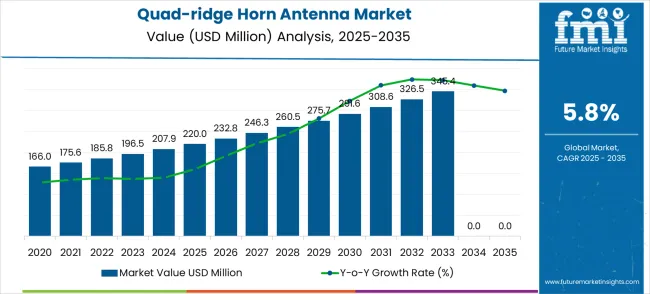

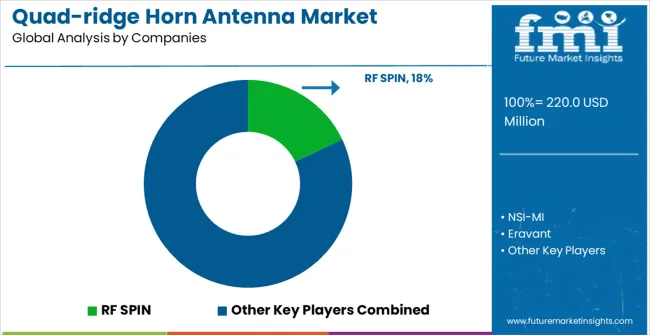

The quad-ridge horn antenna market is valued at USD 220.0 million in 2025 and is anticipated to reach USD 386.6 million by 2035, advancing at a CAGR of 5.8%. In the short term, the forecast indicates a steady upward trajectory, with values climbing to USD 232.8 million in 2026 and USD 246.3 million in 2027. This consistent year-over-year expansion reflects a growth range of around 5.5 to 6.0% annually, suggesting stable demand driven by wider adoption in electromagnetic compatibility (EMC) testing, wireless communication, and defense-related applications.

Early-stage growth is expected to be supported by infrastructure investments in 5G networks and increasing use of wideband antennas for aerospace and satellite communications.

Over the long term, projections point to sustained expansion, with the market progressing from USD 260.5 million in 2028 to USD 345.4 million by 2033 before achieving USD 386.6 million in 2035. The CAGR of 5.8 percent across the decade shows a balanced growth path rather than abrupt surges or downturns.

This trajectory illustrates the market’s alignment with the gradual evolution of telecommunication standards, defense modernization programs, and the increasing importance of precision measurement tools in research laboratories. By 2030, the market is estimated to reach USD 308.6 million, marking a significant transition point where adoption becomes mainstream, particularly across sectors that rely on ultra-wideband testing and high-frequency applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 220.0 million |

| Market Forecast Value (2035) | USD 386.6 million |

| Forecast CAGR (2025–2035) | 5.8% |

Scenario analysis further clarifies growth potential. Under an optimistic outlook, driven by accelerated 6G research initiatives, increased aerospace funding, and high defense procurement, the market could surpass USD 400 million by 2035, achieving a CAGR closer to 6.5 percent. Conversely, a pessimistic scenario, shaped by supply chain disruptions, limited government funding, or slower deployment of advanced telecom infrastructure, might restrict growth to USD 360 million by 2035, with a CAGR near 5.0 percent. The base scenario, supported by stable investment trends and steady product innovation, positions the market comfortably at USD 386.6 million by the end of the forecast period.

The consistency of YoY growth throughout the timeline indicates minimal volatility, reflecting the market’s resilience. Each year contributes proportionately to the cumulative expansion, with growth in later years adding larger absolute values due to compounding. While defense and aerospace segments will remain significant revenue drivers, commercial telecom and EMC testing laboratories are expected to add growing contributions over time. With stable progression, the market provides an attractive outlook for stakeholders focused on long-term investment and technology adoption strategies.

Market expansion is being supported by the rapid advancement of high-frequency communication technologies across defense and telecommunications sectors and the corresponding need for broadband antenna solutions that provide excellent polarization control and wide frequency coverage. Modern communication and radar systems require sophisticated antenna technologies that can deliver consistent performance across wide frequency ranges while maintaining polarization purity and low cross-polarization characteristics. The superior bandwidth capabilities and polarization versatility of quad-ridge horn antennas make them essential components in advanced communication systems where frequency agility and polarization control are critical for system performance.

The growing focus on electromagnetic compatibility testing and spectrum optimization is driving demand for precision antenna technologies from certified manufacturers with proven track records of performance and measurement accuracy. Defense contractors and telecommunications equipment manufacturers are increasingly investing in quad-ridge horn antenna systems that offer exceptional frequency response while enabling accurate electromagnetic field measurements and system characterization. Regulatory requirements and testing standards are establishing performance benchmarks that favor advanced horn antenna solutions with superior gain stability and polarization purity across wide frequency ranges.

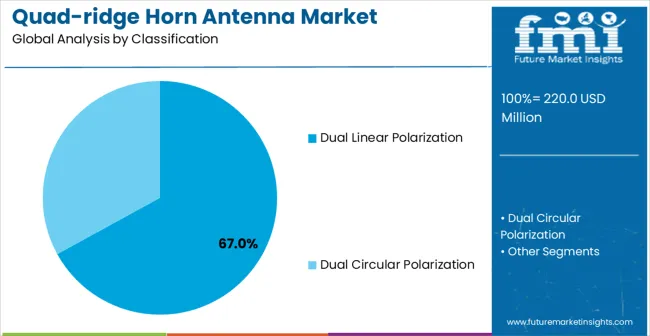

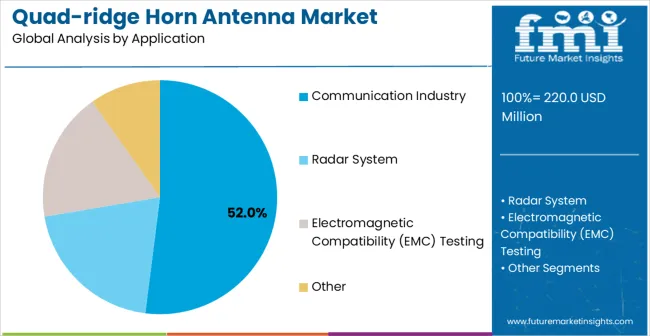

The market is segmented by polarization type, application, and region. By polarization type, the market is divided into dual linear polarization and dual circular polarization configurations. Based on application, the market is categorized into communication industry, radar system, electromagnetic compatibility (EMC) testing, and other segments. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

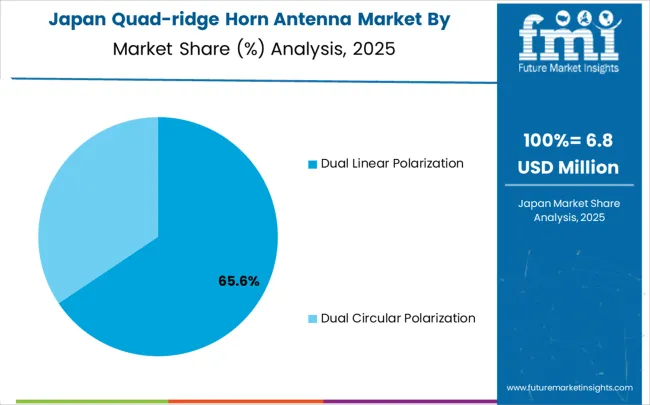

Dual linear polarization configurations are projected to account for 67% of the quad-ridge horn antenna market in 2025. This leading share is supported by the excellent performance characteristics, design flexibility, and broad application compatibility that dual linear polarization systems offer for diverse communication and measurement applications. Dual linear polarization antennas provide orthogonal polarization capabilities with excellent port isolation, making them the preferred choice for communication systems, radar applications, and electromagnetic compatibility testing requiring polarization diversity and cross-polarization measurements. The segment benefits from technological advancements that have improved port isolation, reduced cross-coupling, and enhanced gain stability across wide frequency ranges.

Modern dual linear polarization quad-ridge horn antennas incorporate advanced ridge geometries, optimized feed structures, and sophisticated balun designs that deliver exceptional polarization purity while maintaining consistent impedance characteristics and radiation patterns across ultra-wide frequency bandwidths. These innovations have significantly improved antenna performance while maintaining compatibility with various test equipment and communication systems, reducing measurement uncertainty through precise polarization control and stable gain characteristics. The electromagnetic compatibility testing sector particularly drives demand for dual linear polarization solutions, as this industry requires reliable antenna systems that can provide accurate field strength measurements and interference analysis.

Communication Industry applications are expected to represent 52% of quad-ridge horn antenna demand in 2025. This dominant share reflects the critical role of advanced antenna technologies in modern communication system development and the need for precise measurement capabilities supporting 5G, satellite communication, and wireless technology advancement. Communication industry organizations require reliable and accurate antenna systems for base station testing, antenna characterization, over-the-air testing, and system performance validation across multiple frequency bands and communication standards. The segment benefits from ongoing wireless technology evolution and increasing complexity of modern communication systems requiring comprehensive testing and validation capabilities.

Communication industry applications demand exceptional antenna performance to ensure accurate measurement of communication device characteristics, antenna patterns, and system performance across diverse frequency bands and operational scenarios. These applications require antenna systems capable of providing stable gain, consistent polarization, and low reflection coefficients while supporting automated test systems and measurement equipment integration. The growing focus on 5G millimeter-wave technologies, particularly in base station testing and device certification, drives consistent demand for advanced horn antenna solutions capable of supporting high-frequency measurements with exceptional accuracy.

The market is advancing steadily due to increasing high-frequency communication system deployment and growing recognition of precision antenna importance in electromagnetic compatibility testing and system characterization. The market faces challenges including complex design requirements for ultra-wide bandwidth applications, need for specialized manufacturing capabilities and precision assembly processes, and varying performance specifications across different application segments. Standardization efforts and certification programs continue to influence antenna design quality and market development patterns.

The growing deployment of advanced materials including low-loss dielectrics, precision-machined metals, and specialized coating technologies is enabling superior electrical performance and enhanced mechanical stability in quad-ridge horn antenna designs. Advanced manufacturing techniques and precision assembly processes provide improved dimensional accuracy while enabling reduced size and weight characteristics compared to traditional horn antenna designs. These technologies are particularly valuable for aerospace and defense applications that require lightweight antennas capable of meeting stringent performance specifications and environmental requirements.

Modern antenna manufacturers are incorporating modular design concepts and multi-band optimization techniques that enable flexible system configuration and enhanced frequency coverage while maintaining excellent electrical performance across multiple applications. Integration of advanced feed networks, switchable polarization systems, and intelligent control interfaces enables significant improvement in system versatility and measurement capability compared to traditional fixed-configuration antennas. Advanced simulation tools and optimization algorithms also support development of more efficient and compact antenna designs for demanding space and weight-constrained applications.

| Country | CAGR (2025–2035) |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

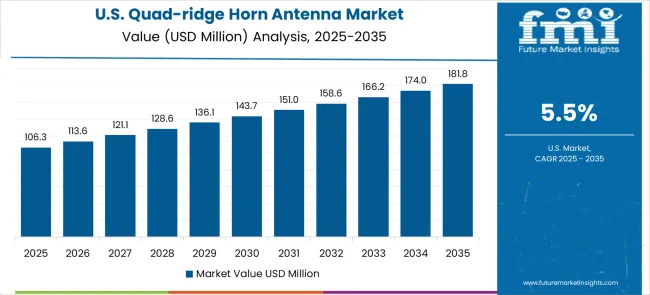

| United States | 5.5% |

| United Kingdom | 4.9% |

| Japan | 4.4% |

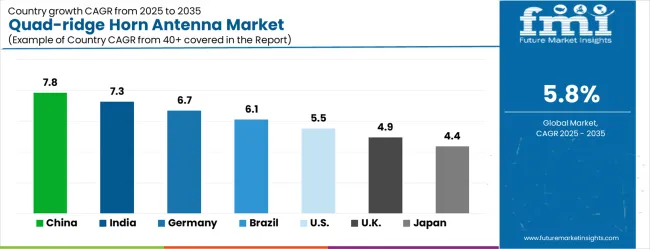

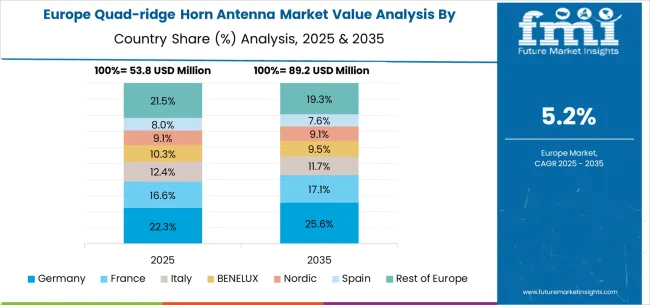

The market is growing steadily, with China leading at a 7.8% CAGR through 2035, driven by massive telecommunications infrastructure development, increasing defense modernization programs, and comprehensive government support for advanced communication technology research and development. India follows at 7.3%, supported by rapid expansion of telecommunications infrastructure, growing defense procurement programs, and increasing investments in satellite communication and radar system development. Germany records strong growth at 6.7%, focusing precision engineering excellence, advanced automotive radar testing, and comprehensive aerospace and defense technology development. Brazil grows steadily at 6.1%, integrating advanced antenna technologies into expanding telecommunications infrastructure and growing defense modernization initiatives. The United States shows solid growth at 5.5%, focusing on defense technology leadership, 5G infrastructure development, and advanced aerospace applications. The United Kingdom maintains steady expansion at 4.9%, supported by defense industry heritage and advanced communication technology development. Japan demonstrates consistent growth at 4.4%, focusing technological innovation and precision manufacturing excellence.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to witness a CAGR of 7.8% from 2025 to 2035, driven by expanding investments in aerospace, defense communications, and advanced wireless testing systems. The increasing deployment of 5G infrastructure and research into 6G applications have created strong demand for high-frequency measurement antennas. Domestic manufacturers are actively innovating in antenna miniaturization and wideband performance optimization, supported by state-led initiatives in satellite communication programs. The growth of defense electronics has further accelerated adoption, as quad-ridge horn antennas are essential in radar cross-section measurement and EMC testing. Partnerships between universities and state enterprises ensure knowledge transfer and localized production efficiency. This ecosystem positions China as one of the most important markets, where both government-driven initiatives and private sector players enhance antenna manufacturing capabilities.

India is forecasted to grow at 7.3% CAGR through 2035, supported by rising investments in electronic warfare, 5G testing, and aerospace research. Growing demand for efficient wideband antennas in both defense and telecom sectors is reshaping procurement strategies. Government-backed initiatives in space exploration and regional satellite programs have further encouraged adoption of advanced antenna technologies. India’s academic institutions are playing a central role by partnering with manufacturers to design cost-effective antenna solutions for diverse applications. Emerging domestic firms are entering the supply chain, strengthening local manufacturing capacity. International players are also forming collaborations with Indian companies to tap into the country’s growing demand for testing and measurement solutions, particularly in 5G base station validation and electronic defense testing applications.

Germany is expected to advance at a CAGR of 6.7% between 2025 and 2035, supported by its strong engineering base and leadership in electromagnetic testing. The country is at the forefront of R&D for high-frequency systems in automotive radar and aerospace communication. Quad-ridge horn antennas are being widely utilized in automotive testing centers for radar cross-section and EMC evaluations. German companies emphasize precision engineering and compliance with EU standards, which has led to strong adoption in industrial measurement applications. Collaborations between universities, research labs, and industrial players are facilitating the development of antennas with higher efficiency and broader bandwidth. Export opportunities for German-made antennas are also increasing, as international markets prefer high-accuracy products designed for advanced measurement systems and wireless infrastructure testing.

Brazil is set to achieve a CAGR of 6.1% from 2025 to 2035, with growing focus on aerospace, defense modernization, and telecommunications testing. Quad-ridge horn antennas are being increasingly adopted in electromagnetic compatibility labs and defense-related radar systems. Expansion of satellite communication programs in Brazil has strengthened requirements for wideband and high-frequency testing devices. Government efforts to modernize defense infrastructure have improved procurement of advanced antennas, while collaborations with international companies bring in technical expertise. Universities and research institutes are also enhancing antenna-related research projects to support the country’s growing industrial and defense applications. Brazil’s telecommunications testing market, particularly in the 5G domain, is expanding rapidly, boosting demand for specialized antennas with broader operational ranges.

The United States is anticipated to post a CAGR of 5.5% during 2025–2035, supported by defense electronics, aerospace programs, and wireless communication testing. The country has a mature market where quad-ridge horn antennas are extensively applied in radar measurement, EMC testing, and satellite communication validation. Leading players are integrating advanced materials and simulation-based design to enhance antenna performance. Growing investments in 5G and upcoming 6G testing infrastructure also boost demand for these systems. Defense contractors in the USA continue to prioritize wideband and highly accurate antenna solutions for radar cross-section measurement. The expanding adoption of electric and autonomous vehicles has increased requirements for automotive radar testing, further supporting the growth of this segment in the American market.

The United Kingdom is forecasted to expand at a CAGR of 4.9% through 2035, supported by its robust research ecosystem and growing need for advanced measurement technologies. Quad-ridge horn antennas are being widely adopted for use in aerospace testing, 5G validation, and defense-oriented electromagnetic studies. Universities in the UK are collaborating with both domestic and international companies to develop cost-efficient yet high-performance antennas. Investment in 5G infrastructure rollouts has created opportunities for advanced testing equipment, where quad-ridge horn antennas play a crucial role. Defense modernization initiatives have also added momentum to the procurement of wideband antennas. With the UK focusing on its role as a research and testing hub, demand for high-frequency antennas in various applications is set to increase steadily.

Japan is expected to record a CAGR of 4.4% between 2025 and 2035, supported by growing demand in advanced telecommunications, aerospace programs, and precision electronics testing. Quad-ridge horn antennas are being applied in satellite communication testing, defense radar validation, and high-frequency EMC applications. Japanese companies emphasize miniaturization and high accuracy, ensuring compatibility with next-generation wireless technologies. The country’s strong focus on R&D in electronics and optics has also contributed to the adoption of advanced antenna designs. Collaborative projects between industry and government agencies are enhancing technological innovation, particularly in radar cross-section and electromagnetic interference testing. Japan’s expanding automotive radar testing requirements further strengthen demand, making quad-ridge horn antennas a key part of the country’s advanced testing ecosystem.

The market is defined by competition among established antenna manufacturers, specialized microwave technology companies, and emerging electromagnetic solution providers. Companies are investing in advanced antenna design technologies, precision manufacturing capabilities, measurement expertise, and technical support services to deliver reliable, accurate, and high-performance antenna solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

RF SPIN, operating globally, offers comprehensive microwave antenna solutions with focus on ultra-wide bandwidth designs, measurement accuracy, and technical support excellence. NSI-MI, antenna testing specialist, provides advanced measurement systems and antenna technologies with focus on precision characterization and system integration capabilities. Eravant, microwave technology company, delivers specialized antenna solutions with focus on high-frequency applications and innovative design approaches. L3Harris offers comprehensive defense communication systems with focus on advanced antenna technologies and system integration.

Microwave Factory provides specialized antenna manufacturing with focus on custom solutions and precision engineering. Electro Compliance delivers electromagnetic compatibility testing solutions with emphasis on antenna measurement systems and compliance expertise. ETS-Lindgren offers comprehensive EMC testing solutions with advanced antenna technologies and chamber integration capabilities. Pasternack provides microwave components and antenna solutions with focus on commercial applications and rapid delivery.

Beijing Hangwei Dayang Microwave Technology, Chengdu Zhongke Xingchi Technology, Nanjing Guanjun Technology, Nanjing Xinweilian Electronic Technology, and Jiangsu Kenli Technology Co., Ltd. offer specialized antenna expertise, regional manufacturing capabilities, and technical support across growing Chinese technology markets.

The quad-ridge horn antenna market underpins communication system advancement, defense technology development, electromagnetic compatibility assurance, and measurement accuracy improvement. With frequency spectrum expansion, increasing system complexity, and demand for precise electromagnetic measurements, the sector must balance performance excellence, manufacturing precision, and cost competitiveness. Coordinated contributions from governments, standards organizations, technology providers, system integrators, and investors will accelerate the transition toward advanced, accurate, and highly versatile antenna measurement systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 220.0 million |

| Polarization Type | Dual Linear Polarization, Dual Circular Polarization |

| Application | Communication Industry, Radar System, Electromagnetic Compatibility (EMC) Testing, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | RF SPIN, NSI-MI, Eravant, L3Harris, Microwave Factory, Electro Compliance, ETS-Lindgren, Pasternack, Beijing Hangwei Dayang Microwave Technology, Chengdu Zhongke Xingchi Technology, Nanjing Guanjun Technology, Nanjing Xinweilian Electronic Technology, Jiangsu Kenli Technology Co., Ltd. |

| Additional Attributes | Dollar sales by polarization type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established antenna manufacturers and emerging microwave technology specialists, deployment preferences for dual linear versus dual circular polarization configurations, integration with communication system testing and electromagnetic compatibility measurement environments, innovations in ridge geometry and feed design technologies for enhanced bandwidth and polarization purity, and adoption of precision manufacturing and advanced materials for improved measurement accuracy and system reliability. |

The global quad-ridge horn antenna market is estimated to be valued at USD 220.0 million in 2025.

The market size for the quad-ridge horn antenna market is projected to reach USD 386.6 million by 2035.

The quad-ridge horn antenna market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in quad-ridge horn antenna market are dual linear polarization and dual circular polarization.

In terms of application, communication industry segment to command 52.0% share in the quad-ridge horn antenna market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hornbeam Market Analysis by Source, Application, End-user, Distribution channel, and Region through 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Sea Buckthorn Actives Market Size and Share Forecast Outlook 2025 to 2035

Sea Buckthorn Market – Growth, Applications & Nutritional Benefits

Motorcycle Horn Market Analysis - Size, Share, and Forecast 2024 to 2034

Electric Motor Horn Market Growth – Trends & Forecast 2025 to 2035

Antioxidant-Rich Sea Buckthorn Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antenna Switch Module Market Size and Share Forecast Outlook 2025 to 2035

Antenna, Transducer, and Radome (ATR) Market Size and Share Forecast Outlook 2025 to 2035

Chip Antenna Market

RFID Antenna Market

Train Antenna Market Size and Share Forecast Outlook 2025 to 2035

Printed Antenna Market Size and Share Forecast Outlook 2025 to 2035

RAIN Tag Antennas Market Size and Share Forecast Outlook 2025 to 2035

Wireless Antenna Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Antenna Market

Satellite Antenna Market

Microwave Antenna Market

Automotive Antenna Module Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel Antenna Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA