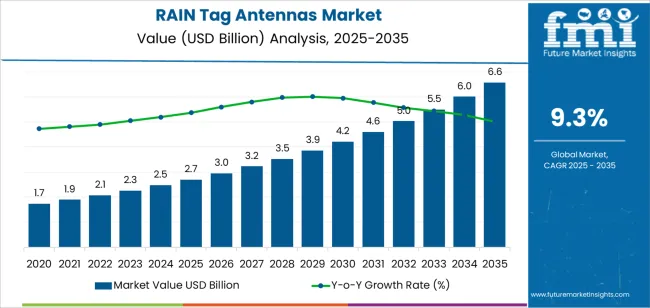

The RAIN tag antennas market is forecast to grow from USD 2.7 billion in 2025 to USD 6.6 billion by 2035, reflecting a CAGR of 9.3%. RFID (Radio Frequency Identification) tag antennas are essential components of RFID systems and are widely used across industries such as logistics, retail, manufacturing, and healthcare. As supply chain efficiency and asset tracking become increasingly important for businesses, the adoption of RAIN RFID technology is expanding. The market for RAIN tag antennas is supported by the growing need for real-time tracking systems, inventory management, and data-driven decision-making, with businesses seeking to improve operational efficiency and customer service.

The global trend toward digitization and the increasing emphasis on automated systems in industries like warehouse management, retail (particularly in inventory tracking), and healthcare (for asset tracking and patient management) will further drive the adoption of RAIN tag antennas. As the infrastructure for smart cities, IoT systems, and supply chain automation continues to grow, the demand for high-performance RFID technologies, including RAIN antennas, will surge. Technological advancements, such as smarter, more energy-efficient RFID tags, will also contribute to the market’s expansion over the next decade.

The Growth Contribution Index (GCI) for the RAIN tag antennas market highlights the distribution of growth throughout the 10-year forecast period from 2025 to 2035. The first phase, from 2025 to 2030, accounts for 50% of total market growth. During this period, the market will expand from USD 2.7 billion to USD 4.2 billion, adding USD 1.5 billion. This rapid growth is driven by the widespread adoption of RFID technology in industries like logistics, retail, and manufacturing, where the need for efficient supply chain management and automated inventory tracking is increasing. The demand for RAIN tag antennas will surge as businesses seek real-time data and automation to improve operational efficiency, minimize human error, and reduce costs. The rise of smart technologies and IoT integration in various sectors will also play a significant role in driving market growth during this early phase.

The second phase, from 2030 to 2035, will see the market grow from USD 4.2 billion to USD 6.6 billion, contributing USD 2.4 billion in growth, also representing 50% of the total market expansion. During this phase, the market will continue to be driven by ongoing industry digitization and the integration of RFID systems into smart city projects, asset management, and healthcare systems. As automated solutions become more widespread, particularly in inventory management and supply chain operations, demand for high-performance RAIN antennas will remain strong. By 2035, the market will reach maturity, but continued technological advancements and expanding industry adoption will fuel steady growth through the forecast period's final phase.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.7 billion |

| Market Forecast Value (2035) | USD 6.6 billion |

| Forecast CAGR (2025-2035) | 9.3% |

The RAIN tag antennas market is being driven by the expanding adoption of passive UHF RFID (RAIN) technology across sectors such as retail, logistics, healthcare, and manufacturing. As firms deploy RAIN-enabled tags to track inventory, assets, and products, the demand for tag antennas capable of supporting long read-ranges, reliable performance in varied environments, and high-volume production has increased. The broader RAIN RFID market is expected to grow at a double-digit compound annual growth rate (CAGR) in the coming years.

Another significant driver is the push for sustainable and cost-efficient tag designs. Manufacturers are developing new antenna materials and manufacturing techniques, such as paper-based antennas or low-cost substrates, to support high-volume deployment of RAIN tags in consumer goods and apparel. These innovations support scale and affordability, further fueling market growth. At the same time, challenges remain, such as the need to optimize antenna performance for compact or embedded applications and ensure compatibility with different tag chips.

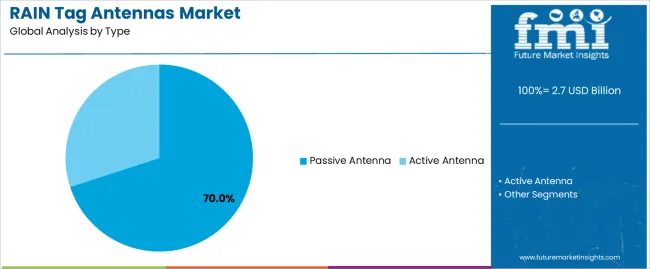

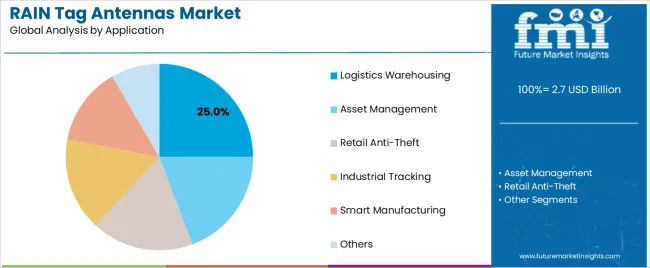

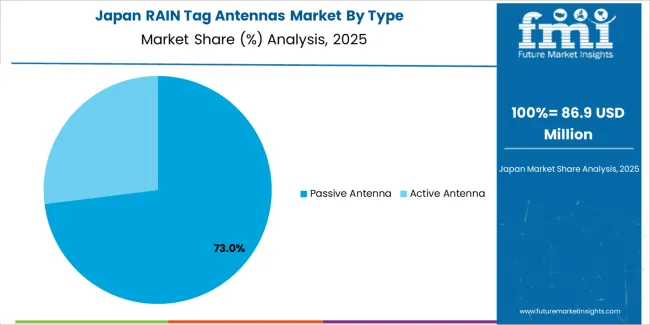

The RAIN tag antennas market is segmented by antenna type and application. The leading type is the passive antenna, which holds 70% of the market share, while the dominant application segment is logistics warehousing, accounting for 25% of the market. These segments are critical drivers of the market, influenced by the growing adoption of RAIN (Radio Frequency Identification) technology in supply chain management and asset tracking, as well as the increasing need for efficient warehouse management solutions.

The passive antenna segment leads the RAIN tag antennas market, capturing 70% of the market share. Passive antennas are widely used in RFID systems due to their cost-effectiveness, simplicity, and low maintenance requirements. These antennas do not require an internal power source and rely on the radio waves transmitted by a reader to generate power, making them ideal for a wide range of applications, particularly in logistics and inventory tracking. Passive antennas are typically used in environments where long-range identification and tracking are required, such as in warehouse management systems, asset management, and supply chain logistics.

The dominance of passive antennas is attributed to their broad adoption in RFID-based systems, where their ability to provide reliable performance at a lower cost is highly valued. As RAIN RFID technology continues to be integrated into industries such as logistics, manufacturing, and retail, the demand for passive antennas will remain strong. Additionally, passive antennas offer flexibility in terms of deployment and scalability, making them a preferred choice for businesses looking to implement or expand their RFID systems.

The logistics warehousing application segment is the leading application in the RAIN tag antennas market, accounting for 25% of the market share. In logistics and warehousing, RAIN RFID systems are increasingly used to automate inventory management, track goods, and streamline operations. The ability to track the movement of goods through large warehouses with high accuracy and efficiency is essential for improving supply chain visibility and reducing human errors. RAIN tag antennas, particularly passive ones, play a crucial role in this process by providing real-time tracking and data collection from items as they move through various stages of the supply chain.

The growth of e-commerce, the need for faster order fulfillment, and the drive to improve operational efficiency in warehouses have significantly increased the adoption of RFID technology in logistics. As more companies seek to optimize their inventory and warehouse management systems, the demand for RAIN RFID tags and antennas is expected to continue growing. The logistics warehousing segment is expected to remain a key driver of the RAIN tag antennas market as the global logistics and supply chain sectors continue to modernize and embrace digital solutions for better tracking and management of assets.

The RAIN tag antennas market is expanding as the adoption of RAIN RFID technology grows across various industries, including retail, logistics, and supply chain management. As these sectors increase the deployment of RFID tags, the need for optimized antennas becomes critical to ensure reliable performance, especially in challenging environments like metal surfaces or items containing liquids. Advancements in antenna technology, including improved materials and designs that can handle diverse use cases, are shaping market demand. At the same time, sustainability trends and the need for cost-effective production are pushing the development of innovative, environmentally friendly antenna materials.

What Are The Primary Growth Drivers For The RAIN Tag Antennas Market?

The primary growth drivers for the RAIN tag antennas market include the rapid expansion of RFID deployments in various industries such as logistics, retail, and asset tracking. The growth of the Internet of Things (IoT) further boosts demand for RFID systems, creating opportunities for advanced antenna designs. Additionally, the increasing need for high-performance antennas that can function in diverse environments, such as metallic surfaces or liquid-rich products, drives innovation. Furthermore, as sustainability becomes a greater concern, the development of more eco-friendly antenna materials, such as paper-based or fiber-based antennas, supports both cost reduction and environmental goals.

What Are The Key Restraints In The RAIN Tag Antennas Market?

Despite significant growth, the RAIN tag antennas market faces several constraints. The high demand for low-cost RFID tags creates pressure on manufacturers to keep antenna production affordable while maintaining performance, particularly in high-volume applications. Additionally, challenges in designing antennas that perform consistently across varied substrates and environments-such as metal, textiles, and liquids-complicate the design process and increase costs. The diversity of antenna designs and the complexity of testing across different applications also add to the challenge. Furthermore, competition from alternative technologies, such as NFC and Bluetooth Low Energy (BLE), may impact the adoption of RAIN RFID in certain sectors.

What Are The Emerging Trends In The RAIN Tag Antennas Market?

Emerging trends in the RAIN tag antennas market include the shift toward sustainable antenna materials, with increasing use of paper-based or fiber-based substrates that reduce the environmental impact. There is also a focus on more compact and flexible antenna designs that can be integrated into a variety of products, including garments and small items. Another trend is the development of specialized antennas designed for challenging environments, such as metal surfaces or high-moisture areas, where traditional antennas might struggle. Additionally, companies are offering modular and reference-design antenna libraries to streamline the development process, reduce time-to-market, and ensure consistency in antenna performance. These trends reflect the growing demand for highly adaptable, eco-friendly, and cost-effective RFID solutions.

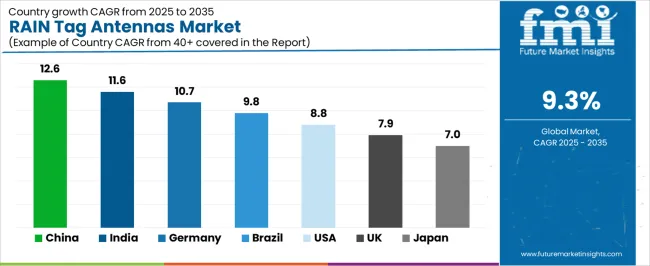

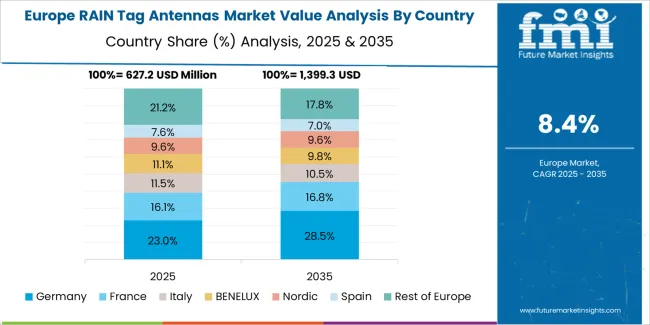

The RAIN (UHF RFID) tag antennas market is experiencing steady growth, driven by the increasing demand for efficient tracking, inventory management, and logistics solutions across various industries, including retail, supply chain, healthcare, and manufacturing. RAIN tag antennas, which are essential components in RFID systems, offer a high level of accuracy and speed for data transmission, making them ideal for a wide range of applications. As industries continue to adopt RFID technology for better automation and inventory control, the demand for RAIN tag antennas is rising. Countries like China and India are seeing rapid market growth due to their expanding manufacturing sectors and increased adoption of smart technologies, while developed regions like the USA and Germany show steady growth driven by advanced industrial applications and high-tech infrastructure. This analysis explores the factors driving the RAIN tag antennas market in different regions.

| Country | CAGR (2025-2035) |

|---|---|

| China | 12.6% |

| India | 11.6% |

| Germany | 10.7% |

| Brazil | 9.8% |

| USA | 8.8% |

| United Kingdom | 7.9% |

| Japan | 7% |

China leads the RAIN tag antennas market with a significant CAGR of 12.6%. The country's rapid industrial growth, along with increased investments in automation and smart manufacturing, is driving demand for RFID technology, including RAIN tag antennas. China is one of the largest adopters of RFID systems for inventory management, asset tracking, and logistics applications, which has significantly boosted the demand for RAIN tag antennas.

The growing retail and e-commerce sectors in China are also contributing to the adoption of RFID-based solutions for supply chain management, improving efficiency and accuracy in operations. Additionally, the government’s push towards digitalization and the integration of smart technologies in industries such as healthcare, logistics, and manufacturing further fuels market growth. As China continues to lead in digital and industrial transformation, the demand for RAIN tag antennas is expected to remain strong.

India’s RAIN tag antennas market is growing at a CAGR of 11.6%. The country’s rapid adoption of RFID technology in various sectors such as retail, manufacturing, and logistics is driving demand for RAIN tag antennas. The Indian government’s initiatives to modernize infrastructure and promote digitalization in industries have led to an increase in the use of RFID systems for inventory tracking, asset management, and supply chain optimization.

The growing e-commerce industry in India, along with the need for better inventory management solutions, is also contributing to the demand for RAIN tag antennas. As India continues to invest in smart technologies and automation, the market for RFID systems and associated components like RAIN tag antennas is expected to see continued growth.

Germany’s RAIN tag antennas market is projected to grow at a CAGR of 10.7%. As a leader in manufacturing and technology, Germany is embracing RFID systems to improve operational efficiency, particularly in industries such as automotive, logistics, and manufacturing. The demand for RAIN tag antennas is being driven by the country’s ongoing digital transformation, as more businesses adopt RFID-based solutions for tracking and managing assets.

Germany’s well-established infrastructure and strong emphasis on Industry 4.0, which includes the adoption of smart factory technologies, are also contributing to the growth of the market. As industries continue to seek automation and greater data accuracy, the demand for RAIN tag antennas is expected to rise steadily in Germany. The country’s focus on innovation and sustainability in manufacturing ensures that RFID technology remains a key part of its industrial strategy.

Brazil’s RAIN tag antennas market is expected to grow at a CAGR of 9.8%. The increasing demand for better inventory control, logistics management, and supply chain optimization is driving the adoption of RFID systems, including RAIN tag antennas, in Brazil. The retail, logistics, and automotive sectors in the country are increasingly adopting RFID technology to improve operational efficiency and reduce costs.

Additionally, the Brazilian government’s focus on digitalizing industries and modernizing infrastructure is further fueling the adoption of RFID-based solutions. As businesses in Brazil look for more effective ways to manage their supply chains and reduce inefficiencies, the demand for RAIN tag antennas is expected to continue growing. The expansion of Brazil’s e-commerce sector also contributes to the market growth.

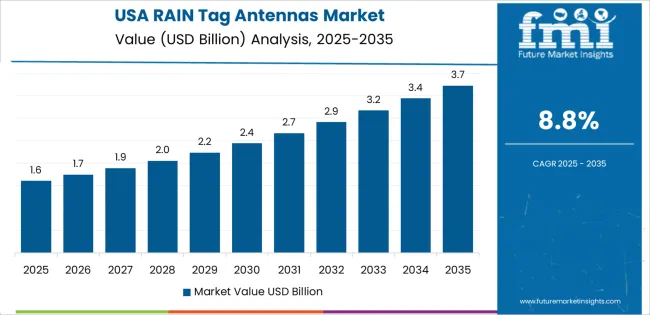

The United States has a projected CAGR of 8.8% for the RAIN tag antennas market. The USA remains one of the largest markets for RFID technology, with a strong presence in industries such as retail, healthcare, logistics, and manufacturing. The increasing adoption of RFID solutions for inventory management, asset tracking, and supply chain optimization is driving the demand for RAIN tag antennas.

The growing emphasis on automation and the Internet of Things (IoT) in various industries is further fueling the need for accurate and efficient tracking solutions. As the USA continues to invest in smart technologies and digital infrastructure, the market for RAIN tag antennas is expected to experience steady growth, particularly in sectors like logistics, healthcare, and retail.

The United Kingdom’s RAIN tag antennas market is projected to grow at a CAGR of 7.9%. The UK is increasingly adopting RFID technology across industries such as retail, logistics, and healthcare to streamline operations and improve supply chain efficiency. The demand for RAIN tag antennas is driven by the growing need for accurate tracking and management of assets, as well as the ongoing digital transformation in various sectors.

The UK’s strong e-commerce sector and the government’s push to support innovation and technological advancement in industries like logistics and manufacturing are contributing to the growth of the RFID market. As the UK continues to embrace automation and digitalization, the demand for RAIN tag antennas is expected to grow steadily.

Japan’s RAIN tag antennas market is expected to grow at a CAGR of 7.0%. Japan has a well-established manufacturing sector, and the adoption of RFID technology for inventory management, asset tracking, and logistics is gaining momentum. The country’s focus on automation, smart factories, and digital transformation is driving demand for RFID solutions, including RAIN tag antennas.

Japan’s strong technological infrastructure, along with its commitment to innovation in manufacturing and supply chain management, supports the growth of the market. As the demand for smarter, more efficient systems increases, Japan’s market for RAIN tag antennas is expected to continue evolving, albeit at a slower pace compared to emerging markets like China and India.

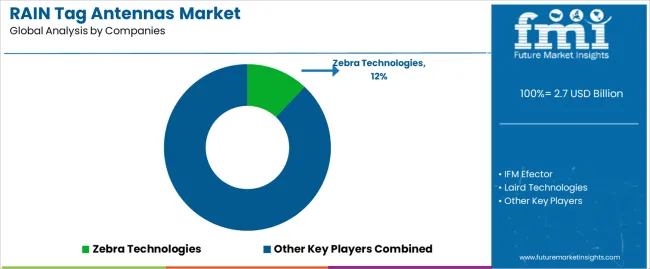

In the RAIN tag antennas market, companies such as Zebra Technologies (holding approx 12% share), IFM Efector, Laird Technologies, Harting, Molex, Abracon, Kathrein Solutions, Honeywell International, RFRain, PREMO USA, Tec Tus, Impinj, Invengo, RFID Inc., Myers Engineering International, Murata Electronics North America, Alien Technology, and TagItron GmbH compete for position. The broader RAIN RFID market is forecast to reach tens of billions of tag chip units and is growing at a double digit annual rate. The antenna segment is critical because proper antenna design supports tag read range, orientation flexibility and environmental robustness. For example, factors such as polarization (linear versus circular), radiation pattern, and mounting orientation have been shown to affect read performance in real world deployment.

These companies pursue distinct strategies. Some lead with global manufacturing scale, strong distribution networks, and broad product portfolios that cover multiple antenna types for diverse applications: retail, logistics, manufacturing, asset tracking. Others differentiate through specialised performance: ultra thin antennas for apparel tagging, high durability antennas for industrial asset monitoring, or flexible form factors for automotive usage. A third group focuses on cost optimisation for high volume applications in low cost goods or consumables. Additional strategic focus areas include regionalisation (manufacturing near large end markets such as Asia Pacific), sustainability (antenna materials that use less plastic or fewer chemicals) and design for integration (antenna+chip modules ready for tag makers). Companies that combine high performance antenna design, manufacturing efficiency, regulatory compliance and close alignment with tag chip vendor ecosystems are likely to improve their standing in the RAIN tag antennas market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Type | Passive Antenna, Active Antenna |

| Application | Logistics Warehousing, Asset Management, Retail Anti-Theft, Industrial Tracking, Smart Manufacturing, Others |

| Key Companies Profiled | Zebra Technologies, IFM Efector, Laird Technologies, Harting, Molex, Abracon, Kathrein Solutions, Honeywell International, RFRain, PREMO USA, Tec-Tus, Impinj, Invengo, RFID, Inc., Myers Engineering International, Murata Electronics North America, Alien Technology, TagItron GmbH |

| Additional Attributes | The market analysis includes dollar sales by antenna type and application categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape focuses on key manufacturers in the RAIN tag antenna market, with innovations in passive and active antenna technologies. Trends in the growing demand for RFID-based solutions in logistics, retail, industrial tracking, and smart manufacturing are explored, along with advancements in automation and asset management technologies. |

The global RAIN tag antennas market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the RAIN tag antennas market is projected to reach USD 6.6 billion by 2035.

The RAIN tag antennas market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in RAIN tag antennas market are passive antenna and active antenna.

In terms of application, logistics warehousing segment to command 25.0% share in the RAIN tag antennas market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rain Barrels Market Size and Share Forecast Outlook 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Rainbow Flatware Market Trends - Growth & Forecast 2025 to 2035

Rain Boots Market Trends - Growth & Industry Forecast 2025 to 2035

Rainscreen Cladding Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Rain Barrel Manufacturers

Grain Hardness Meter Market Size and Share Forecast Outlook 2025 to 2035

Grain Cooling Spear Market Size and Share Forecast Outlook 2025 to 2035

Train Antenna Market Size and Share Forecast Outlook 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Draining Cellulite Treatments Market Size and Share Forecast Outlook 2025 to 2035

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Train Dispatching Market Size and Share Forecast Outlook 2025 to 2035

Grain Roller Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA