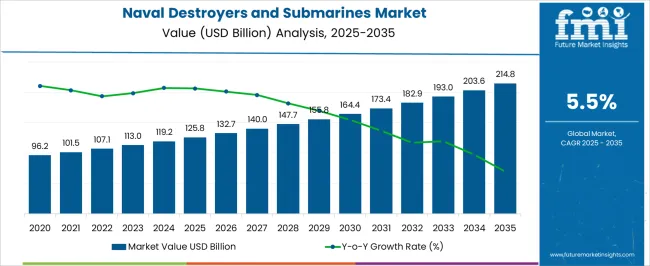

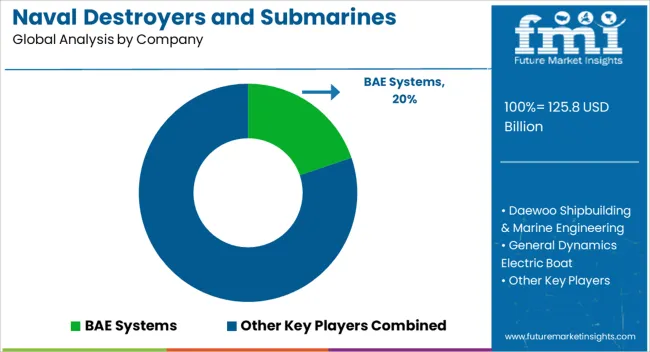

The naval destroyers and submarines market is estimated to be valued at USD 125.8 billion in 2025 and is projected to reach USD 214.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The naval destroyers and submarines market is projected to expand from USD 125.8 billion in 2025 to USD 214.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.5%. Market growth is being driven by the increasing demand for advanced maritime defense systems and strategic naval modernization programs across leading defense economies.

Between 2025 and 2030, the market is anticipated to reach approximately USD 164.4 billion, as procurement of multi-role destroyers and next-generation submarines is being prioritized. Defense contracts and long-term procurement plans are supporting steady revenue growth, with governments focusing on fleet upgrades, advanced weapon systems integration, and operational efficiency enhancements across their naval forces. Year-on-year analysis highlights a consistent upward trajectory, with incremental value increases illustrating steady market expansion.

From 2025 to 2035, the adoption of technologically sophisticated destroyers and submarines is being facilitated by defense budgets that favor modernization and capability enhancement. Incremental market gains are being observed as naval programs integrate sonar systems, missile defense modules, and propulsion improvements to enhance operational performance. Manufacturers and shipbuilders delivering high-performance, customizable naval vessels are being positioned to capture significant market share, as growth is being shaped by demand for performance-oriented platforms and strategic deployment requirements rather than short-term procurement fluctuations.

| Metric | Value |

|---|---|

| Naval Destroyers and Submarines Market Estimated Value in (2025 E) | USD 125.8 billion |

| Naval Destroyers and Submarines Market Forecast Value in (2035 F) | USD 214.8 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The market is estimated to hold a significant proportion within its parent markets, accounting for approximately 25-28% of the naval shipbuilding market, around 18-20% of the defense shipbuilding market, close to 12-14% of the maritime defense equipment market, about 10-11% of the military vessels market, and roughly 5-6% of the global defense spending market. Altogether, the cumulative share across these parent segments is estimated in the range of 70-79%, reflecting the critical role that destroyers and submarines play in naval strategy and defense procurement.

The market has been influenced by the rising demand for advanced maritime defense capabilities, including long-range strike potential, stealth, and enhanced survivability, which have prompted procurement and commissioning across various national navies. Investments are often guided by the need for fleet modernization, strategic deterrence, and operational readiness, while factors such as vessel lifecycle, maintenance efficiency, and integration with broader defense systems are heavily prioritized in decision-making processes.

As a result, the naval destroyers and submarines market has not only established a commanding presence within core shipbuilding domains but has also exerted influence on related maritime defense equipment and military vessel segments, underscoring its central position in shaping naval defense infrastructure and procurement priorities.

The naval destroyers and submarines market is experiencing robust growth driven by increasing geopolitical tensions, modernization of naval fleets, and the need for enhanced maritime security capabilities. Nations are investing heavily in advanced surface and underwater vessels equipped with state of the art combat systems, stealth technology, and improved propulsion efficiency.

Technological innovations in radar, sonar, and integrated combat management systems are further enhancing operational capabilities and survivability. Additionally, the expansion of blue water naval operations and the requirement for power projection in contested waters are contributing to fleet expansions.

Defense procurement policies emphasizing indigenous manufacturing and technology transfer are also supporting market development. The outlook remains strong as governments continue to prioritize maritime dominance and advanced naval readiness in response to evolving security challenges.

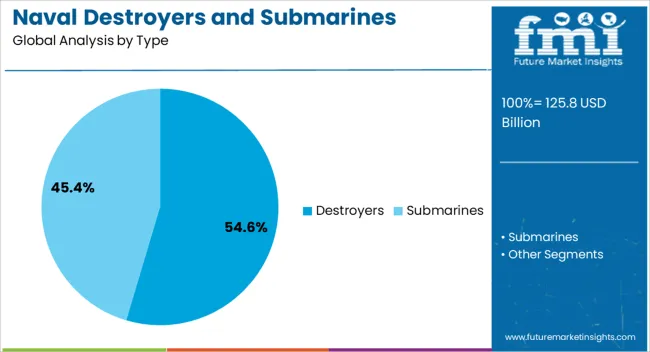

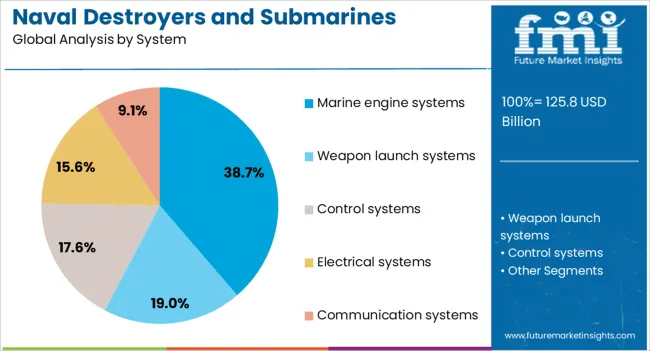

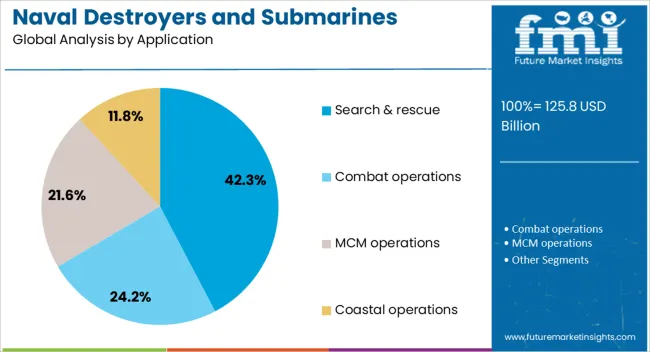

The naval destroyers and submarines market is segmented by type, system, application, and geographic regions. By type, naval destroyers and submarines market is divided into destroyers and submarines. In terms of system, naval destroyers and submarines market is classified into marine engine systems, weapon launch systems, control systems, electrical systems, and communication systems. Based on application, naval destroyers and submarines market is segmented into search & rescue, combat operations, MCM operations, and coastal operations. Regionally, the naval destroyers and submarines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The destroyers segment is projected to account for 54.6% of the total market revenue by 2025 within the type category, making it the leading segment. This dominance is attributed to their versatility in both offensive and defensive roles, advanced weapon systems, and ability to operate in multi mission environments.

Destroyers are increasingly favored for their capability to perform anti submarine warfare, air defense, and surface strike missions, making them essential assets in modern naval strategy.

Their integration with next generation propulsion and stealth features further enhances their operational endurance and survivability, reinforcing their leadership position in the type category.

The marine engine systems segment is expected to hold 38.7% of the total market revenue by 2025 within the system category, positioning it as the top performing segment. This is driven by the critical role propulsion plays in enhancing vessel speed, maneuverability, and operational range.

Advancements in fuel efficiency, hybrid propulsion, and reduced acoustic signatures have increased adoption across both destroyers and submarines.

The demand for reliable, high power engines that meet stringent naval performance requirements continues to propel this segment forward.

The search and rescue segment is projected to represent 42.3% of total market revenue by 2025 under the application category, making it the leading operational focus area. This growth is being driven by the rising need for rapid response capabilities in both military and humanitarian operations.

Naval forces are increasingly tasked with rescue missions in disaster zones, maritime accidents, and conflict areas, necessitating vessels equipped with advanced detection, communication, and deployment systems.

The versatility and readiness of destroyers and submarines to support such missions has reinforced the dominance of this application segment.

The metallocene polyethylene market is being driven by rising demand in packaging films and flexible containers. Opportunities are emerging in healthcare and specialty film applications, while trends highlight lightweight, multi-layer packaging solutions. However, challenges such as raw material price volatility and competition from conventional polyethylene grades remain. Despite these constraints, metallocene polyethylene continues to be favored for its clarity, toughness, and sealability, positioning it as a high-performance polymer with growing adoption across diverse industrial and consumer applications.

The demand for metallocene polyethylene has been reinforced by its increasing use in packaging films, stretch wraps, and flexible containers. Its superior clarity, toughness, and sealability make it highly suitable for food, consumer goods, and industrial packaging. Rising consumption in emerging economies, where modern retail and e-commerce are growing, has further bolstered demand. The ability of metallocene polyethylene to enhance product shelf life and improve processing efficiency is encouraging manufacturers to adopt it over conventional polyethylenes. This trend continues to sustain the overall market expansion across multiple sectors.

Significant opportunities exist in healthcare, medical, and specialty film applications, where high-performance polymers are required for sterile packaging and protective barriers. Metallocene polyethylene is increasingly utilized in medical pouches, pharmaceutical packaging, and industrial liners due to its chemical resistance, clarity, and controlled elasticity. Rising awareness among healthcare providers and strict regulatory compliance requirements have increased adoption rates. Suppliers are capitalizing on these opportunities by offering tailored grades optimized for medical and specialty applications, positioning themselves to capture premium segments in the market.

A prominent trend shaping the market is the shift toward lightweight, multi-layer, and co-extruded packaging solutions. Metallocene polyethylene is being integrated into multi-layer films to improve barrier properties, toughness, and machinability while reducing material usage. Packaging companies are increasingly leveraging its flexibility to design durable yet lightweight packaging that meets performance and cost expectations. This trend is also influencing product development in consumer goods and food packaging, with a focus on reducing processing energy and enhancing overall efficiency in production lines.

The market is challenged by price volatility in ethylene and metallocene catalyst components, which directly affects production costs. Dependence on petrochemical feedstocks exposes manufacturers to fluctuations in crude oil and natural gas markets, creating uncertainty in pricing and margins. Additionally, the adoption of metallocene polyethylene is sometimes constrained by competition from conventional high-density polyethylene and linear low-density polyethylene, which are available at lower costs. These challenges require manufacturers to balance product performance with cost-efficiency to maintain competitiveness across industrial and consumer applications.

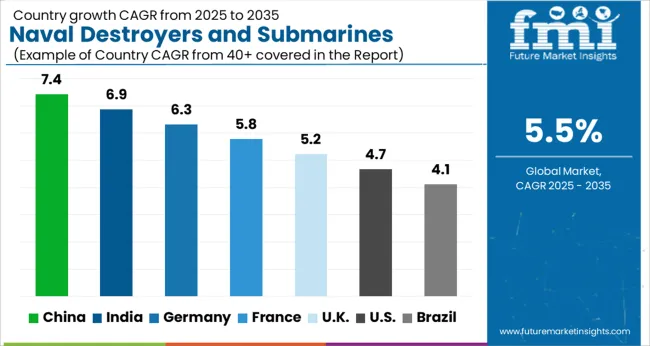

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global naval destroyers and submarines market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads with a growth rate of 7.4%, followed by India at 6.9%, and Germany at 6.3%. The United Kingdom records a growth rate of 5.2%, while the United States shows the slowest growth at 4.7%. Rising defense modernization programs, increasing naval fleet expansions, and strategic maritime security priorities are driving global growth. Emerging economies like China and India experience higher growth due to naval expansion plans, regional security concerns, and increasing defense budgets, while mature markets such as the USA, UK, and Germany focus on upgrading existing fleets, integrating advanced technologies, and maintaining operational readiness. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The naval destroyers and submarines market in China is projected to grow at a CAGR of 7.4%. The country’s strong focus on expanding its naval fleet, securing maritime interests, and enhancing regional defense capabilities is driving growth. China’s defense modernization programs prioritize advanced destroyers and submarine technologies to strengthen strategic deterrence and operational reach. Investments in research, domestic production, and indigenous technology development further support the market. Rising geopolitical tensions in regional waters and increasing maritime trade also contribute to fleet expansion. The growing emphasis on naval power projection and fleet diversification positions China as a leading market for destroyers and submarines, with both surface and underwater capabilities being enhanced consistently.

The naval destroyers and submarines market in India is expected to grow at a CAGR of 6.9%. India’s strategic initiatives to enhance maritime security, safeguard trade routes, and modernize its naval fleet are key drivers. Investments in indigenous defense manufacturing, submarine production, and destroyer upgrades support domestic capabilities and reduce reliance on imports. Rising defense budgets, regional security challenges, and the need for advanced naval systems further propel market growth. The country’s emphasis on strengthening anti-submarine and surface warfare capabilities, coupled with fleet diversification programs, positions India as a critical market in Asia. Continuous adoption of next-generation naval platforms ensures sustained demand for destroyers and submarines across strategic and tactical operations.

The naval destroyers and submarines market in Germany is projected to grow at a CAGR of 6.3%. Germany’s focus on modernizing its naval fleet, integrating advanced technologies, and supporting European maritime defense initiatives drives market expansion. Investments in submarine capabilities, destroyer upgrades, and high-performance naval systems strengthen operational efficiency and strategic deterrence. The country’s defense programs prioritize fleet readiness, interoperability with NATO allies, and advanced research in maritime defense technologies. Growing demand for efficient and multipurpose naval vessels, along with strict regulatory and performance standards, ensures steady market growth. Germany’s mature defense ecosystem emphasizes precision, innovation, and reliability in destroyer and submarine production.

The naval destroyers and submarines market in the United Kingdom is expected to grow at a CAGR of 5.2%. The UK’s focus on upgrading existing fleets, strengthening maritime defense, and integrating cutting-edge technologies underpins market growth. Defense programs prioritize submarine enhancements, destroyer modernization, and interoperability with allied forces. The UK’s mature defense industry and strategic emphasis on operational readiness drive continuous demand for high-performance naval vessels. Fleet diversification programs, research in advanced propulsion systems, and precision engineering initiatives further contribute to market expansion. The combination of technological integration, strategic planning, and fleet optimization positions the United Kingdom as a steadily growing market for naval destroyers and submarines.

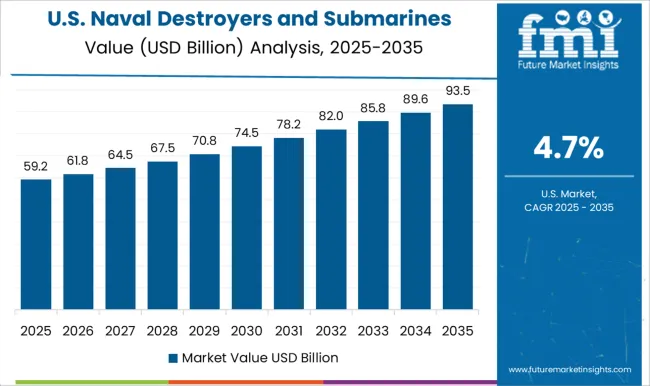

The naval destroyers and submarines market in the United States is projected to grow at a CAGR of 4.7%. The USA focuses on modernizing its existing naval fleet, integrating advanced combat and stealth technologies, and enhancing submarine and destroyer capabilities. Strong defense budgets, operational readiness programs, and a mature domestic defense ecosystem support market stability. The country’s strategic priorities include maintaining global maritime dominance, advancing fleet capabilities, and ensuring interoperability with allied forces. Investment in next-generation propulsion, weaponry systems, and autonomous naval platforms continues to drive demand for high-performance vessels. While mature, the USA market remains crucial for innovation and tactical fleet modernization in surface and underwater naval platforms.

The naval destroyers and submarines market is shaped by defense giants and specialized shipbuilders competing to deliver high-performance, technologically advanced vessels to global navies. BAE Systems, General Dynamics Electric Boat, and Huntington Ingalls Industries dominate the USA and allied markets with destroyers and nuclear-powered submarines featuring stealth, advanced sonar, and precision weapons integration.

Their brochures emphasize operational readiness, survivability, and mission versatility, appealing to strategic defense planners. Daewoo Shipbuilding & Marine Engineering and Mitsubishi Heavy Industries leverage regional expertise in Asia, supplying conventional and diesel-electric submarines, as well as guided missile destroyers, highlighting efficiency, modularity, and reliability in their marketing materials. Naval Group and ThyssenKrupp Marine Systems focus on European naval programs, stressing innovation in propulsion systems, automation, and combat systems integration for multirole deployments.

Competition in this market revolves around advanced technology adoption, vessel customization, lifecycle support, and adherence to stringent defense standards. Suppliers are increasingly positioning themselves as partners rather than mere manufacturers, offering end-to-end solutions including training, maintenance, and upgrades. Marketing materials frequently highlight stealth capabilities, energy efficiency, and advanced electronics, reflecting the rising demand for next-generation naval platforms.

Regional and global players aim to differentiate through modular designs, flexible configurations, and proven reliability under combat conditions. This strategic positioning ensures they remain key contenders for multi-billion-dollar naval contracts while responding to evolving defense and geopolitical requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 125.8 billion |

| Type | Destroyers and Submarines |

| System | Marine engine systems, Weapon launch systems, Control systems, Electrical systems, and Communication systems |

| Application | Search & rescue, Combat operations, MCM operations, and Coastal operations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BAE Systems, Daewoo Shipbuilding & Marine Engineering, General Dynamics Electric Boat, Huntington Ingalls Industries, Mitsubishi Heavy Industries, Naval Group, and ThyssenKrupp Marine Systems |

| Additional Attributes | Dollar sales by vessel type (destroyers, submarines) and propulsion type (nuclear, diesel-electric) are key metrics. Trends include rising demand for advanced naval defense capabilities, modernization of fleets, and adoption of stealth and automated technologies. Regional defense spending, geopolitical factors, and technological advancements are driving market growth. |

The global naval destroyers and submarines market is estimated to be valued at USD 125.8 billion in 2025.

The market size for the naval destroyers and submarines market is projected to reach USD 214.8 billion by 2035.

The naval destroyers and submarines market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in naval destroyers and submarines market are destroyers and submarines.

In terms of system, marine engine systems segment to command 38.7% share in the naval destroyers and submarines market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA