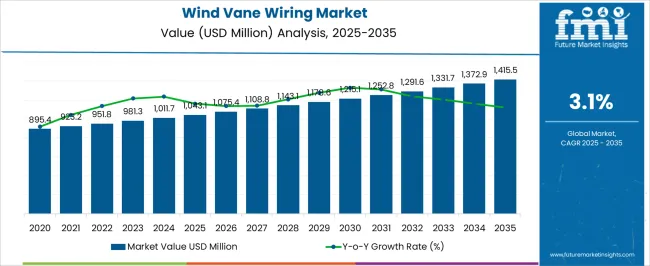

The global wind vane wiring market is expected to be valued at USD 1,043.1 million in 2025 and is projected to reach approximately USD 1,418.3 million by 2035. This reflects an absolute increase of USD 375.2 million, equivalent to a growth of 36.0% over the forecast period. The expansion is forecast to occur at a CAGR of 3.1%, with the market size estimated to grow by nearly 1.4X by the end of the decade.

The wind vane wiring market is growing as renewable energy adoption accelerates worldwide, creating strong demand for accurate wind monitoring and reliable connectivity in wind farms. Wind vane sensors require durable wiring systems to transmit real-time data on wind direction, which is critical for optimizing turbine performance, improving energy yield, and ensuring grid stability. Expanding onshore and offshore wind projects, coupled with government targets for clean energy, are driving large-scale deployment of turbines and associated cabling. Additionally, advances in sensor integration, IoT connectivity, and weather-resistant materials are enhancing the performance and lifespan of wind vane wiring, further fueling market expansion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,043.1 million |

| Industry Value (2035F) | USD 1,418.3 million |

| CAGR (2025 to 2035) | 3.1% |

Between 2025 and 2030, the market is projected to expand from USD 1,043.1 million to USD 1,212.8 million, adding approximately USD 169.7 million. Growth in this first phase will be supported by increasing deployment of automated weather monitoring systems, expansion of wind energy infrastructure, and rising demand for precision meteorological equipment. Industrial automation sectors and offshore installations are emerging as major demand drivers, ensuring reliable data transmission and weather monitoring capabilities across diverse environmental conditions.

From 2030 to 2035, the market is expected to grow from USD 1,212.8 million to USD 1,418.3 million, a further increase of USD 205.5 million. This second phase will be shaped by the integration of advanced materials technology, enhanced shielding solutions for harsh environmental conditions, and deeper penetration in marine and offshore applications. Hardware upgrades will emphasize durability, weather resistance, and improved signal integrity, while technological developments will focus on specialized insulation materials and multi-core configurations for complex monitoring systems.

Between 2020 and 2025, the market rose from USD 928.4 million to USD 1,043.1 million, propelled by the modernization of weather monitoring infrastructure, expansion of renewable energy projects, and increasing adoption of automated wind measurement systems. Equipment manufacturers prioritized specialized wiring solutions over standard cables to ensure accurate data transmission, comply with environmental standards, and enhance system reliability. Early adoption in developed markets established the foundation for the 2025-2035 growth cycle.

Global weather monitoring networks are under increasing pressure to provide accurate, real-time data for climate research, weather forecasting, and environmental monitoring. Wind vane wiring systems, capable of handling precise signal transmission and environmental durability, offer superior performance compared to conventional cables. Demand for automated weather stations, remote monitoring systems, and precision measurement equipment is expected to accelerate adoption across meteorological networks worldwide.

Wind vane wiring systems are increasingly deployed in wind turbine applications, blade positioning systems, and wind farm monitoring installations. Their ability to ensure reliable signal transmission, withstand harsh environmental conditions, and provide long-term durability makes them essential in modern wind energy infrastructure. By 2025, wind turbine applications represent 30% of market value, with steady expansion forecast as renewable energy projects scale globally.

Marine vessel navigation systems and offshore platform installations require specialized wiring solutions that can handle saltwater exposure, extreme weather conditions, and continuous operation. Wind vane wiring offers enhanced corrosion resistance, superior shielding, and compliance with marine safety standards critical for maritime applications. Rising deployment of offshore wind farms and marine monitoring systems will sustain strong demand.

Manufacturing facilities and industrial complexes require precise environmental monitoring for process control, safety compliance, and operational efficiency. Wind vane wiring systems offer reliable data transmission, integration capabilities with industrial control systems, and compliance with automation standards. The ongoing shift toward Industry 4.0 and smart manufacturing is driving adoption across industrial segments.

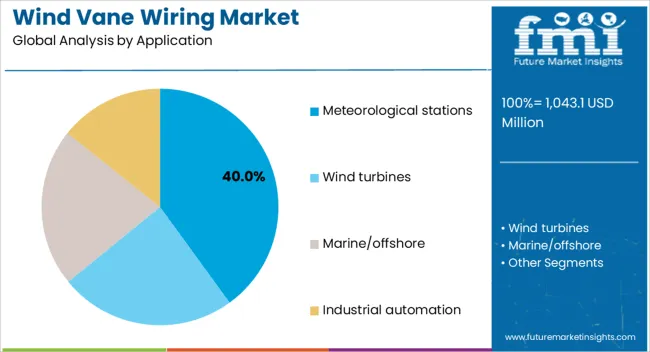

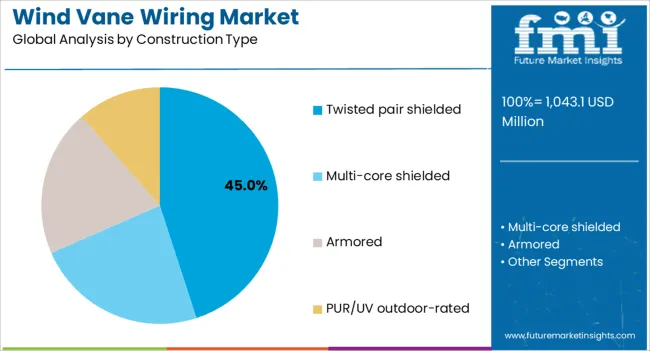

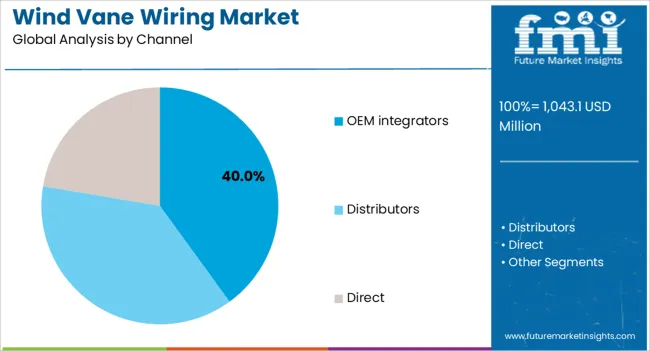

The market is segmented by application, construction type, insulation/sheath material, sales channel, and region. By application, the market is categorized into meteorological stations, wind turbines, marine/offshore, and industrial automation. Based on construction type, the market is divided into twisted pair shielded, multi-core shielded, armored, and PUR/UV outdoor-rated. In terms of insulation/sheath material, the market is segmented into PVC/PE, XLPE, TPE/PUR, and PTFE/others. By sales channel, the market is bifurcated into OEM integrators, distributors, and direct. Regionally, the market is classified into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Meteorological stations hold the largest share at 40% in 2025, as weather monitoring agencies, research institutions, and government organizations deploy advanced wind measurement systems for climate monitoring, weather forecasting, and atmospheric research. Precision requirements, data reliability standards, and environmental compliance make specialized wiring solutions critical in meeting meteorological monitoring objectives. Wind turbine applications strengthen demand by integrating wiring systems into nacelle positioning, blade control, and turbine monitoring systems, where signal accuracy reduces maintenance requirements and optimizes energy generation efficiency. Marine and offshore installations contribute 15% of market demand, driven by coastal monitoring stations, offshore platforms, and marine vessel navigation systems. Industrial automation applications account for 15% share, supporting process control systems, environmental monitoring installations, and automated manufacturing facilities.

Twisted pair shielded cables account for 45% of global demand in 2025, driven by superior electromagnetic interference protection and signal integrity requirements. These systems have been favored for precision measurement applications where data accuracy and noise reduction are paramount. Multi-core shielded variants retain significance in complex monitoring installations requiring multiple signal paths, accounting for 25% of market share. Armored constructions serve specialized applications in harsh environmental conditions with 15% market share, while PUR/UV outdoor-rated cables hold 15% share for applications requiring enhanced weather resistance and long-term outdoor exposure.

PVC/PE insulation systems contribute 40% of market demand, offering cost-effective protection and adequate performance for standard environmental conditions. XLPE insulation maintains strong adoption with 25% share in high-performance applications requiring enhanced electrical properties and temperature resistance. TPE/PUR materials serve specialized applications demanding flexibility and chemical resistance with 25% market share, while PTFE solutions address extreme temperature and chemical exposure requirements with 10% share.

The market for wind vane wiring is being supported by the rapid expansion of wind energy projects and rising demand for reliable meteorological and navigation systems. However, high material costs, specialized certification requirements, and supply-chain constraints continue to pose challenges for wider market adoption. Technology providers are increasingly delivering pre-terminated harnesses, hybrid fiber-copper assemblies, and plug-and-play sensor modules to improve installation efficiency, compliance, and long-term system reliability.

Equipment manufacturers and system integrators increasingly demand wiring solutions with superior environmental protection for outdoor installations, marine applications, and extreme weather conditions. Manufacturers emphasize enhanced UV resistance, temperature stability, and moisture protection in cable designs. This trend strengthens wind vane wiring adoption in applications where standard cables cannot provide adequate long-term reliability and performance.

End-users are prioritizing wiring solutions with advanced electromagnetic shielding to ensure signal integrity in high-interference environments. Industrial facilities, urban installations, and complex monitoring systems require cables with superior noise rejection and data transmission accuracy. Advanced shielding designs and specialized construction methods are becoming standard requirements for precision measurement applications.

Marine and offshore applications are driving development of specialized wiring solutions with enhanced corrosion resistance, saltwater protection, and extreme weather durability. Offshore wind farms, marine vessels, and coastal monitoring stations require cables that maintain performance in harsh maritime environments. This trend is expanding market opportunities in marine applications while driving technological advancement in cable design and materials.

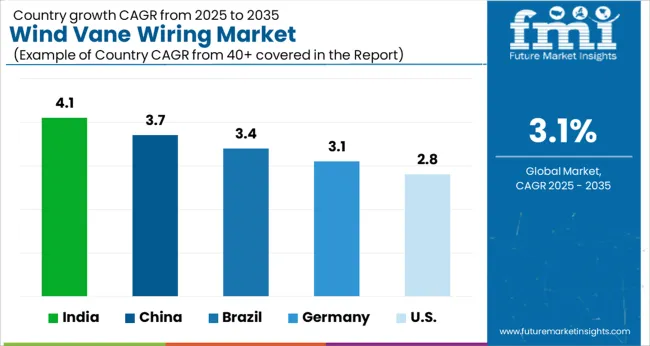

| Country | CAGR |

|---|---|

| India | 4.1 |

| China | 3.7 |

| Brazil | 3.4 |

| Germany | 3.1 |

| USA | 2.8 |

India leads global growth in the conveyor drives market with the highest CAGR of 4.1% from 2025 to 2035, supported by rapid industrial expansion, government initiatives such as “Make in India,” and large-scale infrastructure development. China follows with a strong CAGR of 3.7%, driven by advanced manufacturing upgrades, extensive mining operations, and the adoption of Industry 4.0 automation. Brazil records a steady CAGR of 3.4%, benefiting from growth in automotive, aerospace, mining, and food processing industries. The United States shows moderate growth at 2.8%, reflecting its mature industrial base, reshoring of manufacturing, and rising e-commerce-driven automation. Germany maintains consistent growth at 3.1%, reflecting its engineering excellence, Industry 4.0 leadership, and strict energy efficiency regulations.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

India is projected to lead global growth in the wind vane wiring market, recording a CAGR of 4.1% from 2025 to 2035. Expanding meteorological infrastructure, growing renewable energy sector, and increasing industrial automation are driving demand for specialized wiring solutions. Government initiatives for weather monitoring network modernization and wind energy development are supporting market expansion. The country's focus on climate monitoring, agricultural weather systems, and renewable energy infrastructure is accelerating adoption of wind vane wiring solutions across diverse applications. Rising investment in offshore wind projects and coastal monitoring systems is creating additional demand for marine-grade wiring products.

Demand for wind vane wiring in China is forecast to grow at a CAGR of 3.7%, supported by extensive wind energy development, manufacturing automation, and environmental monitoring system deployment. The country's position as a global manufacturing hub and renewable energy leader is driving consistent demand for specialized wiring solutions across multiple sectors. Domestic production capabilities, technological advancement, and large-scale infrastructure projects are supporting market growth. Integration of wind vane wiring systems in smart city projects, industrial complexes, and offshore installations is expanding application opportunities throughout the forecast period.

Revenue from wind vane wiring in Brazil is expected to witness a 3.4% CAGR, driven by expanding agricultural monitoring systems, renewable energy development, and coastal environmental monitoring requirements. The country's extensive coastline, agricultural sector, and growing wind energy capacity are creating diverse application opportunities for wind vane wiring systems. Investment in weather monitoring infrastructure, offshore wind development, and industrial automation is supporting consistent market growth. Agricultural applications, marine monitoring systems, and industrial facilities are key demand drivers throughout the forecast period.

Sales of wind vane wiring in Germany is projected to grow at a CAGR of 3.1%, reflecting the country's advanced manufacturing capabilities, renewable energy leadership, and precision engineering standards. Strong domestic demand from wind energy, industrial automation, and meteorological applications is supporting steady growth throughout the forecast period. The country's focus on environmental monitoring, industrial automation, and offshore wind development is driving consistent demand for high-quality wiring solutions. German manufacturers' reputation for engineering excellence and quality standards is supporting both domestic consumption and export opportunities.

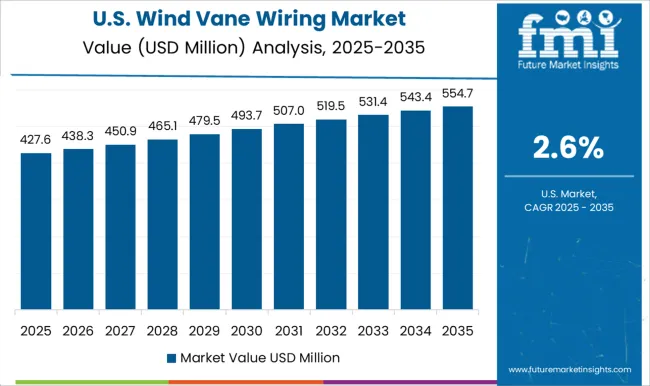

The United States wind vane wiring market is set to grow at a CAGR of 2.8%, supported by infrastructure modernization, renewable energy expansion, and advanced meteorological monitoring requirements. The mature market benefits from established manufacturing capabilities, comprehensive weather monitoring networks, and extensive industrial automation deployment. Replacement demand, technology upgrades, and new installation projects are driving steady growth. The country's focus on climate monitoring, renewable energy development, and industrial automation is maintaining consistent demand for specialized wiring solutions across diverse applications.

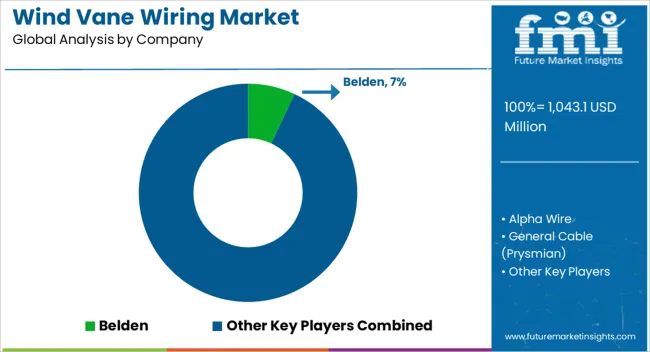

The wind vane wiring market is characterized by established manufacturers offering specialized solutions for demanding environmental and precision requirements. Companies focus on advanced materials technology, enhanced environmental protection, and application-specific designs to serve diverse market segments effectively. Alpha Wire maintains a strong position in the North American market, offering comprehensive wiring solutions for industrial and meteorological applications. The company's focus on quality and reliability supports its market presence across multiple application segments. Belden leverages its extensive experience in signal transmission and industrial connectivity to serve wind vane wiring applications. The company's technological capabilities and market presence support its position in demanding industrial and precision measurement applications.

General Cable (Prysmian) combines global manufacturing capabilities with specialized product development to serve diverse market requirements. The company's international presence and technological resources support its competitive position across regional markets. German manufacturers including HELUKABEL, LAPP Group, and SAB Bröckskes benefit from the country's reputation for engineering excellence and quality standards. These companies serve both domestic demand and international markets with specialized solutions for demanding applications. European manufacturers including HUBER+SUHNER, Nexans, and Prysmian Group leverage advanced materials technology and manufacturing capabilities to serve global markets. Their focus on innovation and quality supports competitive positioning across diverse application segments. igus (chainflex) specializes in dynamic cable applications, serving markets requiring flexible, durable solutions for moving installations and specialized environmental conditions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,043.1 million |

| Application | Meteorological Stations, Wind Turbines, Marine/Offshore, Industrial Automation |

| Construction Type | Twisted Pair Shielded, Multi-core Shielded, Armored, PUR/UV Outdoor-rated |

| Insulation/Sheath | PVC/PE, XLPE, TPE/PUR, PTFE/Others |

| Sales Channel | OEM Integrators, Distributors, Direct |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, France, Italy, India, Brazil and 40+ countries |

| Key Companies Profiled | Alpha Wire, Belden, General Cable (Prysmian), HELUKABEL, HUBER+SUHNER, LAPP Group, Nexans, Prysmian Group, SAB Bröckskes, igus (chainflex) |

| Additional Attributes | Dollar sales by wire type and application, regional renewable energy demand, OEM competition, buyer emphasis on durability and accuracy, integration with smart monitoring, innovations in weatherproofing, and sustainable materials |

The global wind vane wiring market is estimated to be valued at USD 1,043.1 million in 2025.

The market size for the wind vane wiring market is projected to reach USD 1,415.5 million by 2035.

The wind vane wiring market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in wind vane wiring market are meteorological stations, wind turbines, marine/offshore and industrial automation.

In terms of construction type, twisted pair shielded segment to command 45.0% share in the wind vane wiring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Wind Power Coatings Market Size and Share Forecast Outlook 2025 to 2035

Windsurf Foil Board Market Size and Share Forecast Outlook 2025 to 2035

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Forging Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Pitch and Yaw Drive Market Size and Share Forecast Outlook 2025 to 2035

Window Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Wind Turbine Market Analysis and Insights - 2025 to 2035

Window Coverings Market – Trends, Growth & Forecast 2025 to 2035

Assessing Window Packaging Market Share & Industry Trends

Wind Turbine Automation Market Insights - Growth & Forecast through 2035

Wind Turbine Composite Material Market Size 2024-2034

Wind Turbine Blade Repair Material Market Growth – Trends & Forecast 2024-2034

Wind Speed Alarm Market

Window Rain Guards Market

Wind Turbine Shaft Market

Sidewinder Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA