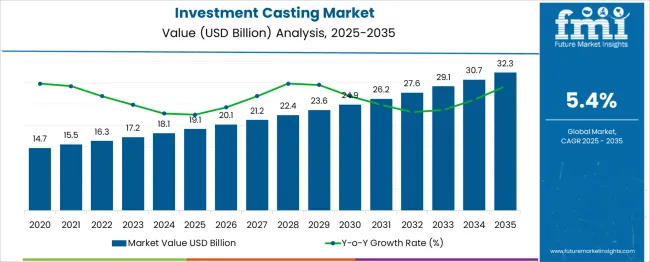

The global investment casting market is estimated to grow from USD 19.1 billion in 2025 to approximately USD 32.3 billion by 2035, recording an absolute increase of USD 13.2 billion over the forecast period. This translates into a total growth of 69.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.69X during the same period, supported by increasing demand for lightweight components in aerospace applications, rising adoption of complex geometries in automotive manufacturing, and growing focus on precision engineering across industrial sectors.

Between 2025 and 2030, the investment casting market is projected to expand from USD 19.1 billion to USD 24.7 billion, resulting in a value increase of USD 5.6 billion, which represents 42.4% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for complex precision components, increasing adoption of additive manufacturing technologies in pattern making, and growing penetration of investment casting in emerging industrial applications. Manufacturing companies are expanding their investment casting capabilities to address the growing demand for lightweight and high-performance components across diverse industries.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 19.1 billion |

| Forecast Value in (2035F) | USD 32.3 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

From 2030 to 2035, the market is forecast to grow from USD 24.7 billion to USD 32.3 billion, adding another USD 7.6 billion, which constitutes 57.6% of the overall ten-year expansion. This period is expected to be characterized by expansion of automation in foundry operations, integration of digital technologies in quality control, and development of casting processes. The growing adoption of Industry 4.0 principles and advanced materials will drive demand for sophisticated investment casting solutions with enhanced precision and performance characteristics.

Between 2020 and 2025, the investment casting market experienced steady expansion, driven by recovery in aerospace manufacturing and growing demand for precision components in medical devices. The market developed as manufacturers recognized the need for cost-effective production methods for complex geometries and high-performance materials. Technological advancements in simulation software and process control began emphasizing the importance of investment casting in achieving near-net-shape manufacturing with minimal material waste.

Market expansion is being supported by the increasing demand for lightweight components in aerospace and automotive industries, where investment casting offers superior design flexibility and material efficiency. Modern manufacturers are increasingly focused on reducing weight while maintaining structural integrity, making investment casting an ideal solution for producing complex, thin-walled components. The process's ability to produce intricate geometries with excellent surface finish and dimensional accuracy makes it a preferred manufacturing method for critical applications.

The growing emphasis on manufacturing and material conservation is driving demand for near-net-shape processes that minimize material waste and machining requirements. Investment casting's capability to work with a wide range of alloys, including superalloys and specialized materials, is creating opportunities for advanced applications in energy, medical, and industrial sectors. The rising influence of additive manufacturing in pattern production and rapid prototyping is also contributing to increased process efficiency and reduced lead times across different industries.

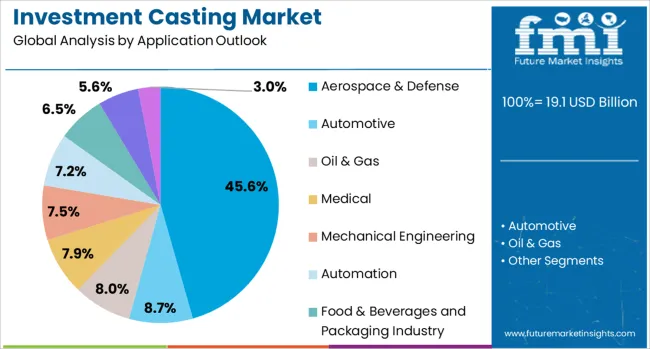

The market is segmented by application and region. By application, the market is divided into aerospace & defense, automotive, oil & gas, medical, mechanical engineering, automation, food & beverages and packaging industry, energy technology, and transportation. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The aerospace & defense application is projected to account for 45.6% of the investment casting market in 2025, reaffirming its position as the category's primary driver. The aerospace industry's stringent requirements for weight reduction, performance optimization, and material integrity align perfectly with investment casting's capabilities. Complex turbine blades, structural components, and engine parts produced through investment casting offer superior mechanical properties and precise dimensional control essential for aerospace applications.

This application benefits from ongoing developments in superalloy processing and ceramic core technology, enabling the production of increasingly complex cooling passages and thin-wall structures. Military modernization programs and commercial aircraft production growth continue to drive demand for investment cast components. With the aerospace industry's focus on fuel efficiency and performance enhancement, investment casting's ability to produce lightweight, high-strength components ensures its continued dominance in this critical market segment.

The investment casting market is advancing steadily due to increasing demand for complex precision components and growing adoption of advanced materials in critical applications. However, the market faces challenges including high initial tooling costs, longer lead times compared to other casting methods, and skilled labor requirements. Innovation in automation technologies and manufacturing practices continue to influence process development and market expansion patterns.

The growing adoption of automation in investment casting foundries is enabling manufacturers to improve process consistency and reduce labor costs. Digital technologies including simulation software, robotic systems, and quality control automation are enhancing production efficiency and product quality. Advanced process monitoring and control systems are driving improvements in yield rates and reducing defect occurrences, particularly in high-value aerospace and medical applications.

Modern investment casting facilities are incorporating 3D printing technologies for rapid pattern production and prototype development. These technologies reduce lead times for new product development while enabling cost-effective production of complex geometries. Additive manufacturing integration also facilitates design optimization and iterative development processes, supporting innovation in component design and accelerating time-to-market for new products.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

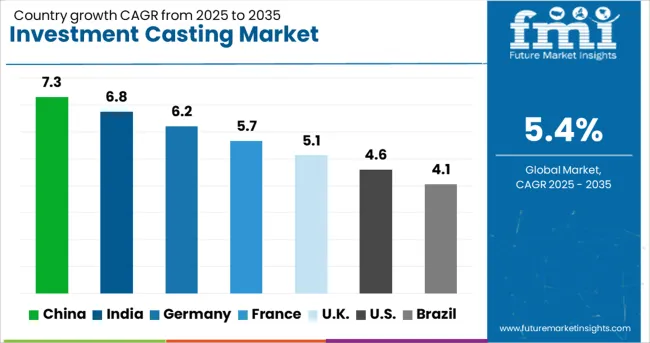

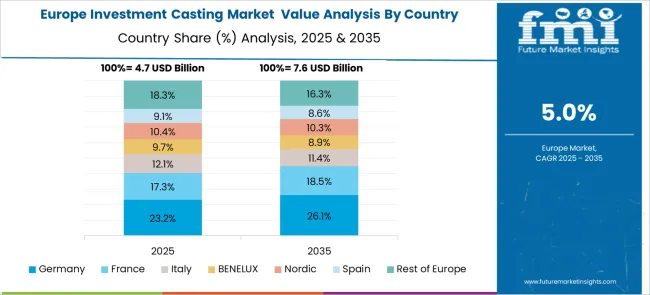

The investment casting market is experiencing varied growth globally, with China leading at a 7.3% CAGR through 2035, driven by rapid industrialization, expanding aerospace sector, and growing automotive manufacturing capabilities. India follows at 6.8%, supported by increasing defense spending, growing medical device manufacturing, and expanding industrial base. Germany shows steady growth at 6.2%, emphasizing precision engineering and advanced automotive applications. France records 5.7%, focusing on aerospace excellence and specialized industrial components. The UK maintains 5.1% growth, prioritizing high-value aerospace and medical applications. The USA shows 4.6% growth, leading in advanced materials and critical aerospace components.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from investment casting in China is projected to exhibit strong growth with a CAGR of 7.3% through 2035, driven by rapid expansion of aerospace manufacturing capabilities and increasing domestic demand for precision components. The country's growing automotive sector and industrial modernization initiatives are creating significant demand for investment cast products. Major international and domestic manufacturers are establishing comprehensive production facilities to serve the expanding requirements of various industrial sectors.

Revenue from investment casting in India is expanding at a CAGR of 6.8%, supported by increasing defense procurement, growing medical device manufacturing, and rising automotive component production. The country's Make in India initiative and focus on import substitution are driving demand for domestic investment casting capabilities. International aerospace companies and automotive manufacturers are establishing partnerships with Indian foundries to leverage cost advantages and technical capabilities.

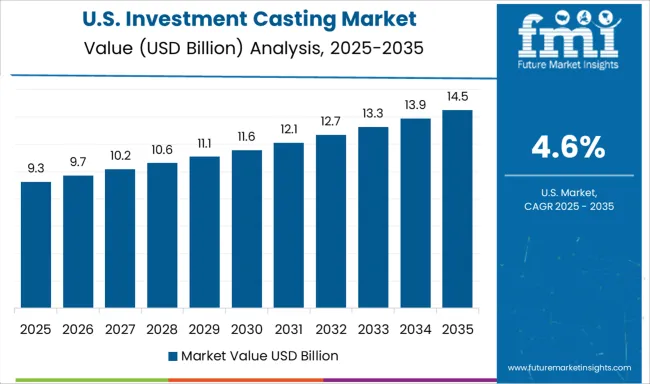

Demand for investment casting in the USA is projected to grow at a CAGR of 4.6%, supported by strong aerospace industry presence and continued innovation in advanced materials processing. American manufacturers are focused on high-value applications requiring exceptional material properties and dimensional precision. The market is characterized by strong demand for superalloy components and specialized materials for extreme environment applications.

Revenue from investment casting in Germany is projected to grow at a CAGR of 6.2% through 2035, driven by the country's strong automotive industry, advanced manufacturing capabilities, and focus on precision engineering. German manufacturers consistently demand high-quality components that meet stringent performance and reliability standards.

Revenue from investment casting in the UK is projected to grow at a CAGR of 5.1% through 2035, supported by strong aerospace sector presence and specialization in high-performance materials. British manufacturers value precision, quality, and technical innovation, positioning investment casting as a critical manufacturing process for advanced applications.

Revenue from investment casting in France is projected to grow at a CAGR of 5.7% through 2035, supported by the country's strong aerospace industry and defense manufacturing capabilities. French manufacturers prioritize technical excellence and material innovation, making investment casting essential for critical component production.

Revenue from investment casting in Brazil is projected to grow at a CAGR of 4.1% through 2035, supported by expanding industrial base and growing demand for precision components in automotive and energy sectors. Brazilian manufacturers are increasingly adopting investment casting for complex component production and import substitution strategies.

The investment casting market is characterized by competition among established foundries, specialized casting companies, and integrated manufacturers. Companies are investing in advanced process technologies, automation systems, quality control capabilities, and manufacturing practices to deliver high-quality, cost-effective, and environmentally responsible casting solutions. Technical expertise, material capabilities, and customer service excellence are central to strengthening market position and customer relationships.

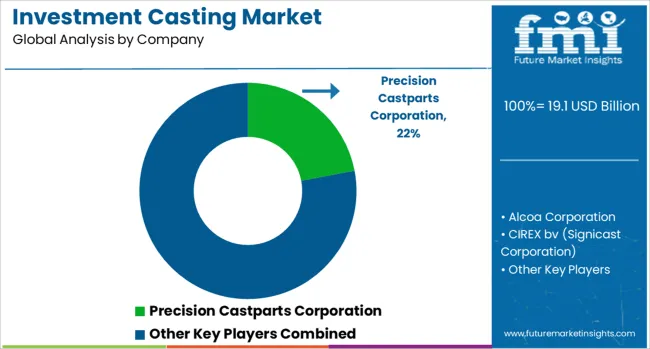

Precision Castparts Corporation leads the market with 22.0% global value share, offering comprehensive investment casting solutions with focus on aerospace and industrial applications. Alcoa Corporation provides advanced aluminum and superalloy casting capabilities with emphasis on lightweight solutions. CIREX bv (Signicast Corporation) delivers precision casting services with specialization in complex geometries and tight tolerances. Dongfeng Metal Products Co. Ltd. and Dongying Giayoung Precision Metal Co. Ltd. represent Chinese manufacturing excellence with cost-competitive solutions.

Impro offers global manufacturing capabilities with focus on automotive and industrial applications. MetalTek provides specialized casting solutions for extreme environment applications. Milwaukee Precision Casting emphasizes quality and customer service in diverse market segments. Ningbo Jiwei Melt Mould Castings Co. Ltd. and Ningbo Wanguan deliver competitive Asian manufacturing solutions. RLM Industries, Taizhou Xinyu Precision Casting Co. Ltd., and Zollern provide specialized capabilities serving regional and global markets with focus on specific application requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 19.1 billion |

| Application | Aerospace & Defense, Automotive, Oil & Gas, Medical, Mechanical Engineering, Automation, Food & Beverages and Packaging Industry, Energy Technology, Transportation |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Precision Castparts Corporation, Alcoa Corporation, CIREX bv (Signicast Corporation), Dongfeng Metal Products Co. Ltd., Dongying Giayoung Precision Metal Co. Ltd., Impro, MetalTek, Milwaukee Precision Casting, Ningbo Jiwei Melt Mould Castings Co. Ltd., Ningbo Wanguan, RLM Industries, Taizhou Xinyu Precision Casting Co. Ltd., and Zollern |

| Additional Attributes | Dollar sales by material type and process technology, regional demand trends, competitive landscape, buyer preferences for different alloy systems, integration with automation and digital manufacturing, innovations in rapid prototyping, ceramic core technology, and foundry practices |

The global investment casting market is estimated to be valued at USD 19.1 billion in 2025.

The market size for the investment casting market is projected to reach USD 32.3 billion by 2035.

The investment casting market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in investment casting market are aerospace & defense, automotive, oil & gas, medical, mechanical engineering, automation, food & beverages and packaging industry, energy technology and transportation.

In terms of application, the aerospace & defense segment is set to command 45.6% share in the investment casting market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA