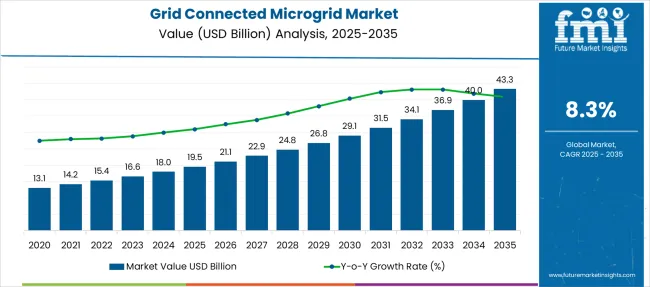

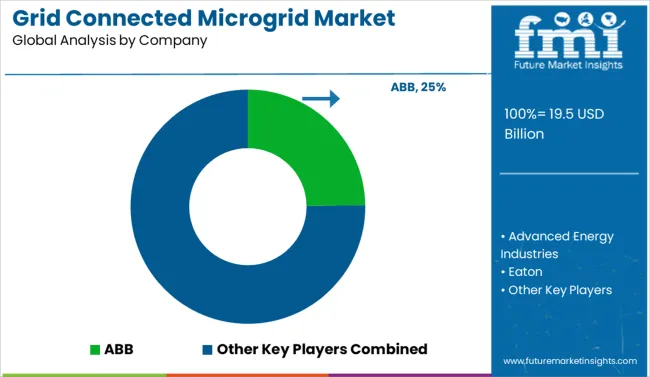

The Grid Connected Microgrid Market is estimated to be valued at USD 19.5 billion in 2025 and is projected to reach USD 43.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period. Elasticity analysis indicates that market growth is highly correlated with renewable energy adoption, regulatory mandates, and infrastructure investment cycles. From 2025 to 2030, the market rises from USD 19.5 billion to 29.1 billion, adding USD 9.6 billion, or 40% of total growth, during a period of rising solar PV integration and carbon-neutral targets in developed economies. However, growth elasticity intensifies post-2030 as government-backed stimulus packages and distributed energy storage adoption accelerate grid resilience programs.

Between 2030 to 2035, the market contribution surges by USD 14.2 billion, representing 60% of incremental expansion, with Asia-Pacific and North America driving utility-scale deployments in response to grid stability issues. External drivers such as fossil fuel price volatility and carbon credit markets further amplify demand elasticity by making renewable-linked microgrids economically favorable.

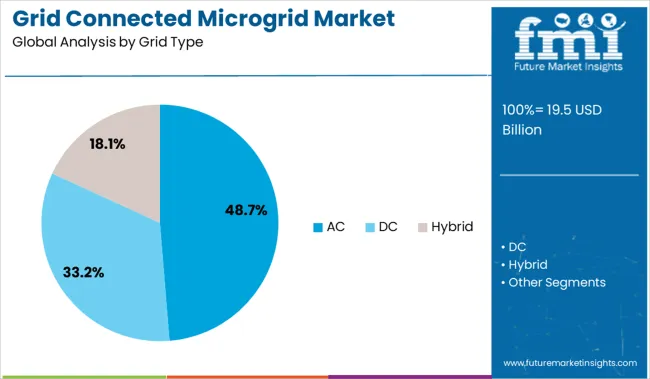

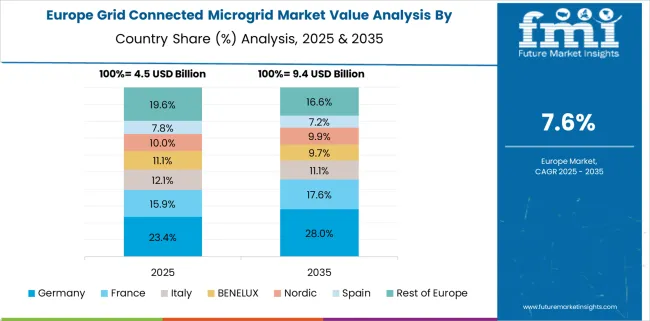

In 2025, the AC segment dominates with 48.7% share, largely because alternating current systems remain the standard for power distribution and compatibility with existing grids. North America leads the market, supported by federal incentives, critical infrastructure reliability programs, and decarbonization goals. Asia-Pacific follows with high momentum due to rural electrification, industrial clusters, and investments in distributed generation in countries like India, China, and Japan. Europe demonstrates strong uptake driven by energy transition policies and EU directives promoting decentralized energy systems.

The growth trajectory is expected to steepen post-2028 as smart grid technologies and advanced energy storage become cost-efficient, enabling high renewable penetration in grid-tied microgrids. Opportunities are emerging in AI-based load optimization, cyber-secure control systems, and multi-energy microgrids that integrate heat and mobility. Strategic partnerships between technology vendors and utilities are shaping the competitive landscape, positioning grid-connected microgrids as a cornerstone for modern, flexible energy ecosystems worldwide.

| Metric | Value |

|---|---|

| Grid Connected Microgrid Market Estimated Value in (2025 E) | USD 19.5 billion |

| Grid Connected Microgrid Market Forecast Value in (2035 F) | USD 43.3 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The grid connected microgrid market is expanding steadily as energy systems worldwide transition toward more resilient, decentralized, and low emission infrastructures. Growing demand for stable power supply, particularly in urban and industrial zones, is pushing utilities and private operators to adopt microgrids that operate in coordination with main grids while offering backup capabilities during outages.

Government initiatives supporting renewable integration, coupled with rising concerns over grid instability due to climate events and aging infrastructure, are accelerating deployment. Technological advances in real-time monitoring, energy management systems, and scalable storage solutions have further improved the operational efficiency and economic viability of grid-connected microgrids.

As sustainability commitments intensify, industries and municipalities alike are viewing these systems as essential components for future-ready energy infrastructure that enhances energy security, reduces peak demand pressure, and supports environmental goals.

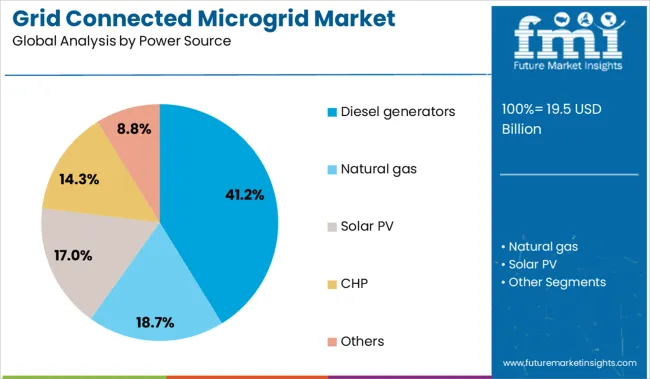

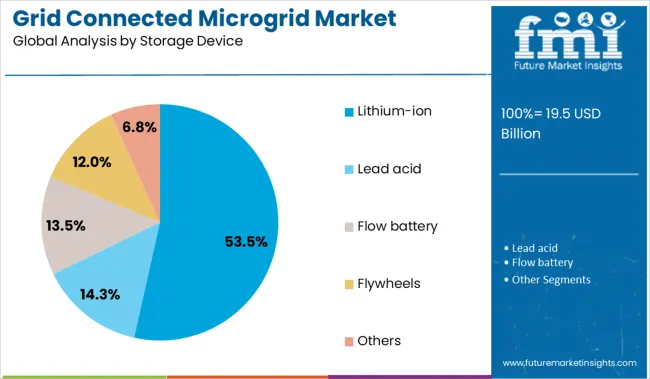

The grid-connected microgrid market is segmented by grid type, power source, storage device, application, and region. By grid type, it includes AC, DC, and hybrid systems, designed to operate in conjunction with main power grids for optimized energy flow. In terms of power source, the segmentation covers diesel generators, natural gas, solar PV, combined heat and power (CHP), and others, enabling flexible generation. Based on storage device, the market includes lithium-ion, lead-acid, flow batteries, flywheels, and other energy storage technologies for improved reliability. By application, it spans healthcare, educational institutes, military, utility, industrial and commercial sectors, remote areas, and other specialized uses. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The alternating current segment is anticipated to contribute 48.70 percent of total market revenue by 2025 within the grid type category, establishing it as the dominant configuration. This preference is due to the widespread compatibility of alternating current with conventional grid infrastructure, industrial systems, and household equipment.

AC based microgrids enable seamless integration and synchronization with existing utility networks, facilitating stable energy transmission and distribution. They also support flexible load management and interoperability with diverse generation sources and backup systems.

The maturity of AC power technology, coupled with its cost effectiveness and standardized components, continues to reinforce its leadership in grid connected microgrid installations.

Diesel generators are projected to account for 41.20 percent of the total market revenue by 2025 within the power source category, positioning them as the leading energy source. Their dominance stems from the reliability, scalability, and operational readiness that diesel generators offer in backup and supplementary power roles.

These systems are particularly valued in mission critical applications where continuous power is essential and renewable sources alone cannot meet the base load. Despite rising interest in clean energy alternatives, diesel generators remain prevalent due to their established supply chains, rapid deployment capability, and high energy density.

Continued usage in remote and industrial microgrids where grid instability or lack of connectivity exists supports their leading role in the power source segment.

The lithium ion storage segment is expected to contribute 53.50 percent of market revenue by 2025 within the storage device category, making it the most prominent choice. This leadership is driven by lithium ion's high energy density, fast charging capability, and long cycle life, which make it ideal for stabilizing energy supply and managing peak load demands in microgrids.

Its compact footprint and superior performance across temperature ranges have enabled its widespread adoption in both commercial and residential microgrid projects. Additionally, falling battery costs and increasing investment in battery manufacturing are supporting scalability.

As energy storage becomes a key enabler of grid flexibility and renewable integration, lithium ion systems continue to be favored for their reliability, responsiveness, and adaptability across diverse operating conditions.

Demand is driven by resilience planning, energy optimization, and grid interconnection contracts. Rapid digital controls and energy management modules are increasingly embedded in modern builds. Governments and utilities now incentivize schemes that enable peak‑shaving and demand charge mitigation for industrial and institutional users.

Increasing need for power reliability and cost control encourages adoption of grid‑integrated microgrids. Industrial parks, university campuses, and remote hospitals use µgrids to manage peak shaving, outage avoidance, and renewable integration. In 2024, deployment of systems with solar plus battery storage rose 21% compared with the prior year.

Operators report up to 18% savings on energy expenditure due to demand charge reduction and optimized dispatch. Load-following capabilities enable automatic transfer during grid disturbances with switching times under 150 ms. Microgrid controllers now optimize across tariff zones and energy markets. Net‑metering and feed‑in tariffs encourage energy export back to primary grid during peak pricing windows.

Adoption is constrained by steep upfront costs, regulatory uncertainty, and system complexity. Typical installation costs for solar‑plus‑battery microgrids exceed USD 1.3 million per megawatt in commercial settings. Commissioning cycles often extend by 6-8 weeks due to component compatibility validation across inverters, protection relays, and control systems. Grid interconnection standards and permission timelines remain inconsistent across regions, with approval delays ranging from 3-5 months.

Energy markets in developing countries often lack stable compensation for exported energy, reducing ROI for early adopters. Technical skill shortages in real‑time dispatch control and microgrid maintenance further restrict operational scaling in smaller facilities and rural zones.

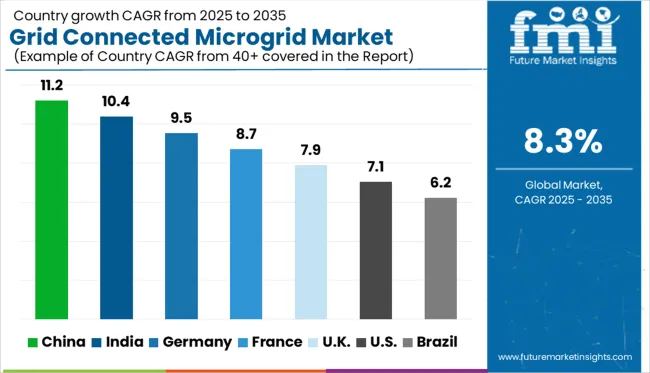

| Countries | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

The global market is projected to expand at a CAGR of 8.3% from 2025 to 2035. China (BRICS) leads with 11.2%, driven by regional deployment targets and utility-scale projects. India (BRICS) follows at 10.4%, supported by distributed energy programs across industrial zones and remote grids. Germany (OECD) records 9.5%, with consistent buildouts tied to energy decentralization strategies. France posts 8.7%, close to the global rate, with installations linked to municipal and campus-based energy systems. The UK (OECD) trails at 7.9%, shaped by policy-driven transitions and localized resilience efforts. The report includes data from more than 40 countries, with the top five shown below.

China shows an 11.2% growth rate in grid connected microgrid deployments, well above the global average of 8.3%. Demand is centered in industrial parks, logistics hubs, and EV production zones. DC-linked storage arrays are co-installed with rooftop solar systems. Procurement teams use state-run digital bidding portals to select lithium-iron systems and bidirectional inverters. Power utilities test microgrid clusters for localized grid balancing. Municipal zones include demand prediction APIs in system architecture. Integration is timed to variable pricing windows and frequency reserve pooling.

India records a 10.4% growth rate in grid-connected microgrids, above the global average. Installations are concentrated in agro-processing units, semi-urban business parks, and tier-2 data centers. Grid-tied storage setups focus on peak-demand offsetting and power quality stabilization. Rural energy development boards subsidize shared microgrid kits bundled with SCADA modules. State utilities adopt dynamic load-shedding protocols integrated with smart meters. Procurement is centered around high-cycle lithium packs and open-source inverters compatible with legacy diesel-hybrid systems.

Germany posts a 9.5% growth rate in grid-connected microgrids, above the global average. Focus remains on institutional campuses, retrofitted housing complexes, and light industry. Municipal procurement teams align battery procurement with district energy retrofit programs. High-voltage converters and dual busbars dominate system architecture. Priority is given to peer-to-peer power routing within grid clusters. Renewable balancing targets guide system optimization logic. Real-time monitoring dashboards log reactive power flows to reduce load-shedding penalties.

France sees an 8.7% growth rate in grid-connected microgrid installations, slightly above the global rate. Primary demand sources include coastal logistics zones, public transport nodes, and localized hydrogen pilots. Project funding links smart substation retrofits with distributed energy analytics. Multilevel control schemes are layered to regulate industrial zones during peak variability. Storage units are heat-optimized to meet regional compliance for fire-resistance. Grid capacity mapping includes microgrid-triggered reserve dispatch data.

United Kingdom shows a 7.9% growth rate in the grid-connected microgrid market, below the global 8.3% level. High penetration is found in hospital campuses, airport logistics yards, and corporate estates. Hybrid gas-solar storage networks are preferred in suburban deployment sites. Regulatory licensing includes inverter synchronization audits. Distribution networks are trialing voltage-phase adjustment tools linked to microgrid demand curves. Priority is given to modular system formats that suit high churn infrastructure leases. Control logic uses machine learning algorithms to dispatch stored power by tariff zone.

ABB has maintained a leadership position through turnkey control systems and strategic alliances with large-scale utilities. These partnerships aim to accelerate the adoption of grid-connected microgrid frameworks for distributed energy management. Siemens, Schneider Electric, and General Electric have strengthened their portfolios with modular platforms designed for industrial, military, and institutional deployments, emphasizing interoperability with existing grid infrastructure. Tesla and FlexGen continue to focus on energy storage-backed systems optimized for renewable energy penetration and demand response strategies, offering enhanced flexibility in hybrid power scenarios.

Eaton, Hitachi Energy, and Emerson are investing in hardware-software orchestration capabilities and real-time grid switching technologies, targeting resilience for mission-critical environments. Meanwhile, PowerSecure, S&C Electric Company, and Princeton Power Systems are delivering site-specific microgrid solutions tailored to grid-tied configurations for utilities and commercial operations. However, integration complexity, strict grid compliance mandates, and interoperability standards are increasing capital requirements, creating substantial entry barriers for emerging participants.

Key Developments in the Grid Connected Microgrid Market

Leading firms like ABB and Siemens are introducing advanced controllers and modular solutions that enhance efficiency and resilience. Partnerships with technology providers and energy companies are being expanded to strengthen deployment capabilities. Investments in R&D focus on integrating renewables, advanced storage, and smart control systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.5 Billion |

| Grid Type | AC, DC, and Hybrid |

| Power Source | Diesel generators, Natural gas, Solar PV, CHP, and Others |

| Storage Device | Lithium-ion, Lead acid, Flow battery, Flywheels, and Others |

| Application | Healthcare, Educational institutes, Military, Utility, Industrial/ commercial, Remote, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Advanced Energy Industries, Eaton, Emerson, FlexGen, General Electric, Heila Technologies, Hitachi Energy, Lockheed Martin Corporation, Princeton Power Systems, PowerSecure, Schneider Electric, S&C Electric Company, Siemens, and Tesla |

| Additional Attributes | Dollar sales by system type and end-use application, growing deployment in campuses and military bases, stable integration in industrial parks and urban utilities, advancements in control systems and renewable hybridization support grid resilience and energy cost optimization |

The global grid connected microgrid market is estimated to be valued at USD 19.5 billion in 2025.

The market size for the grid connected microgrid market is projected to reach USD 43.3 billion by 2035.

The grid connected microgrid market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in grid connected microgrid market are ac, dc and hybrid.

In terms of power source, diesel generators segment to command 41.2% share in the grid connected microgrid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

AC Grid Connected Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Grid Casting Machine Market Size and Share Forecast Outlook 2025 to 2035

Grid Packings Market Size and Share Forecast Outlook 2025 to 2035

Grid Scale Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Griddles Market

On Grid Residential Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid Solar PV Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Mini Grid Market Size and Share Forecast Outlook 2025 to 2035

BGA Packaging Market Insights – Size, Demand & Growth through 2034

Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Analytics Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Home Area Network (HAN) Market Size and Share Forecast Outlook 2025 to 2035

Smart Grid Technology Market Analysis - Growth, Demand & Forecast 2025 to 2035

Power Grid Market Size, Share, Trends & Forecast 2024-2034

Smart Grid Sensors Market

Ground Grid Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA