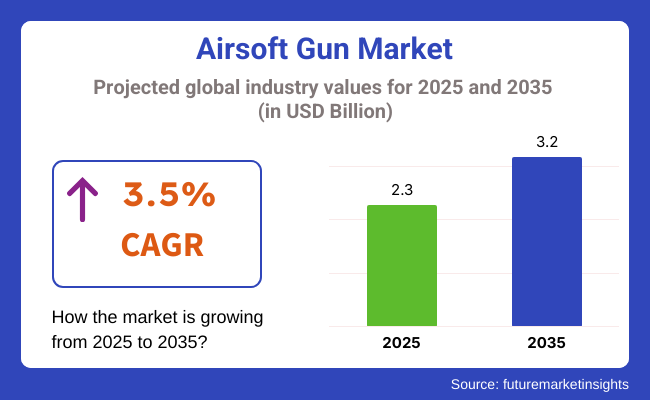

The airsoft gun industry is expected to be USD 2.3 billion in 2025. The industry is expected to increase steadily from 2025 to 2035 with a CAGR of 3.5%. The industry is expected to reach USD 3.2 billion in 2035. A significant drive behind this rising trend is the increasing need for recreational shooting sports and military simulation experiences among young adults and tactical enthusiasts. The industry is evolving with greater and greater global participation in organized airsoft competitions, greater popularity of fighting sports, and greater investment in recreational activities.

The widespread availability of user-configurable airsoft replicas in the form of electric-powered (AEGs), gas-blowback, and spring-loaded versions is appealing to different groups of consumers, from recreational players to champion teams. Enhanced realism of replica design and use of tactical accessories also support adoption.

Aside from leisure use, the industry is gaining growing adoption in military and law enforcement training applications. Airsoft guns are now being used as cost-effective, safe, and realistic alternatives to force-on-force training, tactical coordination, and accuracy training on the battlefield. This convergence of commercial and professional use is driving the industry value chain and technology innovation scope wider.

North America and Europe remain core industries due to established airsoft cultures and regulatory environments enabling ownership within controlled guidelines. However, Asia Pacific remains a rapidly emerging high-growth region with growing disposable incomes, supportive outdoor recreation trends, and growing online retailing channels.

Customization services and local manufacturing are also increasing accessibility and consumer base. Over the forecast period, the future of the industry will be driven by regulatory oversight, continuous innovation in product safety, and emerging technologies like smart targeting systems and biometric locks. Those businesses that cooperate with evolving standards for safety while delivering engaging user experiences are best suited to steer the industry forward into the next decade.

In 2025, 41% of the industry will be dominated by rifles, while the remaining balance goes to handguns, which take 37%. The trend towards these changes is a reflection of the increasing changes in the way fans engage in the game. Differences could be real regarding gameplay strategy, realism, and tactical functionality.

Rifles dominate because they have more range and accuracy than handguns. Most importantly, they are indeed customizable- the exact must-have feature during mil-sim (military simulation) events and competitive airsoft contests.

Many enthusiasts and professional teams widely favor popular models such as the M4, AK-47, and SCAR variants. Their huge success can be attributed to electric rifles (AEGs) differing in modular upgrade kits, programmable triggers, and rail systems offered by major brands like Tokyo Marui, G&G Armament, and VFC. Rifles are generally what enthusiasts prefer using for most outdoor and long-range organized events. Handguns take a 37% share of the market, but they are not that much more valuable than serving as a secondary arm.

They particularly dominate niches in indoor CQB close-quarter battle arenas, where small size and maneuverability are vital components. Under Gas Blowback, an internal gas system whose operation is similar to real firearms from companies like KWA, WE Tech, and Umarex, the user can get realistic-use training. Then, being cheap, easy to maintain, and portable (in regions with more stringent laws on airsoft guns), legally, they are still in great demand among novices, casual players, and law enforcement trainees.

The online sales of airsoft guns will dominate the industry in revenue as it is expected to acquire 52% of the industry share in 2025. The offline distribution channels would be complementary to an extent of 48%. The growth in terms of online sales has been attributed to the many conveniences it provides in terms of a wider selection of products and also better pricing as opposed to online platforms.

This growth in online sales has primarily been attributed to several factors. Thus, they have access to a wide range of entry-level to fully customizable rifles and handguns from different manufacturers without having to worry about whether there is such a product locally.

These are easily accessible through subscriptions on several leading e-commerce websites, such as Amazon and eBay, as well as from certain specialized retailers like Airsoft GI and Evike. Customers can also read other customers' reviews, find the technical specifications, and view demonstration videos, thus helping the buyers in making well-informed buying decisions.

Most, if not all, online sites also have sales, discounts, and bundled deals for access to their chosen brands, like Tokyo Marui, G&G Armament, and Classic Army. The major contributing reasons why online shopping is convenient for an air softer are home delivery and searching for the best price among several stores. Offline channels, including specialty airsoft shops, sporting goods chains, and physical stores scattered throughout major cities, will continue to play an essential role in the growth of airsoft sales in the future.

Here, customers can test and examine the different products and get personal recommendations and professional advice from the staff, other consumers, or both. It also allows immediate possession of items without shipment waiting time, which is sometimes critical for quick replacement or upgrade among players.

End users prefer purchasing electric guns for firing modes that include full-auto and increase the capacity of their magazines and compatibility with tactical products like scopes, lasers and grips. Buyers search for appealing visual realism but also tend to examine the mechanical workings of an airsoft gun because they play to replicate real-life experiences. More institutional and professional scenarios would prefer the incorporation of these guns for the sake of non-lethal training; hence, these can be deemed phenomenally reliable, always offering realistic feedback.

There is an evident necessity on the part of police and military units for authenticity in models, along with recoil simulation and safety features. Such consumers are often drawn to evaluate products on the basis of durability, calibration accuracy, and flexibility in training.

Price remains a key issue, particularly for first-time users and young players. However, the mid-to-premium segment continues to grow because of an increased demand for branded replicas and specialized ones. New safety requirements, age restrictions and transporting rules all affect consumer suitability and purchasing frequency, which in turn reflects the brand positioning of their products in physical and online retail spaces.

The industry, while strong and recreationally active, is subject to a variety of risks that can impact long-term development. First among these is the variability in global and domestic regulations governing airsoft product classification. In some jurisdictions, these guns are classified on par with firearms, subjecting them to legal bans on sale, ownership, or use. Uncertainty or restriction of such legislation can highly deter industry access. There are concerns about public image and safety.

Misuse or misuse-related accidents with airsoft replicas that are virtually indistinguishable from real guns can lead to negative publicity in the media and heightened regulatory attention. This risk places pressure on manufacturers to adopt more design protection, such as blaze tips, tamper-proof safety locks and education campaigns on proper use.

The market's dependency on discretionary consumer spending makes it vulnerable to macroeconomic shifts. As a hobby industry, airsoft is subject to swings in disposable income, leisure trends and global logistics.

Supply chain failure or price instability in foundation materials, such as high-quality polymers and metal alloys, would further challenge dependable product availability and cost structures. Reducing these vulnerabilities with innovation, regulation adherence and risk diversification will be imperative for sustained industry growth.

During 2020 to 2024, the industry developed steadily, stimulated by growing demand for recreational shooting sports and application in military and police training. The industry witnessed growth in the popularity of electric airsoft guns (AEGs) as a result of their ease of use and reliability. Apart from that, the growth of web retailing channels brought these guns closer to a larger base of consumers, especially millennials who sought action sports to ease stress from busy working lives.

The industry can be expected to take huge strides. Advancements in technology ought to lead to smart airsoft guns that are more realistic and practical. Incorporating virtual reality (VR) and augmented reality (AR) technology would add interactive simulated strategy, boosting industry demand. Also, emphasis on sustainability will drive the use of green airsoft bullets, aligned with global environmental goals. Consequently, these guns will transform from simple recreational devices to advanced devices providing realistic and sustainable experiences.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Product Focus: Prevalence of electric-powered airsoft guns (AEGs) on account of easy-to-use features. | Technological Integration: Development of intelligent airsoft guns with AR/VR for an immersive experience. |

| Distribution Channels: Expansion of online shopping sites enabling easier accessibility. | Integrated Platforms: Development of end-to-end online platforms providing community connectivity and virtual simulation. |

| Consumer Demographics: Mainly marketed to millennials looking for recreational activities. | Growth Demographics: Increased user base of police and military officers for training. |

| Sustainability Initiatives: Pre-prototype testing with green material and bio-degradable ammunition. | Sustainable Innovations: Increased usage of green materials and sustainable manufacturing processes. |

| Industry Drivers: Increased popularity of military simulation and target sports recreational shooting. | Advanced Training Solutions: Deployment of airsoft guns in composite training programs to create tactical skills. |

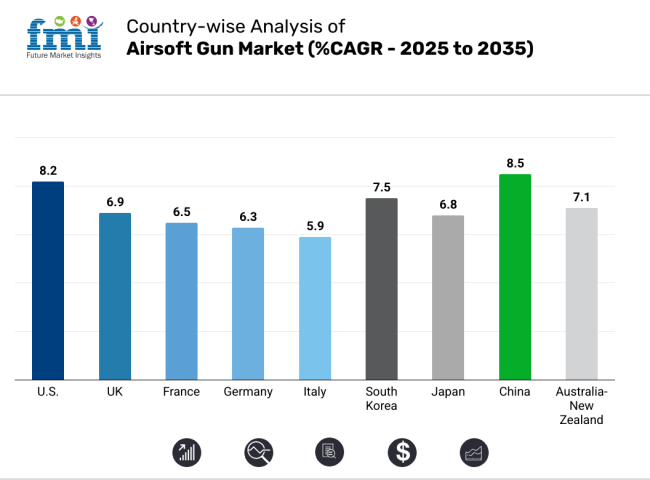

The USA industry will register growth at 8.2% CAGR over the forecast period. The USA is one of the most developed and profitable industries in the world, underpinned by a strong recreational sporting culture and broad access to airsoft fields and events. The growing popularity of tactical sports among millennials and Generation Z has contributed to steady demand for electric as well as gas-powered guns. In addition, a strong distribution base in physical retail outlets and the online marketplace has further improved reach and consumer convenience.

Advances in terms of battery life, accuracy, and upgradeable parts continue to fascinate hobby shooters and semi-pro players. As an added force, expansion is underpinned by the periodic organization of high-end competitive airsoft competitions and scenario game-based events involving the need for expert-grade equipment, thus fueling product upgrade cycles and repeat purchase behavior.

Police and military training simulations also add to industry demand, as these guns offer a realistic yet safe training option. Overall consumer demand for active, immersive entertainment continues to support the USA industry, setting it up for long-term, stable growth. Regulatory stability and high consumer base are likely to continue the momentum, making the USA a leader in both domestic consumption and product innovation in the global market.

The UK industry is expected to grow at 6.9% CAGR during the study period. The UK industry enjoys a rising base of enthusiasts participating in formal airsoft skirmishes and competitive leagues. The success of immersion role-playing scenarios and weekend skirmish events has contributed to expanding the industry across both urban and rural areas.

The existence of established airsoft sites and growing numbers of specialized retail outlets has enhanced accessibility and visibility of the sport. Increasing disposable incomes and cultural attraction to military simulation games have also fueled stronger consumer interest, especially from young adults.

While there are some limitations on replica guns, the industry has evolved to provide compliant versions that satisfy legal requirements yet maintain usability. This flexibility has provided uninterrupted product flow with minimum regulatory interference. The internet sites contribute significantly to product discovery and purchase, as most consumers prefer online means for comparing specs and reviews.

The UK also experiences modest demand from tactical training environments, providing an additional revenue stream. In total, the UK industry is well-positioned for steady growth based upon an informed consumer base and ongoing recreational use.

France industry is anticipated to grow at 6.5% CAGR in the study period. The French industry has registered significant growth in recent years through a growth in the recreational sector and growing youth involvement in tactical sports.

A combination of indoor and outdoor fields for skirmishes in different provinces has increased consumer interest and enabled product demand. Although regulatory guidelines with respect to realistic-looking guns are tight, local manufacturers and suppliers have made adjustments to comply, thus maintaining industry supply.

The growth in e-commerce has facilitated greater product availability and less regional variation in availability. Furthermore, France is witnessing greater demand for customized and high-performance airsoft guns, particularly from frequent players and competitive teams. This trend is forcing companies to develop new models with modular designs and greater accuracy.

Military and police force training simulations play a minimal part in driving the demand, yet the biggest impetus continues to be the recreational segment. Consumer retention and repeat buying are supported by the social nature of airsoft games and facilitated by forums, clubs, and events in localities. With increased visibility and step-by-step strengthening of retail chains, the French industry is poised to maintain its existing growth rate of moderate level.

The German industry will progress at 6.3% CAGR over the period of study. Germany is an important industry for the European airsoft segment based on its rich heritage for outdoor activities and well-organized commercial infrastructure.

The nation boasts a robust foundation of established airsoft clubs and fields, particularly in rural areas where there is greater availability of land for gameplay. German consumers prefer high-quality, long-lasting airsoft gear, which is conducive to a thriving aftermarket for repair and customization. The growing demand for customized gear and tactical looks has resulted in higher expenditures per consumer.

Requirements for the look and performance of airsoft guns are fairly stringent, with open labeling and power restrictions. Nonetheless, the industry has managed to adjust effectively by manufacturing region-specific models that meet German gun legislation. Retailers prioritize educational materials to facilitate well-informed purchases and reduce compliance problems.

Online purchases are common, though on-site demonstrations at clubs and outlets continue to play a significant role in establishing consumer confidence. With increased awareness and solid participant base, the German industry is forecasted to maintain the growth trend at a modest rate up to 2035.

The industry for Italy is expected to rise by 5.9% CAGR from the period studied. Italy shows moderate potential in the industry of airsoft guns due to mainly its cultural focus on team sports and army simulation games. The hobbyist community is fairly niche but highly involved, which creates a solid foundation of repeat sales.

The industry is developed enough to accommodate a range of airsoft products, from low-cost models to high-end precision replicas. Large cities have competitive events and themed gameplay areas, which increase industry visibility and stimulate first-time purchases.

Italian law surrounding replica guns, though existing, is less restrictive than in some neighboring nations, and a relatively free industry exists. Restrictions on power and obligatory markings do necessitate specification changes by manufacturers, though. Traditional sales continue to be robust in Italy, with support from specialty shops providing advice and after-sales support.

Online platforms are increasingly popular, especially among younger buyers. Despite a slower growth rate compared to Northern European counterparts, the Italian industry benefits from steady interest in recreational shooting sports and a supportive regulatory framework. Continued community outreach and product innovation are expected to support gradual growth in the coming decade.

The South Korea industry is expected to grow at 7.5% CAGR during the study period. The South Korean industry is becoming a dynamic sector in the larger recreational weapons market, driven by growing demand for combat simulation games and scenario-based group activities.

The airsoft phenomenon in urban centers like Seoul has been on the increase because of the growing youth interest and the proliferation of organized sports centers. Design and material innovations, such as lightweight and compact models specifically designed for close-quarters combat, have contributed to consumer demand and expanded the target market.

While there are strict regulations regarding firearms and replica weapons, compliant models with low power output are common and make up the bulk of legal sales. Local manufacturers have become adept at producing models that blend safety and realism, which has proven to be highly effective in attracting enthusiasts.

E-commerce continues to expand, offering a convenient channel for accessing a wide variety of gear. Additionally, airsoft-related content on social media and streaming platforms has amplified awareness and community building. With increasing income and increasing demand for experiential entertainment, South Korea is poised for sustained growth in the industry over the forecast period.

The Japan industry is expected to grow at 6.8% CAGR over the forecast period. Japan has one of the most structured and technology-driven industries globally. With a record of leading in airsoft gun production, the nation has a well-established home industry and an advanced consumer class. The industry is driven predominantly by an industry of dedicated fans and collectors and, therefore, demands high levels of performance as well as cosmetic appeal.

Retail hubs are concentrated in Tokyo and Osaka, with several shops hosting testing ranges and custom options. Japanese airsoft regulations are among the world's most stringent, with precise velocity limits and obligatory certification for safety. Yet local companies spearheaded development in the field, creating precision high-quality airsoft guns fully compliant with the law that are generally regarded as among the world's best.

Domestic demand is also boosted by regular themed tournaments and indoor facilities to permit safe round-the-year play. Export opportunities also underpin industry strength overall. Japan's industry sentiment continues to be favorable, driven by innovation, a value-driven consumer base, and sound industry norms that foster healthy growth.

The Chinese industry will grow at 8.5% CAGR over the study period. China is likely to rank among the fastest-growing industries, underpinned by increasing consumer expenditure and demand for tactical sports.

Urban cities like Beijing, Shanghai, and Shenzhen are witnessing a boom in airsoft activities, such as skirmish events and indoor theme parks. The industry is witnessing growing participation from young professionals and gaming communities, who are frequently driven by exposure to international airsoft trends and military-themed esports.

While the regulatory landscape is complicated and region-specific, the industry remains active through locally produced low-power replicas and accessories that are compliant with safety standards. Local manufacturers are taking advantage of cost benefits and volume to launch a variety of products, including electric and spring models appropriate for beginners and experienced players alike.

Online commerce plays a central role in industry expansion, allowing consumers from second- and third-tier cities access to a full product range. The rising influence of online influencers and sports content creators is also expected to contribute significantly to industry awareness. China’s rapid urbanization and increasing interest in interactive leisure activities position it as a high-growth airsoft industry over the next decade.

The Australia-New Zealand industry will grow at 7.1% CAGR over the study period. The Australia-New Zealand industry is growing steadily due to growing consumer demand for action sports and tactical gaming. Australia has witnessed important legislative changes permitting airsoft in controlled conditions in some states, and this has resulted in the establishment of new recreational sites and a broader product range.

New Zealand already has a more relaxed setup, including spring models and electric ones with minimum restrictions. Expansion is driven by increased youth participation, local clubs, and organized game events. Both nations, despite their regional differences in legal compliance, have a strong love for outdoor sports and have sufficient space and infrastructure to accommodate large-scale events.

Online forums and gear review platforms have driven community building, providing new users with advice and encouraging gear upgrading. Both domestic retailers and offshore suppliers are responding to this interest with customized products. With incremental policy support and increasing user bases, the Australia-New Zealand airsoft industry will record steady growth up to 2035.

The industry is shaped by a blend of heritage firearm brands and niche tactical gear manufacturers, each leveraging unique strengths to address an increasingly discerning consumer base. The next hot innovations include realism, modularity, as well as advanced10 firing systems such as programmable automatic electric guns (AEGs) and gas blowbacks. The leaders capitalize on different tastes in regulations among regions and enhance their presence online to engage communities and foster loyalty.

Tokyo Marui defines the premium airsoft industry with its legacy-making precision AEGs, which were invented by electric blowback. Constant with high-quality materials and internal performance, it stays ahead in the eyes of enthusiasts and collectors. G&G ARMAMENT TAIWAN LTD. continues to grow its presence in the world industry by offering versatile platforms from the entry level to the professional level, geared up with programmable internals and competition-grade builds.

ICS Airsoft holds a unique position for serious hobbyists and tactical trainers with its split gearbox, an innovation for enhancing customizability and maintenance. Following the industry strategy outlined in the previous paragraph, Lancer Tactical and VALKEN SPORTS target mass and first-time users with models that are cheap, robust, and readily available continent-wide in North America. While realism and brand licensing drive some successful companies, others focus on upgradability and tactical integration, making this a highly dynamic industry imbued with technology.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Tokyo Marui | 18-22% |

| G&G ARMAMENT TAIWAN LTD. | 15-18% |

| ICS Airsoft, Inc. | 10-13% |

| Lancer Tactical Inc. | 9-12% |

| VALKEN SPORTS | 7-10% |

| Other Players | 25-30% |

Key Company Insights

Tokyo Marui (18-22%) continues to set the benchmark for electric-powered airsoft guns with precision craftsmanship, innovation in gearboxes, and a loyal user base that prioritizes performance as well as realism. Its Japanese manufacturing roots lend it a unique reputation for reliability, especially in competitive shooting circuits and among collectors. With a strong presence across Asia and growing brand reverence in Western markets, Tokyo Marui retains its leadership through continuous innovation and limited-edition launches.

G&G ARMAMENT TAIWAN LTD. (15-18%) has expanded aggressively into European and USA markets with a diverse catalog catering to both beginners and advanced players. The brand's strength lies in smart electronics integration (e.g., ETU systems) and adaptable designs, positioning it well for both recreational users and tactical trainers.

ICS Airsoft (10-13%) stands apart due to its modular gearboxes and user-friendly maintenance systems, making it a favorite in training scenarios and milsim environments.

Lancer Tactical (9-12%) has built its industry share around value pricing, large-scale distribution, and appealing aesthetics tailored to younger demographics as well as casual players. Meanwhile,

VALKEN SPORTS (7-10%) leverages its strong North American distribution network and starter-friendly kits, catering to new entrants and paintball crossovers. These firms collectively drive innovation in realism, affordability, and tactical features, helping diversify the airsoft landscape.

The industry is segmented into four product types-handgun, rifle, shotgun, and muzzle loading.

The industry is divided into two distribution channelsonline and offline.

The industry is analyzed across several regions, including North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is expected to reach USD 2.3 billion in 2025.

The industry is projected to grow to USD 3.2 billion by 2035.

The industry is expected to grow at a CAGR of 3.5% during the forecast period.

Rifles are a key segment within the market.

Key players include VALKEN SPORTS, Colt’s Manufacturing Company, LLC, ICS Airsoft, Inc., Crosman Corporation, Lancer Tactical Inc., Kriss USA, G&G ARMAMENT TAIWAN LTD., Ballistic Breakthru Gunnery Corporation, A&K Airsoft, and Tokyo Marui.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Distribution channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Distribution channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Product, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Product, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Distribution channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Distribution channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Distribution channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Distribution channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Distribution channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Distribution channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Distribution channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Distribution channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nail Guns Market Size and Share Forecast Outlook 2025 to 2035

Rivet Gun Market Growth – Trends & Forecast 2018-2028

Grease Gun Market Growth – Trends & Forecast 2025 to 2035

Massage Guns Market Analysis – Demand, Growth & Forecast 2025–2035

Welding Guns Market Growth - Trends & Forecast 2025 to 2035

Caulking Gun Market

Dispensing Guns Market Size and Share Forecast Outlook 2025 to 2035

Perforating Guns Market Size and Share Forecast Outlook 2025 to 2035

Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

Powder Coating Guns Market

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

USA Percussion Massage Gun Market Growth - Trends & Forecast, 2025 to 2035

Electric Soldering Iron Gun Market

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA