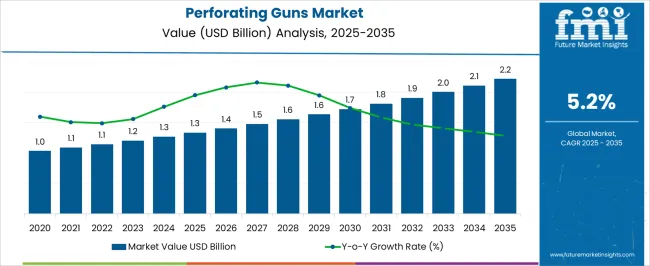

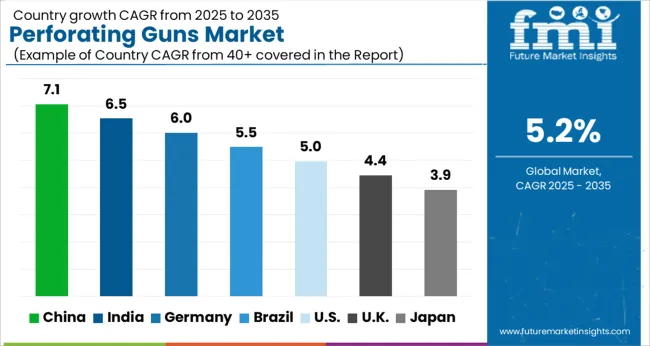

The Perforating Guns Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Perforating Guns Market Estimated Value in (2025 E) | USD 1.3 billion |

| Perforating Guns Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Perforating Guns market is witnessing steady growth, driven by the increasing need for efficient well completion technologies in the oil and gas industry. Rising exploration and production activities, particularly in offshore and unconventional reservoirs, are creating demand for advanced perforating solutions that enhance well productivity. Perforating guns are being adopted to improve hydrocarbon flow, reduce formation damage, and optimize production efficiency.

Technological advancements in gun design, safety mechanisms, and explosive materials are further supporting market growth. Increasing preference for precision perforation and deeper penetration capabilities is shaping the adoption landscape. Regulatory emphasis on operational safety and environmental compliance is also encouraging the use of advanced perforating systems.

Growing investments in horizontal drilling and deepwater exploration, combined with rising energy demand in emerging and mature markets, are expected to sustain market expansion Continuous innovation, such as multi-shot and selective perforating technologies, is enabling operators to achieve higher efficiency while minimizing operational risks, positioning the market for long-term growth.

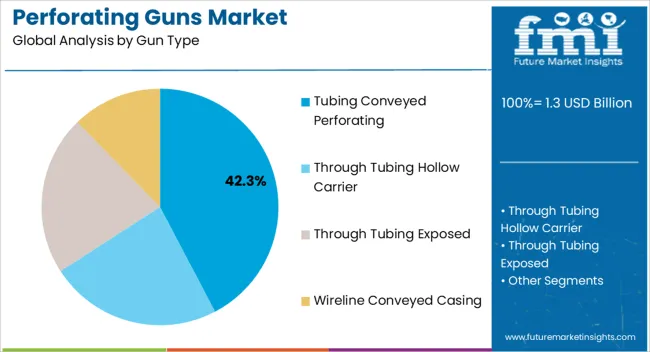

The tubing conveyed perforating gun type segment is projected to hold 42.3% of the market revenue in 2025, establishing it as the leading gun type. Growth in this segment is driven by its ability to deliver precise perforation at targeted depths while maintaining safety and operational control. The design allows the gun to be conveyed through tubing, reducing the risk of mechanical failures and enhancing placement accuracy in complex wells.

This gun type supports high penetration rates and optimal hydrocarbon flow, which is critical for maximizing production efficiency. Adoption is further reinforced by its suitability for horizontal and deviated wells, where precise targeting is essential. Operators are leveraging tubing conveyed perforating guns to achieve efficient perforation while minimizing formation damage.

The integration of advanced detonating systems and modular designs has improved safety and adaptability, strengthening the segment’s position As the demand for optimized well completions and enhanced production continues to grow, tubing conveyed perforating guns are expected to maintain their market leadership due to their performance, reliability, and operational advantages.

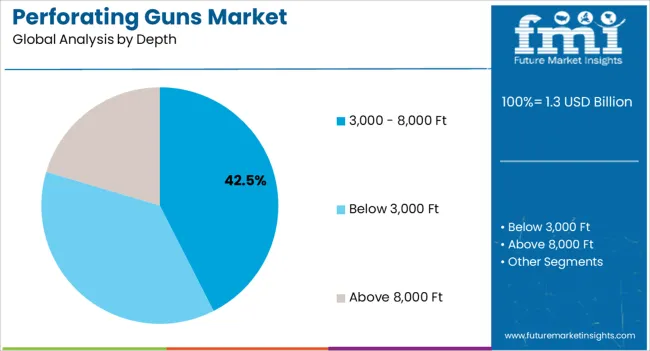

The 3,000 - 8,000 Ft depth segment is expected to hold 42.5% of the market revenue in 2025, making it the leading depth category. Its growth is driven by the increasing number of wells being drilled within this depth range across onshore and offshore locations. This depth category enables effective hydrocarbon extraction while ensuring operational safety and minimizing risks associated with deeper wells.

Perforating guns designed for this depth are optimized for precise charge deployment, maximizing well productivity and reducing formation damage. The ability to handle medium-depth reservoirs efficiently has reinforced its adoption among operators in conventional and unconventional oil and gas fields.

Technological advancements in explosive charges, casing design, and detonation systems have further enhanced reliability and performance As drilling activities continue to expand in regions with medium-depth reservoirs, the 3,000 - 8,000 Ft segment is expected to maintain its leading position, driven by the combination of operational efficiency, safety, and well performance optimization.

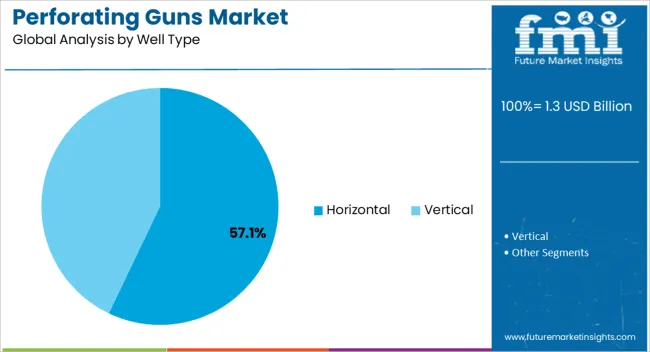

The horizontal well type segment is projected to hold 57.1% of the market revenue in 2025, establishing it as the leading well type. Growth in this segment is being driven by the widespread adoption of horizontal drilling techniques to increase reservoir contact, improve hydrocarbon recovery, and reduce environmental impact. Horizontal wells allow operators to maximize extraction efficiency from tight or unconventional formations, making perforating guns critical for achieving optimal productivity.

Advanced perforating gun systems enable precise targeting along horizontal well sections, ensuring uniform perforation and minimizing formation damage. The segment is further supported by increasing exploration in shale gas, tight oil, and mature reservoirs where horizontal drilling is preferred.

Technological advancements in perforating gun placement, charge design, and detonation reliability are enhancing adoption in horizontal wells As the oil and gas industry continues to prioritize efficiency, productivity, and safety, the horizontal well segment is expected to remain the largest revenue contributor, driven by its compatibility with modern well completion techniques and enhanced hydrocarbon recovery potential.

As per Future Market Insights’ (FMI) latest analysis, global sales of perforating guns grew at around 6.7% CAGR historically from 2020 to 2025. Accordingly, total market valuation in 2025 reached about USD 1.1 billion.

Looking forward, the worldwide perforating guns market is expected to thrive at a CAGR of 5.5% through 2035. It is anticipated to generate an absolute $ opportunity of USD 0.834 billion during the projection period.

Growing energy demand from industrial and residential sectors and increasing oil & gas drilling activities are key factors driving the global perforating guns industry forward.

Perforating guns have become essential tools in oil and gas exploration activities. They are being increasingly used to perforate oil & gas wells in preparation for production. These guns take explosive shaped charges downhole where their detonation creates holes or tunnels that act as conduits through which reserve fluids flow.

Increasing consumption of fuels such as oil and gas across the world is expected to boost the worldwide perforating guns industry during the assessment period.

Rising investments by government in exploring new oil and gas reserves is expected to open a plethora of opportunities for perforated gun manufacturers

Governments throughout the world are launching new oil and gas exploration projects to meet rising energy demand. For instance, recently an investment of USD 1.4 billion for exploring oil and natural gas at nine new sites in the Mediterranean and Red Sea was announced by Egypt.

Similarly, increasing focus on improving productivity and reducing costs during oil & gas exploration activities will create demand for perforating guns.

Another key factor that will fuel global perforating gun sales is the rising production of unconventional oil & gas resources.

According to the International Energy Agency, production of unconventional oil and gas resources such as shale gas, natural gas hydrates, oil sand, coal bed methane, etc, will upsurge significantly. This will create ample growth opportunities for the target market.

| Countries | Market Value (2035) |

|---|---|

| United States | ~USD 2.2 billion |

| United Kingdom | ~USD 0.78 billion |

| China | ~USD 0.506 billion |

| Japan | ~USD 0.384 billion |

| South Korea | ~USD 0.115 billion |

| Countries | Historical CAGR (2020 to 2025) |

|---|---|

| United States | 6.6% |

| United Kingdom | 6.4% |

| China | 6.5% |

| Japan | 6.4% |

| South Korea | 6.2% |

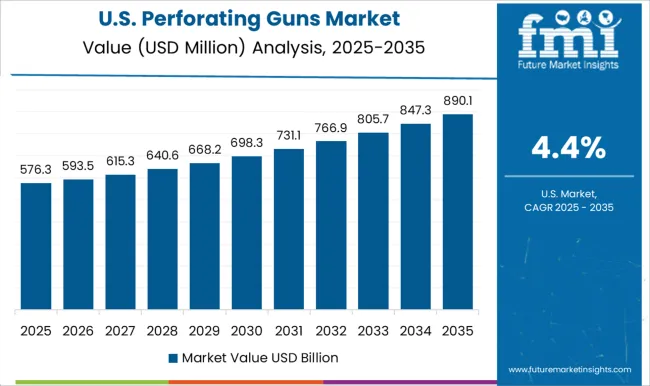

Rising Oil & Gas Exploration Activities Propelling Perforating Gun Demand in the United States

According to Future Market Insights’ (FMI) latest report, the United States perforating gun industry is projected to reach a valuation of around USD 2.2 billion by 2035. It will create an absolute $ opportunity of about USD 1.3 billion between 2025 and 2035.

Over the assessment period, perforating gun demand in the United States is expected to surge 5.5% CAGR in comparison to 6.6% CAGR recorded during the historical timeframe.

Growing demand for energy and increasing oil & gas exploration activities are key factors driving growth in the United States perforating gun industry.

In recent years, oil & gas exploration activities have been on the rise in the United States due to increasing energy consumption. According to the USA Energy Information Administration (EIA), petroleum consumption in the United States reached an average of about 1.3 million barrels per day in 2025.

To meet rising demand for energy resources such as petroleum and gas, new exploration projects are being launched. For instance, the Biden Administration recently approved a USD 8 billion oil drilling project in Alaska. This in turn is expected to elevate demand for perforating guns as they are extensively used in oil & gas exploration and drilling activities.

Strong presence of leading perforating gun system manufacturers and advancements in well perforation technologies are also boosting the United States market.

Favorable Government Support & Rise in Shale Gas Production Making China a Lucrative Market

As per FMI’s latest report, China is likely to emerge as the most lucrative market for perforating gun manufacturers during the assessment period. This is due to favorable government support and increasing production & consumption of shale gas.

China perforating guns market expanded at a CAGR of 6.5% during the historical period. Over the projection period, perforating gun sales in China are expected to soar at 5.5% CAGR, taking the overall market valuation to over USD 0.506 billion by 2035.

Escalating energy demand in China is prompting leading private oil & gas corporations and the government to increase shale gas production. This in turn is creating an enormous demand for drilling technologies including perforating guns and the trend is expected to continue during the projection period.

China’s shale gas production has been rising rapidly during the past few years. As per the USA Energy Information Administration (EIA), since 2020 China’s shale gas production grew at 21% annually and reached about 1.3 billion cubic feet (Bcf) in 2024.

Perforating guns are being increasingly employed during drilling of unconventional oil and gas resources such as shale gas. Hence, increasing investments in increasing shale gas production will eventually uplift perforating gun demand through 2035.

Favorable government support is also positively impacting China perforating guns industry. For instance, the Chinese government recently launched a subsidy program through which it announced financial incentives for producers to promote domestic upstream development of unconventional natural gas.

| Top Segment (Gun Type) | Tubing Conveyed Perforating |

|---|---|

| Historical CAGR (2020 to 2025) | 6.5% |

| Projected CAGR (2025 to 2035) | 5.4% |

| Top Segment (Gun Type) | Below 3000 ft |

|---|---|

| Historical CAGR (2020 to 2025) | 6.4% |

| Projected CAGR (2025 to 2035) | 5.2% |

Demand Remains High for Tubing Conveyed Perforating Guns

According to Future Market Insights (FMI), demand in the global market is likely to remain high for tubing conveyed perforating gun systems. This is due to the versatile nature and high operational efficiency of these perforation gun systems.

The tubing conveyed perforating segment expanded at a CAGR of 6.6% historically from 2020 to 2025. Over the projection period, the target segment is anticipated to thrive at 5.4% CAGR. Hence, it will remain the top-revenue generation segment for perforated gun manufacturers.

Tubing conveyed perforating guns are suitable for both horizontal and deviated wells. They are adaptable to a variety of gun lengths to accommodate a range of completion procedures. These guns are attached to tubing and run in the well using a drilling or workover rig.

Adoption of tubing conveyed perforating guns (TCP) reduces both cost and operational complexity. They also offer benefits such as leaving tubing in place after perforating underbalanced and improved flexibility and performance. These attractive features of tubing conveyed perforating guns are expected to encourage their adoption globally.

Growing popularity of tubing conveyed perforating (TCP) techniques is another key factor that will elevate tubing conveyed perforating gun demand during the assessment period.

To gain maximum profits, leading companies are focusing on offering TCP guns with advanced capabilities. This will bode well for the overall market.

Below 3000 ft Segment Will Dominate the Global Market Through 2035

Based on depth, the worldwide perforated gun industry is segmented into below 3,000 ft, 3,000 to 8,000 ft, and above 8,000 ft. Among these, below 3000 ft segment will continue to lead the global market through 2035.

Growth of the target segment is attributable to rising usage of perforating guns for wells having depth of below 3000ft.

As per Future Market Insights’ (FMI) latest report, the below 3000 ft segment is forecast to expand at 5.2% CAGR during the assessment period, in comparison to 6.4% CAGR registered from 2020 to 2025.

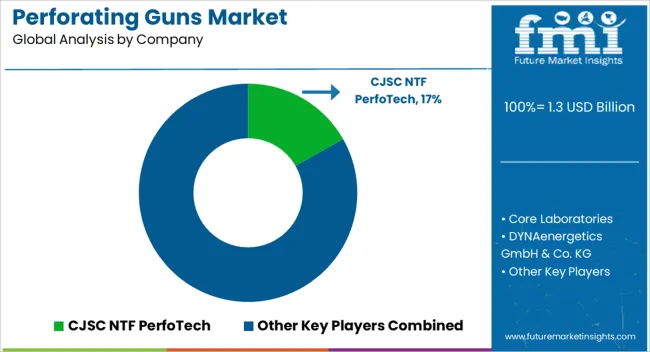

Leading perforated gun manufacturers listed in the report include National Oilwell Varco, Inc., Core Laboratories, Schlumberger Ltd, DYNAenergetics GmbH & Co. KG, CJSC NTF PerfoTech, Halliburton, FHE USA LLC, Oiltech Services Pte Ltd, Hunting Plc, and Shaanxi FYPE Rigid Machinery Co., Ltd. among others.

Key perforated gun manufacturing companies are mostly focusing on developing advanced solutions to meet changing requirements of oil & gas sector. They are also implementing other strategies such as acquisitions, partnerships, agreements, mergers, facility expansions, and collaborations to gain a competitive edge in the market.

Recent developments:

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 1.2 billion |

| Projected Market Value (2035) | USD 2.0 billion |

| Anticipated Growth Rate (2025 to 2035) | 5.5% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Gun Type, Depth, Well Type, Well Pressure, and Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; and the Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, and others. |

| Key Companies Profiled | CJSC NTF PerfoTech; Core Laboratories; DYNAenergetics GmbH & Co. KG; FHE USA LLC; Halliburton; Hunting Plc; National Oilwell Varco, Inc.; Oiltech Services Pte Ltd; Schlumberger Ltd; Shaanxi FYPE Rigid Machinery Co., Ltd. |

The global perforating guns market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the perforating guns market is projected to reach USD 2.2 billion by 2035.

The perforating guns market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in perforating guns market are tubing conveyed perforating, through tubing hollow carrier, through tubing exposed and wireline conveyed casing.

In terms of depth, 3,000 - 8,000 ft segment to command 42.5% share in the perforating guns market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Perforating Roller Market Analysis by End Use Industry, Material, and Region: Forecast for 2025 to 2035

Oriented Perforating System Market Size and Share Forecast Outlook 2025 to 2035

Nail Guns Market Size and Share Forecast Outlook 2025 to 2035

Massage Guns Market Analysis – Demand, Growth & Forecast 2025–2035

Welding Guns Market Growth - Trends & Forecast 2025 to 2035

Dispensing Guns Market Size and Share Forecast Outlook 2025 to 2035

Powder Coating Guns Market

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA