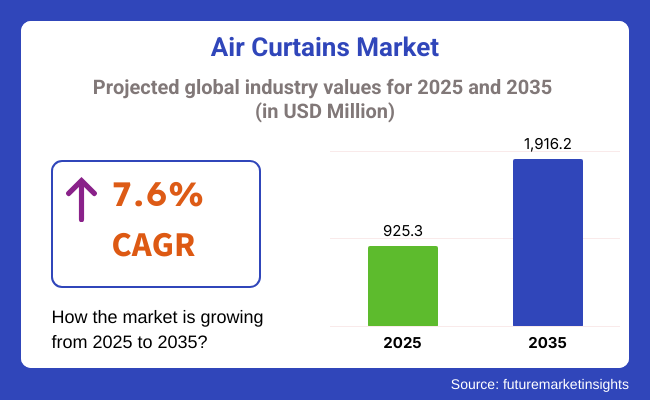

The air curtains market is valued at USD 925.3 million in 2025 and is poised to register a valuation of USD 1,916.2 million by 2035. This growth represents a CAGR of 7.6%, underscoring the increasing adoption of air curtains as essential tools for improving indoor environmental quality and reducing overall energy consumption. In addition, the expanding construction of commercial infrastructure and the rising emphasis on maintaining comfortable, pollution-free indoor environments are key factors fueling this upward trajectory.

A major driver behind this market expansion is the rising global emphasis on sustainability and energy conservation, particularly as governments and industries worldwide respond to escalating environmental concerns. Air curtains serve as an effective means to minimize the infiltration of outside air, dust, and pollutants into temperature-controlled indoor spaces. By doing so, they enhance the efficiency of HVAC (heating, ventilation, and air conditioning) systems and significantly reduce energy costs associated with heating and cooling.

These benefits have made air curtains increasingly popular in settings such as shopping malls, offices, government buildings, and other public spaces where maintaining indoor comfort and air quality is a priority. Furthermore, the growing stringency of environmental regulations and policies aimed at reducing carbon footprints and promoting green building initiatives has incentivized businesses to invest in such energy-saving technologies.

Technological advancements also play a critical role in propelling the growth of the market. The development and integration of sensor-operated and automated air curtain systems enable real-time performance monitoring and optimization, which helps minimize energy wastage and improves operational efficiency.

These smart air curtain solutions address not only energy concerns but also the rising issues related to indoor air pollution and ventilation challenges, which have gained prominence amid increasing awareness about airborne contaminants. As a result, companies are progressively adopting innovative and automated air curtain technologies to enhance indoor comfort and meet regulatory requirements.

Non-recirculating air curtains are estimated to account for approximately 62% of the global air curtain market share in 2025 and are projected to grow at a CAGR of 7.8% through 2035. These units draw ambient air and discharge it as a high-velocity stream to form a barrier, preventing dust, pollutants, and temperature exchange across open entrances.

Their straightforward design, energy efficiency, and minimal ducting requirements make them ideal for commercial and industrial use cases where uninterrupted airflow and ease of service are critical. Retail stores, warehouses, logistics hubs, and food processing facilities continue to favor non-recirculating systems for their cost-effectiveness and proven performance. Manufacturers focus on motor efficiency, noise reduction, and adjustable nozzle design to enhance coverage and airflow uniformity.

Industrial climate control applications are projected to hold approximately 46% of the global air curtain market share in 2025 and are expected to grow at a CAGR of 7.9% through 2035. Demand is driven by the need to maintain controlled internal environments in manufacturing plants, cold storage units, cleanrooms, and logistics centers.

Air curtains in these settings prevent loss of conditioned air, restrict entry of airborne contaminants, and help maintain pressure zones between adjoining spaces. Industries dealing with temperature-sensitive processes, such as food & beverage, pharmaceuticals, and electronics, continue to prioritize air curtain integration as part of energy optimization and indoor air quality strategies. The segment also benefits from regulatory encouragement for energy conservation and indoor hygiene compliance across Europe, North America, and parts of Asia-Pacific.

High Initial Costs and Retrofitting Challenges

The lofty price of installing air curtains, especially for automated and high-performance models, stands out as one of the major obstacles in this market. Customized air curtain solutions are preferred by many commercial and industrial establishments, which adds to the costs of installation and integration. Besides, modern air curtain systems being retrofitted in older buildings are not only technically complex but also expensive, which is a reason adoption in cost-sensitive areas is limited. Along with this, frequent maintenance and periodic filter replacements are also being contributed to by the long-term operational expenses, thus making it hard for small businesses and budget-aware industries to break even on their investments. Manufacturers are countering this challenge by designing low-cost units, extending the leasing option, and supporting the customer in the maintenance prioritization so as to reduce the total cost of ownership.

Limited Awareness and Adoption in Emerging Markets

Adopted in many underdeveloped areas due to the ignorance of the energy-saving benefits and the unavailability of energy efficiency standards, air curtains are energy-savers. The remaining part of the article states that numerous companies in the developing regions are still using old-fashioned heating and vacuum cooling equipment, precluding them from possible cuts in expenses provided by air curtains. Moreover, the insufficiency of specific energy policies and the non-existence of incentives for air curtain fitting in some nations were reasons that reassured the market development. Industry actors are dealing with educating end-users, initiating training courses, and collaborating with state authorities to endorse air curtains deployment as a green climate control measure.

Integration of Smart and IoT-Enabled Air Curtains

The rapid development of smart buildings and automated HVAC systems has resulted in a substantial need for IoT-enabled air curtains. These air curtains are the latest models having additional smart features and the WiFi module for cloud monitoring and control of air curtain from a distance, among which are motion sensors, AI-driven airflow optimization, and remote monitoring capabilities, thus making it possible to adjust in real-time for energy consumption savings and improving user comfort. New technologists are creating air curtains with extra smart connection, which allows the air curtain to work together with BAS (building automation systems), voice assistant devices, and AI techniques for the sustainability of the climate. The prevalence of smart cities and related infrastructure projects is an additional factor that boosts the progress of air curtain systems that have more self-governance and use less energy.

Growing Demand for Energy-Efficient and Eco-Friendly Solutions

As a result of the global agenda that revolves around energy saving, the requirement for air shingles in commercial and industrial buildings has gone up. The authorities and the industrial representatives are rolling out certain policies that are focused on energy-saving. As a result, they are facilitating the installation of high-performance air curtains widely as a part of building solutions. The new models of air curtains that have low environmental impacts come with airflow control, energy-saving motors, and noise-reduction features, which are interesting to companies that care for the environment. Further, the incentives offered for the green building certifications, including LEED and BREEAM, are the trick to persuading the developers to integrate the energy efficiency air curtain technologies in their projects.

An exciting period is on the air curtains market in the USA, which is upwardly transformed, owing to the increasing need for super-efficient HVAC systems, the influence of the willpower of the building energy codes, and the constantly emerging commercial infrastructure. The newly adopted air curtains are one of the main tools for the energy efficiency programs of the USA Department of Energy (DOE), and air curtains are being implemented by the enterprise as a means of achieving the discount on the heating and cooling bill aside from this, these curtains also improve the indoor air quality. The rapid installation of air curtains in retail stores, shopping malls, airports, and warehouses is, in turn, the cause of the market being so successfully developed. Along with these, the drive-thru outlets and QSRs are also seen to be increasing the use of air curtains, thereby maintaining the temperature balance and, at the same time, accomplishing insect and dust control. The new generation of air curtains is smart and automated, and it includes motion sensor-activated and AI-integrated airflow regulation, which is the main reason for the growth of industrial sectors, healthcare, and hospitality outlook.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.8% |

The UK air curtains market is on a growth trend due to the increasing preference for energy-efficient building designs, the rising penetration of intelligent HVAC technologies, and the government rules that advocate the construction of eco-friendly structures. The stringent energy efficiency standards set by the UK (Part L of the Building Regulations) have led to the widespread use of air curtains in retail, public, and business environments. The promotion of air curtains as an energy-saving measure has also been made possible by the advent of sustainable building initiatives and carbon footprint reduction goals. Further, the growing trend towards using contactless entry in hospitals, hotels, and office buildings is offering extra support to the sales of automated air curtains with sensor-based activation. Moreover, added cultivation in the food service sector and the hospitality chain has paved the way for new market exploration.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.3% |

The air curtains market in the European Union is experiencing a rapid rise as a result of stringent energy efficiency regulations, the construction of smart buildings, and the increasing use in retail and healthcare sectors. Germany, France and the Netherlands are the countries that are leading in green building standards that are consequently promoting the demand for energy-efficient air curtains in commercial spaces. The EU's Energy Performance of Buildings Directive (EPBD) has led to further implications, such as the introduction of new stricter HVAC efficiency standards, which are the reasons that air curtains are being installed in offices, retail stores, and industrial warehouses widely to improve thermal insulation and make energy savings. In addition to that, the investment in smart city developments and urban transport infrastructure has also been the reason why there is a higher demand for air curtains in places like public transport stations, airports, and metro systems. Furthermore, the demand for air curtains in health care institutions, food processing plants, and eateries has also increased due to rising hygiene awareness after the pandemic.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.6% |

The air curtains market in Japan is experiencing a trajectory primarily due to a significant surge in energy conservation measures, the increasing acceptance of smart HVAC systems, and the mounting number of commercial urban buildings. The country of Japan has pushed the growth of green energy and the new and improved systems in the building sector, which has, for that reason, raised the demand for air curtains in malls, hotels, and office workplaces. The operators in the hospitality and sustainable sectors have been utilizing air curtains with sensors more frequently due to their efficiency in climate control and comfort, adding to the fact that they affect the environment less negatively. In addition, platforms being set for the installation of air curtains in transit hubs are the increased concerns and investments in high-speed rail infrastructure and metro stations reducing temperature loss in waiting areas. The advent of robotics and automation in Japan has propelled the innovation of controlling robots, which are workerless and run solely by machines; thus, the control of implementation of air curtains in offices and industrial places has taken off.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

The Korean air curtains market is rising quickly due to various factors like urbanization, energy efficiency focus, and adoption of advanced HVAC solutions. Since the demand for air curtains has increased along with South Korea's smart city initiative and commercial sector, office buildings, shopping centres, and public transport are more likely to have them. The country's thriving e-commerce sector has also driven growth in temperature-controlled warehouses and distribution centres, where industrial air curtains help maintain indoor climate conditions. Furthermore, government policies encouraging the purchase of energy-efficient appliances are also facilitating the growth of low-energy air curtains in commercial and residential buildings. Unveiling the latest trend of incorporating AI and IoT tech in air curtains at smart buildings and automated HVAC systems is also emerging, making it possible for companies to optimize airflow control and reduce energy waste.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

The global air curtains market is experiencing steady growth due to increasing demand for energy-efficient HVAC solutions, rising commercial and industrial construction activities, and growing awareness of indoor air quality control. Air curtains are widely used in commercial buildings, industrial facilities, cold storage units, and healthcare institutions to prevent heat loss, improve climate control, and reduce contamination from airborne particles and insects. The market is shaped by technological advancements in high-velocity airflow systems, the integration of smart controls for automated operation, and the rising adoption of energy-efficient air curtains. Leading manufacturers focus on high-performance designs, sustainability features, and customized solutions for various commercial and industrial applications.

Mitsubishi Electric Corporation

A major contender in Mitsubishi Electric's production of air curtains is a company that offers intelligent HVAC solutions that incorporate IoT interconnectivity and automation. The high-velocity air curtain systems installed by the company are innovative, which allow eco-mode operation, adjustable temperature control, and remote monitoring of indoor climate conditions for effective climate regulation. The strong establishment has been putting funds into the research of environmentally friendly air curtains, such as the utilization of low-energy motors and the distribution of the airflow to facilitate sustainable operation in the building.

Mars Air Systems

Mars Air Systems is a major company in high-performance air curtains. We are specifically in charge of commercial, industrial, and cold storage applications. The company’s DC and HV series of air curtains not only have adjustable air velocity but are also equipped with noise reduction technology, besides being made of durable construction material to guarantee long-lasting performance. Mars's primary goal is expanding its energy-efficient product line to achieve maximum cost savings as well as improve indoor air management in large facilities.

Berner International LLC

Berner International boasts a reputation for its specifically tailored solutions for air curtains, which are noiseless and made available to retail outlets, eateries, and medicinal surroundings and have an efficient performance rate. The firm combines the digital control panel with the automatic activation sensor and the advanced air filtration system to promote the user experience and energy conservation further. Conversely, Berner is focused on the realization of smart air curtains with IoT-based blowing modulation, which helps with optimal thermal comfort and lower energy use.

Toshiba Corporation

Toshiba is a manufacturer of small and fast air curtain systems, which is mainly based on energy-efficient operation and better air distribution. The firm's air curtains are prominently found in commercial buildings, hotels, and office spaces, which significantly contribute to thermal comfort and keeping out dust and toxins. The company is still in the process of developing new eco-friendly products, and one of its main projects at the moment is the creation of air curtains that utilize highly efficient DC motors and have features such as automated airflow control.

Systemair AB

Systemair is a primary market provider of industrial and commercial air curtains, which have incorporated the EC motor technology to save energy and optimize air circulation. The company’s air curtains are the ideal protective barriers for cold storage units, logistics centers, and busy retail stores, as they can achieve constant climate control with hardly any energy needed. Systemair is increasing its range of Internet of Things (IoT)-friendly air curtain solutions, which are equipped with remote monitoring and predictive maintenance features.

Recirculating, Non Recirculating

Surface Mounted, Recessed, Walk-through

Horizontal, Vertical

Up to 2000 CFM, 2000-5000 CFM, 5000-15000 CFM

HoReCa, Malls & Shopping Centres, Warehouse & Cold Storage, Hospitals & Clinics, Cineplex & Auditoriums, Offices & Public Spaces

North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa

The global air curtain market is projected to reach USD 925.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 7.6% over the forecast period.

By 2035, the air curtain market is expected to reach USD 1,916.2 million.

The surface-mounted segment is expected to dominate because of its ease of installation and versatility in commercial and industrial applications. These air curtains are commonly used in retail stores, warehouses, and offices to maintain indoor temperatures, reduce energy costs, and improve air quality.

Key players in the air curtain market include Mitsubishi Electric Corporation, Panasonic Corporation, Systemair AB, Berner International LLC, and Mars Air Systems.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA