component (optical terminals, modems, amplifiers) are key metrics. Trends include rising demand for high-speed, secure data transfer, growth in space-based communication networks, and deployment in defense and commercial sectors. Regional adoption, technological advancements, and government investments are driving market growth. |

The global satellite laser communication market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the satellite laser communication market is projected to reach USD 57.3 billion by 2035.

The satellite laser communication market is expected to grow at a 45.4% CAGR between 2025 and 2035.

The key product types in satellite laser communication market are space-to-ground station, space-to-space and space-to-other applications.

In terms of component, laser receivers and transmitters segment to command 36.4% share in the satellite laser communication market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Satellite Launch Vehicle Market Forecast Outlook 2025 to 2035

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Satellite Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Satellite Phased Array Antenna Market Size and Share Forecast Outlook 2025 to 2035

Satellite Solar Cell Materials Market Size and Share Forecast Outlook 2025 to 2035

Satellite-based 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Satellite Launch Vehicle (SLV) Market Size and Share Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Component Market Size and Share Forecast Outlook 2025 to 2035

Satellite As A Service Market Size and Share Forecast Outlook 2025 to 2035

Satellite Payloads Market Size and Share Forecast Outlook 2025 to 2035

Satellite Modem Market Size and Share Forecast Outlook 2025 to 2035

Satellite Ground Station Market Trends – Growth & Forecast 2024-2034

Satellite Antenna Market

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

4K Satellite Broadcasting Market Size and Share Forecast Outlook 2025 to 2035

LEO Satellite Market Size and Share Forecast Outlook 2025 to 2035

Nanosatellite And Microsatellite Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA