The global FGD system market is projected to be valued at USD 24,387.6 million in 2025 and is expected to reach USD 40,812.4 million by 2035, growing at a CAGR of 5.1% over the forecast period. Increasing demand for air quality control systems, especially in coal-fired power plants, is a major growth driver. Regulatory mandates by environmental agencies such as the USA EPA, EU Industrial Emissions Directive, and China's Ministry of Ecology and Environment have spurred adoption of SOx removal technologies across various industries.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 24,387.6 million |

| Industry Value (2035F) | USD 40,812.4 million |

| CAGR (2025 to 2035) | 5.1% |

Rising electricity consumption, coupled with the continued use of thermal power plants, particularly in Asia-Pacific and Eastern Europe, is sustaining FGD demand. The industry is witnessing robust investment in retrofit projects and new installations to comply with emission standards. Countries like India and China are enforcing stricter environmental rules, prompting utility providers to adopt wet and dry FGD systems.

In 2024, capacity additions across the Indian and Chinese power sectors led to increased deployment of wet FGD units. According to the International Energy Agency (IEA), China commissioned over 40 GW of new coal-fired power generation in 2023, with 85% of these installations equipped with wet scrubbing technology. In the USA and EU, aging thermal infrastructure is being upgraded with hybrid and dry FGD systems to extend operational life and reduce emissions.

Technological advancements in the flue gas desulfurization (FGD) system market have significantly improved operational efficiency through enhanced reagent utilization, optimized wastewater treatment, and effective gypsum byproduct recovery. These innovations help reduce operating costs, minimize environmental impact, and increase overall plant performance. Moreover, market participants are increasingly focusing on integrating predictive maintenance tools and remote monitoring systems.

These digital solutions enable real-time system diagnostics, early fault detection, and predictive analytics, ultimately extending equipment life and reducing unplanned downtime. As industries aim for greater sustainability and compliance, smart FGD technologies are becoming a strategic priority for both retrofit and new installations.

Wet FGD systems are estimated to account for approximately 67% of the global FGD system market share in 2025 and are projected to grow at a CAGR of 4.9% through 2035. These systems are highly effective in removing sulfur dioxide (SO2) from exhaust gases, achieving efficiencies above 95%.

Their adoption is dominant in large-scale power plants, cement kilns, and chemical processing facilities. Particularly in Asia-Pacific, where emission standards are becoming increasingly stringent, wet scrubbing systems offer long-term compliance and byproduct recovery in the form of commercial-grade gypsum. Market growth is further fueled by rising demand for turnkey solutions and standardized process control technologies.

The power generation segment is projected to account for approximately 45% of the global FGD system market share in 2025, growing steadily through 2035. Despite a global shift toward renewables, coal and oil-fired plants still form a substantial part of the energy mix in countries like China, India, Poland, and South Africa.

FGD technologies are essential in mitigating SOx emissions from these facilities to meet national and international environmental regulations. Power producers are adopting FGD systems not only to ensure compliance but also to generate high-quality gypsum for downstream applications. Continued investments in coal power capacity in emerging economies and modernization of older plants in developed markets are expected to sustain demand in this segment.

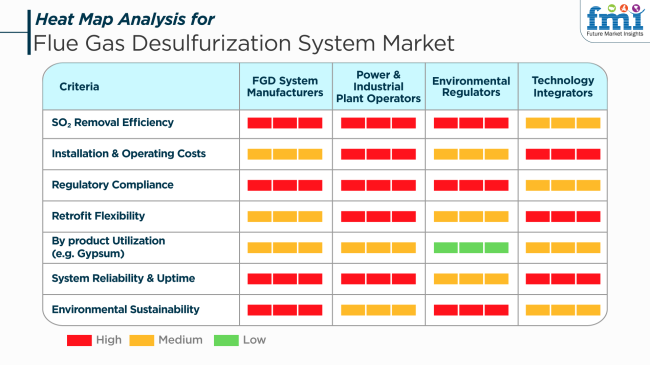

In the changing industrial scenario, flue gas desulfurization system are becoming an essential part of stakeholders walking the tightrope between environmental stewardship and operational effectiveness.

FGD system producers emphasize the efficiency of emission reduction, regulatory compliance, and system longevity. With innovation playing the key role in competitive edge, they also venture into new chemistries and modular arrangements to address retrofit and greenfield projects.Industrial and power operators place a great deal of emphasis on cost-effective deployment and uptime reliability, as much as they can, considering the operational demands on them. Compatibility with retrofit is also important, particularly in mature plants where new technology needs to be seamlessly integrated with minimal downtime.

Environmental regulators prioritize SO₂ removal targets, reporting precision, and compliance schedules. Their power is driving stricter international standards and mandating continuous emissions monitoring systems (CEMS).Ease of installation, compatibility with current systems, and serviceability are important to technology integrators so they can provide stable solutions with narrow operational windows. With increasing decarbonization and air quality regulations around the world, these stakeholder priorities are influencing the next wave of FGD system design and implementation.

The flue gas desulfurization system market is exposed to some major risks affected by strict environmental protection regulations for sulfur dioxide emissions. Adhering to such regulations requires large-scale investment in FGD technology. Nevertheless, high capital and operation costs for the systems can hinder adoption, particularly among small- and medium-scale businesses.

Technological innovations both present opportunities and challenges. While innovations will give rise to more efficient and less costly FGD solutions, technology changes can rapidly make installed systems obsolete. Companies have to invest in R&D to remain competitive, and this can overstretch financial resources.

There are fluctuations in the prices of raw materials, and price volatility in principal components like limestone and other sorbents could influence the general cost structure of FGD systems. Volatility could influence price models and margins of manufacturers and service providers.

Recklessness in coal-based power plants, which is among the key areas of application for FGD systems, is a risk. As the world's energy profile is moving towards renewable sources, the need for power generation based on coal is decreasing. The changeover could curb the need for conventional FGD systems, thereby calling for diversification into other industrial areas.

Geopolitical considerations and trade policies may have an impact on the FGD industry. Tariffs, trade barriers, and global relations can influence the supply chain, creating delays and rising costs. Organizations that have business in various regions need to traverse these complexities in order to achieve steady operations and industry presence.

In summary, there are risks from regulatory compliance costs, technological obsolescence, raw material price volatility, dependence on declining coal power generation, and geopolitical uncertainties. Stakeholders must adopt proactive strategies to mitigate these risks and ensure sustainable growth in a dynamic environment.

| Country | Forecasted CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 4.2% |

| France | 3.9% |

| Germany | 4.1% |

| Italy | 3.7% |

| South Korea | 5.0% |

| Japan | 4.5% |

| China | 6.2% |

| Australia | 3.6% |

| New Zealand | 3.3% |

The USA will grow at a CAGR of 4.8% during the forecast period of 2025 to 2035. The growth is driven by strict environmental regulations to control sulfur dioxide emissions from fossil fuel-fired power plants. The Clean Air Act implementation and its subsequent amendments over time continue to strengthen demand for advanced FGD technologies.

Key sectors such as chemical manufacturing, metallurgy, and cement also contribute towards maintaining demand. Some of the major industry players in the United States include Babcock & Wilcox Enterprises Inc., Ducon Technologies, and General Electric. Wet FGD systems, particularly technologies that rely on limestone, are witnessing a trend toward being used in the industry due to their high efficiency and reliability.

Rising investments in emission control retrofits at old power infrastructure further underscore the long-term outlook of the local industry.

The UK is forecast to grow at 4.2% CAGR through 2035. Policymaking in net-zero and stringent enforcement of emissions rules under Environment Agency regulations are driving the adoption of the FGD system. Coal plant retirements decline, paving the way for emissions control retrofits in the transition power stage.

Key players such as Mitsubishi Heavy Industries, Clyde Bergemann Power Group, and Doosan Lentjes maintain a presence in the UK by providing installation and servicing. The sector is witnessing a change towards hybrid FGD systems for managing variable loads of pollutants. Additionally, an emphasis on the combination of carbon capture and storage (CCS) will further contribute to technological innovation in the coming years.

France is expected to record a CAGR of 3.9% during 2025 to 2035. Government support for clean air policies and policies for industrial emissions reduction continue to be major drivers for the demand for effective desulfurization systems. The energy transition policy supports the upgradation of emission control equipment for heavy sectors such as cement, steel, and waste incineration.

Significant corporate foundations in France are represented by companies such as Alstom, Veolia Environment, and Hamon Group. Wet FGD system demand, particularly seawater- or limestone-reagent-based systems, aligns with relative resource accessibility as well as local environmental policy factors. Growing emphasis on sustainability as well as public health will support long-term growth.

Germany is forecasted to increase by a CAGR of 4.1% over the period 2025 to 2035. The country's focus on industry decarbonization and compliance with European Union directives in relation to emissions control is investing in flue gas cleaning technology. Although the share of coal for electricity generation is falling, the existing installed plants require the replacement of emission control equipment.

Major players are Andritz AG, Lurgi GmbH, and Siemens Energy, who are increasingly engaged in offering advanced FGD technologies appropriate for big-scale industrial applications. Semi-dry and dry systems are increasingly used for low-capacity applications due to cost advantages and adaptability. Utility operators and technology vendors' strategic partnership is pushing growth in the industry.

Italy is expected to grow at a 3.7% CAGR between 2025 and 2035. The focus on emission reduction in the country's national energy and climate plan enables incremental expenditure on flue gas desulfurization system. Ceramics, steel manufacturing, and power generation are industry segments that remain key implementers of FGD technologies.

Key players such as Termokimik Corporation, Enel Produzione, and Ansaldo Energia are strengthening the local supply chain and service base. Modular and low-cost dry FGD systems, particularly for medium-sized industrial plants, have an emerging trend. Continued collaboration with European technology suppliers will continue to enhance innovation and deployment efficiency.

South Korea's flue gas desulfurization system market is predicted to experience high growth during 2025 to 2035, valued at a high CAGR of 5.0%. Government-mandated air quality improvement programs and investment in cleaner industrial processes are major growth drivers. Ongoing refurbishment of thermal power plants and expansion of the petrochemical industry are also propelling growth.

Dominant players like Doosan Heavy Industries, Hyundai Heavy Industries, and GS E&C lead the way in offering domestic and international FGD solutions. Wet FGD systems dominate installations due to their high efficiency in removing pollutants, especially in power plants. Policy support for retrofitting old plants and promoting eco-friendly manufacturing processes will provide consistent growth over the forecast period.

Japan is projected to record a 4.5% CAGR between 2025 and 2035. Driven by the need to maintain compliance with stringent environmental regulations, the country continues to invest in high-performance desulfurization equipment. The progressive transition of the industrial economy from fossil fuels to clean energies necessitates the installation of efficient emissions control systems into existing infrastructure.

Major players include Mitsubishi Heavy Industries, Chiyoda Corporation, and Hitachi Zosen. Japan favors seawater and dual-alkali FGD systems, particularly for coastal plants where the availability of seawater increases system feasibility. Integration of FGD units with larger flue gas treatment systems, like particulate and NOx removal technologies, supports long-term demand for integrated air pollution control systems.

China has a monopoly, with an expected CAGR of 6.2% from 2025 to 2035. Regulations from the government concerning ultra-low emission levels aimed at suppressing industrial pollution are inducing extensive application of FGD systems across power and manufacturing industries. Large-scale coal-fired power plants and heavy industry are the foremost fields of application.

Industry leaders such as Longking Environmental, SPIC Yuanda Environmental Protection, and Guodian Tech & Environment are industry leaders. Wet limestone-gypsum FGD systems are characterized by a strong China preference due to good cost-performance margins. Government incentives, including retrofit and clean technology roll-out subsidies, will be sustained in driving growth.

Australia is expected to record a CAGR of 3.6% in the forecast period from 2025 to 2035. Despite growing dependence on renewable energy, aging coal power plants and emission-based industries still maintain a residual demand for FGD plants. Environmental rules and regulatory pressure are propelling selective adoption.

Key players such as Worley, Downer Group, and Babcock & Wilcox Australia are involved in delivering desulfurization solutions customized to local conditions. Miniature dry FGD systems with remote control and limited water supply are gaining demand. Growing investment in metal processing and mining also presents incremental opportunities for the application of FGD technology in localized industry clusters.

New Zealand is expected to progress at a good CAGR of 3.3% through 2035. Scale restrictions, due to the country's reliance on sustainable energy sources, do not preclude demand niches in incineration wastes and special industrial applications subject to emission compliance requirements. Pressure to conform to sustainable development also benefits technology use.

Local firms partner with worldwide vendors such as Hamon and Clyde Bergemann to supply tailored FGD solutions. Adoption is primarily of dry and semi-dry scrubbing systems that capture the goal of operational simplicity and environmental awareness. Although small in volume, the industry is characterized by a steady interest in upgrading emission control systems across existing industrial plants.

The FGD system market is experiencing intensifying competition as manufacturers focus on innovation, efficiency, and environmental performance. Leading players are developing modular FGD systems and hybrid technologies that integrate both dry and wet processes for cost-effective operations. Strategic collaborations are emerging to address retrofitting challenges and comply with emission mandates under tighter budgets. Players are expanding their presence in Asia-Pacific and the Middle East, where regulatory enforcement and industrial expansion are creating new opportunities. Emphasis on circular economy strategies, including gypsum reuse and waste heat recovery, is reshaping the competitive landscape. As emission norms tighten and stakeholders prioritize sustainability, the FGD system market is expected to witness sustained technological evolution and capital inflow.

Recent Development

The segmentation is into Wet Flue Gas, Dry Flue Gas, and Semi Gas, catering to different treatment processes in flue gas management.

The segmentation is into applications such as Power Generation, Chemical Processing, Iron and Steel, Cement Manufacturing, and Others, reflecting the diverse industrial use of flue gas treatment.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa, with regional variations in industrial growth and regulatory requirements.

The global market is estimated to be worth USD 24,387.6 million in 2025.

Sales are projected to reach USD 40,812.4 million by 2035, fueled by stricter environmental regulations and the growing need to reduce sulfur dioxide emissions from industrial sources.

China is expected to register a CAGR of 6.2%, supported by large-scale coal-based power generation and efforts to control air pollution.

Wet FGD systems are leading due to their high efficiency in removing sulfur dioxide from exhaust flue gases.

Leading companies include Babcock & Wilcox Enterprises, Inc., Marsulex Environmental Technologies, FLSmidth & Co. A/S, Thermax Limited, Siemens AG, Clyde Bergemann Power Group, Burns & McDonnell, Alstom SA, Mitsubishi Electric Corporation, Ltd., Hamon Corporation, Valmet, DUCON Infratechnologies Ltd, GE Power India Limited, Tata Projects, and NTPC Limited.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flue Gas Coolers Market Size and Share Forecast Outlook 2025 to 2035

Flue Gas Desulphurization Market Size and Share Forecast Outlook 2025 to 2035

Flue Gas Analyzer Market

Gas Feed System Market Growth – Trends & Forecast 2024-2034

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Gas Generating Systems Market Size, Growth, and Forecast 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Flare Gas Recovery System Market Outlook – Share, Growth & Forecast 2025–2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Integrated Gas System Market Growth – Trends & Forecast 2025 to 2035

Mobile Gas Pumping System Market

Solvent Degassing System Market Size and Share Forecast Outlook 2025 to 2035

Gastro-retentive Drug Delivery Systems Market - Trends & Demand 2025 to 2035

Burn-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

GCC Flare Gas Recovery System Market Report – Trends, Demand & Industry Forecast 2025–2035

Japan Flare Gas Recovery System Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Flare Gas Recovery System Market Insights – Demand, Size & Industry Trends 2025–2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Europe Flare Gas Recovery System Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA