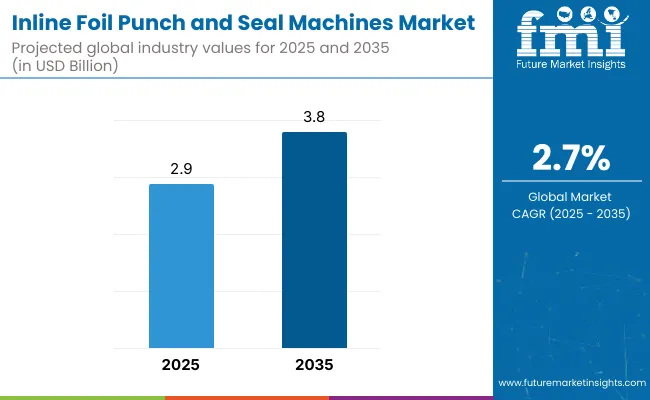

The Inline foil punch and seal machinesmarket is projected to grow from USD 2.9 billion in 2025 to USD 3.8 billion by 2035, marking a total increase of USD 0.9 billion over the forecast decade. This growth reflects a 31.0% overall expansion, with the market advancing at a compound annual growth rate (CAGR) of 2.7%. Over the ten-year span, the market is expected to grow by a 1.3 multiple.

In the first five-year phase (2025 to 2030), the market expands from USD 2.9 billion to USD 3.3 billion, contributing USD 0.4 billion, or 44.4% of the total decade's growth. This stage is driven by growing demand for high-speed, inline packaging systems in the pharmaceuticals, FMCG, and nutraceutical sectors. Manufacturers prioritize integrated sealing and die-punching solutions to reduce production downtime and increase operational efficiency.

During the second phase (2030–2035), the market grows from USD 3.3 billion to USD 3.8 billion, adding USD 0.5 billion, or 55.6% of total growth. Momentum is driven by adoption in digitally controlled packaging lines with features such as vision inspection, foil traceability, and smart diagnostics. Sustainability mandates also encourage the use of precision-based foil application technologies to minimize material wastage and improve pack integrity across regulated verticals.

From 2020 to 2024, the Inline foil punch and seal machines market grew from USD 2.5 billion to USD 2.8 billion, driven by hardware-centric adoption in pharmaceutical, food, and nutraceutical packaging lines where precise foil cutting, sealing accuracy, and hygiene compliance are critical. During this period, the competitive landscape was dominated by machine manufacturers controlling nearly 70% of total revenue, with leaders such as IMS (Imsmachines), NK Industries Limited, and Pillar Technologies, Inc. focusing on modular, high-speed machines that support blister packs, cap sealing, and container foil application. Competitive differentiation relied on format flexibility, thermal consistency, and inline automation integration, while software platforms for remote control or diagnostics were typically bundled and not sold separately. Service-based models had limited traction, contributing less than 10% of total market value, with customers favoring one-time capital investments.

Demand for Inline foil punch and seal machines will expand to USD 3.8 billion in 2035, and the revenue mix will shift as digital features, support services, and IoT-based maintenance grow to over 40% share. Traditional machine builders are facing new competition from automation-forward entrants offering cloud dashboards, recipe-driven parameter control, and predictive failure alerts. Major vendors are pivoting to hybrid models by embedding SCADA compatibility, smart PID controllers, and remote troubleshooting to maintain long-term relevance. Emerging companies such as For‑Bro Engineers (ForBropack), Mahalaxmi Machines, and Shree Vishvakarma Industries are gaining share by specializing in compact, cost-optimized designs with region-specific compliance.

Increasing automation in packaging lines and the rising demand for high-speed, precision sealing in food, pharmaceutical, and cosmetics industries are driving growth in the Inline foil punch and seal machines market. These machines enable accurate punching and hermetic sealing of foil lids onto containers or blisters, enhancing product safety, shelf life, and tamper resistance. The shift toward single-serve and convenience packaging formats has further accelerated adoption of inline foil sealing technologies.

Servo-driven and PLC-controlled inline machines have gained popularity due to their ability to maintain consistent sealing pressure and precision at high speeds. These systems are ideal for applications requiring sterile, leak-proof, and contamination-free packaging. The integration of vision inspection systems and IoT-based monitoring enhances quality control and operational efficiency in continuous packaging environments.

Industries such as dairy, pharmaceuticals, nutraceuticals, and personal care are driving demand for advanced sealing solutions that ensure compliance with safety standards while reducing operational downtime. These machines support scalability, hygienic operations, and energy-efficient workflows across high-volume production settings.

Segment growth is expected to be led by automatic inline sealers, pharmaceutical-grade packaging applications, and rotary punch & seal modules due to their productivity advantages, customization capability, and alignment with GMP and FDA packaging requirements.

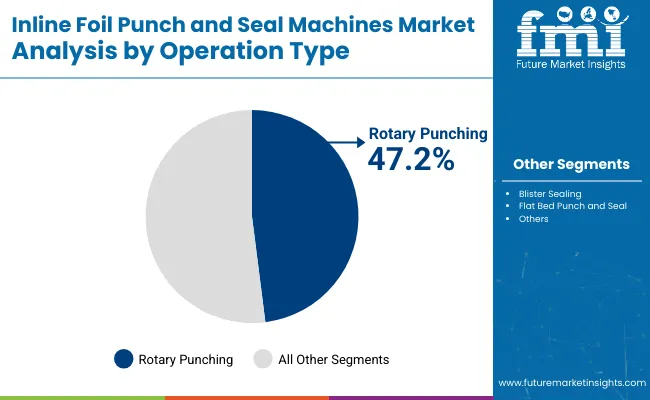

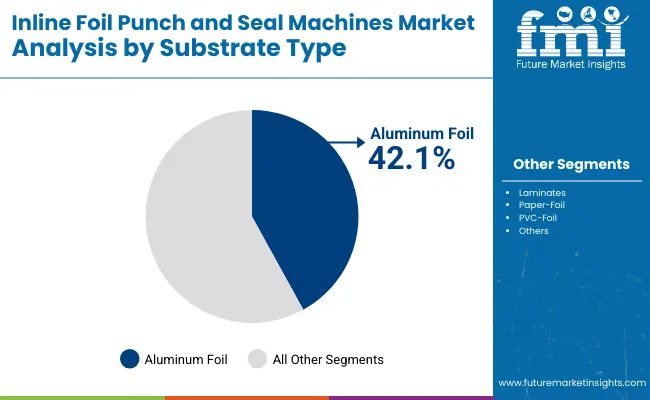

The market is segmented by operation type, substrate type, machine speed, application, end-use industry, and region. Operation type includes rotary punching, blister sealing, and flat bed punch & seal, each designed to meet specific production layouts and packaging configurations. Substrate type segmentation comprises aluminum foil, laminates, paper-foil, and PVC-foil, reflecting the machine’s adaptability to various material combinations used in pharmaceutical and consumer packaging.

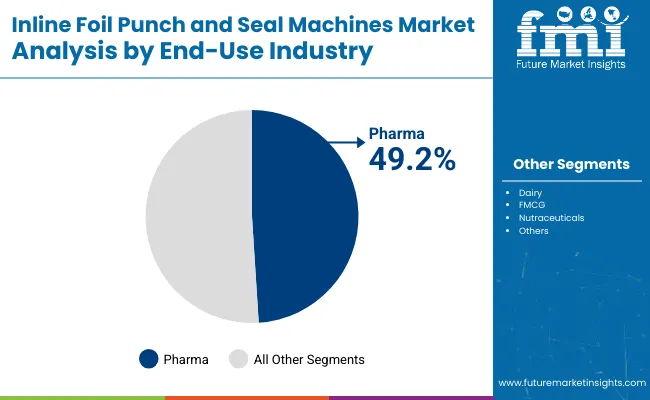

Machine speed is categorized into low-speed (≤100 cycles/min), medium-speed (100–300 cycles/min), and high-speed (>300 cycles/min), addressing throughput needs across small-batch to high-volume manufacturing setups. Application areas include pharmaceuticals (blister packs), dairy lids, and nutraceuticals, where precision sealing and contamination prevention are essential. End-use industries include pharma, dairy, FMCG, and nutraceuticals, indicating widespread utility across regulated and fast-moving sectors. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The rotary punching segment is expected to account for the highest share of 47.2% in 2025 in the Inline foil punch and seal machines market. This dominance stems from its continuous-motion operation that significantly enhances production throughput, especially for high-volume blister packaging lines. Unlike intermittent punching systems, rotary units offer faster cycle times and better alignment accuracy, which is crucial for ensuring seal integrity in foil-based pharmaceutical packaging.

The system's ability to maintain consistent die pressure, minimal material distortion, and adaptability to multiple foil gauges makes it highly desirable for manufacturers seeking operational efficiency. Furthermore, innovations in servo-driven rotary punching units have expanded their flexibility to accommodate custom foil geometries and patterns, helping packaging lines meet stringent GMP and FDA requirements. As manufacturers continue to invest in automated high-output solutions, rotary punching machines will remain the go-to technology for inline foil processing in regulated industries.

The Pharma segment is projected to lead the end-use industry category, capturing a 49.2% share in 2025. This segment's growth is fueled by the increasing demand for blister-packed medications that offer enhanced dosage compliance, tamper resistance, and product traceability. Inline foil punch and seal machines are central to the pharmaceutical blister packaging process, allowing for precise cavity sealing, batch coding, and material validation in real time.

The rise in chronic disease prevalence and the expansion of over-the-counter (OTC) drug markets have driven pharmaceutical companies to adopt faster and more hygienic packaging technologies. Inline systems with integrated vision inspection, rotary punching, and embossing stations ensure packaging line efficiency while reducing error rates. Additionally, with regulatory bodies such as the FDA and EMA emphasizing serialization and anti-counterfeit features, the need for robust inline punch & seal solutions in pharma manufacturing environments is only expected to intensify through the forecast period.

The aluminum foil segment is projected to hold the highest share of 42.1% in 2025 in the Inline foil punch and seal machines market. Its dominance stems from the material's superior barrier properties, including resistance to moisture, oxygen, UV light, and microbial contamination. These attributes are crucial for applications demanding high-integrity sealing, especially in pharmaceutical and medical packaging.

Aluminum foil’s compatibility with heat sealing, embossing, and anti-counterfeiting features further reinforces its use in modern inline sealing systems.

The medium-speed segment (100–300 cycles/min) is anticipated to account for the largest share of 47.3% in 2025 in the Inline foil punch and seal machines market. These systems strike a balance between high throughput and operational manageability, making them ideal for mid-scale pharmaceutical production and contract packaging operations.

Medium-speed machines are valued for their lower capital investment, reduced energy consumption, and flexible configuration options.

The pharmaceuticals segment is forecasted to dominate the application category with a 51.1% share in 2025. This is driven by the increasing demand for blister packs, unit-dose formats, and tamper-evident packaging that complies with FDA, EMA, and WHO standards. Inline foil punch and seal machines are crucial in ensuring high-precision, sterile, and secure sealing required for tablets, capsules, and powders.

The machines offer high adaptability to lidding materials, precise punching, and sealing controls that minimize contamination risks and ensure dose uniformity.

High precision demands and tooling complexity restrain mass-scale customization, even as demand grows across pharmaceuticals, dairy, nutraceuticals, and industrial FMCG for high-speed, inline foil punching and sealing solutions that enhance production efficiency and packaging integrity.

Demand for High-speed Automation and Packaging Line Integration

Inline foil punch and seal machines are increasingly adopted in sectors like pharmaceuticals, dairy, nutraceuticals, and food & beverage, where speed, sterility, and process synchronization are essential. These machines enable continuous punching and sealing of foil lids or membranes directly within a packaging line, reducing manual handling and improving throughput. In aseptic packaging environments, they support compliance by maintaining product hygiene and reducing human intervention. The growing need for tamper-evident and airtight sealing in single-use packs and portion-controlled formats further propels machine demand. As companies scale up production, integrated punch-and-seal systems offer seamless compatibility with filling, labeling, and inspection equipment supporting end-to-end automation goals.

Tooling Precision and Operational Cost Barriers

Despite their operational advantages, Inline foil punch and seal machines face challenges related to tooling complexity and cost-intensive changeovers. Custom die tooling must be engineered to micron-level precision, particularly in pharmaceutical and dairy packaging, where seal strength, edge quality, and foil integrity are strictly regulated. The wear-and-tear of dies during high-speed operation necessitates frequent recalibration and maintenance. multi-format compatibility increases downtime due to tool replacement and format setting. For smaller operations or low-volume SKUs, the return on investment can be limited. These technical and cost constraints often delay adoption in facilities without dedicated engineering support or automation infrastructure.

Digital Tooling, Smart Sensors, and Servo-driven Accuracy

The market is witnessing a strong shift toward digitization and advanced motion control to enhance performance and reduce waste. Manufacturers are deploying servo-driven punching units for precise foil alignment and clean-edge punching, even at high speeds. Integrated sensors now monitor foil positioning, punch wear, and seal quality in real time, enabling predictive maintenance and quality assurance with minimal operator input. Advancements in digital tooling allow faster tool changeovers and format memory storage, enhancing flexibility for multi-SKU operations. These innovations are driving adoption in pharma blistering, yogurt lidding, nutraceutical sachets, and multi-compartment dosing systems where speed, accuracy, and reliability converge as critical production priorities.

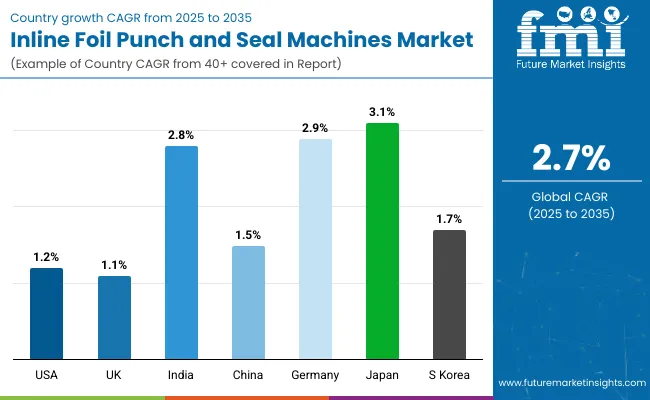

The global Inline foil punch and seal machines market is growing steadily, supported by rising demand for hygienic, tamper-evident, and hermetically sealed packaging across food, beverage, pharmaceuticals, and nutraceuticals. The shift toward automation in form-fill-seal (FFS) lines and growing regulatory focus on contamination prevention are fueling machine-level innovation and adoption. Japan and Germany lead globally due to early integration in high-precision manufacturing environments. India follows closely with strong growth in low-cost pharmaceutical blister packaging. The United States and China are showing gradual upgrades in dairy, condiment, and supplement sectors. UK and South Korea reflect slower yet stable adoption due to high equipment replacement costs and focus on other automation priorities.

The Inline foil punch and seal machines market in the United States is projected to grow at a CAGR of 1.2% from 2025 to 2035. The market is driven by steady adoption in single-serve dairy, nutraceutical sachets, and condiments packaging where foil seals ensure freshness and tamper-evidence. Upgrades remain limited to larger enterprises with high-speed FFS lines, while smaller players rely on semi-automatic or outsourced sealing operations.

The Inline foil punch and seal machines market in the United Kingdom is expected to grow at a CAGR of 1.1%, with moderate adoption across pharmaceuticals and single-use personal care products. Market constraints include high investment costs and slower equipment replacement cycles in SMEs. However, large-scale co-packers and regulated drug manufacturers are embracing integrated foil sealing solutions for compliance and quality assurance.

India’s Inline foil punch and seal machines market is forecast to grow at a CAGR of 2.8%, driven by rapid expansion in pharma, spice, and dairy processing sectors. Government support for domestic pharmaceutical production and clean labeling has spurred demand for localized, efficient packaging lines. Indian machine manufacturers are also offering modular punch & seal systems tailored for high-volume SKU variety.

The Inline foil punch and seal machines market in China is projected to grow at a CAGR of 1.5%, led by demand in health supplements, herbal medicine, and ready-to-eat condiment packaging. Automation initiatives in regional manufacturing hubs are improving throughput in single-serve packaging formats. However, adoption remains fragmented across rural and urban manufacturers.

Germany’s Inline foil punch and seal machines market is expected to grow at a CAGR of 2.9%, backed by high regulatory focus on pharmaceutical packaging integrity and demand for precision-controlled sealing systems in sterile environments. The German machinery industry is also innovating with recyclable foil compatibility, cleanroom integration, and predictive maintenance software.

Japan’s Inline foil punch and seal machines market is forecast to grow at a CAGR of 3.1%, the highest globally. Compact machine footprints, cleanroom compatibility, and strict hygiene protocols are key adoption drivers. The market is driven by widespread use in clinical packaging, anti-microbial sachets, and high-end foodservice applications requiring precise temperature-controlled sealing.

South Korea’s Inline foil punch and seal machines market is projected to grow at a CAGR of 1.7%, supported by increasing automation in OTC pharma, herbal supplements, and skincare sachets. K-beauty and nutraceutical exporters are focusing on hygienic, tamper-evident foil closures to meet export and safety certification standards. However, cost barriers and space constraints in SMEs moderate overall growth pace.

The Inline foil punch and seal machines market is moderately fragmented, with automation OEMs, regional process equipment manufacturers, and application-specific sealing system specialists competing across pharmaceutical, food, chemical, and nutraceutical packaging applications. Global and national leaders such as IMS (Imsmachines), NK Industries Limited, and Pillar Technologies, Inc. hold a significant market share, driven by their precision-controlled punching mechanisms, advanced foil feeding integration, and compatibility with high-speed form-fill-seal lines. Their strategies increasingly emphasize modular PLC control, hygienic design standards, and seamless compatibility with sealing validation protocols.

Established mid-sized players including For-Bro Engineers (ForBropack), Mahalaxmi Machines, and Shree Vishvakarma Industries are accelerating adoption through compact, inline-ready designs featuring customizable punch dies, multi-head configurations, and automation-compatible conveyors. These companies cater to semi-automated to fully integrated production lines in mid-cap operations seeking cost-effective performance without compromising on punch accuracy or foil seal integrity.

Specialized manufacturers focus on regional and niche sectors such as spice caps, nutritional caps, and container sealers in FMCG and pharma industries. Their strengths lie in high adaptability, tailored cavity arrangements, and robust customer support for format changeovers and service parts, especially for India and Southeast Asia-based packaging converters.

Key Development of Inline Foil Punch and Seal Machines

In 2025, Aarvi Engineering published a detailed update showcasing its latest servo‑based flat surface double‑sided sticker labeling machine with PLC/HMI control.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| By Operation Type | Rotary Punching, Blister Sealing, and Flat Bed Punch and Seal |

| By Substrate Type | Aluminum Foil, Laminates, Paper-Foil, and PVC-Foil |

| By Machine Speed | Low-Speed (≤100 cycles/min), Medium-Speed (100–300 cycles/min), and High-Speed (>300 cycles/min) |

| By Application | Pharmaceuticals (blister packs), Dairy Lids, and Nutraceuticals |

| By End-Use Industry | Pharma, Dairy, FMCG, and Nutraceuticals |

| Key Companies Profiled | IMS / Imsmachines , NK Industries Limited, Pillar Technologies, Inc., For ‑ Bro Engineers ( ForBropack ), Mahalaxmi Machines, Shree Vishvakarma Industries . |

| Additional Attributes | Integration of punching and sealing in single-pass systems, high demand for aluminum foil compatibility in blister packaging, growing preference for flatbed designs in pharma-grade sealing, demand driven by blister packs in oral solid dosage forms, increased machine installations in Southeast Asia and Latin America, advancements in high-speed rotary sealing technologies, adoption of servo-driven precision alignment for reduced waste, rising demand for compact machines in cleanroom environments, and customization trends for dairy and nutraceutical applications |

The global Inline foil punch and seal machines market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the Inline foil punch and seal machines market is projected to reach USD 3.8 billion by 2035.

The Inline foil punch and seal machines market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in the Inline foil punch and seal machines market include rotary punch & seal machines, flat-bed punch & seal machines, and servo-driven inline systems.

In terms of punching technology, the rotary punching segment is expected to account for the highest share of 47.2% in the Inline foil punch and seal machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inline Quality Control Sensors Market

Vertical Inline Pumps Market

Foil Embossing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foil Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Foil Laminates Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Foil Laminates Sector

Market Share Breakdown of Foil Labels Manufacturers

Foil Labels Market Analysis by Metal Foils & Polymer-Based Foils Through 2035

Foil Tapes Market

Foil Zipper Bags Market

Multi-foil Rotor Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Evaluating Metal Foil Tapes Market Share & Provider Insights

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Coding Foils & Tapes Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Market Share Insights of Coding Foils & Tapes Providers

Tipping Foils Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in the Tipping Foils Industry

Lidding Foil Market

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA