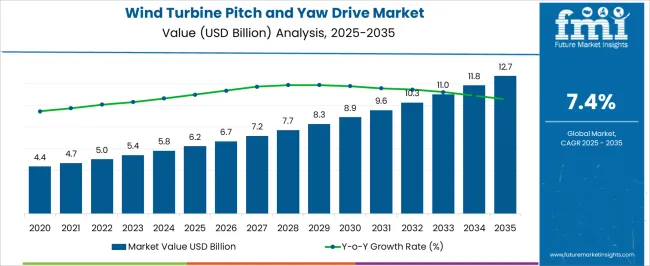

The wind turbine pitch and yaw drive market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 12.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

Over the next few years, growth is propelled by global investments in onshore and offshore wind capacity expansion, rising emphasis on renewable energy targets, and modernization of existing turbine fleets. The market benefits from increasing turbine sizes, with larger rotors and higher hub heights demanding advanced pitch and yaw systems to optimize efficiency and energy output. Regional adoption varies, with Europe and North America prioritizing retrofit and replacement of aging turbines, while Asia-Pacific focuses on new capacity installation driven by government subsidies and green energy mandates.

Manufacturers are integrating smart monitoring, predictive maintenance, and condition-based control technologies into drive systems to reduce downtime and operational costs. Supply chain developments, including local component manufacturing, strategic vendor partnerships, and standardized modular designs, further support market expansion.

Financial incentives, sustainability-driven procurement policies, and growing awareness of lifecycle cost optimization encourage utilities and independent power producers to upgrade turbine controls. The market also experiences competitive dynamics, as OEMs and aftermarket providers differentiate through durability, precision, and low-maintenance solutions.

The wind turbine pitch and yaw drive market is significantly shaped by interrelated parent markets, each playing a distinct role in driving adoption and growth. The onshore wind power generation market holds the largest share at 45%, as utilities and independent power producers deploy turbines requiring precise blade orientation and yaw control to maximize energy output and efficiency.

Offshore wind farms contribute 25%, with larger, high-capacity turbines relying heavily on robust and reliable drive systems to withstand harsh marine environments and optimize performance under variable wind conditions. The wind turbine OEM and component manufacturing market accounts for 15%, supplying precision-engineered pitch and yaw drives, gears, and control systems that ensure turbine longevity, safety, and reduced maintenance costs.

The wind energy services and maintenance market holds a 10% share, driven by retrofitting, replacement, and predictive maintenance solutions that enhance turbine uptime and lifecycle efficiency. Finally, the renewable energy policy and infrastructure investment market represents 5%, providing incentives, subsidies, and regulatory support that encourage installation and modernization of turbine fleets.

Collectively, onshore and offshore wind deployment, OEM supply, and maintenance services account for 95% of overall demand, emphasizing that energy production efficiency, system reliability, and operational optimization remain the primary growth drivers, while policy support and infrastructure investments facilitate broader adoption and market penetration globally.

| Metric | Value |

|---|---|

| Wind Turbine Pitch and Yaw Drive Market Estimated Value in (2025 E) | USD 6.2 billion |

| Wind Turbine Pitch and Yaw Drive Market Forecast Value in (2035 F) | USD 12.7 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The wind turbine pitch and yaw drive market is witnessing steady growth, supported by the global transition towards renewable energy, increasing wind power capacity installations, and technological advancements in turbine design. Demand momentum is being reinforced by supportive government policies, grid decarbonization goals, and cost competitiveness of wind energy compared to conventional power generation.

The market is benefitting from robust expansion in both onshore and offshore projects, although onshore installations continue to dominate due to lower infrastructure costs and easier accessibility. Manufacturers are focusing on improving drive system efficiency, durability, and predictive maintenance capabilities to maximize turbine uptime and operational safety.

The integration of advanced materials, improved sealing technologies, and smart monitoring systems is reducing downtime and enhancing lifecycle performance Over the forecast period, consistent investments in large-scale wind projects, coupled with growing replacement demand for aging turbines, are expected to sustain market growth while innovations in modular drive designs and hybrid control systems further strengthen market competitiveness.

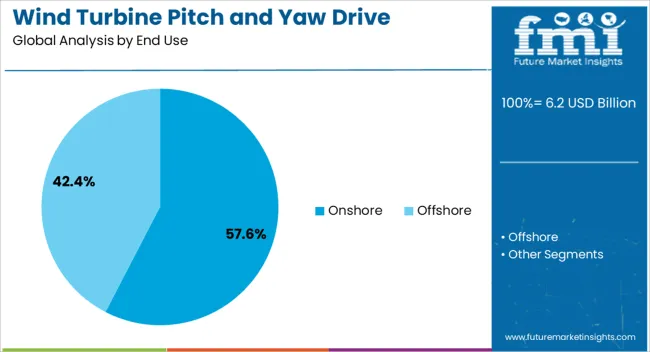

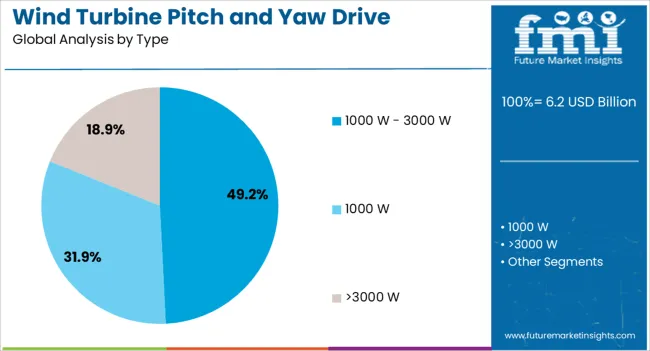

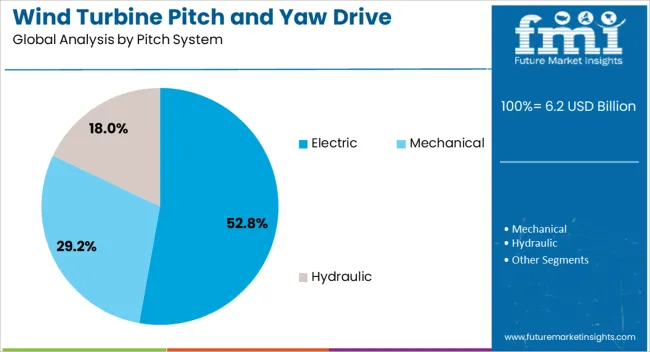

The wind turbine pitch and yaw drive market is segmented by end use, type, pitch system, size, and geographic regions. By end use, wind turbine pitch and yaw drive market is divided into onshore and offshore. In terms of type, wind turbine pitch and yaw drive market is classified into 1000 W - 3000 W, 1000 W, and >3000 W. Based on pitch system, wind turbine pitch and yaw drive market is segmented into electric, mechanical, and hydraulic. By size, wind turbine pitch and yaw drive market is segmented into medium, small, and large. Regionally, the wind turbine pitch and yaw drive industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The onshore segment, holding 57.60% of the end use category, continues to lead the market due to its favorable installation economics, established supply chains, and broad geographic deployment. Reduced logistical challenges, lower maintenance costs, and faster project timelines have supported the segment’s strong share, particularly in regions with mature wind energy policies and land availability.

Onshore turbines offer easier access for repairs and upgrades, which extends operational life and reduces downtime. The segment’s dominance is further supported by increasing adoption in emerging markets where infrastructure constraints limit offshore development.

Consistent investment from both public and private sectors, coupled with ongoing grid expansion, is expected to ensure stable growth in this category Improvements in pitch and yaw drive components for onshore settings are enhancing system reliability, thereby supporting continued leadership in the global wind turbine pitch and yaw drive market.

The 1000 W - 3000 W segment, accounting for 49.20% of the type category, has retained its leading position by offering a balanced mix of power capacity, cost efficiency, and suitability for a wide range of turbine models. This range meets the operational needs of most mid-sized turbines, making it a preferred choice for both new installations and retrofits.

The segment benefits from economies of scale in manufacturing, leading to competitive pricing and widespread adoption across various regions. High compatibility with advanced control systems ensures optimal blade positioning for energy capture, contributing to sustained market share.

Manufacturers are focusing on enhancing torque performance, corrosion resistance, and operational stability under varying environmental conditions The versatility and reliability of this power range continue to reinforce its importance in the wind turbine pitch and yaw drive market, especially as global wind capacity expands.

The electric pitch system segment, with 52.80% share in the pitch system category, leads due to its superior efficiency, reduced maintenance requirements, and integration flexibility compared to hydraulic systems. Electric systems provide precise blade angle control, improving energy capture and reducing mechanical stress during variable wind conditions.

The segment’s growth is supported by advancements in motor technology, lightweight component design, and smart control algorithms that enable predictive maintenance and fault detection. Additionally, electric pitch systems eliminate the need for hydraulic fluids, reducing environmental risk and simplifying maintenance processes.

Growing demand for scalable and modular solutions in both onshore and offshore applications is further enhancing adoption rates Over the forecast period, continuous improvements in reliability, energy efficiency, and compatibility with next-generation turbine designs are expected to strengthen the dominance of electric pitch systems in the global wind turbine pitch and yaw drive market.

Onshore and offshore turbine growth, coupled with maintenance optimization and strategic OEM partnerships, remain the primary drivers of the wind turbine pitch and yaw drive market. Lifecycle management and global deployment are crucial for sustained adoption.

The onshore wind sector is the primary driver of the wind turbine pitch and yaw drive market, accounting for a substantial portion of demand. Utilities and independent power producers are installing medium- to large-capacity turbines that require precise blade orientation and yaw control to maximize energy capture. Manufacturers are focusing on high-reliability drives with low maintenance needs to ensure continuous operations in diverse geographic and climatic conditions. Turbine operators are adopting predictive maintenance and monitoring solutions to reduce downtime and operational costs. Replacement and retrofitting of aging drive systems also contribute to revenue growth. Evolving turbine sizes and rotor diameters necessitate robust and scalable pitch and yaw solutions.

Offshore wind farms represent a fast-growing segment, requiring high-capacity and durable pitch and yaw drive systems. Exposure to harsh marine conditions demands corrosion-resistant materials and precision engineering to maintain efficiency and reliability. Larger rotor diameters and higher turbine capacities necessitate advanced control mechanisms to optimize energy generation. Service and maintenance intervals are critical due to difficult access and higher operational costs at sea. OEMs are designing specialized drives that accommodate extreme weather, saltwater exposure, and dynamic load conditions. Strategic collaborations with turbine manufacturers ensure integration and compatibility. The expansion of offshore wind projects in Europe, Asia, and North America is a major growth driver.

Maintenance services significantly influence the adoption of pitch and yaw drives, as operators aim to maximize turbine uptime and reduce unexpected failures. Predictive and condition-based maintenance solutions help identify wear and mechanical issues before they impact operations. Lifecycle management strategies, including retrofitting older turbines with modern drives, enhance energy efficiency and extend operational life. Service providers offer modular designs for easier component replacement and reduced downtime. The growing demand for low-maintenance, high-reliability systems is accelerating investments in robust and automated monitoring solutions. Efficient maintenance reduces operational expenditure and contributes to stable long-term power output for wind farm operators.

Collaboration between turbine OEMs and drive manufacturers drives market penetration and innovation. Joint development ensures compatibility, reliability, and performance optimization across different turbine models and capacities. Global expansion of wind projects, particularly in Asia-Pacific, Europe, and North America, presents significant opportunities for both established and emerging players. Suppliers are localizing manufacturing and service facilities to meet regional requirements and reduce logistical costs. Integration of control systems with drive units improves operational efficiency and safety. OEM partnerships also accelerate the deployment of next-generation turbines with larger rotors, higher energy yields, and advanced grid compliance.

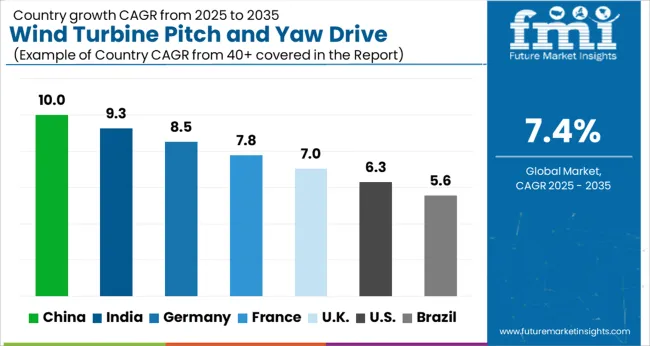

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

The global wind turbine pitch and yaw drive market is projected to grow at a CAGR of 7.4% from 2025 to 2035. China leads at 10.0%, followed by India at 9.3%, Germany at 8.5%, the UK at 7.0%, and the USA at 6.3%. Growth is fueled by rapid expansion of onshore and offshore wind farms, rising demand for higher-capacity turbines, and the need for precise blade and yaw control to maximize energy efficiency.

Asia, particularly China and India, shows accelerated adoption due to government-backed renewable energy initiatives and large-scale wind farm installations. Europe focuses on retrofitting and optimizing existing turbines, while North America emphasizes offshore wind deployment and advanced control solutions. The analysis spans over 40+ countries, with the leading markets shown below.

The wind turbine pitch and yaw drive market in China is projected to grow at a CAGR of 10.0% from 2025 to 2035, fueled by the country’s aggressive renewable energy targets and large-scale onshore and offshore wind farm projects. Manufacturers are investing in high-precision drives to optimize blade angle and yaw control, enhancing energy efficiency and turbine lifespan. Government-backed incentives, feed-in tariffs, and public-private partnerships accelerate deployment across coastal and inland regions.

Domestic drive producers are improving reliability, reducing maintenance cycles, and integrating smart monitoring systems. International collaborations enable technology transfer, ensuring compatibility with large-capacity turbines and advanced grid integration. The demand for modular, durable, and efficient drives is rising across both utility-scale and distributed wind farms.

The wind turbine pitch and yaw drive market in India is expected to expand at a CAGR of 9.3% from 2025 to 2035, driven by rapid capacity additions in onshore wind farms and increasing emphasis on utility-scale renewable projects. Indian manufacturers are focusing on durable and low-maintenance drive systems suitable for diverse climatic conditions.

Government initiatives such as competitive bidding, tax incentives, and renewable purchase obligations encourage wind project developers to invest in high-efficiency turbines. Partnerships with global suppliers ensure access to advanced pitch and yaw technologies, while R&D in predictive maintenance and remote monitoring improves reliability. Wind parks in Tamil Nadu, Gujarat, and Maharashtra are leading deployment, with offshore projects on the horizon.

Germany’s wind turbine pitch and yaw drive market is projected to grow at a CAGR of 8.5% from 2025 to 2035, supported by a mature onshore and emerging offshore wind energy sector. Emphasis on maximizing energy yield and grid stability drives the adoption of precise, low-friction pitch and yaw drive systems. German manufacturers focus on high-efficiency, long-life components integrated with smart control systems for predictive maintenance.

Offshore wind farms in the North and Baltic Seas are increasing demand for robust, corrosion-resistant drives. Collaborative projects between turbine OEMs, system integrators, and component suppliers advance technology standards, while retrofit opportunities for older turbines provide incremental market expansion.

The wind turbine pitch and yaw drive market in the UK is anticipated to grow at a CAGR of 7.0% from 2025 to 2035, driven by large-scale offshore wind projects in the North Sea and evolving national renewable energy targets. UK manufacturers and integrators focus on reliable, low-maintenance drives capable of withstanding harsh offshore conditions.

Investment in digital monitoring systems enables predictive maintenance, reducing downtime and optimizing energy capture. Collaborative initiatives with European suppliers ensure access to advanced drive technologies and support local production. Repowering and upgrading existing wind farms contribute to steady market growth, alongside new offshore project developments.

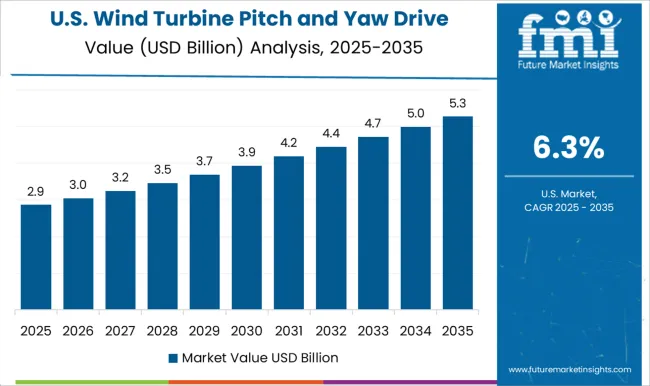

The USA wind turbine pitch and yaw drive market is projected to grow at a CAGR of 6.3% from 2025 to 2035, propelled by increasing wind energy capacity across onshore projects and emerging offshore initiatives along the Atlantic coast. USA manufacturers emphasize scalable, modular, and maintenance-friendly drive solutions to reduce operational costs and improve turbine efficiency.

Integration of condition monitoring and automated control systems supports predictive maintenance and optimal blade alignment. Federal incentives, state-level renewable mandates, and long-term power purchase agreements drive investment in advanced turbines. Collaborative R&D with international suppliers accelerates innovation in high-torque, durable drive systems capable of supporting multi-megawatt turbines.

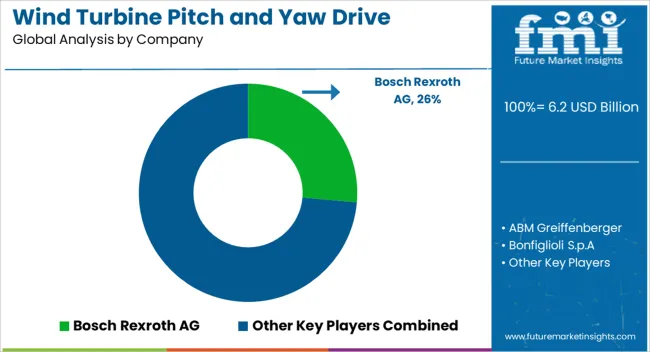

Competition in the wind turbine pitch and yaw drive market is defined by precision, durability, and reliability under diverse operational conditions. Bosch Rexroth AG leads with high-torque, maintenance-friendly drive systems, emphasizing modular designs, advanced monitoring, and integration with turbine control units. ABM Greiffenberger and Bonfiglioli S.p.A compete through robust gear and drive solutions tailored for onshore and offshore turbines, highlighting long operational life and high energy efficiency.

Dana SAC UK and Comer Industries differentiate by offering scalable, low-maintenance drives suitable for multi-megawatt turbines, focusing on performance optimization and reduced downtime. KEBA and Liebherr emphasize intelligent control integration, automation, and predictive maintenance capabilities, improving turbine output and operational reliability.

Regional and specialized players such as Nabtesco Corporation, Nanjing High Speed Gear Manufacturing Co., Ltd, Nidec Conversion, SIPCO–MLS, Schaeffler Group, and ZOLLERN GmbH & Co. provide niche solutions for retrofits, customized turbine sizes, and harsh offshore conditions. Strategies center on precision engineering, corrosion resistance, and compliance with IEC and GL standards, targeting both utility-scale wind farms and distributed energy projects.

Partnerships with turbine OEMs, technology collaborations, and long-term service agreements are marketed to enhance reliability, reduce maintenance costs, and accelerate adoption across mature and emerging wind markets. Product brochure content is detailed and technical. Drives are specified by torque capacity, gear ratios, yaw and pitch accuracy, operational temperature ranges, and maintenance intervals. Features include integrated condition monitoring, predictive maintenance software, and compatibility with turbine control systems.

Materials, corrosion protection, modular designs, and offshore suitability are highlighted. Accessories, installation kits, and maintenance tools are detailed. Compliance with IEC, GL, and other certification standards is emphasized. Brochures also provide operational guidelines, retrofit instructions, and lifecycle service options, reflecting a market focused on precision, efficiency, and reliability for renewable energy applications.

This competitive landscape illustrates a market where global leaders, regional specialists, and technology innovators collaborate to deliver high-performance, reliable, and intelligent pitch and yaw drive solutions. OEM partnerships, advanced engineering, and service excellence are critical to meeting growing global demand in both onshore and offshore wind turbine projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 billion |

| End Use | Onshore and Offshore |

| Type | 1000 W - 3000 W, 1000 W, and >3000 W |

| Pitch System | Electric, Mechanical, and Hydraulic |

| Size | Medium, Small, and Large |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Rexroth AG, ABM Greiffenberger, Bonfiglioli S.p.A, Dana SAC UK, Comer Industries, KEBA, Liebherr, Nabtesco Corporation, Nanjing High Speed Gear Manufacturing Co., Ltd, Nidec Conversion, SIPCO–MLS, Schaeffler Group, and ZOLLERN GmbH & Co. |

| Additional Attributes | Dollar sales, market share, CAGR, adoption by onshore/offshore turbines, torque and reliability trends, regional demand, key OEM partnerships, retrofit opportunities, maintenance cost benchmarks, and regulatory standards globally. |

The global wind turbine pitch and yaw drive market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the wind turbine pitch and yaw drive market is projected to reach USD 12.7 billion by 2035.

The wind turbine pitch and yaw drive market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in wind turbine pitch and yaw drive market are onshore and offshore.

In terms of type, 1000 w - 3000 w segment to command 49.2% share in the wind turbine pitch and yaw drive market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Wind Power Coatings Market Size and Share Forecast Outlook 2025 to 2035

Windsurf Foil Board Market Size and Share Forecast Outlook 2025 to 2035

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wind Vane Wiring Market Size and Share Forecast Outlook 2025 to 2035

Window Packaging Market Size and Share Forecast Outlook 2025 to 2035

Window Coverings Market – Trends, Growth & Forecast 2025 to 2035

Assessing Window Packaging Market Share & Industry Trends

Wind Speed Alarm Market

Window Rain Guards Market

Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Forging Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Wind Turbine Market Analysis and Insights - 2025 to 2035

Wind Turbine Automation Market Insights - Growth & Forecast through 2035

Wind Turbine Composite Material Market Size 2024-2034

Wind Turbine Blade Repair Material Market Growth – Trends & Forecast 2024-2034

Wind Turbine Shaft Market

Sidewinder Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA