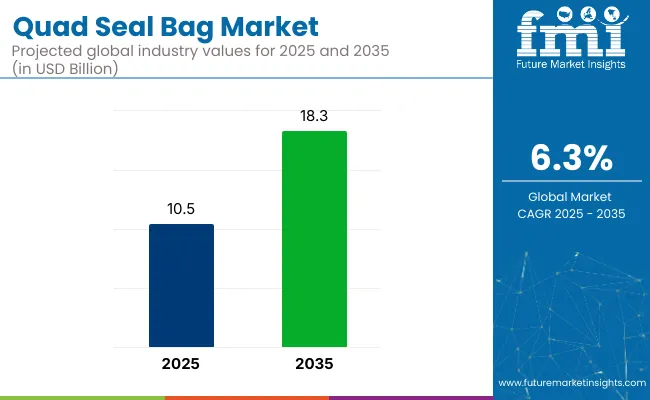

The global quad seal bag market is projected to grow from USD 10.5 billion in 2025 to USD 18.3 billion by 2035, registering a CAGR of 6.3% during the forecast period. This growth is primarily attributed to the rising demand for flexible, durable, and aesthetically appealing packaging solutions across various industries, including food and beverage, pet care, pharmaceuticals, and personal care.

Quad seal bags, characterized by their four-corner seal design, offer enhanced shelf stability, superior barrier properties, and ample branding space, making them a preferred choice for manufacturers aiming to improve product visibility and shelf life. The increasing consumer preference for convenient, single-serve packaging, particularly in ready-to-eat meals and snacks, further propels market expansion.

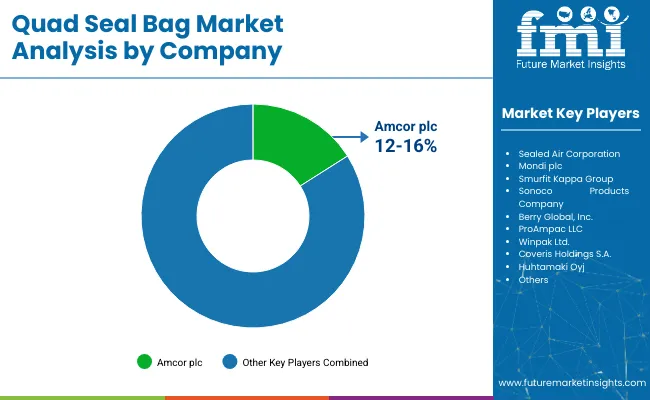

In April 2024, Amcor plc, a global leader in developing and producing responsible packaging solutions, announced a significant expansion of its North American printing and converting capabilities for the dairy market to support customers’ needs for flexible packaging. The installation of new state-of-the-art equipment aims to enhance production capacity and efficiency.

“Amcor is committed to deliver innovation, service flexibility, and agility that will ultimately enhance our customer’s experience," said Derrick Sytsma, Vice President and General Manager - Dairy, Amcor Flexibles North America. “This strategic investment represents the largest of its kind in Amcor Flexible North America’s extensive history within the cheese business and solidifies our commitment to the dairy industry, as well as continued support of our customers’ growth.

Recent innovations in the quad seal bag market have centered around enhancing sustainability, functionality, and consumer convenience. Manufacturers are increasingly adopting biodegradable and recyclable materials, such as PLA and PHA, to produce eco-friendly quad seal bags that meet stringent environmental regulations and cater to the growing consumer demand for sustainable packaging.

Advancements in barrier technologies have led to the development of high-performance films that offer superior protection against moisture, oxygen, and light, thereby extending product shelf life. Additionally, the integration of smart packaging technologies, including QR codes and RFID tags, enables better inventory management, product tracking, and consumer engagement. Design improvements, such as resealable zippers and easy-tear openings, further enhance user convenience and product functionality.

The quad seal bag market is expected to witness significant growth in emerging economies, particularly in the Asia-Pacific region, driven by rapid urbanization, increasing disposable incomes, and the expansion of the foodservice and retail sectors. Countries like China, India, and Indonesia are experiencing a surge in demand for flexible packaging solutions, fueled by changing consumer lifestyles and the proliferation of e-commerce platforms.

Manufacturers are anticipated to focus on developing cost-effective, sustainable, and customizable quad seal bag solutions to cater to diverse industry needs and comply with evolving regulatory standards. Strategic collaborations, technological advancements, and investments in local production facilities are likely to play a crucial role in capturing market share and driving growth in these regions.

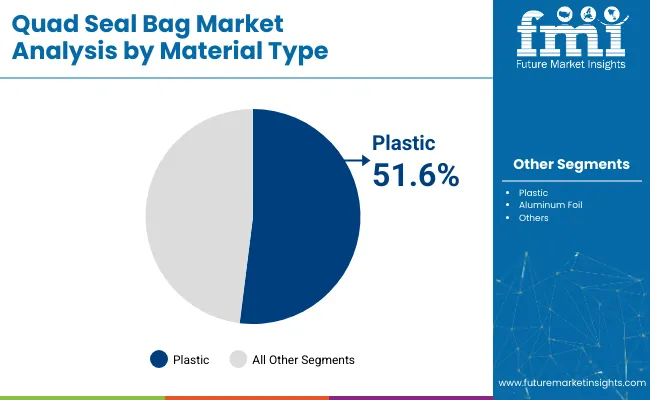

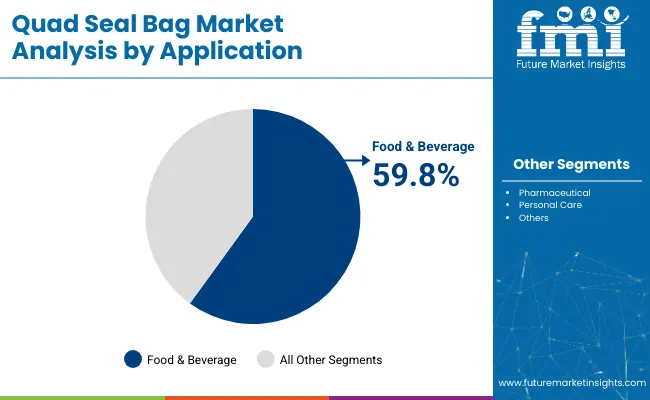

The market has been segmented based on material type, closure type, application, and region. By material type, plastic, aluminum foil, and other flexible substrates are used to enhance puncture resistance, barrier performance, and shelf appeal in high-volume packaging. Closure types include zipper, slider, and heat seal-supporting reseal ability, tamper-evidence, and convenience in consumer packaging.

Application segmentation comprises food & beverage, pharmaceutical, personal care, and others, underlining quad seal bags’ wide adoption across industries demanding superior product protection, extended shelf life, and high-impact branding. Regional segmentation includes North America, Europe, South America, Asia Pacific, and the Middle East and Africa, reflecting evolving packaging legislation, consumer demand for flexible formats, and technological adoption across developed and emerging markets.

The plastic segment is anticipated to dominate the material type category with a 51.6% share in the quad seal bag market by 2025, driven by its exceptional flexibility, seal integrity, and protective barrier characteristics. Plastic materials such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are widely used in quad seal bags for their superior performance in moisture, odor, and UV resistance.

Plastic-based quad seal bags allow for versatile structural configurations, including gussets, resealable zippers, and degassing valves, making them ideal for packaging dry food, pet food, powdered beverages, and household goods. These bags offer high puncture resistance and excellent shelf appeal due to their ability to support vibrant, high-resolution printing.

With demand for durable, lightweight, and efficient packaging growing across retail, e-commerce, and foodservice channels, plastic will remain the go-to material in this category, despite increasing regulatory scrutiny. Continuous innovation in bio-based and recyclable plastics is expected to reinforce its market leadership well into the next decade.

The food & beverage segment is projected to account for the largest share of 59.8% in the quad seal bag market by 2025, primarily due to the packaging demands of coffee, snacks, frozen foods, pet food, and bakery products. Quad seal bags offer superior strength and shape retention, enabling them to stand upright on retail shelves while maintaining a compact footprint a crucial factor for maximizing space and enhancing product visibility.

These bags provide four-side sealing, allowing greater weight capacity and structural stability, making them ideal for bulky or granulated food items. In the coffee and tea markets, quad seal bags with one-way degassing valves preserve aroma and freshness, while in snack foods, they offer reseal ability and extended shelf life through multilayer laminates.

The segment’s dominance is also attributed to branding and consumer engagement potential as all four panels of the bag can be printed, manufacturers benefit from enhanced storytelling, QR code integration, and product differentiation. Furthermore, food safety regulations and the demand for barrier protection have pushed adoption of advanced materials and sustainable formats, including compostable and recyclable quad seal bag solutions.

Complex Recycling and High Production Costs

While this style of bag is favored for its aesthetics, it does come with drawbacks including materials complexity that can make it difficult to recycle, higher costs than pillow pouches, and limited options on the compostable barrier film side. Regulatory changes are pushing manufacturers to move away from mixed plastic layers, which will require investment in material science and packaging redesigns.

Customization, Sustainability, and Smart Features

Digital printing will witness the maximum growth, while other innovations like laser scoring and interactive packaging like QR-enabled product traceability will the packaging market. To stand out on cluttered retail shelves, brands are increasingly employing quad seal bags.

Breakthroughs in fully recyclable mono-material films, as well as compostable packaging and transparent windows that do not compromise barrier performance, are paving the way for new opportunities. Online grocery platforms and bulk retailers are also fueling acceptance of quad seal bags with high end reclose options.

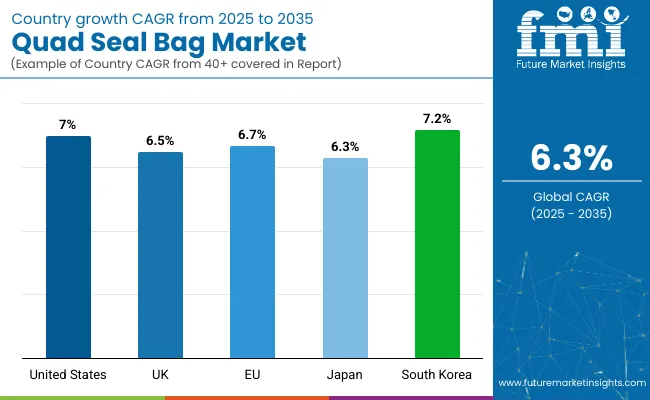

The USA quad seal bag market is anticipated to hold a prominent positon owing to high demand for food, pet care products and coffee amongst the manufacturers. Hence, the increasing demand for flexible, space-efficient packaging formats that ensure excellent shelf appeal and product protection is driving the growth of the market.

With increased branding surfaces, puncture resistance, and superior load-bearing capabilities, they are a common choice in the retail environment. Meanwhile, resealable closure and recyclable material innovations become an answer to sustainability mandates and consumer demands. This demand is further accelerating due to the growing shift towards premium packaging in e-commerce and specialty goods.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.0% |

With growing demand for sustainable packaging, the UK quad seal bag market is also thriving, driven by the shift to private label food brands and extending product portfolios with artisan, organic products. Demand is also being propelled by the popularity of flat-bottom bags in gourmet snack, health food and confectionery.

Also, manufacturers are developing recyclable and compostable laminates in order to comply with packaging waste regulations. They offer proven visibility on shelves and customizable surface area, so quad seal bags are becoming increasingly popular for product differentiation and adapted to suit modern retail formats.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

Germany, France and Netherlands are anticipated to be the dominating countries in the EU quad seal bag market, supported by a developed packaging industry and rising demand from the processed food, dairy and pet food segments. Initiatives to push for sustainability, like the circular economy action plan, are taking EU-wide steps toward the adoption of recyclable materials and mono-layer bag designs.

Additionally, the emphasis on high-barrier flexible packaging for shelf-life extension and food safety compliance in the region is aiding adoption. Quad seal bags give up an abundance of versatility and give an extra premium look that is making them more and more popular specs among small- and mid-size brands.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.7% |

Nearly a decade since the launch of Japan’s quad seal bag, the sector continues to grow at a steady pace with high demand from food packaging at the upper-end of the market, cosmetic refills, and tea products. Adoption is propelled by the country’s precision-driven packaging standards and consumer preference for natural and aesthetically pleasing packaging formats.

All the compact quad seal bags with their easily box-like shape and efficient use of space fit in very well with Japan’s small retail spaces. Furthermore, innovative resealable zippers, aroma locking features, and recyclable plastics are further augmenting the impression of these bags, both in food and non-food sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

North America and Western Europe will continue to dominate the quad seal bags market, New South Wales, South Korea, and Japan are emerging as key markets for quad seal bags. Interest in quad seal bags is driven by demand for compact, environmentally friendly and visually distinctive packaging formats.

South Korean brands are adopting minimalist but high-end packaging aesthetics, and quad seal formats offer excellent real estate for branding. Additionally, government-supported sustainability programs and innovation towards biodegradable films, all contribute to the formulations of the future of flexible packaging. Market growth is also further accelerated by e-commerce-ready pouch designs and high-barrier materials used for moisture-sensitive products.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

Rising need for robust and space-saving packaging, surging emphasis on shelf appeal, and growing preference for flexible plastic packaging across food, pet care, and homecare applications are some factors propelling the demand for quad seal bags in the market.

With growing applications in snack food, coffee, protein powder, and dry goods, the market is increasing at a consistent rate. Some developments driving this include recyclable and compostable materials, resealable zippers, and improved high-definition flexographic and digital printing.

The overall market size for the quad seal bag market was USD 10.5 billion in 2025.

The quad seal bag market is expected to reach USD 18.3 billion in 2035.

The demand for quad seal bags will be driven by increasing need for durable and visually appealing packaging, rising demand from the food and pet food industries, growing preference for packaging that offers better shelf stability, and advancements in recyclable and sustainable material technologies.

The top 5 countries driving the development of the quad seal bag market are the USA, China, India, Germany, and the UK.

The plastic quad seal bags segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Side Gusset/Quad Seal Bag Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Side Gusset/Quad Seal Bag Sector

Quad-ridge Horn Antenna Market Size and Share Forecast Outlook 2025 to 2035

Quadriplegia Treatment Market Insights - Trends & Growth 2025 to 2035

Quadrant Scale Market

Quadripodal Implants Market

Quad-Flat-No-Lead Packaging Market Report – Forecast 2017-2027

Cissus Quadrangularis Market Analysis by Product Form, Grade, End Use and Sales Channel Through 2035

Sealing & Strapping Packaging Tape Market Size and Share Forecast Outlook 2025 to 2035

Sealing Agent for Gold Market Size and Share Forecast Outlook 2025 to 2035

Sealant Web Film Market Size and Share Forecast Outlook 2025 to 2035

Sealed Wax Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sealing And Strapping Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Sealless Magnetic Drive Pump Market- Growth & Demand 2025 to 2035

Sealant Films Market

Resealable Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Resealable Closures And Spouts Packaging Market Size and Share Forecast Outlook 2025 to 2035

2 Seal Pouches Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Resealable Closures and Spouts Packaging Providers

Key Players & Market Share in 2 Seal Pouch Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA