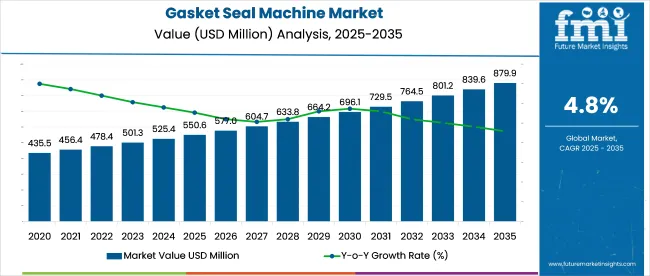

The gasket seal machine market is projected to expand from USD 550.6 million in 2025 to USD 879.9 million by 2035, at a CAGR of 4.8%. Gasket seal machine consumption is rising due to a significant shift in high-precision manufacturing across sectors.

In EV battery production, for example, manufacturers are reporting seal defect rates under 0.2% when using fully automated gasket dispensing systems with inline vision inspection. In the food and beverage sector, the adoption of FDA-grade polyurethane gaskets in clean-in-place (CIP) environments has increased machine uptime by 22% due to more reliable sealing integrity.

Aerospace manufacturers using robotic gasket application systems have achieved cycle time reductions of up to 35% for cabin pressure systems, with torque-controlled compression enhancing compliance with AS9100 standards. In pharmaceutical and biotech plants, digital-controlled gasket sealers are now required to meet validation under EU GMP Annex 1, pushing adoption in aseptic production zones.

These quantifiable performance gains are driving increased investments across global OEM and Tier 1 facilities looking to optimize throughput and reduce operational risk.

As of 2025, the gasket seal machine market holds a modest yet critical share within its broader parent industries.It holds about 2-3% of the overall industrial sealing equipment market, driven by demand for machines that offer consistent and leak-proof sealing. In the packaging machinery sector, it represents around 1-2%, especially in industries that need airtight or fluid-tight seals.

The automotive machinery segment sees a share of nearly 3-4%, as these machines are used in sealing engines, gearboxes, and other components. Around 2% of the HVAC machinery market is tied to gasket sealing applications. In industrial automation, the share stands at 1-2%, where these machines are used to improve production efficiency and quality.

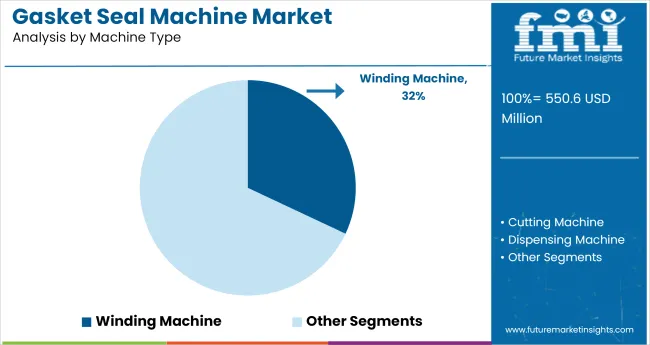

The market is advancing steadily with key momentum in winding machines, automatic equipment, and applications across electrical and heavy machinery industries. Surging automation trends and growing demand for high-performance sealing in industrial environments are accelerating segmental growth across global manufacturing hubs.

Winding machines are expected to capture 32% of the global market share by 2025, driven by their efficiency in producing spiral-wound gaskets. This machine type supports consistent winding pressure, precise material layering, and optimized seal durability for high-pressure applications.

Automatic gasket seal machines are projected to hold a dominant 62% share of the global market by 2025. Their programmable functionality, minimal operator intervention, and superior precision align with smart factory adoption trends in key sectors.

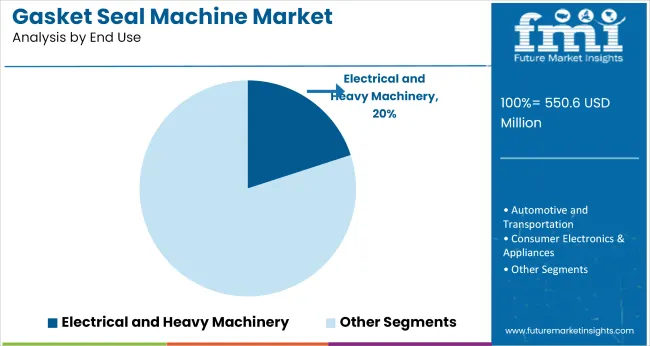

Electrical and heavy machinery applications are expected to account for 20% of the market share by 2025. Growing complexity in heavy-duty equipment design has made high-performance sealing essential for safety and operational reliability.

Growth in the market is supported by automation trends in industrial sealing and component assembly. In 2024, the market expanded by 6.7%, fueled by rising demand for consistent gasketing in automotive, electronics, and HVAC sectors. High-precision foam-in-place (FIP) technology is gaining preference for sealing complex geometries.

Advancements in CNC and 3D Gasketing Improving Accuracy

In 2024, over 46% of new machines featured multi-axis CNC systems with real-time viscosity control. Dynamic mixing heads, servo drives, and programmable dispensing paths are improving seal integrity. PU foam, RTV silicone, and hot-melt materials are being used for tailored performance.

Heavy Machinery, HVAC, and Enclosures Fueling Demand

Machinery panels, electrical cabinets, and air handling units are key application areas. Gasket seal machines are being adopted by OEMs producing large-volume metal enclosures. In 2024, the HVAC segment alone accounted for 21% of market demand, with rising export orders from Asia and Europe.

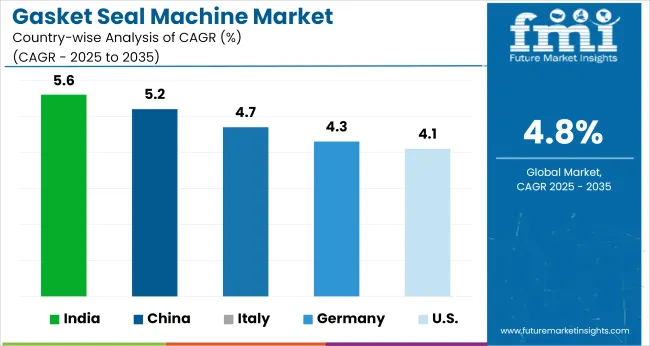

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

| China | 5.2% |

| Italy | 4.7% |

| Germany | 4.3% |

| United States | 4.1% |

The global market is forecast to grow at a CAGR of 4.8% between 2025 and 2035. India leads the profiled group with a CAGR of 5.6%, exceeding the global pace by 17%. This growth is supported by expanding automotive part manufacturing and infrastructure-related sealing applications. China also surpasses the global average at 5.2%, reflecting high-volume production demand across BRICS manufacturing corridors.

Among OECD economies, performance remains comparatively slower. The USA posts 4.1% and Germany 4.3%, reflecting a lag of 15% and 10% against the global baseline, respectively. Italy aligns closely with the benchmark at 4.7%, driven by strong equipment exports across the EU.

This divergence underscores how BRICS countries are gaining traction in sealing equipment deployment, while several OECD members face maturity in production cycles. Demand differentials stem from infrastructure buildouts, automotive part expansions, and diverse industrial sealing requirements.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

India is projected to expand at a CAGR of 5.6% from 2025 to 2035, driven by strong industrialization and local manufacturing incentives. Demand for gasket seal machines is scaling rapidly across automotive components, electrical housings, and heavy equipment production. The shift toward mechanized sealing solutions among MSMEs is also fueling adoption, particularly in Maharashtra, Gujarat, and Karnataka. Domestic OEMs are seeking systems with shorter setup times, low material waste, and high throughput.

Posting a CAGR of 5.2% through 2035, China continues to dominate regional demand for gasket seal machines. Key applications span battery casings, control modules, LED enclosures, and industrial panels. Technological upgrades are focused on enhancing precision and reducing cycle times. OEMs in Jiangsu and Guangdong provinces are integrating foam-in-place (FIP) gasket solutions to reduce manual labor and meet global compliance.

Italy is forecast to grow at a CAGR of 4.7% from 2025 to 2035, supported by strong activity in industrial machinery, HVAC systems, and custom electronics assembly. Medium-sized enterprises are increasingly transitioning to programmable gasket systems with automated bead application. Demand is rising for systems capable of processing polyurethane, silicone, and epoxy-based materials with zero-waste accuracy. Northern industrial zones including Lombardy and Veneto show the highest adoption levels.

Germany is set to grow at a CAGR of 4.3% during the forecast period, as sealing equipment becomes critical in next-generation automotive and renewable energy infrastructure. Gasket machines are increasingly used in control boxes, battery management systems, and precision housings for electric drivetrains. Local manufacturers are adopting machines with modular heads and advanced dosing pumps to ensure consistency and repeatability.

The United States is projected to advance at a CAGR of 4.1% between 2025 and 2035, led by demand from aerospace, telecom, and smart grid industries. Buyers are prioritizing reliability, throughput, and reduced maintenance in gasket seal machines. Modern production lines in Midwest and Southern states are shifting toward programmable FIP equipment with real-time diagnostics and multi-bead functionality.

Shanghai Kaiwei Intelligent Technology leads the global gasket seal machine market, commanding over 30% share in Asia-Pacific due to its advanced robotic dispensing platforms and integrated automation systems tailored for automotive and electronics assembly lines. Dalian Jinjie Innovation Technology has gained prominence in China’s mid-tier segment by offering CNC-controlled gasket applicators with modular retrofit capabilities.

GSKET srl is a key player in Europe, recognized for its precision sealing systems used in HVAC and industrial enclosures, with OEM clients across Italy and Germany. CixiFlyseal and Heroos Sealing Materials are aggressively targeting export markets, especially Southeast Asia and the Middle East, by providing compact and cost-effective solutions suited for gasket production in electrical and water treatment components.

Recent Gasket Seal Machines Industry News

In August 2024, Klinger Thermoseal expanded into the gasket extrusion business with a new high-capacity production line targeting industrial sectors like oil & gas and power. The company followed this by adding 25,000 sqft of extrusion space in Ohio in March 2025, enhancing its rubber gasket manufacturing capabilities.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 550.6 million |

| Projected Market Size (2035) | USD 879.9 million |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Machine Types Analyzed (Segment 1) | Winding Machine, Cutting Machine, Dispensing Machine, Profile Bending Machine |

| Categories Analyzed (Segment 2) | Semi-automatic, Automatic |

| End Uses Analyzed (Segment 3) | Automotive & Transportation, Electrical & Heavy Machinery, Consumer Electronics & Appliances, Metal Fabrication, Oil & Gas, Process Industries, Other Industrial |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Shanghai Kaiwei Intelligent Technology (Group) Co., Ltd., Dalian Jinjie Innovation Technology Co., Ltd., Cixi Flyseal Co., Ltd., MSO Seals and Gaskets, Heroos Sealing Materials Co., Ltd., Sunshine Sealing Technology Co., Ltd., GSKET srl |

| Additional Attributes | Dollar sales by machine type and end use, rising automation in gasket fabrication, demand growth from oil & gas and metal processing sectors, and increasing focus on precision sealing in high-stress environments. |

The market is categorized into winding machines, cutting machines, dispensing machines, and profile bending machines. Each type addresses specific operational needs within industrial and fabrication environments.

Based on automation level, the market is segmented into semi-automatic and automatic machines, enabling flexibility across production volumes and labor efficiency requirements.

End-use industries include automotive and transportation, electrical and heavy machinery, consumer electronics & appliances, metal fabrication, oil & gas, process industries, and other industrial sectors, reflecting the wide applicability of these machines.

Regional segmentation covers North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East and Africa, representing varying levels of industrial automation adoption and infrastructure development.

The market is estimated at USD 550.6 million in 2025.

The market is forecast to reach USD 879.9 million by 2035.

The market is projected to grow at a CAGR of 4.8% over the forecast period.

Winding machines account for the highest share, with 32% in 2025.

India is the fastest-growing country, with a CAGR of 5.6% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Tray Sealer Machines Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Tray Sealer Machines

Side Sealer Machines Market

Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Competitive Breakdown of Tube Sealing Machines Providers

Pouch Sealing Machine Market

Carton Sealer Machine Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Vacuum Sealing Machine Providers

Pick Fill Seal Machines Market Size, Share & Forecast 2025 to 2035

Market Positioning & Share in the Form Fill Seal Machine Industry

Form Fill Seal Machine Market Analysis by Semi-automatic and Automatic Through 2034

Cold Seal Packaging Machine Market Trends & Growth Forecast 2024-2034

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Portable Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Envelope Sealing Machines Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA