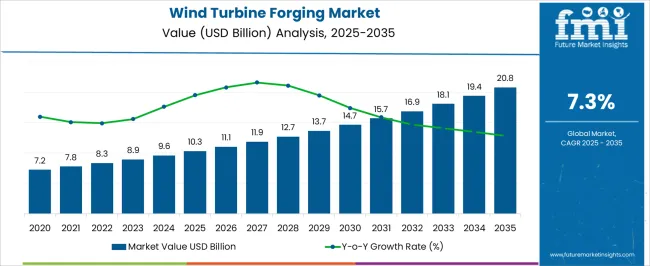

The wind turbine forging sector is forecasted to expand from USD 10.3 billion in 2025 to USD 20.8 billion in 2035, advancing at a CAGR of 7.3%. The growth contribution index highlights consistent value creation, with figures rising from 10.3 billion in 2025 to 12.7 billion in 2028 and 14.7 billion by 2030. This steady climb reflects the critical role of forged components such as shafts, rings, and flanges in ensuring the reliability and performance of large-scale turbines.

The index demonstrates how material strength and precision engineering are shaping demand, driving long-term confidence in forging as a core supply chain asset. By 2031, values are expected to reach 15.7 billion, rising to 18.1 billion in 2033 and closing at 20.8 billion in 2035. The growth contribution index illustrates how increasing turbine size and global expansion of wind projects continue to reinforce the need for high-quality forged components.

The trajectory highlights the irreplaceable role of forging in maintaining the structural integrity and operational safety of wind turbines. The index confirms that consistent investment in forging capacity and specialized alloys will define competitive advantage, positioning this segment as a cornerstone of renewable energy infrastructure growth.

| Metric | Value |

|---|---|

| Wind Turbine Forging Market Estimated Value in (2025 E) | USD 10.3 billion |

| Wind Turbine Forging Market Forecast Value in (2035 F) | USD 20.8 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The wind turbine forging segment is estimated to contribute nearly 13% of the forging market, about 19% of the wind energy components market, close to 11% of the power generation equipment market, nearly 9% of the heavy engineering and industrial components market, and around 15% of the renewable energy infrastructure market.

This accounts for an aggregated share of approximately 67% across its parent categories. This proportion highlights the strategic role of wind turbine forgings as foundational components in towers, shafts, flanges, and bearing housings that determine both reliability and efficiency of wind installations. Their value has been demonstrated in enabling turbines to withstand high stress loads, rotational forces, and demanding climatic conditions, ensuring consistent energy output. Industry observers regard wind turbine forgings not just as industrial inputs but as critical enablers of scale in wind power projects where quality and resilience dominate procurement decisions.

Demand has been reinforced by large-scale offshore and onshore wind projects, which require advanced forging capabilities to deliver longer turbine life cycles and higher capacity factors. The segment has been positioned as a decisive subset of the broader forging industry, shaping investments in specialized facilities, metallurgical expertise, and supply chain partnerships. Wind turbine forging is viewed as indispensable in the evolution of renewable power infrastructure, firmly embedded within its parent markets and shaping long-term competitiveness in global energy systems.

The wind turbine forging market is experiencing robust growth, driven by increasing global investments in renewable energy infrastructure and the rapid expansion of wind power capacity. The market is being shaped by advancements in forging technologies that enhance the strength, reliability, and durability of turbine components, meeting the high-performance requirements of modern wind farms.

Demand is being fueled by the push for larger turbines with higher efficiency, which require precisely engineered forged parts capable of withstanding extreme operational stresses. Government policies promoting clean energy, coupled with declining costs of wind energy generation, are further supporting market expansion.

The ongoing focus on reducing maintenance costs and extending turbine life cycles is prompting the adoption of high-quality forged components. As countries accelerate their transition to low-carbon energy systems, the Wind Turbine Forging market is positioned for sustained growth, with opportunities emerging in offshore wind projects and high-capacity onshore installations.

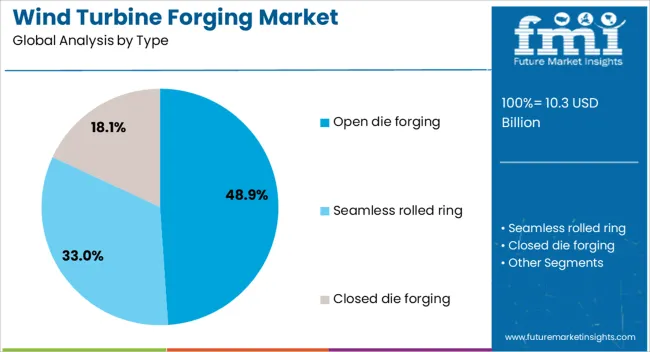

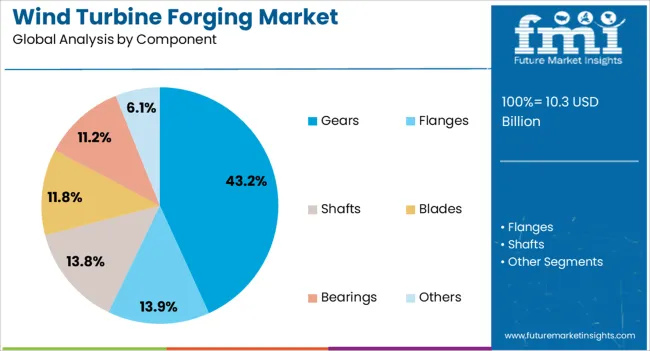

The wind turbine forging market is segmented by type, component, material, application, distribution channel, and geographic regions. By type, wind turbine forging market is divided into Open die forging, Seamless rolled ring, and Closed die forging. In terms of component, wind turbine forging market is classified into Gears, Flanges, Shafts, Blades, Bearings, and Others.

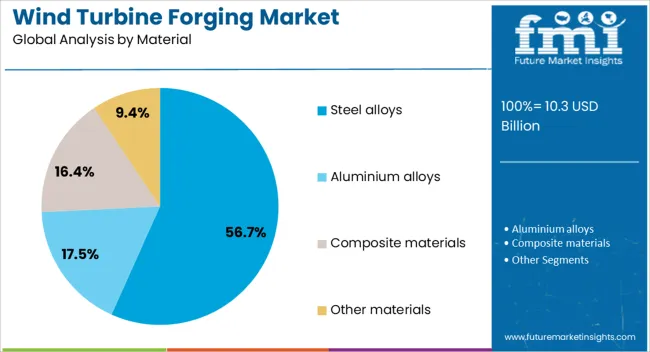

Based on material, wind turbine forging market is segmented into Steel alloys, Aluminium alloys, Composite materials, and Other materials. By application, wind turbine forging market is segmented into Onshore installation and Offshore installation. By distribution channel, the wind turbine forging market is segmented into the Indirect channel and the Direct channel. Regionally, the wind turbine forging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Open die forging segment is projected to account for 48.9% of the overall Wind Turbine Forging market revenue in 2025, making it the leading type segment. This dominance is being driven by its capability to produce large, high-strength components required for wind turbine assemblies.

The process allows for superior mechanical properties, excellent grain structure, and high fatigue resistance, which are critical in wind energy applications exposed to fluctuating loads and harsh environments. The adaptability of open die forging to create custom shapes and sizes without compromising material integrity has supported its adoption in both onshore and offshore turbine projects.

Increased demand for larger rotor diameters and extended hub heights has further strengthened the preference for this forging method, as it ensures consistent quality in large-scale parts such as shafts and flanges. The combination of structural reliability, flexibility in production, and suitability for high-performance applications continues to reinforce the leading position of open die forging in the market.

The Gears segment is expected to hold 43.2% of the total Wind Turbine Forging market revenue in 2025, establishing itself as the most prominent component segment. This leadership is being attributed to the critical role gears play in transmitting mechanical power from the rotor to the generator with maximum efficiency.

Forged gears provide superior wear resistance, enhanced toughness, and the ability to withstand high torque loads, making them indispensable for modern wind turbine operations. The push towards larger and more powerful turbines has increased the demand for precision-engineered forged gears capable of delivering long service life under continuous operation.

The segment’s growth has also been supported by advancements in surface treatment and finishing techniques, which further enhance gear performance and reduce maintenance requirements. As the global wind energy sector continues to scale, the requirement for durable, high-strength gears will remain a key driver of demand within the market.

The Steel alloys segment is anticipated to command 56.7% of the Wind Turbine Forging market revenue in 2025, making it the dominant material segment. This leadership position is being sustained by the exceptional strength, toughness, and fatigue resistance that steel alloys offer, which are essential for critical turbine components.

The ability of steel alloys to maintain performance under high stress and varying environmental conditions makes them highly suited for both onshore and offshore wind applications. Ongoing advancements in alloy compositions are enabling improved corrosion resistance and enhanced mechanical properties, further driving their use in the sector.

The preference for steel alloys is also supported by their proven track record in delivering reliability and cost-effectiveness over the long operational life of turbines. As wind farms increasingly operate in challenging offshore environments, the demand for high-grade steel alloys is expected to remain strong, ensuring their continued dominance in the material selection for wind turbine forging.

The wind turbine forging market is projected to expand steadily, supported by the rising deployment of onshore and offshore wind projects. Demand is being reinforced by the need for high-strength forged components such as shafts, flanges, and bearings to ensure turbine reliability. Opportunities are unfolding in offshore wind expansion, larger turbine designs, and partnerships with OEMs. Trends emphasize advanced forging techniques, lightweight alloys, and regional localization of supply chains. However, challenges including high production costs, raw material volatility, and capacity constraints within forging facilities continue to restrict faster market penetration.

Demand for wind turbine forgings has been reinforced by the increasing installation of both onshore and offshore turbines. Forged components such as rotor shafts, bearing rings, and flanges are indispensable for turbines to withstand extreme mechanical stress and harsh environmental conditions. Demand is particularly strong in offshore projects, where reliability is non-negotiable due to high maintenance costs. Larger turbine designs exceeding 10 MW capacity have created new demand for oversized forgings, challenging manufacturers to expand capabilities. Developing economies investing in wind energy expansion have also contributed to rising demand for locally sourced components. With governments and developers accelerating wind energy deployment, forged components are seen as strategic assets for ensuring durability and long service life, positioning them as a cornerstone in the growth of the wind energy sector.

Opportunities in the wind turbine forging market are being shaped by offshore wind expansion, large-scale turbine adoption, and localization policies. Offshore wind projects, particularly in Europe and Asia, demand heavy-duty forged parts capable of handling high mechanical loads. Larger turbine designs create opportunities for forging companies to supply advanced components with increased size and precision requirements. Localization mandates in emerging markets such as India and Brazil are opening opportunities for domestic forging firms to enter global supply chains. Strategic partnerships with OEMs and component suppliers offer additional pathways for growth. Opportunities also exist in repowering projects, where aging turbines are being replaced with modern, high-capacity models.

Trends in the wind turbine forging market revolve around advanced forging processes, lightweight materials, and localized production. Manufacturers are trending toward precision forging and seamless rolled ring production to meet quality and performance standards. Opinions suggest that lightweight alloys and hybrid materials are being explored to reduce turbine weight while maintaining strength. Regionalization of supply chains is trending, with countries encouraging domestic production to reduce dependency on imports.

The move toward larger turbine sizes has also influenced trends, requiring forging companies to invest in expanded press capacities and advanced machining technologies. Offshore wind growth is reinforcing the need for highly reliable forgings, pushing innovation in heat treatment and testing. These trends highlight a market trajectory where innovation and regional strategies are central to meeting the evolving requirements of global wind projects.

Challenges in the wind turbine forging market stem from high production costs, raw material volatility, and limited forging capacity. Forging large turbine components requires heavy capital investment in presses, machining equipment, and testing facilities, which smaller firms cannot easily afford. Fluctuating steel and alloy prices create cost instability, squeezing margins for suppliers.

Limited global forging capacity for oversized parts is a bottleneck, delaying wind project timelines. Certification and compliance requirements across regions add another layer of complexity, prolonging supplier qualification processes. Competition from cast components, which are cheaper to produce, also presents a challenge in certain applications. These barriers highlight that while demand for wind turbine forgings is strong, long-term growth depends on scaling production, stabilizing raw material sourcing, and ensuring timely delivery to meet the pace of wind energy expansion.

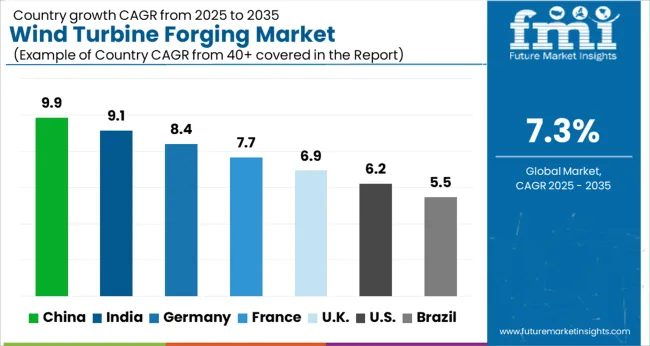

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The global wind turbine forging market is projected to grow at a CAGR of 7.3% between 2025 and 2035. China leads with 9.9%, followed by India at 9.1% and Germany at 8.4%. The United Kingdom is forecast at 6.9%, while the United States records 6.2%. Growth is driven by rising demand for forged components such as shafts, flanges, and rings used in onshore and offshore wind projects. Asian economies expand faster due to large scale renewable capacity additions and cost competitive manufacturing, while Europe focuses on offshore wind development and strict quality standards. The USA shows slower but steady growth, supported by federal incentives, grid modernization, and investment in high capacity turbines. This report includes insights on 40+ countries; the top markets are shown here for reference.

The wind turbine forging market in India is expected to grow at a CAGR of 9.1%. Expansion is supported by strong government renewable energy programs, rising private investment, and expansion of local manufacturing capacity. Domestic forging firms strengthen capabilities in high precision flanges and gear blanks for turbine makers. Onshore projects remain dominant, but offshore development initiatives are beginning to stimulate new demand. India’s cost competitive labor force and expanding renewable capacity reinforce its position as a rapidly growing hub for turbine component supply.

The wind turbine forging market in India is expected to grow at a CAGR of 9.1%. Expansion is supported by strong government renewable energy programs, rising private investment, and expansion of local manufacturing capacity. Domestic forging firms strengthen capabilities in high precision flanges and gear blanks for turbine makers. Onshore projects remain dominant, but offshore development initiatives are beginning to stimulate new demand. India’s cost competitive labor force and expanding renewable capacity reinforce its position as a rapidly growing hub for turbine component supply.

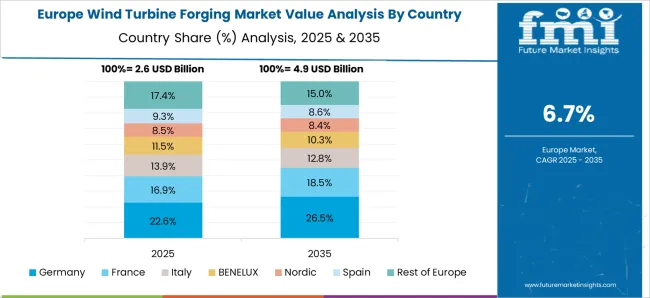

The wind turbine forging market in Germany is forecast to expand at a CAGR of 8.4%. Strong demand is anchored in the country’s focus on offshore wind development and premium quality requirements for critical turbine components. German forging companies specialize in precision engineered shafts, hubs, and rings that comply with stringent EU standards. Partnerships between steel producers and turbine manufacturers reinforce innovation in high capacity turbine components. With the country’s role as a leader in European offshore expansion, Germany remains one of the most important markets for advanced wind turbine forgings.

The wind turbine forging market in the UK is projected to grow at a CAGR of 6.9%. Growth is supported by offshore wind development, which is central to the UK’s renewable targets. Demand for forged flanges, hubs, and shafts rises with the expansion of high capacity offshore wind farms. Local forging capacity is limited, leading to reliance on imports from Europe and Asia. Government backed renewable policies and investment in North Sea wind clusters ensure long term opportunities. While growth is moderate, the UK remains strategically important due to its offshore potential and long term policy stability.

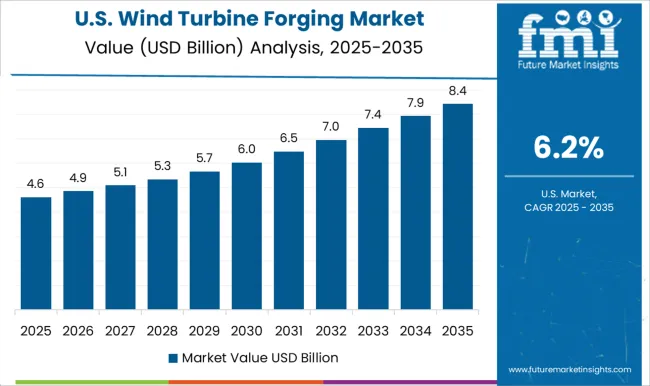

The wind turbine forging market in the US is expected to grow at a CAGR of 6.2%. Growth is moderate, shaped by a mature onshore market and slower offshore expansion compared to Europe and Asia. However, rising demand for high capacity turbines and federal incentives for renewable energy sustain steady adoption. USA forging companies focus on supplying premium grade hubs, shafts, and gear components, while imports fill gaps in large diameter forgings. Investment in grid modernization and offshore pilot projects will provide incremental growth opportunities, ensuring the USA remains a significant consumer of wind turbine forgings.

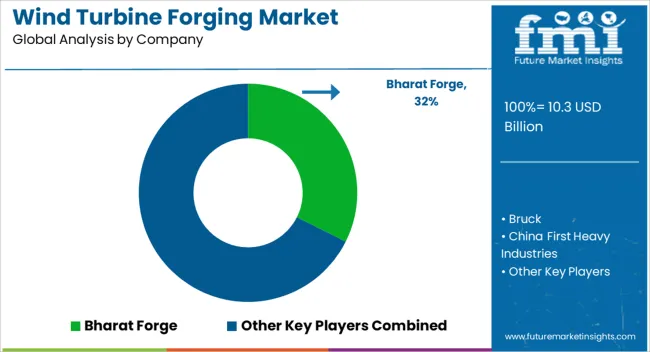

Competition in wind turbine forging has been structured around how brochures position strength, precision, and reliability in massive components. Bharat Forge and Larsen & Toubro distribute brochures that emphasize tower flanges, main shafts, and seamless rolled rings, showcasing metallurgical expertise and global supply chains. Thyssenkrupp and VDM Metals highlight brochures that stress alloy innovations, fatigue resistance, and integration into high-capacity turbines. Forgital Group and Iraeta Energy Equipment publish catalogues presenting ultra-large rolled rings and hubs, stressing precision machining and fast turnaround. Ellwood Group and Scot Forge differentiate with brochures underlining custom forgings for nacelle and bearing housings, backed by USA and European certifications. China First Heavy Industries, Dongfeng Forging, and Jiangsu Pacific Precision Forging stress scale and affordability in brochures, pointing to volume production and government-backed infrastructure.

Smaller players like Bruck, Fountain Town Forge, and VIC Forgings compete through brochures highlighting agility, shorter lead times, and niche component support. Strategy has revolved around using brochures as proof of heavy engineering credibility. Buyers compare tensile strength, dimensional tolerances, surface treatments, and non-destructive testing coverage directly from specification sheets.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.3 Billion |

| Type | Open die forging, Seamless rolled ring, and Closed die forging |

| Component | Gears, Flanges, Shafts, Blades, Bearings, and Others |

| Material | Steel alloys, Aluminium alloys, Composite materials, and Other materials |

| Application | Onshore installation and Offshore installation |

| Distribution Channel | Indirect channel and Direct channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bharat Forge, Bruck, China First Heavy Industries, Dongfeng Forging, Ellwood Group, Fountain town Forge, Forgital Group, Iraeta Energy Equipment, Jiangsu Pacific Precision Forging, Larsen & Toubro, Samuel, Son & Co., Scot Forge, Thyssenkrupp, VDM Metals, and VIC Forgings |

| Additional Attributes | Dollar sales by component type (flanges, shafts, rings, bearings, gears), Dollar sales by application (onshore turbines, offshore turbines, hybrid installations), Trends in large-diameter forging for next-generation turbines, Role of forged components in enhancing load-bearing capacity and fatigue resistance, Growth in offshore wind projects driving demand for high-strength forgings, Regional manufacturing and installation patterns across Asia Pacific, Europe, and North America. |

The global wind turbine forging market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the wind turbine forging market is projected to reach USD 20.8 billion by 2035.

The wind turbine forging market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in wind turbine forging market are open die forging, seamless rolled ring and closed die forging.

In terms of component, gears segment to command 43.2% share in the wind turbine forging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Wind Power Coatings Market Size and Share Forecast Outlook 2025 to 2035

Windsurf Foil Board Market Size and Share Forecast Outlook 2025 to 2035

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wind Vane Wiring Market Size and Share Forecast Outlook 2025 to 2035

Window Packaging Market Size and Share Forecast Outlook 2025 to 2035

Window Coverings Market – Trends, Growth & Forecast 2025 to 2035

Assessing Window Packaging Market Share & Industry Trends

Wind Speed Alarm Market

Window Rain Guards Market

Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Pitch and Yaw Drive Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Wind Turbine Market Analysis and Insights - 2025 to 2035

Wind Turbine Automation Market Insights - Growth & Forecast through 2035

Wind Turbine Composite Material Market Size 2024-2034

Wind Turbine Blade Repair Material Market Growth – Trends & Forecast 2024-2034

Wind Turbine Shaft Market

Sidewinder Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA