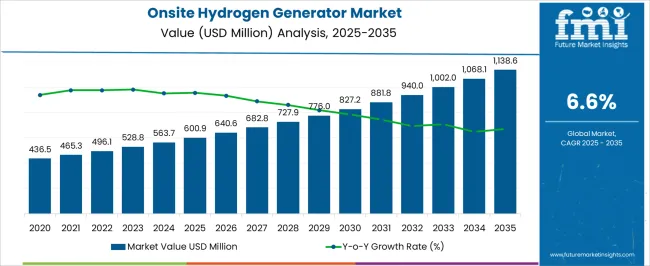

The onsite hydrogen generator market is projected at USD 600.9 million in 2025 and anticipated to reach USD 1,138.6 million by 2035, advancing at a CAGR of 6.6%. The yearly progression shows consistent expansion, with the market moving from USD 436.5 million in 2020 to USD 465.3 million in 2021, followed by USD 496.1 million in 2022. The pace of expansion becomes stronger as the market advances toward USD 528.8 million in 2023 and USD 563.7 million in 2024, demonstrating the momentum that is carried into the 2025 baseline.

Growth thereafter shows a steady trajectory, with USD 640.6 million in 2026, USD 682.8 million in 2027, and USD 727.9 million in 2028, highlighting consistent capacity additions and higher adoption in industries such as refining, chemical production, and distributed power systems. By 2029, the value of USD 776.0 million sets the stage for USD 827.2 million in 2030, with hydrogen infrastructure projects becoming more visible in various geographies. Momentum continues with USD 881.8 million in 2031, USD 940.0 million in 2032, and USD 1,002.0 million in 2033, where integration with fuel cell technologies and on-site industrial applications play a key role.

The upward trend culminates in USD 1,068.1 million in 2034 and USD 1,138.6 million in 2035, driven by local generation models that reduce transportation costs and address growing hydrogen needs across diverse industrial and energy domains. This YoY trajectory highlights a balanced mix of policy incentives, industrial consumption patterns, and strategic investments that create sustained momentum throughout the forecast horizon.

| Metric | Value |

|---|---|

| Onsite Hydrogen Generator Market Estimated Value in (2025 E) | USD 600.9 million |

| Onsite Hydrogen Generator Market Forecast Value in (2035 F) | USD 1138.6 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

The onsite hydrogen generator market is shaped by five interconnected parent markets that together define its trajectory across industrial and energy landscapes. The largest contributor is the industrial gas market, holding about 32% share, as hydrogen is extensively required for refining operations, chemical synthesis, and large-scale manufacturing where on-site generation reduces reliance on supply chains. The energy storage and power generation market contributes around 27%, supported by the increasing role of hydrogen in distributed energy systems and integration with renewable sources for continuous power supply. The chemical processing market accounts for nearly 18% of influence, with hydrogen acting as a critical input in ammonia production, methanol synthesis, and specialty chemicals, making localized generation highly advantageous. The transportation and fuel cell market holds 13%, with hydrogen-powered vehicles and fueling infrastructure increasingly adopting on-site generators to ensure cost efficiency and availability at fueling depots. The remaining 10% share comes from the environmental and water treatment market, where hydrogen plays a role in metal treatment, electronics applications, and reduction processes. Together, these parent markets establish a balanced ecosystem for onsite hydrogen generator growth, with industrial gas and energy storage applications leading adoption, while transportation and environmental applications expand the scope of long-term demand.

The onsite hydrogen generator market is witnessing robust expansion as industries transition toward cleaner energy sources and localized hydrogen production models. Increasing demand for low carbon hydrogen, rising fuel cell adoption, and the decentralization of industrial gas supply chains are key drivers shaping market growth.

Onsite generation eliminates transportation and storage challenges associated with traditional hydrogen supply, reducing costs and emissions. Technological improvements in efficiency, compactness, and integration with renewable power sources have enhanced system performance and appeal across industrial sectors.

Government initiatives promoting green hydrogen and energy independence are further supporting deployment. As industries focus on energy security and sustainable process operations, onsite hydrogen generators are gaining momentum as a reliable and scalable solution.

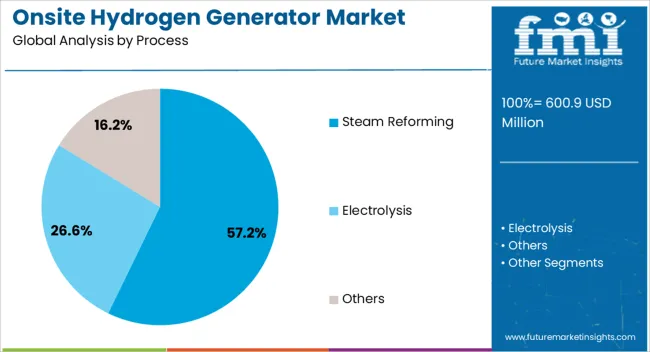

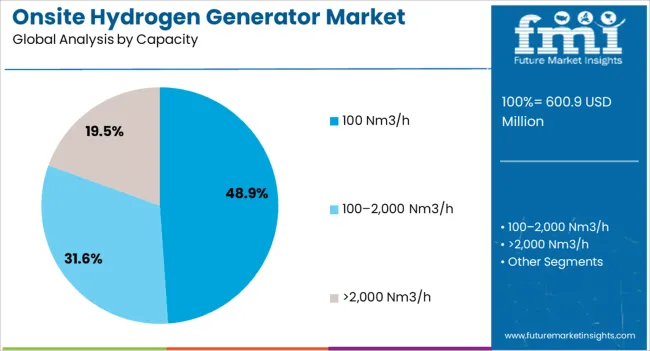

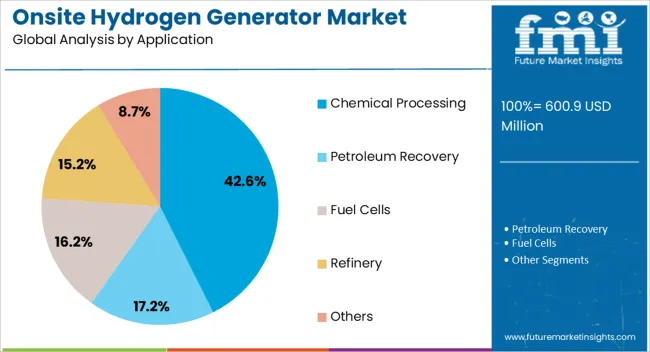

The onsite hydrogen generator market is segmented by process, capacity, application, and geographic regions. By process, onsite hydrogen generator market is divided into Steam Reforming, Electrolysis, and Others. In terms of capacity, onsite hydrogen generator market is classified into 100 Nm3/h, 100–2,000 Nm3/h, and >2,000 Nm3/h. Based on application, onsite hydrogen generator market is segmented into Chemical Processing, Petroleum Recovery, Fuel Cells, Refinery, and Others. Regionally, the onsite hydrogen generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steam reforming segment is projected to contribute 57.20% of the total market revenue by 2025 within the process category, making it the most dominant method. Its prevalence is driven by the maturity of the technology, cost effectiveness, and ability to produce hydrogen at scale for a wide range of industrial applications.

Steam reforming of natural gas remains the most efficient and commercially viable method for onsite hydrogen production, particularly where carbon capture integration is planned. Industries favor this process for its high throughput, operational stability, and compatibility with existing infrastructure.

As clean hydrogen adoption grows, enhancements in low emission steam reforming are expected to further reinforce its market leadership.

The 100 Nm3/h capacity range is expected to hold 48.90% of the market share by 2025, emerging as the leading capacity segment. This range is widely chosen for medium scale industrial use due to its balance between cost, footprint, and production volume.

It is particularly suited for operations requiring steady hydrogen supply without the need for large scale centralized infrastructure. The segment’s growth is further supported by demand from mid sized plants across chemical, refining, and energy sectors, where on demand and localized hydrogen production improves process control and energy efficiency.

The modular design and scalability of this capacity also appeal to enterprises aiming for flexible installation and phased expansion.

Chemical processing is anticipated to account for 42.60% of total market revenue by 2025 within the application category, establishing it as the largest end use segment. Hydrogen plays a critical role in numerous chemical synthesis and refining processes, including hydrogenation, ammonia production, and petrochemical upgrading.

Onsite hydrogen generation ensures uninterrupted supply, enhances operational safety, and reduces logistical dependencies. Chemical plants increasingly prefer onsite systems to align with sustainability mandates and reduce carbon footprints.

Moreover, real time control over hydrogen purity and flow supports optimized reactions and improved product yields. As regulatory pressures and efficiency targets intensify, chemical processing facilities are expected to lead adoption of onsite hydrogen generator technologies.

The onsite hydrogen generator market is shaped by industrial demand, energy transition strategies, transportation integration, and challenges in cost scalability. Its trajectory is defined by strong industrial applications while future expansion relies on transport and policy support.

Industrial demand has been anticipated as a major driver of the onsite hydrogen generator market. Refineries, steel plants, and chemical industries are increasing the deployment of localized hydrogen production units to secure uninterrupted feedstock supply. This shift is driven by the cost-effectiveness of generating hydrogen onsite, eliminating challenges linked to transportation and storage. In sectors such as fertilizers and methanol production, reliability of hydrogen supply is considered vital for operational efficiency. The rising adoption of hydrogen in electronics manufacturing and glass processing has also contributed to stronger uptake. As industrial applications diversify, onsite generation systems are expected to remain at the forefront of meeting volume requirements, particularly in regions with expanding manufacturing clusters.

Energy transition agendas in various countries have anticipated greater adoption of onsite hydrogen generators. Companies are investing in distributed power systems, where hydrogen acts as an energy carrier to balance renewable generation and ensure steady supply. Onsite units are increasingly preferred for backup power in data centers, hospitals, and remote facilities, reducing dependence on centralized grid infrastructure. The ability of hydrogen to serve as a bridge between renewable inputs and consistent energy output has amplified its appeal. Governments offering fiscal incentives and regulatory clarity for hydrogen adoption further accelerate growth. This convergence of policy backing and industrial readiness ensures steady momentum for onsite hydrogen generation in global energy strategies.

Transportation has been identified as a critical growth enabler for onsite hydrogen generator installations. Hydrogen fueling stations increasingly require onsite production to minimize logistics costs and provide immediate availability. Fleets of buses, trucks, and even emerging hydrogen-powered trains are contributing to greater reliance on such units. The distribution model benefits operators by lowering dependence on external delivery systems that often face bottlenecks. Market opportunities are also expanding within maritime applications, where vessels powered by hydrogen fuel cells are gaining acceptance. As nations invest in hydrogen corridors, the presence of onsite generation at fueling hubs becomes indispensable. This segment is anticipated to post strong growth due to rising transport decarbonization priorities worldwide.

Despite positive trends, the onsite hydrogen generator market is restrained by cost considerations and scalability issues. High capital expenditure for equipment and infrastructure often discourages smaller industries from immediate adoption. Operating costs, particularly electricity for electrolysis-based units, continue to influence economic viability. Large-scale deployment remains concentrated in developed regions where financing mechanisms and subsidies ease adoption. Developing economies face barriers related to limited awareness, technological maturity, and grid reliability. Supply chain bottlenecks for components and efficiency limitations also pose challenges. Without continued investments in process optimization and affordability measures, the pace of market penetration may remain slower than anticipated in cost-sensitive industries and emerging markets.

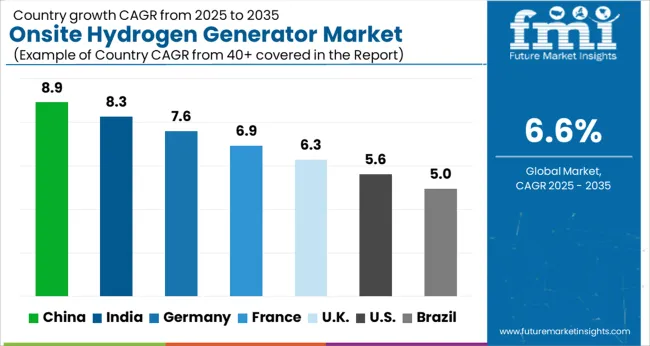

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The global onsite hydrogen generator market is projected to grow at a CAGR of 6.6% from 2025 to 2035, rising from USD 600.9 million in 2025 to USD 1,138.6 million in 2035. China leads expansion at 8.9%, followed by India at 8.3%, Germany at 7.6%, France at 6.9%, the United Kingdom at 6.3%, and the United States at 5.6%. Growth is supported by increasing industrial hydrogen usage, integration with renewable-powered electrolysis, and the role of onsite production in lowering transport costs and ensuring energy security. China and India are accelerating adoption through large-scale refining and chemical projects, while European economies emphasize decarbonization initiatives and integration with green power. The United States shows moderate growth as industrial applications expand alongside gradual transport adoption. The analysis spans across 40+ countries, with the leading markets detailed below.

The onsite hydrogen generator market in China is projected to grow at a CAGR of 8.9% from 2025 to 2035. A large refining and chemicals base has been prioritized for steady hydrogen feedstock, and onsite units are being preferred to reduce trucking and cylinder logistics. Electrolyzer deployments tied to renewable power parks are being commissioned for industrial process gas and captive power balancing. Steel and glass facilities have evaluated onsite production to stabilize operations where hydrogen quality and availability are mission critical. Provincial programs encourage localized equipment sourcing, which improves service support and uptime. Fueling hubs for buses and heavy trucks are adopting compact onsite packages to secure reliable supply at depots. This multi segment pull has positioned China for above baseline growth through 2035.

The onsite hydrogen generator market in India is anticipated to expand at a CAGR of 8.3% during 2025 to 2035. Public sector oil and gas enterprises and private refiners have initiated tenders for onsite production to improve feedstock certainty and lower delivered gas costs. Fertilizer units evaluate onsite hydrogen to de risk supply events and to support ammonia cycles. Distributed generation pilots pair electrolyzers with solar and wind assets for captive power and process heat needs in industrial clusters. Metro rail depots and municipal bus corporations have started early groundwork for hydrogen refueling, where onsite models reduce dependence on bulk deliveries. Vendor ecosystems around compressors, dryers, and storage skids are maturing, improving lifecycle economics. Capital access and structured incentives are expected to sustain the trajectory through the period.

The onsite hydrogen generator market in France is projected to advance at a CAGR of 6.9% between 2025 and 2035. Industrial zones have promoted onsite hydrogen for chemicals, food processing, and metals treatment where purity control and continuous availability are essential. National programs encourage electrolyzer manufacturing and deployment, which supports local content and service networks. Data centers and hospitals examine onsite hydrogen for backup systems paired with fuel cells, seeking high reliability and reduced diesel usage. Ports and logistics corridors are piloting hydrogen for yard tractors and medium duty fleets, and onsite supply reduces operational friction. Industrial gas distributors partner with equipment makers to offer build own operate models that lower entry barriers for mid sized plants. This mix of industrial and mobility use cases sustains steady adoption through 2035.

The onsite hydrogen generator market in the United Kingdom is estimated to grow at a CAGR of 6.3% during 2025 to 2035. Chemical parks and refineries are appraising onsite production to stabilize feedstock and hedge transport exposure. Industrial estates in the Midlands and North have explored hub and spoke models where shared onsite capacity serves multiple plants. Pilot hydrogen villages and commercial fleets are evaluating compact generators for local availability at depots and maintenance yards. Universities and national labs support performance testing, which improves buyer confidence and vendor credibility. Financing structures that combine equipment, maintenance, and power contracts have improved bankability for small and mid scale projects. With measured progress in mobility and a solid industrial base, momentum is expected to remain positive through the horizon.

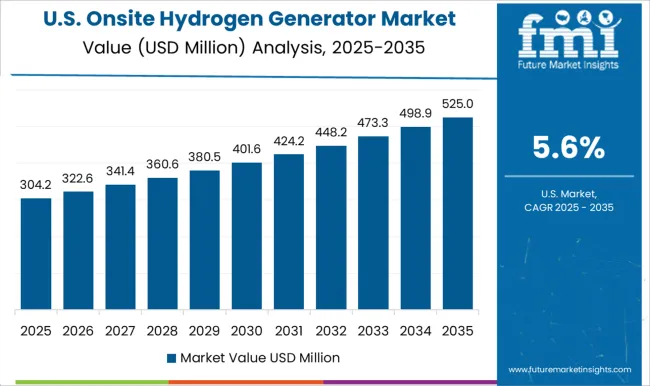

The onsite hydrogen generator market in the United States is expected to rise at a CAGR of 5.6% from 2025 to 2035. Petrochemical complexes along the Gulf Coast evaluate onsite generation to support turnaround planning and reduce merchant hydrogen exposure. Semiconductor and specialty glass facilities require high purity gas with tight uptime targets, which favors onsite production paired with robust quality controls. Municipal transit agencies and warehouse operators are piloting fuel cell fleets where onsite supply enhances availability and lowers delivered cost. Federal and state incentives for electrolyzers and clean hydrogen have improved project economics, while power purchase options provide cost visibility. Industrial gas majors and equipment providers promote turnkey offerings that bundle compression, drying, and storage with long term service.

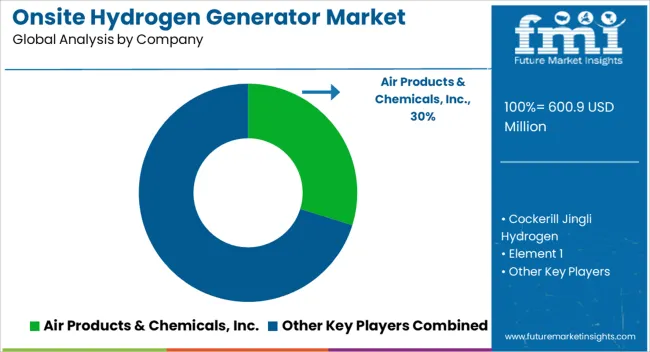

Competition in the onsite hydrogen generator market is shaped by engineering expertise, system efficiency, and integration with renewable energy. Air Products & Chemicals, Inc. leads with extensive industrial gas experience, offering large-scale onsite solutions for refineries, chemicals, and power generation facilities. Cockerill Jingli Hydrogen emphasizes high-capacity alkaline electrolyzers, catering to projects across Asia and Europe. Element 1 specializes in small-scale reformer-based hydrogen systems, serving niche mobility and backup power applications. EPOCH Energy Technology Corp delivers compact electrolysis solutions, focusing on industrial clusters and distributed energy. Hitachi Zosen Corporation extends its engineering strengths into hydrogen by supplying packaged generators suitable for chemical and energy applications. LNI Swissgas Srl competes with advanced laboratory and industrial gas generators where precision and reliability are crucial. Idroenergy has strengthened its foothold in modular solutions for distributed industries and transport hubs. Mahler AGS offers reformer-based onsite hydrogen units with strong penetration in Europe. MVS Engineering Pvt. Ltd. serves industrial and pharmaceutical customers in India with tailored hydrogen generators and turnkey services. Teledyne Technologies Incorporated brings expertise in electrolysis, producing reliable units used in aerospace, defense, and high-spec industrial processes. Competition is defined by differentiation in electrolyzer design, service contracts, and scalability of units. Larger players compete on industrial integration and global project execution, while mid-sized firms emphasize cost-effective modular designs. Turnkey solutions combining hydrogen generation, compression, storage, and service agreements have become a competitive lever. Partnerships with renewable energy developers and government-backed hydrogen initiatives are enabling broader deployment, making the competitive landscape dynamic and multi-tiered across applications and regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 600.9 Million |

| Process | Steam Reforming, Electrolysis, and Others |

| Capacity | 100 Nm3/h, 100–2,000 Nm3/h, and >2,000 Nm3/h |

| Application | Chemical Processing, Petroleum Recovery, Fuel Cells, Refinery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products & Chemicals, Inc., Cockerill Jingli Hydrogen, Element 1, EPOCH Energy Technology Corp, Hitachi Zosen Corporation, LNI Swissgas Srl, Idroenergy, Mahler AGS, MVS ENGINEERING PVT. LTD., and Teledyne Technologies Incorporated |

| Additional Attributes | Dollar sales, share, regional growth hotspots, policy incentives, cost competitiveness, end-use industry adoption, competitive moves, and future opportunities across industrial, transport, and energy segments. |

The global onsite hydrogen generator market is estimated to be valued at USD 600.9 million in 2025.

The market size for the onsite hydrogen generator market is projected to reach USD 1,138.6 million by 2035.

The onsite hydrogen generator market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in onsite hydrogen generator market are steam reforming, electrolysis and others.

In terms of capacity, 100 nm3/h segment to command 48.9% share in the onsite hydrogen generator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA