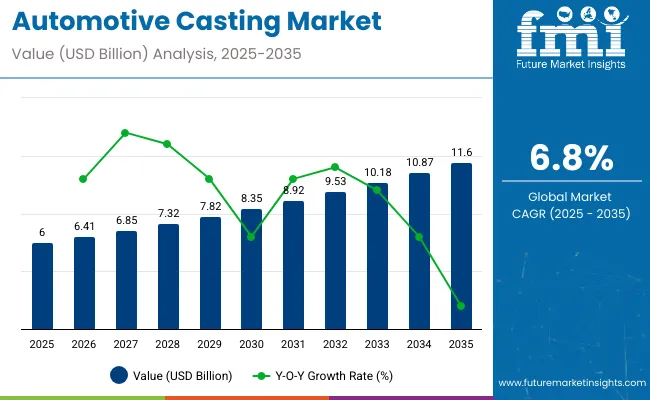

The automotive casting market is valued at USD 6 billion in 2025 and is forecasted to reach nearly USD 11.6 billion by 2035, growing at a compound annual growth rate of 6.8%. The multiplying factor for this period is around 1.93x, showing that the market in 2035 will be nearly twice the size of its 2025 base. A 10-year growth comparison highlights a strong trajectory supported by increasing demand for lightweight components, rising production of electric vehicles, and advancements in casting techniques that improve efficiency and durability.

Between 2025 and 2030, the market is expected to accelerate as automakers focus on weight reduction to meet stricter fuel efficiency and emission norms. This phase will see high adoption of aluminum and magnesium castings in powertrain, structural, and body applications. From 2030 to 2035, growth continues at a steady pace, driven by replacement of traditional materials with advanced alloys, expansion of electric vehicle manufacturing, and wider application of precision casting technologies.

The 10-year comparison highlights an almost twofold increase in market value, reflecting both the technological transformation of the automotive sector and consistent demand from manufacturers seeking cost-effective, durable, and lightweight casting solutions.

The automotive casting market draws strength from five broad parent markets. Automotive components contribute around 40%, since castings are essential in powertrain parts, chassis elements, and body structures. The global automotive sector adds nearly 25%, with overall vehicle production volumes dictating casting demand.

The metals and foundry segment accounts for about 20%, delivering aluminum, iron, and steel used in both lightweight and heavy-duty vehicle parts. Industrial manufacturing provides close to 10%, supporting machinery and processes that improve casting efficiency. Information and communication technology contributes roughly 5%, enabling design software, digital simulation, and process automation in modern casting.Current developments in the market are centered on efficiency, lightweight materials, and digital transformation. Leading companies including Nemak, Ryobi, Rheinmetall, and Endurance Technologies are investing in aluminum and magnesium alloys to cut vehicle weight and improve performance.

The shift toward electric mobility is boosting demand for precision-cast battery enclosures, motor housings, and structural supports. Advanced manufacturing techniques such as high-pressure die casting, additive manufacturing, and robotics are reshaping production capabilities. Strategic alliances between carmakers and foundry operators are common, as firms work toward lower emissions, reduced energy consumption, and higher durability while maintaining cost competitiveness.

The automotive casting market is experiencing strong demand as vehicle manufacturers focus on efficiency and performance. Castings are widely applied in engines, chassis, and structural elements. In 2024, overall casting demand linked to automotive production crossed 80 million tons, with Asia Pacific contributing a large share. Aluminum and magnesium castings are increasingly replacing steel, enabling lighter vehicles with improved fuel efficiency. The expansion of electric and hybrid vehicles further increases the requirement for housings, battery casings, and lightweight drivetrain parts.

Driving Force Rising Vehicle Output and Lightweight Engineering

Vehicle production growth, particularly in passenger cars and logistics fleets, is boosting the need for cast components. Lightweight alloys lower the overall vehicle mass, helping automakers meet emission standards and fuel efficiency regulations. More than two-thirds of new vehicle designs now rely on cast structures for their cost-effectiveness and strength. Asia Pacific is the largest production hub, supported by low-cost manufacturing and domestic demand. Automotive OEMs are also pushing for stronger yet lighter castings to balance safety and energy efficiency.

Growth Avenue Technological Progress and EV Applications

Technological advancements are creating growth opportunities in automotive casting. High-pressure die casting and vacuum processes are increasingly favored for producing high-precision, defect-free parts. The shift to electric vehicles raises demand for aluminum and magnesium housings, improving thermal management and efficiency. Manufacturers are focusing on automation and robotics to achieve greater reliability and faster cycle times. The integration of 3D printing into mold design is further transforming production capabilities, allowing customized components to reach markets quickly.

Emerging Trend Aluminum Dominance and Digital Casting Methods

Aluminum casting has become central to modern vehicle design as automakers prioritize fuel efficiency and emission compliance. Recycling initiatives are reducing reliance on virgin material, with secondary aluminum contributing over 45% of industry supply. New digital tools, such as AI-based monitoring systems, are being deployed to optimize pouring and cooling cycles. Additive manufacturing continues to expand mold and core-making capabilities, offering greater design freedom and efficiency. These innovations support large-scale production while aligning with environmental and regulatory requirements.

Market Challenge Cost Pressure and Quality Complexity

Automotive casting is capital intensive, requiring advanced machinery and strict quality standards. Complex casting techniques raise manufacturing costs, while raw material volatility in aluminum and magnesium markets creates price instability. Small-scale manufacturers struggle with the expense of adopting automation, limiting competitiveness. Ensuring dimensional accuracy and avoiding porosity remain challenges in large-scale production. Skilled workforce shortages also add to operational hurdles. Maintaining consistent quality and affordability is essential to meet growing demand from automakers.

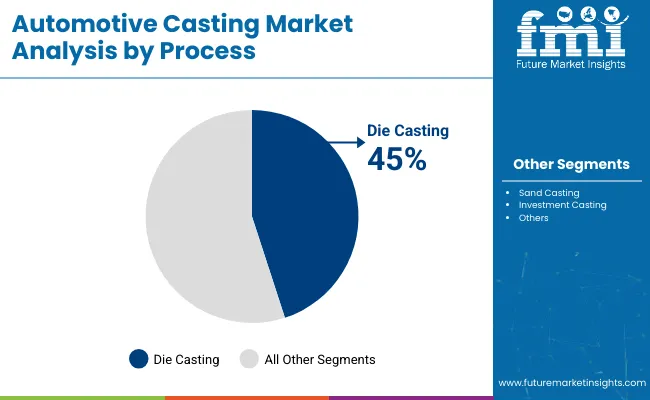

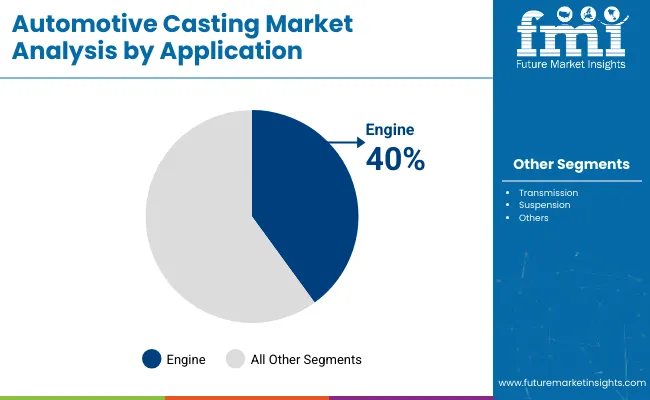

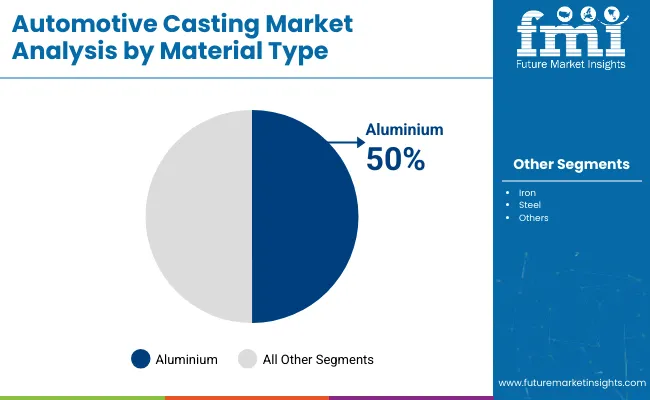

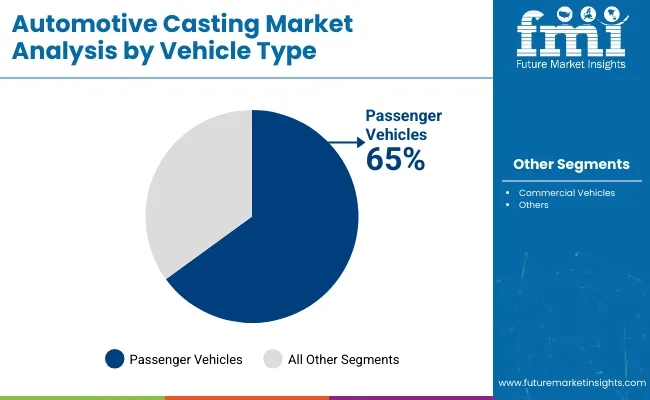

The automotive casting market is shaped by processes, applications, material choices, and vehicle demand. Die casting leads with 45%, supported by precision and high-volume production. Engines remain the largest application at 40%, reflecting their reliance on durable and lightweight castings. Aluminium dominates materials with 50%, valued for weight reduction and efficiency. Passenger vehicles represent 65% of demand, driven by global ownership growth and replacement needs. Together, these segments highlight consistent casting consumption patterns, where process efficiency, material strength, and automotive usage drive long-term component requirements worldwide.

Die casting leads at 45%, supported by its ability to deliver high precision and complex geometries required in automotive parts. It is widely applied in components like engine blocks, housings, and transmission cases. Automakers favor die casting due to its faster cycle times and suitability for large-scale production. The method also supports thinner wall designs, improving weight optimization in vehicles. Leading suppliers invest in automated die casting machinery to enhance efficiency and meet rising demand from OEMs. This keeps die casting the dominant process within the casting segment.

Engines account for 40% of automotive casting demand, reflecting their reliance on durable, heat-resistant parts. Cast components such as cylinder blocks, heads, and manifolds are integral to engine reliability and performance. Lightweight alloys are increasingly used to reduce overall vehicle weight while maintaining durability. Engine casting replacement demand remains high due to continuous wear and operating stress. Automotive manufacturers prioritize precision casting in engines to achieve fuel efficiency targets and regulatory compliance. This ensures engines remain the most consistent driver of casting requirements across global automotive markets.

Aluminium holds 50% of casting demand, favored for its lightweight and corrosion-resistant properties. Its use improves fuel efficiency and reduces emissions while maintaining structural strength in vehicle parts. Aluminium castings are applied in engines, transmission cases, wheels, and structural components. Automakers also prefer aluminium for its recyclability and availability, which reduce lifecycle costs. The material supports complex designs and high-volume production through die casting. Growing electrification in vehicles also supports aluminium demand for battery housing and lightweight structural applications, reinforcing its leadership in casting materials.

Passenger vehicles represent 65% of automotive casting demand, driven by their global ownership base and frequent replacement cycles. Castings are used in engines, transmission systems, and suspension assemblies, which experience higher wear from daily commuting. Automakers integrate precision-cast parts to meet performance, safety, and durability standards. Passenger car ownership expansion in Asia-Pacific contributes to rising casting consumption. Manufacturers continue to rely on lightweight cast alloys to optimize efficiency without compromising strength. Passenger vehicles remain the central focus for casting suppliers, reflecting their scale and consistent demand globally.

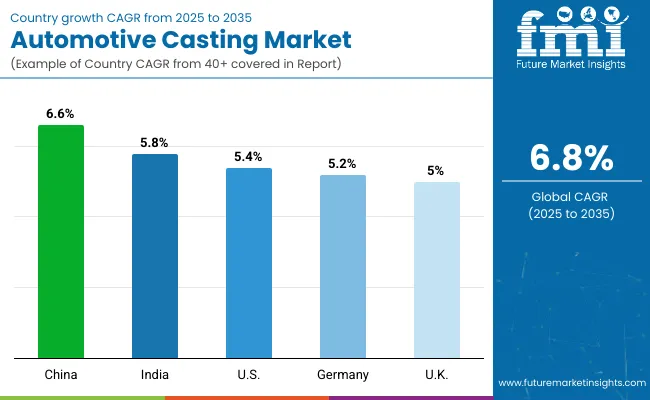

The global market is expected to expand at a CAGR of 6.8% between 2025 and 2035. China records 6.6%, slightly below the global rate at −3%, supported by BRICS-driven automotive manufacturing and lightweight component demand. India follows with 5.8%, showing a −15% difference, influenced by ASEAN-linked industrial collaborations and rising domestic vehicle production.

The United States posts 5.4%, which is −21% under the global benchmark, reflecting steady yet measured adoption in OECD markets. Germany registers 5.2%, or −24% below the global rate, tied to structured integration of advanced casting technologies within its automotive sector. The United Kingdom stands at 5%, lagging −26% compared with the global average, with gradual modernization in production facilities. The trend indicates that while the global market maintains healthy momentum, BRICS economies such as China and India are progressing close to the benchmark, whereas OECD members are advancing at more moderate levels.

China is registering a CAGR of 6.6% in the automotive casting market, slightly below the global level of 6.8%. Expansion is driven by strong vehicle production capacity and rising electric vehicle demand. Domestic manufacturers are investing in advanced casting facilities with automation and robotics to enhance accuracy and efficiency.

Lightweight castings made from aluminum and magnesium are in demand for use in engines, chassis, and structural components. Rapid scaling in industrial hubs such as Shanghai and Guangzhou supports both domestic and export supply chains. Continuous modernization of foundries is allowing suppliers to keep pace with evolving performance and safety requirements.

India is showing a CAGR of 5.8% in the automotive casting market, below the global benchmark of 6.8%. Growth is linked to increased vehicle manufacturing and the gradual modernization of domestic foundries. Passenger car and commercial vehicle segments are boosting demand for both aluminum and steel castings.

Regional hubs such as Pune, Chennai, and Gujarat are leading the expansion, supported by international investments and supply partnerships. Exports of automotive cast components are becoming increasingly important, with India positioning itself as a cost-effective source for global manufacturers. Semi-automated systems are improving production standards and reducing rejection rates across the sector.

The United States is projected to grow at a CAGR of 5.4% in the automotive casting market, lower than the global average of 6.8%. Market growth is influenced by demand for lightweight aluminum and iron castings for passenger and commercial vehicles. Manufacturers are adopting vacuum casting and simulation-based design tools to increase efficiency and reliability.

Rising production of electric and hybrid vehicles is further boosting demand for lightweight structural components. The aftermarket for replacement parts also contributes to consumption, creating consistent demand alongside new vehicle production. Technological improvements and compliance with regulatory standards continue to guide investments in foundries.

Germany is recording a CAGR of 5.2% in the automotive casting market, which is below the global rate of 6.8%. The country’s automotive manufacturers emphasize precision and durability, boosting demand for high-quality aluminum and steel castings. Foundries are adopting advanced die casting systems to reduce production defects while maintaining efficiency.

Lightweight castings are playing a vital role in the production of electric vehicles, particularly in structural and safety components. Research and development in alloy design is strengthening product durability and reducing overall component weight. Germany’s steady growth reflects its strong focus on engineering standards and technological innovation.

The United Kingdom is advancing at a CAGR of 5% in the automotive casting market, the lowest compared to the global benchmark of 6.8%. Growth is supported by demand for lightweight castings across both passenger and commercial vehicle categories.

Manufacturers are focusing on aluminum and magnesium alloys to improve efficiency. Export markets remain a strong driver, with UK suppliers serving automotive hubs across Europe. Investments in automation and digital inspection technologies are helping manufacturers reduce costs and improve quality standards. Despite limited domestic production compared with larger countries, adoption of modern casting techniques continues to stabilize market performance.

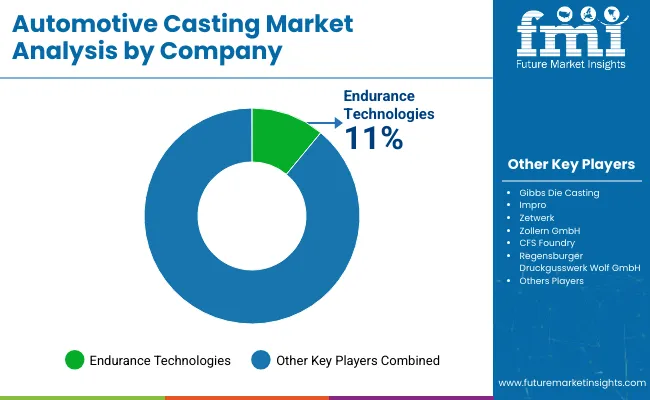

The global market is supported by established manufacturers and emerging suppliers who focus on strengthening their presence through product innovation, research, and partnerships. Gibbs Die Casting continues to expand its portfolio with lightweight aluminum castings designed for engine and transmission components, while RegensburgerDruckgusswerk Wolf GmbH emphasizes precision casting for European automotive brands. CFS Foundry invests in advanced casting processes and material research to provide high-performance parts that meet automaker requirements.

Endurance Technologies has broadened its casting operations across Asia with new facilities, enabling it to serve both domestic and international vehicle manufacturers. Impro focuses on high-quality iron and steel casting solutions and has been diversifying its product lines to serve multiple automotive applications.

Zetwerk and Zollern GmbH are also actively contributing to the industry’s growth through focused strategies. Zetwerk supports global automakers with supply chain integration and contract manufacturing, enabling timely delivery of customized castings. Zollern GmbH concentrates on high-precision casting techniques for complex automotive parts, particularly in drivetrain and engine applications.

These companies are reinforcing their market positions by introducing new casting methods, investing in research, and expanding their distribution networks. Through a combination of regional expansion and product-focused strategies, they continue to meet the evolving requirements of the automotive casting industry.

Recent Industry News In December 2024, Wu Xiaofei, General Manager of Dongfeng Electronic Technology, announced that the company’s technology can reduce overall vehicle weight by streamlining stamping and welding processes while strengthening body rigidity. He noted that this approach extends vehicle lifespan and improves the safety of new energy vehicles. Wu made the statement during the signing and groundbreaking ceremony of the Dongfeng Integrated Die-Casting Industrialization Project in the Wuhan Economic and Technological Development Zone on November 22.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 6 billion |

| Projected Market Size (2035) | USD 11.6 billion |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Processes Analyzed (Segment 1) | Die Casting, Sand Casting, Investment Casting |

| Applications Analyzed (Segment 2) | Transmission, Engine, Suspension |

| Material Types Analyzed (Segment 3) | Steel, Iron, Aluminium |

| Vehicle Types Analyzed (Segment 4) | Commercial Vehicles, Passenger Vehicles |

| Regions Covered | North America; Europe; South America; Asia Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Brazil, Mexico, China, Japan, India, South Korea, UAE, South Africa |

| Key Players Influencing the Market | Gibbs Die Casting, Regensburger Druckgusswerk Wolf GmbH, CFS Foundry, Endurance Technologies, Impro, Zetwerk, Zollern GmbH, Others |

| Additional Attributes | Dollar sales by casting type and vehicle component, demand dynamics across passenger, commercial, and electric vehicles, regional adoption trends, innovation in lightweight alloys and precision methods, recyclability impact, emerging adoption in EV components |

The market is expected to reach nearly USD 11.6 billion by 2035.

The market is growing at a CAGR of 6.8% during this period.

Die Casting leads with 45% market share in 2025.

Aluminium captures 50% of the market by share.

Endurance Technologies holds a leading 11% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Die-casting Lubricants Market – Size, Share, and Forecast 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Casting Mold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA