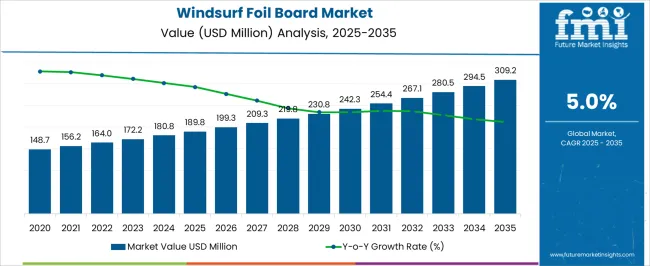

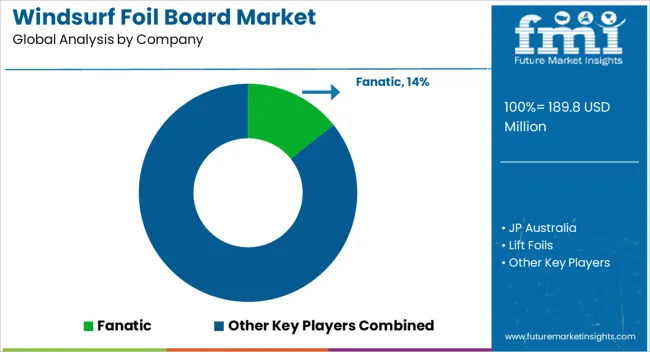

The windsurf foil board market is projected to advance steadily, with an estimated value of USD 189.8 million in 2025 and expected to reach USD 309.2 million by 2035, at a CAGR of 5.0%. Growth is supported by increasing participation in water sports and the rising popularity of foiling technology, which enhances speed and maneuverability. Enthusiasts are drawn to boards that deliver both performance and efficiency, making foil boards a preferred option over traditional windsurfing equipment. Manufacturers are expanding product lines with lightweight materials, modular foil systems, and user-friendly designs to attract both professionals and newcomers. Rising disposable incomes and adventure tourism further contribute to adoption, particularly in Europe and coastal regions of North America. However, high initial costs and the need for training remain barriers for broader penetration. Retail expansion, online availability, and rental services are creating opportunities for greater consumer access. With growing recreational and competitive interest, the market is set for consistent long-term expansion.

Quick Stats for Windsurf Foil Board Market

| Metric | Value |

|---|---|

| Windsurf Foil Board Market Estimated Value in (2025 E) | USD 189.8 million |

| Windsurf Foil Board Market Forecast Value in (2035 F) | USD 309.2 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The windsurf foil board market is gaining momentum as water sports enthusiasts increasingly adopt foil technology for enhanced speed, maneuverability, and performance in varying wind conditions. Industry reports and brand communications have noted that advancements in hydrodynamic design, lightweight materials, and board stability have expanded the sport’s appeal beyond seasoned athletes to recreational users.

The growing popularity of foiling in competitive events and coastal leisure activities has driven demand for versatile board models catering to different skill levels. Manufacturers are also focusing on eco-friendly production techniques and high-performance composites to meet both sustainability goals and consumer performance expectations.

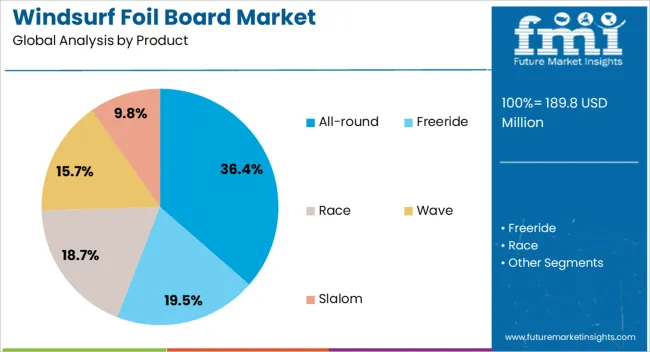

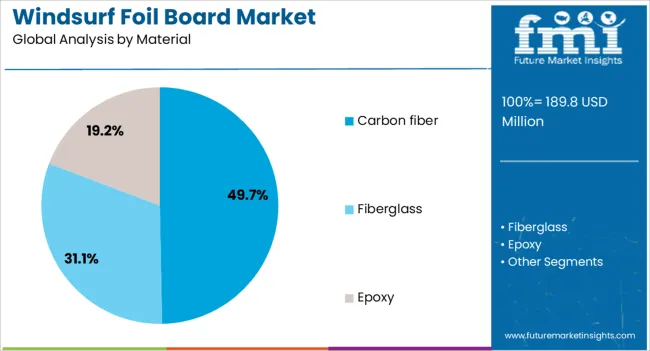

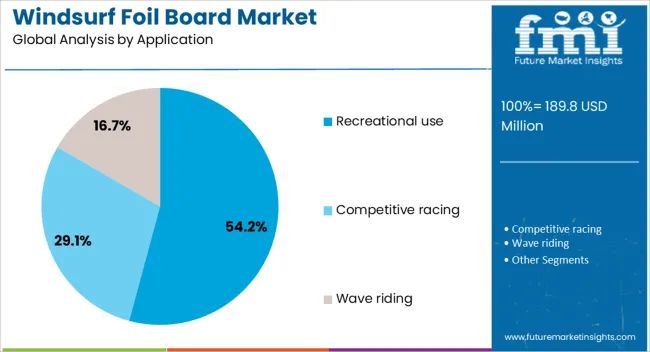

In addition, social media and video-sharing platforms have amplified awareness of foiling techniques, fueling interest among younger demographics. Looking forward, innovation in modular foil systems and increased accessibility through rental and training programs are expected to sustain market growth. Key segmental drivers include the preference for all-round product designs, carbon fiber material composition, and boards tailored for recreational use.

The windsurf foil board market is segmented by product, material, application, end use, distribution channel, and geographic regions. By product, windsurf foil board market is divided into All-round, Freeride, Race, Wave, and Slalom. In terms of material, windsurf foil board market is classified into Carbon fiber, Fiberglass, and Epoxy. Based on application, windsurf foil board market is segmented into Recreational use, Competitive racing, and Wave riding. By end use, windsurf foil board market is segmented into Beginners, Intermediate users, and Professional athletes. By distribution channel, windsurf foil board market is segmented into Online, Offline, and Third-party distributors. Regionally, the windsurf foil board industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The All-round segment is projected to hold 36.4% of the windsurf foil board market revenue in 2025, making it the most popular product type. This segment’s strength is linked to its adaptability for a wide range of conditions and rider skill levels.

Consumers have shown preference for all-round boards due to their balanced design, which offers a blend of stability, speed, and control. Manufacturers have targeted this segment with versatile shapes and adjustable foil mounts, allowing riders to optimize performance across varying water and wind conditions.

This versatility has made all-round boards a common choice for both training and leisure sessions, increasing their adoption in SURF schools and recreational rental programs. As interest in foiling continues to grow globally, the All-round segment is expected to maintain its leadership, driven by its suitability for diverse user profiles and environments.

The Carbon Fiber segment is anticipated to account for 49.7% of the market revenue in 2025, reflecting its dominance in performance-oriented windsurf foil boards. This material’s popularity stems from its exceptional strength-to-weight ratio, which enhances both maneuverability and acceleration on the water.

Riders and manufacturers alike value carbon fiber for its ability to provide stiffness without adding excessive weight, improving energy transfer from rider to foil. Competitive athletes, in particular, benefit from the responsiveness and reduced drag achieved through carbon fiber construction.

Technological advancements in composite manufacturing have also made high-quality carbon fiber boards more accessible, broadening their appeal beyond professional circles. With performance and durability as top priorities for enthusiasts, the Carbon Fiber segment is expected to sustain its strong position in the market.

The Recreational Use segment is forecasted to capture 54.2% of the windsurf foil board market revenue in 2025, underscoring its importance as the largest application category. Growth in this segment is driven by the increasing number of leisure riders seeking the thrill of foiling without competitive pressures.

Tourism operators, coastal resorts, and SURF schools have contributed to this trend by offering beginner-friendly foil boards and training sessions, making the sport more accessible to newcomers. Recreational boards are typically designed with a focus on stability, user safety, and ease of control, encouraging adoption among casual riders.

Social and leisure aspects of foiling, combined with the rise of water sports tourism, have strengthened demand within this segment. As infrastructure for recreational foiling expands and more consumers embrace water-based outdoor activities, the Recreational Use segment is expected to remain a major driver of overall market growth.

The windsurf foil board market is being propelled by the growing popularity of water sports tourism and rising interest in recreational outdoor activities. Improved hydrodynamic designs and lightweight carbon fiber materials enhance maneuverability and speed, attracting both beginners and professionals. Increased participation in international windsurfing competitions and support from sporting federations are stimulating adoption. Expanding availability through online platforms and specialized sporting outlets has also improved accessibility.

High equipment costs and limited awareness in emerging regions act as barriers to market penetration. Foil boards are more expensive than traditional windsurf boards due to the advanced materials and technology involved. Maintenance challenges, including damage to foils in shallow waters, discourage casual users. Additionally, lack of skilled instructors and training facilities in several countries restricts user adoption.

Customization and modular designs are gaining traction, allowing riders to switch between foil and non-foil modes. Eco-friendly materials such as bio-resins and recyclable composites are being integrated. Rental services at coastal resorts are expanding usage among tourists, while collaborations with water sports schools are helping build consumer confidence.

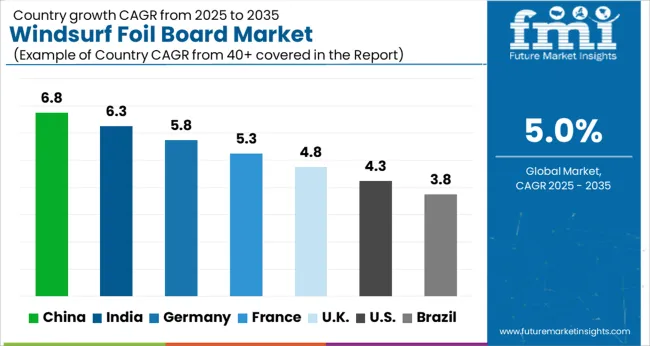

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global nonwoven baby diaper market is projected to grow at a CAGR of 4.5% through 2035, supported by ongoing demand in infant care, healthcare facilities, and retail sectors. Among BRICS nations, China leads with 6.1% growth, driven by large-scale production and expanding domestic consumption. India follows at 5.6%, where rising birth rates and increased product availability have influenced market expansion. In the OECD region, Germany reports 5.2% growth, backed by high product quality standards and established supply chains. France, growing at 4.7%, has maintained steady demand through hospitals and retail pharmacies. The United Kingdom, at 4.3%, reflects consistent usage within both private and public caregiving environments. Market dynamics have been shaped by product safety regulations, absorbency benchmarks, and labeling requirements. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Growth in the nonwoven baby diaper market in China has been recorded at a CAGR of 6.1%, driven by expanding healthcare access and rising newborn populations. Domestic manufacturers have increased production capacity by introducing ultra-absorbent core materials combined with soft nonwoven layers for enhanced comfort. Distribution channels have broadened to include tier-two and tier-three cities where disposable diapers are increasingly adopted over traditional alternatives. Retailers have diversified product portfolios with varying sizes and absorbency levels to meet regional preferences. The demand for hypoallergenic and breathable diaper variants has increased, especially in urban centers. Contract producers have ramped up specialty nonwoven fabrics to support major brands. Packaging innovations aimed at easy handling and disposal have also been implemented.

Ultra-absorbent cores combined with soft nonwoven layers

Expansion into tier-two and tier-three cities observed

Hypoallergenic diaper variants in growing demand

India has witnessed steady growth in the nonwoven baby diaper market at a CAGR of 5.6%, primarily supported by rising awareness of infant hygiene and increased disposable income. Local manufacturers have adopted breathable nonwoven fabric technologies to improve diaper comfort in hot climates. The rural and semi-urban sectors have shown increased acceptance of disposable diapers, driving demand for cost-efficient and mid-range products. Retail chains and online platforms have expanded accessibility, especially during festival seasons and promotions. Product development has focused on leak-proof designs combined with soft elastic waistbands. Educational campaigns on diaper usage and disposal methods have also contributed to market expansion. Packaging tailored for easy portability has been introduced to meet consumer convenience requirements.

Breathable nonwoven fabrics improve comfort in hot climates

Cost-efficient designs targeted at rural and semi-urban users

Leak-proof and elastic waistband features enhanced

A CAGR of 5.2% has been observed in Germany’s nonwoven baby diaper market, driven by a preference for high-performance products meeting strict regulatory standards. Diapers featuring superabsorbent polymers combined with biodegradable nonwoven layers have been adopted to reduce environmental impact. Manufacturers have focused on dermatologically tested fabrics to minimize skin irritation and allergies. Retailers have increased availability of premium and organic diaper lines to cater to eco-conscious consumers. Distribution networks have enhanced supply chain efficiencies to maintain consistent product availability. Innovations in wetness indicators and adjustable fasteners have been integrated to improve user convenience. Specialized packaging designed for recycling and minimal waste has been promoted across stores.

Biodegradable nonwoven layers incorporated for environmental concerns

Dermatologically tested fabrics minimize skin irritation

Wetness indicators and adjustable fasteners improved

Growth of 4.7% CAGR has been recorded in France’s nonwoven baby diaper market as demand rises for gentle, breathable diapers with effective leak protection. Production facilities have adopted multilayer nonwoven structures that improve softness and moisture distribution. Retailers have responded to consumer preferences by stocking fragrance-free and dermatologically safe diaper options. Pediatricians and healthcare providers have supported adoption by recommending products that reduce rash incidences. Promotional activities have focused on highlighting hypoallergenic materials and natural fiber blends. Packaging innovations include compact designs for space-saving storage and enhanced portability. Seasonal demand spikes have been managed through improved inventory strategies across regional warehouses.

Multilayer nonwoven structures enhance softness and moisture control

Fragrance-free and dermatologically safe options promoted

Compact packaging introduced for storage convenience

The United Kingdom has registered a CAGR of 4.3% in the nonwoven baby diaper market, fueled by consumer demand for gentle, high-absorbency products suited for sensitive skin. Manufacturers have integrated elasticized side panels and breathable nonwoven back sheets to improve fit and ventilation. Retailers have expanded product ranges to include hypoallergenic and dermatologically approved diapers targeting newborns and toddlers. Distribution channels have improved accessibility through pharmacy chains and e-commerce platforms. Brands have invested in packaging designs that support resealing and disposal convenience. Medical professionals have advocated for products that reduce diaper dermatitis risk, further increasing adoption. Consumer education on diaper disposal and environmental impact has also been intensified.

Elasticized side panels and breathable back sheets integrated

Hypoallergenic diapers offered for sensitive skin care

Packaging supports resealing and ease of disposal

The competitive landscape of the windsurf foil board market is characterized by a blend of specialized watersport brands, high-performance manufacturers, and niche startups focused on innovation and customization. Leading names such as Duotone, Naish, Slingshot, Starboard, Fanatic, and Cabrinha command influence by offering premium foil board lines with refined materials, engineering precision, and strong brand reputation among enthusiasts. They compete on foil design optimization, carbon composite construction, modular mast and fuselage interfaces, and integrated systems for ease of tuning.

Mid-tier providers and regional brands differentiate via cost efficiency, rental-ready models, and partnerships with water sport schools and resorts. Some niche manufacturers focus on user-centric customization, allowing components like foil wings, masts, and board shapes to be swapped or tuned per rider preference. Distributors and retailers that bundle training programs, maintenance services, and accessory packages also gain a competitive edge.

Key differentiators include product durability, performance in varying water conditions, ease of assembly or disassembly, and ongoing design upgrades. Marketing via pro riders, competition exposure, and demo fleets at surf and foil events is common. As the sport grows, consolidation may emerge among premium brands seeking scale and global reach, while start-ups that deliver user-friendly, better value systems may disrupt the market from the middle tier.

| Item | Value |

|---|---|

| Quantitative Units | USD 189.8 Million |

| Product | All-round, Freeride, Race, Wave, and Slalom |

| Material | Carbon fiber, Fiberglass, and Epoxy |

| Application | Recreational use, Competitive racing, and Wave riding |

| End Use | Beginners, Intermediate users, and Professional athletes |

| Distribution Channel | Online, Offline, and Third-party distributors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fanatic, JP Australia, Lift Foils, Naish, Neil Pryde, RRD (Roberto Ricci Designs), Severne, Slingshot Sports, Starboard, and Tabou Boards |

| Additional Attributes | Dollar sales vary by board type, including beginner, intermediate, and advanced foil boards; by material, spanning carbon fiber, fiberglass, and composite materials; by application, such as recreational windsurfing, competitive sports, and training; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising watersports popularity, demand for high-performance boards, and increasing participation in competitive windsurfing events. |

The global windsurf foil board market is estimated to be valued at USD 189.8 million in 2025.

The market size for the windsurf foil board market is projected to reach USD 309.2 million by 2035.

The windsurf foil board market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in windsurf foil board market are all-round, freeride, race, wave and slalom.

In terms of material, carbon fiber segment to command 49.7% share in the windsurf foil board market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foil Embossing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foil Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Foil Laminates Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Foil Laminates Sector

Market Share Breakdown of Foil Labels Manufacturers

Foil Labels Market Analysis by Metal Foils & Polymer-Based Foils Through 2035

Foil Tapes Market

Foil Zipper Bags Market

Multi-foil Rotor Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Evaluating Metal Foil Tapes Market Share & Provider Insights

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Coding Foils & Tapes Market Size and Share Forecast Outlook 2025 to 2035

Inline Foil Punch and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Market Share Insights of Coding Foils & Tapes Providers

Tipping Foils Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in the Tipping Foils Industry

Lidding Foil Market

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA