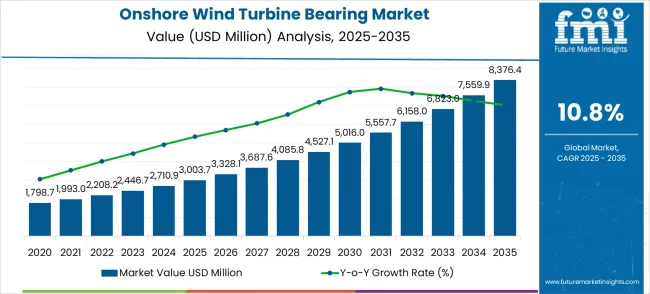

The global Onshore Wind Turbine Bearing Market is projected to grow from USD 3,003.7 million in 2025 to USD 8,376.4 million by 2035, advancing at a CAGR of 10.8%, recording an absolute increase of USD 5,372.7 million over the forecast period. The market is valued at USD 3,003.7 million in 2025 and is set to rise at a CAGR of 10.8% during the assessment period.

The overall market size is expected to grow by approximately 2.8 times during the same period, supported by increasing global renewable energy investments, growing wind energy capacity installations, and expanding onshore wind farm development worldwide. However, supply chain complexities and raw material price volatility may pose challenges to market expansion.

Between 2025 and 2030, the Onshore Wind Turbine Bearing Market is projected to expand from USD 3,003.7 million to USD 5,016.0 million, resulting in a value increase of USD 2,012.3 million, which represents 37.4% of the total forecast growth for the decade.

This phase of development will be shaped by rising demand for renewable energy infrastructure, product innovation in bearing durability technologies and wind turbine efficiency systems, as well as expanding integration with larger turbine designs and advanced monitoring platforms.

Companies are establishing competitive positions through investment in high-capacity bearing technologies, predictive maintenance solutions, and strategic market expansion across onshore wind farms, utility-scale projects, and distributed wind applications.

From 2030 to 2035, the market is forecast to grow from USD 5,016.0 million to USD 8,376.4 million, adding another USD 3,360.4 million, which constitutes 62.6% of the overall ten-year expansion.

This period is expected to be characterized by the expansion of specialized bearing systems, including direct-drive turbine bearings and integrated condition monitoring solutions tailored for next-generation wind turbines, strategic collaborations between bearing providers and turbine manufacturers, and an enhanced focus on operational efficiency and maintenance optimization in wind energy generation.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3,003.7 million |

| Market Forecast Value (2035) | USD 8,376.4 million |

| Forecast CAGR (2025 to 2035) | 10.8% |

The Onshore Wind Turbine Bearing Market grows by enabling wind energy developers to ensure reliable power generation and enhanced operational efficiency in wind turbine systems. Wind farm operators face mounting pressure to maximize energy output and minimize maintenance costs, with advanced bearing systems typically improving turbine reliability by 15-25% and reducing unplanned downtime, making high-performance bearings essential for competitive wind energy infrastructure.

The wind energy industry's need for continuous operation and long-term durability creates demand for advanced bearing solutions that can handle extreme weather conditions, support larger rotor designs, and ensure seamless power generation without service interruptions. Government initiatives promoting renewable energy targets and carbon emission reduction drive adoption in utility-scale wind projects, distributed wind applications, and offshore-to-onshore technology transfer, where reliable mechanical components have a direct impact on energy production efficiency and project economics.

Climate change mitigation policies and renewable energy mandates drive adoption across wind farm development, turbine manufacturing, and energy infrastructure applications. However, high material costs for specialized bearing steel and the complexity of manufacturing large-diameter bearings for modern turbines may limit adoption rates among smaller wind developers and developing regions with limited renewable energy financing capabilities.

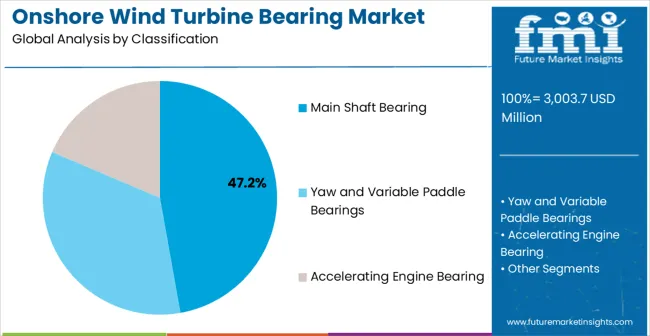

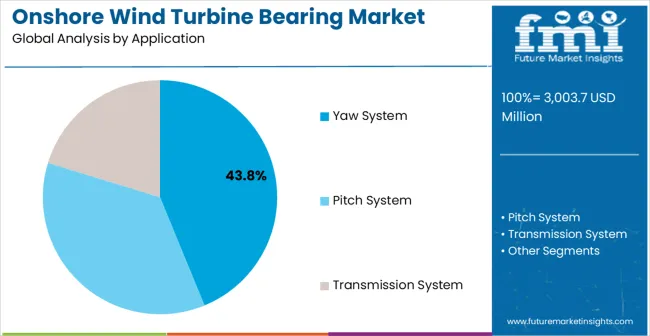

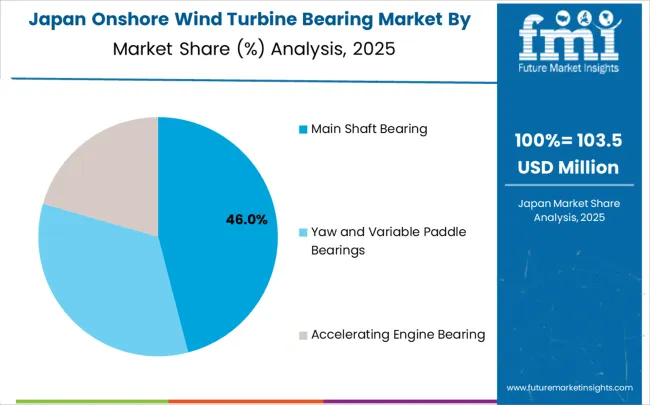

The market is segmented by bearing type, application, and region. By bearing type, the market is divided into main shaft bearing, yaw and variable paddle bearings, and accelerating engine bearing. Based on the application, the market is categorized into yaw system, pitch system, and transmission system. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

Main Shaft Bearing is projected to account for 47.2% share of the Onshore Wind Turbine Bearing Market in 2025. This dominant position is supported by the bearing's critical role in wind turbine drivetrain systems, power transmission applications, and rotor support structures, where main shaft bearings provide essential load-bearing capacity and rotational stability for wind energy generation. The segment enables stakeholders to benefit from proven reliability standards, established maintenance procedures, and enhanced power transmission efficiency that complies with international wind energy industry standards and turbine performance requirements.

The widespread adoption of main shaft bearing systems in modern wind turbines across major wind energy markets worldwide drives consistent demand for these solutions, as turbine manufacturers prioritize components that maximize energy capture while providing reliable performance and extended operational lifespan.

Yaw and Variable Paddle Bearings represent 34.6% of the market share, primarily serving turbine orientation control and blade pitch adjustment applications that require precise positioning and smooth rotational movement. These bearings are essential for wind direction tracking, optimal blade angle control, and turbine systems where accurate positioning mechanisms maximize energy capture efficiency. Accelerating Engine Bearing systems account for 18.2% market share, serving gearbox applications and speed conversion systems in conventional drive train configurations.

Key advantages include:

Yaw System applications are expected to represent 43.8% share of Onshore Wind Turbine Bearing applications in 2025. This leading position reflects the critical role of yaw bearings in wind turbine orientation control, directional positioning systems, and wind tracking infrastructure, where precise rotation is essential for optimal wind capture and energy generation efficiency. The segment provides critical support for turbine positioning in variable wind conditions where consistent directional adjustment directly impacts power output and turbine performance optimization.

Growth drivers include increasing turbine size requirements, growing demand for intelligent wind tracking systems, wind farm development requiring advanced positioning control, and the need for precision bearing solutions that support energy capture maximization and operational efficiency goals.

Pitch System applications account for 32.4% of the market share, serving blade angle adjustment mechanisms, aerodynamic control systems, and wind speed optimization applications that require precise blade positioning for optimal energy capture across varying wind conditions. Transmission System applications represent 23.8% market share, primarily focused on gearbox support, speed conversion mechanisms, and drivetrain applications in conventional wind turbine configurations.

Key market dynamics include:

The market is driven by three concrete demand factors tied to renewable energy expansion outcomes. First, global renewable energy targets and climate commitments create increasing demand for wind energy infrastructure, with wind power capacity growing by 15-20% annually in major markets worldwide, requiring comprehensive wind turbine bearing infrastructure. Second, government initiatives promoting clean energy transition and carbon neutrality drive mandatory adoption of renewable energy technologies, with many countries setting targets for 30-50% renewable energy share by 2030.

Third, technological advancements in turbine design and bearing materials enable more efficient and reliable wind energy solutions that reduce operational costs while improving energy generation performance and system reliability. The growing emphasis on energy independence creates additional demand for domestic wind energy development that requires advanced bearing systems with extended operational lifespans and minimal maintenance requirements.

Market restraints include high material costs for specialized bearing steel and advanced manufacturing processes that can deter smaller wind developers from implementing large-scale wind projects, particularly in developing regions where financing for renewable energy infrastructure remains limited. Supply chain complexity poses another significant challenge, as manufacturing large-diameter bearings requires specialized facilities and expertise, potentially causing project delays and increased component costs.

Raw material price volatility across different global markets creates additional complexity for manufacturers and wind developers, demanding ongoing adaptation to commodity price fluctuations and supply availability constraints. The complexity of integrating advanced bearing systems with existing turbine designs presents engineering challenges that may result in extended development timelines and higher integration costs than initially projected.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where aggressive renewable energy targets and government support programs drive comprehensive wind energy infrastructure deployment. Design shifts toward larger turbine configurations with advanced bearing solutions featuring extended service life, integrated monitoring capabilities, and enhanced load-bearing capacity enable optimized performance approaches that reduce maintenance costs and improve energy output.

The increasing focus on direct-drive turbine technology and gearless configurations drives demand for specialized bearing solutions that can handle higher torque loads while providing simplified maintenance access across wind energy networks. However, the market thesis could face disruption if alternative wind turbine drive train technologies or significant changes in renewable energy policies minimize reliance on conventional bearing-based wind turbine systems.

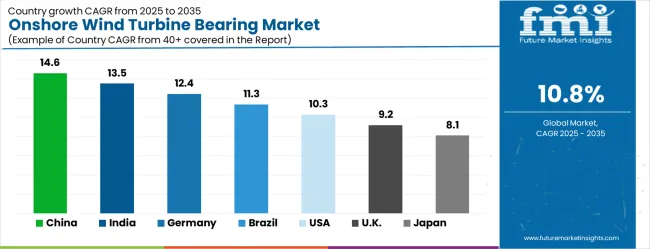

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 14.6% |

| India | 13.5% |

| Germany | 12.4% |

| Brazil | 11.3% |

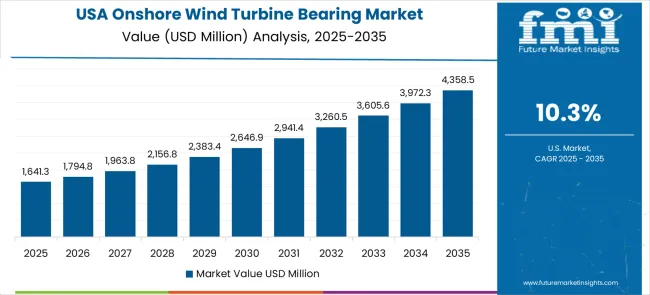

| USA | 10.3% |

| UK | 9.2% |

| Japan | 8.1% |

The onshore wind turbine bearing market is accelerating worldwide, with China leading at a CAGR of 14.6%, driven by massive renewable energy capacity expansion and government-backed clean energy investments. Close behind, India, growing at 13.5% CAGR, is propelled by ambitious renewable energy targets and wind farm development initiatives, positioning it as a strategic Asia-Pacific renewable energy hub. Germany advances steadily with a 12.4% CAGR, supported by integration of advanced wind energy technologies within Europe's renewable energy infrastructure.

Brazil, expanding at 11.3% CAGR, emphasizes wind energy development and clean energy modernization. The USA records 10.3% CAGR, reflecting strong adoption of renewable energy technologies, while the UK (9.2% CAGR) and Japan (8.1% CAGR) sustain consistent renewable energy infrastructure development. Together, China and India anchor global growth momentum, while others contribute stability and technological innovation.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China is the undisputed leader in the global onshore wind turbine bearing market, with revenues forecast to grow at a robust CAGR of 14.6% through 2035. This growth is rooted in China’s unprecedented wind energy expansion programs, state-backed renewable energy development initiatives, and its long-term Carbon Peak and Carbon Neutrality strategy. Together, these factors establish a policy framework that aggressively supports clean energy infrastructure development. Key wind power bases including Inner Mongolia, Xinjiang, Gansu, and Hebei are at the center of deployment, hosting some of the world’s largest wind farms and manufacturing facilities.

Within these regions, advanced turbine bearing solutions are being integrated to maximize energy generation efficiency, reduce downtime, and enhance turbine reliability under demanding environmental conditions. Beyond capacity expansion, China is also accelerating domestic manufacturing of bearings to reduce reliance on imports and ensure supply security. Partnerships between international bearing leaders and Chinese turbine manufacturers are increasingly common, focusing on technology transfer and scaling advanced engineering capabilities.

Distribution channels supported by state-approved renewable energy programs further amplify deployment, ensuring coverage across both utility-scale and distributed wind applications. This combination of government policy, industrial capacity, and technology adoption cements China’s leadership in the global market.

Key Market Factors in China

India’s onshore wind turbine bearing market is rapidly expanding, supported by strong renewable energy infrastructure initiatives and government-led programs. The market is projected to grow at a CAGR of 13.5% through 2035, positioning India as one of the fastest-growing nations in this segment.

Growth is centered in wind-rich states like Gujarat, Tamil Nadu, Maharashtra, and Karnataka, where both utility-scale and distributed renewable projects are gaining momentum. India’s National Wind Mission plays a pivotal role by driving large-scale capacity additions and promoting adoption of advanced turbine technologies. The demand for high-performance bearings arises from the need to enhance energy generation efficiency while meeting rising power requirements across urban and industrial zones.

Public-private partnership (PPP) models are particularly influential in facilitating rapid deployment, ensuring financing, and enabling technology integration. Moreover, international collaboration is boosting local manufacturing competitiveness, with technology transfer agreements accelerating the implementation of advanced bearing solutions. These efforts not only support energy security and climate commitments but also reduce reliance on imported turbine components. As India’s electricity demand continues to surge, integrated bearing adoption will underpin efforts to achieve grid stability, reduce turbine downtime, and optimize long-term renewable energy yields.

Key Market Factors in India

Germany holds a leading position in the European onshore wind turbine bearing market, with growth projected at a CAGR of 12.4% through 2035. The country’s emphasis on engineering excellence and renewable energy innovation drives adoption of high-performance bearing solutions. German wind operators integrate precision bearings into both onshore and offshore turbine projects, with key regions such as Lower Saxony, Brandenburg, North Rhine-Westphalia, and Schleswig-Holstein acting as focal points of deployment. These regions exemplify how advanced bearing systems improve energy efficiency, extend turbine lifespan, and ensure high reliability under rigorous operational conditions.

Germany’s industrial base also fosters close collaboration between domestic engineering companies and international bearing manufacturers, creating a robust ecosystem for technology transfer and innovation. Case studies from German projects illustrate significant improvements in turbine reliability and performance optimization when advanced bearings are applied.

Engineering service providers further support the market by integrating predictive maintenance and performance management solutions into renewable energy operations. With Germany’s established role as a global hub for renewable technology leadership, the adoption of next-generation bearing systems remains aligned with its long-term climate goals and Industry 4.0 integration. This ensures that German projects set benchmarks for advanced wind turbine reliability and efficiency globally.

Key Development Areas in Germany

Brazil’s onshore wind turbine bearing market is developing steadily, with a CAGR of 11.3% forecast through 2035. The country benefits from excellent wind resources, particularly in northeastern states such as Rio Grande do Norte, Ceará, and Bahia, alongside growing projects in Rio Grande do Sul.

Federal and state-level renewable energy initiatives drive expansion, though infrastructure constraints and limited technical expertise necessitate phased deployment strategies. International financing support, particularly from development banks, is playing a crucial role in enabling project execution. Adoption of advanced bearing systems is gradually improving turbine reliability and performance across Brazil’s rapidly expanding wind portfolio.

As renewable energy requirements rise, developers are balancing cost-efficiency with the integration of advanced technologies. The coastal regions, with consistently strong wind resources, are at the forefront of adoption. Brazil is also witnessing partnerships between local operators and international bearing manufacturers, enabling knowledge transfer and local skill development. Despite challenges, Brazil’s renewable energy transition creates a compelling business case for sustained investment in bearing technologies, establishing the nation as a strong regional leader in Latin America’s wind energy growth trajectory.

Market Characteristics in Brazil

The United States demonstrates strong innovation-driven adoption in the onshore wind turbine bearing market, with CAGR projected at 10.3% through 2035. Growth is driven by renewable portfolio standards (RPS) across states and by the country’s continued wind energy expansion in regions such as Texas, Iowa, Oklahoma, and Kansas. What distinguishes the USA market is its integration of intelligent bearing systems that work alongside turbine control systems and AI platforms to optimize output and minimize downtime. By embedding advanced monitoring and predictive maintenance technologies, USA operators maximize turbine efficiency while reducing long-term costs.

Utility-scale wind projects remain the primary adoption channel, though distributed wind projects are also gaining traction as decentralized energy generation becomes a policy priority. Collaboration between wind farm operators and bearing manufacturers ensures access to high-reliability solutions tailored for USA operating conditions. The strong presence of domestic and multinational suppliers enhances competitiveness and enables rapid scaling of technology. As the USA grid modernizes and clean energy investment accelerates, the market’s adoption of advanced bearing systems reflects a broader narrative of leveraging technology innovation to sustain renewable energy leadership.

Leading Market Segments in the USA

The United Kingdom’s onshore wind turbine bearing market is projected to expand steadily, at a CAGR of 9.2% through 2035. The UK maintains one of Europe’s most established renewable energy infrastructures, with projects spread across England, Scotland, Wales, and Northern Ireland. The market is characterized by modernization and replacement demand, as operators focus on upgrading existing turbine fleets with advanced bearings and monitoring platforms. Documented case studies highlight significant gains in turbine efficiency, operational reliability, and reductions in maintenance costs following bearing modernization initiatives.

Regulatory frameworks supporting renewable energy adoption, coupled with the UK’s net-zero ambitions, create strong incentives for ongoing investment. Operators are also entering strategic partnerships with international technology providers, ensuring access to advanced engineering expertise. While the UK may not see explosive growth like emerging markets, its focus on reliability, system integration, and regulatory compliance ensures steady adoption. The market outlook is therefore defined by moderate but consistent demand, driven by infrastructure upgrades and modernization initiatives aligned with national energy targets.

Market Development Factors in the UK

Onshore wind turbine bearing market in Japan demonstrates steady but modest growth, projected at a CAGR of 8.1% through 2035. Growth is concentrated in wind energy-rich regions like Hokkaido, Tohoku, and Kyushu, where advanced turbine technologies are being deployed. The Japanese market is distinguished by its focus on precision engineering and integration of high-quality bearing systems into turbine platforms. Operators prioritize reliability, safety, and performance, making premium solutions the preferred choice even as growth remains slower compared to emerging economies.

Case studies show how intelligent bearing platforms combined with predictive maintenance programs enable significant improvements in operational performance and grid integration. Partnerships between Japanese engineering firms and global bearing providers enhance technical sophistication, aligning with Japan’s broader philosophy of continuous improvement and manufacturing excellence.

Despite infrastructure maturity and limited expansion potential, the market offers high value for advanced technology providers capable of meeting stringent standards. Japan’s demand reflects a premium, reliability-driven approach to wind energy modernization, positioning it as a precision-focused market with enduring opportunities for niche, high-performance bearing systems.

Key Market Characteristics in Japan

The Onshore Wind Turbine Bearing Market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 40-45% of global market share through established engineering platforms and extensive wind energy industry relationships. Competition centers on technological innovation, bearing durability, and wind turbine integration expertise rather than price competition alone.

Market leaders include SCHAEFFLER AG, SKF GROUP, and NTN Corporation, which maintain competitive advantages through comprehensive bearing solution portfolios, global manufacturing networks, and deep expertise in wind energy applications, creating high switching costs for customers. These companies leverage established turbine manufacturer relationships and ongoing technical support contracts to defend market positions while expanding into adjacent renewable energy component applications.

Challengers encompass JTEKT Corporation and NSK, which compete through specialized bearing solutions and strong regional presence in key wind energy markets. Technology specialists, including The Timken Company, Thyssen Krupp AG, and Chinese manufacturers like Zwz Bearing and Luoyang LYC Precision Bearing, focus on specific bearing technologies or vertical applications, offering differentiated capabilities in large-diameter bearings, condition monitoring integration, and cost-effective manufacturing.

Regional players and emerging bearing manufacturers create competitive pressure through specialized solutions and rapid deployment capabilities, particularly in high-growth markets including China and India, where local presence provides advantages in customer support and supply chain optimization. Market dynamics favor companies that combine advanced bearing engineering with comprehensive service offerings that address the complete bearing lifecycle from design through ongoing maintenance and performance optimization.

The onshore wind turbine bearing market is central to renewable energy development, wind power generation, and climate change mitigation systems. With renewable energy transition pressures, wind capacity expansion requirements, and rising demand for clean energy solutions, the sector faces pressure to balance component reliability, cost effectiveness, and performance optimization. Coordinated action from governments, renewable energy agencies, turbine manufacturers, suppliers, and investors is essential to transition toward highly reliable, cost-effective, and performance-optimized wind turbine bearing systems.

| Item | Value |

|---|---|

| Market Value (2025) | USD 3,003.7 million |

| Bearing Type | Main Shaft Bearing, Yaw and Variable Paddle Bearings, Accelerating Engine Bearing |

| Application | Yaw System, Pitch System, Transmission System |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 25+ additional countries |

| Key Companies Profiled | SCHAEFFLER AG, SKF GROUP, NTN Corporation, JTEKT Corporation, NSK, The Timken Company, Thyssen Krupp AG, Zwz Bearing, Luoyang LYC Precision Bearing, Jingye Bearing, Luoyang Xinqianglian Slewing Bearing, Zhejiang Tianma Bearing Group, Dalian Metallurgical Bearing, Luoyang Xinneng Bearing Manufacturing, Luoyang Bearing Research Institute |

| Additional Attributes | Market share analysis by bearing type and application segments, country-wise CAGR projections across Asia Pacific, Europe, and North America, competitive landscape with bearing manufacturers and wind turbine technology providers, technology adoption patterns for utility-scale and distributed wind applications, integration with turbine control systems and condition monitoring platforms, innovations in bearing durability and predictive maintenance technologies, and development of specialized solutions with enhanced performance optimization and reliability capabilities. |

Asia Pacific

Europe

North America

Latin America

Middle East & Africa

The global onshore wind turbine bearing market is estimated to be valued at USD 3,003.7 million in 2025.

The market size for the onshore wind turbine bearing market is projected to reach USD 8,376.4 million by 2035.

The onshore wind turbine bearing market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in onshore wind turbine bearing market are main shaft bearing, yaw and variable paddle bearings and accelerating engine bearing.

In terms of application, yaw system segment to command 43.8% share in the onshore wind turbine bearing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Wind Power Forecasting System Market Size and Share Forecast Outlook 2025 to 2035

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Wind Power Coatings Market Size and Share Forecast Outlook 2025 to 2035

Windsurf Foil Board Market Size and Share Forecast Outlook 2025 to 2035

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wind Vane Wiring Market Size and Share Forecast Outlook 2025 to 2035

Window Packaging Market Size and Share Forecast Outlook 2025 to 2035

Window Coverings Market – Trends, Growth & Forecast 2025 to 2035

Assessing Window Packaging Market Share & Industry Trends

Wind Speed Alarm Market

Window Rain Guards Market

Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Forging Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Pitch and Yaw Drive Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Wind Turbine Market Analysis and Insights - 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA